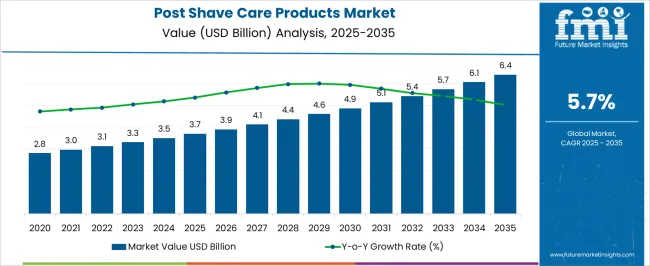

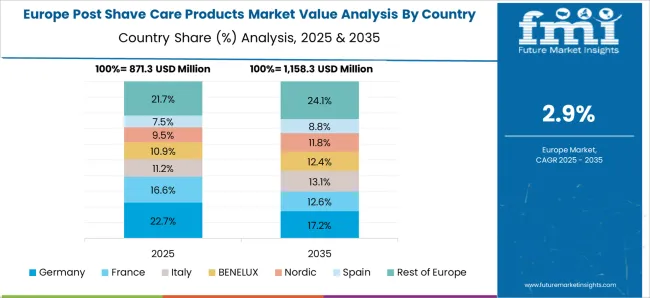

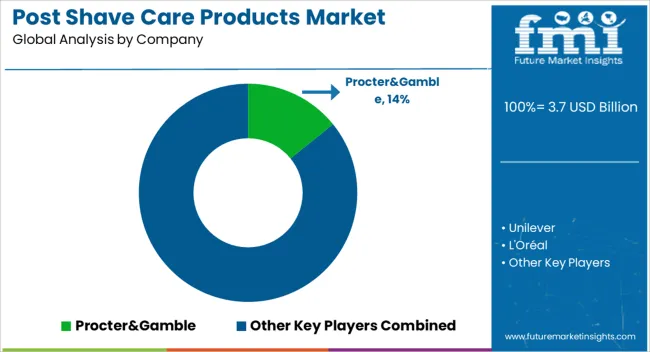

The Post Shave Care Products Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. Asia Pacific is expected to lead expansion, driven by a younger consumer base and rising grooming awareness among men. The adoption curve in this region is steeper due to lifestyle changes and higher penetration of grooming products beyond premium urban clusters, which pushes regional demand above the global average growth rate. Europe represents a mature but stable segment of the market. Cultural grooming traditions and brand loyalty contribute to steady sales, yet the growth rate is relatively modest.

The focus here is shifting toward natural and dermatologically tested products, with innovation centered around skin sensitivity and wellness attributes rather than volume expansion. North America sits between these two dynamics, showing moderate growth tied to premiumization and brand diversification. Strong marketing by established personal care companies supports demand, but consumer preferences are increasingly fragmented. Asia Pacific emerges as the primary engine for volume growth, Europe sustains through product innovation in a saturated landscape, and North America contributes through value-driven expansion, resulting in regional imbalances shaping the global trajectory through 2035.

| Metric | Value |

|---|---|

| Post Shave Care Products Market Estimated Value in (2025 E) | USD 3.7 billion |

| Post Shave Care Products Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

With consumers becoming increasingly mindful of post-shave skin sensitivity and hydration, brands are shifting from alcohol-based formulations to soothing and nourishing alternatives enriched with botanicals, vitamins, and antioxidants.

The market is also being influenced by lifestyle changes, premiumization of grooming products, and the expansion of distribution channels, particularly in urban and online retail ecosystems. Additionally, the clean label movement and demand for cruelty-free, dermatologically tested products are gaining momentum, further enhancing product value propositions.

Social media and influencer-led marketing have played a pivotal role in accelerating product trials and brand visibility. The market is expected to benefit from growing demand in emerging economies, rising disposable income, and the increasing adoption of skincare regimes among Gen Z and millennial consumers, setting the stage for sustained growth across both mass and premium price tiers.

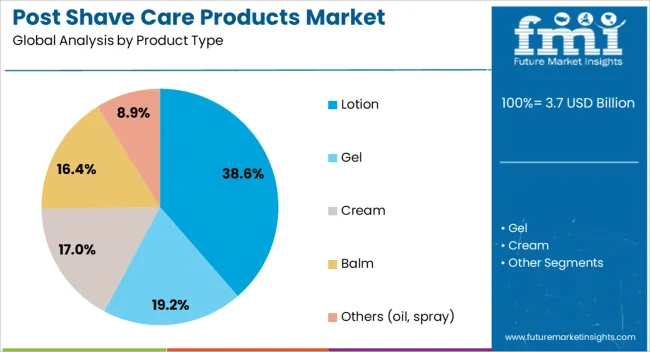

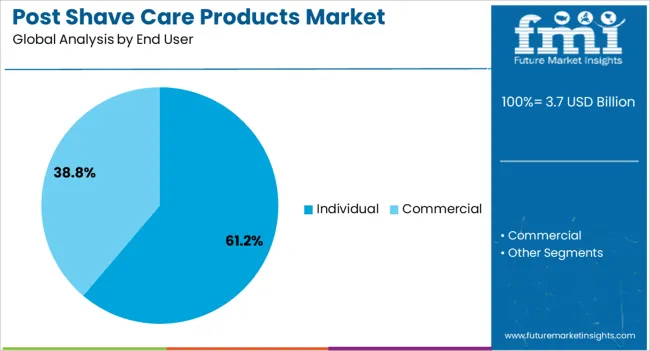

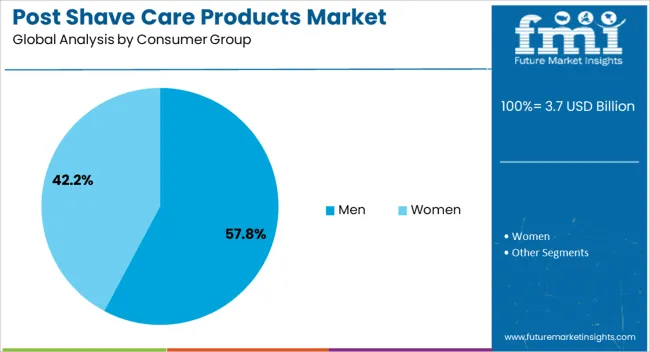

The post shave care products market is segmented by product type, end user, consumer group, price range, distribution channel, and geographic regions. By product type, the post shave care products market is divided into Lotion, Gel, Cream, Balm, and Others (oil, spray). In terms of end users of the post-shave care products market, it is classified into Individual and Commercial. Based on consumer group, the post shave care products market is segmented into Men and Women.

By price range, the post shave care products market is segmented into Medium, Low, and High. By distribution channel, the post shave care products market is segmented into Supermarkets & hypermarkets, Online, E-commerce sites, Company website, Offline, Specialty stores, and Other retail stores. Regionally, the post shave care products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Lotion-based products are expected to account for 38.6% of the revenue share in the post shave care products market in 2025, making them the dominant product type. This leadership position is attributed to the superior hydration and soothing properties offered by lotion formulations, which are particularly effective in calming razor-induced skin irritation. The lightweight, quick-absorbing texture of lotions has made them highly suitable for daily grooming routines, especially among consumers with sensitive or dry skin.

Increased formulation innovation incorporating natural extracts, hyaluronic acid, and anti-inflammatory agents has enhanced the appeal of lotions among health-conscious users. Moreover, the non-greasy nature and ease of application have further reinforced their preference over other formats.

The wide availability of lotion-based products across both luxury and affordable price segments has supported penetration across varied income groups. As post shave care increasingly aligns with skincare and wellness trends, lotions are expected to maintain their leadership through continued product differentiation and targeted marketing strategies.

The individual end user segment is projected to hold 61.2% of the overall market revenue in 2025, reflecting its critical role in driving product adoption and consumption frequency. Growth in this segment is being driven by the increasing personalization of grooming routines and heightened awareness about skincare post shaving. The shift toward self-care practices among working professionals and younger consumers has fueled demand for personal grooming products tailored to individual skin needs.

Evolving lifestyle choices, growing disposable income, and access to global product trends via digital platforms have further influenced purchasing behavior. Individual buyers have also shown a strong preference for multifunctional products that offer soothing, hydrating, and protective benefits in a single application.

The surge in direct-to-consumer and subscription-based grooming services has enhanced accessibility and repeat usage among individuals. As grooming becomes a key component of daily wellness routines, the individual user segment is expected to sustain its dominance through consistent product innovation and brand engagement initiatives.

The men consumer group is expected to account for 57.8% of the total revenue share in the post shave care products market by 2025, underscoring its central role in shaping category demand. This segment's leadership is being driven by increased grooming awareness, evolving perceptions of masculinity, and broader acceptance of skincare among male consumers. The growing popularity of beard grooming, clean shaving, and skin protection post shaving has expanded the relevance of targeted formulations for men.

Formulas designed to address common male skin concerns such as razor burn, ingrown hairs, and oiliness have seen significant traction. Marketing strategies tailored to male audiences through sports endorsements, digital influencers, and functional packaging have also enhanced brand reach and conversion.

Furthermore, urbanization and rising participation of men in beauty and wellness discussions have led to higher product engagement. With shifting cultural narratives and a focus on self-presentation, male consumers are anticipated to remain a major growth contributor in the evolving post-shave care ecosystem.

The market has experienced growth with increased focus on grooming routines and skin health. Products such as balms, lotions, gels, and creams have been developed to soothe irritation, reduce redness, and prevent infections after shaving. Demand has been reinforced by rising awareness of skin care benefits, wider availability of premium grooming brands, and digital retail expansion. Innovations in natural formulations, fragrance variations, and multifunctional grooming products have further diversified consumer choices, making post shave care an essential segment within the broader personal care industry.

The market has been strongly supported by growing awareness of grooming and personal hygiene. Shaving often causes razor burns, cuts, and dryness, which has increased demand for soothing and protective solutions. Products infused with aloe vera, shea butter, and essential oils have been developed to hydrate skin while reducing irritation. Social media trends and influencer-driven grooming culture have amplified the importance of a well-defined shaving routine, encouraging wider adoption of post shave care. In addition, dermatologists have highlighted the benefits of using protective balms and lotions, which has further reinforced demand. As male grooming and unisex grooming categories expand, the role of post shave care products has been strengthened, positioning them as an indispensable part of daily skin health regimens globally.

The market has been reshaped by strong consumer preference for natural and chemical-free formulations. Many individuals have become increasingly cautious about artificial fragrances, parabens, and alcohol-based ingredients that may cause skin dryness or allergic reactions. This has encouraged manufacturers to develop post shave balms, creams, and gels using herbal extracts, essential oils, and plant-based actives. Organic certifications and cruelty-free labeling have also boosted consumer confidence and purchasing decisions. Premium brands have gained traction by highlighting clean label formulations, while mainstream companies have expanded their product lines with natural variants. This trend has been further supported by environmental awareness, which has reinforced the demand for sustainable packaging and biodegradable product formulations. The shift toward organic ingredients has not only elevated product quality but also differentiated brands in a highly competitive grooming market.

E-commerce has played a central role in driving the growth of the market. Online retail platforms have allowed consumers to explore a wider variety of products, compare formulations, and read peer reviews before making purchase decisions. Subscription-based grooming kits and direct-to-consumer models have further enhanced accessibility of specialized products. Brands have utilized digital marketing campaigns and influencer partnerships to reach younger demographics, creating stronger engagement and higher brand loyalty. Personalized recommendations based on skin type and shaving habits have been integrated into online platforms, improving the consumer shopping experience. The availability of international brands through online channels has further broadened market access. As digital penetration continues to expand, e-commerce has become one of the strongest enablers of global growth for post shave care products, reshaping consumer purchasing behavior significantly.

Premiumization trends have had a significant impact on the market. Consumers have shown greater willingness to invest in products that offer additional benefits such as anti-aging properties, long-lasting hydration, and aromatherapy effects. This shift has driven manufacturers to diversify their offerings with multifunctional post shave creams and serums that combine skin repair, hydration, and fragrance in a single application. Customization has also emerged as a differentiator, with brands offering personalized formulations tailored to individual skin types and shaving preferences. Luxury grooming kits that combine razors, pre-shave oils, and post shave balms have attracted niche customers seeking complete shaving solutions. The influence of premiumization has not only raised profit margins for manufacturers but also expanded the perception of post shave care products from basic grooming necessities to lifestyle-enhancing solutions.

| Countries | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The market is expected to witness a CAGR of 5.7% from 2025 to 2035, shaped by rising grooming awareness, premiumization, and demand for natural formulations. China, growing at 7.7%, drives product diversification through herbal blends and digitally driven retail expansion. India follows with a 7.1% CAGR, evolving through affordability-focused ranges and an increasing male grooming culture. Germany advances at 6.6%, innovating with dermatologically tested and eco-conscious product lines targeting sensitive skin. The UK, projected at 5.4%, emphasizes premium grooming brands and the influence of subscription-based services. The USA, at 4.8%, leverages brand loyalty and multifunctional products, although traditional shaving culture moderates the pace of expansion compared with emerging regions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to expand at a CAGR of 7.7%, supported by increasing grooming awareness among male consumers. Rapid growth in premium personal care categories drives the adoption of aftershaves, soothing balms, and moisturizers. Skincare-conscious consumers are increasingly choosing formulations with natural and herbal ingredients. Domestic and international brands are investing in e-commerce platforms to improve product reach and accessibility. Rising disposable spending on grooming routines encourages product innovation, particularly in sensitive skin and anti-irritation categories. With a large urban male population seeking modern grooming solutions, China is projected to remain a major growth center for post shave care products.

India’s market is projected to grow at a CAGR of 7.1%, fueled by rising personal grooming awareness across urban and semi-urban areas. Increasing availability of affordable grooming solutions makes aftershaves and balms more accessible to middle-income groups. Herbal and ayurvedic ingredients dominate product preferences, with domestic brands focusing on cost-effective yet skin-friendly solutions. Growing consumer exposure to international grooming trends through digital platforms accelerates demand for premium formulations. The presence of both large multinational players and strong local brands ensures diverse product offerings that appeal to a wide customer base. India’s cultural acceptance of grooming as part of daily hygiene strengthens the long-term market outlook.

Germany is expected to grow at a CAGR of 6.6%, supported by rising demand for dermatologically tested formulations. Male consumers are showing greater interest in grooming routines that prioritize skin hydration and irritation prevention. Premium international brands dominate the market, while local players focus on natural formulations to appeal to eco-conscious buyers. Product innovation in alcohol-free and sensitive skin categories enhances consumer loyalty. Growth in online and specialty retail channels provides improved product penetration. Germany’s strong presence in the premium personal care sector and the rising acceptance of men’s grooming as part of wellness routines create stable opportunities for growth.

The United Kingdom is forecast to expand at a CAGR of 5.4%, driven by an increasing preference for premium skincare-based aftershave solutions. Consumers are gradually moving away from alcohol-based splashes toward balms and moisturizers that reduce irritation. Growing awareness of grooming as part of a broader self-care lifestyle supports adoption. E-commerce platforms and specialty grooming stores are improving product visibility, while subscription-based grooming kits add convenience for consumers. International brands maintain a strong market presence, complemented by local companies focusing on natural and vegan-friendly alternatives. Shifting consumer preferences toward wellness and sustainability continue to drive product innovation.

The market in the United States is projected to grow at a CAGR of 4.8%, supported by increasing consumer interest in skincare-driven grooming routines. The shift toward premium and multifunctional formulations that combine hydration, anti-aging, and soothing benefits enhances market penetration. Male grooming is increasingly perceived as a wellness extension, driving demand for high-quality products. Domestic and international brands compete through innovative product launches, particularly in organic and cruelty-free categories. Specialty grooming outlets, pharmacies, and online channels expand accessibility across regions. With growing consumer focus on self-care, the USA market presents consistent opportunities for post shave care innovation.

The market is shaped by global consumer goods companies and specialized grooming brands that focus on skin health, hydration, and soothing formulations. Procter and Gamble, Unilever, L'Oréal, Beiersdorf, and Colgate Palmolive Company dominate with extensive product portfolios and distribution channels. Their aftershave balms, gels, and lotions are widely used due to strong brand equity and dermatological expertise. These firms emphasize formulations with natural extracts and active ingredients that reduce irritation while promoting long-lasting skin comfort. Edgewell Personal Care, Estée Lauder Companies Inc., Coty Inc., and Shiseido Company, Limited further strengthen the competitive space with premium grooming solutions and tailored product lines for diverse consumer groups. These companies target both traditional shaving users and modern grooming enthusiasts, offering solutions aligned with evolving skin care preferences and multifunctional routines. Specialized grooming brands including L’Occitane en Provence, Baxter of California, The Art of Shaving, Herbacin Cosmetic GmbH, and Billy Jealousy provide niche offerings that appeal to consumers seeking luxury and artisanal experiences. Their focus lies in botanically enriched, fragrance-infused, and skin-calming innovations that address post-shave redness, dryness, and sensitivity. Collectively, these providers are reshaping male grooming by merging dermatological science with personal care sophistication.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 Billion |

| Product Type | Lotion, Gel, Cream, Balm, and Others (oil, spray) |

| End User | Individual and Commercial |

| Consumer Group | Men and Women |

| Price Range | Medium, Low, and High |

| Distribution Channel | Supermarkets & hypermarkets, Online, E-commerce sites, Company website, Offline, Specialty stores, and Other retail stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procter&Gamble, Unilever, L'Oréal, Beiersdorf, Colgate-PalmoliveCompany, EdgewellPersonalCare, EstéeLauderCompaniesInc., CotyInc., ShiseidoCompany,Limited, L’OccitaneenProvence, BaxterofCalifornia, TheArtofShaving, HerbacinCosmeticGmbH, and BillyJealousy |

| Additional Attributes | Dollar sales by product type and consumer segment, demand dynamics across personal grooming and skincare sectors, regional trends in male grooming adoption, innovation in natural ingredients, multifunctional formulations, and packaging, environmental impact of chemical use and packaging waste, and emerging use cases in premium grooming and dermatological care |

The global post shave care products market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the post shave care products market is projected to reach USD 6.4 billion by 2035.

The post shave care products market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in post shave care products market are lotion, gel, cream, balm and others (oil, spray).

In terms of end user, individual segment to command 61.2% share in the post shave care products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Post-Operative Wound Treatment Market Size and Share Forecast Outlook 2025 to 2035

Post Harvesting Technologies Market Size and Share Forecast Outlook 2025 to 2035

Post-Surgery Skin Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Postpartum Health Supplements Market Size and Share Forecast Outlook 2025 to 2035

Post-Operative Cataract Surgery Inflammation Treatment Market Size and Share Forecast Outlook 2025 to 2035

Post-Quantum Cryptography (PQC) Migration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Post-Traumatic Stress Disorder (PTSD) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Nausea and Vomiting (PONV) Management Market Size and Share Forecast Outlook 2025 to 2035

Postbiotic Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Postbiotic Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Postpartum Depression Management Market Size and Share Forecast Outlook 2025 to 2035

Postnatal Probiotic Supplements Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Pain Market Size and Share Forecast Outlook 2025 to 2035

Postal Automation Systems Market Size and Share Forecast Outlook 2025 to 2035

Post-Harvest Treatment Market Size and Share Forecast Outlook 2025 to 2035

Post-Consumer Recycled (PCR) Plastic Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Posture Correction Market Size and Share Forecast Outlook 2025 to 2035

Postage Stamp Paper Market Size, Share & Forecast 2025 to 2035

Postoperative Panniculus Retractor Market Trends - Growth & Forecast 2025 to 2035

Postnatal Health Supplements Market Trends – Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA