The Oven Bag market is witnessing steady growth, driven by the increasing demand for convenient, hygienic, and efficient cooking solutions across households and commercial food establishments. Rising adoption of ready-to-cook meals and baked products has reinforced the need for high-performance oven bags that maintain food quality while reducing cooking time and cleanup. Advancements in materials and heat-resistant technologies have improved the durability and safety of oven bags, enhancing consumer confidence.

Growing awareness about food hygiene, reduction of oil usage during cooking, and sustainable packaging options are contributing to market expansion. The market is further supported by the increasing presence of food service outlets, bakeries, and institutional kitchens, which require reliable solutions for consistent preparation and serving.

As the focus on operational efficiency, food safety, and convenience continues to grow, oven bags are becoming a preferred choice in both domestic and commercial kitchens Rising consumer preference for innovative cooking aids and investments in product quality improvements are expected to sustain growth in the coming years.

| Metric | Value |

|---|---|

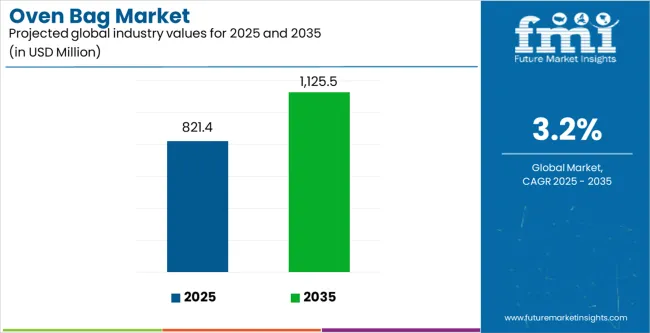

| Oven Bag Market Estimated Value in (2025 E) | USD 821.4 million |

| Oven Bag Market Forecast Value in (2035 F) | USD 1125.5 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

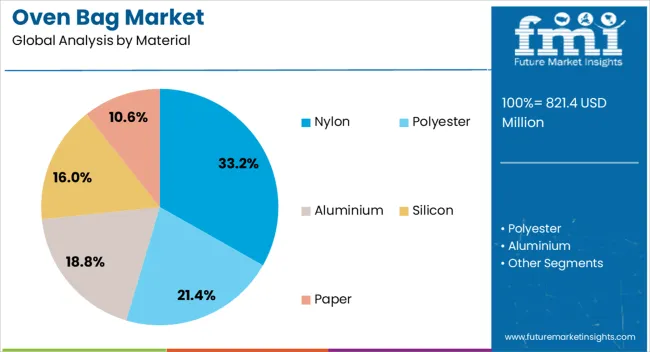

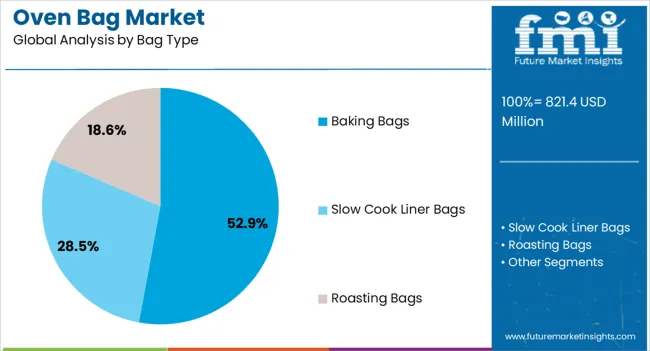

The market is segmented by Material, Bag Type, and End Use and region. By Material, the market is divided into Nylon, Polyester, Aluminium, Silicon, and Paper. In terms of Bag Type, the market is classified into Baking Bags, Slow Cook Liner Bags, and Roasting Bags. Based on End Use, the market is segmented into Food Service Outlets, Institutional Food Services, and Household Use. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The nylon material segment is projected to hold 33.2% of the market revenue in 2025, establishing it as the leading material type. Growth in this segment is being driven by the high heat resistance, strength, and non-stick properties offered by nylon, making it suitable for a wide range of cooking applications. Nylon oven bags enable efficient heat distribution, ensuring even cooking while maintaining food texture and moisture.

Their durability and reliability have reinforced preference among both household users and commercial kitchens. The ability to withstand high oven temperatures without compromising performance or safety has strengthened adoption.

Manufacturers are increasingly focusing on producing nylon oven bags with enhanced thermal stability and food-grade safety certifications, further supporting market demand As consumer awareness of hygienic cooking practices and operational efficiency rises, the nylon material segment is expected to maintain its market leadership, driven by superior performance, safety, and versatility.

The baking bags type segment is anticipated to account for 52.9% of the market revenue in 2025, making it the leading bag type. Growth is being driven by the segment’s suitability for preparing baked goods efficiently while preserving flavor, moisture, and texture. Baking bags provide convenience by reducing cooking time and preventing sticking, which enhances overall food quality.

Their compatibility with a variety of oven types and cooking processes increases adoption across households and commercial kitchens. Manufacturers are focusing on developing bags with reinforced materials, easy handling features, and superior thermal stability to meet increasing consumer and business demands.

Rising preference for convenient and safe cooking solutions, particularly in food service outlets and bakeries, has further reinforced adoption As baking trends continue to grow globally, the baking bags segment is expected to maintain its leading position, supported by product innovation, performance reliability, and operational convenience.

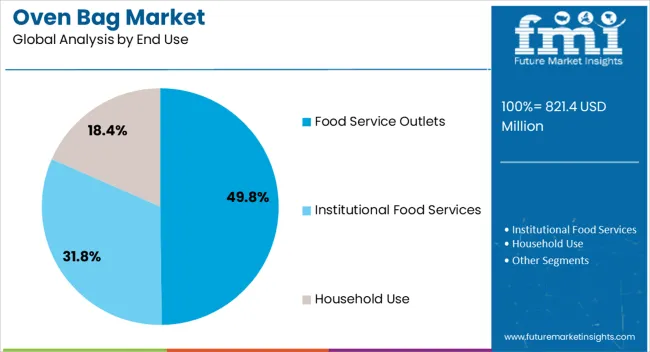

The food service outlets segment is projected to hold 49.8% of the market revenue in 2025, establishing it as the leading end-use industry. Growth in this segment is being driven by the increasing need for operational efficiency, consistency, and hygiene in commercial kitchens, bakeries, and catering services. Oven bags enable quick preparation of a wide variety of dishes while maintaining food quality, reducing cleanup time, and ensuring compliance with food safety standards.

Their durability and ability to withstand frequent use in high-temperature ovens make them ideal for professional environments. The adoption of oven bags allows outlets to streamline cooking processes, reduce labor, and minimize food wastage.

Rising demand for convenient and standardized cooking solutions, coupled with the expansion of food service establishments globally, is further supporting market growth As commercial kitchens prioritize efficiency, hygiene, and high-quality food preparation, the food service outlets segment is expected to remain the largest contributor to market revenue, supported by continued operational and culinary innovations.

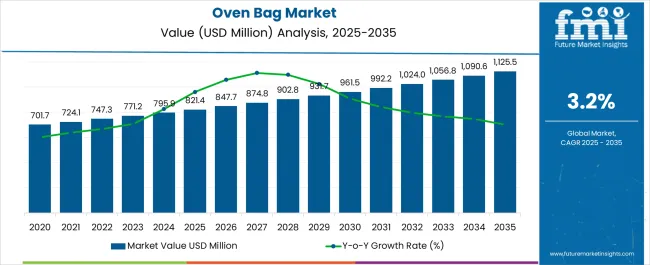

In 2020, the global oven bag market showed a potential worth USD 701.7 million. The oven bag market witnessed sluggish growth, registering a CAGR of 2.6% from 2020 to 2025.

| Historical CAGR | 2.6% |

|---|---|

| Forecast CAGR | 3.2% |

Contribution to this development includes the extension of the popularity of oven-ready meals, customer desire for easy cooking solutions, and escalated knowledge of food safety and cleanliness.

Improvements in the technology of oven bags, like the incorporation of materials resistant to heat and better sealing systems, enhanced the effectiveness of the product and its market share.

With a CAGR of 2.6% predicted by FMI from 2020 to 2025, the oven bag market is contemplated to surge in the next years.

The extension of the ready-to-cook and pre-prepared meal segments, the steady trend toward time and convenience-saving cooking techniques, and the escalated use of oven bags in home and commercial food preparation settings are amplified to propel this upward trend.

Producers have a probability to concentrate on product innovation and keep up with changing consumer tastes and sustainability measures, like creating recyclable and eco-friendly materials.

The below section shows the leading segment. Based on the bag type, the baking bag segment is accounted to hold a market share of 52.9% in 2025. Based on end-use, the food service outlets segment is accounted to hold a market share of 49.8% in 2025.

The ease of usage and adaptability of baking bags in cooking a wide range of foods exponentiates the market appeal.

Food service establishments use oven bags because of their effectiveness and reliability in cooking food.

| Category | Market Share in 2025 |

|---|---|

| Baking Bag | 52.9% |

| Food Service Outlets | 49.8% |

Based on the bag type, the baking bag sector is accounted to hold a market share of 52.9% in 2025. Baking bags are a convenient and mess-free way to cook various meals, including meats, vegetables, and sweets.

The bags are specially made for using it in baking applications. Baking bags are popular because of their adaptability, simplicity of use, and capacity in retaining tastes and juices throughout cooking.

Based on end-user, food service outlets are accounted to hold a market share of 49.8% in 2025. Food service outlets are any number of businesses that largely use oven bags for different types of cooking, including bakeries, cafes, restaurants, and catering services.

Food service establishments easily make and provide a wide variety of foods to their patrons with the use of oven bags. Oven bag usage in these establishments is considerably high.

The table describes about the top five countries ranked by revenue, with India holding the top position.

Oven bags are the most popular in India due to their extensive usage in regular cooking and holiday celebrations. Oven bags are now essential in the homes of India because of their rich culinary history and exponential need for easy cooking options.

The bags thus provide a hassle-free method of making tasty meals that enhance flavor and keep moisture.

Forecast CAGRs from 2025 to 2035

| Countries | CAGR |

|---|---|

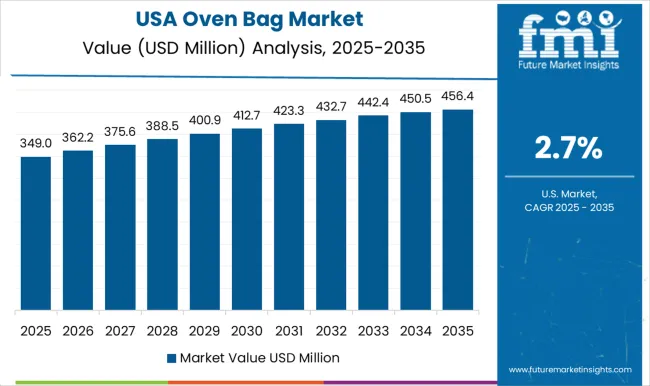

| United States | 2.3% |

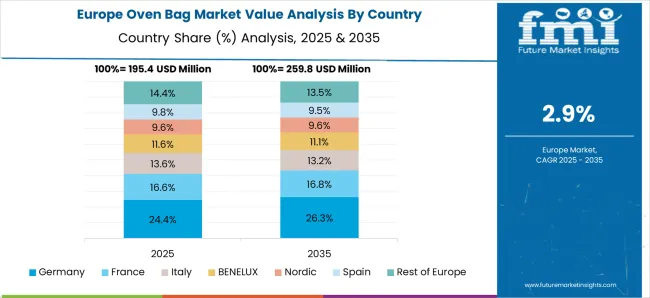

| Germany | 2% |

| China | 5.7% |

| Spain | 3.4% |

| India | 6.5% |

In the United States, consumers predominantly use oven bags for convenient home cooking. The bags offer a hassle-free solution for roasting meats, vegetables, and other dishes in the oven, reducing preparation time and cleanup efforts.

Busy lifestyles broadly focus on convenience, and oven bags have become a popular choice among households in America for preparing delicious and moist meals with minimal fuss.

The oven bag market in Germany is often utilized for gourmet cooking and complementing the rich food culture of Germany. The population of Germany values high-quality ingredients and culinary traditions.

The oven bags offer a convenient way of enhancing flavors and retaining moisture in various dishes. For example- From succulent roasts to savory braises, oven bags cater to discerning palates and love flavorful, home-cooked meals of Germany

The oven bag market caters to the needs of urban dwellers with busy lifestyles. With rapid urbanization and a growing middle class, convenience became predominant in households in China.

Oven bags save time for cooking delicious meals without extensive preparation or cleanup. Whether roasting meats or steaming vegetables, oven bags offer the consumers of China a convenient way to enjoy home-cooked meals amidst their bustling schedules.

In Spain, the oven bag market is often used for traditional and festive cooking. The population of Spain has a culinary heritage in their genes, and oven bags play a role in preparing traditional dishes such as roasted meats, seafood, and vegetables for family gatherings and celebrations.

For example - Whether it is a special holiday meal or a casual get-together, oven bags prepare flavorful and succulent dishes central to the vibrant food culture of Spain

The oven bag market is mainly used for festive celebrations and everyday cooking. The households rely on oven bags to prepare dishes ranging from traditional curries and tandoori specialties to baked goods and roasted delicacies.

Oven bags offer the consumers of India a convenient and efficient way of creating flavorful dishes while preserving moisture and enhancing flavors whether they are celebrating festivals or cooking daily meals.

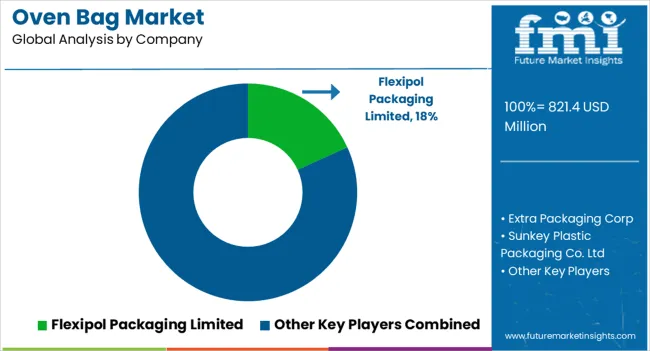

Multinational firms and local producers fight for market share that defines the competitive environment of the oven bag industry. While regional producers concentrate on specialized products or niche markets, multinational corporations use their worldwide presence and resources to maintain a sizable market share.

Some of the key developments are

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 795.9 million |

| Projected Market Valuation in 2035 | USD 1,090.6 million |

| Value-based CAGR 2025 to 2035 | 3.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Material, Bag Type, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Flexipol Packaging Limited; Extra Packaging Corp; Sunkey Plastic Packaging Co. Ltd; Sirane Ltd; Terinex LTD; Yin Tian Industrial Co. Ltd; M&Q Packaging Ltd; Xiong Xian Xinhuarui Plastic Co Ltd; Huangshan Sinoflex Packaging Co. Ltd; Reynolds Consumer Products |

The global oven bag market is estimated to be valued at USD 821.4 million in 2025.

The market size for the oven bag market is projected to reach USD 1,125.5 million by 2035.

The oven bag market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in oven bag market are nylon, polyester, aluminium, silicon and paper.

In terms of bag type, baking bags segment to command 52.9% share in the oven bag market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Landscape of Oven Bag Providers

Woven Bag Market Forecast and Outlook 2025 to 2035

Industry Share Analysis for Polywoven Bag Companies

Polywoven Bags Market by Type & End Use from 2023 to 2033

Laminated Woven PP Bags Market

Market Share Distribution Among Polypropylene Woven Bag and Sack Manufacturers

Polypropylene Woven Bag and Sack Market from 2024 to 2034

Oven Market Analysis – Growth, Demand & Forecast 2024-2034

Woven Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Endovenous Laser Therapy Market Size and Share Forecast Outlook 2025 to 2035

Hypoventilation Management Market - Growth & Treatment Innovations 2025 to 2035

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA