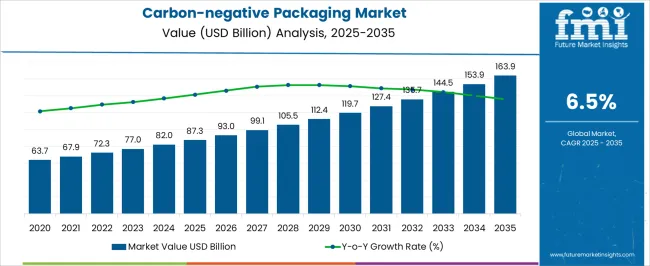

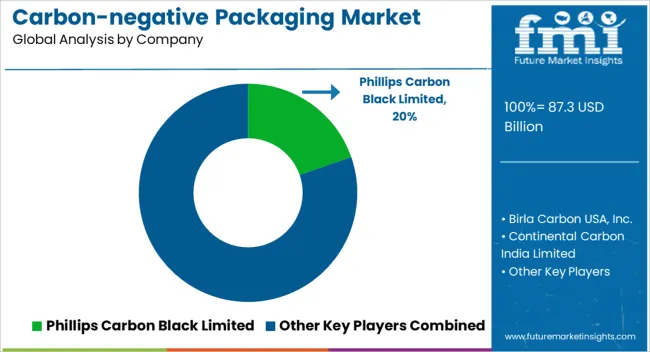

The Carbon-negative Packaging Market is estimated to be valued at USD 87.3 billion in 2025 and is projected to reach USD 163.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Carbon-negative Packaging Market Estimated Value in (2025 E) | USD 87.3 billion |

| Carbon-negative Packaging Market Forecast Value in (2035 F) | USD 163.9 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The carbon negative packaging market is experiencing robust expansion as industries transition toward sustainable practices and prioritize reduced environmental footprints. Rising regulatory pressures to curb single use plastics and growing consumer demand for eco friendly alternatives are accelerating adoption of packaging that actively offsets carbon emissions.

Biodegradable, compostable, and carbon capturing materials are being increasingly integrated into packaging solutions to align with corporate sustainability commitments and net zero targets. Innovations in biopolymer development and renewable raw material sourcing are enhancing durability, performance, and scalability of carbon negative packaging.

Additionally, heightened focus from food and beverage brands on environmentally responsible packaging is expanding market penetration. The outlook remains positive as governments, businesses, and consumers collectively embrace climate friendly packaging options that deliver both functional performance and measurable environmental benefits.

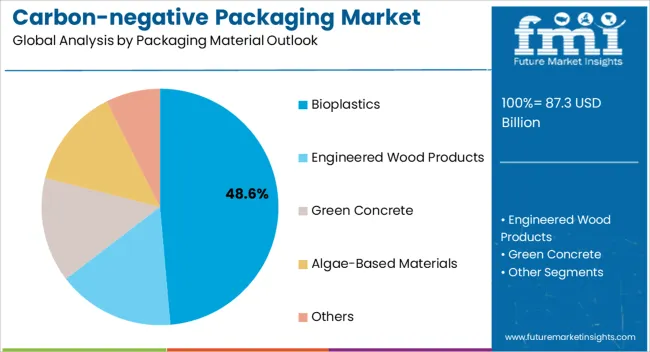

The bioplastics segment is expected to hold 48.60% of total market revenue by 2025 within the packaging material category, positioning it as the leading segment. This leadership is attributed to its renewable sourcing, compostability, and ability to reduce reliance on fossil fuel based plastics.

Bioplastics have gained strong traction across industries due to improvements in barrier properties, printability, and flexibility that make them suitable for both dry and liquid products. Their alignment with circular economy models and regulatory incentives supporting biodegradable materials have further propelled adoption.

Investment in large scale production facilities and increasing collaboration between material innovators and packaging manufacturers are strengthening market growth. As a result, bioplastics remain the preferred choice for carbon negative packaging, offering both sustainability and performance benefits.

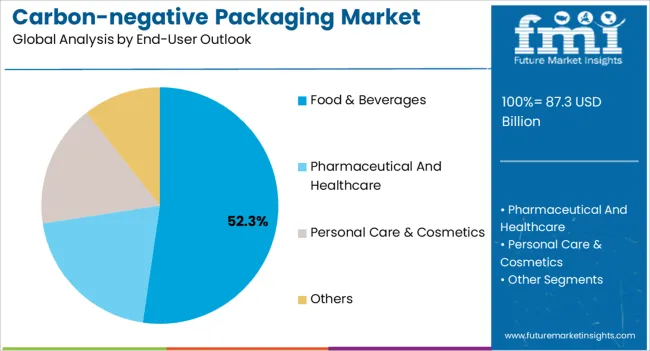

The food and beverages segment is projected to account for 52.30% of total revenue by 2025 under the end user category, making it the dominant segment. This growth is supported by the sector’s high consumption of packaging materials and the need for sustainable alternatives to meet consumer expectations and regulatory requirements.

Carbon negative packaging solutions are being deployed to enhance brand image, comply with eco labeling standards, and reduce environmental impact across product categories such as ready to eat meals, beverages, and snacks. The rising influence of environmentally conscious consumers has accelerated adoption, with leading brands integrating bioplastics and other carbon negative formats into mainstream product lines.

With food and beverages being a highly visible consumer sector, its leadership in adopting sustainable packaging continues to drive overall market momentum.

Historically, the growing awareness of environmental issues and the necessity for sustainable packaging solutions drove the need for carbon-negative packaging. Consumers, governments, and corporations began to recognize the negative environmental effects of traditional packaging materials, resulting in a shift in preferences toward eco-friendly alternatives.

In the future, the carbon-negative packaging market is predicted to increase significantly and boost sales prospects. Additionally, the need to address climate change and environmental challenges is projected to become pressing.

As organizations and consumers seek solutions that actively decrease carbon emissions and contribute to sustainability, demand for carbon-negative packaging is likely to rise.

Governments around the world are going to impose strict restrictions and offer incentives to encourage the adoption of sustainable packaging practices. Businesses across various industries are increasingly integrating sustainability into their corporate strategies.

Moreover, with sustainability becoming a key differentiator, companies invest in carbon-negative packaging to meet their sustainability goals, enhance their brand reputation, and capture consumer loyalty.

According to FMI, the market is likely to witness a growth rate of 6.5% between 2025 and 2035, in comparison to 3.7% from 2020 to 2025.

Investing in the carbon-negative packaging industry can help organizations gain a competitive advantage, increase supply chain efficiency, and satisfy sustainability goals.

Here are several strategies that can facilitate business expansion and success:

Bioplastics are one of the packaging materials that have a substantial market share in the carbon-negative packaging sector. Bioplastics are made from renewable resources such as corn flour, sugarcane, or cellulose, and they have various environmental advantages.

Given their biodegradability, composability, and small carbon footprint, they have gained favor as a viable alternative to standard plastics.

Bioplastics have been widely used in a variety of industries, including food and beverage, personal care, and consumer product packaging. Their adaptability and compatibility with existing packaging methods have helped them gain market share.

Furthermore, advances in bioplastic technology have resulted in great performance and increased adoption by businesses and consumers alike.

In the food and beverage business, carbon-negative packaging solutions frequently focus on materials such as bioplastics, compostable materials, and alternative packaging options.

These materials offer biodegradability, low carbon emissions, and functional packaging qualities. These materials further help to maintain the freshness and quality of food and beverages while reducing their environmental impact.

The food and beverage industry has been aggressive in adopting sustainable practices and resolving packaging-related environmental concerns. Many organizations in this area have ambitious sustainability goals and are actively exploring carbon-negative packaging solutions to satisfy these goals and remain competitive.

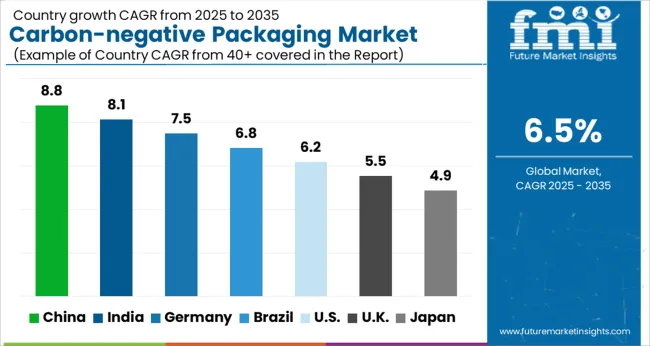

The region's well-established food and beverage industry has played a critical role in encouraging carbon-negative packaging usage. Food manufacturers, retailers, and restaurants in North America have recognized the need for sustainable packaging practices in meeting consumer expectations while reducing their environmental imprint.

The legislative environment in North America has been favorable to sustainable packaging initiatives. Regulations and guidelines aiming at reducing carbon emissions and promoting sustainable practices have been adopted in both the United States and Canada.

These restrictions have motivated enterprises to use carbon-negative packaging solutions, increasing the region's market share of such packaging materials.

In Europe, the food and beverage industry has been a significant driver of carbon-negative packaging usage. Consumers in the region place a premium on eco-friendly packaging and actively seek products with a low environmental impact.

Governments of Europe have enacted tough legislation and procedures for extended producer responsibility (EPR) to encourage sustainable packaging practices. These rules, such as the European Green Deal and the Circular Economy Action Plan, encourage businesses to use low-carbon packaging materials and technologies.

The convergence of rules and consumer demand has increased the market share of carbon-negative packaging in Europe.

Many governments in Asia Pacific area have implemented environmental rules and legislation that support sustainable packaging practices. These initiatives encourage firms to use carbon-negative packaging and fund research and development in environment-friendly materials and technology.

The region's increasing middle class has purchasing power and strong expectations for environment-friendly products and packaging. This demographic transition has increased demand for carbon-neutral packaging solutions, particularly in the food and beverage industry.

There is a great demand for packaging materials that are both protective and environment-friendly with the advent of e-commerce in Asia Pacific.

Several key players and emerging companies are actively involved in developing and providing carbon-negative packaging options. Many startups and innovative ventures have entered the carbon-negative packaging market, focusing specifically on developing sustainable packaging materials and technologies.

These companies bring fresh ideas and disruptive solutions, often utilizing bioplastics, compostable materials, and other innovative approaches to reduce carbon emissions and environmental impact.

Competition is expected to intensify, leading to further innovations and improvements in carbon-negative packaging solutions as the market continues to grow. Market players that can differentiate themselves through product quality, sustainability credentials, cost-effectiveness, and responsive customer service are likely to thrive in this competitive landscape.

Latest Developments

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.5% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Packaging Material, By End User Industry, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Phillips Carbon Black Limited; Birla Carbon USA, Inc.; Continental Carbon India Limited; Cabot Corporation; Tokai Carbon Group (Cancarb); Sealed Air Corporation; Pregis Corporation; DS Smith Plc; Achilles Corporation; Delphon Industries, LLC; Smurfit Kappa Group; Storopack Hans Reichenecker GmbH; Desco Industries Inc.; Nefab Group; Teknis Limited, Elcom (United Kingdom) Ltd.; GWP Group Limited; International Plastics Inc.; AUER Packaging GmbH; Pure-Stat Engineered Technologies, Inc.; Protective Packaging Corporation; Key Segments |

| Customization & Pricing | Available upon Request |

The global carbon-negative packaging market is estimated to be valued at USD 87.3 billion in 2025.

The market size for the carbon-negative packaging market is projected to reach USD 163.9 billion by 2035.

The carbon-negative packaging market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in carbon-negative packaging market are bioplastics, engineered wood products, green concrete, algae-based materials and others.

In terms of end-user outlook, food & beverages segment to command 52.3% share in the carbon-negative packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA