The global market for hypoventilation management is estimated to grow at a magnifying rate due to factors like rising incidences of respiratory disorders, advancements in medical technologies, and a growing preference for home care solutions. The main underlying mechanism of hypoventilation is reduced ventilation leading to paradoxically increased carbon dioxide tension in the blood, which is most often seen with chronic obstructive pulmonary disease (COPD), obesity hypoventilation syndrome, and neuromuscular disorders.

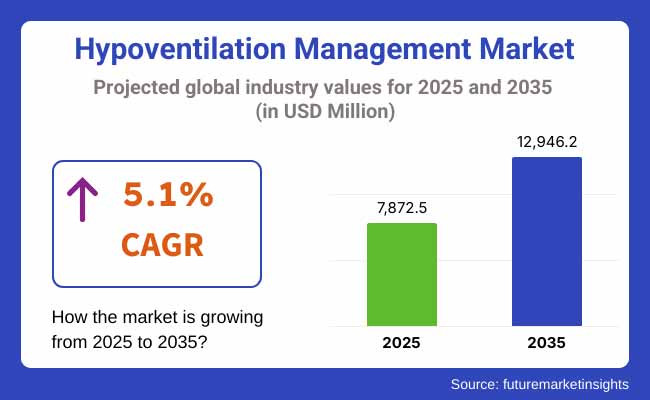

According to our estimations, the market will grow at a significant CAGR of 5.1% over the course of the years 2025 to 2035, gathering USD 12,946.2 Million of revenue by the end of the period in 2035, with the value of USD 7,872.5 Million being reached in 2025. The rising incidence of sleep-related hypoventilation disorders, rising healthcare spending, and introduction of advanced care therapies would boost long-term market growth.

The hypoventilation management market in North America is dominant, attributed to advanced healthcare system and high prevalence of respiratory disorders. The United States is a leader in the region in advanced respiratory care technologies for healthcare facilities that deal with COPD and sleep apnea. Factors such as the presence of key market players and ongoing developments in non-invasive ventilation devices boom market growth in this region.

The hypoventilation management market in Europe is growing steadily with a focus on patient safety and quality care. We are leading with global countries like Germany, France, and the UK, where healthcare systems are implementing to improving therapies and devices for respiratory management. The regional emphasis on readmission rates reductions and management of chronic diseases creates significant demand for hypoventilation treatment that has proven effective in the region.

The Asia-Pacific is the fastest-growing area, driven by rapid urbanization, higher healthcare investment and heightening awareness on the respiratory health. Increasing rise in the number of respiratory disorders in China, India, and Japan along with increasing adoption of novel medical technologies & devices is driving the global market for portable medical devices. Other notable driving factors expected to propel the hypoventilation management market in the region are the increasing mid-range income population, and access to healthcare services.

Challenges

High Cost of Treatment, Limited Awareness, and Regulatory Barriers

High Cost of Respiratory Care Devices, NIV Systems & Home-Based Ventilation Solutions Impacting Availability of Advanced Treatment in Low-Income regions. The hypoventilation management market is challenged by the substantial costs associated with respiratory care devices, non-invasive ventilation (NIV) systems, and home-based ventilation solutions, which limits access to advanced treatment in low-income regions.

Poor recognition and underdiagnoses of different types of hypoventilation disorders, especially obesity hypovention syndrome (OHS) and central hypovation syndromes, lead to delayed or inappropriate management. Moreover, stringent regulatory requirements to get respiratory care devices such as FDA, CE, and ISO certifications are slowing down the development and commercialization of novel treatment methodologies.

Opportunities

Advancements in Non-Invasive Ventilation, AI-Based Monitoring, and Growing Home Healthcare Demand

However the market is conveying as per the challenges in the form of increasing prevalence of obesity related hypoventilation, neuromuscular respiratory disorders, and chronic lung diseases. Non-invasive ventilation (NIV), adaptive servo-ventilation (ASV), and continuous positive airway pressure (CPAP) devices are advancing and leading to improved patient outcomes and reduced hospital admissions.

Key drivers of the market growth include- an increase in home-based ventilation solutions such as portable ventilators, wearable oxygen therapy devices, remote patient monitoring systems in chronic respiratory care, etc.

In addition, AI systems for respiratory monitoring are enhancing early detection and personalized therapy approaches, allowing for real-time tailoring of ventilatory assistance to patients’ needs. Telemedicine and cloud-based ventilatory care platforms are similarly streamlining finding patients while reducing healthcare spending.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, CE Mark, and ISO medical device approvals. |

| Consumer Trends | Demand for CPAP, BiPAP, and invasive ventilators for hospital care. |

| Industry Adoption | Used primarily in ICUs, sleep clinics, and hospital respiratory units. |

| Supply Chain and Sourcing | Dependence on hospital-grade ventilators and respiratory support devices. |

| Market Competition | Dominated by medical device manufacturers and respiratory care providers. |

| Market Growth Drivers | Growing force of sleep apnea, obesity-related respiratory smoking and lung disorders. |

| Sustainability and Environmental Impact | Early adoption of energy-efficient ventilators and oxygen therapy devices. |

| Integration of Smart Technologies | Introduction of wireless CPAP and auto-adjusting BiPAP therapy. |

| Advancements in Respiratory Care | High-efficiency oxygen concentrator and non-invasive ventilator development |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter safety, efficacy, and AI-integrated respiratory device regulations. |

| Consumer Trends | Growth in portable home ventilation, AI-assisted respiratory therapy, and remote patient monitoring. |

| Industry Adoption | Expansion into home-based ventilation, smart wearable respiratory devices, and telemedicine-driven care. |

| Supply Chain and Sourcing | Shift toward compact, AI-integrated home therapy solutions and cloud-based monitoring. |

| Market Competition | Infiltration of AI-based respiratory monitoring startups, wearable tech companies and telehealth platform suppliers |

| Market Growth Drivers | Fast-tracked by intelligent ventilatory support, cloud-based therapy management, and AI-enabled diagnostics. |

| Sustainability and Environmental Impact | Large-scale shift toward battery-operated, eco-friendly ventilation systems with reduced carbon footprints. |

| Integration of Smart Technologies | A further venture into AI driven ventilation algorithms, real-time monitoring of oxygen therapy, and predictive analytics for respiratory failure |

| Advancements in Respiratory Care | Lateral progression to biofeedback mediated mechanistic ventilation, tele-operable CPAP, and adaptive AI metabolic breathing. |

High prevalence of obesity-related respiratory conditions Demand for home-based ventilation solutions and AI-powered respiratory care technologies on advanced levels is some key reasons for the growth of this market in the USA hypoventilation management market Connected CPAP devices and remote patient monitoring systems are changing the face of the industry while also enabling contextual analysis of real-time patient data and customized respiratory treatment.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

The factors are projected to fuel NSA with significant market share from the UK market, which is witnessing steady growth due to increasing cases of chronic respiratory diseases, increasing initiatives taken by NHS for home-based ventilatory care, and good regulatory frameworks for respiratory device safety. Telemedicine-driven ventilatory support solutions are paving the way to expanded access and early intervention in hypoventilation management.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.0% |

The hypoventilation management market in the Europe is influenced by Netherland`s medical devices and population health act, rising R&D investment in AI-driven respiratory monitoring solution, and provide a support to home healthcare in Germany, France, UK, and Italy. Traditional markets like Germany, France and Italy are pioneering in non-invasive ventilation (NIV), smart CPAP devices and AI-embedded breathing help technologies. Increasing awareness of neuromuscular and obesity-related respiratory disorders is also a key growth factor for advanced hypoventilation therapies.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.1% |

Some of the key drivers of Japan’s hypoventilation management market include rising geriatric population, growing prevalence of chronic lung diseases, and advancements in wearable respiratory care technologies The country’s position as a leader in robotics and AI-assisted solutions for healthcare creates ready interest in next-generation mechanical ventilators with real-time assessments of patient condition.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

Factors such as rapid adoption of AI-driven respiratory therapy, increasing government support for telehealth and expanding home healthcare services are driving the growth of hypoventilation management in South Korea. Internet of Things enabled breathing devices and predictive analytics for the prevention of respiratory failure coupled with AI powered ventilation monitoring systems are defining the future of hypoventilation care in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

There are many diseases that lead to respiratory insufficiency and the hypoventilation management market can be segmented accordingly to provide effective treatment solutions, one of the segment types being chronic obstructive pulmonary disease (COPD) and obesity hypoventilation syndrome (OHS).

The segment of structured environment systems market has helped in getting better patient outcomes and avoid complications for the patients which is one of the reasons for the increase in demand because of the disease segments which in turn provides growth to the structured environment systems marketplace.

The influence of smoking, persistent exposure to environmental pollutants, and an increasing geriatric population has contributed to COPD being a major segment in the market. COPD, which differs from other respiratory diseases,is characterized by chronic airflow obstruction that causes progressive hypoventilation in patients with hypoxemia.

A surge in demand for complex respiratory therapies such as long-term oxygen therapy, bi-level positive airway pressure (BiPAP) ventilation, as well as portable non-invasive ventilators has activated market uptake. Researches demonstrates that over 65% of patients with hypoventilation were diagnosed with COPD and they need prolonged respiratory support for symptom management and prevention of complication.

The increased development of COPD management solutions with features such as AI-enabled remote monitoring, automated ventilators that can adjust oxygen supply based on real-time oxygen levels, and customized respiratory care plans are further contributing to market growth, as they ensure better disease control and improvement in quality of life.

Also, based on their market penetration, digital health solutions, which include mobile-focused COPD management applications, remote oxygen therapy monitoring, and AI-enabled patient monitoring, have contributed significantly to the increase in adoption rate to ensure improved compliance and instant intervention during respiratory emergencies.

Expectations of continued advancement of innovative COPD management solutions, such as wearable oxygen concentrators, hybrid BiPAP-oxygen therapy systems and machine-learning driven ventilation support calibrations, have driven industry expansion for improved patient comfort and mobility.While the COPD segment benefits from advantages in respiratory function, prevent hospitalizations, and improve patient mobility, high device costs, lack of reimbursement coverage, and long-term adherence requirements remain some of the challenges inhibiting specific patient groups.

But for more accessibility, new and improved methods such as AI-driven predictive ventilation, home-based respiratory care models and portable oxygen therapy systems are being developed to overcome the roadblock and guarantees that there will be ongoing progress in the management of COPD-related hypoventilation.

Obesity hypoventilation syndrome (OHS) has witnessed high market uptake since its chronicity, particularly in patients with severe obesity, results in chronic respiratory failure with impaired lung function and diminished ventilatory response. In contrast to COPD, the 2 patients with OHS required prolonged periods of non-invasive mechanical ventilation and supplemental oxygen on account of their obesity.Market adoption was driven by the increasing cases of OHS and OSA owing to the growing prevalence of obesity linked respiratory disorders. It is found in more than fifty percent of individuals with OHS would need long-term non-invasive ventilation to maintain blood oxygen levels and avoid complications.

Existence of effective treatment strategies such as AI guided ventilatory management, auto venting through CPAP and BiPAP units, telehealth powered breathing exercise programs have further supported market growth leading to better adherence to the treatment regimen, ultimately resulting in better long-term outcomes for patients.

The adoption has been further bolstered by the incorporation of weight management programs that offer obesity-specific respiratory therapy, artificial intelligence-facilitated dietary interventions, as well as patient-centric metabolic monitoring to ensure that OHS-related hypoventilation is treated holistically.

Emergence of passive-pressure innovation systems generated an alternate non-invasive and non-harmful oxygen therapy mode avoiding invasive ventilation and ventilator-induced lung injury (VILI), squelching pulmonary sequelae, thereby augmenting the growth in the market.

Though anti-obesity agents can help in managing obesity related respiratory conditions, make for improved ventilation, and reduce the likelihood of long-duration hospitalization; the OHS segment is threatened by patient non-compliance, suboptimal awareness of the disease, and a requirement of multi-disciplinary care approaches.

But AI-driven respiratory monitoring, hybrid ventilation-weight management therapies, and predictive analytics for prevention of respiratory failure bring innovation, increase feasibility and warrant continued expansion of yogh management solutions for OHS-hypoventilation.

Key factors to drive the growth of the overall market during the forecast period include increasing focus on advanced respiratory management solutions for hypoventilation disorders, particularly the oxygen therapy and the non-invasive mechanical ventilation (NIV) segments of the market across healthcare settings and home-care settings have enhanced patient safety, satisfaction, and overall health.

The market has viewed oxygen therapy as one of the most commonly used segments aimed at overcoming hypoventilation-based oxygen deficit. Mechanical ventilation, on the other hand, solely offers mechanical assistance, which may not always guarantee adequate oxygen delivery in chronic respiratory disease patients, while advanced oxygen therapy guarantees satisfactory oxygen transportation.

Market Adoption Fueled by the Growing Demand for Portable Oxygen Concentrators Including Light Weight Design, Smart Oxygen Flow Adjustment, and Extended Battery Life Based on studies, in more than 60% of patients with long-term hypoventilation, oxygen therapy provided relief from the symptoms and better activity levels.

And the growing adoption of home-based oxygen therapy devices, such as wearable nasal cannulas, artificial intelligence (AI) powered oxygen delivery optimization solutions, and cloud-connected oxygen management systems, further aids market growth by enhancing patient independence and treatment compliance.

All in all, the combination of these oxygen therapy solution components, which sometimes even included combination oxygen-ventilator systems or novel humidification techniques, combined with the rollout of AI-based prediction for oxygen demand, all have contributed to greater uptake of hybrid solutions during recent years, further enhancing respiratory comfort and efficiency.

Screening lungs today does not require a full body screen as with x-ray or CT. We are now working on using M/c with 3D imaging to not only examine the lungs but even follow up with slow air flow over the available surface area etc.The oxygen therapy segment has limitations including the need for refills in conventional oxygen cylinders, reliance on power sources for oxygen concentrators, and high equipment costs, despite its benefits in better oxygenation, higher patient mobility, and decreased distress.

Innovations such as AI-enabled oxygen modulation, battery-driven concentrators, and smart oxygen therapy combined with wearables are increasing efficiency, so continued growth in oxygen therapy adoption is assured.

The global non-invasive mechanical ventilation (NIV) market has been characterized by a marked uptake, especially for an increasing number of patients with chronic respiratory failure, as ventilatory support has become a requisite management tool for hypoventilation disorders. Due to its mask-based and airway-supportive functionalities that decrease the possibility of intubation and invasive maneuvers, it is also not as invasive as ventilator systems.

Growing applications of auto-adjusting BiPAP, CPAP technologies, adaptive ventilation algorithms, and real-time respiratory pattern monitoring AI tools in the market have supported the demand for AI-driven NIV devices. Research shows that, for patients with hypoventilation needing longer term respiratory support, over 55% choose non-mechanical ventilation (NIV) because it is more comfortable and less likely to cause complications.

The growing adaptation of home-based NIV solutions, comprising compact BiPAP devices, low-noise CPAP machines and portable non-invasive ventilators has fortified the market growth by promising an enhanced quality of life at an affordable cost as well as less hospital dependency.Adoption has also been augmented with smart respiratory therapy, including AI assisted compliance monitoring, cloud enabled ventilator tracking and remote physician assisted ventilatory adjustment.

The emergence of next-generation NIV systems with hybrid oxygen-ventilator integration, dynamic pressure adjustment technology, and smart mask interfaces has facilitated robust market growth by enhancing patient comfort and optimizing respiratory efficiency.Although the NIV segment has advantages such as lower hospitalization rates, improved nighttime breathing, and improvement in overall respiratory function, it suffers from issues such as mask discomfort, adherence to therapy, and the requirement of a continuous power source.

Nonetheless, emerging ideas like artificial intelligence-enabled ventilatory support, wireless CPAP telemetry, and cloud-connected non-invasive ventilation are changing the game of the latest diagnostic equipment, which is expected to enhance patients' wellbeing and broaden the use of NIV in hypoventilation treatment.

Growing prevalence of respiratory disorders, obesity hypoventilation syndrome (OHS), and chronic obstructive pulmonary disease (COPD), along with technological breakthrough in AI-assisted respiratory monitoring and treatment options driving demand for these systems are some of the key factors driving the hypoventilation management market. As such, growing demand for non-invasive ventilation (NIV), advanced oxygen therapy, and AI-empowered sleep-threatening jolts are re-shaping industry growth.

Major industry players are concentrating on AI-enabled real-time respiratory monitoring, adaptive ventilation technologies, and remote patient management solutions. Major innovators include medical device manufacturers, firms specializing in respiratory care technology, and healthcare solutions providers driving innovation in precision-based, automated, and patient-specific hypoventilation management solutions.

Market Share Analysis by Key Players & Hypoventilation Management Solution Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Philips Respironics (Koninklijke Philips N.V.) | 18-22% |

| ResMed Inc. | 14-18% |

| Medtronic Plc | 12-16% |

| Fisher & Paykel Healthcare Corporation Limited | 8-12% |

| Drägerwerk AG & Co. KGaA | 6-10% |

| Other Hypoventilation Management Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Philips Respironics (Koninklijke Philips N.V.) | Specializes in artificial intelligence-driven CPAP and BiPAP devices, non-invasive ventilation systems, and intelligent sleep apnea control systems. |

| ResMed Inc. | Focuses on AI-based sleep and respiratory care devices, adaptive ventilation technology, and remote patient monitoring for disorders associated with hypoventilation. |

| Medtronic Plc | Covers AI-augmented ventilators, wearable respiratory sensors, and automated therapy approaches for chronic hypoventilation states. |

| Fisher & Paykel Healthcare Corporation Limited | Home oxygen therapy solutions, and cutting-edge non-invasive breathing support devices; AI-optimized humidifiers |

| Drägerwerk AG & Co. KGaA | Delivers AI-assisted hospital-grade ventilators, continuous respiratory status monitoring, and emergency ventilators for critical care applications. |

Key Market Insights

Philips Respironics (Koninklijke Philips N.V.) (18-22%)

Philips Respironics leads in AI-powered non-invasive ventilation and sleep therapy, offering smart CPAP, BiPAP, and home respiratory management solutions for hypoventilation disorders.

ResMed Inc. (14-18%)

ResMed specializes in AI-enhanced sleep apnea treatment, adaptive ventilation technologies, and cloud-connected respiratory monitoring for OHS and COPD patients.

Medtronic Plc (12-16%)

Medtronic focuses on AI-driven ventilator solutions, wearable respiratory monitoring devices, and automated therapy management systems for hypoventilation patients.

Fisher & Paykel Healthcare Corporation Limited (8-12%)

Fisher & Paykel provides AI-assisted humidification systems, high-flow oxygen therapy devices, and advanced home-based ventilation solutions for chronic respiratory conditions.

Drägerwerk AG & Co. KGaA (6-10%)

Dräger specializes in AI-powered intensive care ventilators, emergency respiratory support systems, and hospital-based non-invasive ventilation solutions.

Other Key Players (30-40% Combined)

Several respiratory care device manufacturers, AI-driven health monitoring firms, and medical technology companies contribute to next-generation hypoventilation management innovations, AI-powered therapy customization, and remote patient monitoring advancements. Key contributors include:

The overall market size for the hypoventilation management market was USD 7,872.5 Million in 2025.

The hypoventilation management market is expected to reach USD 12,946.2 Million in 2035.

The demand for hypoventilation management is rising due to increasing prevalence of respiratory disorders, advancements in non-invasive ventilation technologies, and growing adoption of oxygen therapy. The rising geriatric population and expanding access to home-based respiratory care solutions are further driving market growth.

The top 5 countries driving the development of the hypoventilation management market are the USA, Germany, China, Japan, and India.

Oxygen Therapy and Non-Invasive Mechanical Ventilation are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End Users , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End Users , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End Users , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End Users , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End Users , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End Users , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End Users , 2018 to 2033

Table 29: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 31: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 32: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by End Users , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Users, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End Users , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Users , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Users , 2023 to 2033

Figure 17: Global Market Attractiveness by Disease Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Treatment, 2023 to 2033

Figure 19: Global Market Attractiveness by End Users , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End Users , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End Users , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End Users , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End Users , 2023 to 2033

Figure 37: North America Market Attractiveness by Disease Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Treatment, 2023 to 2033

Figure 39: North America Market Attractiveness by End Users , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End Users , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End Users , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End Users , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End Users , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Disease Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Treatment, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End Users , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End Users , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End Users , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End Users , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End Users , 2023 to 2033

Figure 77: Europe Market Attractiveness by Disease Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Treatment, 2023 to 2033

Figure 79: Europe Market Attractiveness by End Users , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End Users , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End Users , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End Users , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End Users , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Disease Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Treatment, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End Users , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End Users , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End Users , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End Users , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End Users , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Disease Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Treatment, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End Users , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End Users , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End Users , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End Users , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End Users , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Disease Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Treatment, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End Users , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MIDDLE EAST AND AFRICA Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 142: MIDDLE EAST AND AFRICA Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 143: MIDDLE EAST AND AFRICA Market Value (US$ Million) by End Users , 2023 to 2033

Figure 144: MIDDLE EAST AND AFRICA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 149: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 150: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 151: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 152: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 153: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 154: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by End Users , 2018 to 2033

Figure 155: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by End Users , 2023 to 2033

Figure 156: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by End Users , 2023 to 2033

Figure 157: MIDDLE EAST AND AFRICA Market Attractiveness by Disease Type, 2023 to 2033

Figure 158: MIDDLE EAST AND AFRICA Market Attractiveness by Treatment, 2023 to 2033

Figure 159: MIDDLE EAST AND AFRICA Market Attractiveness by End Users , 2023 to 2033

Figure 160: MIDDLE EAST AND AFRICA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA