The Epoxy Composite Market is estimated to be valued at USD 44.2 billion in 2025 and is projected to reach USD 92.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period. Over the forecast period, the market will experience steady growth, reflecting strong demand across sectors such as automotive, aerospace, construction, and renewable energy.

From 2025 to 2029, the market value will rise from USD 44.2 billion to USD 47.6 billion, marking a gradual increase as industries continue to adopt epoxy composites for their superior mechanical properties, durability, and lightweight characteristics. Between 2029 and 2031, the growth trajectory remains steady, reaching USD 51.3 billion, driven by the expanding use of epoxy composites in automotive and construction applications.

The period from 2031 to 2035 will see a more pronounced acceleration, with the market rising from USD 59.5 billion to USD 92.8 billion. This surge is attributed to increased demand from the renewable energy sector, where epoxy composites are increasingly used in wind turbine blades and other energy-efficient technologies. In terms of market share erosion or gain, the epoxy composite market is likely to see a gain in share, particularly in industries focused on lightweight, high-strength materials. As innovation continues and new applications are explored, the market will gain further ground, benefiting from both established industries and emerging sectors that require advanced composite materials.

| Metric | Value |

|---|---|

| Epoxy Composite Market Estimated Value in (2025 E) | USD 44.2 billion |

| Epoxy Composite Market Forecast Value in (2035 F) | USD 92.8 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The epoxy composite market is advancing steadily due to increasing demand for lightweight, high-strength materials across structural applications. Industries such as aerospace, wind energy, automotive, and marine are prioritizing performance-driven solutions that offer resistance to fatigue, corrosion, and high temperature while reducing overall weight.

Regulatory mandates for fuel efficiency and emission reduction are prompting the use of epoxy composites in place of traditional metals. Technological improvements in resin formulations and manufacturing techniques have enhanced processing efficiency and product consistency.

Furthermore, growing investment in composite material research and the expansion of high performance end use sectors are reinforcing the adoption of epoxy composites. As demand for cost-effective and environmentally resilient materials continues to rise, the market is expected to maintain a positive trajectory driven by innovation, regulatory compliance, and increased material substitution across core industries.

The epoxy composite market is segmented by type, manufacturing process, end user, and geographic regions. By type, the epoxy composite market is divided into Glass, Carbon, and Other types. In terms of the manufacturing process, the epoxy composite market is classified into Resin infusion, Prepreg layup, Compression molding, Filament winding, Pultrusion, and Others.

Based on end user, the epoxy composite market is segmented into Aerospace & defense, Automotive & transportation, Electrical & electronics, Energy & power, Sporting goods, and Others. Regionally, the epoxy composite industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glass segment is projected to account for 47.30% of total revenue within the type category by 2025, making it the most dominant segment. This is attributed to the balanced performance characteristics and cost effectiveness of glass fiber reinforced epoxy composites.

These materials offer high tensile strength, chemical resistance, and design flexibility, making them ideal for a range of industrial applications, including construction, automotive, and sporting goods. Their ease of processing and widespread availability have contributed to large scale adoption, especially in markets seeking economical alternatives to carbon fiber.

The compatibility of glass fibers with automated and scalable manufacturing processes has further strengthened their position as the preferred reinforcement material in the epoxy composite market.

The resin infusion segment is expected to contribute 41.60% of total market revenue within the manufacturing process category by 2025. This growth is driven by the technique’s ability to produce large, complex, and high quality composite structures with minimal voids and optimized fiber resin ratios.

The process supports lower material wastage and reduced labor cost while delivering structural integrity suitable for marine, wind energy, and transportation components. Its compatibility with a wide range of fiber types and tooling configurations has enhanced flexibility in production setups.

The improved surface finish and mechanical performance achieved through resin infusion have positioned this process as a favored choice in sectors emphasizing durability and efficiency.

The aerospace and defense segment is projected to hold 53.20% of total market revenue under the end user category by 2025, establishing it as the leading segment. This dominance is driven by the critical need for lightweight and high strength materials to improve fuel efficiency, structural performance, and payload capacity in aircraft and defense systems.

Epoxy composites are extensively used in fuselage panels, wings, and interior components due to their superior fatigue resistance and dimensional stability. The sector’s stringent regulatory and performance standards have accelerated the adoption of certified and reliable composite materials.

Additionally, defense modernization programs and increasing commercial aircraft production have contributed to rising demand, making aerospace and defense the cornerstone of epoxy composite utilization across global markets.

The epoxy composite market is witnessing significant growth driven by the increasing demand for high-performance materials across various industries such as aerospace, automotive, construction, and wind energy. Epoxy composites offer superior strength, durability, and resistance to chemicals and environmental factors, making them ideal for applications where high performance and lightweight materials are crucial. The growth of the renewable energy sector, particularly wind energy, alongside the rising adoption of electric vehicles and advanced manufacturing processes, is further driving the demand for epoxy composites. The market is also benefiting from ongoing innovations in composite materials and manufacturing techniques that enhance the properties of epoxy-based composites.

The primary driver for the epoxy composite market is the growing demand for lightweight, high-performance materials in industries like aerospace, automotive, and renewable energy. In the aerospace and automotive sectors, epoxy composites are valued for their ability to reduce weight without compromising strength, resulting in improved fuel efficiency and overall performance. The rising demand for electric vehicles (EVs), where lightweight materials play a significant role in battery efficiency and range, is also fueling the growth of epoxy composites. In the wind energy sector, the need for durable and lightweight materials to manufacture wind turbine blades is further driving the market, as epoxy composites provide superior mechanical properties and resistance to environmental wear.

Despite the advantages, the epoxy composite market faces challenges, particularly related to high manufacturing costs and limited recycling options. Epoxy composites are generally more expensive to produce than traditional materials, such as metals and plastics, due to the specialized processes and materials required. The cost of raw materials and the need for advanced curing techniques can increase production expenses, making epoxy composites less attractive for cost-sensitive applications. Additionally, the recycling of epoxy composites remains challenging due to the strong bonds formed during curing, making it difficult to break down the material for reuse. This limitation, combined with the higher cost of production, could hinder the widespread adoption of epoxy composites in industries with tight budget constraints.

The epoxy composite market presents significant growth opportunities, especially with innovations in recycling technologies and advancements in composite material properties. Researchers and manufacturers are exploring ways to make epoxy composites more recyclable and environmentally friendly, developing methods to break down and reuse epoxy resins. In addition, the development of hybrid composites, which combine epoxy resins with other materials like carbon or glass fibers, is opening up new possibilities for improving performance while reducing costs. As industries such as automotive, aerospace, and renewable energy continue to seek stronger, lighter, and more durable materials, the market for epoxy composites is poised for further expansion. The increasing focus on sustainability and environmental concerns is also driving the demand for innovative, eco-friendly composite solutions.

A key trend in the epoxy composite market is the increasing use of these materials in the wind energy and electric vehicle sectors. In wind energy, epoxy composites are crucial for manufacturing larger, lighter, and more durable turbine blades, contributing to improved energy generation and efficiency. As the demand for renewable energy grows, the adoption of epoxy composites in this sector continues to rise. In the automotive industry, particularly with the growing popularity of electric vehicles (EVs), there is an increasing demand for lightweight, high-strength materials to improve vehicle performance and range. Epoxy composites are well-suited for these applications, offering excellent mechanical properties and the potential for weight reduction, which directly impacts the efficiency and performance of electric vehicles. These trends are expected to continue shaping the market, driving innovation and expanding application areas for epoxy composites.

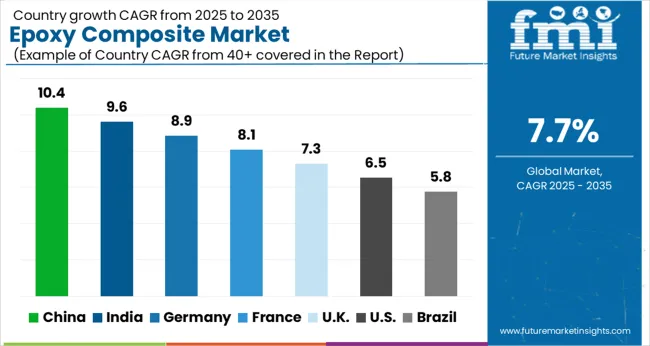

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

The global epoxy composite market is projected to grow at a global CAGR of 7.7% from 2025 to 2035. China leads the market with a growth rate of 10.4%, followed by India at 9.6%. France records a growth rate of 8.1%, while the UK shows 7.3% and the USA follows at 6.5%. The market is primarily driven by the increasing demand for lightweight, high-performance materials in industries such as aerospace, automotive, and construction. China and India are leading the growth, driven by rapid industrialization, infrastructure development, and increasing adoption of composite materials. Developed markets like France, the UK, and the USA are witnessing steady growth, fueled by technological advancements and the demand for energy-efficient and high-performance materials. The analysis spans over 40+ countries, with the leading markets shown below.

The epoxy composite market in China is growing at a 10.4% CAGR, driven by the rapid industrialization and expansion of the aerospace, automotive, and construction industries. The demand for lightweight and high-performance materials, particularly in automotive and infrastructure projects, is accelerating the adoption of epoxy composites. With a growing middle class and increasing investments in infrastructure and manufacturing, China’s need for durable and efficient materials is rising. The country’s focus on improving electrical grid infrastructure and renewable energy initiatives is also driving the use of epoxy composites in construction and energy-efficient applications. China’s strong manufacturing capabilities and competitive pricing further support market growth.

The epoxy composite market in India is projected to grow at a 9.6% CAGR, supported by the country’s expanding infrastructure, automotive, and aerospace sectors. As India continues to urbanize, there is a growing demand for lightweight, durable materials used in construction and manufacturing. The automotive industry’s push toward more fuel-efficient, high-performance vehicles is driving the adoption of epoxy composites. India’s growing middle class and increasing disposable income are contributing to the demand for high-quality materials. The country’s focus on improving electrical infrastructure and industrial capabilities is also promoting the use of advanced composite materials.

The epoxy composite market in France is expected to grow at a 7.8% CAGR, driven by rising demand in the automotive, aerospace, and construction industries. As the automotive industry focuses on increasing vehicle efficiency and performance, the need for lightweight materials such as epoxy composites is increasing. France’s growing focus on reducing carbon emissions and improving energy efficiency in buildings and infrastructure projects is driving the demand for advanced composite materials. The aerospace industry’s need for high-performance and durable components further supports the growth of the epoxy composite market in France.

The UK’s epoxy composite market is projected to grow at a 7.3% CAGR, driven by increasing demand for durable, lightweight materials in the aerospace, automotive, and construction industries. The rise of electric vehicles, which require advanced composite materials for performance and efficiency, is a key driver in the automotive sector. The UK’s construction sector continues to adopt advanced materials to improve building performance and reduce energy consumption. The market is also benefiting from growing interest in high-performance materials for industrial applications, particularly in the automotive and aerospace sectors.

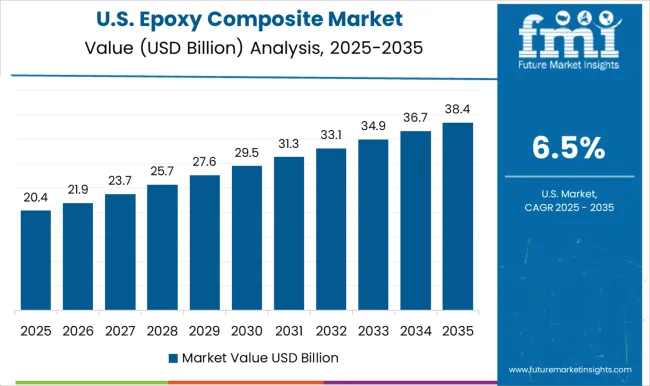

The USA epoxy composite market is expected to grow at a 6.5% CAGR, supported by rising demand for high-performance materials in industries such as aerospace, automotive, and construction. The USA automotive sector is increasingly using epoxy composites to manufacture lightweight vehicles that meet performance standards. Similarly, the aerospace industry’s focus on developing advanced composite solutions for aircraft components is driving the market. In the construction sector, the need for durable and high-performance materials for infrastructure projects continues to increase, contributing to the growing demand for epoxy composites in the USA

The epoxy composite market is driven by leading companies offering high-performance materials for industries such as automotive, aerospace, construction, and marine, known for their strength, durability, and lightweight properties. AOC, LLC provides epoxy composite resins widely used in transportation and construction, focusing on high performance.

Ashland Global Holdings Inc. offers versatile epoxy resins suitable for automotive and industrial applications, ensuring reliable performance. Gurit Holding AG specializes in delivering epoxy-based composite materials for aerospace, wind energy, and marine sectors, focusing on lightweight and durable solutions. Hexcel Corporation offers advanced epoxy composites for aerospace and automotive industries, known for their high strength-to-weight ratio. Hexion Inc. provides various epoxy resins for composite applications, emphasizing high performance and cost-effectiveness in industrial settings. Huntsman Corporation offers a broad range of epoxy resins for automotive, construction, and industrial coatings. Mitsubishi Chemical Corporation focuses on high-performance epoxy composites for automotive, construction, and marine applications, ensuring product reliability. Owens Corning manufactures composite solutions for aerospace, automotive, and construction, focusing on strength and sustainability. Sika AG provides epoxy composite materials for construction and infrastructure, offering high-strength solutions. Solvay S.A. is a global leader in supplying high-performance composites for aerospace, automotive, and energy industries. Teijin Limited offers durable epoxy composites for automotive and industrial applications, while Toray Industries, Inc. focuses on aerospace, automotive, and high-performance sectors, ensuring superior performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 44.2 Billion |

| Type | Glass, Carbon, and Other types |

| Manufacturing Process | Resin infusion, Prepreg layup, Compression molding, Filament winding, Pultrusion, and Others |

| End User | Aerospace & defense, Automotive & transportation, Electrical & electronics, Energy & power, Sporting goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aoc, Llc, Ashland Global Holdings Inc., Gurit Holding Ag, Hexcel Corporation, Hexion Inc., Huntsman Corporation, Mitsubishi Chemical Corporation, Owens Corning, Sika Ag, Solvay S.A., Teijin Limited, and Toray Industries, Inc. |

| Additional Attributes | Dollar sales by product type (epoxy resins, prepregs, fibers) and end-use segments (aerospace, automotive, construction, marine, wind energy). Demand dynamics are driven by the increasing need for lightweight, durable, and high-strength materials in industries such as aerospace, automotive, and renewable energy. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with innovations in resin technologies, enhanced manufacturing capabilities, and the rising demand for high-performance composite materials driving market expansion. |

The global epoxy composite market is estimated to be valued at USD 44.2 billion in 2025.

The market size for the epoxy composite market is projected to reach USD 92.8 billion by 2035.

The epoxy composite market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in epoxy composite market are glass, carbon and other types.

In terms of manufacturing process, resin infusion segment to command 41.6% share in the epoxy composite market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Epoxy Type Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Grouts Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Putty and Construction Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Active Diluent Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Paint Thinner Market Growth - Trends & Forecast 2025 to 2035

Epoxy Curing Agent Market Growth - Trends & Forecast 2025 to 2035

Epoxy Paint Market Growth – Trends & Forecast 2024-2034

Asia Pacific Epoxy Resin Market Growth – Trends & Forecast 2024-2034

Epoxy Resin Market Growth – Trends & Forecast 2024-2034

Epoxy Encapsulation Material Market

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Composite Roller Market Size and Share Forecast Outlook 2025 to 2035

Composite Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Paper Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Drums Market Size and Share Forecast Outlook 2025 to 2035

Composite Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Composite Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Film Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA