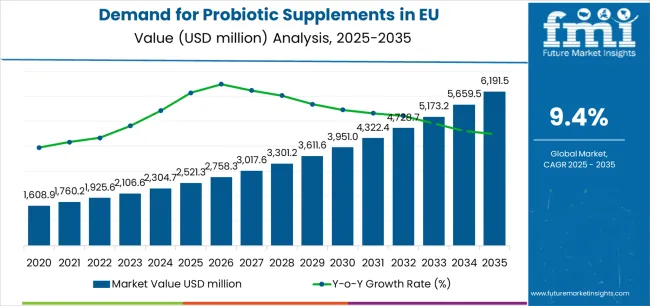

European Union probiotic supplements sales are projected to grow from USD 2,521.3 million in 2025 to approximately USD 6,191.5 million by 2035, recording an absolute increase of USD 3,656.6 million over the forecast period. This translates into total growth of 145%, with demand forecast to expand at a compound annual growth rate (CAGR) of 9.4% between 2025 and 2035. FMI’s recent insights, acknowledged across nutrition, sweetener, and alternative protein markets, indicate that the overall industry size is expected to grow by nearly 2.5X during the same period, supported by the increasing awareness of gut health importance, growing scientific validation of probiotic benefits, and expanding applications across digestive wellness, immune support, and metabolic health throughout European pharmacy and online retail channels.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,521.3 million |

| Market Forecast Value (2035) | USD 6,191.5 million |

| Forecast CAGR (2025-2035) | 9.4% |

Between 2025 and 2030, EU probiotic supplements demand is projected to expand from USD 2,521.3 million to USD 3,914.9 million, resulting in a value increase of USD 1,393.6 million, which represents 38.1% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer awareness of gut-brain axis connections, increasing scientific evidence supporting probiotic efficacy, and growing mainstream acceptance of probiotic supplements as preventive health solutions. Manufacturers are expanding their product portfolios to address the evolving preferences for strain-specific formulations, clinically validated products, and multi-strain combinations targeting diverse health benefits.

From 2030 to 2035, sales are forecast to grow from USD 3,914.9 million to USD 6,177.9 million, adding another USD 2,263 million, which constitutes 61.9% of the overall ten-year expansion. This period is expected to be characterized by further expansion of specialized probiotic formulations, integration of postbiotic and synbiotic innovations, and development of personalized probiotic solutions targeting individual microbiome profiles. The growing emphasis on scientific substantiation and increasing consumer willingness to invest in premium probiotic supplements will drive demand for high-quality products that deliver measurable health outcomes with documented strain efficacy.

Between 2020 and 2025, EU probiotic supplements sales experienced robust expansion at a CAGR of 9.4%, growing from USD 1,610.7 million to USD 2,521.3 million. This period was driven by increasing gut health awareness accelerated by pandemic-related immunity concerns, rising recognition of microbiome's role in overall health, and growing scientific literature supporting probiotic benefits. The industry developed as pharmaceutical companies, specialized nutrition brands, and wellness companies recognized the commercial potential of evidence-based probiotic solutions. Product innovations, improved strain stability technologies, and clinical validation began establishing consumer confidence and mainstream acceptance of probiotic supplements.

Industry expansion is being supported by the rapid increase in digestive health concerns across European populations and the corresponding demand for natural, scientifically validated, and targeted wellness solutions with proven efficacy in gut microbiome support. Modern consumers rely on probiotic supplements as essential tools for maintaining digestive balance, supporting immune function, and optimizing metabolic health, driving demand for products that deliver clinically studied strains, appropriate colony forming unit (CFU) counts, and guaranteed potency through shelf life. Even minor digestive concerns, such as occasional bloating, irregular bowel movements, or antibiotic-associated disruption, can drive comprehensive adoption of probiotic supplements to restore optimal gut health and support overall wellbeing.

The growing awareness of microbiome science and increasing recognition of probiotic supplements' health benefits are driving demand for evidence-based products from reputable manufacturers with appropriate strain identification and clinical documentation. Regulatory authorities are increasingly establishing clear guidelines for probiotic labeling, strain nomenclature standards, and health claim validation to maintain consumer safety and ensure product quality. Scientific research studies and clinical trials are providing evidence supporting specific probiotic strains' digestive and immune benefits, requiring specialized manufacturing protocols and quality assurance systems for strain purity verification, CFU count accuracy, and stability maintenance throughout distribution and storage.

Sales are segmented by product type (bacteria type), application (functionality), distribution channel, nature, and country. By product type, demand is divided into Lactobacillus, Bifidobacterium, Streptococcus, Bacillus coagulans, Saccharomyces, and Lactococcus lactis strains. Based on application, sales are categorized into digestive health, immune support, metabolic health, and others. In terms of distribution channel, demand is segmented into pharmacy/drugstores, online/e-commerce, supermarkets/hypermarkets, and specialty/others. By nature, sales are classified into conventional, organic, non-GMO, and vegan. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

.webp)

The Lactobacillus segment is projected to account for 35% of EU probiotic supplements sales in 2025, declining slightly to 33% by 2035, establishing itself as the most widely used bacterial genus across European formulations. This commanding position is fundamentally supported by Lactobacillus strains' extensive clinical documentation, proven digestive health benefits, and broad safety profile enabling widespread consumer acceptance. The Lactobacillus segment delivers exceptional formulation value, providing manufacturers with well-researched strains that facilitate evidence-based marketing, health claim substantiation, and professional endorsement essential for market credibility.

This segment benefits from decades of scientific research, well-established manufacturing protocols, and comprehensive strain libraries from multiple probiotic suppliers who maintain rigorous quality standards and genetic stability verification. Additionally, Lactobacillus strains offer versatility across various applications, including digestive wellness, vaginal health, immune support, and oral health, supported by proven survival technologies addressing traditional challenges in gastric acid resistance and shelf-life stability.

The segment is expected to maintain its leadership position through 2035 at 33%, demonstrating stable dominance as emerging strains like Bifidobacterium complement rather than displace Lactobacillus's established scientific foundation throughout the forecast period.

Key advantages:

.webp)

Digestive health applications are positioned to represent 38% of total probiotic supplements demand across European operations in 2025, declining to 34% by 2035, reflecting the segment's maturity as the foundational application within the overall category. This substantial share directly demonstrates that digestive wellness represents the primary consumer motivation, with individuals purchasing probiotic supplements for bloating relief, regularity support, IBS symptom management, and general gut health maintenance.

Modern consumers increasingly view digestive health probiotics as essential wellness tools, driving demand for products optimized for specific digestive concerns with appropriate strain selection, sufficient CFU counts ensuring therapeutic dosage, and targeted delivery systems protecting bacterial viability. The segment benefits from continuous innovation focused on strain-specific research, improved enteric coating technologies, and multi-strain formulations enhancing comprehensive digestive support.

The segment's declining share reflects faster expansion in immune support and metabolic health applications, with digestive health maintaining solid absolute growth while representing a smaller percentage as alternative wellness applications expand throughout the forecast period.

Key drivers:

Pharmacies and drugstores are strategically estimated to control 40% of total European probiotic supplements sales in 2025, declining to 34% by 2035, reflecting the critical importance of pharmacy channels for ensuring professional guidance and cold chain management. European consumers consistently demonstrate preference for pharmacy purchases that deliver pharmacist consultation, quality assurance confidence, and proper storage handling across temperature-sensitive probiotic products.

The segment provides essential value through expert recommendations, personalized strain selection guidance, and refrigerated storage protocols supporting probiotic viability and efficacy. Major European pharmacy chains, including DocMorris, Boots, Apoteket, and independent pharmacies, systematically expand probiotic supplement selections, often featuring pharmacist-endorsed brands, clinically validated formulations, and refrigerated storage sections that establish consumer trust and product quality confidence.

The segment's declining share through 2035 reflects rapidly growing online/e-commerce adoption, which expands from 35% to surpass pharmacy channels at 41%, as digital-savvy consumers increasingly leverage convenient online purchasing with improved cold chain shipping while maintaining pharmacy preference for complex health consultations throughout the forecast period.

Success factors:

Conventional probiotic supplements are strategically positioned to contribute 70% of total European sales in 2025, declining to approximately 55% by 2035, representing products manufactured through standard fermentation processes meeting regulatory requirements without organic, non-GMO, or vegan certifications. These conventional products successfully deliver proven probiotic efficacy and consistent quality while ensuring broad commercial availability across all retail channels that prioritize clinical validation and cost accessibility.

Conventional production serves mainstream consumers, value-conscious shoppers, and medically motivated users that require evidence-based probiotics at accessible price points without premium certifications. The segment derives significant competitive advantages from established manufacturing infrastructure, economies of scale enabling competitive pricing, and the ability to utilize proven excipients and stabilizers optimizing bacterial survival and shelf stability.

The segment's declining share through 2035 reflects the category's rapid evolution toward premium certified products, with organic growing from 12% to 20%, vegan expanding from 8% to 13%, and non-GMO increasing from 10% to 12%, as health-conscious consumers increasingly prioritize clean-label formulations and natural certification aligned with holistic wellness philosophies.

Competitive advantages:

EU probiotic supplements sales are advancing robustly due to increasing gut health awareness, growing scientific validation of microbiome importance, and rising preventive healthcare adoption. However, the industry faces challenges, including regulatory complexity requiring strain-specific health claim validation, cold chain requirements increasing distribution costs, and consumer confusion regarding appropriate strain selection. Continued innovation in stability technologies and personalized probiotic solutions remains central to industry development.

The rapidly accelerating development of next-generation probiotic products is fundamentally transforming the category from live bacterial supplements to comprehensive microbiome support solutions, enabling postbiotic metabolites and synbiotic combinations delivering enhanced efficacy previously unattainable through probiotics alone. Advanced formulation platforms featuring heat-killed bacteria with immunogenic properties, bacterial metabolites providing direct health benefits, and synergistic prebiotic-probiotic combinations allow manufacturers to create products with improved stability, broader health benefits, and enhanced consumer convenience eliminating refrigeration requirements. These innovation breakthroughs prove particularly transformative for immune-focused consumers, shelf-stable product seekers, and comprehensive wellness enthusiasts, where advanced formulations prove essential for efficacy confidence and usage convenience.

Major probiotic supplement brands invest heavily in postbiotic research, synbiotic formulation development, and stability testing programs, recognizing that next-generation products represent premium positioning opportunities for differentiated offerings. Manufacturers collaborate with microbiome researchers, formulation scientists, and clinical investigators to develop evidence-based innovations that deliver measurable health outcomes while maintaining regulatory compliance supporting emerging health claim categories.

Modern probiotic supplement companies systematically incorporate digital health platforms, including microbiome testing services, AI-powered strain recommendation algorithms, and personalized formulation capabilities that deliver customized probiotic solutions based on individual gut microbiome composition, health goals, and lifestyle factors. Strategic integration of personalization technologies enables manufacturers to position probiotic supplements as precision wellness solutions where individualized strain selection directly determines health outcome optimization and consumer satisfaction. These personalization innovations prove essential for premium positioning, as health-conscious consumers demand scientific personalization, measurable outcome tracking, and data-driven product recommendations supporting individualized wellness strategies.

Companies implement extensive digital infrastructure development, genetic testing partnerships, and algorithm validation protocols targeting recommendation accuracy, including microbiome analysis interpretation, strain-health outcome correlation, and personalized dosage optimization. Manufacturers leverage personalization positioning in direct-to-consumer marketing, subscription model development, and outcomes-based engagement, positioning personalized probiotics as next-generation wellness solutions delivering individualized health optimization.

European consumers increasingly prioritize probiotic supplements featuring specific strain designations, published clinical research, and health condition-targeted formulations demonstrating measurable efficacy beyond generic "probiotic" claims. This specificity trend enables manufacturers to drive premium pricing through evidence-based positioning, establish medical professional endorsement through clinical documentation, and create differentiated products resonating with informed consumers seeking validated wellness solutions. Strain-specific marketing proves particularly important for digestive condition management where clinical evidence directly influences purchasing decisions and healthcare provider recommendations.

The development of sophisticated clinical research programs, including randomized controlled trials, systematic review publications, and strain-specific health outcome documentation expands manufacturers' abilities to create scientifically substantiated products supporting regulatory health claims. Brands collaborate with gastroenterologists, clinical researchers, and medical institutions to develop validated formulations balancing clinical efficacy with commercial scalability, supporting professional endorsement and consumer trust while maintaining competitive pricing across evidence-based probiotic categories.

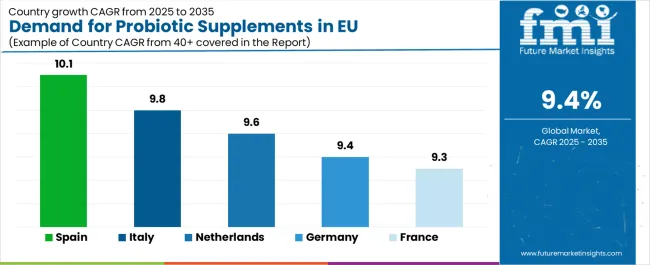

| Country | CAGR % (2025-2035) |

|---|---|

| Spain | 10.1 |

| Italy | 9.8 |

| Netherlands | 9.6 |

| Germany | 9.4 |

| France | 9.3 |

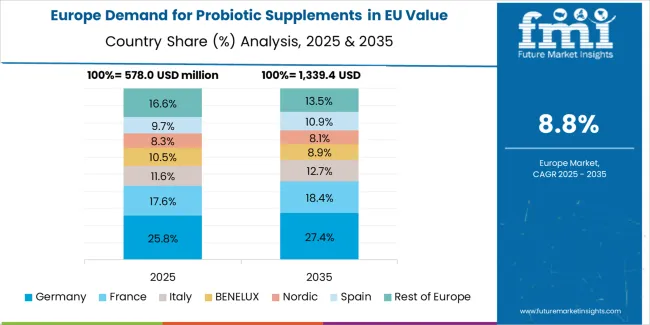

EU probiotic supplements sales demonstrate exceptional growth across major European economies, with Rest of Europe leading expansion at 10.3% CAGR through 2035, driven by emerging market development and growing wellness adoption. Spain shows robust growth at 10.1% CAGR through accelerating health awareness. Italy maintains 9.8% CAGR, benefiting from developing supplement culture. Netherlands records 9.6% CAGR with growing gut health focus. Germany and France show solid 9.4% and 9.3% CAGR maintaining established market positions. Overall, sales show strong regional development reflecting EU-wide microbiome awareness and probiotic supplement acceptance.

Revenue from probiotic supplements in Germany is projected to exhibit robust growth with a CAGR of 9.4% through 2035, driven by exceptionally well-developed pharmacy distribution network, comprehensive health insurance supporting preventive wellness, and strong consumer commitment to evidence-based supplementation throughout the country. Germany's sophisticated understanding of microbiome science and internationally recognized leadership in pharmaceutical quality standards are creating substantial demand for high-quality probiotic supplements across all consumer segments.

Major pharmacy chains and independent apotheken systematically expand probiotic supplement selections, often dedicating refrigerated storage sections to temperature-sensitive formulations positioned prominently to encourage pharmacist consultation-based purchasing. German demand benefits from high health consciousness, substantial disposable income supporting premium supplements, and medical professional involvement that naturally supports probiotic supplement adoption across mainstream consumers seeking clinically validated digestive wellness solutions.

Growth drivers:

Revenue from probiotic supplements in France is expanding at a CAGR of 9.3% through 2035, supported by strong pharmacy tradition, growing awareness of microbiome importance, and evolving consumer attitudes toward digestive health supplementation. France's sophisticated healthcare system and increasing recognition of probiotics' preventive health roles are driving demand for quality supplements across diverse demographic segments.

Major pharmacy chains establish comprehensive probiotic supplement ranges serving growing consumer demand while maintaining professional oversight and cold chain integrity. French sales particularly benefit from medical professional influence supporting evidence-based supplement adoption, driving category legitimacy and consumer confidence within the traditional pharmaceutical retail environment focused on scientifically validated wellness products.

Success factors:

Revenue from probiotic supplements in Italy is growing at a robust CAGR of 9.8% through 2035, fundamentally driven by increasing digestive health awareness among Italian consumers, growing supplement category acceptance, and evolving wellness approaches incorporating preventive probiotic supplementation. Italy's traditionally diet-focused health culture is rapidly embracing probiotic supplements as consumers recognize gut microbiome importance and digestive wellness benefits.

Major pharmacy chains and health retailers strategically invest in probiotic supplement category expansion and consumer education programs addressing growing interest in microbiome wellness. Italian sales particularly benefit from rising digestive health concerns, creating natural demand for probiotic solutions, combined with increasing wellness awareness in Milan, Rome, and other major cities contributing to accelerated market expansion.

Development factors:

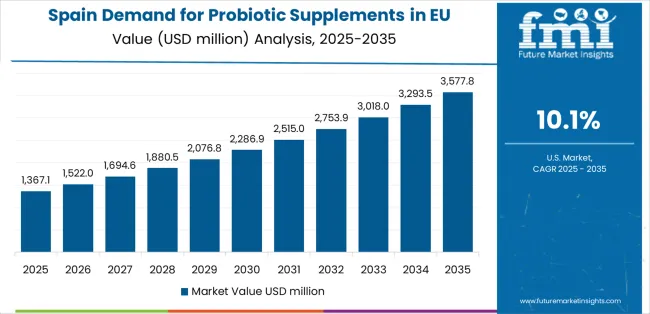

Demand for probiotic supplements in Spain is projected to grow at a robust CAGR of 10.1% through 2035, substantially supported by rapidly increasing health consciousness among Spanish consumers, expanding pharmacy and online distribution, and growing awareness of gut health importance. Spanish consumer interest in wellness and preventive health positions probiotic supplements as aligned with evolving health-focused lifestyles.

Major pharmacy chains and online retailers systematically expand probiotic supplement offerings, with growing consumer demand for digestive support, immune enhancement, and general wellness products driving accelerated category development. Spain's rapidly evolving wellness culture supports probiotic supplement adoption among health-conscious consumers seeking microbiome optimization and preventive health strategies.

Growth enablers:

Demand for probiotic supplements in the Netherlands is expanding at a CAGR of 9.6% through 2035, fundamentally driven by strong evidence-based wellness culture, high consumer awareness of microbiome science, and progressive health attitudes supporting preventive supplementation. Dutch consumers demonstrate particularly high receptivity to scientifically validated probiotics and willingness to invest in evidence-based digestive wellness.

Netherlands sales significantly benefit from well-developed pharmacy infrastructure, progressive health policies supporting preventive care, and educated consumer base valuing clinical documentation and strain-specific efficacy. The country's advanced healthcare system coexists with strong supplement adoption, as consumers increasingly seek proactive microbiome management beyond traditional medical interventions.

Innovation drivers:

Demand for probiotic supplements in Rest of Europe is expanding at the leading CAGR of 10.3% through 2035, representing collective strength across diverse smaller EU markets including Poland, Czech Republic, Belgium, Austria, and other European countries demonstrating rapid wellness adoption. These varied markets show fastest growth driven by emerging supplement culture, increasing gut health awareness, and modernizing retail distribution.

Rest of Europe sales benefit from developing wellness consciousness, increasing online retail penetration introducing probiotic supplements to broader audiences, and growing health awareness creating new consumer segments. These markets represent highest growth potential as supplement acceptance accelerates and microbiome awareness expands across diverse European populations previously underserved by probiotic supplement availability.

Development drivers:

EU probiotic supplements sales are projected to grow from USD 2,521.3 million in 2025 to USD 6,177.9 million by 2035, registering a CAGR of 9.4% over the forecast period. Spain is expected to demonstrate the strongest growth trajectory with a 10.1% CAGR, supported by rapidly growing wellness awareness and expanding retail distribution. Italy follows with 9.8% CAGR, attributed to increasing digestive health focus and developing supplement culture.

Germany maintains the largest share at 33.7% in 2025, driven by extensive pharmacy infrastructure and strong health consciousness, while growing at 9.4% CAGR. France holds 24.1% share growing at 9.4% CAGR, while Italy and Spain demonstrate accelerated growth at 9.8% and 10.1% respectively. Netherlands shows 9.6% CAGR with 2.8% share, while Rest of Europe demonstrates 10.3% CAGR reflecting emerging market dynamics.

EU probiotic supplements sales are defined by competition among multinational pharmaceutical companies, specialized probiotic brands, wellness companies, and direct-to-consumer startups. Companies are investing in clinical validation, strain-specific research, personalized nutrition platforms, and cold chain optimization to deliver high-quality, scientifically validated, and consumer-trusted probiotic supplements. Strategic partnerships with healthcare professionals, pharmacy chains, and microbiome research institutions, along with clinical trial investments and transparency initiatives, are central to strengthening competitive position.

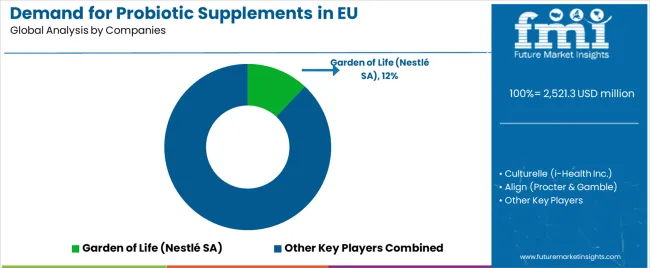

Major participants include Garden of Life (Nestlé SA) with an estimated 12% share, leveraging its premium positioning, comprehensive strain portfolio, and established European presence through health retailer partnerships. Garden of Life benefits from Nestlé's scientific resources, global distribution capabilities, and ability to position probiotics alongside nutrition products, supporting mainstream acceptance and premium brand credibility.

Culturelle (i-Health Inc.) holds approximately 9% share, emphasizing pharmacy channel strength, evidence-based health claims, and Lactobacillus GG strain leadership with extensive clinical documentation. The company's success in developing pharmacist-endorsed probiotics with proven efficacy creates strong positioning among digestive health seekers, supported by professional recommendation programs and clinical evidence marketing.

Align accounts for roughly 7% share through its position as gastroenterologist-recommended brand with Bifidobacterium 35624 strain, providing targeted IBS support through clinical validation and medical professional partnerships. The company benefits from healthcare provider endorsement, condition-specific positioning, and pharmaceutical-grade quality supporting professional confidence and consumer trust.

NOW Foods represents approximately 5% share, supporting growth through broad online distribution, competitive pricing strategies, and comprehensive probiotic portfolio spanning multiple strains and formulations. NOW Foods leverages e-commerce effectiveness, value positioning, and extensive product range enabling consumer choice across diverse probiotic needs and budget considerations.

Other companies collectively hold 67% share, reflecting highly competitive dynamics within European probiotic supplements sales, where numerous specialized brands, pharmacy private labels, direct-to-consumer startups, and emerging personalized probiotic companies serve specific consumer preferences, therapeutic niches, and distribution channels. This competitive environment provides opportunities for differentiation through specialized strain formulations, clinical validation, personalized microbiome platforms, and targeted health condition positioning resonating with health-conscious consumers seeking trusted probiotic partners.

| Item | Value |

|---|---|

| Quantitative Units | USD 6,177.9 million |

| Product Type (Bacteria Type) | Lactobacillus, Bifidobacterium, Streptococcus, Bacillus coagulans, Saccharomyces, Lactococcus lactis |

| Application (Functionality) | Digestive Health, Immune Support, Metabolic Health, Others |

| Distribution Channel | Pharmacy/Drugstores, Online/E-commerce, Supermarkets/Hypermarkets, Specialty/Others |

| Nature | Conventional, Organic, Non-GMO, Vegan |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Garden of Life (Nestlé), Culturelle, Align, NOW Foods, Renew Life |

| Additional Attributes | Dollar sales by bacteria type, application functionality, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with pharmaceutical companies and specialized probiotic brands; consumer preferences for various strain formulations and delivery formats; integration with digital health platforms and personalized microbiome testing; innovations in postbiotic development and synbiotic formulations; adoption across pharmacy, online, and specialty retail channels; regulatory framework analysis for probiotic health claim validation and strain nomenclature standards; cold chain management strategies; and penetration analysis for preventive healthcare adoption across European consumer demographics. |

Product Type (Bacteria Type)

The global demand for probiotic supplements in EU is estimated to be valued at USD 2,521.3 million in 2025.

The market size for the demand for probiotic supplements in EU is projected to reach USD 6,191.5 million by 2035.

The demand for probiotic supplements in EU is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in demand for probiotic supplements in EU are lactobacillus, bifidobacterium, streptococcus, bacillus coagulans, saccharomyces and lactococcus lactis.

In terms of application (functionality), digestive health segment to command 38.0% share in the demand for probiotic supplements in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Probiotic Strains Market Outlook – Share, Growth & Forecast 2025–2035

Europe Probiotic Ingredients Market Trends – Growth, Demand & Forecast 2025-2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

EU Longevity Supplements Sales Analysis Size and Share Forecast Outlook 2025 to 2035

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

UK Probiotic Supplements Market Report – Size, Share & Outlook 2025-2035

Pet Probiotics Supplements Market - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025-2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Probiotic Yogurt Market Analysis by Product Type, Flavor, Sales Channel, and Countries through 2025 to 2035

Postnatal Probiotic Supplements Market Size and Share Forecast Outlook 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Western Europe Dietary Supplements Market Analysis by Ingredients, Form, Application, and Country Through 2025 to 2035

Latin America Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Demand for Dietary Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Calcium Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Fertility Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Postbiotic Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Multistrain Probiotics in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA