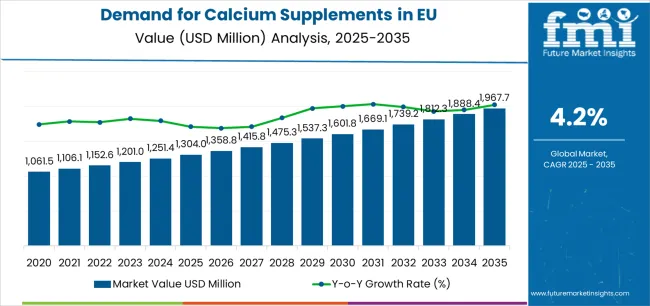

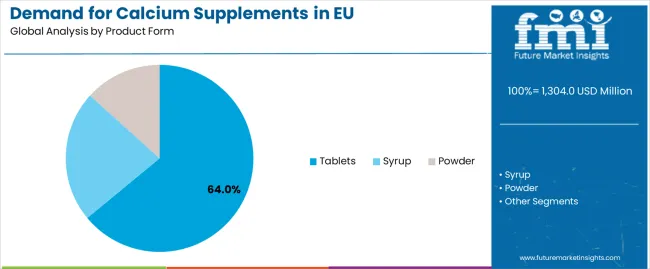

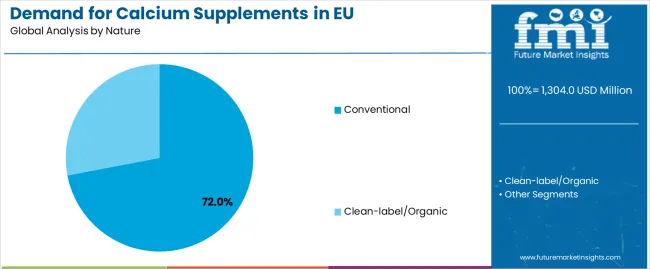

The European Union calcium supplement industry is positioned for sustained growth, projected to expand from USD 1,304.0 million in 2025 to USD 1,967.7 million by 2035, advancing at a CAGR of 4.2%. This growth trajectory reflects the convergence of multiple demographic and health trends, including aging populations requiring bone health support, increasing osteoporosis awareness, and growing preventive healthcare adoption across European markets. The tablet form maintains a dominant market position with a 64.0% share in 2025, though moderating to 60.0% by 2035 as syrup and powder formats gain traction among consumers seeking alternative delivery methods and enhanced absorption profiles.

Between 2025 and 2030, EU calcium supplement demand is projected to expand from USD 1,304.0 million to USD 1,602.0 million, resulting in a value increase of USD 298.0 million, which represents 44.9% of the total forecast growth for the decade. This initial phase of development will be characterized by rising awareness of bone health importance among middle-aged populations, increasing healthcare provider recommendations for preventive supplementation, and growing recognition that dietary calcium intake often falls below recommended levels. Manufacturers are expanding product portfolios to address evolving consumer preferences for enhanced bioavailability formulations, combination products with vitamin D and magnesium, and specialized supplements targeting specific demographic needs including postmenopausal women, elderly populations, and adolescents during peak bone-building years.

From 2030 to 2035, sales are forecast to grow from USD 1,602.0 million to USD 1,967.7 million, adding another USD 366.0 million, which constitutes 55.1% of the overall ten-year expansion. This accelerated growth period is expected to be characterized by mainstream adoption of personalized nutrition approaches, integration of advanced delivery technologies improving calcium absorption, and development of condition-specific formulations addressing diverse bone health requirements. The growing emphasis on clean-label and organic products will drive market premiumization, while expanding online distribution channels and direct-to-consumer models continue transforming purchase behaviors across European markets.

Between 2020 and 2025, EU calcium supplement sales experienced steady expansion at a CAGR of 3.0%, growing from USD 1,124.8 million to USD 1,304.0 million. This foundational period was driven by pandemic-heightened health consciousness, increasing focus on immune system support through adequate nutrition, and growing awareness of vitamin D and calcium synergy for optimal health outcomes. The industry benefited from expanded pharmacy recommendations, improved product formulations, and educational initiatives establishing consumer understanding of calcium's role beyond bone health in muscle function, nerve transmission, and cardiovascular health.

Industry expansion is fundamentally supported by demographic transitions across European countries with aging populations requiring enhanced bone health support to maintain quality of life and independence. The rising prevalence of osteoporosis and osteopenia, particularly among postmenopausal women and elderly populations, creates sustained demand for calcium supplementation as primary prevention and treatment support strategy. European healthcare systems increasingly emphasize preventive nutrition to reduce long-term healthcare costs associated with fractures, falls, and mobility limitations, driving policy support and reimbursement coverage for calcium supplementation in at-risk populations.

The growing body of clinical research demonstrating calcium's multifaceted health benefits beyond skeletal health is expanding market opportunities across diverse consumer segments. Scientific evidence supporting calcium's role in weight management, cardiovascular health, and metabolic syndrome prevention broadens appeal beyond traditional bone health positioning. Healthcare professionals increasingly recommend calcium supplementation for diverse indications including pregnancy support, PMS symptom management, and blood pressure regulation, creating multiple growth vectors. The development of enhanced bioavailability formulations using calcium citrate, calcium hydroxyapatite, and chelated minerals addresses absorption challenges, particularly important for elderly consumers with reduced gastric acid production.

Sales are comprehensively segmented by product form, application demographics, distribution channel, nature, and geographic region. This multi-dimensional segmentation framework provides granular insights into market dynamics, enabling stakeholders to identify growth opportunities and optimize strategic positioning across diverse consumer segments.

Tablets (64.0% share in 2025, 60.0% in 2035) The tablet segment commands USD 834.6 million in 2025, expanding to USD 1,180.8 million by 2035. Tablets maintain dominance through convenience, precise dosing, extended shelf life, and consumer familiarity with traditional supplement formats. Advanced tablet technologies including chewable formats, effervescent formulations, and sustained-release designs address diverse consumer preferences and absorption optimization needs. The segment benefits from cost-effective manufacturing, enabling competitive pricing essential for mainstream market penetration. Combination tablets incorporating vitamin D, magnesium, and trace minerals provide comprehensive bone health support through single-dose convenience.

Syrup (20.0% share in 2025, 22.0% in 2035) Syrup formulations generate USD 260.8 million in 2025, growing to USD 432.9 million by 2035. This segment serves pediatric populations, elderly consumers with swallowing difficulties, and adults preferring liquid formats for perceived superior absorption. Flavored syrups improve compliance among children and seniors, while liquid formulations enable dose flexibility for personalized supplementation protocols. The segment's growth reflects increasing demand from caregivers seeking easy-to-administer formats and consumers believing liquid calcium offers enhanced bioavailability compared to solid forms.

Powder (16.0% share in 2025, 18.0% in 2035) Powder formats account for USD 208.6 million in 2025, expanding to USD 354.3 million by 2035. This segment appeals to consumers seeking versatile supplementation options allowing incorporation into beverages, smoothies, and food products. Powder formats enable higher calcium doses per serving compared to tablets, benefiting individuals with significant supplementation requirements. The segment's growth reflects trends toward functional nutrition, with calcium-fortified powder blends combining protein, vitamins, and minerals for comprehensive nutritional support.

Conventional Calcium Supplements (72.0% share in 2025, 62.0% in 2035) Conventional calcium supplements maintain dominant position with USD 938.9 million in 2025, expanding to USD 1,220.2 million by 2035. This segment serves mainstream consumers prioritizing efficacy, affordability, and accessibility over premium attributes. Conventional products benefit from established manufacturing processes, economies of scale, and widespread distribution through pharmacies and mass retail channels. The segment successfully balances quality standards with competitive pricing, serving price-sensitive consumers and healthcare system reimbursement programs requiring cost-effective solutions.

Clean-Label/Organic Calcium Supplements (28.0% share in 2025, 38.0% in 2035) The clean-label/organic segment represents USD 365.1 million in 2025, growing substantially to USD 747.8 million by 2035, driven by increasing consumer demand for transparency, natural sourcing, and minimal processing. Clean-label calcium derived from algae, coral, and plant sources commands premium pricing averaging 30-45% above conventional variants, justified by sustainable sourcing, superior mineral profiles, and alignment with holistic health philosophies. This segment particularly resonates with educated, affluent consumers prioritizing ingredient quality, environmental sustainability, and whole-food nutrition approaches.

The rising prevalence of osteoporosis and bone health concerns is a major driver for the calcium supplements market across Europe. With an aging population increasingly at risk of fractures, bone density loss, and related mobility issues, calcium supplementation is gaining traction as both a preventive and corrective health measure. This demographic trend is expected to continue fueling demand over the forecast period.

Preventive healthcare adoption is another strong growth factor. Consumers are increasingly conscious of long-term wellness and nutrition, leading to higher uptake of calcium supplements in daily routines. Post-menopausal women and elderly populations are particularly targeted, given their elevated risk of calcium deficiency and bone degeneration.

A further catalyst is the fortification of functional food and beverage products. Calcium is no longer limited to standalone supplement formats like tablets or capsules; it is now being incorporated into fortified dairy alternatives, plant-based beverages, breakfast cereals, and nutrition bars. This shift toward integrated nutrition broadens consumer reach and aligns calcium intake with everyday food habits.

Additionally, the sports nutrition sector is driving diversification. Calcium supplementation is increasingly embraced by athletes and fitness enthusiasts due to its role in muscle contraction, endurance, and recovery, boosting demand beyond traditional elderly and women-focused consumer groups.

Despite these drivers, the market faces restraints. One key barrier is skepticism around absorption and bioavailability, as consumers question whether supplemental calcium delivers the same benefits as dietary sources. This limits repeat purchase among more informed or skeptical demographics.

There are also risks of side effects and overconsumption, such as kidney stones, constipation, or even cardiovascular concerns, which create hesitation around high-dosage product usage. These safety concerns, while not universal, restrain aggressive adoption.

Price sensitivity also acts as a hurdle, with many consumers preferring to obtain calcium from natural dietary sources like dairy or fortified foods instead of purchasing standalone supplements. Furthermore, regulatory complexity across EU member states—covering health claims, labeling, and dosage thresholds—creates friction for manufacturers, slowing new product launches and cross-border harmonization.

On the trend side, one of the most significant shifts is the expansion of functional food integration. Calcium is increasingly embedded into formats like fortified plant milks, snack bars, and ready-to-drink shakes. This allows consumers to access calcium through familiar, convenient foods rather than separate supplement routines, appealing especially to busy professionals, active families, and younger demographics.

The growth of premium organic and natural certification is also reshaping the landscape. Producers are emphasizing clean-label and natural calcium sources such as algae-derived or eggshell-based formulations, supported by EU Organic and vegan certifications. Clinical validation of bioavailability and transparent sourcing are becoming essential to capture the premium, quality-driven segment of the European market.

At the same time, innovation in delivery formats is helping overcome barriers to adoption. Gummies, effervescent tablets, liquid shots, and microencapsulated powders are being launched to improve taste, compliance, and convenience. Travel-friendly packaging and single-serve sachets target younger and mobile consumers, increasing everyday usage occasions. Finally, the market is being shaped by digital health integration. Partnerships with wellness platforms, bone density monitoring applications, and personalized nutrition services are connecting calcium supplementation with measurable health outcomes. This digital link enhances consumer trust, engagement, and compliance, while also opening up new avenues for personalized supplement recommendations.

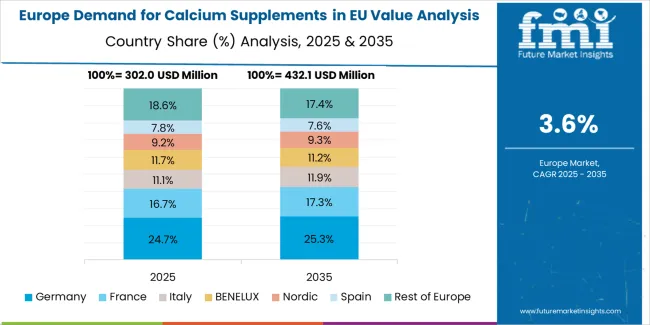

The EU calcium supplements market is forecast to expand from USD 9,560.0 million in 2025 to USD 16,890.0 million by 2035, reflecting a CAGR of 5.7% during the period. Growth across the region is underpinned by aging demographics, rising adoption of preventive nutrition, and continuous innovation in fortified product development. Germany holds the largest share of the market at 28.0% in 2025, supported by its significant aging population, a deeply rooted supplement culture, and proactive government and healthcare programs focused on osteoporosis prevention. France follows with a 19.0% share, driven by strong adoption in women’s health and a growing presence of calcium in functional dairy and plant-based beverages.

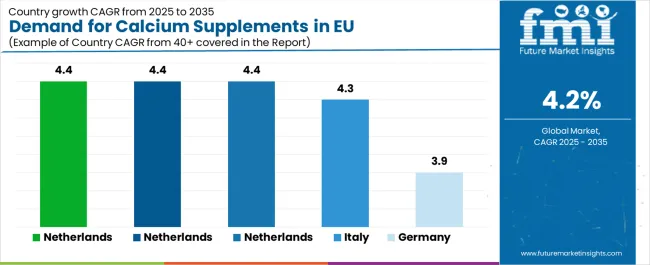

Italy, accounting for 13.0% of the market, is seeing steady expansion as consumer awareness of bone and joint health increases, aided by the launch of new functional food products. Spain represents 11.0%, where rising expenditure on preventive healthcare and a preference for convenient supplement formats such as effervescent tablets are spurring demand. The Netherlands, with 7.0% of the market, benefits from high consumer trust in clean-label and vegan-certified supplements, positioning it as an early adopter of premium, natural calcium products. The Rest of Europe, making up the remaining 22.0%, is experiencing broad-based growth across the Nordics, Eastern Europe, and BENELUX. In these markets, preventive healthcare awareness is rapidly catching up with Western Europe, creating new opportunities for supplement manufacturers to expand penetration.

Germany commands 28.0% of EU calcium supplement market share in 2025, with revenue projected to grow from USD 364.8 million to USD 532.8 million by 2035 at 3.9% CAGR. The country's aging population, comprehensive healthcare system, and strong preventive health culture drive consistent calcium supplement demand. German consumers demonstrate high health literacy, understanding calcium's importance for bone density maintenance and osteoporosis prevention. Extensive pharmacy networks provide professional guidance while insurance coverage for prescribed supplements ensures accessibility.

The market benefits from rigorous quality standards, with German consumers preferring clinically-validated formulations from established pharmaceutical companies. Strong organic market development reflects environmental consciousness, though price sensitivity limits premium segment expansion. Distribution through drugstore chains like DM and Rossmann complements pharmacy sales, providing competitive pricing and convenient access. Despite market maturity, innovation in delivery formats and combination products sustains growth momentum.

France represents 17.2% of EU calcium supplement sales, expanding from USD 224.0 million in 2025 to USD 343.2 million by 2035 at 4.4% CAGR. French healthcare system emphasis on preventive medicine and reimbursement for prescribed supplements supports market development. Pharmacy monopoly on health product sales ensures professional guidance and quality control, building consumer confidence in supplementation. French consumers increasingly adopt holistic health approaches, seeking natural calcium sources and clean-label formulations. The market benefits from strong women's health focus, with targeted products addressing life-stage specific needs.

Growing elderly population and osteoporosis awareness drive demand for comprehensive bone health solutions. Parapharmacy development within hypermarkets expands distribution while maintaining professional credibility. Cultural emphasis on pharmaceutical solutions over dietary changes supports supplement adoption. Innovation in French laboratories produces advanced formulations with enhanced bioavailability. Marketing emphasizing scientific validation resonates with educated French consumers valuing evidence-based health decisions.

Italy accounts for 12.5% of EU calcium supplement market, growing from USD 163.2 million in 2025 to USD 249.6 million by 2035 at 4.3% CAGR. Italian consumers increasingly recognize supplementation importance despite traditional Mediterranean diet reputation, addressing modern dietary inadequacies and aging population needs. The country's rapidly aging demographic, with highest EU proportion of elderly citizens, creates substantial demand for bone health products. Pharmacy-centric distribution ensures professional recommendations while expanding parapharmacy channels improve accessibility. Italian preference for combination products incorporating vitamin D and magnesium drives product innovation.

Regional health disparities create varied market dynamics, with northern regions showing higher supplement adoption. Family-oriented culture encourages intergenerational health awareness, supporting market education efforts. Growing health consciousness among younger Italians drives preventive supplementation adoption. Economic recovery enables increased health spending on premium supplement options. Traditional medicine integration creates opportunities for innovative natural calcium formulations.

Market Dynamics:

Spain demonstrates 10.6% market share, with sales projected to increase from USD 137.6 million in 2025 to USD 211.2 million by 2035 at 4.4% CAGR. Spanish market recovery following economic challenges creates pent-up demand for health products including calcium supplements. Expanding private health insurance coverage includes preventive nutrition benefits, supporting supplement accessibility. Mediterranean lifestyle paradox of healthy diet reputation versus modern nutritional realities drives supplementation needs. Growing awareness of osteoporosis risk, particularly among postmenopausal women, increases calcium demand.

Pharmacy liberalization allows broader distribution while maintaining professional guidance through trained staff. Tourism industry creates additional market through visitor purchases and expatriate communities. Regional autonomy in healthcare creates varied reimbursement policies affecting market dynamics. Increasing sports participation and fitness culture drive calcium demand among active populations. Digital health adoption enables online consultation and personalized supplement recommendations. Economic improvement enables trading up to premium, clinically-validated calcium products.

Growth Enablers:

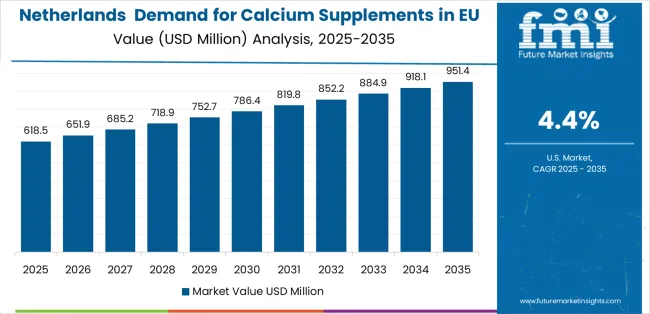

The Netherlands represents 5.5% of EU market share, expanding from USD 72.0 million in 2025 to USD 110.4 million by 2035 at 4.4% CAGR. Dutch consumers exhibit high health literacy and preventive health engagement, supporting consistent calcium supplement adoption. Progressive healthcare policies emphasizing prevention over treatment create favorable supplementation environment. Strong cycling culture and active lifestyle increase awareness of bone health importance across age groups.

Multiculturalism introduces diverse health practices and supplement preferences, expanding market segmentation opportunities. Advanced retail infrastructure and high e-commerce penetration facilitate convenient supplement access. Environmental consciousness drives demand for sustainable, plant-based calcium sources. Workplace wellness programs increasingly include nutritional supplementation benefits. High female workforce participation creates demand for convenient, effective calcium solutions. Innovation in Dutch research institutions produces novel calcium formulations and delivery systems. Regulatory efficiency facilitates new product introductions and market entry.

Competitive Advantages:

Rest of Europe collectively represents 26.3% market share, growing from USD 342.4 million in 2025 to USD 520.8 million by 2035 at 4.3% CAGR. This diverse region encompasses Belgium, Austria, Poland, Scandinavian countries, and Eastern European nations exhibiting varied development stages. Nordic countries demonstrate sophisticated supplement markets with high per-capita consumption, quality focus, and preventive health emphasis. Eastern European markets show rapid growth from lower bases as economic development enables health spending increases.

Belgium's pharmaceutical industry strength and central location support distribution hub development. Austria's alpine lifestyle and health consciousness drive premium calcium supplement demand. Poland's large population presents volume opportunities despite price sensitivity and limited reimbursement. Scandinavian welfare systems support preventive nutrition through various reimbursement mechanisms. Baltic states show accelerating growth as EU integration improves product access and affordability. Regional diversity requires tailored strategies balancing premium positioning in developed markets with accessibility in emerging ones.

Regional Opportunities:

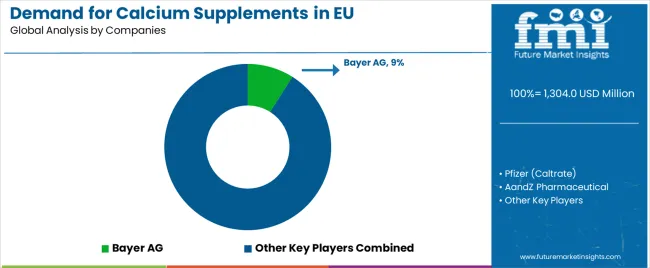

EU calcium supplement sales are characterized by competition among global pharmaceutical companies, specialized nutrition firms, and regional supplement manufacturers. Companies compete through clinical validation, formulation innovation, brand trust, and distribution network strength. Strategic focus on product differentiation, scientific substantiation, and consumer education remains central to competitive positioning.

Bayer AG maintains market leadership with an estimated 9.0% share, leveraging strong pharmacy presence, trusted healthcare brand portfolio, and extensive clinical research supporting product efficacy. Bayer's pharmaceutical heritage provides credibility while consumer health division expertise ensures market-appropriate formulations. The company benefits from integrated European operations, established distributor relationships, and comprehensive marketing capabilities reaching healthcare professionals and consumers.

Nestlé Health Science holds approximately 7.5% share through strategic acquisitions, innovative formulations, and strong research and development capabilities. The company's nutrition expertise, global sourcing networks, and advanced manufacturing technologies support consistent quality and competitive pricing. Focus on medical nutrition and condition-specific formulations differentiates products in crowded marketplace.

Pfizer (Caltrate) accounts for roughly 6.5% share through established brand recognition, pan-European availability, and clinical positioning emphasizing bone density preservation. Caltrate's long market presence, healthcare provider familiarity, and extensive clinical evidence support premium pricing and strong pharmacy recommendations.

Haleon/GSK captures 5.5% share through pharmacy-led bone health product lines, combining consumer health expertise with pharmaceutical credibility. The company's recent formation consolidates strong brand portfolios, distribution networks, and innovation capabilities supporting competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,967.7 million (2035) |

| Product Form | Tablets, Syrup, Powder |

| Application | Women's Health, General Adult, Senior/Aging, Pediatric |

| Distribution Channel | Pharmacy/Drugstore, Online/Marketplace, Mass Retail/Grocery |

| Nature | Conventional, Clean-label/Organic |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Bayer AG, Nestlé Health Science, Pfizer (Caltrate), Haleon/GSK |

Product Form

The global demand for calcium supplements in EU is estimated to be valued at USD 1,304.0 million in 2025.

The market size for the demand for calcium supplements in EU is projected to reach USD 1,967.7 million by 2035.

The demand for calcium supplements in EU is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in demand for calcium supplements in EU are tablets, syrup and powder.

In terms of nature, conventional segment to command 72.0% share in the demand for calcium supplements in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Calcium Propionate Market Outlook – Share, Growth & Forecast 2025-2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

EU Longevity Supplements Sales Analysis Size and Share Forecast Outlook 2025 to 2035

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Western Europe Dietary Supplements Market Analysis by Ingredients, Form, Application, and Country Through 2025 to 2035

Demand for Dietary Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Fertility Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Probiotic Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Postbiotic Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Postnatal Health Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Calcium Supplement in Western Europe Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Calcium Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA