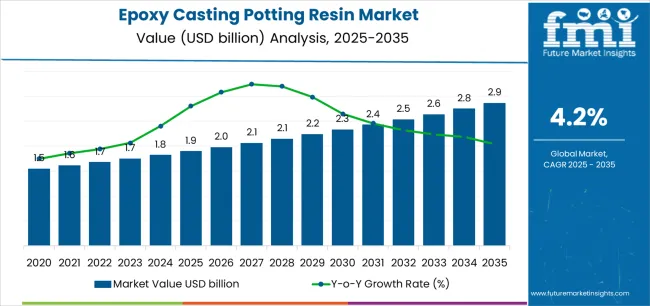

The global epoxy casting potting resin market, valued at USD 1.9 billion in 2025, is projected to reach USD 2.9 billion by 2035, registering an absolute increase of USD 1.0 billion and expanding at a CAGR of 4.3%. The overall market is expected to grow by 1.5X, supported by the growing demand for epoxy casting potting resin across electronic encapsulation, automotive electrical systems, aerospace equipment, and industrial control units. The end-use sector penetration and performance differentiation reflect how material properties, curing behavior, and dielectric performance drive selection preferences among key industries adopting epoxy resin systems for component protection and long-term insulation stability.

The electronics and electrical sector accounts for the highest penetration within the epoxy casting potting resin market, primarily due to increasing miniaturization of devices and the growing integration of high-power components in compact assemblies. The adoption of epoxy resin systems in this sector is influenced by superior dielectric strength, low shrinkage, and high thermal endurance required in applications such as transformers, printed circuit boards, sensors, and power converters. Epoxy formulations filled with thermally conductive additives, such as alumina and boron nitride, are gaining prominence for dissipating heat effectively in confined spaces. The rising adoption of encapsulation materials in semiconductor packaging, LED drivers, and automotive control modules underscores the critical role of epoxy resins in ensuring circuit reliability and operational safety under continuous electrical stress.

The latter half (2030-2035) will witness continued growth from USD 2.4 billion to USD 2.9 billion, representing an addition of USD 539.3 million or 55% of the decade's expansion. This period will be defined by mass market penetration of specialized formulation technologies, integration with comprehensive quality management platforms, and seamless compatibility with existing electronics manufacturing infrastructure. The epoxy casting potting resin market trajectory signals fundamental shifts in how electronics facilities approach component encapsulation and environmental protection, with participants positioned to benefit from growing demand across multiple curing methods and application segments.

The automotive industry represents another high-value growth segment, driven by the increasing electrification of vehicles and the use of electronic control units (ECUs), sensors, and charging modules. The demand for epoxy casting potting resin in automotive applications is closely tied to its capability to provide mechanical protection, moisture resistance, and vibration damping in powertrain and battery systems. Advanced epoxy potting grades with high temperature tolerance and chemical resistance are being adopted to ensure long-term reliability in electric vehicles and hybrid platforms. The integration of lightweight, thermally stable epoxy encapsulants also aligns with the automotive industry’s focus on efficient design and improved energy management within confined electronic housings.

In the aerospace and defense sector, epoxy resin systems are used for encapsulating navigation modules, radar components, and control circuits that must endure extreme temperature fluctuations and mechanical stress. High-purity, low-outgassing epoxy formulations are preferred for their stable dielectric behavior and low moisture absorption, which are critical for avionics reliability. The segment continues to expand with the rising use of epoxy systems in composite bonding and thermal insulation for mission-critical applications.

The industrial equipment segment shows increasing penetration as factories deploy smart automation systems, actuators, and control panels that require long-lasting insulation materials. Epoxy potting compounds are being chosen over polyurethane and silicone alternatives where hardness, dimensional stability, and chemical resistance are prioritized. Across all sectors, performance differentiation is defined by how epoxy resins balance heat resistance, mechanical strength, and electrical insulation.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New resin sales (normal temp, heated cure) | 62% | Volume-driven, electronics production-led |

| Specialty formulations | 18% | High-performance aerospace, automotive grades | |

| Technical support services | 12% | Application engineering, curing optimization | |

| Custom blending services | 8% | Customer-specific formulations, color matching | |

| Future (3-5 yrs) | Advanced curing systems | 55-58% | Fast-cure formulations, low-temperature options |

| High-performance specialty resins | 20-24% | Thermal conductivity, flame retardant grades | |

| Application engineering services | 10-14% | Process optimization, cure cycle design | |

| Sustainability solutions | 8-11% | Bio-based content, low-VOC formulations | |

| Testing & validation services | 4-7% | Performance verification, regulatory compliance | |

| Digital material selection tools | 2-4% | Online formulation matching, cure simulation |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.9 billion |

| Market Forecast (2035) | USD 2.9 billion |

| Growth Rate | 4.2% CAGR |

| Leading Technology | Normal Temperature Curing |

| Primary Application | Capacitors Segment |

The epoxy casting potting resin market demonstrates strong fundamentals with normal temperature curing resin systems capturing a dominant share through ambient processing capabilities and electronics manufacturing optimization. Capacitor applications drive primary demand, supported by increasing electronic component production and environmental protection requirements. Geographic expansion remains concentrated in developing electronics manufacturing markets with expanding production infrastructure, while established electronics regions show steady adoption rates driven by miniaturization initiatives and rising performance standards.

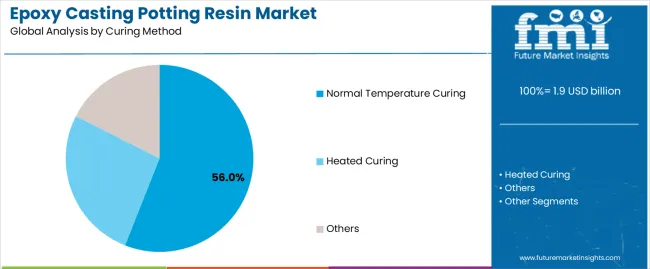

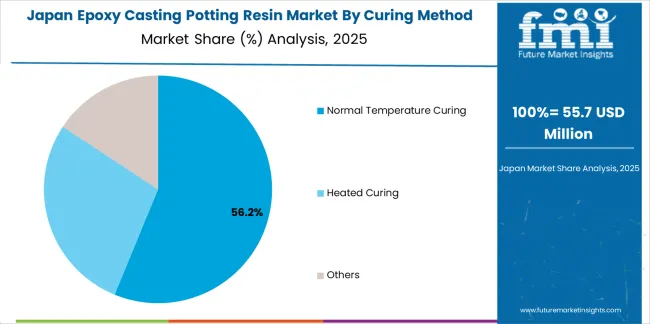

Primary Classification: The epoxy casting potting resin market segments by curing method into normal temperature curing, heated curing, and others, representing the evolution from basic ambient-cure resins to sophisticated thermal processing solutions for comprehensive electronics encapsulation optimization.

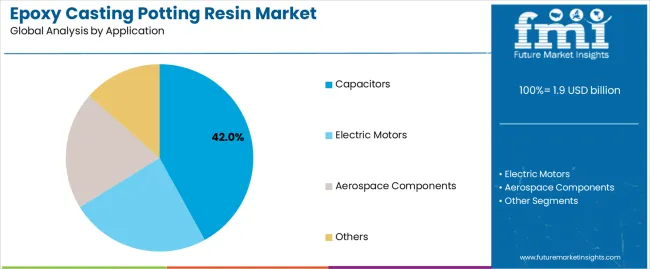

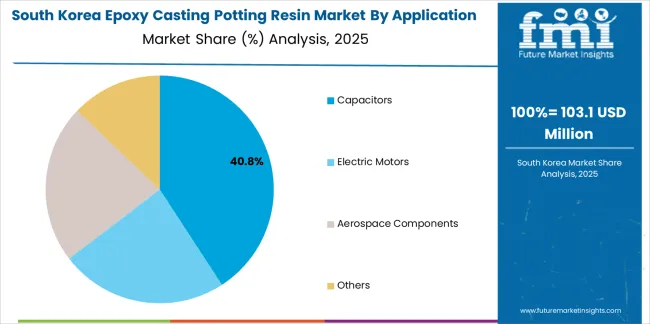

Secondary Classification: Application segmentation divides the epoxy casting potting resin market into capacitors, electric motors, aerospace components, and other sectors, reflecting distinct requirements for electrical insulation, thermal management, and environmental protection standards.

Tertiary Classification: Geographic distribution covers major electronics manufacturing regions including East Asia, South Asia Pacific, Western Europe, North America, Latin America, and other emerging markets, with developing electronics hubs leading adoption while established regions show technology upgrade-driven growth patterns.

The segmentation structure reveals technology progression from standard potting compounds toward sophisticated resin systems with enhanced thermal and electrical properties, while application diversity spans from consumer electronics protection to mission-critical aerospace encapsulation requiring stringent performance specifications.

Market Position: Normal Temperature Curing resin systems command the leading position in the epoxy casting potting resin market with 56% market share through advanced processing convenience features, including ambient cure capability, operational simplicity, and electronics manufacturing optimization that enable production facilities to achieve optimal encapsulation efficiency across diverse electronic component and industrial applications.

Value Drivers: The segment benefits from electronics manufacturer preference for cost-effective curing systems that provide reliable protection performance, reduced energy consumption, and production efficiency optimization without requiring specialized heating equipment. Advanced formulation features enable effective moisture protection, electrical insulation, and mechanical support, where processing convenience and cure reliability represent critical production requirements.

Competitive Advantages: Normal Temperature Curing resin systems differentiate through proven cure consistency, ambient processing characteristics, and compatibility with temperature-sensitive components that enhance production effectiveness while maintaining optimal protection standards suitable for diverse electronics and electrical applications.

Key market characteristics:

Heated Curing resin systems maintain a 35% market position in the epoxy casting potting resin market due to their enhanced performance properties and demanding application suitability. These systems appeal to manufacturers requiring superior thermal and mechanical properties with accelerated cure cycles for high-reliability electronics applications. Market growth is driven by aerospace and automotive expansion, emphasizing advanced material performance and quality assurance through controlled thermal cure processing.

Others curing methods capture 9% market share through specialized processing requirements in UV-cure systems, moisture-cure formulations, and hybrid curing technologies. These applications demand unique cure mechanisms capable of specific processing conditions while providing effective encapsulation capabilities and application-specific performance characteristics.

Market Context: Capacitors segment demonstrates the highest market share in the epoxy casting potting resin market with 42% share due to widespread adoption of electronic component protection and increasing focus on reliability enhancement, moisture protection, and electrical insulation optimization that ensure long-term component performance while meeting stringent quality standards.

Appeal Factors: Capacitor manufacturers prioritize resin dielectric properties, moisture resistance, and thermal stability that enables reliable component protection across diverse operating environments. The segment benefits from substantial electronics industry growth and miniaturization programs that emphasize the acquisition of advanced potting resins for component longevity and performance assurance applications.

Growth Drivers: Electronics production expansion incorporates epoxy potting as essential protection for capacitor manufacturing, while electric vehicle growth increases demand for high-reliability capacitors that require superior environmental protection and thermal management capabilities.

Market Challenges: Varying capacitor designs and voltage requirements may necessitate customized resin formulations across different component specifications or application scenarios.

Application dynamics include:

Electric Motors applications capture 28% market share through specialized encapsulation requirements in stator potting, coil protection, and winding insulation applications. These operations demand thermally conductive resin systems capable of heat dissipation while providing effective electrical insulation and mechanical support throughout motor operation cycles.

Aerospace Components applications account for 18% market share, including avionics encapsulation, sensor protection, and harsh-environment electronics requiring mission-critical reliability with extreme temperature resistance and stringent quality certification requirements.

Others applications capture 12% market share through varied encapsulation requirements in transformers, LED lighting, automotive electronics, and industrial controls requiring specialized protection capabilities for specific environmental and performance requirements.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Electronics miniaturization & component density (consumer electronics, 5G infrastructure) | ★★★★★ | Smaller components need better protection from moisture and vibration; advanced potting resins essential for reliability in compact designs. |

| Driver | Electric vehicle & renewable energy growth (power electronics protection) | ★★★★★ | EV charging systems and solar inverters require high-performance potting; thermal management and electrical insulation critical for safety and longevity. |

| Driver | Industrial automation & harsh environment electronics (IoT sensors, field devices) | ★★★★☆ | Growing deployment of electronics in challenging conditions; potting resins protect against moisture, chemicals, and temperature extremes. |

| Restraint | Material cost volatility & raw material dependency (epoxy resin, hardeners) | ★★★★☆ | Petroleum-derived materials subject to price fluctuations; impacts manufacturer margins and customer pricing stability. |

| Restraint | Application complexity & skill requirements (mixing ratios, degassing, cure control) | ★★★☆☆ | Proper potting requires technical expertise and equipment; application errors lead to failures increasing reluctance among smaller manufacturers. |

| Trend | Thermal conductivity enhancement & heat dissipation optimization | ★★★★★ | Power electronics generate significant heat; thermally conductive potting compounds enable effective heat transfer transforming thermal management approaches. |

| Trend | Low-VOC & sustainable formulation development | ★★★★☆ | Environmental regulations and corporate sustainability goals drive demand; bio-based content and reduced emissions become competitive differentiators. |

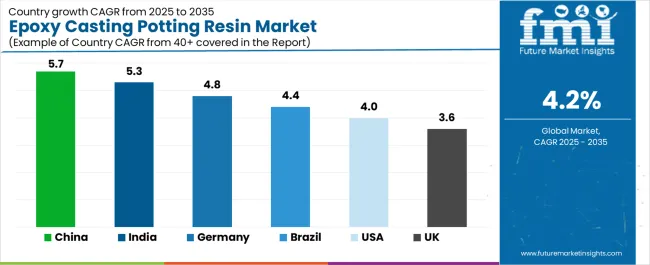

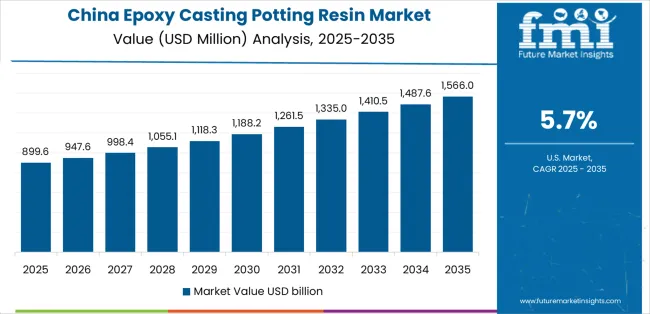

The epoxy casting potting resin market demonstrates varied regional dynamics with Growth Leaders including China (5.7% growth rate) and India (5.3% growth rate) driving expansion through electronics manufacturing growth and industrial development initiatives. Steady Performers encompass Germany (4.8% growth rate), Brazil (4.4% growth rate), and developed manufacturing regions, benefiting from established electronics industries and automotive electrification programs. Emerging Markets feature developing regions where electronics production expansion and industrial modernization support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through electronics manufacturing dominance and component production scale, while South Asian countries maintain strong growth supported by government manufacturing initiatives and electronics assembly expansion. Western European markets show moderate growth driven by automotive electronics applications and industrial automation integration trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.7% | Lead with cost-effective, high-volume solutions | Local competition; quality consistency |

| India | 5.3% | Focus on electronics manufacturing support | Infrastructure limitations; technical expertise |

| Germany | 4.8% | Offer automotive-grade, certified formulations | Stringent regulations; sustainability requirements |

| Brazil | 4.4% | Value-oriented with local technical support | Import dependencies; economic volatility |

| United States | 4.0% | Provide aerospace-grade, specialty formulations | Certification requirements; competition |

| United Kingdom | 3.6% | Push high-performance, specialized solutions | Post-Brexit supply chains; market size |

China establishes fastest market growth through dominant electronics manufacturing presence and comprehensive industrial development programs, integrating epoxy casting potting resins as essential materials in consumer electronics, industrial equipment, and automotive electronics production. The country's 5.7% growth rate reflects massive electronics production capacity and increasing domestic technology requirements that mandate the use of reliable encapsulation materials in component and assembly manufacturing facilities. Growth concentrates in major electronics manufacturing hubs, including Guangdong, Jiangsu, and Zhejiang, where production facilities showcase integrated potting processes that appeal to electronics manufacturers seeking component protection capabilities and quality assurance applications.

Chinese chemical manufacturers are developing competitive resin formulations that combine domestic production advantages with performance characteristics, including electrical insulation and environmental protection capabilities. Distribution channels through electronics material suppliers and industrial chemical distributors expand market access, while competitive pricing supports adoption across diverse electronics and industrial segments.

Strategic Market Indicators:

In Bangalore, Chennai, and Pune, electronics manufacturing operations and industrial facilities are implementing epoxy casting potting resins as critical protection materials for component reliability and equipment durability applications, driven by increasing government electronics manufacturing promotion and industrial infrastructure programs that emphasize the importance of quality material adoption. The epoxy casting potting resin market holds a 5.3% growth rate, supported by government Make in India initiatives and electronics assembly growth that promote advanced protection materials for manufacturing operations. Indian manufacturers are adopting resin systems that provide cost-effective protection performance and application versatility features, particularly appealing in regions where electronics production expansion and industrial development represent significant economic priorities.

Market expansion benefits from growing electronics assembly capabilities and foreign investment in manufacturing facilities that enable technology transfer and quality standard implementation for production applications. Technology adoption follows patterns established in chemical materials, where performance reliability and cost-effectiveness drive material selection and production deployment.

Market Intelligence Brief:

Germany establishes technology leadership through comprehensive automotive electrification programs and advanced industrial electronics development, integrating epoxy casting potting resins across automotive electronics, industrial automation, and renewable energy applications. The country's 4.8% growth rate reflects established automotive industry relationships and mature high-performance material adoption that supports widespread use of certified potting compounds in demanding applications. Growth concentrates in automotive and industrial centers, including Baden-Württemberg, Bavaria, and North Rhine-Westphalia, where manufacturing facilities showcase premium material deployment that appeals to manufacturers seeking proven reliability capabilities and regulatory compliance applications.

German chemical suppliers leverage established technical service capabilities and comprehensive certification programs, including automotive qualifications and performance testing that create customer confidence and specification compliance. The epoxy casting potting resin market benefits from mature quality standards and automotive requirements that mandate high-performance material use while supporting innovation, advancement, and sustainability optimization.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse industrial development, including automotive electronics production in São Paulo, industrial equipment manufacturing, and renewable energy infrastructure that increasingly incorporate potting resins for component protection applications. The country maintains a 4.4% growth rate, driven by rising manufacturing activity and increasing recognition of quality encapsulation benefits, including improved reliability and extended component life.

Market dynamics focus on value-oriented resin solutions that balance protection performance with cost considerations important to Brazilian manufacturers. Growing industrial modernization creates continued demand for reliable potting materials in equipment manufacturing and electronics assembly projects.

Strategic Market Considerations:

United States establishes established market position through comprehensive aerospace and defense programs and advanced electronics manufacturing infrastructure, integrating epoxy casting potting resins across aerospace components, military electronics, and industrial applications. The country's 4.0% growth rate reflects mature industry relationships and established high-performance material adoption that supports widespread use of certified potting compounds in mission-critical applications. Growth concentrates in aerospace centers and technology hubs where manufacturing facilities showcase premium material deployment that appeals to manufacturers seeking proven performance capabilities and stringent certification compliance.

American material suppliers leverage established technical support infrastructure and comprehensive testing capabilities, including aerospace qualification programs and military specifications that create customer trust and application success. The epoxy casting potting resin market benefits from mature certification requirements and performance standards that mandate high-reliability material use while supporting advanced formulation development and application optimization.

Market Intelligence Brief:

United Kingdom's industrial market demonstrates steady epoxy casting potting resin deployment with documented performance effectiveness in aerospace applications and industrial electronics through integration with existing manufacturing processes and quality management systems. The country leverages aerospace engineering expertise and industrial electronics capabilities to maintain a 3.6% growth rate. Manufacturing regions showcase installations where potting materials integrate with comprehensive quality systems and performance verification processes to optimize component protection and reliability effectiveness.

British manufacturers prioritize material certification and performance consistency in resin selection, creating demand for qualified formulations with verified characteristics, including electrical properties and environmental resistance. The epoxy casting potting resin market benefits from established aerospace infrastructure and certification standards that encourage adoption of high-performance materials, providing long-term reliability and compliance with stringent industry requirements.

Market Intelligence Brief:

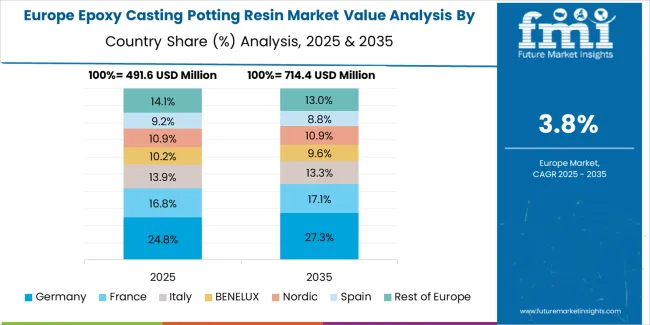

The epoxy casting potting resin market in Europe is projected to grow from USD 468.5 million in 2025 to USD 672.8 million by 2035, registering a CAGR of 3.7% over the forecast period. Germany is expected to maintain its leadership position with a 38.4% market share in 2025, declining slightly to 37.6% by 2035, supported by its advanced automotive electronics infrastructure and major industrial manufacturing centers.

France follows with a 21.6% share in 2025, projected to reach 22.1% by 2035, driven by aerospace industry presence and renewable energy infrastructure development. The United Kingdom holds a 16.8% share in 2025, expected to maintain 16.5% by 2035 through aerospace and defense applications. Italy commands a 12.2% share, while Spain accounts for 8.4% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 2.6% to 3.3% by 2035, attributed to increasing electronics manufacturing in Eastern European countries and emerging industrial facilities implementing advanced encapsulation technologies.

Japan's epoxy casting potting resin market reflects the country's leadership in advanced electronics manufacturing and automotive technology innovation, maintaining a 3.2% growth rate through 2035. The epoxy casting potting resin market benefits from an established electronics industry presence and a strong emphasis on quality and reliability in component protection. Japanese electronics manufacturers in Tokyo, Osaka, and Nagoya regions are implementing high-performance potting resins with stringent quality specifications and advanced electrical properties. The emphasis on miniaturization and reliability drives demand for specialized formulations that deliver superior insulation and thermal management. Market development is supported by strong chemical industry capabilities and close collaboration between resin suppliers and electronics manufacturers, enabling adoption of innovative encapsulation solutions in consumer electronics, automotive components, and industrial equipment that require exceptional performance and long-term reliability in demanding operating conditions.

South Korea's epoxy casting potting resin market maintains steady growth with a projected rate of 2.9% through 2035, driven by advanced electronics manufacturing capabilities and significant investments in electric vehicle and battery technologies. The country's electronics and automotive sectors are adopting specialized potting resins for power electronics protection and battery management system encapsulation. Market development is characterized by strong focus on thermal management and electrical performance as manufacturers address heat dissipation challenges in high-power applications. Growing emphasis on electric vehicle production and energy storage systems increases demand for thermally conductive potting compounds with enhanced reliability. The epoxy casting potting resin market benefits from a robust domestic chemical industry and technology partnerships between Korean manufacturers and global material suppliers, while electronics giants drive specification requirements and performance standards that influence material development tailored to advanced manufacturing processes and next-generation electronic systems.

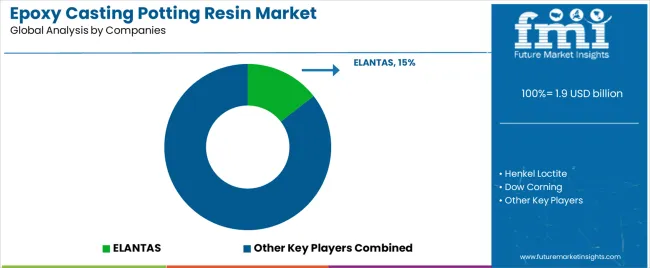

The epoxy casting potting resin market exhibits a moderately consolidated competitive structure with 15-20 credible players, where the top 4-5 companies hold approximately 52-58% of global revenue. Market leadership is maintained through technical expertise, formulation capabilities, and continuous innovation in curing systems, thermal conductivity, and application-specific performance characteristics. The competitive landscape is evolving from standard potting compound supply toward comprehensive material solutions that incorporate application engineering support, custom formulation development, and performance testing services.

Leadership positioning is driven by technical service infrastructure, global manufacturing footprint, and the ability to provide certified materials meeting diverse industry specifications from consumer electronics to aerospace applications. Established players leverage decades of formulation experience and extensive testing data to maintain customer relationships, while emerging competitors differentiate through specialized formulations such as ultra-fast cure systems, bio-based content, or extreme thermal conductivity addressing specific market niches.

Commoditization trends affect basic room-temperature cure formulations and standard electrical-grade potting compounds, pushing manufacturers to differentiate through value-added features including enhanced thermal performance, flame retardancy, low-stress characteristics, and sustainable formulation options. Margin opportunities concentrate in specialty grades for demanding applications, custom formulation services, application engineering support, and performance testing programs that provide qualification data for aerospace, automotive, and medical electronics applications commanding premium pricing through enhanced properties and certification compliance.

The epoxy casting potting resin market structure creates distinct competitive advantages for different stakeholder types. Global chemical companies maintain leadership through comprehensive product portfolios, worldwide technical support networks, and extensive certification databases serving multiple industries from consumer electronics to aerospace. Specialized electronic materials suppliers compete through deep application expertise, responsive technical service, and formulation optimization for specific electronics manufacturing processes. Regional formulators focus on cost-competitive solutions and rapid customization for local electronics manufacturers. Application engineering specialists differentiate through process optimization expertise, equipment integration, and training programs. Niche material innovators address emerging applications such as power electronics thermal management, flexible electronics encapsulation, and sustainable formulation development, requiring advanced chemistry and specialized performance characteristics.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 billion |

| Curing Method | Normal Temperature Curing, Heated Curing, Others |

| Application | Capacitors, Electric Motors, Aerospace Components, Others |

| Regions Covered | East Asia, South Asia Pacific, Western Europe, North America, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, United States, Brazil, United Kingdom, Japan, South Korea, France, Italy, Spain, Netherlands, Canada, Australia, and 22+ additional countries |

| Key Companies Profiled | ELANTAS, Henkel Loctite, Dow Corning, Huntsman, EFI Polymers, Evonik Industries, Sika, Zhejiang Rongtai Technical Enterprise, Shanghai Beginor Polymer Materials |

| Additional Attributes | Dollar sales by curing method and application categories, regional adoption trends across East Asia, South Asia Pacific, and Western Europe, competitive landscape with specialty chemical manufacturers and electronic materials suppliers, electronics manufacturer preferences for electrical insulation and thermal management, integration with production processes and quality management systems, innovations in resin formulation and thermal conductivity enhancement, and development of sustainable potting solutions with enhanced performance and electronics protection optimization capabilities. |

The global epoxy casting potting resin market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the epoxy casting potting resin market is projected to reach USD 2.9 billion by 2035.

The epoxy casting potting resin market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in epoxy casting potting resin market are normal temperature curing, heated curing and others.

In terms of application, capacitors segment to command 42.0% share in the epoxy casting potting resin market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Epoxy Type Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Grouts Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Putty and Construction Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Active Diluent Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Composite Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Paint Thinner Market Growth - Trends & Forecast 2025 to 2035

Epoxy Curing Agent Market Growth - Trends & Forecast 2025 to 2035

Epoxy Paint Market Growth – Trends & Forecast 2024-2034

Epoxy Encapsulation Material Market

Epoxy Resin Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Epoxy Resin Market Growth – Trends & Forecast 2024-2034

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Fast Curing Epoxy Adhesive Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

Casting Mold Market Size and Share Forecast Outlook 2025 to 2035

Casting Multi-stage Centrifugal Blower Market Size and Share Forecast Outlook 2025 to 2035

Podcasting Market Size and Share Forecast Outlook 2025 to 2035

Die Casting Services Market Analysis - Growth & Forecast 2025 to 2035

Grid Casting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA