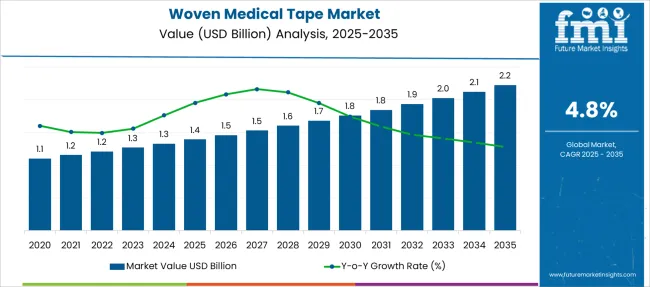

The Woven Medical Tape Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Woven Medical Tape Market Estimated Value in (2025 E) | USD 1.4 billion |

| Woven Medical Tape Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The woven medical tape market is witnessing steady growth, driven by increasing surgical volumes, enhanced clinical demand for secure wound fixation, and growing preference for skin-friendly, breathable materials. Improvements in adhesive technologies and regulatory emphasis on patient safety have led to the adoption of hypoallergenic, durable tapes in both acute and chronic care settings.

Rising incidences of injuries, diabetic ulcers, and post-operative complications are creating sustained demand for advanced wound management solutions that rely on stable fixation products. Moreover, hospitals and clinical institutions are prioritizing single-use, high-performance tapes to reduce infection risk and enhance procedural efficiency.

Market expansion is further supported by an aging population, healthcare infrastructure investments in emerging economies, and innovations in tape flexibility and wear-time performance. The trend toward minimal trauma adhesive systems is likely to shape future adoption, particularly in outpatient and homecare scenarios where ease of removal and skin preservation are critical.

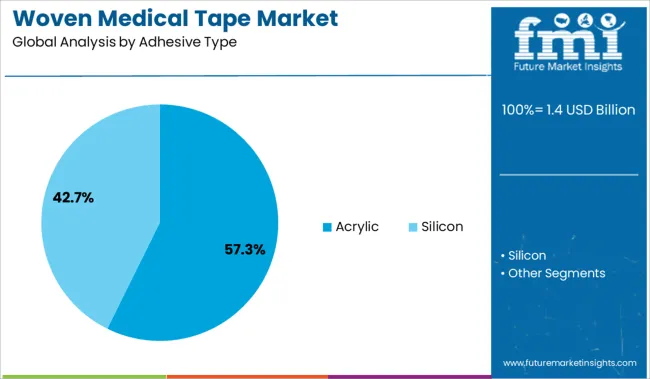

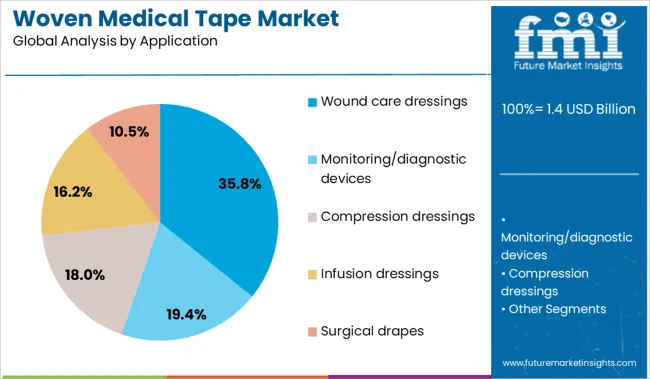

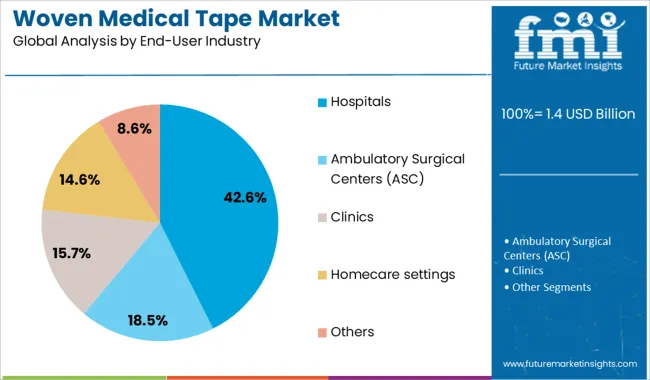

The market is segmented by Adhesive Type, Application, and End-User Industry and region. By Adhesive Type, the market is divided into Acrylic and Silicon. In terms of Application, the market is classified into Wound care dressings, Monitoring/diagnostic devices, Compression dressings, Infusion dressings, and Surgical drapes. Based on End-User Industry, the market is segmented into Hospitals, Ambulatory Surgical Centers (ASC), Clinics, Homecare settings, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Acrylic adhesives are expected to dominate the market with a projected 57.3% share in 2025, making them the leading adhesive type in woven medical tapes. This leadership is attributed to their strong bonding capabilities, long-term adhesion performance, and compatibility with sensitive and fragile skin.

Acrylic formulations are known for their breathable, moisture-resistant properties, which support extended wear in wound management and surgical applications. The demand for tapes that maintain adhesion without frequent reapplication has led hospitals and outpatient clinics to prefer acrylic-based systems.

Additionally, reduced allergenicity and stable adhesion under fluctuating environmental conditions have increased their use in a wide range of clinical and ambulatory care environments. The segment's growth is further supported by ongoing R&D investments focused on transparent, repositionable, and antimicrobial variants of acrylic adhesives.

Wound care dressings are anticipated to contribute 35.8% of the overall market revenue in 2025, making them the largest application segment. This dominance is being driven by increased surgical procedures, trauma incidents, and chronic wound conditions such as pressure ulcers and diabetic foot ulcers.

Woven medical tapes are increasingly preferred for securing primary dressings due to their breathability, softness, and adaptability to jointed or contoured areas of the body. The ability to maintain dressing integrity without damaging the peri-wound skin has elevated their role in advanced wound care protocols.

As clinical outcomes increasingly focus on moisture balance and infection prevention, tapes that facilitate secure fixation without disrupting the wound bed are seeing greater adoption. Continued improvements in absorbent material integration and compatibility with hydrocolloid or foam dressings are expected to bolster demand further.

Hospitals are projected to lead with a 42.6% revenue share in 2025, establishing them as the dominant end-user segment for woven medical tapes. This prominence is due to the consistent need for wound closure, IV line stabilization, catheter fixation, and post-surgical dressing security in inpatient environments.

Hospitals require adhesives that are reliable, hypoallergenic, and easy to apply across a range of procedures, from emergency to intensive care. The emphasis on infection control and adherence to sterile protocols has increased reliance on single-use, sterile-packaged woven tapes.

Procurement decisions are further influenced by clinician familiarity, tape performance across body types, and reduced incidence of skin injury upon removal. As hospitals continue to implement quality care metrics and patient satisfaction benchmarks, the use of premium woven tapes is becoming a standard in both general and specialty care units.

Woven medical tapes are the type of medical tape which is made of woven, knitted fabric. The woven fabrics in the woven medical tape are washing durable and can also be made flame retardant.

Woven medical tapes are stronger and considerably more cumbersome than the counterparts such as non-woven medical tapes. Woven medical tapes are breathable, comfortable, and removes cleanly and painlessly. These tapes are explicitly used for dressing wound care, tagging medical devices and equipment, splitting, and tubing.

The woven medical tapes are used for cover tape and to finish devices. High adhesiveness and durability coupled with flawless finish make woven medical tape an ideal solution for use in the pharmaceutical industry. Woven medical tapes are specially used for children care because of their painless removal.

Woven medical tapes are printable and available in various sizes and colors. Besides, the woven medical tapes have high moisture vapor transmission rate (MVTR), and acrylic adhesives are used with the woven fabric.

The high demand for painless and clean medical tapes is fulfilled by the woven medical tapes coupled with the increase of healthcare industries is expected to propel the global woven medical tape market.

The higher reliability and security provided by the woven medical tape is expected to fuel the global woven medical tape market. The woven medical tapes are used in infusion dressing, diagnostic service, wound care dressing, surgical drapes, and compression dressing.

The diverse use of woven medical tapes in healthcare industries is expected to contribute to the growth of woven medical tape market.

Use of non-woven medical tape can be a potential restraint for the woven medical tape market. The non-woven medical tape is lighter in weight and cheaper in cost as compared to woven medical tape.

Besides, accessibility of advanced wound care products, lack of proper guidelines for right woven medical tape selection and Medical Adhesive-Related Skin Injuries (MARSI) is expected to hamper the growth of woven medical tape market.

Some of the key players operating in the global woven medical tape market are

North America is expected to have the largest share in the global woven medical tape market. The largest healthcare industry set up in the region is expected to fuel the growth of global woven medical tape market. The USA is expected to have the largest share in the global woven medical tape market of North America.

Western Europe is expected to have market share just after North America in global woven medical tape market. The better infrastructure and use of the high-quality medical product in the region is expected to bolster the growth of woven medical tape market. Germany, France, Italy, and UK are expected to have the maximum share in the woven medical tape market of Western Europe.

Asia Pacific and MEA are projected to have maximum growth in global woven medical tape market. The increasing infrastructure of healthcare industries and various government initiatives for better quality medical treatment is expected to fuel the growth of medical woven tape market in the regions.

Globally, the Woven Medical Tape market is segmented on the basis of material type, capacity and end-user industries which are further segmented as

The global woven medical tape market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the woven medical tape market is projected to reach USD 2.2 billion by 2035.

The woven medical tape market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in woven medical tape market are acrylic and silicon.

In terms of application, wound care dressings segment to command 35.8% share in the woven medical tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Woven Bag Market Forecast and Outlook 2025 to 2035

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

Non-Woven Fabric Rolls Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA