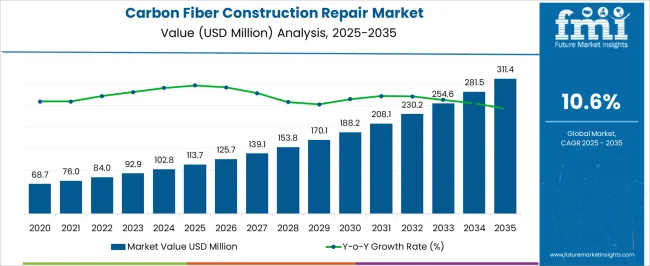

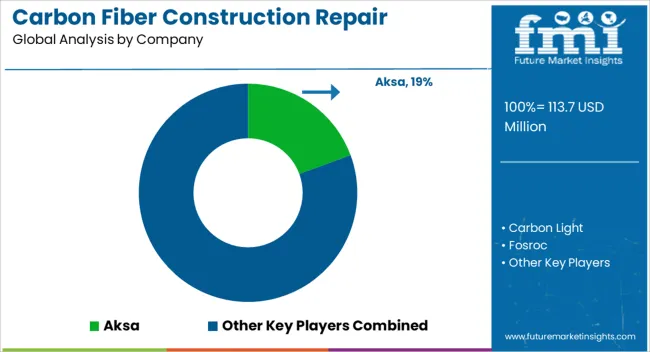

The carbon fiber construction repair market is projected to reach 113.7 million dollars in 2025 and 311.4 million dollars in 2035, growing at a CAGR of 10.6% between 2025 and 2035. During the early adoption phase from 2020 to 2024, demand was driven by pilot projects in bridge retrofitting, building reinforcement, and infrastructure repair, as contractors tested carbon fiber solutions for durability and load-bearing performance. Entering the scaling phase in 2025, adoption expands across commercial and public construction projects.

Manufacturers increase production, improve supply chain reliability, and provide technical support, contributing to steady revenue growth and broader market penetration. From 2030 to 2035, the market enters the consolidation phase, with leading suppliers strengthening positions through strategic partnerships, long-term contracts, and expanded service offerings. Smaller competitors either focus on niche applications or exit the market. Adoption stabilizes as most potential construction and infrastructure projects integrate carbon fiber repair solutions. Companies focus on operational efficiency, project cost management, and quality assurance. By 2035, the market exhibits predictable growth, mature competition, and standardized repair procedures, creating a stable and well-structured industry landscape.

| Metric | Value |

|---|---|

| Carbon Fiber Construction Repair Market Estimated Value in (2025 E) | USD 113.7 million |

| Carbon Fiber Construction Repair Market Forecast Value in (2035 F) | USD 311.4 million |

| Forecast CAGR (2025 to 2035) | 10.6% |

The carbon fiber construction repair market is driven by multiple end-use segments, each contributing to overall growth. Bridges and Highways dominate with approximately 30% of the market, as carbon fiber solutions are increasingly used for structural reinforcement, crack repair, and load-bearing improvements. Commercial Buildings contribute 20%, incorporating carbon fiber for retrofitting, seismic strengthening, and façade restoration. Residential Infrastructure accounts for 15%, focusing on smaller-scale structural repairs and renovation projects.

Industrial Facilities hold 12%, where carbon fiber is applied to reinforce critical machinery foundations and structural elements. Tunnels and Underground Structures represent 8%, addressing water ingress, stress cracks, and long-term durability. Railway and Metro Networks contribute 7%, supporting bridges, elevated tracks, and station repairs. Airports and Ports account for 5%, strengthening runways, terminals, and cargo facilities. Heritage and Historical Structures represent 2%, where minimally invasive reinforcement is critical. Smaller segments, such as Research and Specialty Projects, make up 1%, focusing on experimental applications or pilot programs.

Revenue growth aligns with adoption trends, expanding from 68.7 million dollars in 2020 to 113.7 million in 2025 and projected to reach 311.4 million by 2035 at a CAGR of 10.6%. Bridges, commercial buildings, and industrial facilities remain primary drivers, while heritage and niche applications steadily contribute to market diversity and long-term expansion.

The carbon fiber construction repair market is experiencing strong growth due to the rising demand for high strength, lightweight, and corrosion resistant materials in infrastructure rehabilitation. Aging building stocks, increased seismic retrofitting needs, and the focus on extending the service life of structures are driving adoption across both developed and emerging economies.

Advancements in resin formulations and fiber weaving technologies have enhanced the structural performance and durability of carbon fiber solutions, making them increasingly competitive against traditional repair methods. Regulatory guidelines emphasizing sustainable and long lasting construction practices are further promoting the use of carbon fiber in repair and reinforcement applications.

With urbanization accelerating and infrastructure investments increasing, the market outlook remains favorable as stakeholders seek efficient and long term solutions to address structural deficiencies and minimize maintenance costs.

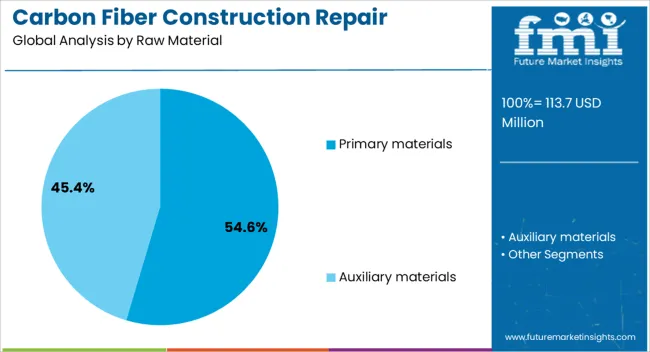

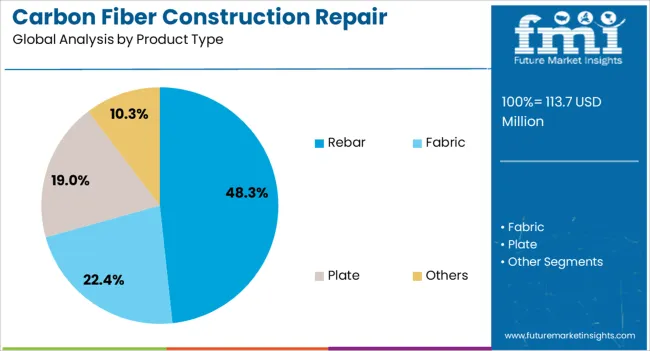

The carbon fiber construction repair market is segmented by raw material, product type, application, and geographic regions. By raw material, carbon fiber construction repair market is divided into Primary materials and Auxiliary materials. In terms of product type, carbon fiber construction repair market is classified into Rebar, Fabric, Plate, and Others.

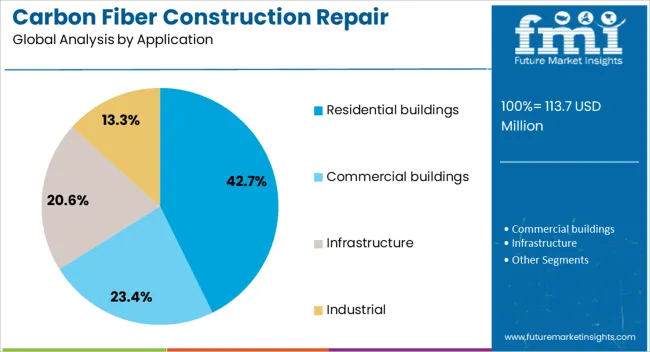

Based on application, carbon fiber construction repair market is segmented into Residential buildings, Commercial buildings, Infrastructure, and Industrial. Regionally, the carbon fiber construction repair industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The primary materials segment is projected to account for 54.60% of total revenue by 2025 within the raw material category, making it the leading segment. This dominance is supported by the superior strength to weight ratio, corrosion resistance, and longevity offered by high quality carbon fibers derived from primary sources.

These materials enable enhanced structural integrity and performance, particularly in demanding environments where durability is critical.

Continuous innovation in production processes has improved cost efficiency and expanded applicability, ensuring their preference in large scale construction repair projects.

The rebar segment is expected to hold 48.30% of the total market revenue by 2025, positioning it as the most significant product type.

This growth is driven by its effectiveness in reinforcing concrete structures while eliminating issues such as rusting and reduced load capacity found in steel rebars.

The high tensile strength and lightweight properties of carbon fiber rebars allow for easier handling, reduced installation time, and improved seismic performance, making them a preferred choice for long term infrastructure stability.

The residential buildings segment is anticipated to capture 42.70% of total market revenue by 2025 within the application category, maintaining its leadership position. This is due to increasing renovation and repair activities in urban housing sectors, driven by aging properties and stricter building safety standards.

Carbon fiber solutions provide a non intrusive, aesthetically adaptable, and structurally reliable method for reinforcing residential buildings without significantly altering their design or function.

The growing emphasis on sustainable housing and reduced lifecycle maintenance costs further supports the dominance of this application area.

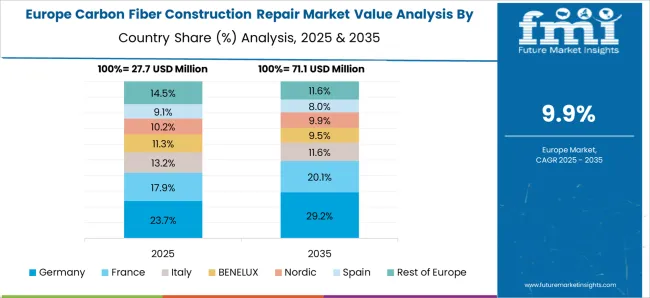

The carbon fiber construction repair market is expanding due to increasing demand for structural strengthening, retrofitting, and durability enhancement in aging infrastructure. North America and Europe lead with high-performance carbon fiber systems applied to bridges, commercial buildings, and industrial facilities. Asia-Pacific shows rapid growth driven by urbanization, infrastructure development, and seismic retrofitting needs. Manufacturers differentiate through fiber quality, resin systems, installation techniques, and modular solutions. Regional variations in construction standards, structural demands, and environmental conditions strongly influence adoption, repair efficiency, and competitive positioning globally.

The adoption of carbon fiber in construction repair is driven by the need for high-strength, lightweight, and durable reinforcement solutions. North America and Europe prioritize carbon fiber wraps, laminates, and sheets to retrofit bridges, industrial buildings, and heritage structures with minimal downtime and high load-bearing capacity. Asia-Pacific markets increasingly adopt carbon fiber solutions for earthquake-prone zones, aging urban infrastructure, and fast-growing construction projects. Differences in structural load requirements, environmental exposure, and retrofitting complexity affect material choice, installation methods, and repair timelines. Leading suppliers provide high-modulus fibers, advanced epoxy resins, and modular systems for rapid application, while regional players focus on cost-effective, practical reinforcement options. Structural and retrofitting contrasts shape adoption, durability, and market competitiveness.

Carbon fiber quality and associated resin systems significantly influence repair effectiveness and adoption. North America and Europe favor high-tensile, pre-impregnated fibers combined with epoxy or polyurethane resins to ensure optimal bonding, longevity, and environmental resistance. Asia-Pacific markets often utilize cost-effective fibers with compatible resin systems adapted for humid, hot, or seismic-prone regions. Differences in fiber tensile strength, resin curing properties, and compatibility affect structural reinforcement efficiency, durability, and service life. Leading suppliers focus on standardized, tested fibers with optimized resin formulations, while regional manufacturers offer practical, locally sourced solutions. Material and resin contrasts shape adoption, repair performance, and competitive positioning globally.

Adoption of carbon fiber repair solutions depends on efficient installation methods and trained personnel. North America and Europe emphasize automated wrapping, pre-impregnated laminates, and specialized curing systems applied by certified technicians to ensure consistent quality and safety. Asia-Pacific markets focus on manual or semi-automated installation due to cost constraints, balancing speed with reliability. Differences in workforce expertise, application techniques, and equipment availability affect repair precision, timeline, and long-term performance. Leading suppliers provide comprehensive training, installation guides, and modular systems for ease of use, while regional players offer practical solutions suited to local workforce capabilities. Installation technique contrasts shape adoption, repair efficiency, and competitiveness globally.

Compliance with construction codes, safety regulations, and infrastructure standards strongly influences adoption of carbon fiber repair solutions. North America and Europe enforce strict building codes, seismic reinforcement standards, and quality certifications, ensuring reliable structural performance. Asia-Pacific regulations vary, with advanced regions following international norms while emerging markets adopt locally defined standards to balance cost and performance. Differences in certification requirements, testing protocols, and safety standards affect material approval, project timelines, and adoption rates. Leading suppliers provide certified, code-compliant carbon fiber systems, while regional manufacturers deliver practical, regulation-aligned alternatives. Regulatory and standard contrasts shape adoption, credibility, and competitive positioning in global markets.

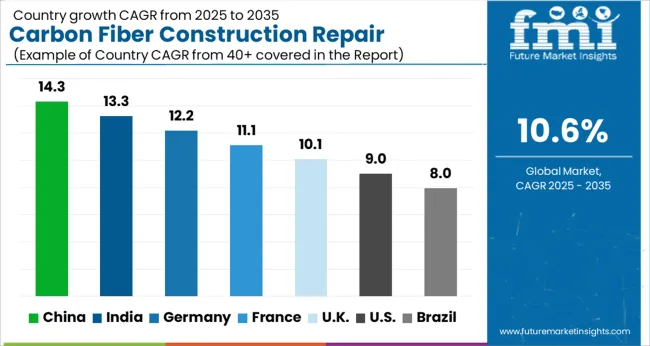

| Country | CAGR |

|---|---|

| China | 14.3% |

| India | 13.3% |

| Germany | 12.2% |

| France | 11.1% |

| UK | 10.1% |

| USA | 9.0% |

| Brazil | 8.0% |

The global carbon fiber construction repair market is projected to grow at a 10.6% CAGR through 2035, supported by rising demand in infrastructure reinforcement and structural restoration. Among BRICS nations, China led with 14.3% growth as extensive deployment in bridges, buildings, and transport infrastructure was carried out, while India at 13.3% growth expanded usage across civil projects and industrial facilities. In the OECD region, Germany at 12.2% registered consistent adoption under construction standards promoting durability and efficiency, while the United Kingdom at 10.1% integrated carbon fiber solutions across refurbishment and public infrastructure. The USA, with 9.0% growth, applied carbon fiber repair methods across transportation and energy sectors under regulated frameworks for safety and longevity. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The carbon fiber construction repair market in China is projected to expand at a CAGR of 14.3%, supported by large scale investments in infrastructure maintenance and structural reinforcement. Adoption is being accelerated by the superior strength to weight ratio of carbon fiber materials which allows efficient repair of bridges, tunnels, and high rise buildings. Local manufacturers are being encouraged to provide cost effective products that meet safety and durability requirements. Distribution is being strengthened through partnerships with construction firms, government projects, and engineering contractors. Training initiatives and awareness programs are being conducted to ensure proper installation practices. Expanding urban construction, aging infrastructure, and increasing safety standards are recognized as key factors boosting the carbon fiber construction repair market in China.

In India, the carbon fiber construction repair market is expected to grow at a CAGR of 13.3%, driven by increasing demand for advanced repair solutions in bridges, highways, and public buildings. Adoption is being supported by the lightweight yet strong properties of carbon fiber that enhance structural durability without adding significant load. Manufacturers are being encouraged to expand product availability and supply solutions tailored to Indian infrastructure needs. Distribution through engineering contractors, state funded projects, and construction firms is being strengthened. Knowledge sharing sessions and technical demonstrations are being conducted to improve acceptance among engineers and contractors. Rapid urban development, government spending on repair programs, and emphasis on long lasting materials are supporting the carbon fiber construction repair market in India.

Germany is witnessing steady expansion in the carbon fiber construction repair market with a CAGR of 12.2%, supported by demand for reinforcement of aging infrastructure and heritage sites. Adoption is being encouraged by carbon fiber materials that offer high tensile strength, durability, and minimal disruption during application. Manufacturers are being urged to innovate in resin systems and bonding techniques for stronger results. Distribution channels include engineering firms, government projects, and specialized repair contractors. Research activities focusing on sustainability of materials and enhanced bonding efficiency are being pursued. Increasing demand for reinforcement of old bridges, emphasis on structural safety, and need for long term repair solutions are driving the carbon fiber construction repair market in Germany.

The carbon fiber construction repair market in the United Kingdom is projected to register a CAGR of 10.1%, driven by demand for effective rehabilitation of aging infrastructure across cities. Adoption is being encouraged by materials that provide high tensile strength, resistance to corrosion, and lightweight handling advantages. Manufacturers are being urged to expand offerings of preformed strips, sheets, and wraps suitable for varied repair applications. Distribution through construction companies, public infrastructure projects, and engineering consultancies is being supported. Awareness campaigns and demonstrations are being organized to promote carbon fiber adoption in repair work. The growth of urban infrastructure projects, stricter safety regulations, and focus on cost effective repair are major contributors to the carbon fiber construction repair market in the United Kingdom.

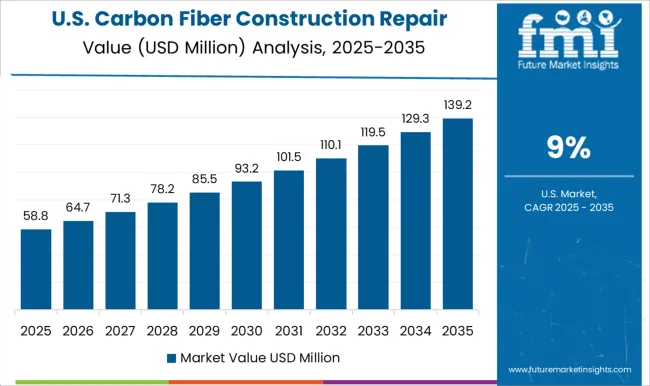

The carbon fiber construction repair market in the United States is projected to grow at a CAGR of 9.0%, supported by large investments in strengthening bridges, highways, and commercial buildings. Adoption is being encouraged by materials that provide durability, low maintenance requirements, and high resistance to environmental stress. Manufacturers are being urged to supply high performance and certified carbon fiber systems that meet national standards. Distribution through infrastructure contractors, private construction firms, and government repair programs is being strengthened. Research activities focusing on advanced bonding technologies, long term durability, and performance testing are being pursued. Rising government spending, emphasis on safety, and increasing repair needs of aging structures are considered key drivers of the carbon fiber construction repair market in the United States.

The carbon fiber construction repair market is shaped by global composite material manufacturers, specialized repair solution providers, and regional contractors catering to civil infrastructure and industrial facilities. Leading players such as Sika AG, BASF SE, Owens Corning, and 3M hold strong positions by offering a diversified portfolio of carbon fiber-reinforced polymer (CFRP) solutions, including laminates, sheets, and strengthening systems for bridges, buildings, tunnels, and pipelines. Competitive differentiation is driven by product performance, including tensile strength, corrosion resistance, durability, and ease of application. Regional suppliers, particularly in Asia-Pacific and Europe, compete by offering cost-effective solutions and localized technical support for infrastructure repair and retrofitting projects.

Strategic collaborations with construction companies, engineering consultants, and government agencies help enhance market penetration and credibility. Innovation in lightweight, high-strength CFRP materials, adhesive technologies, and rapid curing systems further strengthens competitive positioning. Companies prioritizing regulatory compliance, long-term performance guarantees, and robust after-sales support are poised to capture significant shares.

| Item | Value |

|---|---|

| Quantitative Units | USD 113.7 Million |

| Raw Material | Primary materials and Auxiliary materials |

| Product Type | Rebar, Fabric, Plate, and Others |

| Application | Residential buildings, Commercial buildings, Infrastructure, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aksa, Carbon Light, Fosroc, Horse Construction, Mapei, Master Builders Solutions, Mitsubishi Chemical Corporation, Rhino Carbon Fiber, Sika, Sireg Geotech, and Toray Industries |

| Additional Attributes | Dollar sales vary by repair type, including structural reinforcement, crack repair, and seismic retrofitting; by application, such as bridges, commercial buildings, residential structures, and industrial facilities; by end-use, spanning construction companies, civil engineering firms, and infrastructure maintenance agencies; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by aging infrastructure, demand for durable repairs, and lightweight, high-strength materials. |

The global carbon fiber construction repair market is estimated to be valued at USD 113.7 million in 2025.

The market size for the carbon fiber construction repair market is projected to reach USD 311.4 million by 2035.

The carbon fiber construction repair market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in carbon fiber construction repair market are primary materials and auxiliary materials.

In terms of product type, rebar segment to command 48.3% share in the carbon fiber construction repair market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Carbon Textile Reinforced Concrete Market Size and Share Forecast Outlook 2025 to 2035

Carbon And Graphite Felt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Black Content Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA