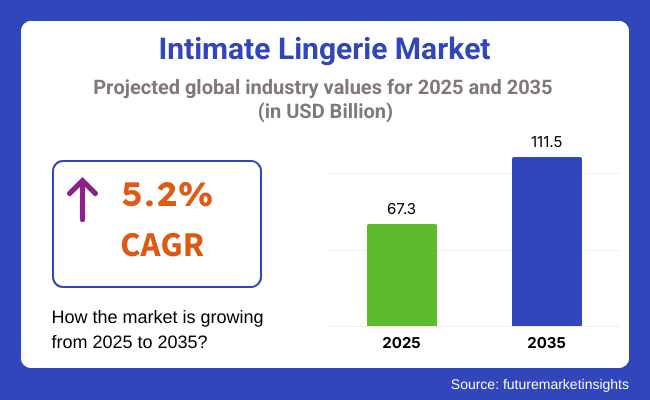

The global intimate lingerie market size was USD 67.3 billion in 2025 and is anticipated to expand at a 5.2% CAGR between 2025 and 2035. The intimate lingerie industry is forecast to reach USD 111.5 billion by 2035. One of the main drivers for this growth is the greater focus on self-expression, body positivity, and comfort on a daily basis, fueled by evolving consumer sentiments and inclusive branding.

There is a major shift in the industry as shoppers are looking not just for beauty but also for performance and all-day wearability. Seamless construction, breathability, and adaptive sizing are becoming top selling points among demographics. Lingerie is changing from an occasional or luxury buy to a daily wardrobe staple, as it mirrors the larger lifestyle shifts towards personal comfort and wellness.

Digitalization remains a powerful growth enabler. Direct-to-consumer (DTC) brands and online platforms have transformed the way intimate wear is bought, providing discreet shopping, virtual try-ons, and size-inclusive stock. Furthermore, customization technologies and data-driven personalization tools are improving consumer satisfaction and minimizing product returns, thus enabling sustainable growth.

he emergence of inclusive and gender-neutral collections is boosting sales. Brands are more and more adopting diverse body shapes, ethnicities, and gender identities in their product offerings and campaigns. This inclusivity not only addresses contemporary consumer demands but also encourages brand loyalty and greater customer engagement in mature and emerging regions.

Geographically, Western Europe and North America lead existing revenues, but Asia-Pacific is the fastest-growing region. Disposable incomes have become high, urbanization is happening rapidly, and fashion trends are accessible through social media. With more competition and innovation, firms with an emphasis on fabric technology, ethical sourcing, and added-value design will be best placed to succeed in the long run.

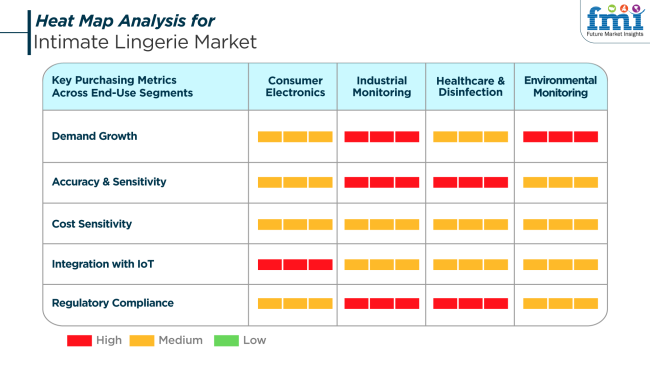

For intimate apparel, wearables integration and material innovation are revolutionizing the consumer electronics industry. Biometric sensor-integrated, temperature-sensitive smart lingerie offers higher comfort and functionality, particularly in wellness and maternity segments. Such technology-driven designs appeal to health- as well as fashion-aware consumers.

In the medical and disinfection industry, intimate wear for post-surgery recuperation, medical ailments, or skin hypersensitivity must comply with stringent material standards and offer comfort in gentle-touch, non-constricting support. Hygiene compliance and functionality take center stage here, and there is growing interest in hypoallergenic and antimicrobial fabrics.

From an ecological standpoint, the rising trend for sustainability in fashion is impacting lingerie purchasing behavior and design. Brands offering reusable packaging, biodegradable components, and transparent supply chains are gaining traction. As consumers get more eco-friendly, especially Gen Z and millennials, these aspects are increasingly driving the frequency of purchase and brand selection.

One of the largest intimate lingerie threats is rapid trend volatility, which comes largely from shifting social norms and social media trends. Consumer design, diversity, and messaging expectations shift quickly, and failing to meet them in a timely way can lead to brand obsolescence, particularly with younger consumers who are interested in authenticity and representation.

Supply chain complexity is another key problem. Utilization of specialty materials, intricate designs, and responsible manufacturing processes adds levels of production risk. Production delays resulting from labor shortages, geopolitical tensions, or inflation of raw materials have the potential to extend product cycles and increase costs, affecting profitability and brand consistency.

The intense competition from legacy brands and new DTC entrants squeezes prices and innovation. While consumers will pay for quality, the presence of fast-fashion alternatives has the potential to chip away at margins. Brands must balance between innovation, value, and sustainability to remain viable in the highly customized market.

Between 2020 and 2024, the intimate lingerie industry witnessed a change towards comfort, inclusivity, and digitalization. The COVID-19 pandemic resulted in a growth in online purchasing of lingerie as most consumers opted for comfortable loungewear and intimate clothing for use at home. As consumers stayed indoors more, brands reacted by emphasizing soft, airy fabrics such as cotton, modal, and bamboo. Inclusive sizing also gained prominence, with more and more brands introducing more sizes and employing body-positive language.

Between 2025 and 2035, there will be a transition towards a more technology-oriented, sustainable, and personalized market. Smart lingerie, such as health-monitoring sensors embedded in clothes, can be a leading trend. Sustainability will remain a force driving innovation, with recycled content, biodegradable lace, and ethical manufacturing becoming the default.

Brands will use AI-driven customization for made-to-measure fits, and virtual try-ons enabled by immersive shopping experiences such as AR/VR will disrupt online shopping. Moreover, the increased focus on unisex and gender-neutral lingerie collections will be fulfilled with increasingly inclusive customer demands.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Comfort-driven designs, fit-based sizing, digitalization, and expansion of digital channels. | Smart bras, AI-fueled fashion, green policies, and unisex products. |

| Women of all age groups who want to feel comfort, inclusivity, and self-expression. | A wider and more diverse range of gender-fluid, eco-friendly, and digitally savvy consumers. |

| Soft textures, lightweight, airy design, seam-free seams, sizes for all. | Smart materials, green materials, and fit-to-order with AI and body scan technology. |

| E-commerce, influencer marketing, online shopping experiences. | AR/VR virtual try-ons, wearables with health monitoring features, and AI-driven fit technologies. |

| Growth of sustainable materials such as organic cotton and recycled lace. | Circular fashion, biodegradable fabrics, and ethically sourced materials are becoming standard. |

| Online shops, direct-to-consumer brands, and brick-and-mortar stores. | Artificial intelligence-powered online shopping websites, virtual shops, and experiential retail. |

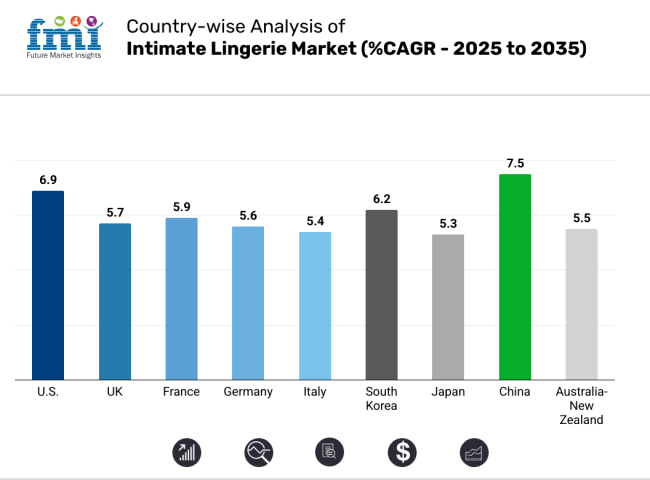

The USA is expected to achieve a 6.9% CAGR during the study period. Growth is being driven by demand for fashionable, comfortable, and body-positive intimate wear, fueled by shifting values and e-consumption. Victoria's Secret, Savage X Fenty, and Aerie are some of the brands that have redefined diversity and body-positivity benchmarks by introducing broader product categories to cater to evolving body types and lifestyles.

Seamless design and smart textile advancements have assisted in propelling rising expectations of performance and comfort. Growth in direct-to-consumer and subscription models has also played an important role.

ThirdLove and CUUP are leveraging technology and data to offer personalized fitting experiences and convenience. A growing demand for sustainability has led to a number of companies introducing environmentally friendly collections featuring recycled fibers and sustainable sourcing. With a rich fashion-forward consumer base and continuous investment in innovation and personalization, the USA remains a prime area of focus for growth.

The UK market will expand at 5.7% CAGR during the study period. Cultural shifts to self-expression and well-being are reshaping lingerie fashion. British brands such as Marks & Spencer, Boux Avenue, and Bluebella are renowned for blending traditional beauty with value and comfort. The businesses have observed their product offerings expand to include more sizes and eco-friendly products that are currently aligned with the shopper agenda.

Internet platforms have seen unprecedented momentum, enabling consumers to browse a broad range of products. Textile and design innovation is also supported by digital communication and social media marketing. Brands such as Lounge Underwear and Figleaves are increasingly well-known for their minimalist styles and influencer-led marketing campaigns. Combining fashion and functionality is driving innovation to help sales growth in the UK.

France will experience a 5.9% CAGR during the forecast period. Renowned for its fashion-oriented culture, France has maintained its lead in the lingerie industry with companies such as Chantelle, Aubade, and Simone Pérèle. All such brands emphasize creativity, masterly artistry, and superior-quality materials, placing France as an upmarket business.

The use of eco-friendly materials and ventures into virtual retailing can be seen. Online platforms are gaining momentum, though physical stores are still culturally significant, particularly for luxury purchases. New players such as Ysé and Livy are combining Parisian sophistication with modern comfort and body inclusivity. French lingerie firms still enjoy a strong international presence while evolving in harmony with contemporary needs.

Germany will expand at 5.6% CAGR during the forecast period. Consumers prefer functionality, comfort, and sustainability, which makes Germany a robust industry. Leading players such as Triumph, Schiesser, and Anita have built reputations on high-end engineering and perfect fit. Such players now focus on green materials and ergonomic fit to adapt to evolving consumer needs.

E-commerce and multi-channel retailing are gaining popularity with the support of efficient logistics. Also, these companies have hassle-free customer return policies. Innovation also exists in the increased use of intelligent fabrics and seam-free design, which achieve style and comfort balance. Smaller local brands such as Opaak are now gaining momentum with their minimal and ethical approach to design. With a strong manufacturing culture and consumer sustainability awareness, Germany continues to register steady growth.

The Italian market is projected to expand at 5.4% CAGR over the study period. Aesthetic sophistication and high-quality manufacturing characterize the Italian industry. La Perla, Intimissimi, and Yamamay are well-known brands that reflect the nation's focus on design, sensuality, and luxurious materials. Italian lingerie features sophisticated silhouettes and fastidious detailing, which attract domestic as well as international consumers.

Italian manufacturers are increasingly incorporating sustainable processes and digital innovation to stay competitive. Internet shopping is growing, backed by a well-established network of boutique stores that offer personalized shopping experiences. Boutique and artisanal brands are also increasing, contributing to a diversified product mix. By having a balance between innovation and heritage, Italy stands to continue holding its ground in Europe.

South Korea is expected to grow at 6.2% CAGR during the study period. Fashion consciousness, urbanization, and shifting values are fueling demand for contemporary lingerie. Local production is being led by players such as Vivien, BYC, and Yes, with fashionable lines that emphasize comfort and simplicity. Players are also tapping into the growing trend of seamless and wire-free fabric styles among young consumers.

Technological convergence, such as AI-based recommendations and textile technologies, is at the forefront. Digital channels, such as mobile commerce and influencer-led promotions, are at the center of consumer engagement. Sustainability is gaining momentum, with startups introducing green lines and cruelty-free manufacturing. The convergence of beauty, fashion, and wellness trends gives South Korea a distinctive advantage, making it one of the most dynamic markets in the region.

Japan is expected to grow at 5.3% CAGR during the period under study. Japan's intimate lingerie industry is driven by comfort, discretion, and quality. Major brands include Wacoal, Peach John, and Triumph Japan through their sophisticated and well-designed offerings that appeal to a broad section of body shapes. The focus of the market is on practical elegance, comfort, and ergonomics.

E-commerce is increasing steadily, supported by efficient logistics and technology-driven shopping experiences. Inclusive and gender-free lines are evolving, driven by shifting social norms and trends. Demand is also increasing for functional undergarments designed for older customers, an important consideration in Japan's aging population. Ongoing textile innovation and rigorous standards of production continue to support market dependability and consumer confidence across the country.

China is expected to grow at 7.5% CAGR during the research period. China leads in growth opportunities with high-speed urbanization, rising middle-class incomes, and strong e-commerce infrastructure. Neiwai, Aimer, and Ubras are driving innovation through product personalization, minimalist designs, and digital engagement. These brands specialize in comfort-first collections that resonate with evolving consumer preferences.

Global players also have an increasing presence in China, but Indigenous companies are fiercely competitive with real-time marketing, live streaming, and AI-based size tools. Intelligent fabrics, adaptive fits, and sustainability initiatives are on the rise as major trends. Cross-industry collaborations with influencers and tech firms further enhance industry responsiveness.

The Australia-New Zealand region will expand at 5.5% CAGR during the forecast period. Sustainability, comfort, and lifestyle-oriented products define the consumer behavior here. Brands such as Bonds, Berlei, and Bras N Things are widely recognized and well-trusted for inclusive sizes, comfort, and quality. These brands are adopting more ethical sourcing and sustainable materials for their product portfolios to meet the needs of the consumers.

Online shopping is the dominant channel, complemented by traditional retail and mobile-first commerce experiences. Boutique brands such as Kat the Label and Nala are seducing younger consumers with stylish yet functional lingerie products. Social media advertising and influencer partnerships continue to be at the forefront of visibility and brand engagement. With increasing consumer awareness about well-being and environmental impact, the Australia-New Zealand region is set for ongoing and healthy growth.

In terms of material, cotton will be the leading material in the intimate lingerie industry in 2025 by 34.6%, followed by satin at 21.3%.

Ever since time immemorial, cotton has remained an integral part of everyone's lives and a consumer favorite beyond just being an economic good but also an endearing and natural breathability. Moisture-wicking properties and hypoallergenic add more life to cotton standards, and such attributes make it liberally worn for routine usage-prioritized woman's care towards their comfort and skin health.

Hanes, Calvin Klein, and Fruit of the Loom are some of the key leaders in this space that offer core basic garments such as briefs, wireless bras, and cotton bralettes. There is also the more mainstream organic cotton lingerie from brands that do have the likes of Boody and Organic Basics, who at this juncture seem to be targeting the growing group of consumers who take an interest in how commodities are produced and are very conscious about environmental healing and their health.

Satin is used for its smooth and glossy finish. Amongst premium collections published by high-end brands like La Perla and Agent Provocateur, satin has received a significant portion of their marketing due to its sensuality and elegance. Furthermore, it is common practice for Victoria's Secret to use satin in sleepwear and lingerie sets that have an adage of softness and femininity.

Savage X Fenty's new label, Rihanna, adds much material diversity by blending satin with stretch mesh or microfiber for comfort without compromising the aesthetics. The younger fashionable generation might find such wear to be attractive and trendy. Besides, retailers are also working toward the objectives of sustainability by incorporating recycled satin into their lines. Parade or Natori brands have launched eco-friendly satin blends to lessen environmental disturbance.

By distribution channel, offline channels will hold 55.2% of the intimate lingerie industry, while online platforms are expected to have a strong 44.8% share.

Offline sales continue to dominate the industry owing to the sensory and personalized nature of the lingerie shopping experience-consumers mostly want to touch and try their pieces and speak with a sales associate before making the purchase. Department stores, specialty boutiques, and brand-exclusive stores are, hence, million-makers when it comes to offline sales, offering deeper brand engagement, fitting services and product availability on the same day.

Retail chains provide in-store experiences with trained fit specialists and smart fitting rooms that enhance customer experience. Many of these pop-ups also offer a redux space for click-and-collect orders, joining offline and online for more convenience.

The online channel is gaining more ground owing to the adoption of e-commerce along with higher digital catalogs and the growing need for discreet shopping experiences. With e-commerce only, brands like ThirdLove, Lively, and Cuup are changing lingerie retail by providing inclusive sizing, AI-powered fit assessments, and subscription models to personalize the shopping experience. Marketplaces such as Amazon, ASOS, and Zalando offer a plethora of lingerie choices and peer-generated reviews that provide purchase guidance.

An integral part of enhancing the growth of online channels are technologies such as virtual try-ons and interaction with real people between consumers and brands via live streaming and influencer partnerships. Witness proof of a digital-first approach augmenting traditional retail via Savage X Fenty's mobile-first approach and SKIMS' viral social media campaigns.

The industry is highly competitive, with global brands catering to diverse consumer preferences for comfort, style, and luxury. Victoria's Secret remains a dominant force, maintaining a strong presence in both physical retail and e-commerce with its wide range of bras, panties, sleepwear, and loungewear. Known for its glamorous image and extensive advertising, Victoria's Secret appeals to a broad consumer base, from everyday wearers to those seeking luxury and sensuality.

Zivame, a major player in India and expanding internationally, has gained traction with its inclusive sizing, personalized shopping experience, and strong digital presence. The brand's direct-to-consumer model and focus on online sales cater to modern, digitally savvy consumers. Meanwhile, Gap, Inc., with its mass-market appeal, has built a significant presence in the intimate apparel segment by focusing on affordable and comfortable everyday lingerie.

Triumph International continues to be a key player globally, known for its premium quality and focus on fit, comfort, and innovation. With a longstanding history in lingerie, Triumph has successfully merged functionality and elegance, offering a wide variety of products for different body types.

Brands like Wacoal Holdings Corp., Chantelle, and HanesBrands also contribute significantly, offering high-quality, well-priced, intimate apparel that combines luxury and comfort. Hunkemöller remains a key player in Europe, appealing to fashion-forward consumers with trendy designs and competitive pricing.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Victoria’s Secret | 22-25% |

| Zivame | 8-10% |

| Gap, Inc. | 7-9% |

| Triumph International | 9-11% |

| Calvin Klein | 6-8% |

| Other Players | 40-48% |

Key Company Insights

Simon Focus has become synonymous with having the best quality product in its entire range. They offer a whole breadth of products that enter every dimension of marriage- from the most glamorous lingerie to the humblest yet intimate nightwear, and they thrill customers into all the styles that one can think about.

The brand keeps its glamour and attraction at an all-time high by going into great big marketing campaigns, putting together the most fabulous fashion shows, and entertaining the minds of the luxury and sensuality-its competition is higher than ever from that kind of brand, known to offer a more diversified and more inclusive range of products within, especially belonging to size and body positive.

Zivame is one of the top giants in India; it has created its brand around an online first model for women getting pampered through an easy way to personalized shopping experience. More and more consumers are choosing Zivame for the comfort they also seek in fashion with its all-inclusive aspect of sizing, styles, and much more. The brand has proven to be the more competitive entity because of its foray into international markets and its commendable digital footprint.

The segmentation is into Bras (T-shirt bras, Sports bras, Minimizer bras, Push-up bras, Bralettes, Nursing bras, and Others), Knickers and Panties (Briefs, Thongs, Boy Shorts, Boxers, Others), Loungewear, Shapewear, and Swimwear.

The segmentation is into Cotton, Satin, Silk, Muslin, Rayon, Net, and Others.

The segmentation is into Online Distribution (eCommerce websites, Company-owned websites) and Offline Distribution (Hypermarket/Supermarket, Brand Stores, Retail Stores).

The regions covered include North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The intimate lingerie industry is expected to reach USD 67.3 billion in 2025.

The industry is projected to grow to USD 111.5 billion by 2035.

The industry is expected to grow at a CAGR of approximately 7.5% during the forecast period.

Cotton is a key segment in the intimate lingerie market.

Key players include Victoria’s Secret, Zivame, Gap, Inc., Triumph International, Calvin Klein, Wacoal Holdings Corp., Chantelle, HanesBrands Inc., Hunkemöller, and Natori.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intimate Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Intimate Wash Care Product Market Trends – Growth & Forecast 2024-2034

Men's Intimate Hygiene Products Market Size and Share Forecast Outlook 2025 to 2035

Men's Intimate Care Products Market - Trends, Growth & Forecast 2025 to 2035

Women's Intimate Care Product Market Trends - Growth, Demand & Analysis 2025 to 2035

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Lingerie Market Growth – Trends, Demand & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA