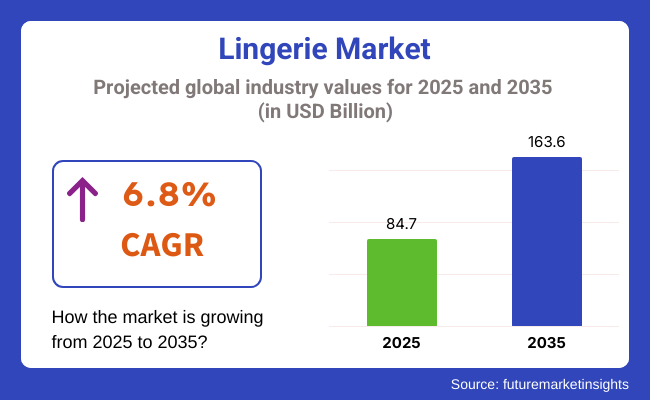

The value of the lingerie market was USD 84.7 billion in 2025 and is expected to grow at a 6.8% CAGR from 2025 to 2035. The value of the global industry is expected to be USD 163.6 billion in 2035. One of the major drivers of this growth is growing consumer demand for trendy yet practical innerwear that aligns with evolving body positivity, inclusivity and lifestyle trends.

In the past, dominated by a small group of body types and design specifications, this category also underwent a paradigm shift. Shifting toward inclusive sizes, comfort-driven engineering, and variability in presentation has been opening the category for her previously ignored segments to date. This flattening of design has been prompted by strong consumer demand for products that offer both appearance and wearability.

Technological advancements in fabric technology, such as breathable microfiber, memory foam cups, and wireless support systems, are redefining consumer expectations. Seamless development, sustainable materials, and multifunctional wear are now mainstream for the design. These technologies cater not only to comfort but to wellness-based lifestyles by integrating intimate wear with performance wear attributes.

Direct-to-consumer business models and social media-driven brand strategies have made the industry more accessible. New players have utilized influencer marketing and digital storytelling to disrupt incumbents, winning over customer loyalty through authentic stories and transparent value propositions. With more mature e-commerce, virtual fitting rooms and AI-powered sizing technology are reducing return rates and making consumers more confident in online purchases.

Cultural shifts are also reframing the symbolic connotation. No longer solely within age-old product classes such as bridal or romantic usage, the industry is increasingly a means of self-expression and empowerment. This movement- from hidden demand to outer self-confidence- also continues to lengthen the category's salience across age groups, body forms, and gender identities, so intimate apparel is becoming a cornerstone within both fashion and functional wear communities.

Briefs will dominate the global industry in 2025, capturing a whopping 54.5% of the industry share. Bras will come next in line with 30.6% of their share. The surge of briefs reflects a tradeoff commitment by consumers from their comfort, inclusivity, and minimalist fashion trends to now being trendy.

Briefs are gaining immense popularity on account of their versatility and ergonomic design, making them ideal for all-day wear. Demand for comfort-centric lingerie has surged, thanks to the pandemic-induced lifestyle changes, along with a growing emphasis on body positivity. Mass-market brands like Hanes, Jockey, and Fruit of the Loom dominate this segment, proving true value multipacks and breathable fabrics like cotton-spandex blends.

Digitally-native, sustainability-driven brands like Knickey and Parade ramp up value with organic cotton briefs and inclusive sizing with bold colors for the Generation Z and millennial demographic. Even big-name fashion companies such as Calvin Klein and Tommy Hilfiger are trying to gain a foothold by enlarging their brief collection with performance fusion fashion materials such as stretch modal and breathable mesh.

Thus far, bras make up only 30.6% of this total, but they will always form a fundamental part of the portfolio. Bralettes and wireless bras are trying to dominate the space previously assigned to the underwire category, thanks to customers' yearning for comfort in appreciative support. Advanced sizing algorithms are the secret behind the successful fitting of Third Love and Pepper on small busts.

This is where Lively, true & co., and savage x Fenty come in, giving stylish bralettes, molded cups, and wireless options, all of which double up as loungewear or a fashion layer. Active bodies have also found a cult following in the hybrid sports bras launched by sports powerhouses like Nike and Adidas that cater to performance and everyday wear. The bra category is also innovating on breathability and moisture-wicking fabrics, as well as customizable straps, making it fit for comfort, use, function, and style all in one parcel.

In the underwear industry, offline retail will gross about 55.5%. The remaining sales will be earned by the online sales segment, with only 44.5%.

People enjoy shopping from an offline channel due to the reasons that inspire the customers to buy lingerie in physical stores rather than online: They try the lingerie themselves and feel the fit and comfort it imparts before purchase. High street department stores such as Macy's, Nordstrom, and Marks & Spencer, as well as an eminent list of lingerie boutique names like Victoria's Secret and La Perla, would always be offline for them.

They offer personalized services such as fittings and demonstrations, making it an experiential shopping destination. Consumption of items without further delay usually drives consumers to such physical sites with immediate access to products.

Online shopping is emerging strongly but without overshadowing offline channels: E-commerce promises a robust 44.5% of estimated purchases in 2025. Very simply, all measures of convenience, such as shopping for things at home, comparing prices, and easy product reviews, are fueling the growth of lingerie sales.

Major e-commerce leaders like Amazon, ASOS, and Zalando have dedicated online lingerie retailers like Savage X Fenty, as well as ThirdLove, that have thrived on this momentum of having extensive product catalogs, size guides, and easy return policies.

There is also the subscription model, such as the one by Adore Me, which addresses the new trend of increasingly valuing convenience, more personalized selections, and weighing disruption against effort in receiving the product. Suppose digital channels keep on developing and converting the interface created with the clients for a proper customer experience. In that case, they will include, among other things, augmented reality (AR) try-ons, virtual fittings and online purchases, which are expected to keep on winning ground.

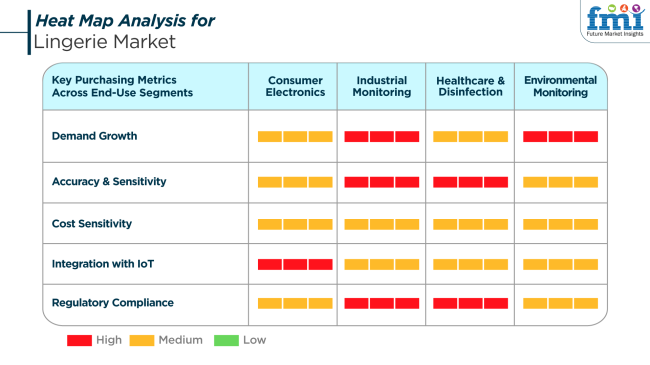

The purchasing dynamics are characterized by high demand growth and heightened sensitivity to fit and comfort, mirroring the precision required in sectors like healthcare. Precision in size and support are essential to customer satisfaction, with the growing emphasis on body-positive products and ergonomic design.

Sensitivity to cost is moderate. While mass-market affordability is addressed through basic collections, premium and luxury segments are slowly growing with demand for high-quality fabrics, custom-fit styles, and bespoke themes. Customers in this segment are slowly becoming more willing to spend money on high-quality, durable products that are comfortable and empowering.

Regulatory compliance, though less severe than in healthcare industries, is evolving. Intimate apparel materials, dyes, elastic mixes, and underwire composition are regulated by health and safety requirements. Sustainability also pushes brands toward OEKO-TEX certifications and circular fashion trends. These forces now influence not only manufacturing tendencies but also consumer purchasing behavior.

The intimate apparel industry, though promising continued growth, also has unique dangers that would strain its trend. One significant risk is mounting pressure to innovate in terms of size and inclusivity without degrading production efficiency. While brands move up size ranges and provide individualized fits, consistency in quality and inventory control proves to be complex and costly.

Sustainability concerns represent another emerging risk. Shoppers are increasingly scrutinizing fast fashion systems and demanding greater transparency in sourcing and manufacturing. Lingerie brands that rely heavily on artificial materials or fossil fuels can expect to get flak unless they move to more sustainable, traceable content. Compliance with environmental certifications and reducing carbon footprints will become key to brand reputation.

Industry saturation and brand homogenization are concerns, particularly in the mid-market. With numerous direct-to-consumer entrants and legacy brands entering digital, differentiation is growing harder. Companies that fail to break out of traditional storytelling or disregard experiential retailing and digital personalization risk being outpaced by more agile, consumer-centric competitors.

Between 2020 and 2024, the industry saw a dramatic shift, primarily due to a change in consumer mindset towards comfort, inclusivity, and self-expression. The COVID-19 pandemic also played its part in fueling the demand for comfortable loungewear and home-friendly intimates as consumers remained indoors more frequently.

There was a discernible increase in the demand for soft and comfortable materials like cotton, modal, and silk, with a focus on stretchy and breathable fabrics. Wireless bras, seamless construction, and body-positive intimate apparel were in great demand, as women sought comfort over conventional stiff designs.

Forecasting from 2025 to 2035, the industry will likely continue to evolve based on personalization, technology integration, and sustainability. Customized lingerie with AI-based fit algorithms and intelligent sizing technology will enable a more customized shopping experience. Temperature control and health monitoring smart fabrics could be the next mass industry fashion.

Unisex and gender-neutral products will also be leading the way, driven by diversity and shifting beauty definitions. Sustainability will also be on the trend, with more and more brands focusing on waste reduction, biodegradable materials, and circular economies.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Demand driven by comfort, inclusive sizing, growth through e-commerce, sustainability, and body positivity. | Personalization, integration of smart technology, gender-neutral styling, and environmentally conscious innovation. |

| Women of all ages seeking comfort, inclusivity, and self-expression, and environmentally aware consumers. | Tech-savvy shoppers, gender-diverse consumers, and sustainable consumers seeking intelligent, customizable, and eco-friendly lingerie. |

| Seamless fits, wireless bras, body-positive communications, and inclusive sizing. | Intelligent fits, health-tracking smart fabrics, and gender-neutral/unisex ranges. |

| Development of e-commerce websites, online promotions, and influencer marketing campaigns. | AI-driven fit technology, temperature-control smart fabrics, and augmented reality (AR) for virtual fitting rooms. |

| Increased demand for sustainable materials such as organic cotton and recycled fibers. | Circular economies, biodegradable textiles, green manufacturing processes, and zero-waste processes. |

| Direct-to-consumer marketplaces, online retailing, physical stores. | Virtual shopping experiences, AI-powered personalization platforms, and subscription lacy services. |

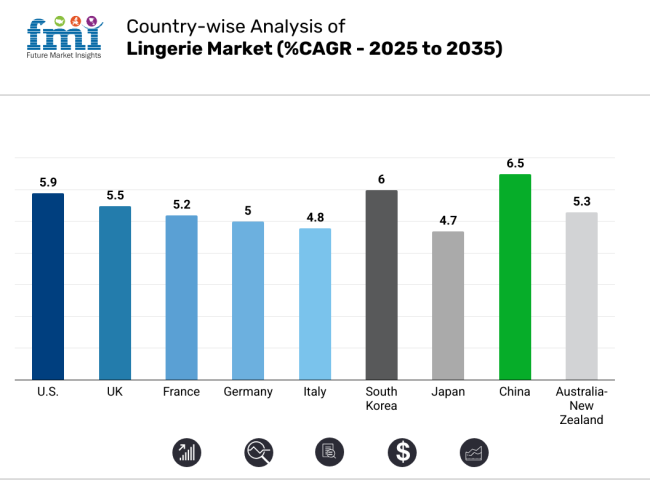

The USA industry is likely to expand at a 5.9% CAGR throughout the study. The sector reflects consistent growth fueled by rising consumer expenditure on undergarments and personal care products. There is increasing demand for relaxed and fashionable lingerie, driving brands to innovate and launch varied product ranges that suit various segments and body types.

A strong focus on body positivity and inclusivity is assisting in redefining industry strategies and expanding the consumer base. The growth in online sales, along with improvements in e-commerce logistics, has enabled higher availability of premium and mid-range items in urban and suburban areas. Consumer preferences are changing towards intimate wear that combines fashion and function, encouraging greater use of seamless, wireless, and environmentally friendly lingerie.

Millennials and Gen Z populations exhibit higher sensitivity towards sustainable and ethically sourced collections, which in turn has contributed to a larger share of organic cotton and recycled material-based offerings. The retail infrastructure in the USA is also mature, and there is a widespread presence of global brands and enhanced brand visibility through online media.

Such an environment lends itself to regular revenue generation and supports strong brand-consumer relationships. Technological convergence within fabric production and customization software will continue to build industry penetration within the forecast horizon.

The UK industry will grow at 5.5% CAGR throughout study. Demand is building up on account of changing fashion trends, increased thrust toward body-positive campaigns, and increased awareness about self-care products. UK consumers are seeking comfort without losing style, which is creating sustained growth in premium as well as affordable segments. The increased preference for size-inclusive and gender-neutral ranges is driving product innovation and repositioning across channels.

The online shopping platform is at the forefront of the lingerie industry, with more and more consumers buying online because of convenience, privacy, and wider product offerings. Local and global brands are taking advantage of this by partnering with influencers and targeted marketing. The industry also shows greater interest in soft bralettes, shapewear, and hybrid innerwear that can be worn for lounging and light activity.

With evolving workplace trends and blended work lifestyles, multi-benefit intimate wear is seeing higher demand. Further, sustainability has emerged as a defining quality of brand consciousness, leading to environmentally friendly processes and materials on the part of manufacturers. As the industry reaches maturity, ethical consumerism and innovation are poised to fuel sustained growth in the lingerie category.

The French industry is likely to register a 5.2% CAGR through the study period. France continues to be a center of global fashion and luxury, and this carryover applies broadly to lingerie as well, in which premium positioning and aesthetic elegance are driving performance in the marketplace. Refined taste and robust brand loyalty amongst French consumers propel steady demand for quality fabrications, elegant forms, and progressive collections.

Highly regarded traditional craftsmanship and heritage brands have a very strong industry share, and more youthful consumers are driving demand for contemporary, minimalist fashions. The local industry is responding to new consumer values by incorporating comfort-driven silhouettes and environmentally friendly production practices.

E-commerce growth has provided further distribution channels for independent labels and boutique brands. Increased product availability and the growing power of social media trends are driving category relevance among a broader audience. French lingerie is frequently viewed as a fashionable as well as functional item, which stimulates greater spending per product compared to worldwide averages.

The industry further indicates increased demand for lingerie promoting well-being in the form of maternity and post-surgery lingerie. This intersection of aesthetics, comfort, and functionality is projected to maintain France's status as a leading player in international markets.

The German industry will grow at a 5% CAGR through the course of the study. The industry in Germany is supported by a highly structured retail environment and a consumer who values durability, fit, and fabric. Decision-making revolves around functional performance, comfort, and durable material. German consumers have a strong preference for established home and European brands that emphasize engineering excellence and skin-husbandry fabrics.

Digitalization throughout the retail sector has enhanced access to virtual fitting solutions and personalized recommendations, and online platforms are becoming more and more influential in driving buyer behavior. The industry is reacting to increasing environmental awareness through an increased variety of sustainable lingerie collections with organic materials and ethical supply chains.

Neutral colors and classic cuts prevail, but younger consumers are adopting colorful and expressive styles that mirror individual style and inclusivity. Furthermore, incorporating wellness benefits in lingerie like temperature-control material or posture-support designs is increasingly picking up. With age-group shifts pushing up the proportion of young, fashion-conscious consumers, the German industry is on the verge of steady growth in the future with emphases on quality, innovation, and sustainability.

Italy is anticipated to develop at a rate of 4.8% CAGR through the analysis period. Italy's strong cultural heritage in textile artistry and fashion design continues to impact its lingerie industry, where design perfection and high-quality materials continue to be major value drivers.

Italian companies are famous for their precise attention to detail and high-level tailoring, which appeal to a consumer who appreciates visual sophistication as well as comfort. In spite of this, the industry is slowly accepting new lingerie requirements, with increasingly more adaptable, day-to-day wear items gaining traction.

Over the past few years, Italian consumer behavior has moved towards minimalist yet elegant innerwear, mirroring wider lifestyle changes. The growth of online commerce platforms and social commerce patterns are facilitating improved product discovery, particularly among the digitally savvy youth.

Ethical production and transparency in sourcing are increasingly shaping brand decisions, leading manufacturers to embrace more sustainable practices. Boutiques and specialty stores still dominate customer interaction, but mass-market retailers are bringing curated lingerie lines to target larger segments. With innovation intersecting tradition, the Italian lingerie industry is adapting to shift to accommodate new consumer needs while still upholding design superiority.

The South Korean industry will develop at a 6% CAGR for the study period. South Korea has a vibrant demand for style-driven and trend-forward lingerie driven by high social media penetration, urban lifestyle orientations, and changing notions of beauty. The industry features a fast-paced embrace of new styles, materials, and technological innovations.

Metropolitan-dwelling young consumers are particularly sensitive to international fashion influences, leading to fast-moving collection turnovers and rich diversity in brand offerings. Consumer demand for beauty is offset by a need for comfort throughout the day, especially with the trend towards wireless and seamless lingerie.

The local industry is also evolving, with regional players partnering with international fashion players to provide co-branded collections. E-commerce has become a leading channel, backed by experiential online shopping and quick delivery networks. With cultural attitudes changing and individuality becoming more tolerated, product variety and sizing inclusiveness are on the march.

Moreover, South Korean consumers are focusing more on skincare-friendly fabrics and smart fabric technologies like temperature regulation and anti-bacterial functionality. The industry is positioned to sustain growth driven by technology integration and fashion-savvy sensibilities.

The Japanese industry is forecasted to expand at a 4.7% CAGR throughout the study. Local preferences for modesty, minimalism, and refined quality influence the Japanese industry. Comfort for use, delicate details, and good standards of artistry dictate purchase decisions.

As old styles persist with older consumer bases, newer generations are embracing a combination of domestic and international influences, meshing comfort with a contemporary feel. Japan's robust department store and specialty boutique infrastructure underpins premium product availability and brand variety.

The rising power of social media and evolving fashion mindsets are encouraging producers to innovate with respect to size range, design, and performance characteristics. Customers are also migrating toward materials that provide breathability and moisture-wicking, particularly in the summer months.

Though overall industry growth is modest, increasing interest in wellness-oriented and sustainable lingerie indicates hidden potential. Technology developments like 3D fitting technology and AI-powered style advice will improve online interaction and shopping ease. The coming together of tradition and innovation makes Japan a stable but forward-looking industry in the lingerie industry.

The China industry is projected to grow at 6.5% CAGR over the study period. China is among the most promising industries for lingerie, underpinned by rapid urbanization, increasing disposable income, and escalating fashion consciousness among young consumers. The industry is witnessing a move from utilitarian innerwear to aspirational and expressive lingerie, with high demand for local as well as international brands.

Digital channels are playing a significant role in molding consumer behavior with live streaming, influencer marketing, and targeted campaigns motivating purchase intent. Strong logistics and mobile commerce penetrations lead to an increase in online sales. Consumption is especially sought after in Tier 1 and Tier 2 cities, as style trends there are changing at a rapid rate.

Trends of soft cup bras, breathable shapewear, and sustainable collections are picking up pace. In addition, lifestyle congruence and wellness are increasingly relevant, driving brands to launch multifunctional lingerie that addresses both comfort and looks. Smart lingerie and material technology are set to be driven by the Chinese industry, providing robust opportunities for long-term and strong growth.

The Australia-New Zealand industry will grow at 5.3% CAGR over the period under study. A high regard for lifestyle-driven fashion and functionality influences consumer tastes in this industry. Comfort, durability, and sustainability take precedence when purchasing, with a strong interest in ethically made lingerie. Both nations exhibit a mix of Western-style influence and domestic sensibilities, which results in the growing demand for minimalist yet functional designs.

Digital shopping channels have become part of industry growth, allowing niche and emerging brands to acquire loyal customer bases. The demand for wireless bras, seamless panties, and green fabrics is creating category diversification. Wellness-based lingerie, such as products designed for maternity and post-surgery, is also becoming more important.

With a high awareness of environmental concerns, consumers are willing to support open and conscious brands. Retailers are countering by providing greater size ranges, body-positivity marketing, and accommodating return policies. The industry in Australia-New Zealand is shifting gradually, underpinned by a matured economy, progressive fashion trends, and an ongoing focus on sustainable consumption.

A highly competitive industry is becoming very competitive because of legacy brands and new D2C entrants. Victoria's Secret has long been the name in lingerie. Yet, when compared to Jockey International Inc., Hanesbrands Inc., and Calvin Klein - all of which are household names today in part because they strike chords in marketing concepts of comfort and style for multiple price ranges - Victoria's Secret has some strong competitors.

While it has had less than a stellar reputation during the past couple of years, the company still proves to be the leader when it comes to premium lingerie because of its glitzy brand image, wide-ranging retail presence, and product lines that keep reinventing themselves to either inclusivity or comfort.

Emerging D2C brands like Zivame and Bare Necessities aim to remove all barriers between the consumer and an endless range of sizes and styles of unparalleled comfort. There are several ways these brands use online platforms and digital marketing to attract the interest of millennials and Gen Z consumers. Triumph International Ltd. and Hunkemoller are joined by an additional few established and emerging players.

They can enjoy the high-end and low-end lingerie and roll out internationally with an emphasis on quality and innovation. Apart from these established and new entrants, MAS Holdings concentrates primarily on the manufacture of softer lingerie for various international brands and grows its footprint with its brand to keep the competition level high across multiple segments. Such fundamental principles, in addition to the trend toward body positivity and inclusiveness, will create spaces for new entrants and niche brands with wider customer segmentation.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Jockey International Inc. | 12-14% |

| Victoria’s Secret | 15-17% |

| Zivame | 7-9% |

| Gap, Inc. | 8-10% |

| Hanesbrands Inc. | 10-12% |

| Other Players | 42-46% |

Key Company Insights

Victoria's Secret has long cherished a leadership position in the industry owing to the iconic brand image itself; however, now the company seems to have repositioned its strategy in recent years to be more in keeping with consumer demand for portrayal and body positivity. Having said this, they are on the path towards a wider, more all-embracing product line, along with revamping the marketing strategy to supplement the already great. Helping them reposition in lost industry share even amidst intense competition from other D2C players such as Zivame and Bare Necessities.

Jockey International Inc., Hanesbrands, and Calvin Klein continue to dominate the mid-level industry today, giving excellent but very fashionable options for casual and comfortable lingerie at affordable costs. With their superb coverage through retail stores, a greater range of products, and innovations like seamless or eco-friendly fabrics, they managed to cater to a larger segment of customers. Additionally, these brands are also present in new industries and selling through e-commerce channels.

By product type, the industry is segmented into briefs, bras, shapewear, and others.

By distribution channel, the industry is categorized into Online and Offline.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The industry is expected to reach USD 84.7 billion in 2025.

The industry is projected to grow to USD 163.6 billion by 2035.

The industry is expected to grow at a CAGR of approximately 6.5% during the forecast period.

Briefs are a key segment in the industry.

Key players include Jockey International Inc., Victoria’s Secret, Zivame, Gap, Inc., Hanesbrands Inc., Triumph International Ltd., Hunkemoller, Bare Necessities, Calvin Klein, and MAS Holdings.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Distribution channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Distribution channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Distribution channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Distribution channel, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Distribution channel, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Distribution channel, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Distribution channel, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Distribution channel, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intimate Lingerie Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA