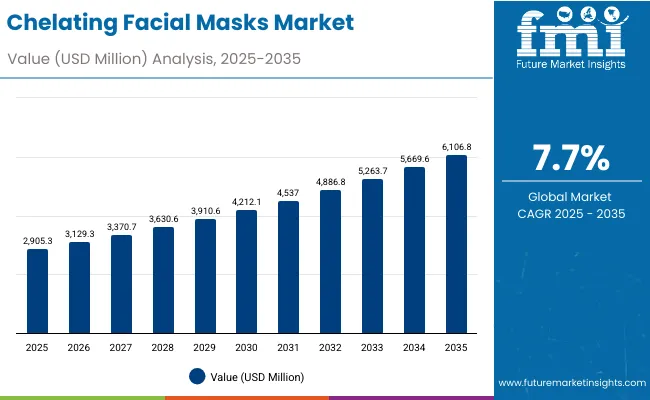

The Chelating Facial Masks Market is expected to record a valuation of USD 2,905.3 million in 2025 and USD 6,106.8 million in 2035, with an increase of USD 3,201.5 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 7.7% and a 2X increase in market size.

Chelating Facial Masks Market Key Takeaways

| Metric | Value |

|---|---|

| Chelating Facial Masks Market Estimated Value in (2025E) | USD 2,905.3 million |

| Chelating Facial Masks Market Forecast Value in (2035F) | USD 6,106.8 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,905.3 million to USD 4,212.1 million, adding USD 1,306.8 million, which accounts for 41% of the total decade growth. This phase records steady adoption in heavy-metal detox, pore purification, and brightening skincare routines, driven by the demand for formulations containing EDTA derivatives and citric acid. Gel-based chelating masks dominate this period as they cater to over 60% of applications, preferred for their ease of use and compatibility with sensitive skin.

The second half from 2030 to 2035 contributes USD 1,894.7 million, equal to 59% of total growth, as the market jumps from USD 4,212.1 million to USD 6,106.8 million. This acceleration is powered by the widespread adoption of advanced chelation complexes, AI-personalized skincare formulations, and online retail penetration in emerging economies. E-commerce platforms and specialty beauty retail chains together capture a larger share above 90% by the end of the decade. Ingredient innovation and digital engagement models add recurring brand value, increasing the premium skincare share beyond 50% in total value.

From 2020 to 2024, the Chelating Facial Masks Market expanded steadily, driven by rising demand for heavy-metal detox and anti-pollution skincare. During this period, the competitive landscape was dominated by established beauty and clean skincare brands controlling nearly 80-85% of global revenue, led by The Body Shop and L’Oréal (Kiehl’s). Competitive differentiation relied on ingredient transparency, product texture innovation, and clean-label certification, while e-commerce platforms began replacing traditional retail as primary sales drivers. Service-based personalization models had minimal traction, contributing less than 10% of total market value.

Demand for Chelating Facial Masks is projected to reach USD 2,905.3 million in 2025, with the revenue mix shifting as online and specialty beauty retail grow beyond 90% of total distribution share. Traditional offline brands now face competition from digital-first entrants offering AI-personalized skincare recommendations, subscription-based routines, and chelation-focused detox kits. Major beauty houses are pivoting to hybrid retail models, integrating virtual skin diagnostics and sustainability-driven refills to retain market relevance. The competitive edge is moving away from basic formulation innovation toward ecosystem strength, digital engagement, and recurring consumer loyalty streams.

Growing urban pollution and exposure to heavy metals have heightened consumer awareness about skin detoxification. Chelating facial masks, enriched with EDTA derivatives, citric acid, and phytic acid, effectively remove impurities and pollutants that regular cleansers cannot. This performance-driven positioning is drawing dermatological endorsement and mass-market adoption, particularly among urban millennials and professional women. The anti-pollution skincare trend is also prompting premium brands to launch chelating formulations marketed as "deep detox" and "pore-cleansing therapy," accelerating global market expansion.

The surge in digital beauty retail channels and consumer demand for ingredient transparency are fueling the chelating facial masks market. E-commerce platforms have widened access to premium and niche skincare brands offering clean, vegan, and chelation-based solutions. Consumers increasingly seek scientifically backed formulations that emphasize visible results, authenticity, and eco-conscious sourcing. As influencer-driven marketing and AI-based skin diagnostics gain traction, brands integrating digital personalization and sustainable packaging are witnessing faster adoption rates, driving long-term growth across major markets in Asia-Pacific and North America.

The Chelating Facial Masks Market is segmented by product type, key ingredients, function, distribution channel, end user, and region. By product type, the market includes clay-based chelating masks, gel masks, sheet masks, and peel-off masks, catering to varied skin types and detox needs. Based on key ingredients, it is categorized into EDTA derivatives, citric acid, phytic acid, and lactic acid, which function as active chelating agents for removing heavy metals and impurities. By function, the market is divided into heavy-metal detox, pore purification, and skin brightening, addressing preventive and restorative skincare demands.

Distribution channels include e-commerce, pharmacies/drugstores, specialty beauty retail, and spas & salons, reflecting a balanced mix of online and offline sales. End-user segmentation comprises women, men, and unisex consumers, highlighting broad adoption across demographics. Regionally, the market covers North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with China and India emerging as the fastest-growing markets.

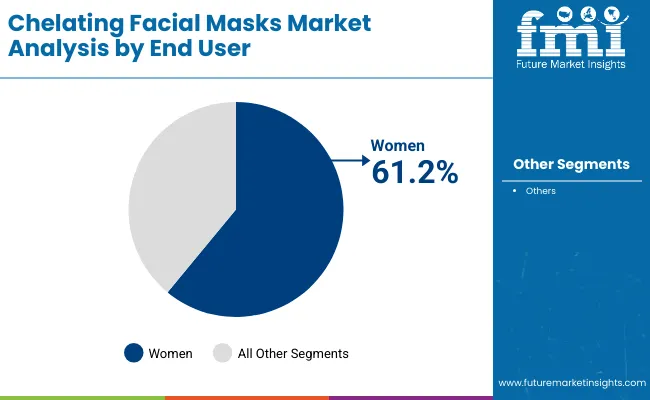

| End User | Value Share% 2025 |

|---|---|

| Women | 61.2% |

| Others | 38.8% |

The women’s segment is projected to contribute the largest share of the Chelating Facial Masks Market revenue in 2025, maintaining its lead as the dominant end-user category. This growth is driven by the increasing awareness among female consumers regarding heavy-metal detoxification, skin protection from pollution, and the use of clean beauty formulations. Women are also more inclined toward consistent skincare routines, favoring gel and clay-based chelating masks enriched with EDTA and citric acid.

The segment’s expansion is further supported by the rising influence of beauty influencers, dermatologists, and digital skincare platforms promoting tailored detox solutions. With increasing purchasing power and the preference for high-performance, ingredient-transparent formulations, the women’s category is expected to remain the primary driver of market demand through 2035.

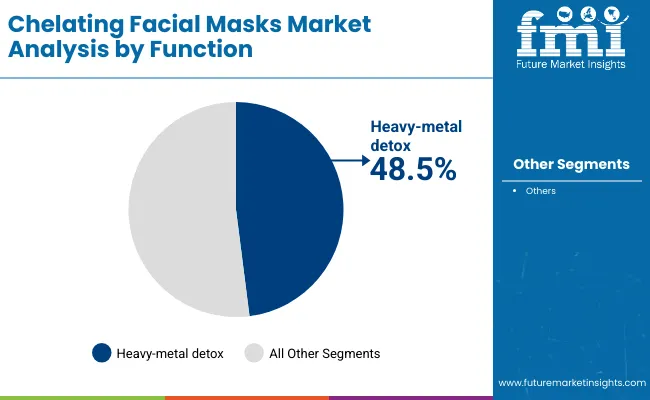

| Function | Value Share% 2025 |

|---|---|

| Heavy-metal detox | 48.5% |

| Others | 51.5% |

The heavy-metal detox segment is forecasted to hold the largest share of the Chelating Facial Masks Market in 2025, driven by its efficacy in removing environmental toxins, pollutants, and heavy metal residues from the skin. These formulations are increasingly preferred by urban consumers exposed to industrial and vehicular pollution. Products containing EDTA derivatives and citric acid have gained strong traction due to their proven ability to bind and neutralize harmful ions.

The segment’s growth is also fueled by rising dermatological endorsements and the shift toward preventive skincare routines that emphasize long-term skin health. As awareness regarding detoxification and anti-pollution skincare expands globally, heavy-metal detox formulations are expected to maintain dominance throughout the forecast period.

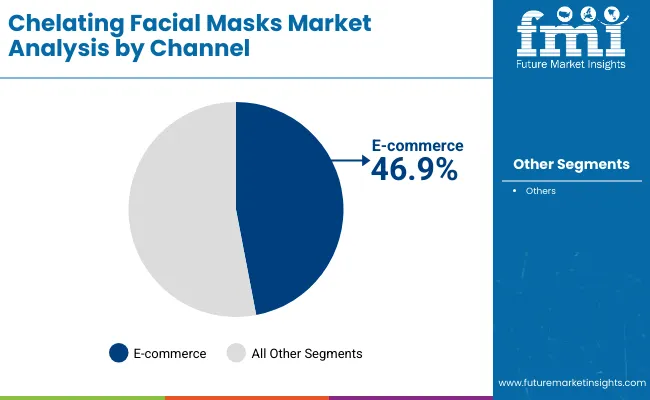

| Channel | Value Share% 2025 |

|---|---|

| E-commerce | 46.9% |

| Others | 53.1% |

The e-commerce segment is projected to account for a significant share of the Chelating Facial Masks Market revenue in 2025, establishing it as the leading distribution channel. This dominance is driven by the rapid growth of online beauty retail, convenience of home delivery, and easy access to product comparisons and reviews. E-commerce platforms such as Amazon, Sephora, and brand-owned websites have become primary channels for skincare purchases, supported by influencer marketing and personalized recommendations.

Subscription models and AI-driven skin analysis tools are further enhancing consumer engagement and repeat purchases. As digital adoption and mobile commerce continue to expand, e-commerce is expected to remain the key driver of sales and brand visibility in the Chelating Facial Masks Market throughout the forecast period.

Rising Awareness of Heavy-Metal Detoxification in Skincare

Consumer awareness of skin exposure to environmental pollutants, heavy metals, and particulate matter is driving the adoption of chelating facial masks. These formulations, infused with ingredients like EDTA derivatives, citric acid, and phytic acid, effectively neutralize and remove metal ions that accelerate aging and dullness. As dermatologists emphasize detoxification and urban wellness, consumers are increasingly turning to chelation-based products for preventive skin health. The growing demand for clinically backed, clean-label, and anti-pollution skincare solutions is strengthening the market’s premiumization trend, particularly across Asia-Pacific and North America.

Growing Penetration of Premium and Clean Beauty Brands

The expansion of clean beauty brands emphasizing transparency, sustainability, and non-toxic formulations is a major growth catalyst for the chelating facial masks market. Consumers are increasingly scrutinizing ingredient lists and preferring products with scientifically validated detox agents that promise visible results. Premium skincare brands such as L’Oréal, The Body Shop, and Paula’s Choice are incorporating advanced chelating technologies in their facial masks to enhance consumer trust and brand loyalty. This shift toward "clean science" formulations, coupled with ethical sourcing and eco-friendly packaging, continues to redefine consumer expectations and drive consistent category growth.

Limited Consumer Awareness and Misconception of Chelating Benefits

Despite its efficacy, the chelating facial masks segment faces challenges due to limited consumer understanding of how chelating agents work. Many buyers still associate detox skincare with exfoliation or clay-based cleansing rather than metal ion removal. This knowledge gap restricts adoption in emerging markets, where ingredient education remains low. Additionally, misconceptions about the chemical composition of chelating ingredients can create skepticism among natural skincare consumers. As a result, brands must invest heavily in consumer education, dermatological endorsements, and clear labeling to overcome awareness-related barriers and unlock wider acceptance.

Integration of AI and Personalization in Skincare Formulation

Artificial intelligence is reshaping how consumers interact with skincare, and the chelating facial masks market is aligning with this trend. Leading brands are deploying AI-driven skin diagnostic tools to recommend personalized detox solutions based on pollution exposure, skin pH, and sensitivity. Digital platforms now leverage data analytics to tailor product suggestions and track skin progress, enhancing long-term engagement. This hyper-personalized approach, combined with subscription-based delivery and virtual consultations, is transforming chelating facial masks from generic skincare products into data-driven wellness solutions, appealing to tech-savvy, urban, and health-conscious consumers worldwide.

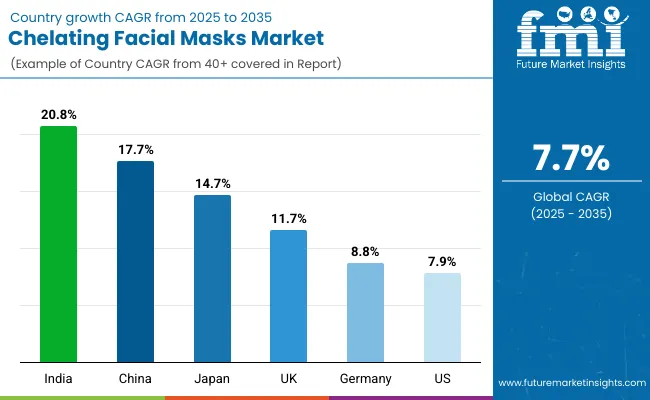

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 17.7% |

| USA | 7.9% |

| India | 20.8% |

| UK | 11.7% |

| Germany | 8.8% |

| Japan | 14.7% |

The global Chelating Facial Masks Market shows strong geographic variation in adoption and growth, shaped by consumer awareness, skincare innovation, and retail modernization. Asia-Pacific is the fastest-growing region, led by India (20.8%) and China (17.7%), fueled by rising disposable incomes, urban pollution exposure, and growing demand for detox and anti-pollution skincare.

China’s dominance stems from its advanced beauty manufacturing ecosystem, local ingredient sourcing, and strong online retail infrastructure. India’s growth is driven by clean beauty adoption, influencer-driven awareness, and expansion of premium skincare retail. Japan (14.7%) benefits from scientific skincare innovation and strong consumer trust in dermatological formulations. Europe demonstrates steady progress, led by the UK (11.7%) and Germany (8.8%), supported by eco-conscious consumers, sustainable ingredient demand, and stringent product safety standards.

Meanwhile, the USA (7.9%) shows moderate but stable growth, reflecting high market maturity and premiumization trends focused on multifunctional detox masks. Collectively, Asia-Pacific’s youthful consumer base and e-commerce strength position it as the global growth engine for chelating facial masks through 2035.

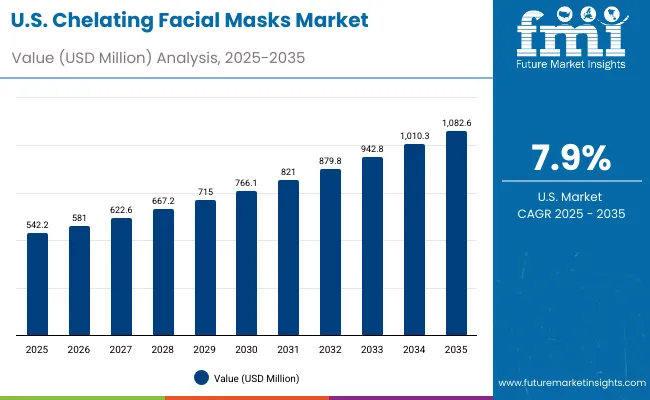

| Year | USA Chelating Facial Masks Market (USD Million) |

|---|---|

| 2025 | 542.2 |

| 2026 | 581.0 |

| 2027 | 622.6 |

| 2028 | 667.2 |

| 2029 | 715.0 |

| 2030 | 766.1 |

| 2031 | 821.0 |

| 2032 | 879.8 |

| 2033 | 942.8 |

| 2034 | 1010.3 |

| 2035 | 1082.6 |

The Chelating Facial Masks Market in the United States is projected to grow at a CAGR of 7.9%, driven by heightened consumer interest in detoxifying and pollution-protective skincare. The increasing prevalence of urban pollution and exposure to heavy metals has encouraged dermatologists and premium skincare brands to promote chelation-based formulations that deeply cleanse and restore skin balance. Product innovation integrating EDTA and citric acid complexes has enhanced the appeal of both clay and gel-based masks. The rise of clean beauty, e-commerce sales, and dermatology-endorsed routines has amplified category awareness.

The Chelating Facial Masks Market in the United Kingdom is expected to grow at a CAGR of 11.7%, supported by increasing demand for clean, sustainable, and high-performance skincare products. British consumers are becoming more aware of the impact of pollution and environmental toxins on skin health, prompting a surge in adoption of detoxifying and anti-pollution skincare routines. Premium brands are introducing chelating-based facial masks enriched with ingredients such as EDTA, phytic acid, and citric acid to cater to urban consumers seeking visible results and safety assurance. The rise of dermatology-led skincare, influencer-backed product launches, and the expansion of online beauty retail are accelerating adoption.

India is witnessing rapid growth in the Chelating Facial Masks Market, which is forecast to expand at a CAGR of 20.8% through 2035. The surge in demand is being driven by rising urban pollution levels, expanding beauty consciousness, and the growing influence of digital skincare trends. Consumers in both metropolitan and tier-2 cities are increasingly adopting chelating-based detox masks containing ingredients such as EDTA, citric acid, and phytic acid to combat environmental stressors and improve skin clarity. Local and international brands are launching cost-effective formulations tailored to India’s humid climate and diverse skin types.

The Chelating Facial Masks Market in China is expected to grow at a CAGR of 17.7%, the highest among leading economies, driven by rapid urbanization, rising skincare awareness, and strong domestic brand innovation. Chinese consumers are increasingly adopting chelating-based detox and anti-pollution masks to combat skin damage caused by industrial emissions and urban smog. Domestic brands are introducing affordable yet high-efficacy formulations using EDTA derivatives and lactic acid, while international brands focus on premium positioning and clean-label certifications. E-commerce giants like Tmall and JD.com have amplified accessibility through targeted marketing and influencer collaborations.

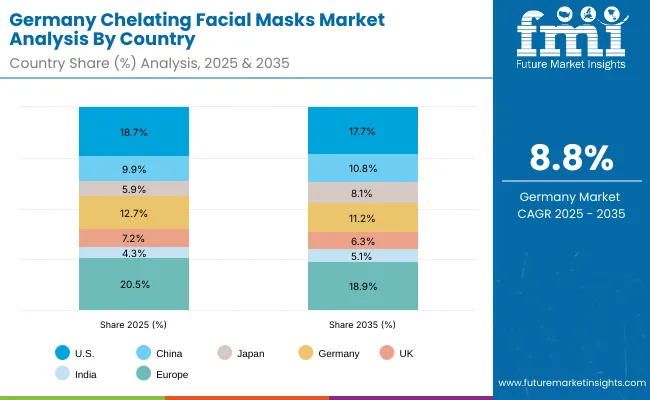

| Countries | 2025 Share (%) |

|---|---|

| USA | 18.7% |

| China | 9.9% |

| Japan | 5.9% |

| Germany | 12.7% |

| UK | 7.2% |

| India | 4.3% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.7% |

| China | 10.8% |

| Japan | 8.1% |

| Germany | 11.2% |

| UK | 6.3% |

| India | 5.1% |

The Chelating Facial Masks Market in Germany is projected to grow at a CAGR of 8.8%, reflecting stable demand in a mature yet innovation-driven skincare landscape. German consumers show a high preference for dermatologist-tested, clinically proven, and fragrance-free detox masks, aligning with the country’s emphasis on scientific skincare and ingredient integrity. Local brands and pharmacies are expanding their chelation-based product lines, focusing on phytic acid and citric acid formulations that cater to sensitive skin. The regulatory alignment with EU cosmetic standards continues to favor brands emphasizing safety, transparency, and sustainability. Clean beauty stores and pharmacy chains such as dm and Rossmann dominate distribution, while online channels are rapidly expanding due to digital adoption among younger consumers.

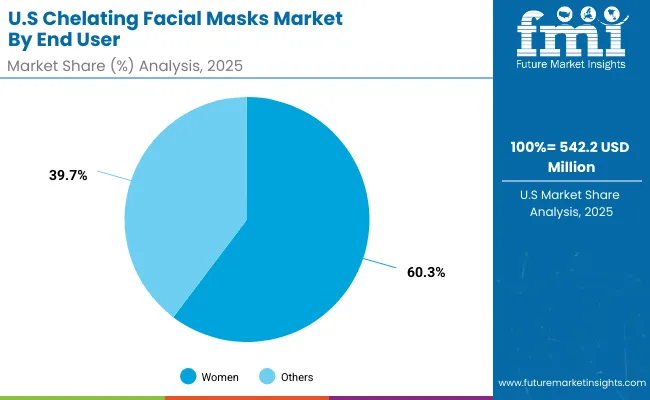

| USA by End User | Value Share% 2025 |

|---|---|

| Women | 60.3% |

| Others | 39.7% |

The Chelating Facial Masks Market in the United States is projected to reach USD 542.2 million in 2025, with women contributing the majority share at 60.3%. This dominance reflects heightened awareness of anti-pollution skincare, detoxification treatments, and clean beauty formulations. Premium brands are increasingly introducing chelating-based facial masks with ingredients such as EDTA, lactic acid, and citric acid, aligning with dermatology-backed claims for toxin removal and skin clarity. The market is witnessing a transition toward digitally personalized skincare solutions, supported by AI-based skin analysis tools and subscription models. E-commerce continues to serve as the primary growth channel, with online-exclusive launches and influencer collaborations shaping consumer engagement.

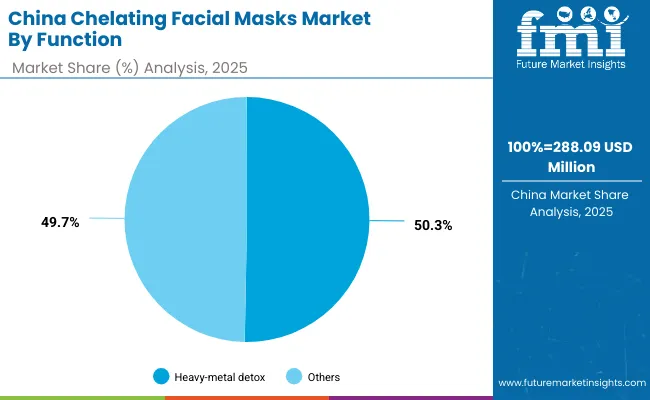

| China by Function | Value Share% 2025 |

|---|---|

| Heavy-metal detox | 50.3% |

| Others | 49.7% |

The Chelating Facial Masks Market in China presents strong growth opportunities, valued at USD 288.09 million in 2025, with heavy-metal detox formulations holding a slight edge at 50.3%. The market’s rapid expansion is fueled by worsening urban air quality, rising skincare awareness, and the growing preference for scientifically formulated detox products. Local manufacturers are leveraging chelation technologies using EDTA and phytic acid to address metal ion accumulation caused by pollution and water contamination. International brands are investing in localized formulations suited for Asian skin types, emphasizing safety, hydration, and environmental protection. As digital beauty ecosystems expand through Tmall, JD.com, and Douyin, personalized marketing and influencer-driven campaigns are accelerating adoption among younger demographics.

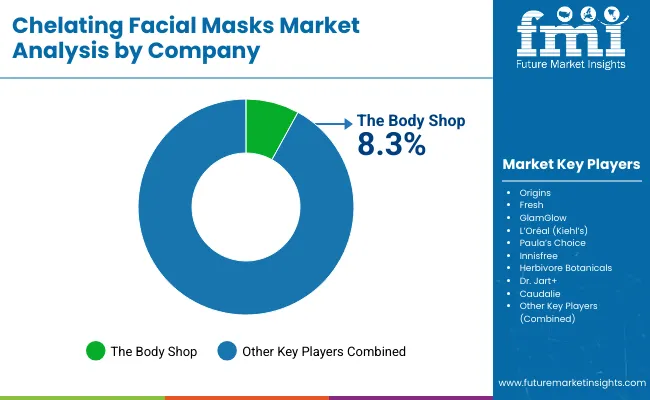

The Chelating Facial Masks Market is moderately fragmented, featuring a blend of global beauty leaders, mid-tier innovators, and emerging clean-beauty brands competing across varied consumer segments. Global skincare leaders such as The Body Shop, L’Oréal (Kiehl’s), and Fresh hold notable shares, driven by strong brand recognition, dermatologically tested formulations, and clean-label positioning. Their strategies emphasize detox-based skincare innovation, eco-friendly packaging, and omnichannel retail integration.

Mid-sized brands such as Paula’s Choice, Innisfree, and GlamGlow are focusing on ingredient transparency, vegan formulations, and digital engagement through influencer marketing. They have effectively penetrated premium and mass-market categories by combining chelating actives like EDTA and phytic acid with hydration-based ingredients for visible detox results.

Niche clean-beauty players such as Herbivore Botanicals and Dr. Jart+ target specialized consumer segments seeking minimalist formulations, cruelty-free certification, and sensitive-skin compatibility. Their agility in product customization and e-commerce presence gives them a competitive edge in Asia-Pacific and North American markets.

Competitive differentiation is shifting from conventional skincare claims toward holistic detox, AI-personalized skincare experiences, and sustainability-driven branding. As digital retail ecosystems mature, partnerships with dermatologists, tech-based skincare platforms, and clean beauty influencers are becoming core growth enablers for long-term market leadership. Competitive differentiation is shifting away from hardware specifications toward integrated ecosystems that include predictive analytics, AR/VR-enabled visualization, and subscription-based service models.

Key Developments in Chelating Facial Masks Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,905.3 Million |

| Product Type | Clay-based chelating masks, Gel masks, Sheet masks, Peel-off masks. |

| Key Ingredients | EDTA derivatives, Citric acid, Phytic acid, Lactic acid. |

| Function | Heavy-metal detox, Pore purification, Skin brightening. |

| Channel | E-commerce, Pharmacies/drugstores, Specialty beauty retail, Spas & salons. |

| End User | Women, Men, Unisex. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Body Shop, Origins, Fresh, GlamGlow, L’Oréal (Kiehl’s), Paula’s Choice, Innisfree, Herbivore Botanicals, Dr. Jart+, Caudalie. |

| Additional Attributes | Dollar sales by mask type and end-use consumer group, adoption trends in detox and anti-pollution skincare, rising demand for gel-based and clay-based chelating masks, segment-specific growth in women’s skincare, premium beauty, and dermatology-backed product lines, ingredient-based revenue segmentation featuring EDTA derivatives, citric acid, phytic acid, and lactic acid, integration with AI-driven skin diagnostics and personalized skincare technologies, regional trends influenced by pollution awareness and clean beauty movements, and innovations in chelation chemistry, skin barrier repair, and pollution-neutralizing formulations. |

The global Chelating Facial Masks Market is estimated to be valued at USD 2,905.3 million in 2025.

The market size for the Chelating Facial Masks Market is projected to reach USD 6,106.8 million by 2035.

The Chelating Facial Masks Market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in the Chelating Facial Masks Market are clay-based chelating masks, gel masks, sheet masks, and peel-off masks.

In terms of function, the heavy-metal detox segment is expected to command a significant share in the Chelating Facial Masks Market in 2025, driven by growing demand for anti-pollution skincare and detoxifying formulations enriched with EDTA and citric acid.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Facial Serum Market Forecast and Outlook 2025 to 2035

Chelating / Sequestering Agents Market Size and Share Forecast Outlook 2025 to 2035

Facial Care Products Market Size and Share Forecast Outlook 2025 to 2035

Facial Recognition Market Size and Share Forecast Outlook 2025 to 2035

Facial Mask Maker Market Size and Share Forecast Outlook 2025 to 2035

Facial Erythema Treatment Market Size and Share Forecast Outlook 2025 to 2035

Chelating Agent Market Growth & Forecast 2025 to 2035

Facial Oil Market Analysis by Product Type, End User, Sales Channel and Region Through 2025 to 2035

Facial Tissue Paper Market Analysis - Trends, Growth & Forecast 2025 to 2035

Facial Steamer Market - Trends, Growth & Forecast 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Facial Tracking Solution Market by Component, Technology Type, Industry & Region Forecast till 2035

Facial Tissue Market Growth – Size, Demand & Forecast 2024-2034

Facial Epilator Market Analysis – Size, Trends & Forecast 2024-2034

Facial Implants Market

Facial Recognition Machine Market

Bifacial Solar Module Market Size and Share Forecast Outlook 2025 to 2035

Craniofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

ETCO2 masks market

Electric Facial Cleansing Brush Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA