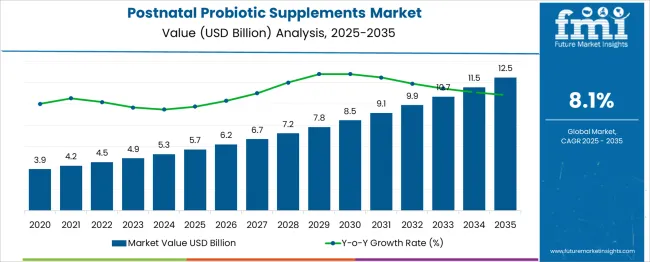

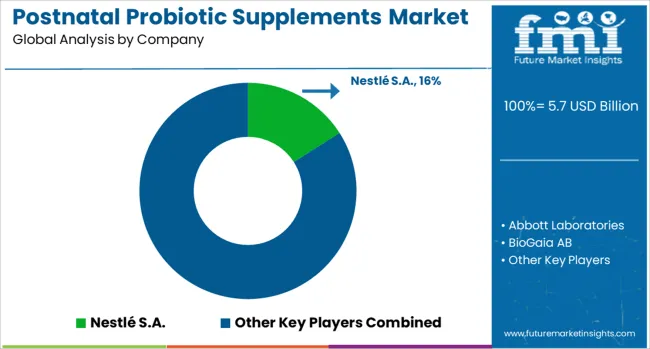

The Postnatal Probiotic Supplements Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 12.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period. Examining the market through a breakpoint analysis lens highlights critical phases in growth dynamics. During the initial years following 2025, growth is steady as the market expands due to rising awareness of postnatal health and increasing consumer acceptance of probiotic supplements. This early phase is marked by gradual adoption and market penetration, setting the foundation for accelerated growth. As the market progresses toward the midpoint around 2030, the market size notably shifts upward, indicating a breakpoint where demand strengthens significantly.

This period likely benefits from intensified research outcomes, improved product formulations, and broader distribution channels, driving an increase in consumer trust and purchase frequency. Approaching the latter years toward 2035, the growth rate stabilizes but remains robust, as market maturity takes hold. Here, incremental innovations and niche segment developments help sustain the momentum. This breakpoint analysis reveals that while the market experiences phases of accelerated adoption, it maintains steady growth overall, which is critical for stakeholders evaluating investment timing and scaling strategies. The identified breakpoints provide insight into evolving market opportunities and risks, allowing decision-makers to optimize resource allocation for maximum return over the forecast period.

| Metric | Value |

|---|---|

| Postnatal Probiotic Supplements Market Estimated Value in (2025 E) | USD 5.7 billion |

| Postnatal Probiotic Supplements Market Forecast Value in (2035 F) | USD 12.5 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The postnatal probiotic supplements market is witnessing robust expansion due to increasing maternal health awareness, growing demand for gut-health-focused postpartum care, and the rising popularity of microbiome-centered wellness. Healthcare practitioners are increasingly recommending probiotics for lactating women to support immune modulation, nutrient absorption, and digestive health restoration after childbirth.

Key market players are investing in clinical trials and evidence-backed formulations to gain consumer trust and differentiate their products in a sensitive health category. Expanding e-commerce access and DTC channels have enhanced availability, while strategic collaborations between supplement brands and maternity care providers are increasing visibility.

The trend toward clean-label, allergen-free, and vegan probiotic formulations further supports market penetration, especially in developed economies. Regulatory support for probiotic safety and innovation is likely to catalyze further product diversification in the coming years.

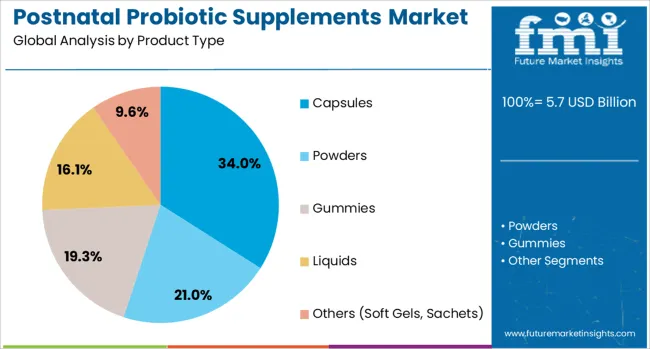

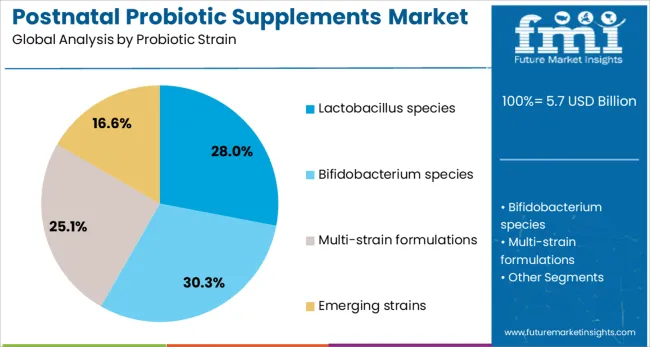

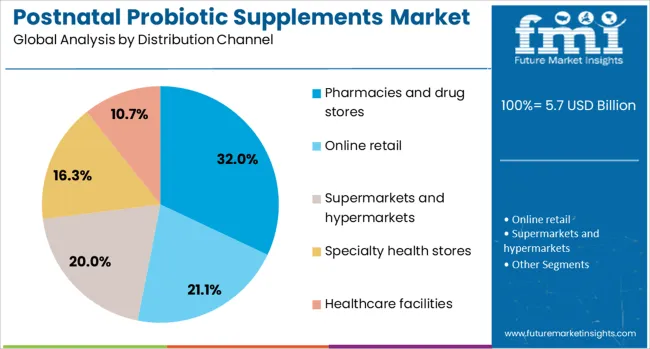

The postnatal probiotic supplements market is segmented by product type, probiotic strain, distribution channel, application, and geographic regions. By product type, the postnatal probiotic supplements market is divided into Capsules, Powders, Gummies, Liquids, and Others (Soft Gels, Sachets). In terms of probiotic strains, the postnatal probiotic supplements market is classified into Lactobacillus species, Bifidobacterium species, Multi-strain formulations, and emerging strains. The distribution channel of the postnatal probiotic supplements market is segmented into Pharmacies and drug stores, Online retail, Supermarkets and hypermarkets, Specialty health stores, and Healthcare facilities. By application of the postnatal probiotic supplements market is segmented into Digestive health support, Immune system enhancement, Mood and mental health support, Mastitis prevention and treatment Overall wellness and recovery. Regionally, the postnatal probiotic supplements industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Capsules are expected to dominate the postnatal probiotic supplements market with a 34.00% share in 2025. Their popularity stems from dosage precision, longer shelf life, and ease of consumption compared to other forms like powders or liquids.

Capsules also provide enhanced stability for probiotic strains, especially when formulated with delayed-release or enteric coating technologies to ensure survival through the gastrointestinal tract. The convenience of capsule-based intake appeals strongly to postpartum mothers seeking low-maintenance and effective health routines.

Moreover, the widespread availability of capsule formats across both prescription and over-the-counter (OTC) channels supports their market leadership. As innovation focuses on strain viability and delivery efficiency, capsule-based supplements remain a preferred format for both consumers and formulators.

Lactobacillus species are set to lead the probiotic strain segment with a 28.00% share by 2025, due to their proven efficacy in maintaining vaginal flora, enhancing immune health, and promoting gastrointestinal balance in postpartum women. Clinical studies support Lactobacillus strains such as L. rhamnosus and L.

reuteri for reducing postpartum infections, improving nutrient assimilation, and modulating infant microbiota through breastfeeding. Their stability, safety profile, and compatibility with diverse delivery formats have made them the strain of choice in most maternal probiotic formulations.

Manufacturers continue to prioritize Lactobacillus-based blends owing to strong consumer awareness and favorable outcomes in maternal health research. As demand grows for science-backed, targeted probiotic solutions, Lactobacillus species are expected to maintain dominance in both single-strain and multi-strain formulations.

Pharmacies and drug stores are projected to account for 32.00% of the total market share by 2025, positioning them as the leading distribution channel. These outlets are trusted sources of health-related products, particularly for postpartum women seeking guidance from pharmacists and healthcare professionals.

Brick-and-mortar pharmacies offer immediate product access, professional recommendations, and brand visibility, which are key to consumer decision-making in the postnatal category. Increasing collaborations between OB-GYN clinics and pharmacy chains further bolster this channel’s relevance.

Despite the rise of online retail, pharmacies remain dominant due to their regulatory compliance, reliable sourcing, and ability to handle temperature-sensitive probiotic supplements. As healthcare access widens in urban and semi-urban areas, pharmacies and drug stores are expected to retain their lead in distribution.

The market has evolved as a specialized segment within the broader dietary supplements industry, focusing on maternal and infant health after childbirth. These supplements have been formulated to support gut microbiota balance, improve digestive function, and enhance immunity during the postpartum recovery period. Probiotic strains have been selected for their potential benefits in reducing gastrointestinal discomfort, supporting lactation, and promoting nutrient absorption. Increasing scientific research on maternal microbiome health has encouraged greater adoption among healthcare professionals and consumers. The market has been shaped by the expansion of e-commerce distribution channels, rising product innovations in capsule, powder, and chewable formats, and the introduction of multi-strain formulations.

Consumer interest in gut microbiota balance during the postpartum phase has been amplified by increasing awareness of its role in recovery, immunity, and overall wellness. Healthcare practitioners have recommended probiotic supplementation to address common postnatal concerns such as constipation, bloating, and immune vulnerability. Scientific publications highlighting the maternal microbiome’s influence on both mother and infant health have increased public trust in probiotics. Women have sought solutions that can be integrated into daily routines without disrupting breastfeeding, making naturally derived and allergen-free formulations more appealing. Awareness campaigns by maternity care providers and online wellness platforms have also broadened knowledge about the potential long-term benefits of microbiome support. As a result, more postnatal care plans have incorporated probiotic supplementation as a preventive and restorative measure, driving demand across both developed and emerging markets.

Manufacturers have expanded product portfolios with innovative delivery formats and targeted strain combinations to address specific postnatal needs. Multi-strain blends containing Lactobacillus and Bifidobacterium species have been developed to enhance digestive health and immune function. Probiotic supplements fortified with vitamins, minerals, and prebiotic fibers have been introduced to provide broader nutritional benefits. Shelf-stable formulations have been designed for convenience, reducing the need for refrigeration and improving accessibility in diverse markets. Chewables, sachets, and liquid drops have been launched to cater to preferences for taste and ease of intake. Clinical studies validating strain-specific benefits have been used in marketing to build credibility and differentiate products. Such innovations have allowed brands to target not only direct postpartum recovery but also long-term wellness, increasing their appeal to a wider consumer base.

Online platforms have become a key driver in expanding the availability and visibility of postnatal probiotic supplements. E-commerce has enabled niche brands to reach global consumers without the limitations of traditional retail networks. Subscription-based delivery models have gained traction, offering convenience and encouraging consistent product usage. Social media marketing, influencer endorsements, and partnerships with maternal health communities have enhanced consumer engagement. Direct-to-consumer brands have leveraged personalized nutrition tools to recommend strain-specific probiotics based on individual health profiles. Digital marketplaces have also allowed consumers to compare product reviews, verify certifications, and access educational content, boosting purchase confidence. These developments have significantly shortened the adoption curve for new products while intensifying market competition.

Regulatory scrutiny in the dietary supplements sector has impacted product formulation, labeling, and marketing claims for postnatal probiotics. Authorities in various regions have required manufacturers to substantiate health claims with credible scientific evidence, leading to increased investment in clinical research. Quality assurance processes, including third-party testing for potency and purity, have become essential to maintain consumer trust. Certification programs for allergen-free, non-GMO, and organic status have been used to appeal to health-conscious consumers. In some markets, classification differences between dietary supplements and functional foods have influenced distribution strategies. Companies adhering to rigorous safety standards and transparent labeling have been better positioned to expand in both domestic and export markets. Regulatory harmonization across regions remains a potential catalyst for accelerating global trade in postnatal probiotic supplements.

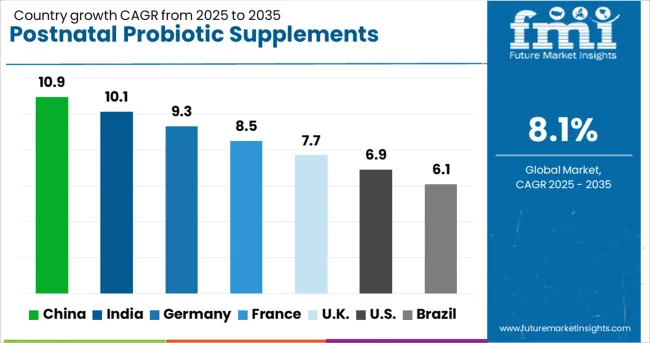

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

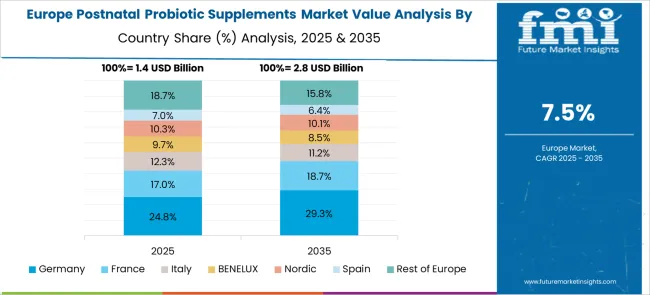

The market is expected to grow at a CAGR of 8.1% between 2025 and 2035, driven by rising awareness of maternal health, increasing research on gut microbiome benefits, and expanding supplement accessibility. China leads with a 10.9% CAGR, supported by government health initiatives and growing consumer acceptance of functional nutrition. India follows at 10.1%, fueled by increasing postnatal care focus and expanding retail distribution channels. Germany, growing at 9.3%, benefits from strong nutraceutical regulations and advanced probiotic formulations. The U.K., with 7.7% growth, experiences rising demand from health-conscious mothers and evolving prenatal care practices. The U.S., at 6.9%, reflects steady market penetration driven by wellness trends and product innovation. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 10.9% from 2025 to 2035 in the postnatal probiotic supplements market, supported by rising maternal health awareness and expanding premium nutrition segments. Domestic nutraceutical producers are introducing probiotic blends targeting postpartum recovery and immune system support. Distribution through pharmacy chains and e-commerce platforms is expanding, aided by increased consumer trust in clinically validated formulations. The integration of probiotics into postnatal care programs at urban hospitals is further strengthening demand. Preference is shifting toward multi-strain products with documented gut health benefits.

India is anticipated to register a CAGR of 10.1% in the postnatal probiotic supplements market, driven by growing recommendations from gynecologists and pediatricians for postpartum digestive and immunity support. Domestic and multinational brands are introducing affordable sachets and capsule formats to improve accessibility in tier two and tier three cities. Awareness campaigns in maternity clinics are improving consumer understanding of probiotic benefits during the postnatal period. Retail pharmacy penetration is widening, with a notable increase in probiotic shelf space.

Germany is forecasted to expand at a CAGR of 9.3% in the postnatal probiotic supplements market, with emphasis on scientifically validated strains for postpartum recovery. The integration of probiotics into medical nutrition therapy is gaining traction in both hospital and outpatient care settings. Premium capsule and powder formulations with targeted delivery mechanisms are being adopted by health-conscious consumers. Collaborations between nutraceutical firms and research institutes are enhancing product credibility, boosting uptake across pharmacy and health store channels.

The United Kingdom is expected to post a CAGR of 7.7% in the postnatal probiotic supplements market, supported by rising adoption of functional health products among new mothers. Specialist health retailers and online subscription platforms are becoming primary distribution channels. Manufacturers are focusing on allergen-free and vegan-friendly formulations to cater to niche dietary requirements. Marketing strategies highlight digestive comfort, improved energy levels, and immunity support as key product benefits.

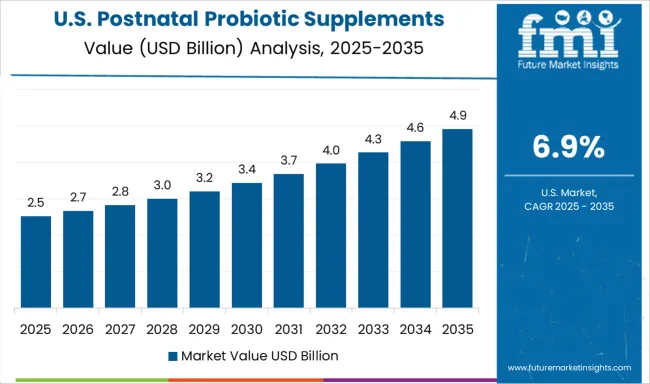

The United States is projected to grow at a CAGR of 6.9% in the postnatal probiotic supplements market, driven by demand for innovative delivery formats such as probiotic gummies, fast-dissolving strips, and microencapsulated capsules. Integration of probiotics into broader postnatal wellness packs is gaining traction in premium retail outlets. E-commerce platforms are offering personalized supplement recommendations based on maternal health profiles. Increasing investment in clinical validation and consumer education is strengthening product acceptance across varied demographics.

The market is experiencing sustained growth as awareness rises about the role of beneficial bacteria in supporting maternal recovery and infant health after childbirth. These supplements are designed to aid digestion, enhance immune function, and restore microbiome balance, which may be impacted during pregnancy and delivery. Growing clinical research linking probiotics to reduced postpartum discomfort and improved lactation outcomes has strengthened consumer confidence. Distribution through pharmacies, online platforms, and maternity-focused retail channels has expanded accessibility, supporting global adoption trends. Nestlé S.A. and Abbott Laboratories have developed targeted probiotic blends integrated into maternal nutrition programs.

BioGaia AB specializes in clinically validated strains with documented benefits for postpartum use. Danone S.A., through its specialized nutrition division, focuses on formulations combining probiotics with vitamins and minerals to enhance recovery. Bayer AG and Reckitt Benckiser Group plc leverage extensive consumer health portfolios to market science-backed probiotic products. DuPont Nutrition & Biosciences supplies high-quality probiotic strains and technical expertise to multiple supplement brands. Market competition is shaped by product differentiation through strain specificity, clinical validation, and delivery formats such as capsules, powders, and functional foods. Companies investing in research partnerships and educational initiatives are positioned to strengthen brand trust in this emerging wellness category.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.7 Billion |

| Product Type | Capsules, Powders, Gummies, Liquids, and Others (Soft Gels, Sachets) |

| Probiotic Strain | Lactobacillus species, Bifidobacterium species, Multi-strain formulations, and Emerging strains |

| Distribution Channel | Pharmacies and drug stores, Online retail, Supermarkets and hypermarkets, Specialty health stores, and Healthcare facilities |

| Application | Digestive health support, Immune system enhancement, Mood and mental health support, Mastitis prevention and treatment, and Overall wellness and recovery |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé S.A., Abbott Laboratories, BioGaia AB, Danone S.A., Bayer AG, Reckitt Benckiser Group plc, and DuPont Nutrition & Biosciences |

| Additional Attributes | Dollar sales by probiotic strain type and distribution channel, demand dynamics across postpartum recovery, infant gut health support, and maternal wellness programs, regional trends in consumption across North America, Europe, and Asia-Pacific, innovation in microencapsulation technology, multi-strain formulations, and shelf-stable delivery formats, environmental impact of packaging materials, production energy use, and cold chain logistics, and emerging use cases in personalized nutrition plans, fortified functional foods for lactating mothers, and integration into holistic postnatal care regimens. |

The global postnatal probiotic supplements market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the postnatal probiotic supplements market is projected to reach USD 12.5 billion by 2035.

The postnatal probiotic supplements market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in postnatal probiotic supplements market are capsules, powders, gummies, liquids and others (soft gels, sachets).

In terms of probiotic strain, lactobacillus species segment to command 28.0% share in the postnatal probiotic supplements market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

UK Probiotic Supplements Market Report – Size, Share & Outlook 2025-2035

Postnatal Health Supplements Market Trends – Demand & Forecast 2025-2035

Pet Probiotics Supplements Market - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025-2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Demand for Probiotic Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Latin America Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Demand for Postnatal Health Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA