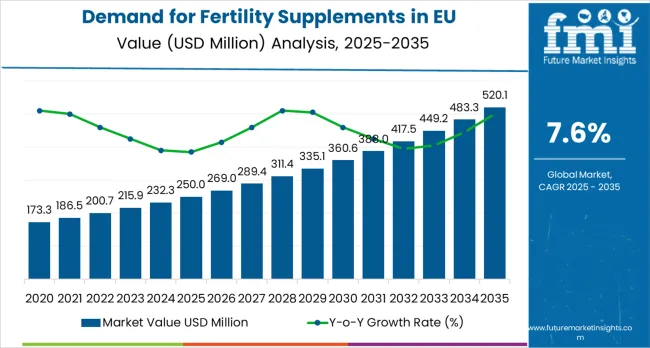

The demand for fertility supplements in the EU is projected to increase from USD 250.0 million in 2025 to USD 520.1 million in 2035, reflecting a CAGR of 7.6%. The contribution of volume versus price growth highlights how market expansion is influenced by both increasing consumption and changes in product pricing.

As per FMI’s latest global food industry intelligence, widely referenced in health and ingredients studies, volume growth is expected to be the primary driver, supported by rising awareness of fertility health, increasing adoption among couples, and growing availability of supplements through pharmacies, health stores, and online channels. Greater acceptance of preventive health and lifestyle-focused products is likely to boost unit sales steadily across the forecast period.

Price growth will play a smaller but meaningful role, driven by the introduction of premium formulations, organic and plant-based supplements, and enhanced delivery mechanisms. Between 2025 and 2030, volume-driven growth is likely to dominate, reflecting steady adoption and increasing consumption among the target population. From 2030 to 2035, price contribution may increase moderately as innovative products and higher-quality supplements gain traction, allowing manufacturers to capture additional value.

The European fertility supplements market is projected to reach USD 250 million in 2025, with growth expected to continue, reaching approximately USD 520.1 million by 2035 at a forecast CAGR of 7.6%. Women’s supplements dominate the market, accounting for around 65% of demand, while men’s supplements represent the remaining 35%.

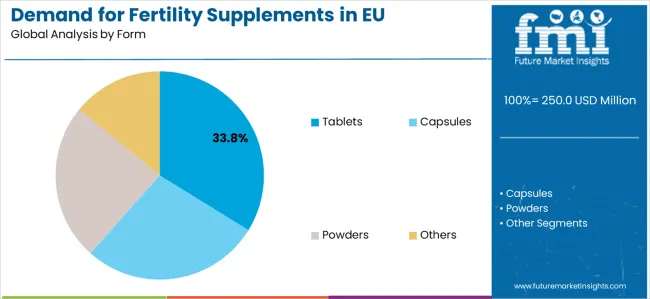

Capsules and tablets are the leading product forms, making up about 70% of total consumption, whereas liquid and powder formulations account for the rest. Online and pharmacy channels are the primary distribution avenues, contributing roughly 60% of sales, with specialty stores and other retail making up the remaining 40%.

Recent trends indicate a strong shift toward natural and plant-based ingredient, which now constitute around 40% of new product launches. Personalized and gender-specific formulations are gaining popularity, representing approximately 25% of innovations in the market. The rising awareness of preconception health and fertility management is driving demand for supplements that include vitamins, minerals, and herbal extracts. Online marketing and direct-to-consumer models are also expanding, providing easier access and increasing consumer engagement across EU countries.

Market expansion is being supported by the fundamental shift in consumer attitudes toward reproductive health and proactive fertility management across European societies, with fertility supplements increasingly regarded as essential healthcare alternatives deserving premium nutritional ingredients, scientifically validated formulation methods, and overall reproductive efficacy comparable to clinical fertility treatments. Modern European consumers and reproductive healthcare professionals consistently prioritize ingredient authenticity, clinical efficacy, scientific validation, and bioavailability when selecting fertility supplements, driving demand for specialty formulations that deliver superior reproductive health performance, evidence-based nutritional approaches, visible fertility benefits, and clinical certifications compared to general wellness supplements. Even minor concerns about reproductive health, fertility optimization, or preconception nutritional adequacy can drive comprehensive adoption of specialized premium fertility supplements designed to maintain optimal reproductive function, support specific fertility applications, and enhance overall reproductive satisfaction throughout all reproductive health categories.

The growing complexity of reproductive health science and increasing awareness of nutrition-specific fertility factors are driving demand for professionally validated specialty products from certified European manufacturers with appropriate clinical certifications, reproductive health research capabilities, technical expertise, and compliance with stringent EU healthcare regulations. Regulatory authorities across European Union member states are increasingly establishing comprehensive guidelines for fertility supplement manufacturing, reproductive health claim accuracy, clinical efficacy standards, and supplement safety requirements to ensure product effectiveness and consumer safety. Scientific research studies and clinical trials conducted at European reproductive health research institutions are providing evidence supporting specific nutritional interventions for common fertility challenges including ovulation optimization, sperm quality enhancement, hormonal balance support, and overall reproductive wellness maintenance, requiring specialized formulation expertise and clinically controlled production processes that meet EU healthcare standards.

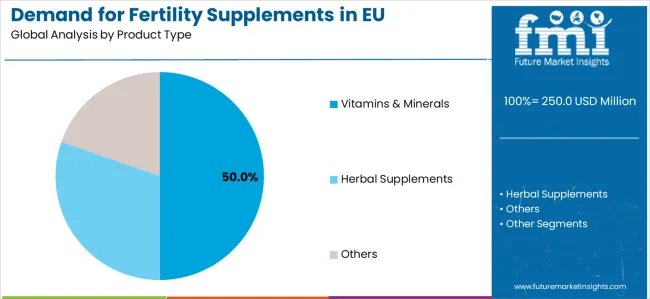

The market is segmented by product type, form, distribution channel, and sales region. By product type, the market is divided into vitamins & minerals, herbal supplements, and other specialized formulations. Based on form, the market is categorized into tablets, capsules, powders, and other delivery formats.

By distribution channel, the market spans specialty stores (reproductive health retailers, clinical nutrition suppliers), pharmacies (community pharmacies, hospital pharmacies), and online retail (e-commerce platforms, healthcare websites). Regionally, the market covers Germany, France, Italy, Spain, Netherlands, and Rest of Europe.

Vitamins & minerals segment is projected to account for 50.0% of the Demand for Fertility Supplements in EU in 2025, establishing itself as the dominant product category across European reproductive health and clinical nutrition facilities.

This commanding market position is fundamentally supported by the widespread adoption of essential micronutrients for comprehensive fertility optimization, evidence-based reproductive nutrition protocols, and specialized preconception health applications that deliver exceptional bioavailability, consistent nutritional performance, and superior therapeutic properties throughout large-scale clinical operations across EU member states.

Fertility-focused vitamin and mineral products provide European healthcare professionals with unparalleled formulation precision, targeted nutrient delivery during reproductive cycles, enhanced clinical outcomes, and seamless integration with evidence-based fertility treatments that comply with stringent EU healthcare safety directives.

This product sophistication enables European supplement manufacturers to achieve optimal production economics while maintaining rigorous quality protocols mandated by European Medicines Agency (EMA) regulations, comprehensive traceability systems required under EU law, and consistent therapeutic performance across millions of individual reproductive health applications produced annually.

The segment derives substantial competitive advantages from established European micronutrient processing infrastructure offering specialized bioavailability solutions, comprehensive clinical support services, and continuous product innovation that incorporates enhanced absorption technologies, improved stability characteristics, and advanced formulation capabilities aligned with clinical nutrition standards.

The vitamins & minerals systems deliver superior clinical positioning particularly important in evidence-based healthcare markets, enhanced therapeutic profiles, improved patient compliance, and superior regulatory compliance with EU supplement standards.

Tablets applications are positioned to represent 33.8% of total European fertility supplement demand in 2025, reflecting the segment's dominant position within the overall market ecosystem and the substantially larger clinical consumption patterns compared to other form categories across most European countries.

This substantial market share directly demonstrates the exceptionally high adoption rates of tablet formulations among European healthcare providers and the continuously expanding population of reproductive health clinics and fertility specialists across both Western and Eastern European markets.

Modern European fertility supplement tablet applications are increasingly featuring sophisticated formulations that deliver enhanced bioavailability profiles, extended release characteristics, and specialized therapeutic properties specifically designed to address common reproductive health challenges including nutrient absorption optimization, hormonal balance support, reproductive function enhancement, and overall fertility improvement.

European supplement manufacturers consistently demonstrate willingness to invest substantially in premium tablet formulations that deliver visible reproductive benefits, support optimal clinical outcomes, comply with EU pharmaceutical standards, and provide consistent results for both clinical and consumer reproductive health operations. Within the tablets segment, immediate release formulations command 18% share, extended release represents 10%, and enteric coated accounts for 5.8%, reflecting comprehensive formulation segmentation strategies tailored to European healthcare preferences.

The demand for fertility supplements in EU is advancing steadily due to intensifying reproductive health awareness and growing recognition of nutritional factors in fertility outcomes across EU member states. The market faces challenges including fluctuating raw material costs for specialized reproductive nutrients, complex regulatory requirements for fertility health claims across diverse European jurisdictions, varying clinical evidence standards across different therapeutic applications, competition from emerging fertility treatments including assisted reproductive technologies, and varying healthcare professional awareness levels across different EU countries despite clinical education efforts. Scientific research initiatives, personalized nutrition development programs, clinical validation solutions, and digital health platforms continue to influence product development strategies and market evolution patterns across European markets.

The rapidly accelerating deployment of personalized fertility nutrition approaches and healthcare integration strategies is fundamentally enabling broader market reach across European countries, enhanced therapeutic precision for individual reproductive health needs particularly for clinical applications, and significantly improved healthcare professional relationships through evidence-based nutrition protocols.

Advanced personalized nutrition platforms operated by specialized reproductive health clinics, professional fertility specialists, and major healthcare systems equipped with detailed nutrient analysis in multiple European languages, clinical research reviews, therapeutic guides, and personalized recommendations provide comprehensive scientific education resources while dramatically expanding product visibility across diverse healthcare segments and geographic markets throughout the European Union.

These personalized approaches prove particularly valuable for specialty fertility supplements that require detailed clinical explanations, reproductive health benefit documentation, and targeted therapeutic approaches to effectively communicate complex fertility benefits and justify premium pricing positions across sophisticated European healthcare segments.

Healthcare integration also enables sophisticated patient data analytics, personalized therapeutic recommendations based on reproductive health status and nutritional deficiencies, direct clinical feedback collection that informs product development, and subscription models that ensure predictable revenue streams while reducing patient acquisition costs across fragmented European healthcare markets.

Progressive European fertility supplement manufacturers are systematically incorporating innovative clinical research including reproductive health studies, biomarker analysis, therapeutic efficacy enhancement, and safety optimization that address growing European healthcare professional demands about clinical effectiveness, scientific credibility, and therapeutic performance in fertility nutrition products.

Strategic integration of these clinical approaches, combined with rigorous efficacy testing and validation protocols conducted at European reproductive health research institutions, enables manufacturers to develop differentiated product propositions that appeal to evidence-based European healthcare professionals while maintaining essential safety profiles and therapeutic performance.

These clinical research initiatives also support development of specialized formulations for fertility conditions increasingly recognized across European healthcare systems, enhanced efficacy options for therapeutic applications recommended by European reproductive health specialists, and clinically-proven products that resonate with science-driven healthcare segments particularly prevalent in Nordic and Western European countries. Investment in research facilities established in Netherlands and Germany, precision clinical capabilities, and advanced therapeutic validation technologies enable European manufacturers to explore next-generation fertility supplements while maintaining competitive positioning in premium and ultra-premium healthcare segments.

European healthcare providers and consumers are increasingly prioritizing sustainability credentials and clean label principles when selecting fertility supplements, driving fundamental changes in sourcing strategies across the European reproductive health supplement industry. Companies are implementing comprehensive sustainable sourcing systems using organic ingredient cultivation, reducing environmental impact through efficient processing technologies, and developing fully traceable supply chains that align with EU sustainability directives and extended producer responsibility regulations.

This trend is particularly pronounced across Nordic countries, Germany, Netherlands, and France where healthcare consumers demonstrate exceptional environmental consciousness and willingness to pay premiums for supplements with verified sustainability credentials and clean label certifications.

Manufacturers are responding by developing partnerships with certified organic ingredient suppliers, implementing sustainable manufacturing programs, obtaining multiple environmental certifications including EU Organic and sustainable production standards, and providing transparent environmental impact information that differentiates their products in increasingly competitive European markets emphasizing environmental responsibility and clean label commitments.

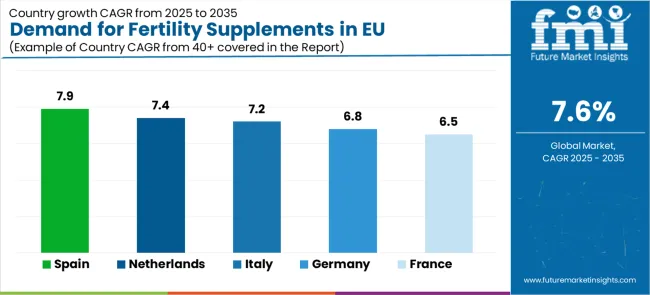

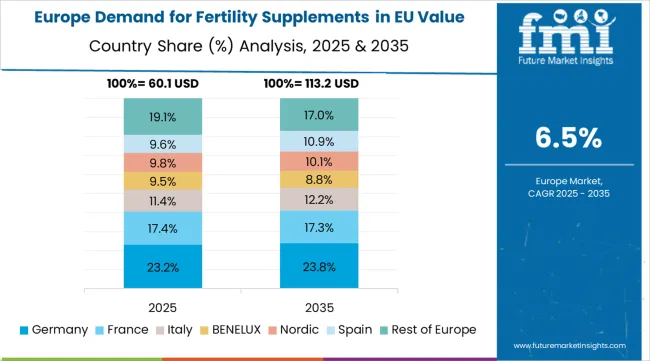

The demand for fertility supplements in EU is projected to grow from USD 250.0 million in 2025 to USD 520.0 million by 2035, registering a CAGR of 7.6% over the forecast period. Germany is expected to maintain its leadership with a 28.5% share in 2025, supported by its expansive reproductive health infrastructure and strong tradition of evidence-based healthcare utilization.

France follows with a 19.2% market share, attributed to growing demand for premium and clinical fertility solutions. Italy contributes 15.1% of the market, driven by increasing adoption in reproductive healthcare and wellness applications. Spain accounts for 8.7% of the market, while Netherlands represents 4.2%. The Rest of Europe region holds the remaining market share, encompassing Nordic countries, Eastern Europe, and other EU member states with emerging demand for fertility supplement products.

| Country | CAGR (2025-2035) |

|---|---|

| Spain | 7.9% |

| Netherlands | 7.4% |

| Italy | 7.2% |

| Germany | 6.8% |

| France | 6.5% |

The demand for fertility supplements in EU demonstrates consistent growth across major economies, with Rest of Europe leading at an 8.1% CAGR through 2035, driven by emerging reproductive health markets and expanding fertility healthcare adoption. Spain follows at 7.9%, supported by growing fertility awareness culture and Mediterranean wellness traditions. Netherlands grows at 7.4%, integrating fertility supplements into advanced reproductive healthcare practices. Italy and Germany record 7.2% and 6.8% respectively, emphasizing clinical standards and evidence-based healthcare applications. France maintains 6.5% growth, focusing on premium wellness and specialized reproductive applications.

Demand for fertility supplements in Germany is projected to exhibit steady growth with a CAGR of 6.8% through 2035, driven by exceptionally strong reproductive healthcare infrastructure, comprehensively well-established distribution networks for clinical nutrition products, and sophisticated regulatory frameworks supporting therapeutic standards throughout the country.

Germany's advanced healthcare regulations and internationally recognized clinical standards through organizations including German Society for Reproductive Medicine are creating substantial demand for certified therapeutic and specialty fertility supplements across diverse healthcare and clinical segments. Major pharmaceutical companies including Bayer HealthCare, Merck KGaA, specialized fertility clinics including IVF centers, and professional distribution networks are systematically establishing extensive product portfolios serving both reproductive health specialists and healthcare consumers throughout German medical centers, fertility clinics, and research communities.

The German market benefits from exceptionally high healthcare professional fertility supplement standards, substantial reproductive health industry presence, strong clinical validation programs delivering efficacy at accessible price points, and healthcare emphasis on evidence-based methods that naturally support premium fertility supplement adoption.

Demand for fertility supplements in France is expanding at a steady CAGR of 6.5%, substantially supported by increasing French healthcare professional preference for clinical fertility solutions and premium reproductive health products, growing awareness of nutritional fertility benefits, and sophisticated appreciation for therapeutic excellence reflecting French healthcare culture. France's well-established healthcare tradition and premium positioning strategies across medical sectors are systematically driving demand for high-quality fertility supplements across diverse healthcare and wellness segments.

Specialized healthcare suppliers including French pharmaceutical companies, traditional medical distributors, major healthcare systems (Assistance Publique, private clinics), and professional medical schools are establishing comprehensive product ranges featuring premium imported and French-manufactured fertility supplements emphasizing clinical validation and therapeutic efficacy.

The French market particularly benefits from strong cultural emphasis on healthcare quality traditions, reproductive health techniques, and evidence-based methods that align perfectly with fertility supplements' positioning as essential clinical components for superior reproductive health results.

Demand for fertility supplements in Italy is growing at a consistent CAGR of 7.2%, fundamentally driven by increasing integration of fertility supplements into traditional Italian healthcare patterns, growing recognition of reproductive health enhancement benefits, and strong Italian cultural appreciation for natural healthcare solutions and traditional wellness values.

Italy's deeply established healthcare culture is gradually incorporating specialty fertility supplements to enhance traditional reproductive health approaches, improve clinical outcomes, and modernize classic Italian healthcare methods while maintaining authentic regional characteristics.

Professional healthcare manufacturers, specialized pharmaceutical distributors including Italian suppliers, leading healthcare retailers (major Italian pharmacy groups), and traditional medical suppliers are strategically investing in education programs and clinical demonstrations addressing growing Italian interest in fertility supplement solutions.

The Italian market particularly benefits from strong cultural appreciation for therapeutic naturalness, traditional family-oriented healthcare approaches reflecting close cultural health traditions, and growing healthcare capacity particularly in Northern Italian regions supporting premium clinical product adoption.

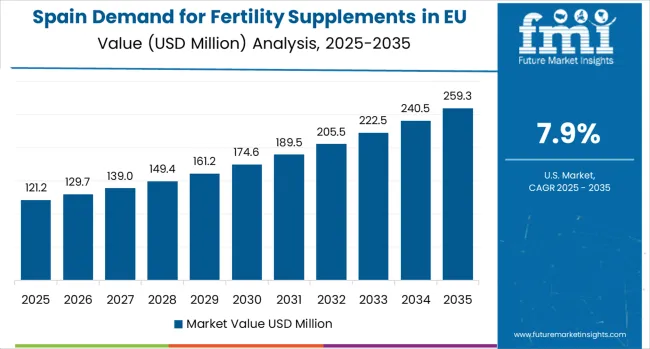

Demand for Fertility Supplements in Spain is projected to grow at a strong CAGR of 7.9%, substantially supported by rapidly expanding reproductive health sector that actively promotes fertility supplement applications, increasing Spanish consumer awareness of fertility health benefits, and growing health consciousness particularly in major metropolitan areas including Madrid, Barcelona, Valencia, and Seville.

Spanish healthcare sector is experiencing significant modernization with expansion of fertility clinics, premium reproductive health suppliers, and major healthcare distributors systematically increasing fertility supplement category investments and introducing premium therapeutic capabilities.

The Spanish market is increasingly characterized by reproductive health trends reflecting broader European patterns, growing interest in fertility supplement formulations addressing specific reproductive applications, and increasing acceptance of higher investment levels for quality fertility supplements delivering visible reproductive benefits. Spain's substantial healthcare export potential, strong cultural appreciation for reproductive wellness innovation reflecting Mediterranean values, and expanding fertility healthcare manufacturing capacity create favorable conditions for fertility supplement market expansion.

Demand for Fertility Supplements in the Netherlands is expanding at a robust CAGR of 7.4%, fundamentally driven by exceptionally strong Dutch commitment to reproductive health innovation, premium fertility supplement solutions, and clinical consciousness that positions Netherlands among European healthcare research leaders.

Dutch healthcare professionals and fertility specialists are increasingly selecting fertility supplements based on comprehensive clinical credentials, verified therapeutic efficacy through European standards, and complete research documentation demonstrating reproductive benefits and safety profiles throughout development processes.

The Netherlands market significantly benefits from exceptionally well-developed reproductive health research infrastructure including major fertility clinics, specialized fertility supplement suppliers, and professional medical distributors, combined with demonstrated willingness to invest substantial resources in fertility supplements with verified clinical certifications and efficacy standards.

Dutch regulatory environment actively supports reproductive health innovation, fertility supplement research development, transparent health claim requirements, and evidence-based validation initiatives that enhance healthcare confidence and market development.

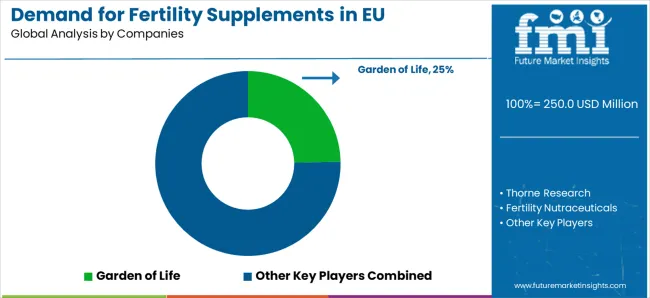

The demand for fertility supplements in EU is defined by intense competition among multinational pharmaceutical corporations, regional European manufacturers, specialized reproductive health producers, and clinical research companies from major healthcare suppliers. Companies are investing in European production capacity expansion, advanced therapeutic technologies, fertility supplement research development through European innovation centers, clinical validation solutions aligned with EU healthcare directives, and direct-to-healthcare professional distribution platforms serving diverse European reproductive health markets.

Strategic acquisitions, product portfolio expansion, geographic market penetration across Eastern European growth markets, healthcare professional partnership programs, and clinical certifications are central to strengthening market position and capturing share in this dynamic European category.

Major market participants include Garden of Life with significant European market presence through comprehensive reproductive health solutions and clinical efficacy focus manufactured at European facilities. Thorne Research maintains substantial European market leadership through healthcare integration and evidence-based fertility supplement applications across clinical sectors including professional and consumer markets.

Fertility Nutraceuticals emphasizes premium specialized reproductive health systems and technical support services for professional healthcare manufacturers across European markets. Nature's Way represents significant European ingredient innovation with specialized fertility-focused solutions and comprehensive therapeutic technologies.

Regional European producers and specialized clinical brands are establishing significant market presence through premium positioning, EU clinical certifications, specialty fertility supplement formulations including evidence-based alternatives and therapeutic options, and direct-to-healthcare professional business models.

Clinical research programs from major European reproductive health institutes including established fertility research centers provide evidence-based alternatives supporting market development, capturing meaningful market share particularly in science-driven healthcare markets. European co-manufacturing specialists including specialized therapeutic processors operate comprehensive production facilities serving both branded manufacturers and healthcare customers, representing critical infrastructure enabling market expansion and product innovation across European healthcare markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 520.1 million |

| Product Type | Vitamins & Minerals, Herbal Supplements, Others |

| Form | Tablets, Capsules, Powders, Others |

| Distribution Channel | Specialty Stores, Pharmacies, Online Retail |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, Rest of Europe |

| Key Companies Profiled | Garden of Life, Thorne Research, Fertility Nutraceuticals, Nature's Way, New Chapter, Vitafusion, Zahler, MediNatura, Carlyle, European Regional Producers |

| Additional Attributes | Dollar sales by product type, form, and distribution channel, regional demand trends across Western and Eastern European markets, competitive landscape analysis with multinational corporations and specialized European clinical brands, consumer preferences for tablets versus capsules and clinical validation requirements, integration with European reproductive health trends and fertility healthcare strategies, innovations in therapeutic technologies and clinical validation solutions aligned with EU healthcare regulations, adoption of direct sales models and healthcare professional distribution networks across EU markets, regulatory framework analysis and fertility health claim standards, supply chain optimization strategies including clinical ingredient sourcing partnerships, and market penetration analysis for diverse healthcare segments and geographic regions throughout European Union member states. |

The global demand for fertility supplements in EU is estimated to be valued at USD 250.0 million in 2025.

The market size for the demand for fertility supplements in EU is projected to reach USD 520.1 million by 2035.

The demand for fertility supplements in EU is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in demand for fertility supplements in EU are vitamins & minerals, herbal supplements and others.

In terms of form, tablets segment to command 33.8% share in the demand for fertility supplements in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EU Longevity Supplements Sales Analysis Size and Share Forecast Outlook 2025 to 2035

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

Western Europe Dietary Supplements Market Analysis by Ingredients, Form, Application, and Country Through 2025 to 2035

Demand for Dietary Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Calcium Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Probiotic Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Postbiotic Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Postnatal Health Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Fertility Test Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA