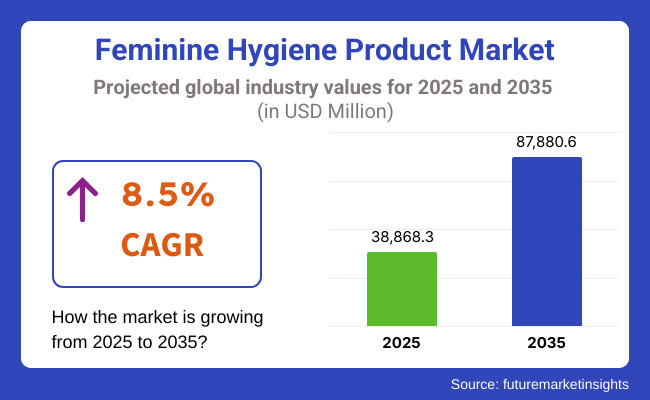

The global feminine hygiene products market is expected to witness a steady growth in the upcoming years between 2025 and 2035 due to high awareness regarding menstrual health, growing disposable incomes and the development of sustainable and organic hygiene solutions. The market is estimated to be valued at USD 38,868.3 million in 2025 and is projected to reach USD 87,880.6 million by 2035, registering a CAGR of 8.5% during the forecast period.

Sanitary napkins, tampons, menstruation cups, and panty liners are primary feminine hygiene items that help largely towards overall well-being and personal health. On top of this, growing demand for the adoption of ecologically friendly and biodegradable items, alongside improving penetration of feminine hygiene solutions across emerging economies, are proving to be boosters for growth in the market. Another component driving demand is growth in antimicrobial, organic, and reusable menstruation care solutions.

But affordability issues in developing regions, cultural taboos related to menstrual hygiene, and environmental concerns of disposable products may dampen the growth of the market. In order to solve these issues, manufacturers are emphasizing affordability, accessibility, and sustainable product development. Based on product type, distribution channel and material the feminine hygiene product market is further divided.

The North American region is one of the prominent markets for feminine hygiene products, wherein the USA and Canada have been leading in terms of adoption owing to very high consumer awareness, penetration of supermarkets and hypermarkets and high demand for organic and chemical free products.

An increase in the availability of new menstrual care products in the market, including period underwear and pads made from plant-based materials, is also propelling market growth. Growth is also being fuelled by government initiatives to enhance menstrual equity and provide free products in schools and public institutions.

The high price of products based on these new approaches and concerns surrounding the use of synthetic chemicals have inhibited the potential of the market, however ongoing innovations and advancements in sustainable menstrual care solutions are anticipated to prevent stagnation in market growth.

Germany, the UK, and Franconia is the major contributing country in the Europe feminine hygiene products market. And the region’s push for sustainability and strict rules on plastic waste are driving demand for biodegradable and reusable alternatives. Consumer preferences are rapidly changing with the increasing adoption of menstrual cups and organic tampons.

Furthermore, government initiatives that enhance free accessibility to menstrual hygiene products in public sector are propelling market growth. Despite this, challenges driven due to price sensitivity and regulatory compliance may pose challenges, but continued investments by companies such as Bratsk on research and development of hypoallergenic and environmentally friendly products to support future growth is expected.

Asia Pacific region is projected to gain the highest growth in feminine hygiene products market owing to increasing awareness, better standards of living and government programs focusing on menstrual hygiene in the countries like, China, India, Japan, and South Korea. Access to sanitary products for rural and lower-class population is being enhanced through initiatives like e-commerce platforms and affordable sanitary product initiatives.

In addition, cultural shifts and education campaigns are improving adoption rates, especially in developing economies. Market penetration may be restricted by factors such as affordability limitations and lack of access in remote areas. Despite these challenges, significant investments in domestic production and sustainable menstrual hygiene initiatives are projected to drive market growth in the region.

Challenge: Affordability and Cultural Taboos

The growth of this market is mainly attributed to the unaffordability of luxury and sustainable feminine hygiene products across developing nations. It simply is not accessible for lower-income groups.

Moreover, in some societies, menstrual-related cultural taboos stand in the way of education and product usage. These pressing issue will bring additional attention to government programs, educational programs, and affordable solutions to underserved populations.

Opportunity: Expansion of Sustainable and Innovative Menstrual Care Solutions

The public's growing interest in sustainable menstrual care alternatives offers significant growth opportunities within the market. The ascendancy of reusable menstrual cups, biodegradable pads and smart period-tracking technologies are changing consumer behaviour.

Though subscription-based models and direct-to-consumer brands are allowing menstrual care to be more convenient and heard. The industry of environmental friendly and technology based feminine hygiene products is likely to expand as more awareness is being spread about menstrual health and environmental sustainability.

The demand for menstrual hygiene products increased between 2020 and 2024, as well as the demand for organic & sustainable products rises. The sector saw a transition in direction of common disposable sanitary merchandise to an extra eco-friendly choices like menstrual cups, reusable pads, and biodegradable tampons.

Arrow Organic and fragrance-free sanitizer pads and chemical-free products for women were introduced right when demand rose on consumers hands for safe non-irritation solutions. However, problems like period poverty, the high cost of eco-friendly substitutes, and stigma in some regions were hindrances to the expansion of the market.

Fast forward to 2025 to 2035, and, the market will be fuelled by AI-driven personalized menstrual care, smart period-tracking soft goods, and bioengineered superabsorbent materials. Self-cleaning reusable menstrual cups, AI-driven hormonal cycle monitoring and temperature-sensitive smart sanitary pads are expected to be adopted, thereby adding convenience and health tracking capabilities for everyone.

Advances in lab-grown biodegradable menstrual materials, antimicrobial self-sterilizing pads and blockchain-enabled supply chain transparency will also encourage more innovation. Zero-waste menstrual care models, AI-assisted menstrual health analytics, and carbon-negative hygiene product manufacturing will also shape the next era of sustainability, affordability and accessibility in the space.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EU, and WHO guidelines on feminine hygiene product safety. |

| Product Innovation | Use of organic cotton tampons, reusable pads, and menstrual cups. |

| Industry Adoption | Growth in retail and e-commerce sales of sustainable period products. |

| Smart & AI-Enabled Products | Early adoption of period-tracking apps, pH-balanced hygiene products, and reusable menstrual solutions. |

| Market Competition | Dominated by legacy hygiene brands, sustainable period care startups, and reusable product innovators. |

| Market Growth Drivers | Demand fuelled by growing menstrual health awareness, rising sustainability concerns, and expansion in emerging markets. |

| Sustainability and Environmental Impact | Early adoption of plastic-free tampons, compostable sanitary pads, and reduced-waste packaging. |

| Integration of AI & Digitalization | Limited AI use in basic period tracking apps and menstrual health awareness programs. |

| Advancements in Manufacturing | Use of traditional cotton-based menstrual products and manual absorbency testing methods. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven compliance tracking, eco-certification mandates, and blockchain-backed ethical sourcing transparency. |

| Product Innovation | Adoption of biodegradable lab-grown menstrual materials, self-cleaning hygiene products, and AI-personalized menstrual care. |

| Industry Adoption | Expansion into AI-integrated period tracking, smart menstrual care wearables, and biotech-enhanced absorbent materials. |

| Smart & AI-Enabled Products | Large-scale deployment of AI-driven hormonal cycle monitoring, smart self-sterilizing menstrual cups, and sensor-based period care. |

| Market Competition | Increased competition from AI-driven femtech companies, biotech-based absorbent material developers, and blockchain-powered menstrual care supply chain solutions. |

| Market Growth Drivers | Growth driven by AI-enhanced personalized menstrual care, biodegradable high-performance materials, and global zero-waste menstrual initiatives. |

| Sustainability and Environmental Impact | Large-scale transition to zero-waste menstrual care, carbon-negative hygiene product manufacturing, and AI-optimized material lifecycle tracking. |

| Integration of AI & Digitalization | AI-powered real-time menstrual health analytics, predictive ovulation cycle monitoring, and blockchain-enabled ethical product sourcing. |

| Advancements in Manufacturing | Evolution of 3D-printed biodegradable menstrual materials, self-repairing antimicrobial hygiene fabrics, and nanotechnology-enhanced ultra-absorbent menstrual products. |

USA is still a key market for feminine hygiene products, fuelled by awareness for menstrual health, organic and biodegradable products, and distribution channels like e-commerce. The presence of key personal care brands and increasing initiatives promoting menstrual equity are supporting market growth.

Also, government metrics, such as tax exemptions on menstrual products and free distribution system in public institutions, are defining industry trends. In addition, growing use of sustainable and reusable hygiene products, such as menstrual cups and period underwear, is contributing to market opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.8% |

The UK menstrual hygiene products market is experiencing steady growth as a function of the aforementioned factors, as well as increasing government efforts to improve access of menstrual products for free, along with the growing lobbying by the public to promote menstrual health awareness campaigns. Product innovation in formulations is driven by consumer demand for chemical-free and hypo-allergenic sanitary products.

The market is also being upended by the growth of direct-to-consumer brands and subscription-based menstrual care services. The refinement of menstrual cycle and symptom prediction through smart apps that are paired with customized product recommendations is also helping grow the consumer base.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.1% |

Germany, France, and Italy are dominating the feminine hygiene product industry in the European Union due to the strong regulatory frameworks encouraging sustainability, increasing demand for biodegradable and reusable menstrual products, and growing investment in menstrual health awareness initiatives. The EU’s plastic-free and compostable sanitary product project helped facilitate product innovation.

Also, introduction and availability of organic cotton enabled sanitary pads and tampons, and increasing zero-waste personal care brands increased upsurge in market growth. The emergence of gender-inclusive menstrual care campaigns is transforming product marketing strategies as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.4% |

Increasing demand for high-quality personal care solutions, rising adoption of technologically advanced absorbent materials and favourable government initiatives for promoting menstrual health education are driving the growth of feminine hygiene product market in Japan. China’s emphasis on ultra-thin and high-absorbency sanitary products is also forcing innovations in product design.

Further, consumer demands are changing with the rising preference for reusable menstrual care products, like menstrual cups and period panties. The increasing number of feminism hygiene product vending machines and on-the-go packages solution are some of the factors affecting the market trends in a positive manner.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.0% |

The South Korean feminine hygiene products market is witnessing significant growth owing to the growing awareness regarding sustainable menstrual care products, growing demand for fragrance-free and dermatologically tested feminine products, and the influence of K-beauty trends in the personal care industry.

The fast-growing e-commerce sector in the country and innovative digital marketing strategies are contributing to the accessibility of premium menstrual care brands to consumers. Introduction of eco-friendly and biodegradable sanitary product manufacturing & increase the number of refillable menstrual care subscription services creating new opportunities for the market. Increasing emphasis on menstrual wellness and holistic self-care solutions also contribute towards market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.6% |

The Sanitary Pads and Tampons segments hold the largest share of the Feminine Hygiene Product Market, where women demand hygiene, comfort, and convenience. Such product types are essential for managing menstrual hygiene, preventing infections, and offering ease of use. With an increasing Global awareness towards Women’s health and hygiene, Menstrual hygiene products will continue to remain in-demand as consumers seek out the high-quality and eco-friendly menstrual products.

Sanitary pads are more popular nowadays, thanks to their ease of use, excellent absorbance capacity, and availability in various lengths and thickness levels. Sanitary pads are an external protection method compared to tampons or menstrual cups, this is why sanitary pads are a favourite not just for women of all ages but also for teenagers or first-time users.

Factors such as spiralling need for ultra-thin, high-absorbent, and eco-friendly sanitary pads, especially in developing countries are driving the adoption. More than 65% of menstruating women around the it was given, thus, preferred sanitary pads as they are both the most convenient and most accessible form of menstrual management.

As a result, the increasing availability of biodegradable and organic sanitary pads, containing chlorine-free cotton, plant-based absorbents, and compostable packaging, has augmented the overall market demand, guaranteeing minimal environmental harm as well as skin safety.

Additionally, the introduction of smart sanitary pads with moisture-wicking layers, antibacterial properties, and odour-neutralizing technology has also contributed to the growth, providing an improved experience in terms of comfort and hygiene when used during menstrual cycles.

The introduction of overnight and long-wear sanitary pads, with an extended length, fine leak barriers, as well as breathable back sheet is contributing towards the market growth, as these features offer better protection while being used for an extended period of time.

The launch of subscription based pad services which emphasizes doorstep delivery, customizable selection of products depending on consumer’s preference, and use of sustainable packaging has also contributed to market growth which is aiding in overall accessibility and affordability by consumers.

Although the sanitary pad segment has the advantages of high convenience, accessibility, and high absorbency, it faces challenges such as growing environmental concerns regarding plastic-based pads, skin irritation caused by synthetic materials, and disposal-related issues. Nonetheless, innovations such as plant-based super absorbents, AI-based menstrual cycle tracking apps, and reusable sanitary pad solutions are building out sustainability, comfort, and market rivalry stability, ensuring year-on-year growth in sanitary pads market all over the globe.

Discreteness, high absorbency level, and adaptability during active lifestyles attribute to Tampon's share of Feminine Hygiene Product Market. Tampons are placed inside the vagina, unlike sanitary pads, which gives women much more comfort and freedom to do sports, swim, and other daily activities.

Growing demand for organic, fragrance-free and hypoallergenic tampons, especially among health conscious and environmentally aware population, has supplemented growth. More than 40% of women in developed markets rely on tampons for their convenience and reliability, according to studies.

The introduction of biodegradable and organic tampons, with 100% cotton applicators and chemical-free absorbent cores and compostable wrappers, has further bolstered market demand, enabling better sustainability and reduced chances of irritation.

The adoption is further propelled by the advent of smart tampons with pH-sensitive indicators, leak detection sensors, and biodegradable applicators, adding to the menstrual hygiene tracking and safety.

Additionally, compact, travel-friendly tampon packaging with features such as re-sealable pouches, discreet pocket-sized designs, and moisture-resistant casings has also optimized how well the market develops, increasing the amount of portable and user-friendly products available on the market.

The increasing acceptance of reusable tampon substitutes, which include medical-grade silicone applicators, washable absorbent cores, and refill programs on a subscription basis, has fuelled market growth while minimizing waste and maximizing cost efficiency.

While the tampon segment benefits from several qualitative advantages, including discretion, flexibility, and ultra-high absorbency, it also faces challenges in the form of health and socio-cultural stigmas. But new innovations in toxin-free tampon manufacturing, AI-driven menstrual health tracking combined with tampon usage insights, and biodegradable tampon applicators are providing safety, accessibility and sustainability, so tampons can continue to thrive globally.

As personal care brands, pharmaceutical companies, and eco-conscious individuals are jumping on board to demand user-friendly, sustainable packaging components, the Bottles/Jars and Tubes segments hold a strong share in the Feminine Hygiene Product Market. Packaging types also provide a product with ease of use, extended shelf life, and environmentally friendly, which translates into higher satisfaction and compliance with regulations for consumers.

Bottles and jars are the largest packaging type for feminine hygiene products owing to their vast applicability with various liquid and cream-based feminine hygiene products, also due to their durable and lightweight nature. Bottles and jars, unlike flexible packaging, provide a rigid structure for containment, which will help with the shelf life of the product and allows for easy dispensing.

Adoption has been further propelled by the growing demand for liquid-based feminine hygiene products, especially intimate washes, pH-balanced cleansers, and soothing gels. Research shows that more than 60% of intimate care products are in bottles or jars because the designs are secure, spill-proof and easy to use.

Eco-friendly bottles and jars, including those made with recycled plastic and glass alternatives, as well as refillable bottles, have all contributed to burgeoning market demand and better sustainability and reduced plastic waste.

While glass packaging offers several benefits, including durability, the prevention of spill, and the stability of the product, the bottles/jars segment also encounters certain restraints, such as a higher cost of materials, the weight of packaging formats, and a greater carbon footprint while transporting.

But big packed bottle/jar innovation, including bio-resin based bottles, AI-powered refill station integrations, and more extreme minimalist packaging designs, is making it easier, less expensive, and less destructive to the environment, so the category will continue to grow in feminine hygiene products.

As personal care brands, as well as pharmaceutical manufacturers, increasingly gravitate toward compact, user-friendly, and mess-free packaging formats for creams, gels, and serums, tubes remain in strong credit market growth. Rigid bottles and jars can be bulky and difficult to travel with, and due to their nature, they allow products to pour out, while tubes offer targeted dispensing.

Growth in the adoption is aided by rising notes for single-use and travel-sized feminine hygiene products, particularly intimate moisturizers, vaginal creams, and deodorizing gels. According to studies, over 55% of the intimate care product lines use tube packaging for their products owing to its being lightweight and hygienic to apply.

The growth of sustainable tube packaging, such as with biodegradable materials, post-consumer recycled plastic, and airless pump structures, has also supported market demand by providing greater sustainability and product shelf-life.

In comparing the tube segment with other packaging options, in spite of the former’s benefits such as improved ease of transport, controlled dispensing and compactness, the tube segment is dealing with challenges including limited recyclability of some tube materials, product wastage potential in traditional squeeze tubes, and compatibility concerns with viscous formulations.

But innovations in recyclable aluminium tubes, squeeze control packaging powered by AI, and zero-waste tube refill stations are enhancing functionality, customer convenience, and sustainability, so that growth in the feminine hygiene product market in tubes can continue unabated.

Increasing awareness regarding the importance of personal care, growing adoption of organic as well as sustainable hygiene products, innovation in menstrual health, etc. The market is steadily growing due to increasing focus on sustainable alternatives and menstrual health education. Some trends driving the industry include biodegradable sanitary goods, smart period tracking integrations, and subscription-based menstrual care services.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Procter & Gamble (P&G) | 12-16% |

| Kimberly-Clark Corporation | 10-14% |

| Unicharm Corporation | 8-12% |

| Edgewell Personal Care | 6-10% |

| Essity AB | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Procter & Gamble (P&G) | Develops innovative sanitary pads and tampons under brands like Always and Tampax. |

| Kimberly-Clark Corporation | Specializes in sustainable feminine hygiene products, including organic cotton options. |

| Unicharm Corporation | Offers ultra-thin and super-absorbent sanitary products, catering to global markets. |

| Edgewell Personal Care | Focuses on menstrual cups, tampons, and skin-friendly feminine care products. |

| Essity AB | Provides eco-friendly and biodegradable hygiene products for sustainable menstrual care. |

Key Company Insights

Procter & Gamble (P&G) (12-16%)

P&G leads in menstrual hygiene innovation, offering a wide range of absorbent and comfortable feminine care products.

Kimberly-Clark Corporation (10-14%)

Kimberly-Clark specializes in sustainable and organic feminine hygiene solutions, catering to eco-conscious consumers.

Unicharm Corporation (8-12%)

Unicharm focuses on high-performance sanitary products with ultra-thin and super-absorbent designs.

Edgewell Personal Care (6-10%)

Edgewell develops menstrual cups, tampons, and skin-friendly hygiene products, enhancing user comfort and safety.

Essity AB (4-8%)

Essity pioneers in biodegradable and eco-friendly feminine hygiene products, addressing sustainability concerns.

Other Key Players (45-55% Combined)

Several personal care and hygiene product manufacturers contribute to the expanding Feminine Hygiene Product Market. These include:

The overall market size for the feminine hygiene product market was USD 38,868.3 million in 2025.

The feminine hygiene product market is expected to reach USD 87,880.6 million in 2035.

The demand for feminine hygiene products will be driven by increasing awareness about menstrual health, rising adoption of sustainable and biodegradable hygiene products, growing female workforce participation, and government initiatives promoting menstrual hygiene management.

The top 5 countries driving the development of the feminine hygiene product market are the USA, China, India, Germany, and Japan.

The Sanitary Pads segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 4: Global Market Volume (Unit Pack) Forecast by Product type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Unit Pack) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 10: North America Market Volume (Unit Pack) Forecast by Product type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: North America Market Volume (Unit Pack) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 16: Latin America Market Volume (Unit Pack) Forecast by Product type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Latin America Market Volume (Unit Pack) Forecast by Distribution Channel, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 22: Western Europe Market Volume (Unit Pack) Forecast by Product type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Western Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Unit Pack) Forecast by Product type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Eastern Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Unit Pack) Forecast by Product type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Unit Pack) Forecast by Distribution Channel, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 40: East Asia Market Volume (Unit Pack) Forecast by Product type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 42: East Asia Market Volume (Unit Pack) Forecast by Distribution Channel, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Unit Pack) Forecast by Product type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Unit Pack) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Unit Pack) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 9: Global Market Volume (Unit Pack) Analysis by Product type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Global Market Volume (Unit Pack) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Product type, 2023 to 2033

Figure 17: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 27: North America Market Volume (Unit Pack) Analysis by Product type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: North America Market Volume (Unit Pack) Analysis by Distribution Channel, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Product type, 2023 to 2033

Figure 35: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 45: Latin America Market Volume (Unit Pack) Analysis by Product type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Latin America Market Volume (Unit Pack) Analysis by Distribution Channel, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 63: Western Europe Market Volume (Unit Pack) Analysis by Product type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Western Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Unit Pack) Analysis by Product type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Unit Pack) Analysis by Product type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Unit Pack) Analysis by Distribution Channel, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 117: East Asia Market Volume (Unit Pack) Analysis by Product type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 121: East Asia Market Volume (Unit Pack) Analysis by Distribution Channel, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Unit Pack) Analysis by Product type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Unit Pack) Analysis by Distribution Channel, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feminine Wipes Market Demand & Forecast 2025-2035

Feminine Care Pouch Film Market

Hygiene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Hygiene Packaging Market Trends & Industry Outlook 2025 to 2035

Women Hygiene Care Product Market Growth, Trends and Forecast from 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Hygiene Instrument Market Analysis by Product, Application, Usage, End User, and Region through 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Tissue and Hygiene Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Footwear Market

Tissue and Hygiene Paper Packaging Market

Disposable Hygiene Products Market Analysis by Product Type, Sales Channel, and Region through 2025 to 2035

Stethoscope Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

Men's Intimate Hygiene Products Market Size and Share Forecast Outlook 2025 to 2035

BRICS Disposable Hygiene Products Market Analysis – Size, Share & Trends 2025 to 2035

Industrial and Institutional Hand Hygiene Chemicals Market - Trends & Forecast 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA