The Europe Probiotic Strains market is set to grow from an estimated USD 943.9 million in 2025 to USD 1,452.0 million by 2035, with a compound annual growth rate (CAGR) of 4.4% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 943.9 million |

| Projected Europe Value (2035F) | USD 1,452.0 million |

| Value-based CAGR (2025 to 2035) | 4.4% |

The European probiotic strains sector is witnessing an active expansion with probiotics being more and more introduced to diverse healthy items. Probiotics are live microorganisms that, when eaten in adequate quantities, can offer benefits to health.

These benefits are of great interest to European consumers for the digestive system, immunity, and overall well-being. The major driving force behind this growth is the increase in consumer knowledge of the significance of gut microbiota in health management and the growing market for functional foods that have certain beneficial properties on health.

Lactobacillus, Bifidobacterium, and Streptococcus are the probiotic strains that are frequently used in products, especially Lactobacillus which is the most prominent due to its strong partnership with food companies that produce dietary supplements and functional foods.

Saccharomyces, a yeast strain, is improving its position as a brand for health benefits due to the possibility of using it in pharmaceuticals, and in animal feeds, apart from addressing gastrointestinal issues. In addition, other probiotic strains are coming up with solutions such as mental health, skin health, and immunity.

This market is noted for the growing availability of probiotics in various formulation types, notably capsules, powders, tablets, and gummies, which are preferred by consumers who look for simplicity and convenience.

The leaders in the European probiotic strains market, which comprise Danone, Yakult, and Nestlé, are resorting to strategy innovations and enhancements of product portfolios to cover the growing consumer demand gap.

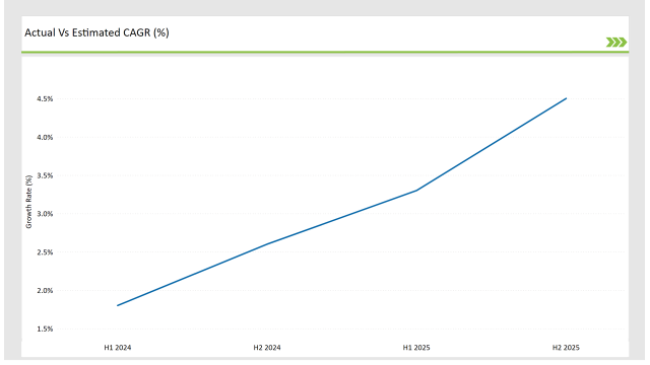

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Probiotic Strains market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 1.8% (2024 to 2034) |

| H2 2024 | 2.6% (2024 to 2034) |

| H1 2025 | 3.3% (2025 to 2035) |

| H2 2025 | 4.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Probiotic Strains market, the sector is predicted to grow at a CAGR of 1.8% during the first half of 2024, with an increase to 2.6% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 3.3% in H1 but is expected to rise to 4.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | Product Launch : A European company launched a new range of probiotic-infused skin care products designed to enhance skin health and gut-skin connection, responding to the increasing demand for beauty-from-within solutions. |

| March-2024 | Partnership Announcement : A major pharmaceutical firm partnered with a probiotic strain developer to create a targeted oral treatment for IBS, marking a significant step in integrating probiotics into pharmaceutical applications. |

| February-2024 | Expansion of Product Line : A leading European dairy brand expanded its probiotic product range to include dairy-free alternatives, catering to the growing vegan and lactose-intolerant consumer base in Europe. |

Rising Trend of Using Probiotics in Cosmetics and Personal Care

The cosmetics and personal care segment is being identified as one of the prime possible large application areas for probiotic strains, with a large number of probiotic-containing skin products being introduced by different companies.

The most important function of probiotics in this regard is to keep the skin’s microbiota balanced, lessen the inflammation, and therefore make the skin barrier stronger. People are opting for probiotic-based products to enhance their skin barrier and the use of these products is greatly increasing as they learn more of the gut-skin-axis.

As a case in point, some probiotic beauty brands from Europe add probiotic strains to their products, and they include moisturizers, serums, and masks in the line. The probiotics present in these products largely support the process of normalizing the skin's microbiota that is disturbed by bacterial infective agents such as acne, eczema, and rosacea.

The notable probiotic strains from Lactobacillus and Bifidobacterium are the ones usually associated with the effect of lowering oxidative stress and enhancing the skin's elasticity.

Probiotics in the Feed of Animals Are Rising

There has been a notable development of probiotics in animal feed as the European market is experiencing a notable demand for probiotics that promote intestinal health in livestock and pets.

The addition of probiotics in the mixture of feed is re-establishing the bacterial population, thus improving nutrient absorption along with immunity and reducing the amount of antibiotics used. This approach is even more significant as the European Union's directives on antibiotics used in animal husbandry are being made stricter.

The focus of companies is increasingly directed at designing probiotic strains specifically tailored for animals, including livestock, poultry, and pets. These probiotic supplements not only increase the digestion and growth rates of animals but also they are responsible for better health outcomes, in particular, the bowel problems getting less frequent.

Apart from that, European farmers and pet owners are increasingly recognizing probiotics’ potential in preventing illness, alleviating stress, and bettering operational productivity.

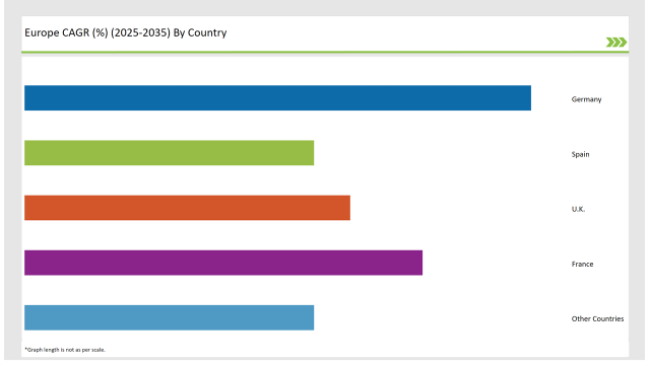

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| Spain | 16% |

| UK | 18% |

| France | 22% |

| Other Countries | 16% |

Germany is leading the European market for probiotic strains, as there is an advanced healthcare system, high consumer awareness, and a strong preference for functional foods in the country. The overall growth of the probiotics market has been very strong in dietary supplements, functional beverages, and food products in Germany, where consumers increasingly become health-conscious and prefer digestive wellness.

Probiotic brands, including Danone and Yakult, have a presence in this region, market competition is indeed great, and companies look forward to expanding their portfolio lines to change consumer preferences. The dairy-free and vegan probiotic products are increasingly gaining popularity in Germany, a trend influenced by the growing numbers of lactose-intolerant as well as plant-based customers.

Probiotic strains form the largest and second-largest segment of the United Kingdom's main European market; its growth factor can be directly associated with enhanced consumer interest in gut health and immunity.

Beliefs of UK-based consumers in that probiotics would improve the gut, help strengthen immunity, and prevent ailments like colds and infection, thereby leading to an increased demand for the consumption of probiotic supplements and functional foods.

The COVID-19 pandemic has accelerated this trend further as many consumers seek ways to strengthen their immune systems. Probiotics have emerged as known contributors to immune function, and with that have come many UK consumers seeking probiotic-enriched foods, such as yogurt and kefir, and dietary supplements. Demand for plant-based probiotic products is also increasing, with the country's growing vegan and vegetarian population.

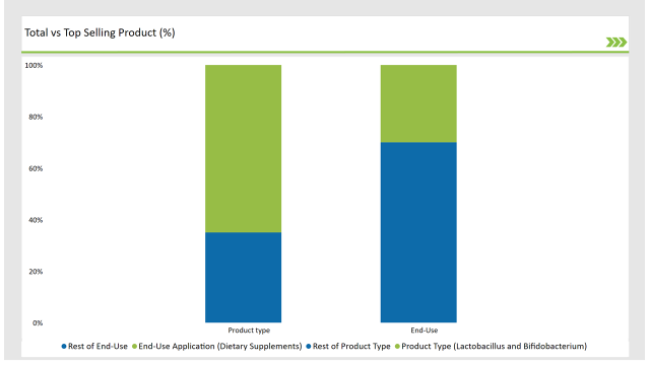

% share of Individual Categories End-Use Application and Product Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| End-Use Application (Dietary Supplements) | 30% |

| Remaining segments | 70% |

The largest and fastest-growing segment in the European probiotic strain market is dietary supplements. These are increasingly being consumed by the population, especially in the form of capsules, soft gels, and tablets, as consumers increasingly seek out natural and preventive health solutions. The growing interest in gut health, mental well-being, and immunity has made probiotic supplements highly popular among health-conscious individuals.

It has been increasingly driven by consumer awareness regarding gut health and wellness. For instance, research has shown that maintaining a healthy balance of gut microbiota is critical for digestion, immunity, and even mental health. Because of the consumers' increased demand for natural preventive health solutions, probiotics are increasingly consumed in the form of supplements such as capsules, soft gels, and tablets.

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Lactobacillus and Bifidobacterium) | 65% |

| Remaining segments | 35% |

Lactobacillus and Bifidobacterium probiotic supplements are on an increasing growth level, because of the essential role that these play in the digestive and immune support fields. As consumers are becoming more conscious of the significance of gut health to overall well-being, demand for Lactobacillus-based supplements is on the rise.

These probiotics are commonly available in a variety of forms, such as capsules, powders, and fermented foods, which makes them accessible to a wide range of consumers. The trend of preventive health and self-care is further accelerating the demand for Lactobacillus supplements as people prefer natural products that can satisfy their health needs.

The Bifidobacterium species segment is also upbeat, mainly driven by the market demand from health-conscious consumers demanding targeted digestive support. Bifidobacterium strains are recognized for their action in gut health, improving nutrient absorption, and supporting immune function.

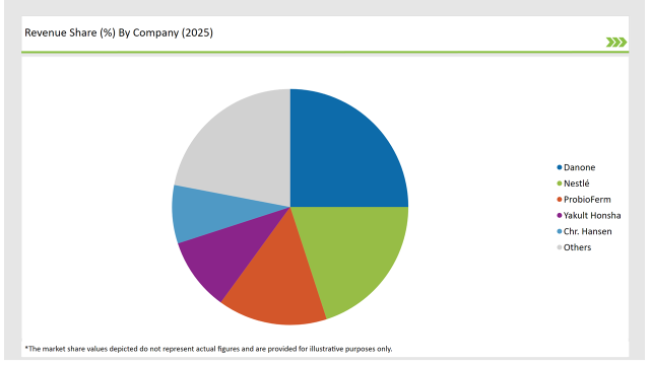

2025 Market share of Europe Probiotic Strains manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Danone | 25% |

| Nestlé | 20% |

| ProbioFerm | 15% |

| Yakult Honsha | 10% |

| Chr. Hansen | 8% |

| Others | 22% |

Note: The above chart is indicative in nature

The market shares that major players in the European probiotic strains market maintain as well as the extent of research and development and distribution capabilities is highly competitive. Tier 1 companies include Danone, Nestlé, and Yakult, which are known for diversified product portfolios and innovative approaches in developing probiotics.

Danone, with its portfolio of probiotic products, including Activia and DanActive, is the leader in the European market. The company invests heavily in research to develop new probiotic strains and enhance the efficacy of its products. Yakult, for example, has been the leading probiotic beverage brand since the introduction of its iconic drink, Yakult, and the company continues to innovate by increasing its product portfolio.

Tier 2 players are Lonza Group and Sabinsa Corporation, which are regionally based on niche probiotic products. Specifically, Lonza is recognized for the development of innovative probiotic delivery systems; encapsulation technologies enhance the stability and efficacy of probiotics.

Tier 3 companies are small regional players with a focus on local markets. Even though they are not at the same level as Tier 1 companies in terms of global reach, they play an important role in fulfilling local consumer preferences and providing cheaper options for probiotic products.

As per End Use Application, the industry has been categorized into Food & Beverage Processing, Dietary Supplements, Personal Care & Cosmetics, and Others.

As per Product Type, the industry has been categorized into Lactobacillus Species, Bifidobacterium Species, Bacillus Species, Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Probiotic Strains market is projected to grow at a CAGR of 4.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,452.0 million.

Key factors driving the probiotic strains market in Europe include the increasing consumer awareness of gut health and its connection to overall well-being, as well as the rising demand for natural and functional food products that promote digestive health. Additionally, the growing trend of preventive healthcare and self-care is further fueling the market's expansion.

Germany, France, and UK are the key countries with high consumption rates in the European Probiotic Strains market.

Leading manufacturers include Danone, Nestlé, ProbioFerm, Yakult Honsha, and Chr. Hansenknown for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA