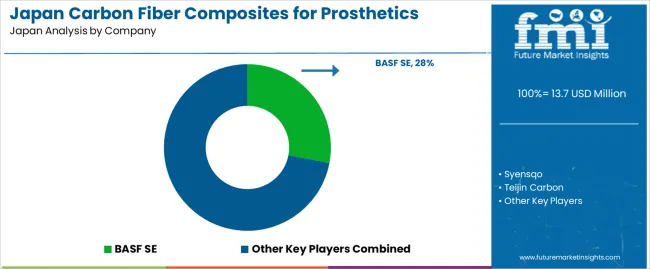

The demand for carbon fiber composites for prosthetics in Japan is valued at USD 13.7 million in 2025 and is projected to reach USD 18.7 million by 2035, reflecting a compound annual growth rate of 3.2%. Growth is supported by rising interest in lightweight prosthetic components that enhance mobility and comfort for users. Carbon fiber composites are widely adopted due to their strength-to-weight ratio, durability and ability to improve energy return in prosthetic limbs. Japan’s aging population, combined with increasing occurrences of mobility-related conditions, contributes to rising demand for high-performance prosthetic materials. As healthcare providers incorporate advanced prosthetic solutions, the adoption of carbon fiber components continues to expand in both clinical and rehabilitation settings.

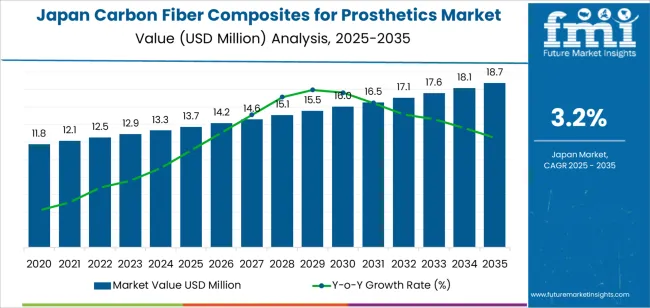

The growth curve shows a steady upward pattern, beginning at USD 11.8 million in earlier years and rising to USD 13.7 million in 2025 before progressing to USD 18.7 million by 2035. Incremental gains remain consistent, with demand moving from USD 14.2 million in 2026 to USD 14.6 million in 2027, followed by gradual increases across the remaining timeline. The year-on-year growth underscores the expanding use of carbon fiber composites as prosthetic designs evolve toward improved performance and user comfort. As manufacturers refine fabrication techniques and healthcare systems adopt advanced mobility solutions, demand continues to build across Japan’s prosthetics sector.

Demand in Japan for carbon fiber composites used in prosthetic devices is projected to rise from USD 13.7 million in 2025 to USD 18.7 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 3.2%. Starting at USD 11.8 million in 2020, the value grows steadily through USD 13.3 million in 2024 and reaches USD 13.7 million in 2025. Over the forecast period, demand then expands to USD 17.1 million in 2032 and ultimately USD 18.7 million in 2035. This steady increase is underpinned by Japan’s ageing population, higher incidence of limb loss or amputation, and increasing adoption of lightweight, high performance prosthetic materials in rehabilitation and mobility devices.

The value uplift of USD 5.0 million over the decade from 2025 to 2035 emphasises both volume expansion and incremental value per unit. Early growth is primarily driven by unit installations as more patients gain access to advanced prosthetic care and practitioners adopt carbon fiber solutions. Over time, enhancements such as customisation, improved durability, enhanced performance and integration of advanced composite materials contribute to rising average selling value. As such, the shift from standard prosthetics to premium carbon fiber composite devices support sustained demand growth toward USD 18.7 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 13.7 million |

| Forecast Value (2035) | USD 18.7 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

The demand for carbon fiber composites for prosthetics in Japan is rising as the country manages higher rates of limb loss linked to diabetes, peripheral arterial disease and age-related conditions. Japan’s aging population requires prosthetic solutions that are light, durable and supportive of daily mobility, which makes carbon fiber a preferred material. These composites help reduce fatigue during walking and improve overall balance, enabling users to maintain independence for longer periods. Clinics and rehabilitation centers across Japan rely on materials that withstand repeated stress, and carbon fiber offers consistent performance. Domestic availability of carbon-fiber materials also supports local manufacturing of prosthetic components, allowing faster delivery and better customization for individual users.

Healthcare delivery patterns in Japan are reinforcing this growth. Many patients receive rehabilitation through community hospitals and outpatient centers that focus on improving functional outcomes with devices that enhance comfort and movement. Carbon-fiber prosthetics meet this need because they provide strong energy return during gait while remaining easy to fit and adjust. Growth in home-care services also encourages adoption of lightweight prosthetic devices that help users manage daily tasks without strain. Challenges remain, including higher material costs and the need for skilled fitting professionals, yet the shift toward mobility-focused care keeps demand for carbon-fiber prosthetics on an upward trajectory.

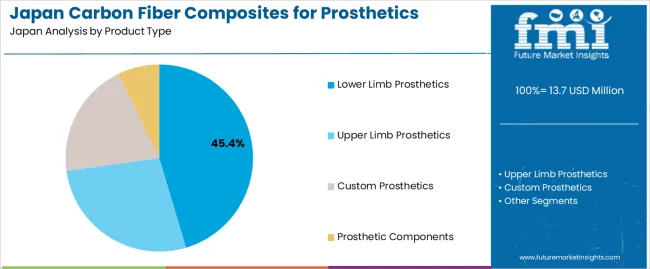

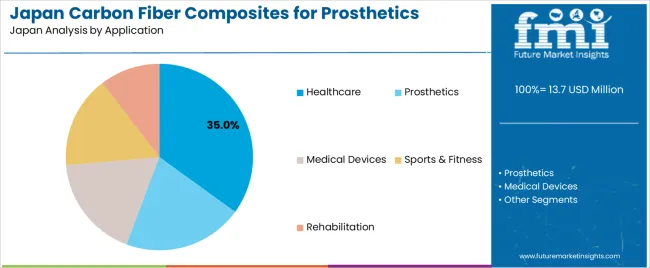

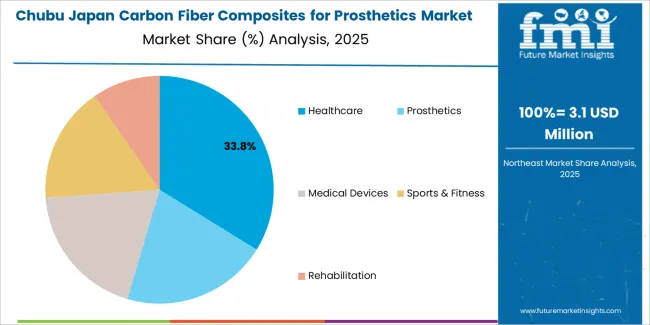

The demand for carbon fiber composites for prosthetics in Japan is shaped by the range of product types and the applications that rely on lightweight, durable prosthetic materials. Product types include lower limb prosthetics, upper limb prosthetics, custom prosthetics and prosthetic components, each meeting specific anatomical and performance needs. Applications span healthcare, prosthetics, medical devices, sports and fitness and rehabilitation. These segments reflect growing clinical emphasis on mobility solutions that improve patient comfort and function. As Japan’s aging population and rehabilitation needs expand, the combination of diverse product types and broad application use drives steady demand for advanced composite materials.

Lower limb prosthetics account for 45% of demand for carbon fiber composites used in prosthetic applications in Japan. Their high share is linked to the need for materials that deliver strength, stability and low weight for devices that support everyday mobility. Carbon fiber composites help create limbs that improve gait efficiency and reduce fatigue, making them suitable for a wide range of patients. Lower limb prosthetics are widely used in clinical settings for amputations caused by vascular conditions, diabetes and trauma, which increases adoption of composite-based components.

Demand for lower limb prosthetics is also supported by improvements in socket design, foot modules and joint mechanisms that rely on carbon fiber for stiffness and energy return. These developments improve walking comfort and functional capability, which strengthens their clinical acceptance. As rehabilitation programs emphasize long-term mobility outcomes, lower limb prosthetics benefit from continued investment in advanced materials. This encourages consistent use of carbon fiber composites across Japan’s healthcare and rehabilitation systems.

Healthcare applications account for 35% of the total demand for carbon fiber composites used in prosthetics in Japan. This leading position reflects the central role of hospitals and rehabilitation centers in prescribing and fitting prosthetic devices. Healthcare settings require materials that combine durability, low weight and biomechanical efficiency to support patient mobility. Carbon fiber composites meet these requirements and are used widely in prosthetic limbs and components designed for daily use. Their adoption is reinforced by the need for reliable materials that support long-term performance across varied patient conditions.

Demand in healthcare is also driven by Japan’s aging population and the rising incidence of limb-related conditions that require prosthetic intervention. Clinical teams prioritize materials that enhance user comfort and promote sustained mobility during rehabilitation. Carbon fiber components help achieve these objectives by improving device function and reducing overall device weight. As healthcare providers continue to focus on patient outcomes and mobility restoration, carbon fiber composites maintain strong demand within clinical prosthetic applications in Japan.

Demand for carbon fiber composite prosthetics in Japan is rising as healthcare providers prioritize lightweight materials that support mobility, durability and daily comfort. Growth is influenced by an ageing population, higher incidence of limb loss linked to chronic diseases and strong domestic expertise in advanced materials. At the same time, challenges such as high device cost, uneven access to specialized fitting services and reimbursement limitations restrict wider use. These dynamics shape how rapidly carbon fiber composite prosthetics gain traction across Japan’s healthcare and rehabilitation settings.

Japan’s ageing demographic is driving interest in prosthetic solutions that reduce fatigue, improve balance and support daily independence. Older adults who experience limb loss often require devices that are lighter and more responsive, making carbon fiber composites appealing due to their strength-to-weight performance. The emphasis on maintaining quality of life and mobility encourages the adoption of materials that enhance comfort. As chronic conditions associated with ageing increase, prosthetic centers respond by incorporating carbon fiber components into more lower-limb and upper-limb devices.

Opportunities exist in outpatient rehabilitation facilities, specialized prosthetic clinics and sports-oriented prosthetic programs. As Japan expands its focus on assistive technologies and personalized rehabilitation, demand grows for customized prosthetic components that offer both functional and aesthetic advantages. Domestic expertise in carbon fiber manufacturing supports the development of advanced designs suited for active users. Growth potential also lies in lighter components that address comfort needs for everyday users, opening opportunities across both urban and regional care environments.

Broader adoption is limited by high device costs, which place pressure on both healthcare budgets and household spending. Specialized fitting, maintenance and adjustment requirements add to long-term expenses. Some rehabilitation facilities lack trained personnel for advanced carbon fiber fitting techniques, which restricts access outside major urban areas. In addition, certain users may prefer conventional materials due to familiarity or lower cost. These factors slow the pace at which carbon fiber composite prosthetics are adopted across Japan’s diverse user groups.

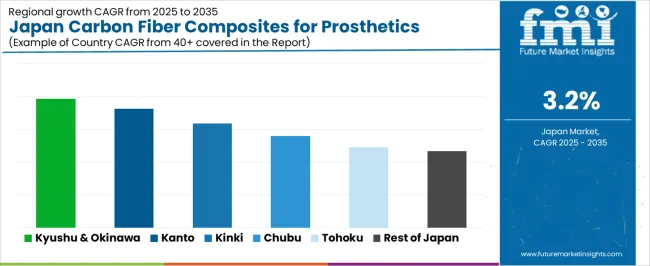

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.9% |

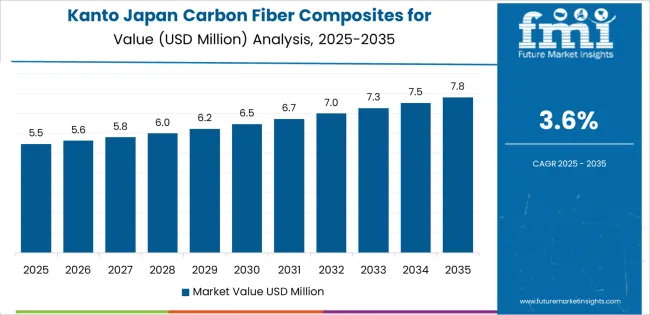

| Kanto | 3.6% |

| Kinki | 3.2% |

| Chubu | 2.8% |

| Tohoku | 2.5% |

| Rest of Japan | 2.3% |

Demand for carbon fiber composites for prosthetics in Japan is rising across regions. Kyushu and Okinawa lead at 3.9%, supported by expanding rehabilitation services and increased use of lightweight materials in prosthetic design. Kanto follows at 3.6%, driven by advanced medical centers and higher adoption of modern prosthetic technologies among patients. Kinki records 3.2%, influenced by steady demand from clinics and hospitals serving urban populations. Chubu grows at 2.8%, where orthotic and prosthetic providers show consistent interest in durable composite materials. Tohoku reaches 2.5%, with gradual adoption across its healthcare network. The rest of Japan grows at 2.3%, reflecting stable but slower uptake of carbon fiber prosthetic components in smaller regions.

Kyushu & Okinawa is projected to grow at a CAGR of 3.9% through 2035 in demand for carbon fiber composites for prosthetics. The region’s healthcare facilities, especially in Fukuoka, are adopting lightweight, high-strength materials to improve prosthetic functionality and patient comfort. Rising cases of limb loss due to accidents, chronic illnesses, or congenital conditions contribute to the demand. Advanced manufacturing facilities in Kyushu & Okinawa are increasingly producing carbon fiber prosthetic components. The emphasis on improving mobility, durability, and customization in prosthetics further drives adoption in medical and rehabilitation centers across the region.

Kanto is projected to grow at a CAGR of 3.6% through 2035 in demand for carbon fiber composites for prosthetics. As Japan’s economic and healthcare hub, including Tokyo, the region sees widespread adoption of advanced prosthetic technologies. Hospitals and rehabilitation centers are increasingly using carbon fiber prosthetics for enhanced mobility, reduced weight, and better patient outcomes. Rising awareness of rehabilitative care and increasing healthcare expenditure drive the demand. The integration of prosthetics with digital design and customized solutions further accelerates adoption across Kanto’s urban healthcare facilities.

Kinki is projected to grow at a CAGR of 3.2% through 2035 in demand for carbon fiber composites for prosthetics. The region’s medical and rehabilitation facilities, particularly in Osaka and Kyoto, are increasingly adopting lightweight, high-strength prosthetic components. Growing awareness of prosthetic solutions, combined with advances in carbon fiber technology, drives market growth. Patients seeking durable, high-performance prosthetics benefit from enhanced mobility and comfort. The integration of prosthetic customization with advanced manufacturing processes further supports adoption, and regional healthcare providers continue to implement carbon fiber-based prosthetic devices to improve the quality of rehabilitative care.

Chubu is projected to grow at a CAGR of 2.8% through 2035 in demand for carbon fiber composites for prosthetics. The region’s healthcare infrastructure, particularly in Nagoya, is expanding the use of advanced prosthetic technologies. Hospitals and rehabilitation centers are increasingly adopting carbon fiber prosthetic components for patients requiring limb replacement or support. Rising focus on patient comfort, lightweight prosthetic solutions, and durability accelerates the adoption of carbon fiber composites. Chubu’s medical and manufacturing industries are collaborating to supply high-quality prosthetic materials, supporting growth in both urban and semi-urban healthcare facilities across the region.

Tohoku is projected to grow at a CAGR of 2.5% through 2035 in demand for carbon fiber composites for prosthetics. The region’s healthcare facilities, although less concentrated than in major urban areas, are adopting advanced prosthetic solutions for improved patient mobility and comfort. Rising awareness of rehabilitation and assistive care, along with the availability of lightweight carbon fiber components, supports adoption. Tohoku hospitals and clinics are integrating these advanced prosthetic devices into treatment plans for patients with limb loss or disability. Regional initiatives to enhance rehabilitative care further support the growth of carbon fiber prosthetics.

The Rest of Japan is projected to grow at a CAGR of 2.3% through 2035 in demand for carbon fiber composites for prosthetics. Smaller cities and rural areas are gradually adopting advanced prosthetic solutions to meet the needs of patients requiring limb replacement or support. The demand for lightweight, high-strength prosthetic components improves patient mobility and treatment outcomes. Regional healthcare providers are increasingly incorporating carbon fiber prosthetic devices into rehabilitation programs. The adoption of advanced manufacturing processes for customized prosthetics further contributes to steady growth across these less urbanized regions of Japan.

The demand for carbon fiber composites for prosthetics in Japan is driven by an aging population, a high incidence of vascular and chronic health conditions that can lead to amputation, and a strong domestic materials-engineering base. Japan has established capability in advanced carbon fiber production and composite manufacturing, which supports local supply chains for prosthetic components. The preference for prosthetic limbs that are lightweight, durable, and comfortable for daily use aligns with carbon fiber’s strength-to-weight advantages. In addition, the universal health system and increasing focus on mobility and quality of life for older citizens further underpin adoption of advanced prosthetic solutions incorporating carbon fiber composites.

Key companies shaping the segment in Japan include BASF SE, Syensqo, Teijin Carbon, Toray Industries Inc., Hexcel Corporation and Nitpro Composites. These suppliers provide carbon fiber materials, prepregs and composite parts which prosthetics manufacturers can integrate into limb systems. Toray and Teijin are especially relevant in Japan given their strong local production presence, which facilitates supply into domestic prosthetic manufacturing. BASF and Hexcel contribute advanced composite capabilities and global best practice in material performance. With support from local firms like Syensqo and Nitpro, the value chain is strengthened. These players help enable prosthetic device makers to produce limbs that leverage the key benefits of carbon fiber composites while addressing the specific needs of Japanese users.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End Users | Hospitals, Rehabilitation Centers, Prosthetic Clinics, Sports & Fitness Facilities |

| Product Types | Lower Limb Prosthetics, Upper Limb Prosthetics, Custom Prosthetics, Prosthetic Components |

| Applications | Healthcare, Prosthetics, Medical Devices, Sports & Fitness, Rehabilitation |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | BASF SE, Syensqo, Teijin Carbon, Toray Industries Inc, Hexcel Corporation, Nitpro Composites |

| Additional Attributes | Dollar by sales across product types and applications; regional adoption patterns; integration into lower limb and upper limb prosthetics; customization and advanced composite use; material cost and manufacturing insights; influence of aging population on demand. |

The demand for carbon fiber composites for prosthetics in Japan is estimated to be valued at USD 13.7 million in 2025.

The market size for the carbon fiber composites for prosthetics in Japan is projected to reach USD 18.7 million by 2035.

The demand for carbon fiber composites for prosthetics in Japan is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in carbon fiber composites for prosthetics in Japan are lower limb prosthetics, upper limb prosthetics, custom prosthetics and prosthetic components.

In terms of application, healthcare segment is expected to command 35.0% share in the carbon fiber composites for prosthetics in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA