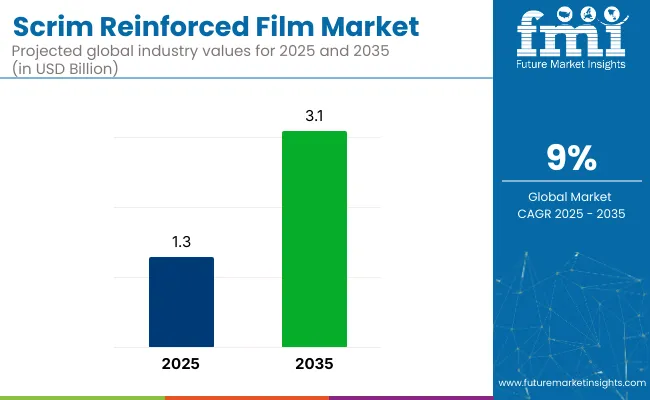

The global Scrim Reinforced Films market is projected to grow from USD 1.3 billion in 2025 to approximately USD 3.1 billion by 2035, registering a CAGR of 9% during the forecast period. This growth is primarily attributed to the increasing demand for durable, lightweight, and weather-resistant materials across various industries, including construction, packaging, agriculture, and automotive.

Scrim reinforced films, which combine a flexible film layer with a reinforcing scrim made from materials like fiberglass, polyester, or nylon, offer enhanced mechanical strength and tear resistance without compromising flexibility. These properties make them ideal for applications such as protective covers, tarps, greenhouse films, and heavy-duty packaging. The market's expansion is further driven by the growing emphasis on sustainable and recyclable materials, as well as advancements in multi-layer film technologies that improve strength and protection.

Recent innovations in the Scrim Reinforced Films market have centered around enhancing sustainability, functionality, and adaptability to diverse applications. Manufacturers are increasingly adopting biodegradable and recyclable materials, such as bio-based polymers, to produce eco-friendly scrim reinforced films that align with stringent environmental regulations and cater to the growing consumer demand for sustainable packaging solutions.

Advancements in coating technologies have led to the development of films with improved moisture resistance, UV protection, and anti-slip properties, ensuring better performance in various environmental conditions. Additionally, the integration of smart technologies, including RFID tags and sensor-embedded films, is enabling better inventory management, product tracking, and real-time monitoring of environmental conditions, aligning with the growing trend of smart packaging and logistics.

Design improvements, such as multi-layer constructions and customizable thicknesses, further enhance the versatility and functionality of scrim reinforced films across different industries.

The Scrim Reinforced Films market is expected to witness significant growth in emerging economies, particularly in the Asia-Pacific region, driven by rapid industrialization, urbanization, and infrastructural development. Countries like China, India, and Indonesia are experiencing a surge in demand for durable and sustainable materials in construction, agriculture, and packaging sectors.

The expansion of the e-commerce industry and the increasing need for efficient logistics and protective packaging solutions further propel the market's growth in these regions. Manufacturers are anticipated to focus on developing cost-effective, sustainable, and customizable Scrim Reinforced Films solutions to cater to diverse industry needs and comply with evolving regulatory standards. Strategic collaborations, technological advancements, and investments in local production facilities are likely to play a crucial role in capturing market share and driving growth in these regions.

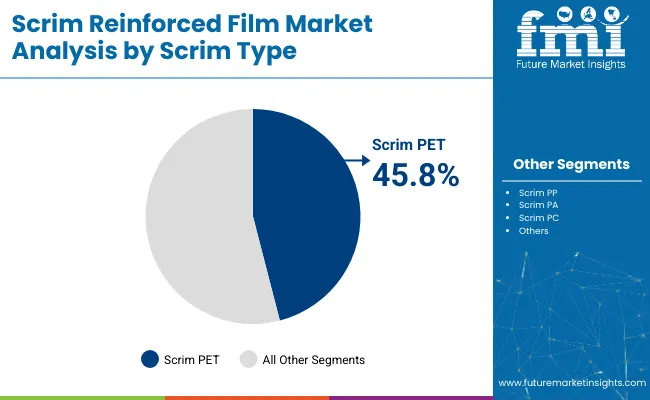

The market has been segmented based on scrim type, application, scrim reinforcement, end-use industry, and region. By scrim type, scrim PET, scrim PP, scrim PA, and scrim PC are utilized to enhance tensile strength, puncture resistance, and dimensional stability across barrier film constructions.

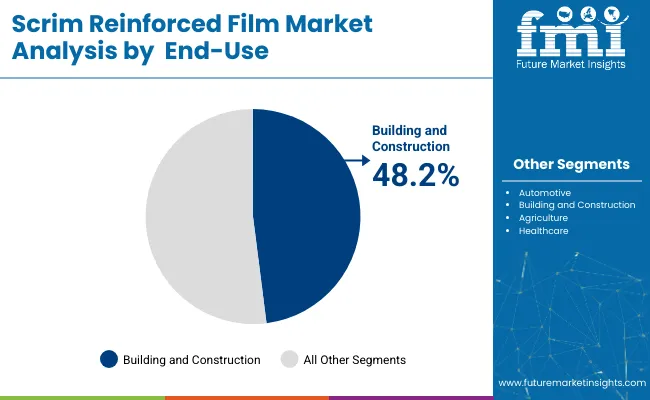

Applications include automotive, construction, medical, and packaging sectors-driven by growing demand for durable multilayer films in sealing, insulation, and protective uses. Scrim reinforcement formats-single-scrim, double-scrim, and multi-scrim reinforced films-support tailored mechanical performance across various thickness and load-bearing requirements.

End-use industries span automotive, building and construction, agriculture, and healthcare, reflecting the cross-sector utility of reinforced film solutions. Regional segmentation includes North America, Europe, Latin America, Asia Pacific, and the Middle East and Africa, capturing global infrastructure development, material innovation trends, and regulatory drivers.

The scrim PET segment is forecasted to capture the highest share of 45.8% in the Scrim Reinforced Films market by 2025, driven by its excellent mechanical strength, UV resistance, and dimensional stability. Scrim-reinforced polyethylene terephthalate (PET) films are commonly used in high-stress industrial and construction applications where tear resistance, tensile strength, and flexibility are paramount.

PET-based scrim films offer outstanding thermal performance and can withstand temperature fluctuations, making them ideal for both indoor and outdoor environments. Their ability to resist moisture, corrosion, and chemical degradation has made them highly suitable for vapor barriers, protective covers, industrial tarpaulins, and membrane reinforcements.

With growing demand for durable, sustainable building materials and rising infrastructure development across Asia Pacific, North America, and the Middle East, scrim PET is set to remain the dominant reinforcement type, offering a strong balance between performance, longevity, and environmental compliance.

The building and construction segment is projected to account for the largest share of 48.2% in the Scrim Reinforced Films market by 2025, primarily due to the increasing use of reinforced films in roofing membranes, wall wraps, concrete underlays, and insulation systems. These films provide structural reinforcement, moisture control, and energy efficiency key factors in both residential and commercial building envelopes.

With rising global investments in smart cities, public infrastructure, and affordable housing, the demand for scrim-reinforced solutions that offer long-term durability and energy conservation has intensified. In particular, construction firms and developers favor scrim films for their role in extending the life cycle of waterproofing systems, preventing vapor intrusion, and reducing air leaks all of which contribute to building code compliance and LEED certifications.

As global building practices shift toward lightweight, eco-efficient materials that minimize environmental impact while maximizing performance, scrim reinforced films are positioned as essential components in the evolution of next-generation construction materials.

High Production Costs and Recycling Challenges

One of the main issues in the scrim reinforced films market is the high expense of new polymer-based supports. This can make it too costly for some industries that are careful with money. Also, it is hard to recycle films with many layers. This is because they have many different materials, making it tough to deal with waste.

Using high-grade raw items and cutting-edge ways to make sure the film is strong, bendy and can handle the environment. This also leads to production problems for those who make the films.

Smart Coatings, Bio-Based Films, and High-Strength Industrial Applications

Even with difficulties, the scrim reinforced films market has big growth chances. New smart-coated scrim films add features like self-healing, killing germs, and blocking heat, making products better for tech uses.

The rise of eco-friendly and reusable scrim films helps industries that care about the earth, opening new market doors. Also, more people want very strong films for industrial and military needs. These films must resist fire, handle impacts, and stand up to the elements, likely increasing market use.

New and tough scrim films for heavy jobs in building, planes, and transport will also speed up market growth.

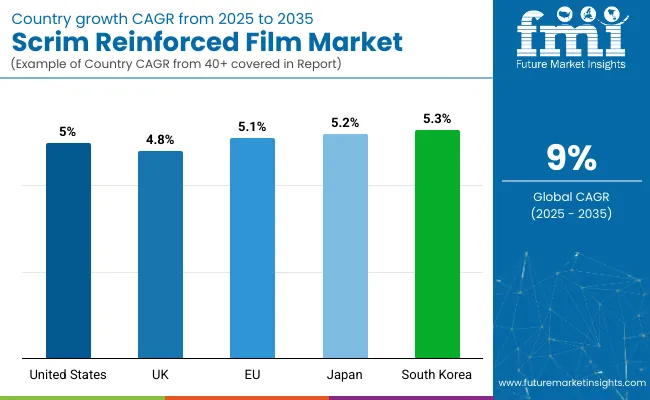

The scrim reinforced films market in the USA keeps growing. More people need strong, tear-proof films for building, packing, and factory uses. The EPA and FDA check film materials for safety and for use with food.

More scrim reinforced films are used to stop moisture. Planes and cars use them more because they are light and strong. Farms and greenhouses also use them more. The market grows because of these reasons. Eco-friendly and recyclable options are new trends shaping the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

The UK market for scrim reinforcedfilms is growing. More people need strong, weather-proof films in building projects. Reinforced packaging is more popular too. Strict rules on eco-friendly materials help this trend.

Groups like the UK Environment Agency and the British Plastics Federation keep an eye on safety and recycling work. High-performance scrim films are becoming more common in industrial covers. They are also used more in medical and hygiene packaging. Fire-resistant and UV-resistant films are spreading too.

New steps in bio-based and compostable scrim films are shaping the industry. These changes are pushing the market further. Print on all new rules and common words please.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

The scrim reinforced films market in the European Union is seeing steady growth. This is because of strict EU packaging rules, more need for strong films in industry and farming, and rising investments in new composite materials. The European Chemicals Agency and the EU’s Circular Economy Action Plan ensure that scrim film materials are safe and can be recycled.

Germany, France, and Italy are leading in using strong scrim films for building projects. They are also putting more money into flexible packaging and lightweight materials for transport and green energy. Research in nanocomposite technology is also helping the market grow.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.1% |

The scrim reinforced films market in Japan is growing. This is because there is more need for strong films in electronics and semiconductor industries. More money is going into smart packaging. Also, the government is pushing hard for less waste and more green ways. METI and JPI make the rules for scrim film standards and policies about their impact on the environment.

Japanese companies are putting money into great scrim films for precise electronics packaging. They are working on better films that block moisture and gas. They are also growing the market for UV-stable reinforced films for use outside. Innovative concepts in compostable mesh films and durable fiber enhancements are shaping the latest developments in this industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The scrim reinforced films market in South Korea is seeing fast growth. This is due to more use in electronics, cars, and flexible screens. There is also more use in safety barrier films and eco-friendly packaging. The South Korean Ministry of Environment and the Korea Institute of Industrial Technology check for safety, quality, and eco-friendliness of these films.

Growing smart packaging, rising need for scrim films in lithium batteries, and more use in strong films for planes and defense are setting market trends. Also, investments in AI for better and stronger films are becoming popular.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

The scrim reinforced films market is growing as more people want tough, strong, and tear-resistant films. These films are used in industries like packaging and building. The need for moisture barrier solutions, better multi-layer materials, and uses in medical and aerospace fields help grow the market.

Firms focus on making lightweight, strong, and UV-resistant films. These films are durable, weather-resistant, and flexible. The market has top film makers, composite material providers, and packaging firms. They all work on new ideas in laminated, fire-proof, and high-barrier scrim films.

The overall market size for the scrim reinforced films market was USD 1.3 billion in 2025.

The scrim reinforced films market is expected to reach USD 3.1 billion in 2035.

Increasing demand for durable and high-strength packaging materials, rising adoption in construction and industrial applications, and advancements in multi-layer reinforced film technology will drive market growth.

The USA, China, Germany, Japan, and India are key contributors.

Polyethylene (PE) scrim reinforced films are expected to dominate due to their superior tear resistance, flexibility, and cost-effectiveness.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Glass Reinforced Plastic (GRP) Piping Market Size and Share Forecast Outlook 2025 to 2035

Fiber-reinforced Plastic (FRP) Recycling Market Growth- Trends and Forecast 2025-2035

Central Reinforced Tape Market Size and Share Forecast Outlook 2025 to 2035

Particle Reinforced Aluminum Matrix Composite Brake Disc for Electric Automobiles Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Reinforced Polyethylene Pipe Market Size and Share Forecast Outlook 2025 to 2035

Glass Fiber Reinforced Plastic (GFRP) Composites Market Growth - Trends & Forecast 2025 to 2035

Carbon Fiber Reinforced Plastic Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fiber Reinforced Polymer BFRP Market Size and Share Forecast Outlook 2025 to 2035

Carbon Textile Reinforced Concrete Market Size and Share Forecast Outlook 2025 to 2035

High Heat Glass Reinforced Polyamide 66 Market Size and Share Forecast Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

LDPE Films Market

Card Films Market

Mulch Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA