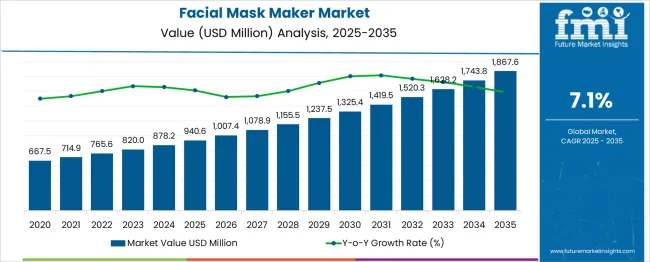

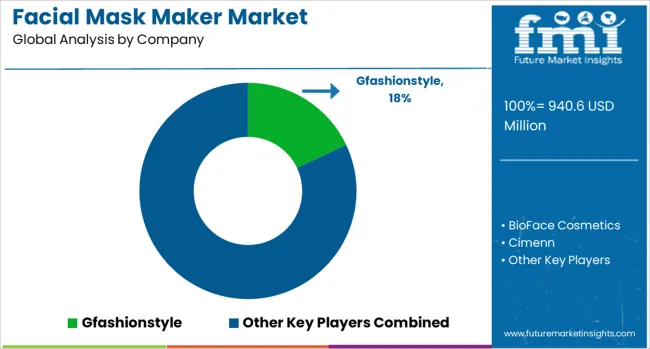

The Facial Mask Maker Market is estimated to be valued at USD 940.6 million in 2025 and is projected to reach USD 1867.6 million by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. Evaluating the Growth Rate Volatility Index (GRVI), which measures fluctuations in year-on-year (YoY) percentage growth, indicates a highly stable expansion profile with minimal deviation across the forecast horizon. From 2025 to 2027, YoY growth hovers between 7.1% and 7.1%, reflecting uniform early-phase adoption driven by consumer interest in personalized skincare devices and home-based beauty treatments. Mid-period years (2028–2031) maintain a near-identical growth band of 7.0–7.2%, suggesting consistent demand patterns and steady channel penetration, particularly via online retail platforms. From 2032 to 2035, YoY growth remains anchored at approximately 7.0–7.1%, signaling no major cyclicality or demand shocks. This yields a low GRVI score, indicative of predictable revenue scaling, an attractive characteristic for investors seeking low-risk growth exposure. The absence of significant volatility can be attributed to the product’s alignment with long-term consumer wellness trends, limited seasonality, and recurring purchase potential for consumable mask-making ingredients. Such stability supports accurate capacity planning for manufacturers and steady margin protection, positioning the market as a reliably expanding niche within the global beauty and personal care technology sector.

| Metric | Value |

|---|---|

| Facial Mask Maker Market Estimated Value in (2025 E) | USD 940.6 million |

| Facial Mask Maker Market Forecast Value in (2035 F) | USD 1867.6 million |

| Forecast CAGR (2025 to 2035) | 7.1% |

The facial mask maker market is regarded as a specialized yet steadily expanding category across its parent industries. It is estimated to represent about 2.4% of the global personal care appliance market indicating rising consumer interest in beauty and skincare devices. Within the home beauty and wellness equipment sector a share of approximately 3.2% is assessed driven by at home skincare routines. In the micro electronics and consumer electronics market around 1.8% is observed reflecting demand for smart, connected appliances. Within the spa and professional aesthetic equipment industry about 2.6% is calculated supported by product adoption by boutique salons and clinics. In the smart home and health tech market a share of roughly 1.9% is evaluated as app-enabled mask makers and connected devices gain traction. Trends in this market have been shaped by growing popularity of customizable at home skincare treatments. Innovations have been focused on mask makers offering precise temperature control, steam delivery and reusable molds for personalized facial masks. Interest has increased in devices integrated with app control, skin sensing feedback and usage analytics. The Asia Pacific region has been observed to show the fastest consumer uptake while North America has maintained strong demand for premium, smart variants. Strategic initiatives have included collaborations between beauty device brands and skincare ingredient companies to deliver formula tailored mask systems, wellness subscriptions and extended product ecosystems.

The facial mask maker market is gaining momentum due to increasing consumer demand for personalized skincare and at-home beauty solutions. Rising awareness of ingredient transparency and the trend toward DIY wellness regimens have driven adoption of facial mask makers, particularly in urban, skincare-conscious demographics.

The shift toward multifunctional skincare appliances that offer convenience, cost-efficiency, and control over formulation has attracted interest from both individuals and salon professionals. Brands are enhancing user interfaces, integrating mobile apps, and expanding capacity and ingredient compatibility to differentiate offerings.

The market is also benefitting from expanding e-commerce access and growing demand across emerging economies for beauty technology products that support holistic and customizable skin care.

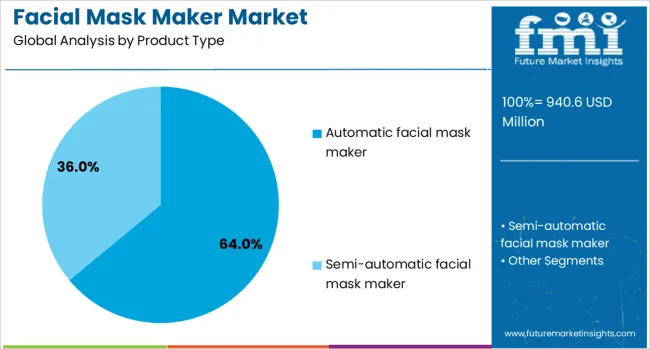

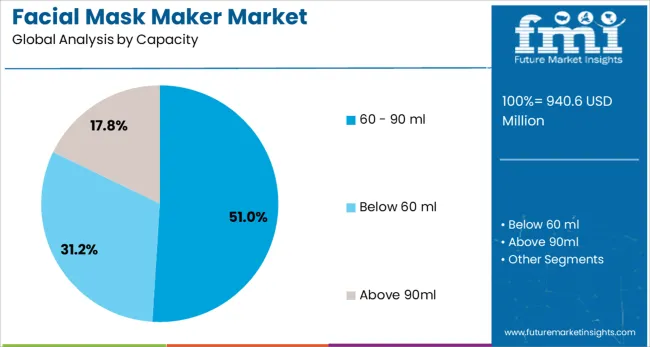

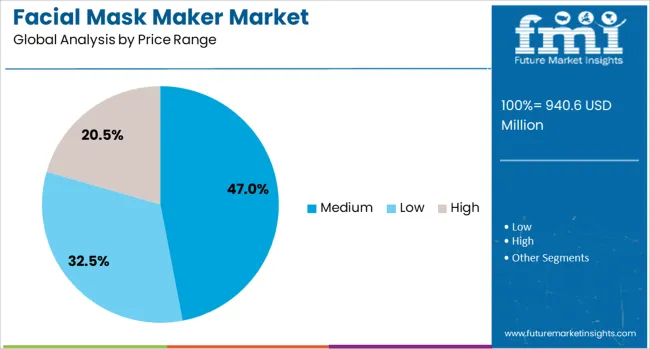

The facial mask maker market is segmented by product type, capacity, price range, end use, distribution channel, and geographic regions. By product type, the facial mask maker market is divided into Automatic facial mask makers and Semi-automatic facial mask makers. The facial mask maker market capacity is classified into 60-90 ml, below 60 ml, and above 90 ml. Based on the price range, the facial mask maker market is segmented into Medium, Low, and High. The end use of the facial mask maker market is segmented into Home use and Commercial use. The distribution channel of the facial mask maker market is segmented into Online and Offline. Regionally, the facial mask maker industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

By product type, automatic facial mask makers are projected to dominate the market with a 64.00% share in 2025. The segment's leadership stems from increasing consumer preference for one-touch operations, ease of use, and consistent formulation quality.

Automatic models offer fast processing, intuitive interfaces, and compatibility with a wider range of natural ingredients, including fruits, collagen, and essential oils. Manufacturers are focusing on portable designs and enhanced safety features, making these devices suitable for home and spa settings alike.

As self-care and beauty tech become increasingly integrated into daily routines, the convenience and functionality of automatic mask makers continue to drive their widespread adoption.

The 60–90 ml capacity segment is expected to lead with a 51.00% market share in 2025, reflecting user preference for standard single-use or short-duration facial treatments. This capacity range aligns well with the average mask formulation volume for one-time use, providing optimal freshness and ingredient potency.

It also supports minimal product waste, hygienic use, and compatibility with standard mask tray sizes. Brands are standardizing their machines within this capacity to simplify ingredient measurement and reduce complexity in the formulation process.

This segment’s growth is being reinforced by rising consumer demand for efficient, precise skincare routines without ingredient excess.

In terms of price range, medium-priced facial mask makers are anticipated to account for 47.00% of total sales in 2025. This segment’s strength lies in offering a balance between performance and affordability, catering to both premium-conscious and value-seeking consumers.

Medium-range devices often include auto-cleaning features, multiple temperature settings, and smartphone compatibility, making them appealing to tech-savvy users. The segment benefits from strong presence in both online and offline retail channels and often receives higher consumer trust due to product reviews, influencer marketing, and customer support offerings.

As beauty appliances continue to be viewed as long-term investments, medium-tier products offer the right mix of quality, design, and innovation.

Facial mask maker devices have been gaining popularity among home skincare users for their ability to create customized facial masks using natural ingredients. These machines blend fruit, vegetable, collagen, and nutrient-rich powders into a gel-based mask within minutes. Adoption has been driven by growing interest in personalized skincare routines and DIY beauty solutions. Compact designs, user-friendly interfaces, and quick preparation times have supported household usage. Expanding availability through e-commerce platforms and beauty specialty stores has further increased consumer awareness and market penetration.

Consumers have been drawn to facial mask maker devices for the flexibility to create masks suited to specific skin needs, such as hydration, brightening, or oil control. The ability to avoid synthetic preservatives by using fresh ingredients has appealed to users seeking natural skincare alternatives. Simple operation and short preparation times have encouraged routine use. Lightweight and portable designs have made these machines suitable for home settings, apartments, and even travel. Online beauty influencers and video tutorials have boosted awareness of mask-making techniques, increasing consumer confidence in device use. Retailers in North America, Europe, and Asia have reported strong sales during beauty and self-care promotional campaigns. The combination of customization, freshness, and convenience has positioned facial mask makers as an attractive addition to personal beauty appliances for skincare-focused households.

Facial mask maker devices have benefited from innovations in heating, mixing, and gelling technology that improve mask consistency and nutrient retention. Some models have integrated automated cleaning cycles to reduce maintenance effort. LED display panels, touch controls, and preset skincare recipes have enhanced usability for a wide range of consumers. Manufacturers in South Korea, Japan, and China have incorporated advanced collagen infusion techniques, allowing better skin adhesion and improved mask texture. Enhanced safety features, including temperature regulation and overflow prevention, have been included to ensure reliable performance. The introduction of multilingual user interfaces and recipe customization apps has broadened appeal to global markets. These technological upgrades have not only improved the functionality of the devices but have also strengthened brand differentiation in a growing personal skincare appliance sector.

The availability of facial mask maker devices through online marketplaces and beauty-focused retail chains has significantly increased market accessibility. E-commerce platforms have allowed brands to reach consumers in regions without specialized beauty stores, offering direct-to-home delivery and promotional bundles. Demonstration videos, user reviews, and influencer endorsements on social media have enhanced product visibility and credibility. Physical retail locations have provided opportunities for live demonstrations, enabling hands-on experience before purchase. Distributors in Southeast Asia, Europe, and North America have leveraged seasonal beauty events to stimulate demand. The combination of online and offline channels has ensured year-round product exposure, contributing to steady sales growth and wider consumer adoption across different income groups and geographic regions.

Despite functional advantages, the adoption of facial mask maker devices has been limited by high initial purchase prices compared to disposable facial masks. In price-sensitive markets, consumers have preferred ready-to-use sheet masks due to lower upfront cost and immediate convenience. Limited awareness about device benefits in emerging regions has slowed adoption, with many potential buyers unfamiliar with the mask-making process. Availability of replacement mask gel powders and compatible ingredients can also be inconsistent outside major beauty retail hubs. Maintenance requirements, including cleaning and proper ingredient handling, have been cited as deterrents for casual skincare users. Without broader education efforts, price adjustments, and reliable after-sales support, market penetration may remain concentrated among dedicated skincare enthusiasts and premium beauty product consumers.

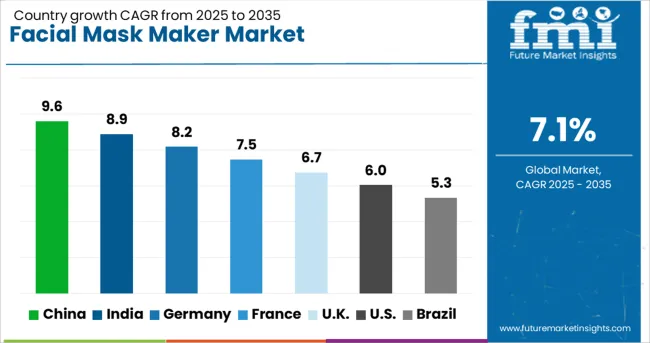

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The market is expected to grow at a global CAGR of 7.1% between 2025 and 2035, driven by rising demand for at-home skincare devices, personalization trends, and increasing consumer focus on natural ingredients. China leads with a 9.6% CAGR, supported by strong beauty device manufacturing capabilities and expanding domestic consumption. India follows at 8.9%, fueled by the growing personal care sector and urban consumer adoption. Germany, at 8.2%, benefits from advanced product design and premium skincare technology exports. The UK, projected at 6.7%, sees growth from luxury skincare trends and online retail expansion. The USA, at 6.0%, reflects steady demand from home beauty device users and wellness-focused consumers. The report provides insights for 40+ countries, with the five below highlighted for their strategic importance and growth outlook.

China is projected to grow at a CAGR of 9.6% from 2025 to 2035 in the facial mask maker market, supported by a large domestic beauty and personal care industry. Manufacturers such as Kingdom Cares, Xiaomi, and TouchBeauty are offering smart, app-connected devices capable of customizing masks using fruit extracts, collagen, and plant-based serums. Rising popularity of DIY skincare routines among urban consumers is fueling demand. Strong e-commerce channels, including Tmall and JD.com, are enabling rapid product distribution. Integration of temperature control and ultrasonic infusion features is becoming a key differentiator in premium models.

India is expected to post a CAGR of 8.9% from 2025 to 2035, driven by growing interest in personalized skincare and increasing influence of K-beauty trends. Local brands and importers are introducing affordable mask-making devices targeted at young consumers. Companies such as Gorgio Professional and Panasonic India are promoting models that allow the use of herbal ingredients, catering to the preference for natural skincare. Expansion of organized retail and beauty specialty stores is improving consumer access. Marketing through social media influencers is significantly boosting awareness and sales.

Germany is forecasted to grow at a CAGR of 8.2% from 2025 to 2035, driven by strong consumer demand for high-quality, skin-safe home devices. Brands like Beurer and Medisana are emphasizing dermatologically tested materials and eco-friendly mask sheets. Growing interest in at-home spa experiences is increasing adoption, particularly among middle-aged consumers. Integration of LED light therapy and micro-vibration massage functions in mask makers is expanding the market for multifunctional beauty appliances. Demand is also supported by the country’s strong professional salon equipment supply chain.

The United Kingdom is expected to record a CAGR of 6.7% from 2025 to 2035, supported by growing adoption of home-based beauty treatments. Retailers such as Boots, John Lewis, and LookFantastic are expanding their product ranges to include both entry-level and premium facial mask makers. Consumer demand is being influenced by time-saving features such as 5-minute mask preparation and pre-programmed skincare modes. Collaborations between device manufacturers and skincare brands are resulting in exclusive ingredient kits for use with specific machines.

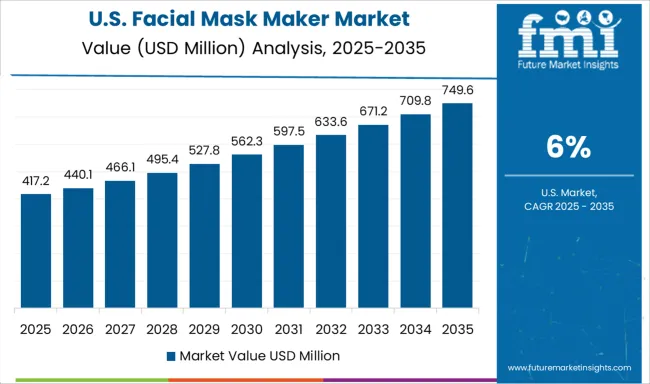

The United States is projected to grow at a CAGR of 6.0% from 2025 to 2035, driven by strong interest in tech-enabled beauty products and customization in skincare routines. Brands like Foreo, Pure Daily Care, and Vanity Planet are focusing on multifunctional devices that combine mask making with deep infusion technology. The premium segment is benefiting from wellness-focused consumers seeking spa-like treatments at home. Distribution through specialty beauty retailers such as Sephora and Ulta Beauty is expanding market reach. Subscription-based ingredient delivery models are also emerging as a way to boost recurring sales.

The market is composed of beauty device brands, skincare solution providers, and OEM/ODM manufacturers serving both consumer and professional spa segments. Gfashionstyle and BioFace Cosmetics lead with compact, user-friendly home facial mask machines designed for custom sheet masks using natural ingredients. Cimenn and COMFORTH specialize in multifunctional units integrating heating, mixing, and shaping functions for enhanced mask preparation efficiency.

Foshan Liqia Hardware Products Co., Ltd. and Shenzhen M Tide Light Co., Limited operate as key OEM producers, supplying private-label mask makers to global beauty brands and e-commerce sellers. Zhongshan Meiyigou Electronics Co., Ltd. focuses on electric facial mask devices with programmable settings, targeting mid- to high-end consumer segments. Hapilin and Lushy Skin Care offer mask makers bundled with skincare formulations, creating integrated beauty solutions for at-home spa experiences. Ilika caters to niche wellness markets by providing devices compatible with natural extracts and premium cosmetic essences, appealing to health-conscious consumers. Strategies among leading players include collaborations with skincare brands for co-branded devices, participation in beauty expos for market visibility, and offering customizable product designs to attract private-label clients. Competitive differentiation often comes from ease of use, compact form factors, and compatibility with a wide range of mask-making ingredients. Entry into this market is challenged by product safety compliance, small appliance manufacturing expertise, and the ability to build brand trust in a competitive beauty device category.

| Item | Value |

|---|---|

| Quantitative Units | USD 940.6 Million |

| Product Type | Automatic facial mask maker and Semi-automatic facial mask maker |

| Capacity | 60 - 90 ml, Below 60 ml, and Above 90ml |

| Price Range | Medium, Low, and High |

| End Use | Home use and Commercial use |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gfashionstyle, BioFace Cosmetics, Cimenn, COMFORTH, Foshan Liqia Hardware Products Co., Ltd., Hapilin, Ilika, Lushy Skin Care, Shenzhen M Tide Light Co., Limited, and Zhongshan Meiyigou Electronics Co., Ltd. |

The global facial mask maker market is estimated to be valued at USD 940.6 million in 2025.

The market size for the facial mask maker market is projected to reach USD 1,867.6 million by 2035.

The facial mask maker market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in facial mask maker market are automatic facial mask maker and semi-automatic facial mask maker.

In terms of capacity, 60 - 90 ml segment to command 51.0% share in the facial mask maker market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chelating Facial Masks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Mask Reticle Cleaning Agent Market Size and Share Forecast Outlook 2025 to 2035

Facial Serum Market Forecast and Outlook 2025 to 2035

Masking Tape Market Size and Share Forecast Outlook 2025 to 2035

Mask Bacterial Filtration Efficiency Tester Market Size and Share Forecast Outlook 2025 to 2035

Facial Care Products Market Size and Share Forecast Outlook 2025 to 2035

Facial Recognition Market Size and Share Forecast Outlook 2025 to 2035

Facial Erythema Treatment Market Size and Share Forecast Outlook 2025 to 2035

Masking Paper Market Analysis by Product Type, Basis Weight, Paper Grade, Application, End Use, and Region through 2025 to 2035

Facial Oil Market Analysis by Product Type, End User, Sales Channel and Region Through 2025 to 2035

Facial Tissue Paper Market Analysis - Trends, Growth & Forecast 2025 to 2035

Facial Steamer Market - Trends, Growth & Forecast 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Facial Tracking Solution Market by Component, Technology Type, Industry & Region Forecast till 2035

Market Share Insights of Masking Tape Providers

Market Share Distribution Among Masking Paper Manufacturers

Facial Tissue Market Growth – Size, Demand & Forecast 2024-2034

Facial Epilator Market Analysis – Size, Trends & Forecast 2024-2034

Facial Implants Market

Facial Recognition Machine Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA