The Epoxy Active Diluent Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. Starting at USD 1.3 billion in 2025, the market maintains steady expansion through the initial years, reaching approximately USD 1.3 billion in 2026 and USD 1.4 billion in 2027. Growth accelerates modestly, moving to USD 1.5 billion in 2028 and 2029, driven by increasing applications in coatings, adhesives, and composite materials where diluents enhance viscosity control and crosslinking efficiency.

By 2030, the market reaches USD 1.6 billion, reflecting the cumulative effect of industrial adoption, improved formulation techniques, and regional production expansion, particularly in North America, Europe, and Asia-Pacific. The year-on-year progression highlights incremental market gains, illustrating a consistent preference for high-performance epoxy systems and formulations tailored to construction, automotive, and marine applications.

Continuing from 2031 to 2035, the epoxy active diluent market sustains its trajectory, gradually reaching USD 2.1 billion by 2035. Yearly increases remain steady, reflecting the combined influence of technological refinement, growing industrial end-use applications, and global supply chain optimization. The market benefits from rising demand for customizable epoxy formulations and higher throughput in chemical manufacturing processes. Additionally, the shift toward multi-functional resins and blended systems further supports incremental growth, providing formulators with greater flexibility and efficiency. Regional expansion into emerging economies contributes to market resilience, while established markets maintain stable demand. Overall, the year-on-year analysis demonstrates a balanced growth pattern, driven by adoption across diverse sectors, incremental product improvements, and the continuous expansion of epoxy formulation applications worldwide.

| Metric | Value |

|---|---|

| Epoxy Active Diluent Market Estimated Value in (2025 E) | USD 1.3 billion |

| Epoxy Active Diluent Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The epoxy active diluent market is experiencing consistent growth, supported by its critical role in improving the performance, processing efficiency, and cost-effectiveness of epoxy resin systems. Increasing demand for lightweight, durable, and high-strength materials in industries such as construction, automotive, marine, and electronics is driving the adoption of active diluents. The ability of these compounds to modify viscosity, enhance flexibility, and improve adhesion properties is making them essential in a wide range of end-use applications.

Technological advancements in formulation chemistry are enabling the production of high-purity, low-toxicity diluents that meet stringent environmental and safety regulations. Expanding construction activities, rising infrastructure investments, and the growth of composite materials in industrial applications are further influencing demand.

The market is also benefiting from the trend toward sustainable materials, with manufacturers focusing on bio-based and low-VOC active diluents As application requirements evolve and performance expectations increase, epoxy active diluents are expected to remain integral to resin formulation strategies, ensuring strong growth opportunities across multiple industrial sectors over the coming years.

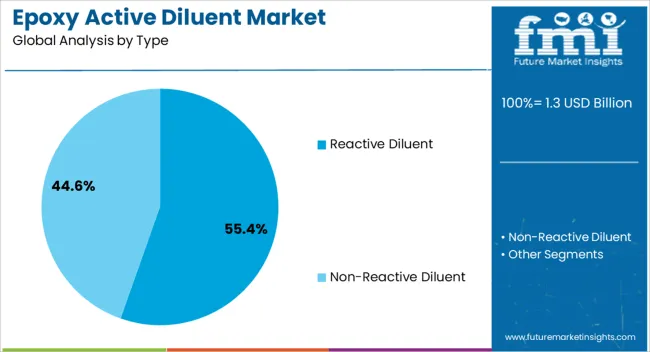

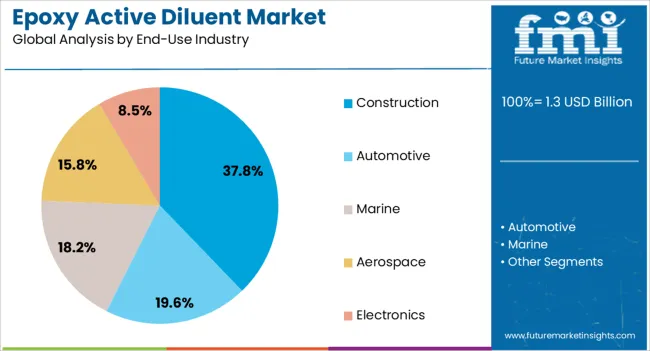

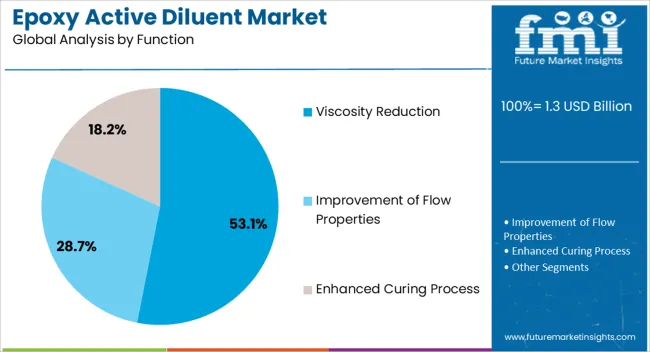

The epoxy active diluent market is segmented by type, end-use industry, function, application, product form, and geographic regions. By type, the epoxy active diluent market is divided into Reactive Diluent and Non-Reactive Diluent. In terms of end-use industry, the epoxy active diluent market is classified into Construction, Automotive, Marine, Aerospace, and Electronics. Based on function, the epoxy active diluent market is segmented into Viscosity Reduction, Improvement of Flow Properties, and Enhanced Curing Process.

By application, the epoxy active diluent market is segmented into Coatings, Adhesives, Composites, and Sealants. By product form, epoxy active diluent market is segmented into Liquid and Solid. Regionally, the epoxy active diluent industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The reactive diluent segment is projected to account for 55.4% of the epoxy active diluent market revenue share in 2025, establishing it as the leading type. This dominance is being supported by the ability of reactive diluents to chemically integrate into epoxy resin systems, resulting in improved mechanical properties, reduced brittleness, and enhanced durability. The incorporation of reactive diluents allows formulators to lower resin viscosity without sacrificing performance, enabling more efficient processing and better substrate wetting.

These benefits are particularly valued in applications where strong adhesion, chemical resistance, and long service life are required. The segment is further benefiting from advancements in product development that allow for tailored reactivity profiles to meet specific curing conditions and performance requirements.

Increasing demand from high-performance coatings, adhesives, and composite materials is reinforcing the segment’s position. Additionally, the cost-effectiveness of reactive diluents, combined with their ability to enhance end-product quality, is expected to sustain their leadership in the market throughout the forecast period.

The construction segment is anticipated to hold 37.8% of the epoxy active diluent market revenue share in 2025, making it the dominant end-use industry. Its leadership is being driven by the widespread use of epoxy-based coatings, adhesives, sealants, and composites in structural applications. Epoxy active diluents in construction are utilized to improve workability, extend pot life, and enhance application performance in varying environmental conditions.

Growing infrastructure investments, rapid urbanization, and the expansion of commercial and residential construction projects are directly supporting demand. The segment is also benefiting from the need for high-strength, chemical-resistant, and weather-durable materials in flooring, protective coatings, and repair systems.

As sustainability becomes a key focus, low-VOC and bio-based epoxy formulations with active diluents are gaining traction in the construction sector. The ability of these products to deliver consistent performance while meeting evolving regulatory requirements is further reinforcing their adoption, ensuring that construction remains the largest consumer of epoxy active diluents in the global market.

The viscosity reduction function segment is expected to capture 53.1% of the epoxy active diluent market revenue share in 2025, positioning it as the leading functional category. Its dominance is attributed to the essential role of viscosity modifiers in enabling easier handling, improved processability, and enhanced application control in epoxy resin systems. By reducing viscosity, active diluents facilitate better substrate penetration, improved fiber wet-out in composites, and more uniform coating application.

These benefits contribute to higher product quality, reduced waste, and increased production efficiency. The segment is also supported by the demand for low-viscosity epoxy systems in industries such as construction, automotive, electronics, and marine, where precision and consistency are critical.

Ongoing innovations in diluent chemistry are allowing manufacturers to develop solutions that achieve viscosity control without compromising mechanical strength, chemical resistance, or environmental compliance. As production processes become more advanced and application requirements grow more stringent, viscosity reduction will continue to be a primary function driving the adoption of epoxy active diluents across industrial sectors.

The epoxy active diluent market is witnessing steady momentum with demand supported by coatings, adhesives, composites, and energy applications. Opportunities are expanding in renewable infrastructure and electric mobility, while trends are shifting toward bio-based, low-VOC solutions under regulatory influence. However, price volatility of feedstocks and competitive pressures remain persistent challenges. Producers are strategically adapting through product innovation, backward integration, and portfolio diversification. This combination of rising industrial demand, evolving regulatory frameworks, and raw material risks makes the market both promising and highly competitive, demanding continuous adaptation by stakeholders across regions.

Demand for epoxy active diluents has expanded as formulators in coatings, adhesives, and composites seek enhanced processing efficiency and tailored performance. These low-viscosity additives have been integrated to reduce brittleness in epoxy resins, improve substrate adhesion, and extend pot life during applications. Demand has also been influenced by their compatibility with solvent-free and high-solids formulations, making them useful in protective coatings, flooring systems, and marine composites. Rising infrastructure projects in Asia and rapid industrial output have further pushed demand in construction-grade coatings and electronic encapsulation. Automotive refinish coatings, wind energy composites, and aerospace-grade adhesives are witnessing a higher adoption rate due to reduced volatility and improved handling characteristics. Regional manufacturers have adapted portfolios to offer both reactive and non-reactive diluents to address specialized customer needs. The expansion of resin producers into Asia-Pacific has also widened the consumption base, driving consistent demand across multiple industrial verticals.

Epoxy active diluents are securing opportunities in renewable energy and electric mobility applications. Their ability to improve the toughness and curing profile of epoxy systems has opened pathways for wider use in wind turbine blades, photovoltaic panels, and high-voltage insulation. Energy infrastructure projects across Asia and Europe are incorporating advanced composites with diluent-modified epoxies to extend service life and reduce maintenance intervals. The electric vehicle sector is particularly significant, as active diluents enhance the mechanical integrity of adhesives and coatings used in battery modules, motor housings, and lightweight structural components. Growing investments in gigafactories and battery pack assembly plants have created long-term opportunities for epoxy resin suppliers to deepen penetration into high-performance applications. Strategic collaborations between chemical producers and EV component manufacturers are accelerating this adoption. This emerging synergy highlights how epoxy active diluents are positioned as enablers of future-oriented industrial sectors where durability and processing efficiency are critical.

A notable trend shaping the epoxy active diluent landscape is the pivot toward bio-based and environmentally compliant formulations. Manufacturers are under pressure to develop alternatives that reduce reliance on petroleum feedstock and lower volatile organic compound (VOC) emissions. Bio-derived diluents sourced from plant oils and glycidyl ethers have entered the market, offering lower toxicity and enhanced biodegradability compared to conventional petrochemical-based variants. This shift is supported by regulatory frameworks in North America and Europe that restrict the use of hazardous substances in industrial coatings and adhesives. Demand for low-VOC floor coatings, industrial paints, and electronic encapsulants has been reinforced by customer preference for safer and greener solutions. Several leading producers have unveiled pilot projects for bio-based diluents, particularly in automotive and electronics applications, where compliance and eco-labelling are valued. This trend is gradually transitioning from niche adoption to mainstream commercial availability as cost competitiveness improves.

Challenges in the epoxy active diluent sector are primarily linked to volatility in raw material prices and logistics constraints. Feedstocks such as epichlorohydrin and bisphenol-A have experienced frequent price fluctuations due to supply disruptions, regulatory scrutiny, and energy market swings. Producers are under pressure as input cost surges compress operating margins, while downstream customers resist proportional price adjustments. Import-dependent regions such as South Asia and parts of Europe face heightened risk from freight cost spikes and port congestion. Smaller manufacturers struggle to maintain profitability when supply contracts are short-term and hedging options are limited. Market fragmentation and intense competition also prevent easy pass-through of costs, leading to thinner margins. Some companies are countering this challenge by forward-integrating into resin production, while others are exploring long-term offtake agreements with feedstock suppliers. Nevertheless, margin pressure remains a defining hurdle, influencing pricing stability and investment decisions across the epoxy active diluent ecosystem.

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

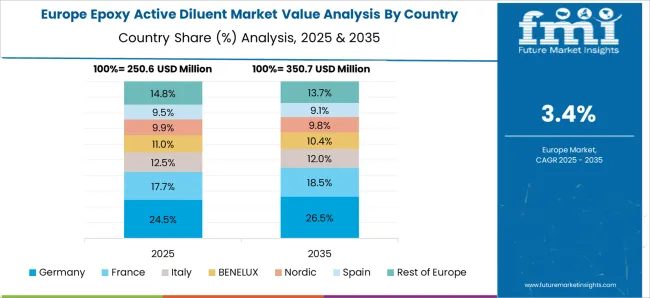

Global epoxy active diluent demand is projected to rise at a 5.1% CAGR from 2025 to 2035. Of the profiled markets, China leads at 6.9%, followed by India at 6.4%, and Germany at 5.9%, while the United Kingdom records 4.8% and the United States posts 4.3%. These rates translate to a growth premium of +35% for China, +26% for India, and +16% for Germany versus the baseline, while the United States and the United Kingdom reflect more moderate expansion. Divergence is shaped by industrial needs, with China and India integrating diluents in paints, adhesives, and composites, while the United States and the United Kingdom see steadier usage tied to established construction and automotive sectors. This report spans 40+ countries; the top five are detailed below.

The epoxy active diluent market in China is forecast to grow at a CAGR of 6.9% between 2025 and 2035, making it the fastest among key economies. Adoption is strongly tied to the country’s booming construction and automotive sectors, where diluents improve processing efficiency in coatings, adhesives, and composites. The wind energy industry also presents significant demand, with epoxy-based systems widely used in turbine blade production. Expanding electronics manufacturing further drives application in encapsulants and protective coatings. China benefits from domestic chemical producers investing in capacity expansion, ensuring steady availability. Rising emphasis on lower viscosity formulations and compatibility with varied epoxy resins continues to position China as the most competitive market for these materials.

Demand Outlook for Epoxy Active Diluent Market in India

The epoxy active diluent market in India is expected to expand at a CAGR of 6.4% from 2025 to 2035, reflecting its rising role in industrial coatings, infrastructure, and consumer goods. Demand is supported by increasing construction activity, where diluents enhance workability and reduce viscosity in epoxy resins used in flooring and adhesives. The packaging and electronics industries are also fueling adoption, particularly in protective coatings and printed circuit board applications. India benefits from competitive labor costs and expanding manufacturing bases that ensure widespread use of low-viscosity epoxy formulations. Government infrastructure spending and the shift toward lightweight composites in automotive manufacturing further strengthen opportunities in the Indian market.

Analysis of Epoxy Active Diluent Market in Germany

The epoxy active diluent market in Germany is projected to grow at a CAGR of 5.9% from 2025 to 2035, sustained by its precision-driven automotive and industrial engineering sectors. Demand is particularly high in adhesives and coatings, where epoxy active diluents support efficiency and flexibility in formulation. The renewable energy industry, especially wind power, also underpins demand for epoxy composites. German manufacturers favor high-quality diluents that comply with strict EU chemical safety regulations, ensuring reliability in high-performance applications. The presence of advanced R&D facilities fosters continuous product innovations, helping the country retain a strong foothold in Europe. Adoption in electric vehicle battery housings and aerospace materials further elevates its market relevance.

Demand Forecast for Epoxy Active Diluent Market in United Kingdom

The epoxy active diluent market in the United Kingdom is anticipated to grow at a CAGR of 4.8% during 2025–2035. The construction sector remains a key contributor, with increasing use of epoxy systems in flooring, waterproofing, and structural adhesives. The aerospace and defense industries also represent steady demand, where lightweight composite materials incorporate epoxy diluents. Rising refurbishment and repair activities in housing and infrastructure continue to sustain moderate growth. The UK market is characterized by strong regulatory compliance with EU and domestic standards, promoting use of low-toxicity and high-performance formulations. Import dependency for raw materials remains a challenge, though localized distribution networks maintain stable supply chains.

Epoxy Active Diluent Market Growth Outlook in the United States

The epoxy active diluent market in the United States is expected to expand at a CAGR of 4.3% between 2025 and 2035, indicating slower but stable growth compared to Asian economies. Industrial applications are concentrated in automotive, construction, and marine coatings, where diluents enable easier application and performance enhancement. The aerospace industry’s requirement for lightweight composites continues to generate consistent demand. Strict USA chemical safety and environmental standards drive the preference for low-viscosity, non-toxic diluents, creating opportunities for specialized producers. Growth is tempered by market maturity and high penetration of established resin systems, yet innovation in electronics encapsulation and 3D printing materials presents emerging opportunities.

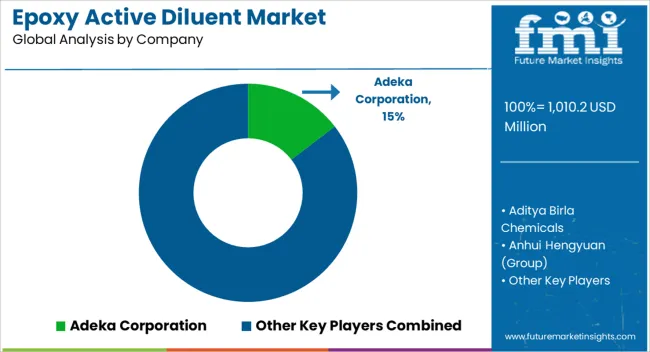

In the epoxy active diluent market, leading companies are advancing growth through performance enhancement, portfolio diversification, and downstream integration. Major players such as Dow, Huntsman, Arkema, Evonik, and Air Products emphasize high-purity formulations for coatings, adhesives, and composites, focusing on viscosity control and enhanced mechanical strength. Hexion and Aditya Birla Chemicals leverage scale and regional supply chains to strengthen pricing power and expand reach across Asia-Pacific and North America. Niche innovators like Cardolite and Gabriel Chem (Huntsman) are investing in bio-based diluents sourced from cashew nut shell liquid, carving a position where regulatory compliance and environmental preferences create opportunities for adoption.

Specialty suppliers such as EMS-Chemie, Sakamoto Yakuhin Kogyo, and King Industries focus on differentiated grades for electronics, automotive, and aerospace sectors, while distributors like Brenntag extend access for mid-tier users in Europe and the US through logistics and technical services. Players including SACHEM Inc. and Arnette Polymers pursue tailored epoxy modifications, frequently partnering with end users on custom blends. Competitive intensity stems from cost-to-performance optimization, pressuring smaller firms to establish differentiation against vertically integrated leaders. To defend positions, suppliers are pursuing three priorities: strengthening alliances with coating and adhesive formulators, expanding renewable or bio-based chemistries to diversify, and consolidating distribution channels for regional reliability. This combination defines the forward outlook of the industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Type | Reactive Diluent and Non-Reactive Diluent |

| End-Use Industry | Construction, Automotive, Marine, Aerospace, and Electronics |

| Function | Viscosity Reduction, Improvement of Flow Properties, and Enhanced Curing Process |

| Application | Coatings, Adhesives, Composites, and Sealants |

| Product Form | Liquid and Solid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dow Chemical Company (Dow, Inc.), Huntsman Corporation, Arkema, Evonik (RAG-Stiftung), Air Products and Chemicals, Hexion, Aditya Birla Chemicals, Cardolite, Gabriel Chem (Huntsman Corporation), EMS-CHEMIE HOLDING AG, LLC, Sakamoto Yakuhin Kogyo, King Industries, Inc., Brentagg (DB US Holding Corporation), SACHEM Inc., and Arnette Polymers |

| Additional Attributes | Dollar sales by product type (aliphatic vs aromatic vs cycloaliphatic), Dollar sales by application (coatings, adhesives, composites, sealants), Adoption of low-viscosity diluents in high-performance epoxy formulations, Influence of VOC regulations on formulation trends and product adoption, Expansion of reactive diluents in wind energy, aerospace, and electronics sectors, Regional preferences for epoxy active diluents in industrial and construction applications. |

The global epoxy active diluent market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the epoxy active diluent market is projected to reach USD 2.1 billion by 2035.

The epoxy active diluent market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in epoxy active diluent market are reactive diluent and non-reactive diluent.

In terms of end-use industry, construction segment to command 37.8% share in the epoxy active diluent market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Epoxy Type Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Grouts Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Putty and Construction Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Composite Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Paint Thinner Market Growth - Trends & Forecast 2025 to 2035

Epoxy Curing Agent Market Growth - Trends & Forecast 2025 to 2035

Epoxy Paint Market Growth – Trends & Forecast 2024-2034

Asia Pacific Epoxy Resin Market Growth – Trends & Forecast 2024-2034

Epoxy Resin Market Growth – Trends & Forecast 2024-2034

Epoxy Encapsulation Material Market

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Fast Curing Epoxy Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Active Charcoal Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Active & Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Active Network Management Market Analysis by Component, End Users, and Region Through 2025 to 2035

Active Oxygens Market Analysis by Product Type, Application and Region: Forecast for 2025 to 2035

Market Share Distribution Among Active, Smart, and Intelligent Packaging Manufacturers

Market Share Insights for Active Packaging Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA