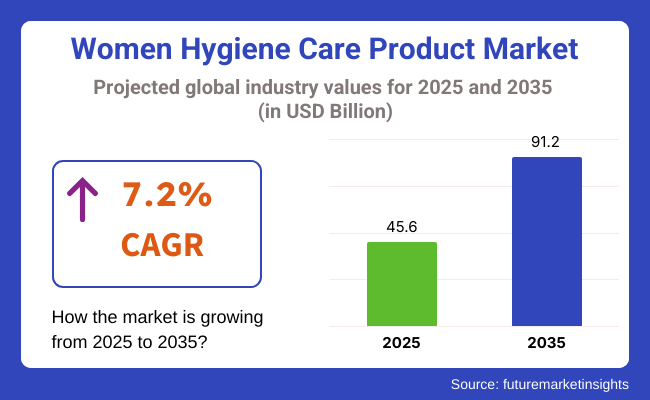

The industry size of the global women hygiene care product market was USD 45.6 billion in 2025 and is projected to register a 7.2% CAGR during the forecast period of 2025 to 2035. The global industry is projected to reach USD 91.2 billion by 2035. The major growth driver is growing awareness and advocacy about menstrual health along with product innovation catering to varied needs across different regions and age groups.

Rising urbanization, along with enhanced disposable incomes, is fostering rising demand for premium and green hygiene products. Consumers are shifting toward organic and chemical-free products, particularly in emerging economies where government programs and awareness initiatives are making reproductive health and menstruation solutions more widespread.

Technological advancements are also changing the industry environment. Intelligent sanitary products, biodegradable sanitary pads, reusable menstrual cups, and odor-control technologies are improving product comfort and effectiveness. At the same time, online retail growth is growing product availability in urban and rural markets, fueling penetration and brand engagement.

Menstrual cultural taboos are being progressively undermined through proactive education campaigns, mass media efforts, and policy reform. This change in culture is establishing an enabling environment for business development, particularly in Asia-Pacific, Africa, and Latin America, where previous under-penetration is being reversed by outreach and subsidized distribution.

The producers are adopting more sustainable production practices with the aim of reducing environmental impact without compromising on quality. Such strategic initiatives, along with partnerships with healthcare professionals and NGOs, are expected to drive inclusive and scalable growth in the industry across the globe during the coming decade.

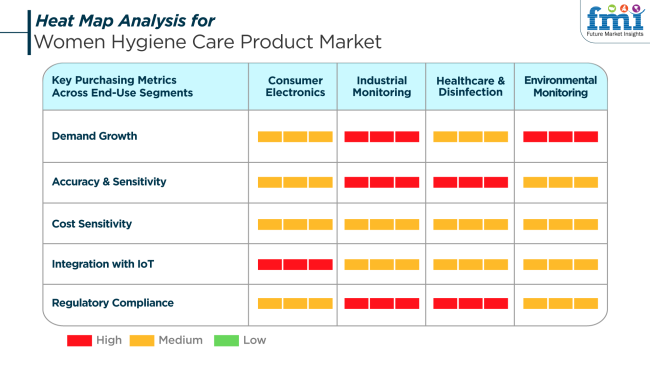

In the consumer electronic segment, hygiene-integrated technology for hygiene care is best delivered through devices such as smart menstrual cups and tracking systems. It attracts tech-savvy consumers who are interested in personalized wellness in addition to data-enabled insights.

Hygiene, accuracy, and biocompatibility continue to be a high priority in the healthcare and disinfection segment. Regulatory compliance, along with the reliability of performance, are among the major features weighing on the purchase decision of the last lot of products-feminine hygiene care and postpartum hygienic products in hospitals.

Intersects with environmental monitoring are increasing, particularly with the growing demand for sustainable hygiene products. Brands championing the usage of biodegradable materials and low-impact manufacturing are more attuned to changing consumer demands about an environmentally responsible end-to-end supply chain that drives both B2B and B2C purchasing behavior.

One of the key risks in the industry is the persistent disparity in access across rural and underserved regions. While awareness is growing, logistical challenges, affordability constraints, and sociocultural stigmas continue to impede equitable distribution, especially in lower-income countries.

Another risk stems from regulatory changes regarding ingredients and waste management. With rising scrutiny over chemicals used in sanitary products and increasing demand for eco-friendly packaging, manufacturers may face cost pressures to comply with evolving environmental and health standards across diverse jurisdictions.

Industry saturation in developed countries poses a challenge for growth, pushing brands to invest in innovation and differentiation strategies. The shift toward reusable products, while eco-conscious, also reduces purchase frequency, potentially slowing revenue growth unless offset by value-added services or broader product portfolios.

From 2020 to 2024, the industry experienced a major change in the direction towards eco-friendly and sustainable products. The consumers grew wiser to the environmental effects of the conventional hygiene products and pushed the demand for products such as menstrual cups, reusable pads, and biodegradable tampons.

This time also saw a growing emphasis on chemical-free and organic products, with more women demanding healthier, gentler products for their skin. The growing literacy about menstrual well-being, as well as the efforts of governments and campaigns, further pushed women to focus on hygiene and wellness. The industry was also dominated by the emergence of e-commerce, which opened up these products to a larger audience.

With a look forward to 2025 to 2035, sustainability will remain the driving force.The shift towards environmentally friendly and sustainable products will widen, with developments aimed at waste reduction and the environmental impact of cleansing products.

More emphasis will be put on customized and targeted products, offering solutions for specific uses such as sensitive skin, odor, and enhanced comfort. Technology can also enable smart feminine hygiene products, for example, app-linked menstrual care devices. Online stores will remain a significant channel, offering more direct-to-consumer channels and subscription options for convenience.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Greater demand for eco-friendly and sustainable products. | Emergence of eco-friendly innovation and sustainable hygiene practices. |

| Growing awareness of individual and menstrual hygiene. | Growing importance on tailored-to-need customized hygiene solutions. |

| Boost in e-commerce due to convenience and easy accessibility. | Growth in direct-to-consumer models and subscription-based services that endure. |

| Increased uptake of organic and chemical-free products. | Newer trends in intelligent hygiene products, perhaps in terms of incorporation in health applications. |

| Introduction of substitute products such as menstrual cups and reusable pads. | Continued innovation in eco-friendly materials and biodegradable items. |

| Transition towards more natural and skin-friendly soaps. | Technology advancements to ensure greater comfort, hygiene, and product performance. |

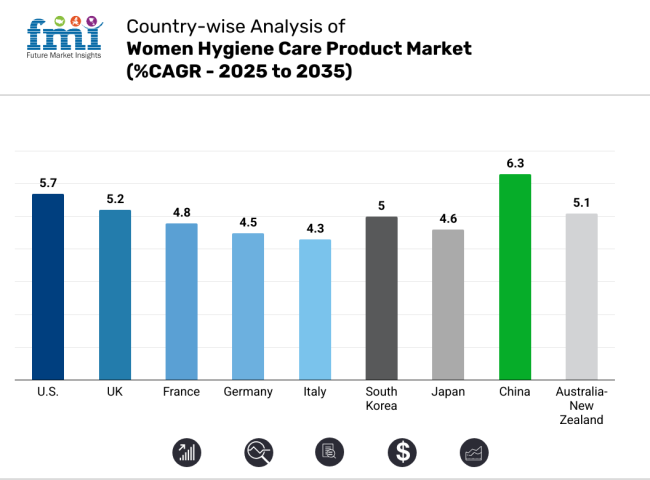

The USA industry is expected to record a 5.7% CAGR during the study period. The demand for women hygiene care products in the USA is driven by excessive consumer awareness, increased focus on body hygiene, and extensive distribution of advanced feminine hygiene products. Enhanced support for women's health and the high industry presence of established brands have aided industry penetration.

Demographics with high purchasing power and a favorable retail environment facilitate the premiumization of value-added items such as organic tampons, menstrual cups that are reusable, and intimate washes. Besides that, green packaging innovation and biodegradable materials are targeted to grow eco-friendly consumer demand, which is leading to a shift in brand loyalty. Increasing workforce engagement by women, lifestyle changes and extended working hours are fueling demand for discreet and comfortable hygiene items.

Distribution via digital channels and pharmacies is expanding broader, with online stores offering convenience and subscription formats gaining wider acceptance. Ongoing government initiatives and awareness campaigns for menstrual health are fueling expansion further. Overall, the USA industry depicts a matured and open consumer base, so it is a major contributor to the overall regional share of North America.

The UKindustry will increase at 5.2% CAGR during the study period. UK demand for women hygiene care products is primarily driven by increasing awareness of menstrual health and increased adoption of sustainable products. The UK consumer industry is shifting towards green and reusable items like menstrual cups and organic cotton sanitary napkins as environmental sustainability becomes an important buying criterion. In addition, shifting public discourse regarding period poverty has resulted in policy measures to make products available in schools and public toilets.

Healthy shoppers in the UK are increasingly choosing products with limited chemicals, fragrances, or artificial ingredients. The rise in visibility of digital health platforms is facilitating greater access to hygiene education and product exploration, especially among younger generations.

Retailers are also expanding private label lines in response to value-conscious segments, while premium international brands continue to hold strong industry share. Greater investment in R&D and consumer-driven innovation has assisted in fueling the development of skin-friendly, dermatologically tested products, propelling product adoption among women across all age groups.

The French industry will record a growth of 4.8% CAGR during the study period. France is a significant industry in Western Europe for women hygiene care products owing to a mix of traditional brand loyalty and evolving tastes for more environmentally friendly and health-focused products. The growing emphasis on women's health has driven formulation and design innovation, especially among tampons, pantyliners, and intimate care.

Increased demand for transparency in product labeling has driven increased popularity for organic and hypoallergenic types. Cultural attitudes in France increasingly embrace open discussion of menstrual health, driving a more open retail culture. Pharmacies remain the favored channel of distribution, although web platforms are slowly making inroads on the basis of convenience and product variety.

The expansion of direct-to-consumer products offering subscription or customized packs is a sign of the dynamic shift in the French industry, too. Government campaigns regarding women's hygiene, along with investment in biodegradable and chemical-free products, are creating long-term opportunities for industry growth.

The German industry is expected to increase at a 4.5% CAGR during the forecast period. Germany's status as one of the largest consumer economies in Europe has a tremendous influence on the women hygiene care product market. Strong brand rivalry, large product lines, and increasing consumer inclination towards organic, natural, and vegan-certified personal care products dominate the market.

German consumers are among the first movers to adopt environmental menstrual products such as reusable pads and menstrual cups. Retailers, supermarkets, and pharmacies are still dominant distributors, but Internet sales are rivaling them due to shifting consumption behaviors and growing product education.

German women are marked by high cleanliness sensitivity and quality concerns, so companies are directed to emphasize security, dermato-compatibility, and nature-friendly packaging. The population aging and growing numbers of women in the working-age group are also influencing product development and promotion strategies. There is a growing demand for discreet, travel-sized packaging and skin-sensitive solutions, offering opportunities for growth to local as well as international players.

The Italian industry is expected to grow at a 4.3% CAGR during the study period. Although traditionally conservative in product selection, Italy is experiencing a gradual shift in the women hygiene care products sector. There is an increasing understanding of feminine hygiene and health that has encouraged greater openness to newer product forms such as intimate washes, reusable products, and environmentally friendly alternatives. Urbanization and increases in working women are also playing major roles in reshaping demand.

Pharmacies and supermarkets remain leading points of sale, yet online shops are experiencing strong growth, particularly among young consumers. Period poverty and related social concerns are being addressed by non-profit initiatives and grassroots movements, which allow for a more inclusive hygiene culture. Aesthetic, comfort and natural contents are increasingly relevant, which impacts consumer loyalty and purchasing behaviors. Regulatory compliance and increasing pressure for eco-labels are also encouraging manufacturers to produce more responsibly.

The South Korean industry will grow at 5% CAGR during the study period. Demand for women hygiene care products in South Korea is rising in tandem with increased emphasis on personal health and appearance. South Korean consumers are well known for embracing high-quality and innovative personal care solutions, and the same is true for the hygiene category as well. Increased product efficacy, hygiene, and dermatological compatibility drive demand for highly sophisticated formulations for sanitary pads, tampons, and intimate hygiene washes.

Korean players are advancing at a rapid rate with lightweight, breathable, ultra-thin ingredients and biodegradable packaging focused on comfort-oriented and sustainable momentum in the markets. Besides, health concerns and recent controversies surrounding toxic chemicals used in personal hygiene products increased demand for certified, dermatologically tested, and chemically safe alternatives.

A technologically sophisticated population is pushing online sales, and social media and influencers have a significant role in shaping people's attitudes and confidence. The intersection of fashion, well-being, and hygiene trends positions South Korea in a rapidly evolving and responsive industry for women's hygiene care.

The Japanese industry is expected to grow at 4.6% CAGR during the forecast period. Japan's women hygiene care industry is mature but is witnessing new dynamism due to premiumization and innovation in product material and design. There is evolving consumer demand for ultra-comfort, odor-control, and sensitive skin-friendly products. There is a high cultural value for discretion and cleanliness that affects purchasing decisions, particularly in urban areas.

Sanitary napkins remain most prevalent, with increased recognition of tampons and menstrual cups, especially among young female consumers. Japanese manufacturers emphasize technological advances, such as superabsorbent polymers and breathable material layers, to enhance comfort and usage.

The principal retail outlets are drugstores and convenience stores, with more consumers purchasing over the Internet for those digitally connected. Greater talk about women's wellness and gender inclusivity is driving stigma reduction and encouraging broader conversation about menstrual well-being. Furthermore, Japan's aging population ensures that there is a need for tailored hygiene solutions for post-menopausal women, further segmenting the industry.

The China industry will expand at 6.3% CAGR during the forecast period. China is one of the fast growing and highest potential markets for women hygiene care products. Sustained urbanization, rising levels of income, and increasing awareness about feminine hygiene are fueling demand. Successive generations of younger shoppers are more ready to experiment with alternative formats of products like organic tampons, menstrual cups, and personal hygiene sprays. Domestic and foreign brands alike are also investing in education campaigns so as to leverage this new willingness.

Virtual shopping centers are particularly robust in China, with websites competing on price, product variety, and speedy delivery. The adoption of products is particularly driven by live streaming and influencer marketing in Tier I and Tier II cities.

Meanwhile, sustainability and green living are becoming leading themes, and this results in interest in reusable substitutes. Improved access to healthcare and regulatory incentives are also driving industry growth. The sheer size of the women of reproductive age ensures steady demand and consistent industry expansion.

The Australia-New Zealand industry will expand at 5.1% CAGR during the study period. The combined market of Australia and New Zealand is led by high awareness, a strong regulatory environment, and increasing demand for organic and environmentally friendly feminine hygiene products.

Purchasers are actively seeking ingredient transparency in sourcing and sustainable packaging, and that is pushing manufacturers toward chemical-free and biodegradable options. Reusable products like period underwear and menstrual cups are gaining popularity on environmental and financial grounds.

Availability is retail channel-wide, and there are broad selections at pharmacies, supermarkets, and specialty channels. Online platforms increasingly drive subscription-led recurring buying and personalized product exploration. Government-funded menstrual health programs and education outreach programs are also major drivers in fostering hygiene awareness. Inclusivity marketing and focus on comfort and wellness also contribute to industry appeal. The region will likely continue to develop at a fast pace, with innovation and sustainability being the focus.

Feminine hygiene products will take a big proportion of sales containment in the women hygiene care products industry, with 45.3% in the year 2025, then by 20.1% for intimate wash and cleansers.

Women hygiene care products are expected to be primarily forthcoming from feminine hygiene, including sanitary pads, tampons, panty liners, and menstrual cups. Such products will account for a 45.3% industry share of the production in 2025, as the continuing demand for menstrual care products keeps such items aside to be considered in women's health and well-being.

Among those, the most widely used are sanitary pads and tampons, which are highly embraced in geographical areas of North America, Europe, and parts of Asia. Tampax and Kotex are also industry leaders because they provide their customers with a very wide variety of products, offering a lot of options for choosing which generic-type products they prefer, which are eco-friendly and organic.

The recognition of menstrual health and hygiene, with increased access to products through e-commerce as well as retail outlets, stimulates growth in this segment. Innovations in this category include biodegradable sanitary products and reusable cups, which have also facilitated the rising trend among consumers leaning towards more sustainable options.

Most of the industry, which accounts for 20.1% in 2025, belongs to the Intimate Washes and Cleansers segment, as they are increasingly emphasized in terms of personal care and hygiene. Such products are mainly targeted towards women looking for daily hygiene solutions for their intimate parts, which later results in better health, comfort, and freshness experienced by individuals.

Many people are also becoming aware of vaginal health; thus, the demand for gentle and pH-balanced products, which promise hygiene without disturbing the natural microbiome, would increase. Major brands like Vagisil, Summer's Eve, and Lactacyd offer a variety of intimate washes and cleansers to cater to problems related to odor control, irritation, and sensitive skin.

Consumers even turn towards natural and organic products, which are preferred because they contain fewer chemicals and additives.

In 2025, bottles/jars will be given considerable preference as the major packaging type in the industry, bringing along 38.5% of the industry share, followed by pumps and dispensers with a share of 26.2% of the industry.

The bottles/jars will lead the industry by holding a whopping 38.5% share in 2025. This packaging option is used for products such as wash, creams, and wipes, which, due to their convenience, are good for holding large volumes of products for daily use and long-term use. Bottles and jars are easy to store and offer high protection to products, something extremely needed for hygiene care products.

Leading brands like Vagisil, Lactacyd, and Summer's Eve package feminine hygiene products in bottles and jars so they can be accessible to consumers and still be hygienic. Though plastic is the common material chosen for packaging due to its cost-effectiveness and easy availability, there is a gradual but promising shift towards eco-friendly materials such as glass or recycled plastic packaging.

The pump and dispenser packaging type will capture 26.2% in terms of industry share in 2025. This type of packaging is small-value; thus, it is widely used for intimate washes, lotions, gels, and rinses that are dispensed from pumps. The pump solution allows for controlled dispensing, thus lessening wastage and improving overall consumer convenience.

Some brands, such as K-Y, Lactacyd, and Summer's Eve, often adopt pump bottles for their intimate care products, giving consumers a hygienic and convenient option to use the products. Moreover, dispensers are preferred for antibacterial or medicated feminine hygiene products to ensure consistent and accurate application.

The industry is dominated by global FMCG and pharmaceutical companies with expansive portfolios spanning sanitary pads, tampons, intimate washes, and feminine wipes. Industry leaders are doubling down on sustainability, ingredient transparency, and product customization to appeal to Gen Z and millennial consumers while navigating regional regulatory and cultural dynamics.

Procter & Gamble holds a dominant share through its iconic Always and Tampax brands, complemented by new eco-conscious formats and digital campaigns targeting menstrual equity. Kimberly-Clark continues to expand its industry footprint with Kotex, focusing on high-absorbency innovations and initiatives supporting education and access. Unicharm Corporation is a major player in Asia-Pacific and the Middle East, leveraging its stronghold in disposable hygiene with region-specific SKUs and aggressive retail expansion.

Svenska Cellulosa Aktiebolaget (SCA) and its Libresse brand remain competitive in Europe through premium offerings with sustainable fiber sourcing and ergonomic design. Kao Corporation has scaled its Laurier and Merries brands by investing in high-speed manufacturing and advancing comfort-led innovation. Meanwhile, newcomers like Nua Woman and Lil-lets are disrupting legacy segments via direct-to-consumer channels, clean-label formulations, and modern branding tailored for digital-native consumers.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Procter & Gamble Co. | 24-28% |

| Kimberly-Clark Corporation | 18-22% |

| Unicharm Corporation | 14-17% |

| Svenska Cellulosa Aktiebolaget SCA | 9-12% |

| Kao Corporation | 7-10% |

| Other Players | 15-18% |

Key Company Insights

Procter & Gamble Co. is dominant in women hygiene care products with a market share of about 24-28%, fueled by the stronghold of Always and Tampax. P&G has continued to innovate in comfort, leak protection, and sustainability, including now biodegradable product lines and reusable offers in its brand-growth strategy. An international distribution network and social responsibility programs, such as menstrual health education and donations of products, further underpin the company's leadership in this category.

Kimberly-Clark Corporation has about 18-22% of the industry with Kotex and Intimus, which successfully build on strong brand-consumer loyalty. The brand's proposition of safety, comfort, and inclusion resonates very well, particularly in developing economies. Unicharm Corporation takes 14-17% of the global share with its adeptness at customizing products to local needs, especially in the fast-growing Asian and Middle Eastern markets. Svenska Cellulosa Aktiebolaget SCA has Marque 9-12%, with sustainability as its first approach and Libresse as a premium position. Kao Corporation is at 7-10%, taking advantage of design features and advanced absorption technology to penetrate East Asia and selectively Europe.

The industry is segmented into feminine hygiene products, intimate washes and cleansers, intimate wipes, intimate moisturizers, hair removal products, intimate deodorants, lubricants, and specialty products.

The industry is divided into teenage and adult consumer orientations.

The industry is segmented by packaging type, including bottles/jars, pumps and dispensers, tubes, flexible packaging, and other packaging types.

The industry is divided into modern trade, convenience stores, departmental stores, specialty stores, mono-brand stores, online retailers, drug stores, and other sales channels.

The industry is segmented by region, including North America, Latin America, East Asia, South Asia, Europe, Middle East and Africa, and Oceania.

The industry is expected to reach USD 45.6 billion in 2025.

The industry is projected to grow to USD 91.2 billion by 2035.

The industry is expected to grow at a CAGR of 7.2% during the forecast period.

Feminine hygiene products are a prominent segment within the industry.

Key players include Ontex Group, Unicharm Corporation, Svenska Cellulosa Aktiebolaget SCA, Kimberly-Clark Corporation, Kao Corporation, Henkel AG & Co. KGaA, Edgewell Personal Care Co., Glenmark Pharmaceuticals Ltd., Procter & Gamble Co., Unilever PLC, and Johnson & Johnson Services, Inc.

Table 1: Global Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 2: Global Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 3: Global Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 4: Global Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 5: Global Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 6: Global Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 7: Global Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 8: Global Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 9: Global Market Value (US$ million) Analysis By Region, 2019 to 2034

Table 10: Global Market Value (US$ million) Analysis By Region, 2019 to 2034

Table 11: North America Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 12: North America Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 13: North America Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 14: North America Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 15: North America Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 16: North America Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 17: North America Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 18: North America Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 19: North America Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 20: North America Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 21: Latin America Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 22: Latin America Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 23: Latin America Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 24: Latin America Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 25: Latin America Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 26: Latin America Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 27: Latin America Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 28: Latin America Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 29: Latin America Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 30: Latin America Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 31: East Asia Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 32: East Asia Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 33: East Asia Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 34: East Asia Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 35: East Asia Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 36: East Asia Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 37: East Asia Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 38: East Asia Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 39: East Asia Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 40: East Asia Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 41: South Asia Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 42: South Asia Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 43: South Asia Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 44: South Asia Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 45: South Asia Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 46: South Asia Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 47: South Asia Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 48: South Asia Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 49: South Asia Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 50: South Asia Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 51: Oceania Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 52: Oceania Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 53: Oceania Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 54: Oceania Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 55: Oceania Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 56: Oceania Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 57: Oceania Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 58: Oceania Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 59: Oceania Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 60: Oceania Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 61: Europe Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 62: Europe Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 63: Europe Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 64: Europe Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 65: Europe Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 66: Europe Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 67: Europe Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 68: Europe Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 69: Europe Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 70: Europe Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 72: Middle East and Africa Market Value (US$ million) Analysis By Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 74: Middle East and Africa Market Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 76: Middle East and Africa Market Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 78: Middle East and Africa Market Value (US$ million) Analysis By Packaging, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 80: Middle East and Africa Market Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 01: Global Value (US$ million) Analysis, 2019 to 2023

Figure 02: Global Value (US$ million) Forecast, 2024 to 2034

Figure 03: Global Value (US$ million) Analysis, 2019 to 2023

Figure 04: Global Value (US$ million) Forecast, 2024 to 2034

Figure 05: Global Absolute $ Opportunity Value (US$ million), 2024 to 2034

Figure 06: Global Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 07: Global Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 08: Global Attractiveness By Product Type, 2024 to 2034

Figure 09: Global Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Figure 10: Global Y-o-Y Growth (%) Projections, By Consumer Orientation, 2024 to 2034

Figure 11: Global Attractiveness By Consumer Orientation, 2024 to 2034

Figure 12: Global Value (US$ million) Analysis By Packaging, 2019 to 2034

Figure 13: Global Y-o-Y Growth (%) Projections, By Packaging, 2024 to 2034

Figure 14: Global Attractiveness By Packaging, 2024 to 2034

Figure 15: Global Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 16: Global Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 17: Global Attractiveness By Sales Channel, 2024 to 2034

Figure 18: Global Value (US$ million) Analysis By Region, 2019 to 2034

Figure 19: Global Y-o-Y Growth (%) Projections, By Region, 2024 to 2034

Figure 20: Global Attractiveness By Region, 2024 to 2034

Figure 21: North America Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 22: North America Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 23: North America Attractiveness By Product Type, 2024 to 2034

Figure 24: North America Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Figure 25: North America Y-o-Y Growth (%) Projections, By Consumer Orientation, 2024 to 2034

Figure 26: North America Attractiveness By Consumer Orientation, 2024 to 2034

Figure 27: North America Value (US$ million) Analysis By Packaging, 2019 to 2034

Figure 28: North America Y-o-Y Growth (%) Projections, By Packaging, 2024 to 2034

Figure 29: North America Attractiveness By Packaging, 2024 to 2034

Figure 30: North America Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 31: North America Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 32: North America Attractiveness By Sales Channel, 2024 to 2034

Figure 33: Latin America Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 34: Latin America Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 35: Latin America Attractiveness By Product Type, 2024 to 2034

Figure 36: Latin America Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Figure 37: Latin America Y-o-Y Growth (%) Projections, By Consumer Orientation, 2024 to 2034

Figure 38: Latin America Attractiveness By Consumer Orientation, 2024 to 2034

Figure 39: Latin America Value (US$ million) Analysis By Packaging, 2019 to 2034

Figure 40: Latin America Y-o-Y Growth (%) Projections, By Packaging, 2024 to 2034

Figure 41: Latin America Attractiveness By Packaging, 2024 to 2034

Figure 42: Latin America Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 43: Latin America Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 44: Latin America Attractiveness By Sales Channel, 2024 to 2034

Figure 45: East Asia Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 46: East Asia Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 47: East Asia Attractiveness By Product Type, 2024 to 2034

Figure 48: East Asia Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Figure 49: East Asia Y-o-Y Growth (%) Projections, By Consumer Orientation, 2024 to 2034

Figure 50: East Asia Attractiveness By Consumer Orientation, 2024 to 2034

Figure 51: East Asia Value (US$ million) Analysis By Packaging, 2019 to 2034

Figure 52: East Asia Y-o-Y Growth (%) Projections, By Packaging, 2024 to 2034

Figure 53: East Asia Attractiveness By Packaging, 2024 to 2034

Figure 54: East Asia Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 55: East Asia Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 56: East Asia Attractiveness By Sales Channel, 2024 to 2034

Figure 57: South Asia Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 58: South Asia Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 59: South Asia Attractiveness By Product Type, 2024 to 2034

Figure 60: South Asia Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Figure 61: South Asia Y-o-Y Growth (%) Projections, By Consumer Orientation, 2024 to 2034

Figure 62: South Asia Attractiveness By Consumer Orientation, 2024 to 2034

Figure 63: South Asia Value (US$ million) Analysis By Packaging, 2019 to 2034

Figure 64: South Asia Y-o-Y Growth (%) Projections, By Packaging, 2024 to 2034

Figure 65: South Asia Attractiveness By Packaging, 2024 to 2034

Figure 66: South Asia Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 67: South Asia Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 68: South Asia Attractiveness By Sales Channel, 2024 to 2034

Figure 69: Oceania Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 70: Oceania Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 71: Oceania Attractiveness By Product Type, 2024 to 2034

Figure 72: Oceania Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Figure 73: Oceania Y-o-Y Growth (%) Projections, By Consumer Orientation, 2024 to 2034

Figure 74: Oceania Attractiveness By Consumer Orientation, 2024 to 2034

Figure 75: Oceania Value (US$ million) Analysis By Packaging, 2019 to 2034

Figure 76: Oceania Y-o-Y Growth (%) Projections, By Packaging, 2024 to 2034

Figure 77: Oceania Attractiveness By Packaging, 2024 to 2034

Figure 78: Oceania Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 79: Oceania Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 80: Oceania Attractiveness By Sales Channel, 2024 to 2034

Figure 81: Europe Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 82: Europe Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 83: Europe Attractiveness By Product Type, 2024 to 2034

Figure 84: Europe Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Figure 85: Europe Y-o-Y Growth (%) Projections, By Consumer Orientation, 2024 to 2034

Figure 86: Europe Attractiveness By Consumer Orientation, 2024 to 2034

Figure 87: Europe Value (US$ million) Analysis By Packaging, 2019 to 2034

Figure 88: Europe Y-o-Y Growth (%) Projections, By Packaging, 2024 to 2034

Figure 89: Europe Attractiveness By Packaging, 2024 to 2034

Figure 90: Europe Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 91: Europe Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 92: Europe Attractiveness By Sales Channel, 2024 to 2034

Figure 93: Middle East and Africa Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 94: Middle East and Africa Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 95: Middle East and Africa Attractiveness By Product Type, 2024 to 2034

Figure 96: Middle East and Africa Value (US$ million) Analysis By Consumer Orientation, 2019 to 2034

Figure 97: Middle East and Africa Y-o-Y Growth (%) Projections, By Consumer Orientation, 2024 to 2034

Figure 98: Middle East and Africa Attractiveness By Consumer Orientation, 2024 to 2034

Figure 99: Middle East and Africa Value (US$ million) Analysis By Packaging, 2019 to 2034

Figure 100: Middle East and Africa Y-o-Y Growth (%) Projections, By Packaging, 2024 to 2034

Figure 101: Middle East and Africa Attractiveness By Packaging, 2024 to 2034

Figure 102: Middle East and Africa Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 103: Middle East and Africa Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 104: Middle East and Africa Attractiveness By Sales Channel, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Women's Intimate Care Product Market Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Nail Care Products Market Growth, Trends and Forecast from 2025 to 2035

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

Facial Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Senior Care Product Market Analysis – Size, Share & Forecast 2025 to 2035

Personal Care Products Filling System Market Size and Share Forecast Outlook 2025 to 2035

The Dementia Care Products Market is segmented by Memory Exercise & Activity Products, Daily Reminder Products and Dining Aids from 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Pregnancy Care Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feminine Hygiene Product Market Analysis – Growth & Forecast 2025 to 2035

Post Shave Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Care Products Market Growth, Trends and Forecast from 2025 to 2035

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA