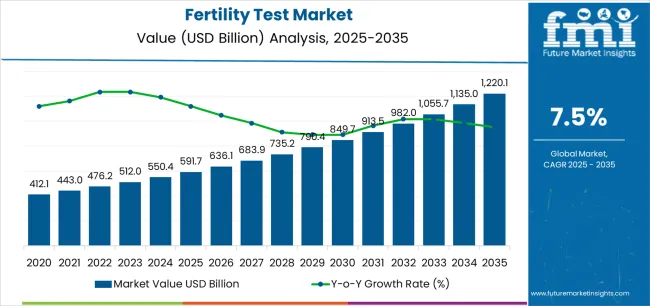

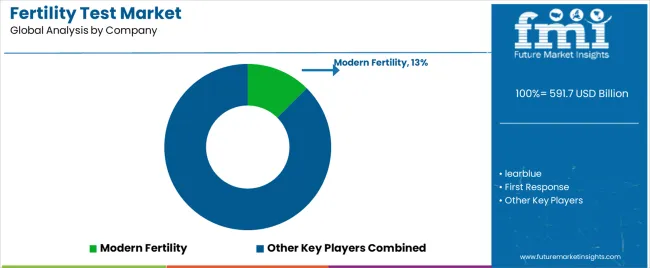

The Fertility Test Market is estimated to be valued at USD 591.7 billion in 2025 and is projected to reach USD 1220.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

The fertility test market is expanding steadily due to rising awareness of reproductive health, delayed parenthood trends, and technological advancements in home-based diagnostic testing. Increased prevalence of fertility-related concerns among both men and women has amplified demand for accurate and convenient testing solutions.

The market is witnessing a shift toward digital and user-friendly devices that enable real-time hormone tracking and result interpretation. Enhanced distribution through retail and online channels has improved accessibility, while growing healthcare expenditure supports product adoption globally.

Furthermore, expanding educational initiatives by healthcare organizations and manufacturers have increased public awareness regarding early fertility assessment. With innovation in biosensors and mobile-connected fertility tracking kits, the market outlook remains optimistic, indicating sustained growth in both developed and emerging regions.

| Metric | Value |

|---|---|

| Fertility Test Market Estimated Value in (2025 E) | USD 591.7 billion |

| Fertility Test Market Forecast Value in (2035 F) | USD 1220.1 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

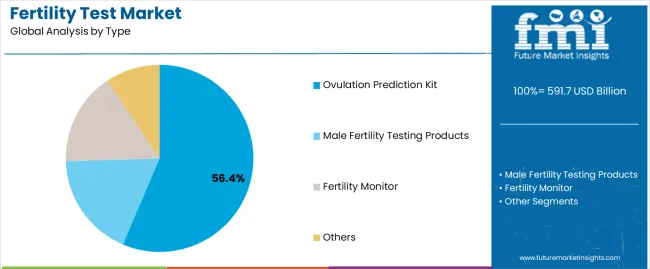

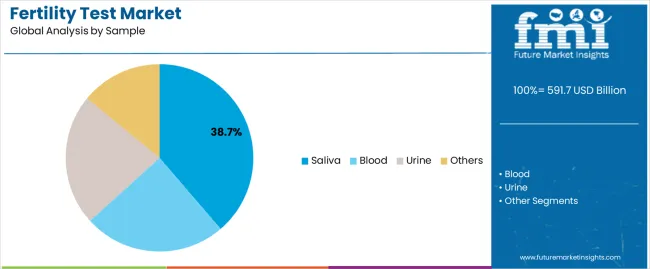

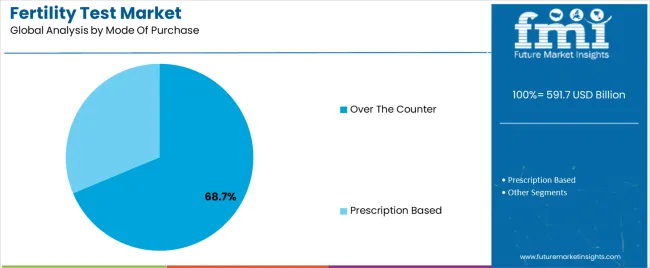

The market is segmented by Type, Sample, Mode Of Purchase, Application, and End User and region. By Type, the market is divided into Ovulation Prediction Kit, Male Fertility Testing Products, Fertility Monitor, and Others. In terms of Sample, the market is classified into Saliva, Blood, Urine, and Others. Based on Mode Of Purchase, the market is segmented into Over The Counter and Prescription Based. By Application, the market is divided into Female and Male. By End User, the market is segmented into Homecare Settings, Hospitals, Fertility Clinics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ovulation prediction kit segment dominates the type category, capturing approximately 56.4% share of the fertility test market. This segment’s leadership is attributed to its convenience, accuracy, and cost-effectiveness for home-based fertility monitoring.

Ovulation kits detect hormonal changes related to the luteinizing hormone surge, offering reliable timing insights for conception planning. Increased consumer preference for non-invasive and easy-to-use devices has accelerated adoption.

Product innovation in digital and smartphone-compatible kits has further improved result interpretation and user engagement. With greater accessibility through pharmacies and e-commerce platforms, the ovulation prediction kit segment is expected to retain its strong market position throughout the forecast period.

The saliva segment holds approximately 38.7% share of the sample category, reflecting its growing acceptance as a non-invasive and convenient testing method. Saliva-based tests eliminate the discomfort associated with blood or urine samples while providing accurate fertility tracking through electrolyte and hormonal pattern analysis.

Advancements in sensor technology and microfluidic analysis have enhanced test precision and ease of use. The segment benefits from increased consumer preference for discreet, hygienic, and reusable testing options.

With rising adoption of digital fertility devices using saliva samples, this segment is expected to experience continued growth as consumers prioritize convenience and accuracy in reproductive health monitoring.

The over the counter segment accounts for approximately 68.7% share in the mode of purchase category, driven by consumer preference for privacy, accessibility, and ease of procurement. The wide availability of fertility test kits in pharmacies, supermarkets, and online platforms has made self-testing more approachable.

Increased marketing efforts by manufacturers, coupled with improved product reliability, have boosted consumer confidence in over-the-counter options. The segment’s growth is also reinforced by the rising trend of self-care and early fertility awareness among women.

As distribution networks expand globally and product affordability improves, the over the counter segment is anticipated to maintain its leading position within the fertility test market.

The demand for home-based fertility testing kits is on the rise. These kits are cost-effective and offer convenience to users, making them an attractive option for those who prefer to assess their fertility levels in the privacy of their homes.

As a result, many companies are focusing on developing innovative and accurate home-based testing kits to meet this demand.

The rise of digital health technology is also creating new opportunities for market players in the fertility testing market. Mobile apps, wearables, and other digital health tools are gaining popularity among consumers. Many companies are developing fertility testing products that can be integrated with these tools.

This integration allows for a more personalized approach to fertility testing, potentially leading to better outcomes for users. Companies that can develop innovative and accurate fertility testing products catering to these trends are likely to be well-positioned for success in this market.

The ovulation prediction kit segment dominates the market by product and is projected to maintain its dominance through 2035, registering a 7.7% CAGR. The saliva segment leads the market in terms of the sample category. This segment is expected to record a CAGR of 7.4% during the forecast period.

| Attributes | Details |

|---|---|

| Product | Ovulation prediction kit |

| Forecasted CAGR From 2025 to 2035 | 7.7% |

The market is significantly influenced by the dominance of the ovulation prediction kit segment, supported by the following points:

| Attributes | Details |

|---|---|

| By Sample | Saliva |

| Forecasted CAGR from 2025 to 2035 | 7.4% |

The market is LED by the saliva segment within the sample category, a fact reinforced by the following:

| Countries | Forecasted CAGR from 2025 to 2035 |

|---|---|

| United States | 7.6% |

| United Kingdom | 9.1% |

| China | 8.7% |

| Japan | 9.3% |

| South Korea | 9.8% |

The increasing awareness among people about their reproductive health in the United States is a primary factor contributing to its dominance in the fertility test market. Other supporting factors include:

The fertility test market in the United Kingdom holds significant growth potential. Factors backing up this growth are:

The demand for fertility testing is considerable in China. This growth in the fertility test market can be attributed to the following factors:

The rise in demand for fertility tests in Japan can be attributed to the country's strict regulations on assisted reproductive technologies. In addition to this, there are several other reasons supporting the expansion of the fertility test market:

The adoption rate of fertility tests in South Korea is significantly higher than in other Asian countries, and this trend is anticipated to continue in the upcoming years. This trend is supported by:

The fertility test market is highly competitive, with several players offering a range of products and services. These companies provide various fertility tests, ranging from prediction kits to sperm count tests. Additionally, several new players in the market are leveraging technology such as artificial intelligence and machine learning to develop advanced fertility testing solutions.

Recent Developments

The global fertility test market is estimated to be valued at USD 591.7 billion in 2025.

The market size for the fertility test market is projected to reach USD 1,220.1 billion by 2035.

The fertility test market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in fertility test market are ovulation prediction kit, male fertility testing products, fertility monitor and others.

In terms of sample, saliva segment to command 38.7% share in the fertility test market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fertility Pregnancy Rapid Test Kits Market Analysis - Size, Share, and Forecast 2025 to 2035

Fertility Supplement Market Trends - Growth & Industry Forecast 2025 to 2035

Fertility Tracking Apps Market

Infertility Treatment Market Size and Share Forecast Outlook 2025 to 2035

Infertility Drugs Market Analysis - Size, Share & Forecast 2025 to 2035

Demand for Fertility Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Testosterone Test Market Size and Share Forecast Outlook 2025 to 2035

Test rig Market Size and Share Forecast Outlook 2025 to 2035

Test and Measurement Sensors Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Testosterone Booster Industry Analysis by Component, Source, Distribution Channels and Regions 2025 to 2035

Testosterone Injectable Market

Test Tube Market

Testliner Market

Testicular Cancer Treatment Market

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Intestinal Pseudo-Obstruction Treatment Market - Trends, Growth & Forecast 2025 to 2035

Intestinal Fistula Treatment Market Growth - Demand & Innovations 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA