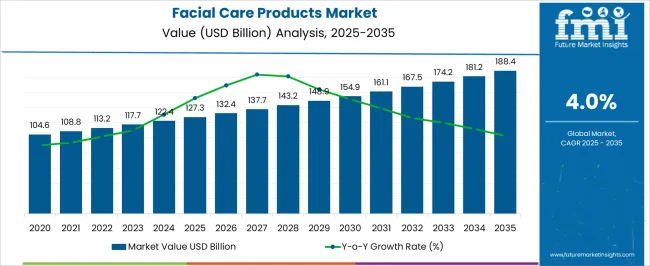

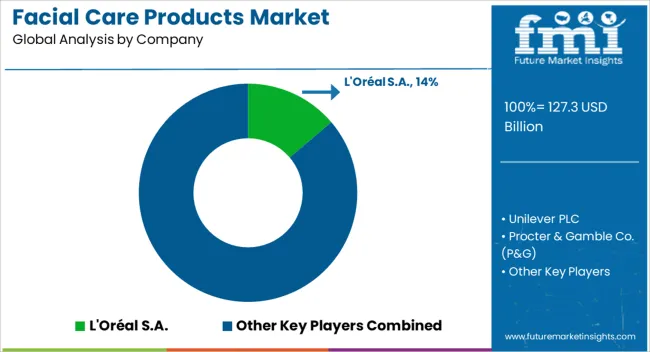

The facial care products market is estimated to be valued at USD 127.3 billion in 2025 and is projected to reach USD 188.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. Growth from USD 127.3 billion to USD 137.7 billion between 2025 and 2027 reflects an industry adapting to increasingly stringent ingredient safety regulations and transparency requirements. These measures, enforced by agencies such as the US FDA and the European Commission, emphasize restrictions on harmful additives, preservatives, and allergens, driving manufacturers toward safer, compliant formulations.

Between 2027 and 2031, with the market expanding from USD 137.7 billion to USD 161.1 billion, the impact of regulatory alignment on labeling, advertising, and sustainability claims becomes evident. Guidelines around claims verification and packaging recyclability influence cost structures while simultaneously creating opportunities for premiumization and consumer trust. Regulatory demands for eco-friendly packaging and traceability systems increase investment in supply chain monitoring, reshaping competitive strategies.

From 2031 to 2035, as the market grows from USD 161.1 billion to USD 188.4 billion, stricter global harmonization efforts push manufacturers to adopt clean-label standards and comply with cross-border trade regulations. The regulations act as both constraints and enablers, limiting certain chemical uses while promoting innovation in natural formulations, sustainable packaging, and digital compliance technologies that ultimately define the market’s evolution.

| Metric | Value |

|---|---|

| Facial Care Products Market Estimated Value in (2025 E) | USD 127.3 billion |

| Facial Care Products Market Forecast Value in (2035 F) | USD 188.4 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The facial care products market represents a specialized segment within the global personal care and beauty industry, emphasizing skin health, cosmetic appeal, and consumer wellness. Within the broader skincare and beauty sector, it accounts for about 7.2%, driven by rising demand for cleansers, moisturizers, serums, and anti-aging formulations. In the personal care and cosmetics segment, its share is approximately 6.5%, reflecting adoption across mass-market, premium, and natural product lines. Across the dermatological and cosmetic treatment market, it holds around 5.3%, supporting products targeting specific skin concerns, pigmentation, and hydration.

Within the organic and natural personal care category, it represents 4.7%, highlighting growth in plant-based, chemical-free, and sensitive skin formulations. In the overall beauty and wellness solutions sector, the market contributes about 4.1%, emphasizing integration of innovative ingredients, advanced formulations, and consumer-centric product development. Recent developments in the market have focused on natural formulations, multifunctional products, and personalized skincare solutions. Innovations include the incorporation of antioxidants, peptides, hyaluronic acid, and plant-derived actives to enhance efficacy and skin protection. Key players are collaborating with biotech firms, dermatologists, and ingredient suppliers to develop targeted solutions and clinical-grade products.

Adoption of clean-label, vegan, and cruelty-free certifications is gaining traction to meet evolving consumer expectations. The digital tools, AI-powered skin analysis, and direct-to-consumer platforms are being deployed to provide personalized product recommendations and optimize skincare routines.

The facial care products market is witnessing consistent expansion, supported by rising consumer awareness about skincare, evolving beauty standards, and increasing demand for tailored personal care solutions. Growing urbanization and the rising influence of social media have contributed to heightened interest in maintaining skin health and appearance, particularly among millennials and Gen Z consumers. A noticeable shift is taking place toward preventive skincare and early-age adoption of facial care routines, encouraging the use of specialized products for cleansing, moisturizing, and treatment.

Market growth is further reinforced by increasing disposable income, particularly in developing economies, which is enabling greater spending on premium and multifunctional skincare products. Innovation in ingredient formulations, sustainability trends, and the growing popularity of natural and organic ingredients are shaping brand strategies and consumer preferences.

Advancements in dermatological research and increased availability of personalized skincare solutions are enhancing consumer trust and product efficacy. As digital retail platforms expand, accessibility to a wider range of skincare brands is improving, driving global penetration and sustaining long-term growth in the facial care products market.

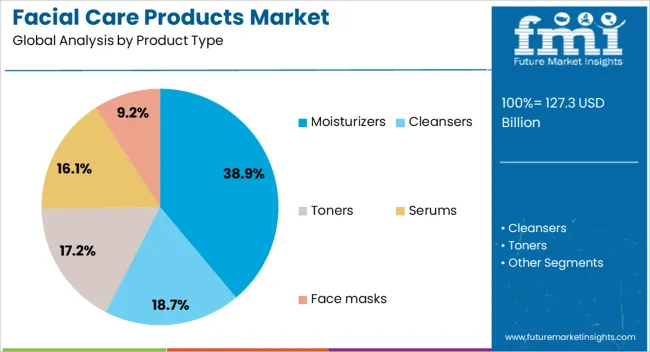

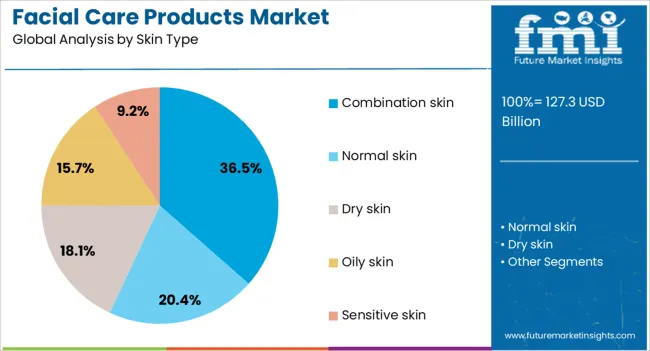

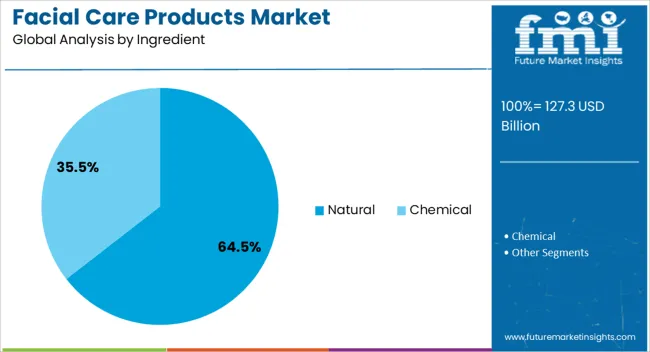

The facial care products market is segmented by product type, skin type, ingredient, consumer group, price, distribution channel, and geographic regions. By product type, facial care products market is divided into Moisturizers, Cleansers, Toners, Serums, Face masks, Sunscreens, Exfoliators, and Others (face mist, pimple patches etc.). In terms of skin type, facial care products market is classified into Combination skin, Normal skin, Dry skin, Oily skin, and Sensitive skin. Based on ingredient, facial care products market is segmented into Natural and Chemical.

By consumer group, facial care products market is segmented into Women, Men, and Children’s. By price, facial care products market is segmented into Medium, Low, and High. By distribution channel, facial care products market is segmented into E-commerce platforms and Offline retail. Regionally, the facial care products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The moisturizers segment is projected to hold 38.9% of the facial care products market revenue share in 2025, positioning it as the leading product type. Its dominance is being supported by the foundational role moisturizers play in daily skincare routines, promoting hydration, protection, and overall skin barrier function. The widespread perception of moisturization as an essential step in maintaining skin health has ensured high adoption across age groups and geographies.

Continued innovation in moisturizer formulations, including lightweight textures, non-comedogenic blends, and added sun protection benefits, has enhanced product appeal for both men and women. The segment is also benefiting from rising demand for multifunctional products that combine hydration with anti-aging, brightening, or pollution-protection properties. Easy incorporation into both morning and nighttime routines has contributed to consistent usage patterns and repeat purchases.

As skincare trends evolve toward prevention and maintenance rather than correction, the role of moisturizers as an everyday essential remains strong. Their adaptability across skin types and compatibility with other facial care products further reinforce their leading position in the global market.

The combination skin segment is expected to account for 36.5% of the facial care products market revenue share in 2025, making it the leading skin type category. This dominance is being driven by the high prevalence of combination skin characteristics among the global population, requiring targeted skincare solutions that balance oil control and hydration. Consumers with combination skin typically experience both oily and dry areas on the face, which has increased demand for products that address dual concerns without causing irritation or imbalance.

Formulations that offer matte finishes for the T-zone while maintaining moisture in drier areas are being increasingly favored. The segment is benefiting from the rising availability of dermatologist-tested and pH-balanced products designed specifically for combination skin.

Personalized skincare regimens and diagnostic tools offered through online platforms are also guiding consumers toward products tailored for their skin type, improving product efficacy and satisfaction. As awareness around proper skincare techniques continues to grow, the demand for products catering to combination skin is expected to remain elevated, further reinforcing its leading share in the market.

The natural ingredient segment is anticipated to capture 64.5% of the facial care products market revenue share in 2025, making it the most dominant ingredient category. Its leadership is being fueled by a widespread shift in consumer preference toward clean, sustainable, and plant-based skincare formulations. Increased awareness about the potential long-term effects of synthetic chemicals and parabens has prompted a significant move toward products that utilize botanical extracts, essential oils, and naturally derived actives.

The natural segment is being further propelled by global wellness trends and the perceived safety, gentleness, and environmental friendliness of such formulations. Brands are expanding their natural product portfolios in response to consumer demand for ingredient transparency and ethical sourcing practices.

The rise of eco-conscious lifestyles and cruelty-free certifications is also influencing purchase decisions in favor of natural skincare. With evolving regulatory support and increasing investment in green chemistry, manufacturers are now able to offer high-efficacy natural formulations that meet both consumer expectations and environmental standards, securing the segment’s leading position in the market.

The market has experienced significant growth driven by increasing consumer focus on skin health, personal grooming, and anti-aging solutions. Rising awareness regarding sun protection, pollution-related skin damage, and the benefits of natural and organic ingredients has influenced purchasing behavior. Products including moisturizers, cleansers, serums, masks, and sunscreens are being tailored for diverse skin types and concerns. E-commerce channels, social media influence, and beauty subscription services have accelerated accessibility and product awareness. Technological innovations in formulation, encapsulation, and delivery systems have enhanced efficacy and consumer satisfaction.

Consumer focus on aging prevention and skin wellness has driven the development of functional facial care products. Ingredients such as peptides, antioxidants, hyaluronic acid, and natural extracts are integrated into moisturizers, serums, and masks to target wrinkles, fine lines, and elasticity. Dermatologically tested formulations are gaining preference among safety-conscious buyers. Anti-pollution and brightening products respond to urban environmental challenges, while sensitive skin products cater to allergen-aware users. Market players invest in research to enhance bioavailability, stability, and absorption of active ingredients. Personalization in product offerings, based on skin type, age, and lifestyle, has become a strategic differentiator. These trends are driving innovation, expanding product portfolios, and increasing overall demand across global and regional markets.

The expansion of online retail, beauty platforms, and social media marketing has accelerated the reach and adoption of facial care products. Consumers increasingly rely on digital reviews, influencer recommendations, and virtual try-on tools to make informed decisions. Direct-to-consumer sales models reduce intermediaries, improving accessibility and price competitiveness. Brands are leveraging AI-driven skin analysis apps, subscription boxes, and targeted campaigns to enhance engagement. E-commerce platforms facilitate rapid launch and promotion of niche, organic, and premium products, broadening consumer choice. The growth of digital channels enables market players to reach untapped demographics, including younger consumers and male buyers, while gathering data for personalized product development and marketing strategies, thus strengthening market presence.

The incorporation of natural, organic, and ethically sourced ingredients has become a key driver in the facial care products market. Consumers increasingly seek products free from parabens, sulfates, and synthetic fragrances. Botanical extracts, essential oils, and naturally derived actives are emphasized for their perceived safety and effectiveness. Certifications for cruelty-free, vegan, and eco-friendly formulations influence purchase behavior. Sustainable sourcing and transparency in ingredient disclosure build brand credibility. Companies are investing in clean beauty R&D, focusing on plant-based bioactives, biodegradable formulations, and eco-conscious packaging. These strategies appeal to environmentally and health-conscious consumers, ensuring market differentiation and loyalty, while encouraging innovation in natural and sustainable facial care solutions globally.

Premium facial care products are gaining traction due to increased consumer willingness to invest in high-quality, technologically advanced formulations. Products integrating nanotechnology, encapsulated actives, and multifunctional benefits offer enhanced delivery and efficacy. Luxury packaging, brand heritage, and experiential offerings elevate perceived value, attracting high-income consumers. Research in dermocosmetics and clinically proven formulations ensures targeted performance for specific skin concerns. Innovations such as hybrid skincare-makeup products, anti-pollution coatings, and time-release delivery systems address evolving consumer needs. The focus on performance-driven, aesthetically appealing, and scientifically validated products strengthens differentiation in competitive markets. Premiumization, coupled with global distribution and online accessibility, supports sustained growth and higher average revenue per user in the facial care segment.

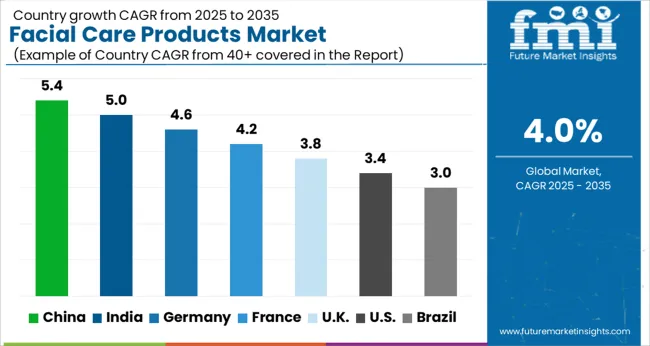

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The market is projected to grow at a CAGR of 4.0% between 2025 and 2035. Germany reached 4.6%, supported by premium skincare adoption and evolving consumer preferences. China led with 5.4%, fueled by a growing beauty industry and expanding retail channels. India recorded 5.0%, reflecting rising personal care awareness and increasing product availability. The United Kingdom reached 3.8%, driven by demand for specialized skincare formulations. The United States recorded 3.4%, reflecting steady market consumption and innovation in natural and effective products. These nations are actively advancing, producing, and innovating in the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 5.4%, driven by increasing awareness of skincare routines, rising demand for anti-aging and brightening formulations, and expanding e-commerce distribution channels. Adoption is reinforced by the growing influence of social media, beauty influencers, and rising preference for premium and natural ingredients in facial care products. Domestic manufacturers focus on integrating herbal and advanced scientific formulations with attractive packaging to enhance consumer appeal. Expansion of online retail platforms accelerates market penetration across tier 1 and tier 2 cities.

India is expected to grow at a CAGR of 5.0%, supported by rising consumer awareness of skincare, urban retail expansion, and increasing preference for natural and herbal ingredients. Adoption is reinforced by growth in male grooming and demand for multifunctional facial care products such as moisturizers with SPF. Manufacturers are focusing on affordable and mid-premium formulations to cater to diverse income groups, leveraging online and offline retail networks for distribution.

Germany is forecast to grow at a CAGR of 4.6%, driven by rising demand for certified organic, dermatologically tested, and environmentally friendly facial care products. Adoption is reinforced by consumer preference for clean label, hypoallergenic, and cruelty free products. Manufacturers focus on product efficacy, skin sensitivity solutions, and sustainability certifications to appeal to conscientious consumers. Demand is concentrated in specialty stores, pharmacy chains, and online platforms.

The United Kingdom is projected to grow at a CAGR of 3.8%, supported by rising consumer interest in natural, vegan, and sustainable facial care products. Adoption is reinforced by premium brand expansion, innovative packaging, and increasing online retail penetration. Manufacturers focus on multifunctional formulations addressing hydration, anti-aging, and skin protection. The growing influence of beauty bloggers and social media campaigns enhances product visibility and consumer education.

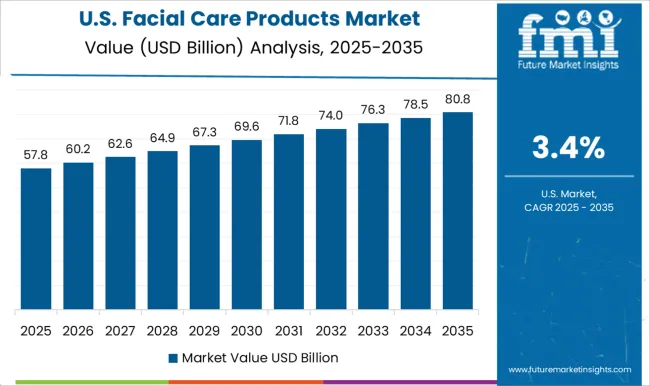

The United States is projected to grow at a CAGR of 3.4%, driven by demand for anti-aging, SPF, and multifunctional facial care products. Adoption is reinforced by rising awareness of natural and clean beauty products and preference for premium skincare brands. Manufacturers focus on product efficacy, brand loyalty programs, and omni-channel retail presence. Expansion of online and subscription-based sales supports market growth.

The market is highly competitive, dominated by multinational personal care conglomerates that focus on product innovation, brand loyalty, and global distribution networks. L'Oréal S.A. leads the market with a diversified portfolio of premium, mid-range, and mass-market skincare products, leveraging advanced R&D for anti-aging, hydration, and brightening formulations. Unilever PLC and Procter & Gamble (P&G) emphasize mass-market accessibility, combining wide retail reach with affordable, clinically tested products, enhancing consumer trust and repeat purchases. Premium skincare segments are shaped by players such as Estée Lauder Companies Inc., Shiseido Company, Limited, and Beiersdorf AG, which focus on technologically advanced formulations, natural ingredient incorporation, and targeted solutions for aging, sensitive, or problem-prone skin. Johnson & Johnson Services, Inc. and Kao Corporation maintain competitiveness through pediatric and dermatologist-recommended product lines, emphasizing safety and hypoallergenic certifications.

Emerging and niche brands like Amorepacific Corporation, Natura &Co, Himalaya Wellness, and Revlon, Inc. differentiate themselves with natural, herbal, or sustainable product offerings, appealing to environmentally conscious consumers. Coty Inc., Colgate-Palmolive Company, and Avon Products, Inc. leverage direct selling, e-commerce, and influencer-driven campaigns to expand market penetration. The competition in the facial care segment is shaped by innovation in formulations, branding strategies, marketing reach, digital presence, and consumer perception of quality and efficacy. Companies continuously focus on product differentiation, regional expansion, and sustainable practices to capture shifting consumer preferences, making the market highly dynamic and segmented across premium, mid-tier, and mass-market categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 127.3 Billion |

| Product Type | Moisturizers, Cleansers, Toners, Serums, Face masks, Sunscreens, Exfoliators, and Others (face mist, pimple patches etc.) |

| Skin Type | Combination skin, Normal skin, Dry skin, Oily skin, and Sensitive skin |

| Ingredient | Natural and Chemical |

| Consumer Group | Women, Men, and Children’s |

| Price | Medium, Low, and High |

| Distribution Channel | E-commerce platforms and Offline retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L'Oréal S.A., Unilever PLC, Procter & Gamble Co. (P&G), Estée Lauder Companies Inc., Johnson & Johnson Services, Inc., Shiseido Company, Limited, Beiersdorf AG, Kao Corporation, Amorepacific Corporation, Natura &Co, Coty Inc., Colgate-Palmolive Company, Avon Products, Inc., Himalaya Wellness Company, and Revlon, Inc. |

| Additional Attributes | Dollar sales by product type and application, demand dynamics across skincare, cosmetic, and personal care segments, regional trends in natural and premium ingredient adoption, innovation in formulation, delivery systems, and multifunctionality, environmental impact of packaging and ingredient sourcing, and emerging use cases in anti-aging, sensitive skin solutions, and personalized skincare routines. |

The global facial care products market is estimated to be valued at USD 127.3 billion in 2025.

The market size for the facial care products market is projected to reach USD 188.4 billion by 2035.

The facial care products market is expected to grow at a 4.0% CAGR between 2025 and 2035.

In terms of skin type, combination skin segment to command 36.5% share in the facial care products market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Facial Serum Market Forecast and Outlook 2025 to 2035

Facial Recognition Market Size and Share Forecast Outlook 2025 to 2035

Facial Mask Maker Market Size and Share Forecast Outlook 2025 to 2035

Facial Erythema Treatment Market Size and Share Forecast Outlook 2025 to 2035

Facial Oil Market Analysis by Product Type, End User, Sales Channel and Region Through 2025 to 2035

Facial Tissue Paper Market Analysis - Trends, Growth & Forecast 2025 to 2035

Facial Steamer Market - Trends, Growth & Forecast 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Facial Tracking Solution Market by Component, Technology Type, Industry & Region Forecast till 2035

Facial Tissue Market Growth – Size, Demand & Forecast 2024-2034

Facial Epilator Market Analysis – Size, Trends & Forecast 2024-2034

Facial Implants Market

Facial Recognition Machine Market

Bifacial Solar Module Market Size and Share Forecast Outlook 2025 to 2035

Craniofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

Electric Facial Cleansing Brush Market Size and Share Forecast Outlook 2025 to 2035

Chelating Facial Masks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Gluten-Free Facial Product Market Trends – Growth & Forecast 2024-2034

Cranial And Facial Implants Market

Craniomaxillofacial Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA