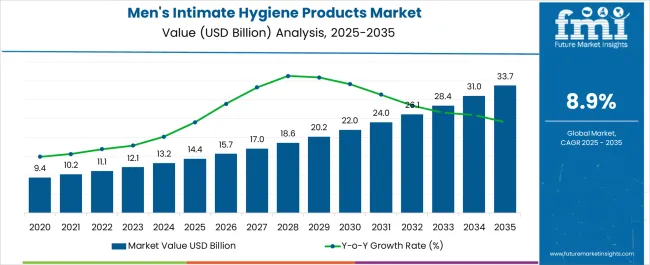

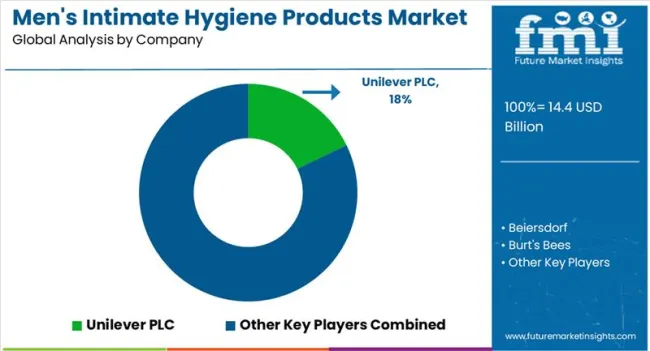

The men's intimate hygiene products market is projected to grow from USD 14.4 billion in 2025 to USD 33.7 billion by 2035, representing a CAGR of 8.9%. This growth corresponds to an absolute dollar opportunity of USD 19.3 billion over the decade. Expansion is driven by increasing consumer awareness, rising demand for personal care solutions, and broader product adoption across male grooming segments. Companies can leverage this growth by expanding distribution networks, optimizing product portfolios, and enhancing marketing strategies.

Over the next ten years, the USD 19.3 billion opportunity highlights a strong growth trajectory for the men's intimate hygiene products market. By 2035, revenue will be supported by both new product adoption and repeat purchases across commercial and retail segments. The CAGR of 8.9% indicates a robust and profitable expansion, enabling companies to scale operations efficiently and strengthen market reach. Businesses can focus on aligning sales, distribution, and marketing strategies with consumer demand to maximize returns. The absolute growth potential provides a clear incentive for companies to capture incremental revenue throughout the forecast period while maintaining operational efficiency.

| Metric | Value |

|---|---|

| Men's Intimate Hygiene Products Market Estimated Value in (2025 E) | USD 14.4 billion |

| Men's Intimate Hygiene Products Market Forecast Value in (2035 F) | USD 33.7 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

In the early growth phase of the men’s intimate hygiene products market, revenue expands steadily from USD 14.4 billion in 2025, reflecting a CAGR of 8.9%. Growth during this period is primarily driven by initial adoption among consumers and increasing availability through retail and e-commerce channels. Companies focus on building brand awareness, establishing distribution networks, and developing product portfolios to meet emerging demand. The absolute dollar opportunity in this phase is moderate, allowing firms to refine operations, test marketing strategies, and respond to customer feedback.

Market strategies shift toward scaling production, expanding regional and online presence, and leveraging established consumer loyalty. The absolute dollar opportunity in this stage is substantial, representing most of the USD 19.3 billion growth over the decade. Companies benefit from operational efficiencies and stronger brand recognition, ensuring the 8.9% CAGR translates into consistent and profitable growth. Late growth reflects a mature stage where market share optimization and product availability are key for sustained success.

The men’s intimate hygiene products market is gaining traction as societal taboos diminish and awareness regarding male personal hygiene improves. Urbanization, increased disposable incomes, and the influence of social media have contributed to the demand for specialized products tailored for men’s needs.

Men are gradually adopting skincare and hygiene routines once considered niche or gender-specific, fueling product innovation in this domain. Growth is also supported by targeted marketing campaigns, pharmacy and e-commerce availability, and increased inclusion of hygiene education in health discourse.

Rising concerns over genital health, sweat control, and odor management are driving demand for daily-use products like intimate washes and wipes, particularly among the younger demographic.

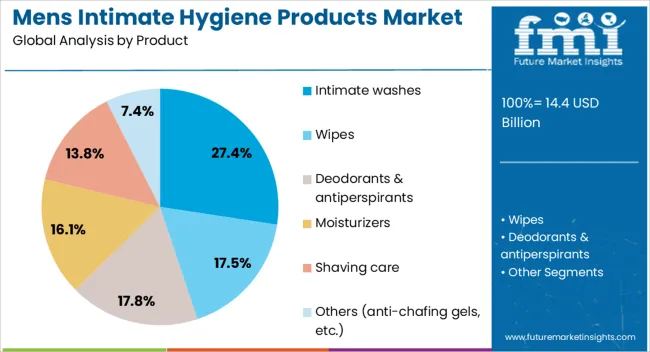

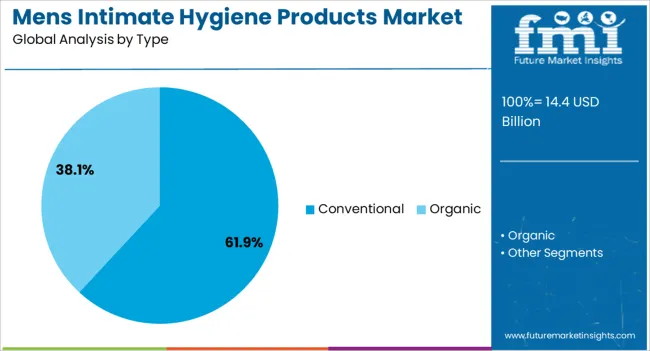

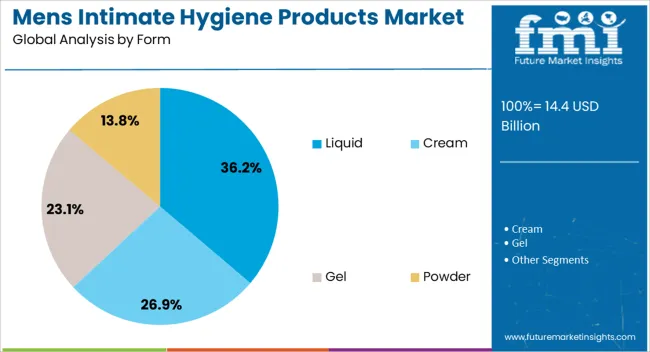

The men's intimate hygiene products market is segmented by product, type, form, price, packaging, age group, application, and geographic regions. By product, the men's intimate hygiene products market is divided into Intimate washes, Wipes, Deodorants & antiperspirants, Moisturizers, Shaving care, and Others (anti-chafing gels, etc.). In terms of type, the men's intimate hygiene products market is classified into Conventional and Organic. Based on form, men's intimate hygiene products market is segmented into Liquid, Cream, Gel, and Powder. By price, the men's intimate hygiene products market is segmented into Medium, Low, and High.

By packaging, the men's intimate hygiene products market is segmented into Bottles, Aerosols, Sticks, Roll-ons, Tubes, and Others. By age group, men's intimate hygiene products market is segmented into Adults and Teenagers. By application, men's intimate hygiene products market is segmented into Sweat control and freshness, Erectile dysfunction (ED), Post-sexual care, Skin condition management, and Others. Regionally, the men's intimate hygiene products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Intimate washes are projected to command 27.40% of the total market by 2025, making them the leading product in this category. This growth stems from increased awareness of male-specific hygiene needs and rising dermatological recommendations for pH-balanced genital cleansing.

Unlike traditional soaps, intimate washes offer gentler formulations tailored to sensitive areas, reducing risks of irritation and infections. Their presence in men’s grooming kits is becoming more normalized, especially in urban and semi-urban regions.

The segment benefits from high repeat purchase potential and wide distribution across pharmacies, supermarkets, and online platforms.

Conventional hygiene products are expected to account for 61.90% of the market by 2025, retaining dominance over organic or herbal alternatives. The widespread availability, lower cost, and consumer familiarity with established conventional brands are key factors driving this share.

While organic offerings are gaining ground among niche segments, conventional products maintain strong appeal due to their proven efficacy, wide range of fragrances, and aggressive brand marketing.

Additionally, conventional items are typically supported by broader clinical testing and regulatory approvals, increasing consumer trust in their safety and functionality.

The liquid format is anticipated to represent 36.20% of the total market by 2025, positioning it as the leading form segment. Liquids are preferred for their ease of application, better lathering properties, and ability to deliver consistent cleansing performance.

This form is ideal for intimate washes and is increasingly being packaged in travel-friendly, pump-based, or squeeze bottles for convenience. Brands are also leveraging liquid formulations to incorporate soothing and anti-bacterial agents like tea tree oil or aloe vera.

As consumers shift toward multi-step hygiene routines, liquid-based products are expected to remain at the forefront of product development and user preference.

The men’s intimate hygiene products market is expanding as male consumers increasingly focus on personal grooming, wellness, and hygiene. Products include washes, wipes, creams, powders, and deodorizing sprays designed for sensitive areas. Rising awareness about skin health, odor management, and prevention of infections is driving adoption. Urbanization, increasing disposable income, and social media influence on personal care trends are boosting demand.

Manufacturers offering dermatologist-tested, pH-balanced, fragrance-free, and natural ingredient-based products are well-positioned to capture opportunities. Retail channels such as e-commerce, pharmacies, and modern trade outlets enhance accessibility. Additionally, growing emphasis on men’s self-care and grooming routines globally is supporting the expansion of the men’s intimate hygiene segment.

Market growth faces challenges due to the sensitivity of intimate hygiene products and the need for consumer trust. Male consumers are cautious about skin irritation, allergic reactions, and product efficacy. Products with harsh chemicals, artificial fragrances, or improper pH balance can cause discomfort and reduce repeat purchases. Lack of awareness about the benefits of specialized intimate hygiene products limits adoption, especially in developing regions. Manufacturers are addressing these challenges by emphasizing dermatological testing, using natural and gentle ingredients, and educating consumers on product usage and benefits. Building credibility through certifications, clinical validation, and marketing campaigns is essential to encourage adoption and boost consumer confidence globally.

Market trends are shaped by the use of natural ingredients, pH-balanced formulations, and digital marketing strategies. Increasingly, products feature aloe vera, chamomile, tea tree oil, and other botanicals that soothe sensitive skin while maintaining hygiene. pH-balanced solutions prevent irritation and support skin health. Social media campaigns, influencer endorsements, and targeted online advertisements educate consumers and normalize intimate hygiene practices. Subscription-based e-commerce models and personalized product recommendations are enhancing convenience and brand engagement. These trends highlight the growing focus on gentle, safe, and effective formulations combined with awareness-driven marketing strategies to drive adoption in the men’s personal care segment globally.

Opportunities in the men’s intimate hygiene products market are driven by rising awareness of male grooming, personal hygiene, and online retail growth. Urban male populations and millennials are increasingly adopting hygiene routines as part of self-care practices. E-commerce platforms provide discreet, convenient access to intimate hygiene products, expanding reach beyond traditional retail. Growth in male grooming trends, wellness campaigns, and increasing social acceptance of personal care products creates additional demand. Manufacturers offering safe, natural, and dermatologically tested products with convenient packaging, subscription options, and discreet delivery are well-positioned to capitalize on these trends globally, particularly in regions with rising disposable income and male consumer awareness of personal health.

Market growth is restrained by intense competition, price sensitivity, and stringent regulatory requirements. Numerous brands, both global and local, compete on pricing, packaging, and ingredient quality, impacting profitability for premium products. Price-sensitive consumers may opt for general body washes rather than specialized intimate hygiene solutions.

Compliance with cosmetic and personal care regulations, including ingredient safety, labeling, and claims validation, increases operational costs for manufacturers. Additionally, improper formulation or lack of testing can lead to adverse skin reactions, negatively affecting brand reputation. Until manufacturers differentiate through efficacy, safety, and consumer education while managing pricing and regulatory compliance, adoption may remain concentrated among urban, health-conscious, and premium male consumers.

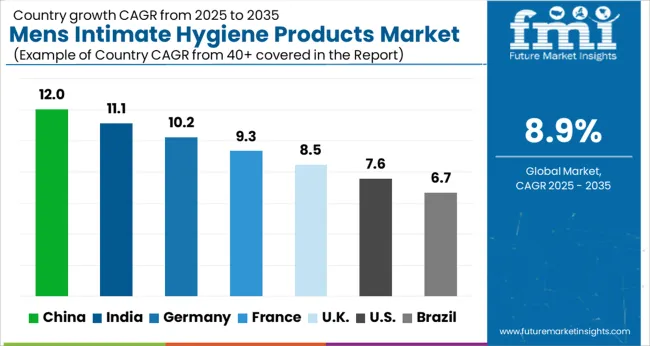

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

The global men’s intimate hygiene products market is projected to grow at a CAGR of 8.9% through 2035, driven by demand across personal care, grooming, and wellness segments. Among BRICS nations, China has been recorded with 12.0% growth, where production and distribution of intimate washes, wipes, and grooming solutions have been extensively carried out by companies such as Beiersdorf, P&G, and Reckitt Benckiser. India has been observed at 11.1%, supported by rising adoption in urban and semi-urban personal care markets. In the OECD region, Germany has been measured at 10.2%, where production for retail, pharmacies, and e-commerce channels has been steadily maintained. The United Kingdom has been noted at 8.5%, reflecting consistent use in grooming and wellness products, while the USA has been recorded at 7.6%, with deployment across personal care, healthcare, and online retail channels being steadily increased. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expanding at a CAGR of 12.0%, driven by rising awareness of personal care, urban male grooming trends, and increased e-commerce penetration. Manufacturers supply body washes, cleansing wipes, intimate washes, and grooming kits for retail, e-commerce, and pharmacy channels. Government initiatives promoting hygiene, public health awareness, and men’s wellness programs support adoption. Pilot projects in urban centers and wellness campaigns demonstrate benefits including improved personal hygiene, enhanced skin care, and increased consumer confidence. Collaborations between personal care brands, e-commerce platforms, and health institutions are improving product formulations, packaging, and accessibility. Growing male grooming awareness and digital retail expansion continue to drive the Chinese men's intimate hygiene products market.

The market for men's intimate hygiene products in India is growing at a CAGR of 11.1%, supported by increasing male grooming awareness, urban lifestyle changes, and online retail growth. Manufacturers supply intimate washes, body wipes, grooming kits, and specialized hygiene products for retail stores, e-commerce platforms, and pharmacies. Government initiatives promoting personal hygiene, men’s health awareness, and wellness programs encourage market adoption. Pilot campaigns in urban centers and health awareness drives demonstrate benefits, including improved hygiene, skin protection, and enhanced consumer confidence. Collaborations between personal care manufacturers, wellness brands, and online retail platforms are enhancing product formulation, packaging, and distribution. Rising awareness of male grooming and hygiene continues to drive growth in the Indian market.

The market for men's intimate hygiene products in Germany is recording a CAGR of 10.2%, driven by the mature personal care industry, urban male grooming trends, and strong retail penetration. Manufacturers supply intimate washes, body wipes, grooming kits, and skin-friendly hygiene products for pharmacies, retail stores, and online platforms. Government initiatives promoting public health, male wellness, and personal hygiene encourage adoption. Pilot campaigns in urban centers and wellness programs demonstrate operational benefits including improved hygiene, skin protection, and higher consumer satisfaction. Collaborations between personal care brands, dermatology experts, and retail chains are improving formulations, packaging, and accessibility. Germany’s focus on wellness and hygiene supports continuous market growth.

The market for men's intimate hygiene products in the United Kingdom is growing at a CAGR of 8.5%, supported by increasing awareness of male grooming, urban lifestyle trends, and retail availability. Manufacturers supply intimate washes, wipes, grooming kits, and skin-sensitive hygiene products for retail and e-commerce channels. Government initiatives promoting hygiene awareness, male wellness, and public health campaigns support adoption. Pilot programs in urban areas and wellness campaigns demonstrate benefits including enhanced hygiene, skin care, and consumer confidence. Collaborations between personal care brands, dermatology experts, and e-commerce platforms enhance product formulations, packaging, and distribution. Rising awareness of male grooming and hygiene continues to drive the UK market.

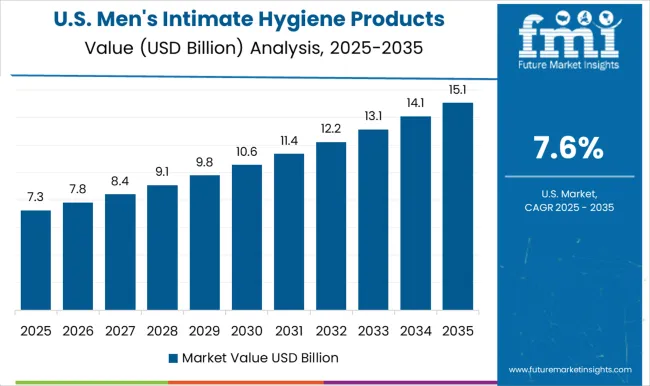

The market for men's intimate hygiene products in the United States is expanding at a CAGR of 7.6%, driven by urban male grooming trends, e-commerce growth, and health-conscious consumers. Manufacturers supply intimate washes, body wipes, grooming kits, and skin-friendly hygiene products for retail, pharmacy, and online platforms. Government programs promoting personal hygiene, male wellness, and public health campaigns encourage market adoption. Pilot campaigns in urban centers and wellness initiatives demonstrate benefits including improved hygiene, skin protection, and increased consumer confidence. Collaborations between personal care brands, e-commerce platforms, and dermatology experts enhance formulations, packaging, and accessibility. Rising awareness of male grooming and hygiene continues to sustain growth in the USA market.

Unilever PLC, Beiersdorf AG, and Burt’s Bees supply men’s intimate hygiene products, including body washes, intimate wipes, and grooming gels, with brochures highlighting pH-balanced formulations, dermatological testing, and natural ingredient composition. Church & Dwight Co., Colgate-Palmolive Company, and Coty Inc. provide cleansers, deodorizing gels, and wipes, with technical literature detailing antimicrobial efficacy, scent profiles, and dermatological safety. Cremo Company and Edgewell Personal Care offer intimate washes and grooming care products, with brochures emphasizing mild formulas, skin hydration, and ease of use.

Hawkins & Brimble and Kimberly-Clark supply premium hygiene solutions, with datasheets presenting product composition, usage guidelines, and skin compatibility. L’Oréal and Manscaped provide specialized male grooming and hygiene products, with literature highlighting formulation science, hypoallergenic properties, and fragrance options. Procter & Gamble and Reckitt & Benckiser deliver products across body wash, wipes, and intimate care, with brochures detailing cleansing efficacy, moisturizing performance, and packaging hygiene standards.

The Man Company supplies natural and ayurvedic hygiene solutions, with brochures presenting ingredient sourcing, formulation benefits, and skin safety. Other regional players compete with cost-efficient products, herbal formulations, and targeted hygiene solutions, with technical guides focused on skin tolerance, pH balance, and ease of application. Market strategies focus on product efficacy, skin safety, and differentiation through formulation.

Product development emphasizes pH-balanced formulas, antimicrobial performance, and mild ingredient profiles suitable for sensitive areas. Partnerships with dermatologists, e-commerce platforms, and retail distributors are leveraged to improve reach and consumer trust. Observed industry patterns indicate focus on hypoallergenic testing, packaging hygiene, and multi-functional products such as cleansing plus moisturizing.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.4 Billion |

| Product | Intimate washes, Wipes, Deodorants & antiperspirants, Moisturizers, Shaving care, and Others (anti-chafing gels, etc.) |

| Type | Conventional and Organic |

| Form | Liquid, Cream, Gel, and Powder |

| Price | Medium, Low, and High |

| Packaging | Bottles, Aerosols, Sticks, Roll-ons, Tubes, and Others |

| Age Group | Adults and Teenagers |

| Application | Sweat control and freshness, Erectile dysfunction (ED), Post-sexual care, Skin condition management, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Unilever PLC, Beiersdorf, Burt's Bees, Church & Dwight, Colgate Palmolive, Coty Inc., Cremo Company, Edgewell Personal Care, Hawkins & Brimble, Kimberly-Clark, L’Oreal, Manscaped, Procter & Gamble, Reckitt and Benckiser, and The Man Company |

| Additional Attributes | Dollar sales by type including washes, wipes, sprays, and deodorants, application across personal care, travel kits, and healthcare, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising awareness of male grooming, increasing focus on personal hygiene, and expanding product availability through retail and e-commerce channels. |

The global mens intimate hygiene products market is estimated to be valued at USD 14.4 billion in 2025.

The market size for the mens intimate hygiene products market is projected to reach USD 33.7 billion by 2035.

The mens intimate hygiene products market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in mens intimate hygiene products market are intimate washes, wipes, deodorants & antiperspirants, moisturizers, shaving care and others (anti-chafing gels, etc.).

In terms of type, conventional segment to command 61.9% share in the mens intimate hygiene products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Men's Intimate Care Products Market - Trends, Growth & Forecast 2025 to 2035

Women's Intimate Care Product Market Trends - Growth, Demand & Analysis 2025 to 2035

Intimate Wash Care Product Market Forecast and Outlook 2025 to 2035

Intimate Lingerie Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Intimate Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

In Motion Dimensioning Systems Market Analysis Size and Share Forecast Outlook 2025 to 2035

Menstrual Care Market - Size, Share, and Forecast Outlook 2025-2035

Menstrual Cups Market Growth - Trends & Forecast 2025 to 2035

Menstrual Cup Foam Wash Market Trends - Growth & Demand From 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA