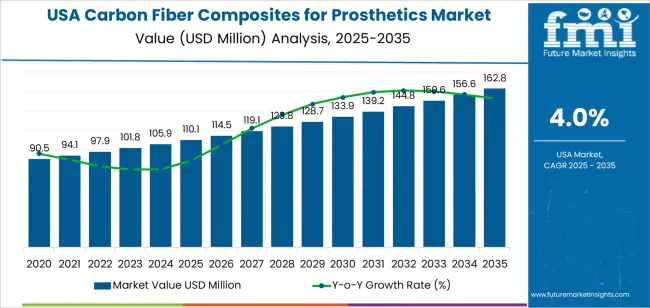

The demand for carbon fiber composites for prosthetics in the USA is projected to grow from USD 110.1 million in 2025 to USD 162.8 million by 2035, reflecting a CAGR of 4%. Carbon fiber composites are highly valued in the prosthetics industry due to their lightweight, strong, and durable properties, making them ideal for creating prosthetic limbs that offer enhanced functionality and comfort for patients. As the aging population in the USA continues to grow, the need for advanced prosthetic solutions will drive increased demand for these materials. Additionally, advancements in manufacturing technologies and customization capabilities for prosthetic devices will further support the adoption of carbon fiber composites as a preferred material.

The increasing focus on personalized medicine, improved prosthetic designs, and higher patient satisfaction in the healthcare industry is pushing demand for more advanced materials that not only meet strength requirements but also offer aesthetically pleasing designs. As prosthetic technology evolves, the high-performance characteristics of carbon fiber composites will continue to play a central role in enhancing prosthetic functionality and improving quality of life for patients. Furthermore, insurance coverage expansion and rising awareness of advanced prosthetic solutions will continue to drive the growth of the market in the coming years.

From 2025 to 2030, the demand for carbon fiber composites for prosthetics in the USA will grow from USD 110.1 million to USD 133.9 million, contributing USD 23.8 million in value. This phase will experience acceleration in demand, driven by the growing adoption of advanced prosthetic solutions and the increasing availability of customizable prosthetic devices.

The early part of the forecast period will see rapid growth as healthcare providers and prosthetic manufacturers adopt carbon fiber composites for their ability to meet strength-to-weight ratios while providing patients with better comfort and mobility. Innovations in prosthetic design and the integration of carbon fiber into custom-made prostheses for different types of amputations will further enhance market expansion. Rising demand for high-performance prosthetics will push the market forward during this period, leading to an accelerated adoption of carbon fiber-based materials.

From 2030 to 2035, the market will grow from USD 133.9 million to USD 162.8 million, contributing USD 28.9 million in value. This phase will see a deceleration in the growth rate as the market matures and carbon fiber composites become increasingly standardized in prosthetic devices. While the overall demand for prosthetics will continue to rise, the rate of acceleration will slow down, as most healthcare providers and prosthetic manufacturers will have already integrated these materials into their offerings. The market will continue to expand due to continuous improvements in materials and the development of next-generation prosthetic technologies that further enhance patient outcomes. The focus will shift from early adoption to sustained growth, with the market growing steadily, but at a more moderate pace compared to the early stage of development.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 110.1 million |

| Industry Forecast Value (2035) | USD 162.8 million |

| Industry Forecast CAGR (2025-2035) | 4% |

Demand for carbon fiber composites in prosthetic applications in the USA is being driven by the growing prevalence of limb loss due to diabetes, vascular disease, and trauma, alongside rising expectations for lightweight, performance-oriented prosthetic devices. The USA prosthetics and orthotics market is projected to grow at a compound annual growth rate (CAGR) of around 4.9% through 2034. Materials such as carbon fiber composites are particularly valued because of their high strength-to-weight ratio, which improves mobility, comfort, and user endurance compared with heavier metal or plastic alternatives.

Another factor supporting demand is rapid innovation in prosthetic design, manufacturing techniques, and patient expectations. Advances in customized socket design, modular component systems, and 3D-printed prosthetic elements are increasing the adoption of carbon fiber composite solutions in both lower and upper limb prosthetics. Global market projections for carbon fiber composites for prosthetics indicate steady growth. Challenges remain such as higher material and production costs, reimbursement constraints, and the need for better access in underserved markets. Nevertheless, the convergence of clinical need, material performance advantages, and manufacturing innovation suggests that demand for carbon fiber composites for prosthetics in the USA will continue to expand steadily.

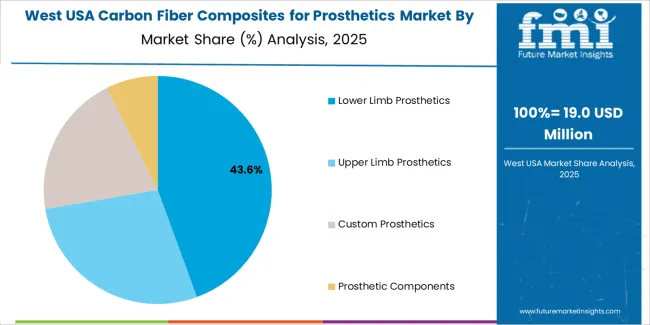

The demand for carbon fiber composites for prosthetics in the USA is primarily driven by product type and end-user segment. The leading product type is lower limb prosthetics, capturing 45% of the market share, while hospitals are the dominant end-user segment, accounting for 40% of the demand. Carbon fiber composites are increasingly used in prosthetic devices due to their lightweight, durable, and high-strength properties, which provide greater comfort and functionality for users. The demand for these advanced materials continues to rise as the need for more efficient and effective prosthetic solutions grows across various healthcare sectors.

Lower limb prosthetics lead the market for carbon fiber composites in the USA, capturing 45% of the demand. Carbon fiber is highly preferred in the production of lower limb prosthetics, such as above-the-knee and below-the-knee prostheses, due to its strength, flexibility, and ability to support weight while being lightweight. These properties are essential for prosthetic devices that need to endure the stresses of walking, running, and other daily activities.

The demand for carbon fiber in lower limb prosthetics is driven by its ability to improve mobility and provide a more comfortable, functional solution for amputees. Carbon fiber prosthetics are durable, offer better shock absorption, and can be customized for a more precise fit, contributing to their popularity in this segment. As advancements in materials technology continue to enhance the quality of life for amputees, the use of carbon fiber composites in lower limb prosthetics is expected to remain a key driver in the prosthetics market.

Hospitals are the largest end-user segment for carbon fiber composites in prosthetics in the USA, accounting for 40% of the demand. Hospitals play a central role in the rehabilitation process for individuals requiring prosthetic devices. They provide the necessary clinical environment for amputees to receive proper assessment, fitting, and training for their prosthetics. Carbon fiber composites are often used in the manufacturing of high-performance, custom prosthetic limbs that offer both durability and comfort, making them a preferred material choice in medical settings.

The demand from hospitals is driven by the increasing focus on improving the quality of life for patients through advanced prosthetic solutions. As hospitals continue to adopt cutting-edge materials and technologies to meet the needs of their patients, the use of carbon fiber composites in prosthetics will remain a key component in providing superior functionality, comfort, and mobility for amputees. Furthermore, as healthcare continues to prioritize personalized care, the demand for high-quality prosthetics made from carbon fiber will likely grow, solidifying hospitals as a major driver of the prosthetic materials market.

Major growth enablers include increasing prevalence of limb loss due to vascular disease, diabetes and trauma, creating a growing patient base needing prosthetics. Technological advancements in materials, 3D manufacturing and biomechanics make carbon fiber limbs more capable and desirable. The performance orientation of users, especially active individuals and athletes, favors lighter, stronger prostheses. Additionally, USA healthcare infrastructure, specialist prosthetics clinics and rehabilitation networks support uptake of premium prosthetic technologies.

Despite favorable factors, several constraints exist. The high cost of carbon fiber composite prosthetic components and manufacturing remains a barrier, especially when reimbursement is limited or patient out of pocket burden is high. Manufacturing complexity, material supply chain issues and the need for skilled fabrication limit wide scalability. Also, not all prosthetic patients opt for or qualify for high performance composite limbs, which restricts penetration in some segments.

Key trends include wider use of carbon fiber composites not only in lower limb prostheses but also in upper limb and modular socket systems, reflecting the shift toward customization and high functionality. There is integration of sensors, micro processors and hybrid materials in prosthetics that push designers toward carbon fiber frameworks for structural support. Sustainability and recycling of composite materials are receiving attention, as companies look to reduce cost and material waste. Finally, declining material costs and improved manufacturing methods are slowly making carbon fiber prosthetics more accessible beyond elite or athletic use.

The demand for carbon fiber composites for prosthetics in the USA is growing due to their exceptional strength-to-weight ratio, durability, and flexibility, which make them ideal materials for creating high-performance prosthetic devices. Carbon fiber composites are increasingly used in the manufacturing of prosthetic limbs, offering lightweight yet strong alternatives to traditional materials like metal and plastics. As the healthcare industry continues to prioritize patient comfort, mobility, and overall quality of life, carbon fiber prosthetics are becoming the material of choice for creating custom, high-quality prosthetic devices.

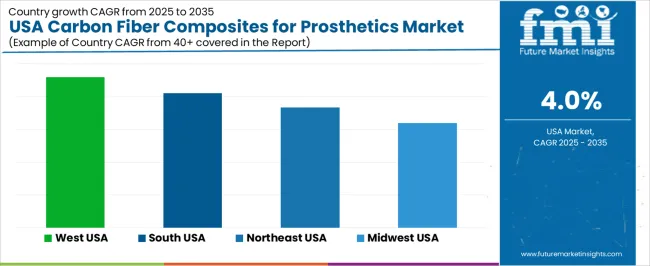

The demand for these advanced materials is also driven by technological advancements in prosthetics, greater awareness and acceptance of prosthetic solutions, and the rise in amputations due to medical conditions, accidents, and injuries. Furthermore, with the continued growth in the elderly population, the need for prosthetic solutions is increasing. Regional variations in demand reflect factors such as healthcare infrastructure, technological adoption in the prosthetics industry, and population health trends. Below is an analysis of the demand for carbon fiber composites for prosthetics across different regions in the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 4.6% |

| South | 4.1% |

| Northeast | 3.7% |

| Midwest | 3.2% |

The West leads the demand for carbon fiber composites for prosthetics in the USA with a CAGR of 4.6%. This can be attributed to the region’s strong healthcare infrastructure, high concentration of leading medical technology companies, and advancements in prosthetics. States like California, Washington, and Oregon are home to many healthcare providers and prosthetics manufacturers who are at the forefront of using cutting-edge materials such as carbon fiber composites to create advanced prosthetic devices.

The West’s emphasis on innovation, as well as its large population of elderly and disabled individuals, further contributes to the growing demand for lightweight, durable, and customizable prosthetics. Additionally, the region’s high adoption of technological advancements in healthcare and the presence of numerous R&D centers focused on improving prosthetic solutions ensure that the demand for carbon fiber composites remains strong.

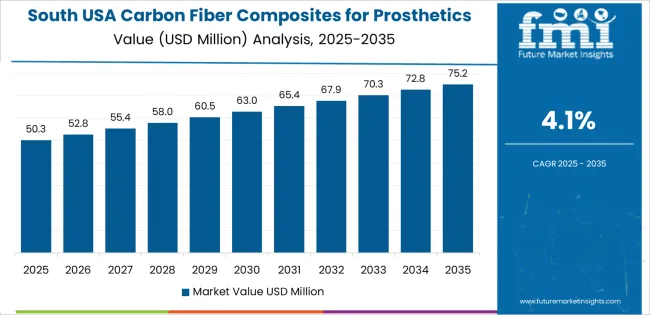

The South shows strong demand for carbon fiber composites for prosthetics with a CAGR of 4.1%. The region’s growing healthcare sector, coupled with a rising awareness of advanced prosthetics solutions, contributes to the increasing use of carbon fiber composites. States like Texas, Florida, and Georgia have a significant population of individuals requiring prosthetic devices due to medical conditions, accidents, and injuries, driving the need for high-quality, lightweight prosthetics.

The demand is also supported by the South’s expanding healthcare infrastructure and increased focus on rehabilitation and recovery services, which have led to a greater emphasis on improving the quality of prosthetic devices. As more hospitals and clinics in the South adopt carbon fiber composite prosthetics to enhance patient comfort and mobility, the market for these materials continues to grow.

The Northeast shows steady demand for carbon fiber composites for prosthetics with a CAGR of 3.7%. The region has a well-established healthcare infrastructure, with leading medical institutions and prosthetics providers that utilize advanced materials such as carbon fiber composites. States like New York, Pennsylvania, and Massachusetts are home to a large number of amputees due to medical conditions like diabetes and vascular diseases, increasing the demand for advanced prosthetic devices.

While the growth rate is slower than in the West and South, the steady demand in the Northeast is driven by the region’s aging population and the increasing focus on patient-centered care. The ongoing investment in healthcare technologies and the rise in the number of individuals seeking high-performance prosthetics are key drivers behind the region’s demand for carbon fiber composites.

The Midwest shows moderate growth in the demand for carbon fiber composites for prosthetics with a CAGR of 3.2%. The region, which includes states like Illinois, Michigan, and Ohio, has a significant healthcare infrastructure but has been slower to adopt advanced materials like carbon fiber in the prosthetics industry compared to other regions. However, with advancements in medical technologies and the growing awareness of the benefits of carbon fiber composites, demand is steadily increasing.

The Midwest's demand for carbon fiber composites is supported by its strong industrial base, which has expanded into medical technologies, as well as the region's rising focus on providing high-quality, affordable prosthetics. As more individuals in the Midwest seek customized, durable, and lightweight prosthetic solutions, the demand for carbon fiber composites is expected to grow at a moderate pace.

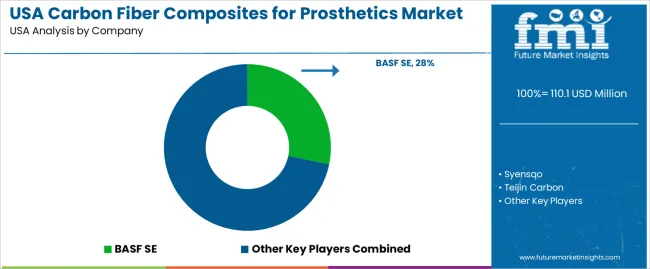

The demand for carbon fiber composites in the prosthetics industry in the United States is increasing, driven by the need for lightweight, durable, and high-performance materials in the design and production of prosthetic limbs. Companies like BASF SE (holding approximately 28.2% market share), Syensqo, Teijin Carbon, Toray Industries Inc., Hexcel Corporation, and Nitpro Composites are key players in this specialized market. Carbon fiber composites are highly sought after in prosthetics for their strength-to-weight ratio, flexibility, and durability, offering users enhanced mobility and comfort.

Competition in this market is focused on material performance, customization, and cost-effectiveness. Companies are developing carbon fiber composites that provide not only structural integrity but also comfort and ease of use for prosthetic wearers. Innovations in material properties, such as improved flexibility and impact resistance, are key to addressing the unique needs of prosthetic users. Another area of competition is the ability to tailor the composites for specific prosthetic applications, whether for lower-limb prosthetics, upper-limb prosthetics, or specialized sports prosthetics.

Additionally, companies are working to reduce production costs and improve the affordability of high-quality carbon fiber composites, making them more accessible to a wider range of consumers. Marketing materials often emphasize strength, durability, weight reduction, and comfort. By aligning their offerings with the growing demand for high-performance and customizable prosthetic materials, these companies aim to strengthen their position in the USA carbon fiber composites for prosthetics market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | USA |

| Product Type | Lower Limb Prosthetics, Upper Limb Prosthetics, Custom Prosthetics, Prosthetic Components |

| End-User | Hospitals, Rehabilitation Centers, Orthopedic Clinics, Home Care Settings, Research and Educational Institutions |

| Key Companies Profiled | BASF SE, Syensqo, Teijin Carbon, Toray Industries Inc, Hexcel Corporation, Nitpro Composites |

| Additional Attributes | The market analysis includes dollar sales by product type and end-user categories. It also covers regional demand trends in the USA, particularly driven by the increasing adoption of carbon fiber composites in prosthetic devices for their lightweight, high-strength properties. The competitive landscape highlights key manufacturers focusing on innovations in prosthetic materials and design. Trends in the growing demand for custom and specialized prosthetics, along with advancements in carbon fiber composite technologies for improved functionality and comfort, are explored. |

The global demand for carbon fiber composites for prosthetics in USA is estimated to be valued at USD 110.1 million in 2025.

The market size for the demand for carbon fiber composites for prosthetics in USA is projected to reach USD 162.8 million by 2035.

The demand for carbon fiber composites for prosthetics in USA is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in demand for carbon fiber composites for prosthetics in USA are lower limb prosthetics, upper limb prosthetics, custom prosthetics and prosthetic components.

In terms of end-user, hospitals segment to command 40.0% share in the demand for carbon fiber composites for prosthetics in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Carbon Textile Reinforced Concrete Market Size and Share Forecast Outlook 2025 to 2035

Carbon And Graphite Felt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Black Content Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA