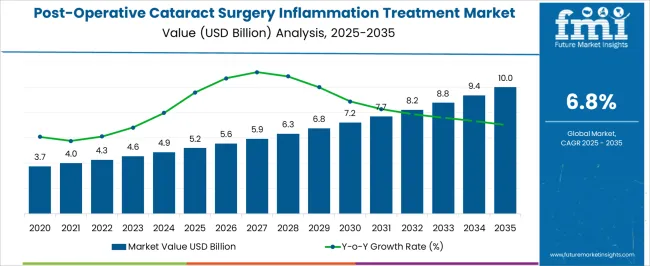

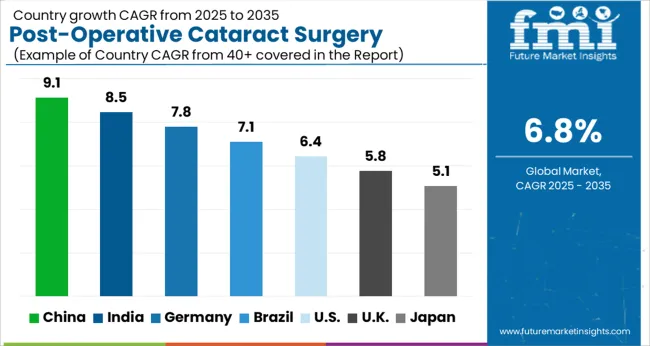

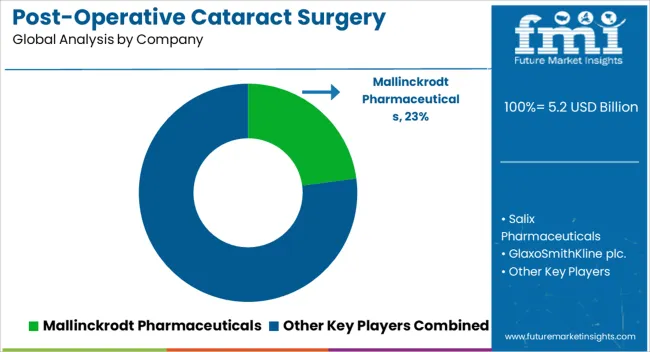

The Post-Operative Cataract Surgery Inflammation Treatment Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 10.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Post-Operative Cataract Surgery Inflammation Treatment Market Estimated Value in (2025 E) | USD 5.2 billion |

| Post-Operative Cataract Surgery Inflammation Treatment Market Forecast Value in (2035 F) | USD 10.0 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The post operative cataract surgery inflammation treatment market is experiencing consistent growth driven by the rising prevalence of cataract surgeries, improved access to ophthalmic care, and the introduction of advanced anti inflammatory formulations. Increasing geriatric population and greater awareness of post surgical complications are supporting the steady demand for effective therapeutic interventions.

The market is also benefitting from the availability of cost effective generic drugs alongside innovative formulations that improve patient compliance and therapeutic outcomes. Regulatory emphasis on reducing surgery related complications and the adoption of minimally invasive techniques have further heightened the need for safe and efficient anti inflammatory therapies.

With continued innovation in drug delivery systems and expanding healthcare infrastructure across emerging economies, the market outlook remains positive, offering opportunities for both established and emerging pharmaceutical players.

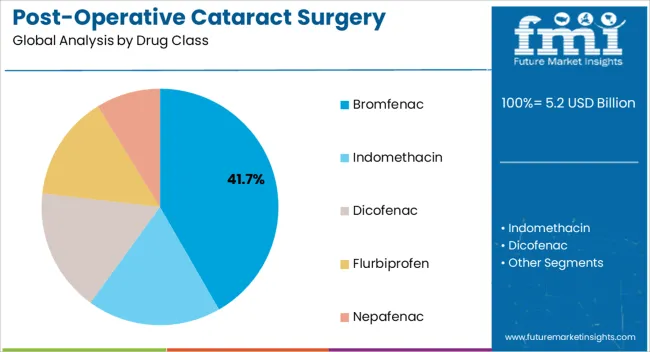

The bromfenac segment is projected to hold 41.70% of total market revenue by 2025 within the drug class category, making it the leading segment. Growth in this segment is supported by its proven efficacy in reducing ocular inflammation and pain following cataract surgery.

Its favorable safety profile, strong clinical adoption, and established presence in ophthalmology practices have contributed to its dominance. Additionally, bromfenac offers convenient dosing schedules and high bioavailability, which improve patient compliance.

These attributes have reinforced its leadership among the available drug classes in this treatment market.

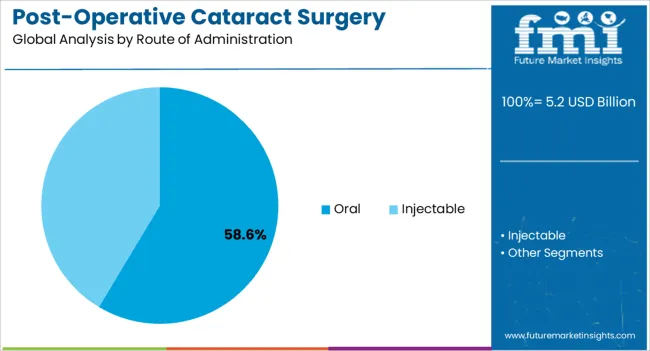

The oral route of administration is expected to account for 58.60% of the overall market by 2025, positioning it as the most significant route segment. This dominance is attributed to the ease of administration, widespread patient acceptance, and reduced dependence on healthcare professionals for drug delivery.

Oral formulations also offer consistent absorption and systemic efficacy, making them preferable for both patients and providers.

The ability to combine oral treatments with other therapeutic options has further strengthened their adoption, consolidating the position of this route of administration within the market.

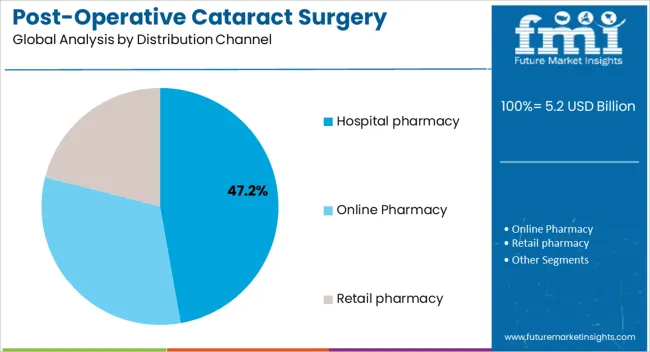

The hospital pharmacy channel is projected to generate 47.20% of total revenue by 2025, securing its place as the leading distribution channel. This is largely due to the high concentration of cataract surgeries conducted in hospital settings where immediate access to post operative medications is essential.

Hospital pharmacies ensure the availability of specialized ophthalmic drugs and facilitate adherence to prescribed treatment protocols.

Their integration with surgical centers and direct patient access have reinforced their role as the dominant distribution channel in the post operative cataract surgery inflammation treatment market.

The global post-operative cataract surgery inflammation treatment grew at a CAGR of 6.45% from 2020 to 2025, as per Future Market Insights, a provider of market research and competitive intelligence.

Historically, the choice of intraocular lenses (IOLs) is a field that has seen great improvement. Optical biometers were then available and had become more affordable, providing more accurate measurements than those provided by ultrasonography, by reaching optimal accuracy even in dense and advanced cataracts.

Also, artificial intelligence was used for enhancing the precision of IOL calculations and personalized approaches for both patients and surgeons. Postoperative adjustment of IOL power had become available with the introduction of novel IOL technologies.

The progress in evaluating the anterior surface and the tear apparatus has shown that tear dysfunction can significantly affect surgical outcomes, including producing a less precise IOL calculation and a longer postoperative recovery.

But nowadays, the current study is the first to compare intracanalicular dexamethasone directly to topical steroids after cataract surgery. Importantly, the study showed that the safety and efficacy of the two approaches were similar.

The rates of breakthrough inflammation reported for both groups were similar to those reported by previous studies where more than half of the patients experiencing breakthrough inflammation admitted poor compliance or anxiety over administering drops.

Although, the investigators of the current study have noted that patients should be counseled on possible epiphora in the postoperative period where two of 24 patients have been experiencing canalicular obstruction with an intracanalicular dexamethasone ophthalmic insert.

Rising prevalence of ophthalmic disorders & ocular pains

Ophthalmic disorders are the vital cause of major ocular and orbital pains in the eye. Ocular pain occurs over the surface of the eyes along with symptoms such as scratching, burning, or itching sensation.

This may be due to multiple reasons, including irritation from foreign objects, infection, or trauma. Eyelashes or pieces of dirt, smoke, dust, or some harsh eye cosmetics are the common causes leading to ocular pain, redness, and watery eyes.

The prevalence of ocular pain keeps showing a surge in growth as chemical industries and pollution around the world are growing. Chemical burns and flash burns cause significant and severe ocular pain due to irritations over the eye surface. Style and blepharitis lead to severe ocular pain as they cause eye and oil glands to be more sensitive around the area.

A rise in traumatic injuries

Traumatic head injury is one of the causes of such disorders as optic nerve disorders. A traumatic injury is a physical injury that occurs suddenly with a certain degree of severity. Trauma can be caused by a variety of external injuries.

The most common causes of traumatic injury include road accidents, sports injuries, and violence, among others which can lead to some serious eye disorders as well. The prevalence of such traumatic injuries is highly seen worldwide.

Hence, such traumatic injuries lead to optic nerve disorders, which are affecting the population in these years and it is increasing with the rising population. Therefore, a rise in traumatic injuries is expected to drive market growth.

High cost & risks associated with eye surgery & treatment

The cost of the various disorders treatment plays a major role in the market. The optic nerve disorders treatments are highly sophisticated, as the prevalence of such disorders is increasing; hence the need for such products has eventually raised, thereby raising the treatment cost, which can hinder the market growth in the coming years.

There are various methods for the treatment of optic neuritis disorder. Some of them are patients can take various medicines such as corticosteroids like methylprednisolone, prednisone, immunoglobulin, vitamin B12 shots, and various other surgeries. With these, there are some risks associated with it.

Therefore, for some of the population around the country, it is difficult for them to undergo such treatments due to the high cost. Hence, the high cost associated with ophthalmic disorders treatment is expected to restrain the market growth.

Lack of skilled professionals

The number of ophthalmologists in both emerging and industrialized countries is minor. However, projections are a little higher for developing countries. The number of ophthalmologists is cumulative but not as fast as the population of elderly patients aged 60 years or older who need to be amplified ophthalmologic care.

In most countries, the problem is that demographic changes do not match up with professional development. It is required to train eye care teams to meet the current number of ophthalmologists worldwide. The increased need for ophthalmologists globally also reflects an increase in the cases of diabetes.

Diabetic patients should get their eyes inspected every year. The increasing demand for ophthalmologists is directly proportional to the growing geriatric population since eye care is an integral part of healthcare. The access to care gaps can be met by combining factors, including more efficient practice structures, processes, and appropriate use of technology.

Growth in the number of surgical procedures

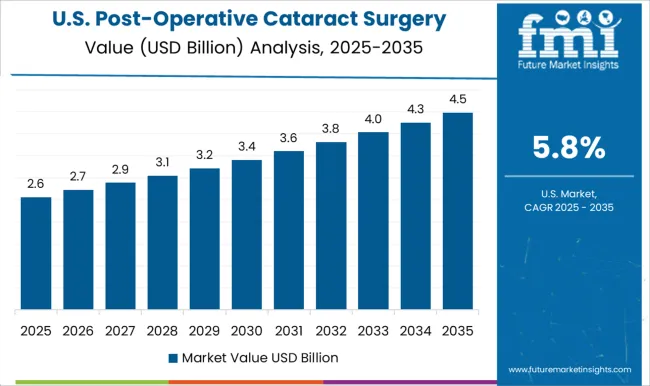

The United States is expected to hold a major share of the market in North America. The major factors bolstering the market's growth are the growing number of surgical procedures, surge in awareness regarding postoperative pain management drugs, increasing number of product approvals, and rising focus on palliative care.

A research study titled "Comparison of Postoperative Pain Management Outcomes in the United States” was published stating that the American Pain Society Patient Outcome Questionnaire-Revised (APS-POQ-R) was completed by 244 patients in the United States with similar surgery sites. The Pain Management Index (PMI) was calculated on their first postoperative day.

Patients in the United States had a higher score on the APS-POQ "perception of pain management" subscale and a larger proportion of acceptable treatment, as assessed by the PMI.

Also, higher compliance with pain management recommendations has resulted in higher perceptions among patients. Such statistics are likely to increase the demand for postoperative pain management medications within the country, thereby boosting the market's growth.

Several market players are engaged in implementing strategic initiatives, thereby contributing to the market's growth.

In May 2024, Allay Therapeutics, a clinical-stage biotechnology company pioneering ultra-sustained analgesic products to transform postsurgical pain management and recovery, reported the first-ever clinical data showing non-opioid pain relief lasting two weeks after a single administration and Heron.

Therapeutics, Inc., a commercial-stage biotechnology company focused on developing treatments to address some of the most important unmet patient needs, reported that the United States Food and Drug Administration (FDA) has approved ZYNRELEF (bupivacaine and meloxicam) extended-release solution for use in adults for soft tissue or periarticular instillation to produce postsurgical analgesia for up to 72 hours after a bunionectomy, open inguinal herniorrhaphy, and total knee arthroplasty.

Bromfenac drug gains the dominant market share

Bromfenac ophthalmic solution 0.09% is indicated for the treatment of postoperative inflammation in patients who have undergone cataract extraction.

This is so because, the efficacy and safety of sodium bromfenac eye drop in the treatment of postoperative inflammation of cataract surgery were evaluated by the effective rate, symptom score, adverse reactions, incidence, recurrence rate, etc.

Injections are expected to boost the market share

Intracameral dexamethasone injection in the treatment of cataract surgery-induced inflammation.

Topical ophthalmic drug delivery represents the most popular option among cataract surgeons due to its effectiveness and good safety profile in controlling inflammation after cataract surgery.

Some of the prominent players in the post-operative cataract surgery inflammation drug treatment market are

Some of the important developments of the key players in the market are

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.77% from 2025 to 2035 |

| Market value in 2025 | USD 5.2 billion |

| Market value in 2035 | USD 10.0 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD Billion for Value and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Drug class, Route of Administration, Distribution Channel, Region |

| Regions Covered |

North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, GCC countries, South Africa, Israel |

| Key Companies Profiled | Mallinckrodt Pharmaceuticals; Salix Pharmaceuticals; GlaxoSmithKline plc.; Pfizer Inc.; ASKA Pharmaceutical Co., Ltd.; Bausch Health; Johnson & Johnson Services, Inc.; Janssen Global Services; Takeda Pharmaceutical Company Limited; Merck & Co., Inc. |

| Customization Scope | Available on Request |

The global post-operative cataract surgery inflammation treatment market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the post-operative cataract surgery inflammation treatment market is projected to reach USD 10.0 billion by 2035.

The post-operative cataract surgery inflammation treatment market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in post-operative cataract surgery inflammation treatment market are bromfenac, indomethacin, dicofenac, flurbiprofen and nepafenac.

In terms of route of administration, oral segment to command 58.6% share in the post-operative cataract surgery inflammation treatment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cataract Surgery Device Market Analysis – Growth & Forecast 2024-2034

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Nausea and Vomiting (PONV) Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Pain Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Panniculus Retractor Market Trends - Growth & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Biosurgery Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Post-Surgery Skin Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Neurosurgery Surgical Power Tools Market Analysis – Growth & Forecast 2022-2032

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA