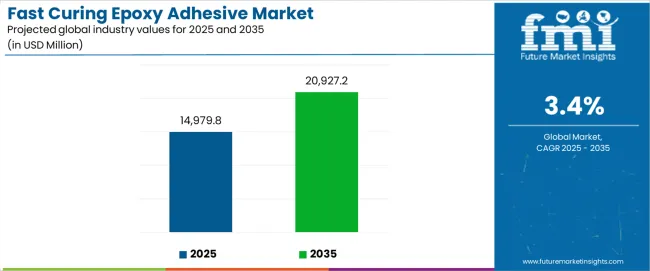

The global fast curing epoxy adhesive market, valued at USD 14,979.8 million in 2025 and forecast to reach USD 20,927.2 million by 2035 at a CAGR of 3.4%, reflects moderate but steady growth, supported by structural demand across automotive, aerospace, electronics, and industrial fabrication. While the fast curing epoxy adhesive market is expected to expand by nearly 1.40X during the forecast period, regional growth imbalances highlight clear differences in adoption intensity, production capabilities, and regulatory support across economies.

North America is positioned as a mature market with established demand from aerospace and automotive manufacturing. Growth here is steady but slower, as much of the demand is tied to replacement, incremental upgrades, and compliance-driven adoption of adhesives in critical applications. The region emphasizes advanced formulations for lightweight structures, regulatory-approved bonding materials, and specialty adhesives for defense and aerospace, but overall CAGR lags behind emerging economies due to market saturation.

Europe mirrors a similar pattern of stable yet moderate expansion. Strong environmental regulations push manufacturers toward eco-compliant, solvent-free, and advanced curing formulations. Automotive clusters in Germany, France, and Italy provide consistent demand, while aerospace hubs maintain procurement of high-performance epoxy adhesives. Growth, however, is constrained by slower industrial expansion and high compliance costs, which limit large-scale volume adoption compared to Asia Pacific.

Asia Pacific emerges as the fastest-growing regional market. China, India, South Korea, and Southeast Asian nations are driving the adoption of these technologies due to the rapid expansion of electronics manufacturing, automotive production, and industrial fabrication. The emphasis on faster assembly processes in consumer electronics, coupled with investments in aerospace manufacturing capabilities, positions the region as the leading contributor to incremental market value. Asia Pacific’s growth rate surpasses global averages, underpinned by high-volume manufacturing ecosystems and lower production costs. Latin America and the Middle East & Africa present emerging opportunities, but growth remains irregular. Latin America benefits from expanding automotive manufacturing in Mexico and Brazil, though industrial volatility tempers consistent expansion. The Middle East and Africa show niche adoption in construction, energy, and select aerospace contracts, but weaker industrial bases and infrastructure challenges restrict faster growth.

Between 2025 and 2030, the fast curing epoxy adhesive market is projected to expand from USD 14,979.8 million to USD 17,123.3 million, resulting in a value increase of USD 2,143.5 million, which represents 36.0% of the total forecast growth for the decade. This phase of development will be shaped by increasing automotive production requiring rapid assembly processes, rising adoption of automated dispensing systems, and growing demand for high-temperature resistant fast cure formulations with enhanced bonding characteristics. Manufacturing facilities are expanding their fast-cure adhesive sourcing capabilities to address the growing demand for electronics miniaturization, precision component assembly, and high-throughput production requirements.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 14,979.8 million |

| Forecast Value in (2035F) | USD 20,927.2 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

From 2030 to 2035, the fast curing epoxy adhesive market is forecast to grow from USD 17,123.3 million to USD 20,927.2 million, adding another USD 3,803.9 million, which constitutes 64.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of UV-activated fast cure technologies, the integration of conductive epoxy formulations, and the development of thermally conductive fast cure adhesives with maintained bonding performance. The growing adoption of automated assembly systems will drive demand for fast curing epoxies with superior dispensing characteristics and compatibility with high-speed application equipment across manufacturing facilities.

Between 2020 and 2025, the fast curing epoxy adhesive market experienced robust growth, driven by increasing demand for automotive lightweighting solutions and growing recognition of fast cure epoxies as essential bonding materials for time-sensitive assembly operations across electronics, aerospace, and industrial equipment applications. The fast curing epoxy adhesive market developed as manufacturers recognized the potential for fast cure epoxies to reduce production cycle times while maintaining high-strength bonding characteristics and enabling cost-effective manufacturing processes. Technological advancement in catalyst systems and accelerator formulations began emphasizing the critical importance of maintaining cure speed and bond strength performance in high-volume production environments.

Market expansion is being supported by the increasing global demand for manufacturing efficiency solutions and the corresponding need for adhesive materials that can provide superior bonding strength and rapid cure times while enabling reduced production cycles and enhanced throughput across various automotive, aerospace, and electronics manufacturing applications. Modern production facilities and assembly operations are increasingly focused on implementing bonding solutions that can achieve full cure strength in minutes, prevent production bottlenecks, and provide consistent performance throughout complex multi-stage manufacturing processes. Fast curing epoxy adhesives' proven ability to deliver exceptional bond strength, enable production line optimization, and support high-volume assembly make them essential materials for contemporary industrial manufacturing and precision component assembly operations.

The growing emphasis on production efficiency and manufacturing optimization is driving demand for fast cure epoxies that can support high-speed assembly requirements, improve production throughput, and enable automated dispensing systems. Manufacturers' preference for adhesives that combine rapid cure speed with processing reliability and bond durability is creating opportunities for innovative fast cure epoxy implementations. The rising influence of electric vehicle production and advanced electronics assembly is also contributing to increased demand for fast cure epoxies that can provide electrical insulation, thermal conductivity, and reliable performance across demanding application environments.

The fast curing epoxy adhesive market is poised for rapid growth and transformation. As industries across automotive, aerospace, electronics, medical devices, and industrial equipment seek adhesives that deliver exceptional bond strength, rapid cure times, and manufacturing efficiency, fast cure epoxies are gaining prominence not just as specialty bonding materials but as strategic enablers of production optimization and quality enhancement.

Rising electric vehicle production in Asia-Pacific and expanding automotive manufacturing globally amplify demand, while manufacturers are leveraging innovations in catalyst systems, heat-activated cure mechanisms, and automated dispensing technologies.

Pathways like thermally conductive formulations, UV-activated cure systems, and application-specific customization promise strong margin uplift, especially in high-value segments. Geographic expansion and vertical integration will capture volume, particularly where local manufacturing capabilities and technical support proximity are critical. Regulatory pressures around automotive safety standards, electronics reliability requirements, aerospace certification standards, and manufacturing quality assurance give structural support.

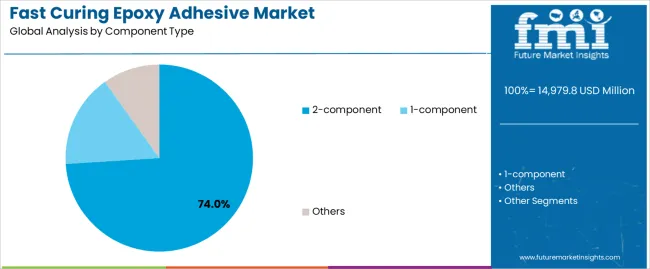

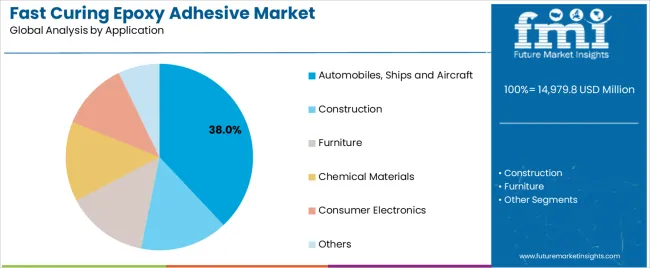

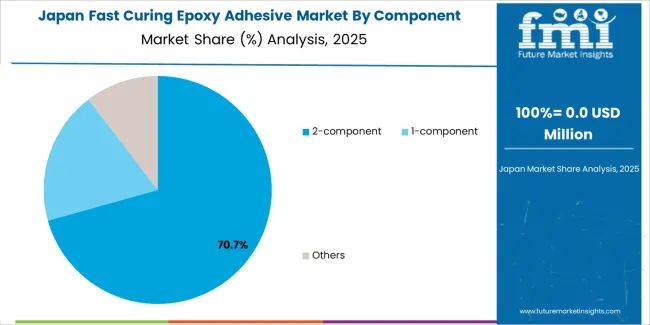

The fast curing epoxy adhesive market is segmented by component type, application, cure mechanism, viscosity, end-use industry, and region. By component type, the fast curing epoxy adhesive market is divided into 2-component, 1-component, and others. By application, it covers automobiles, ships and aircraft, construction, furniture, chemical materials, consumer electronics, and others. By cure mechanism, the fast curing epoxy adhesive market is segmented into heat-activated, UV-activated, and ambient cure. The viscosity includes low (below 1000 cPs), medium (1000-5000 cPs), and high (above 5000 cPs). By end-use industry, it is categorized into automotive, aerospace & defense, electronics, construction, medical devices, and others. Regionally, the fast curing epoxy adhesive market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The 2-component segment is projected to account for 74% of the fast curing epoxy adhesive market in 2025, reaffirming its position as the leading component category. Manufacturing facilities and assembly operations increasingly utilize 2-component fast cure epoxies for their superior mixing control when processed through automated dispensing systems, excellent bond strength characteristics, and versatility in applications ranging from automotive structural bonding to electronics component assembly. 2-component fast cure epoxy technology's advanced catalyst systems and controlled pot life capabilities directly address the industrial requirements for reliable cure performance in high-volume production environments.

This component segment forms the foundation of modern manufacturing operations, as it represents the fast cure epoxy type with the greatest control over cure characteristics and established market demand across multiple application categories and industry sectors. Manufacturer investments in advanced mixing technologies and automated dispensing compatibility continue to strengthen adoption among automotive manufacturers and electronics assemblers. With companies prioritizing production efficiency and bond reliability, 2-component fast cure epoxies align with both performance requirements and manufacturing control objectives, making them the central component of comprehensive assembly strategies.

Automobiles, ships and aircraft applications are projected to represent 38.0% of fast curing epoxy adhesive demand in 2025, underscoring their critical role as the primary industrial consumers of rapid-cure bonding materials for vehicle assembly, aircraft component manufacturing, and marine equipment fabrication. Automotive and aerospace manufacturers prefer fast cure epoxies for their exceptional bond strength capabilities, rapid production throughput characteristics, and ability to meet stringent safety requirements while ensuring structural integrity with reliable curing performance. Positioned as essential bonding materials for modern transportation manufacturing, fast cure epoxies offer both strength advantages and production efficiency benefits.

The segment is supported by continuous innovation in high-temperature formulations and the growing availability of specialized cure systems that enable crash-resistant bonding with enhanced durability performance and rapid assembly throughput. Additionally, automotive manufacturers are investing in lightweighting technologies to support large-volume fast cure epoxy utilization and production optimization. As electric vehicle production becomes more prevalent and aerospace manufacturing volumes increase, automobiles, ships and aircraft applications will continue to dominate the end-use market while supporting advanced structural bonding utilization and assembly automation strategies.

The fast curing epoxy adhesive market is advancing rapidly due to increasing demand for manufacturing efficiency solutions and growing adoption of rapid-cure bonding systems that provide superior bond strength and quick cure times while enabling reduced production cycles across diverse automotive, aerospace, and electronics assembly applications. However, the fast curing epoxy adhesive market faces challenges, including raw material price volatility, temperature sensitivity of cure mechanisms, and the need for specialized mixing and dispensing equipment investments. Innovation in catalyst systems and accelerator formulations continues to influence product development and market expansion patterns.

The growing adoption of thermally conductive formulations, electrically insulating barrier properties, and flame-retardant fast cure epoxies is enabling manufacturers to produce specialized adhesives with superior heat transfer capabilities, enhanced electrical isolation properties, and improved fire safety functionalities. Advanced specialty systems provide improved electronics protection while allowing more efficient thermal management and consistent performance across various temperature conditions and applications. Manufacturers are increasingly recognizing the competitive advantages of specialized fast cure epoxy capabilities for product differentiation and premium market positioning.

Modern fast cure epoxy producers are incorporating automated mixing systems, precision dispensing equipment, and sensor-controlled application mechanisms to enhance manufacturing accuracy, enable production cost reduction, and deliver value-added solutions to automotive and electronics customers. These technologies improve assembly consistency while enabling new operational capabilities, including high-speed component bonding, precise adhesive placement, and reduced material waste. Advanced automation integration also allows manufacturers to support large-scale production operations and facility modernization beyond traditional manual application approaches.

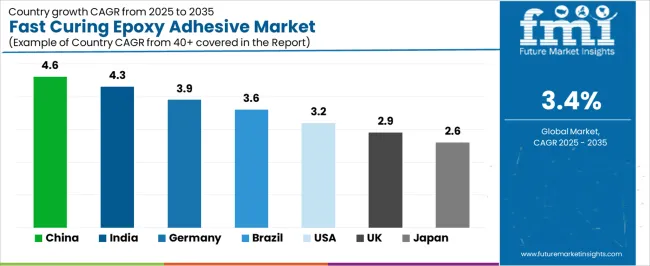

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| Brazil | 3.6% |

| USA | 3.2% |

| UK | 2.9% |

| Japan | 2.6% |

The fast curing epoxy adhesive market is experiencing strong growth globally, with China leading at a 4.6% CAGR through 2035, driven by the expanding automotive manufacturing sector, growing electronics production capabilities, and significant investment in industrial automation development. India follows at 4.3%, supported by rapid automotive industry growth, increasing aerospace manufacturing demand, and growing domestic production capabilities. Germany shows growth at 3.9%, emphasizing automotive engineering excellence and aerospace manufacturing development. Brazil records 3.6%, focusing on automotive market expansion and industrial manufacturing growth. The USA demonstrates 3.2%, prioritizing aerospace innovation and advanced manufacturing development. The UK exhibits 2.9% growth, emphasizing precision manufacturing and automotive lightweighting production. Japan shows 2.6% growth, supported by electronics miniaturization demand and high-precision assembly concentration.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from fast curing epoxy adhesive in China is projected to exhibit exceptional growth with a CAGR of 4.6% through 2035, driven by expanding automotive production and rapidly growing electronics manufacturing supported by government initiatives promoting advanced manufacturing development. The country's strong position in electric vehicle production and increasing investment in industrial automation are creating substantial demand for rapid-cure bonding solutions. Major automotive manufacturers and electronics producers are establishing comprehensive fast cure epoxy sourcing capabilities to serve both domestic assembly demand and export manufacturing markets.

Revenue from fast curing epoxy adhesive in India is expanding at a CAGR of 4.3%, supported by the country's growing automotive sector, expanding aerospace manufacturing activities, and increasing adoption of advanced assembly technologies. The country's government initiatives promoting manufacturing excellence and growing industrial capabilities are driving requirements for sophisticated rapid-cure bonding solutions. International suppliers and domestic manufacturers are establishing extensive production and distribution capabilities to address the growing demand for fast cure epoxy products.

Revenue from fast curing epoxy adhesive in Germany is expanding at a CAGR of 3.9%, supported by the country's automotive engineering expertise, strong emphasis on manufacturing precision technologies, and robust demand for high-performance bonding materials in automotive and aerospace applications. The nation's advanced manufacturing sector and quality-focused operations are driving sophisticated fast cure epoxy systems throughout the supply chain. Leading manufacturers and technology providers are investing extensively in automated dispensing equipment and high-performance formulations to serve both domestic and international markets.

Revenue from fast curing epoxy adhesive in Brazil is growing at a CAGR of 3.6%, driven by the country's expanding automotive sector, growing industrial manufacturing market, and increasing investment in production modernization. Brazil's large automotive production base and commitment to manufacturing advancement are supporting demand for rapid-cure bonding solutions across multiple industrial segments. Manufacturers are establishing comprehensive production capabilities to serve the growing domestic market and regional export opportunities.

Revenue from fast curing epoxy adhesive in the USA is expanding at a CAGR of 3.2%, supported by the country's aerospace industry leadership, advanced manufacturing capabilities, and strategic focus on high-performance rapid-cure materials. The USA innovation excellence and manufacturing technology leadership are driving demand for fast cure epoxies in aerospace assembly, defense applications, and advanced electronics manufacturing. Manufacturers are investing in comprehensive R&D capabilities to serve both domestic aerospace contractors and international specialty markets.

Revenue from fast curing epoxy adhesive in the UK is growing at a CAGR of 2.9%, driven by the country's expertise in precision manufacturing, emphasis on automotive lightweighting, and strong position in aerospace and specialty manufacturing. The UKs established manufacturing technology capabilities and commitment to advanced materials are supporting investment in rapid-cure bonding technologies throughout major production centers. Industry leaders are establishing comprehensive quality systems to serve domestic automotive manufacturers and aerospace contractors.

Revenue from fast curing epoxy adhesive in Japan is expanding at a CAGR of 2.6%, supported by the country's electronics manufacturing concentration, growing precision assembly sector, and strategic position in advanced materials development. Japan's prestige manufacturing capabilities and integrated production infrastructure are driving demand for high-precision fast cure epoxies in electronics assembly, automotive component manufacturing, and specialty industrial applications. Leading manufacturers are investing in specialized capabilities to serve the stringent requirements of electronics and precision manufacturing industries.

The fast curing epoxy adhesive market in Europe is projected to grow from USD 4,200 million in 2025 to USD 5,850 million by 2035, registering a CAGR of 3.3% over the forecast period. Germany is expected to maintain its leadership position with a 32.0% market share in 2025, declining slightly to 31.5% by 2035, supported by its strong automotive industry, advanced manufacturing capabilities, and comprehensive aerospace sector serving diverse fast cure epoxy applications across Europe.

France follows with a 18.5% share in 2025, projected to reach 19.0% by 2035, driven by robust demand for fast cure epoxies in automotive manufacturing, aerospace assembly, and industrial equipment production, combined with established manufacturing infrastructure and specialty bonding expertise. The United Kingdom holds an 17.0% share in 2025, expected to reach 17.5% by 2035, supported by strong aerospace sector and growing precision manufacturing activities. Italy commands a 14.0% share in 2025, projected to reach 14.2% by 2035, while Spain accounts for 8.5% in 2025, expected to reach 8.8% by 2035. The Netherlands maintains a 4.0% share in 2025, growing to 4.2% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Poland, and other nations, is anticipated to maintain momentum, with its collective share moving from 6.0% to 4.8% by 2035, attributed to increasing automotive production in Eastern Europe and growing aerospace manufacturing in Nordic countries implementing advanced bonding programs.

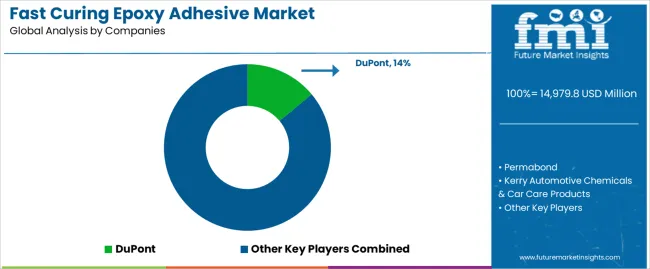

The fast curing epoxy adhesive market is characterized by competition among established adhesive manufacturers, specialized epoxy producers, and integrated chemical solutions providers. Companies are investing in catalyst system research, cure mechanism optimization, automated dispensing system development, and comprehensive product portfolios to deliver consistent, high-performance, and application-specific fast cure epoxy solutions. Innovation in thermally conductive materials, UV-activated systems, and automation compatibility is central to strengthening market position and competitive advantage.

DuPont leads the fast curing epoxy adhesive market with a strong market share, offering comprehensive fast cure epoxy solutions with a focus on automotive and aerospace applications. Permabond provides specialized structural bonding capabilities with an emphasis on automated dispensing systems and customized cure formulations. Kerry Automotive Chemicals & Car Care Products delivers innovative bonding products with a focus on automotive assembly and lightweighting alternatives. HP-Textiles GmbH specializes in technical textile bonding and composite assembly technologies for industrial applications. Parker focuses on precision dispensing equipment and integrated bonding solutions. PPG offers specialized coating-compatible adhesives with emphasis on automotive and aerospace finishing applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 14,979.8 Million |

| Component Type | 2-component, 1-component, Others |

| Application | Automobiles, Ships and Aircraft, Construction, Furniture, Chemical Materials, Consumer Electronics, Others |

| Cure Mechanism | Heat-Activated, UV-Activated, Ambient Cure |

| Viscosity | Low (Below 1000 cPs), Medium (1000-5000 cPs), High (Above 5000 cPs) |

| End-Use Industry | Automotive, Aerospace & Defense, Electronics, Construction, Medical Devices, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | DuPont, Permabond, Kerry Automotive Chemicals & Car Care Products, HP-Textiles GmbH, Parker, and PPG |

| Additional Attributes | Dollar sales by component type and application category, regional demand trends, competitive landscape, technological advancements in catalyst systems, cure mechanism development, automation equipment innovation, and supply chain integration |

The global fast curing epoxy adhesive market is estimated to be valued at USD 14,979.8 million in 2025.

The market size for the fast curing epoxy adhesive market is projected to reach USD 20,927.2 million by 2035.

The fast curing epoxy adhesive market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in fast curing epoxy adhesive market are 2-component, 1-component and others.

In terms of application, automobiles, ships and aircraft segment to command 38.0% share in the fast curing epoxy adhesive market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fastener Insertion Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fast Food Containers Market Trends – Growth & Forecast 2025 to 2035

Fast-Food Reusable Market Growth – Demand & Forecast 2025 to 2035

Fast Food & Quick Service Restaurant Market Trends – Growth & Forecast 2025 to 2035

Fast Food Bag Market Trends – Growth & Forecast 2024-2034

Breakfast Drinks Market Size and Share Forecast Outlook 2025 to 2035

Breakfast Cereal Market Trends – Healthy & Indulgent Options Driving Growth 2025 to 2035

Ultrafast Lasers Market Analysis - Industry Growth & Forecast 2025 to 2035

Breakfast Takeout Market Growth – Morning Convenience & Market Expansion 2025 to 2035

Rail Fasteners Market

Analysis and Growth Projections for Vegan Fast-Food Market

Flange Fasteners Market Size and Share Forecast Outlook 2025 to 2035

Marine Fasteners Market

Plastic Fasteners Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Assembly Fastening Tools Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Automotive Fastener Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fasteners Market Growth -Trends & Forecast 2025 to 2035

Liquid Breakfast Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA