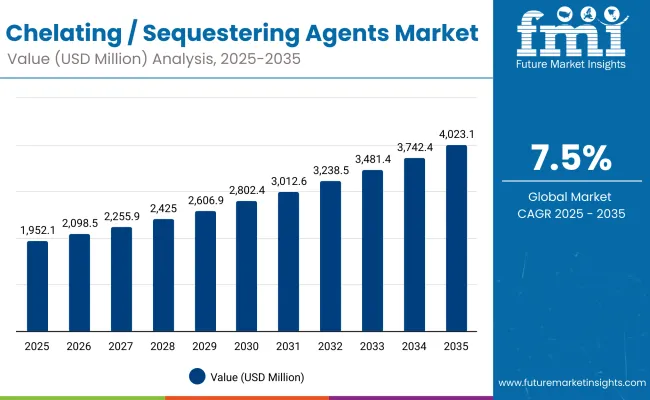

The Chelating / Sequestering Agents Market is expected to record a valuation of USD 1,952.1 million in 2025 and USD 4,023.1 million in 2035, with an increase of USD 2,071 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 7.5% and a 2X increase in market size.

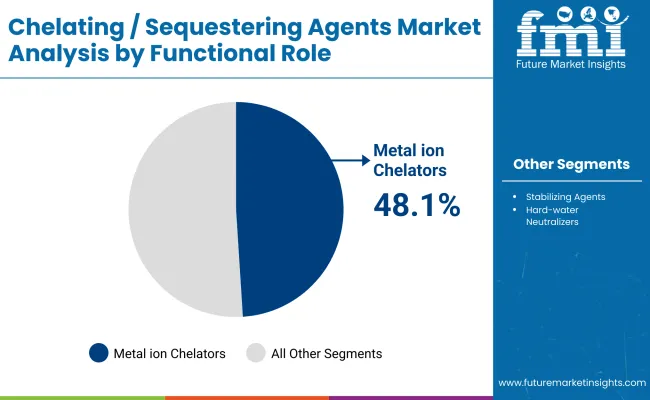

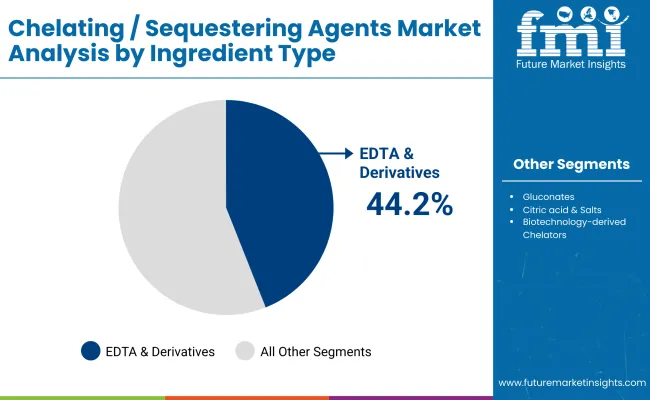

During the first five-year period from 2025 to 2030, the market increases from USD 1,952.1 million to USD 2,802.4 million, adding USD 850.3 million, which accounts for 41% of the total decade growth. This phase records steady adoption in personal care manufacturing, premium cosmetics, and dermocosmetic products, driven by the rising demand for metal ion chelators, which capture 48.1% share in 2025. EDTA & derivatives dominate ingredient usage, representing 44.2% of sales by 2025.

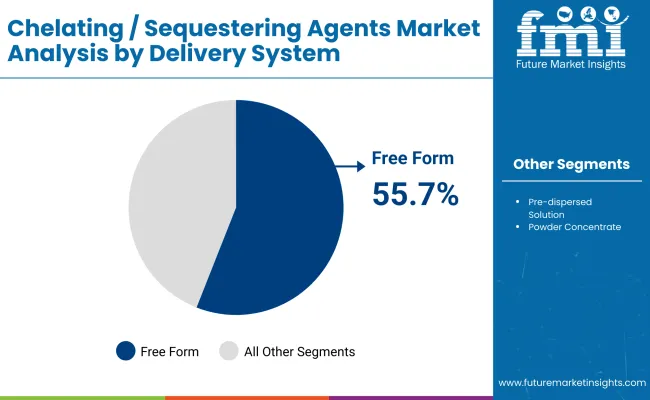

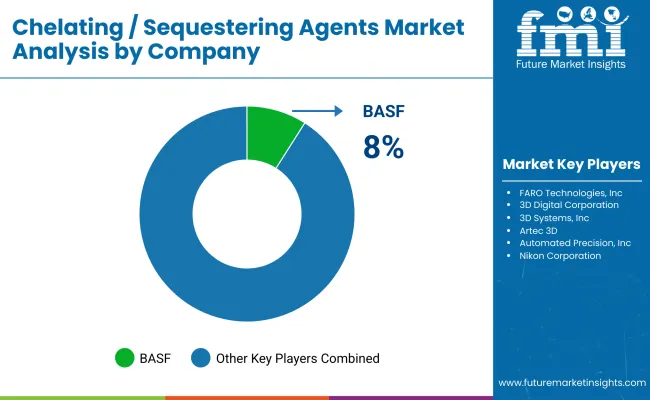

The second half from 2030 to 2035 contributes USD 1,220.7 million, equal to 59% of total growth, as the market jumps from USD 2,802.4 million to USD 4,023.1 million. This acceleration is powered by strong demand in Asia-Pacific, particularly India (14.1% CAGR) and China (12.5% CAGR), alongside Europe’s stable expansion. Biotechnology-derived chelators and sustainable alternatives gain traction, while free form delivery systems retain dominance with 55.7% share in 2025. BASF remains the leading global player with 8% share in 2025, though the market remains fragmented with 92% split among other manufacturers.

Chelating / Sequestering Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Chelating / Sequestering Agents Market Estimated Value in (2025E) | USD 1,952.1 million |

| Chelating / Sequestering Agents Market Forecast Value in (2035F) | USD 4,023.1 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

From 2020 to 2024, the Chelating / Sequestering Agents Market grew steadily on the back of rising adoption in personal care, skin care, and household formulations, with demand concentrated in traditional chelators such as EDTA and citric acid & salts. During this period, suppliers of synthetic ingredients held the majority of revenue, while biotechnology-derived chelators accounted for a niche but emerging share. Differentiation was largely based on cost efficiency, stability, and formulation compatibility, with sustainable and bio-based options only beginning to surface in specialty cosmetics.

Looking forward, demand will expand to USD 1,952.1 million in 2025, and the revenue mix will shift significantly toward sustainable and biotechnology-derived chelators. By 2035, the market will more than double, driven by regulatory pressure on persistent compounds, consumer preference for clean-label products, and growth in Asia-Pacific markets. Traditional leaders such as BASF, Dow, and Evonikare pivoting toward greener portfolios, investing in biotechnology-based formulations, circular chemistry, and eco-certifications to remain competitive. Emerging players with strong sustainability credentials and COSMOS / ECOCERT-compliant solutions are gaining share. Competitive advantage is moving away from commodity chelators toward portfolio diversity, eco-compliance, and integration into premium personal care formulations.

Growth in the market is being accelerated by the transition from synthetic chelators like EDTA toward biotechnology-derived and eco-certified alternatives. Regulatory restrictions on non-biodegradable agents in Europe and increasing consumer preference for clean-label cosmetics are pushing formulators to adopt natural and biodegradable chelators such as gluconates and bio-based citric salts. This creates new opportunities for companies innovating in sustainable chemistry, especially within premium personal care and dermocosmetic applications where eco-compliance is becoming a market differentiator.

The market is also benefiting from the rapid expansion of premium and dermocosmetic product lines, which demand advanced chelators for enhanced stability, efficacy, and compatibility with sensitive-skin formulations. Chelating agents are being increasingly incorporated in anti-aging serums, high-performance sunscreens, and microbiome-focused products to prevent metal ion interference and oxidative degradation. This premiumization trend is particularly strong in Asia-Pacific and Europe, where consumer spending on advanced skin and hair care solutions is fueling higher-value adoption of chelating/sequestering agents.

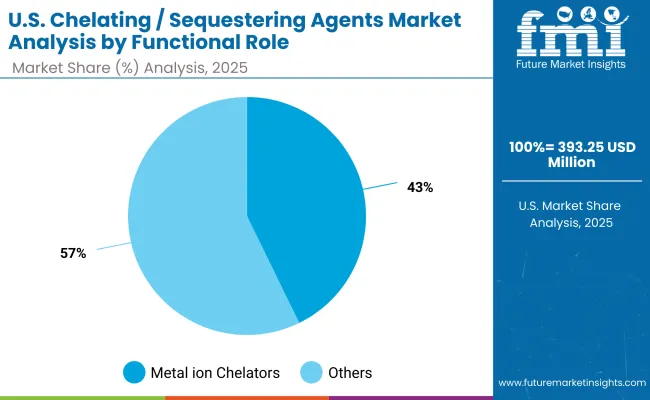

The Chelating / Sequestering Agents Market is segmented by functional role, ingredient type, delivery system, physical form, application, end use, and region. By functional role, the market includes metal ion chelators, stabilizing agents, and hard-water neutralizers, each supporting stability and efficacy in formulations. Ingredient segmentation covers EDTA & derivatives, gluconates, citric acid & salts, and biotechnology-derived chelators, reflecting both traditional and sustainable options. Delivery systems include free form, pre-dispersed solutions, and powder concentrates, while physical forms span solutions/concentrates, powders, and granules. Applications are concentrated in skin care, hair care, bath & shower formulations, and color cosmetics, with end uses in personal care manufacturing, premium cosmetics, and dermocosmetic products. Regionally, the market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with strong growth led by India, China, and Japan.

| Functional Role | Value Share % 2025 |

|---|---|

| Metal ion chelators | 48.1% |

| Others | 51.9% |

The metal ion chelators segment is projected to contribute 48.1% of the Chelating / Sequestering Agents Market revenue in 2025, maintaining its lead as the dominant functional category. This growth is driven by their essential role in stabilizing cosmetic and personal care formulations, preventing metal ion -induced degradation, and enhancing product efficacy. Their broad compatibility across skin care, hair care, and dermocosmetic products ensures consistent adoption.

The segment’s strength is also supported by regulatory-driven demand for effective yet safe alternatives, especially as consumers favor formulations free of contaminants and oxidative instability. With rising applications in premium cosmetics and biotechnology-enhanced formulations, metal ion chelators are expected to remain the backbone of the Chelating / Sequestering Agents Market throughout the forecast period.

| Ingredient Type | Value Share % 2025 |

|---|---|

| EDTA & derivatives | 44.2% |

| Others | 55.8% |

The EDTA & derivatives segment is forecasted to hold 44.2% of the Chelating / Sequestering Agents Market share in 2025, led by its long-standing use as an efficient and cost-effective chelating agent. EDTA’s ability to bind metal ions, stabilize formulations, and extend shelf life has made it a staple across skin care, hair care, and bath & shower products. Its proven compatibility with diverse cosmetic formulations continues to secure its strong presence.

The segment’s growth is reinforced by widespread acceptance in both mass-market and premium personal care products, where consistent performance and regulatory familiarity drive adoption. At the same time, companies are investing in modified EDTA derivatives to reduce environmental persistence, ensuring compliance with tightening sustainability regulations. As a result, EDTA & derivatives are expected to retain their leadership role in the ingredient mix of chelating/sequestering agents, even as natural and biotechnology-based alternatives gain traction.

| Delivery System | Value Share % 2025 |

|---|---|

| Free form | 55.7% |

| Others | 44.3% |

The free form delivery system segment is projected to account for 55.7% of the Chelating / Sequestering Agents Market revenue in 2025, establishing it as the leading format. Free form chelators are widely favored for their flexibility in blending with diverse formulations, enabling ease of use in skin care, hair care, and bath & shower products. Their direct incorporation without additional processing steps ensures cost efficiency for manufacturers while supporting high-volume production.

The segment’s growth is further supported by increasing demand from premium and dermocosmetic brands that prioritize ingredient transparency and clean-label positioning. Free form delivery enables consistent dosing and predictable performance, which is critical for products requiring stability and precision. As cosmetic and personal care manufacturers accelerate new product launches, free form delivery systems are expected to retain their leadership due to their adaptability, cost-effectiveness, and broad formulation compatibility.

Rising equipment costs and data complexity challenge Chelating / Sequestering Agents adoption, even as Rising demand in premium cosmetics and dermocosmetics

The increasing adoption of high-performance cosmetics and dermocosmetic products is driving the demand for chelating agents. These ingredients prevent metal ion interference, enhance product stability, and improve the efficacy of active formulations, particularly in anti-aging serums, sunscreens, and skin microbiome-focused lines. Premium brands in Europe and Asia-Pacific are emphasizing chelator-enabled formulations to differentiate on product longevity and safety. As consumer spending rises on advanced personal care, chelating agents will play a central role in ensuring performance, fueling market growth across both premium and mass-market channels.

Transition toward eco-friendly and bio-based chelators

Regulatory restrictions on persistent compounds such as conventional EDTA are prompting the shift toward biodegradable and biotechnology-derived chelating agents. Consumers are increasingly seeking clean-label, sustainable, and eco-certified formulations, creating opportunities for gluconates, citric acid, and next-generation biobasedchelators. Multinationals are investing in green chemistry platforms and partnering with biotech startups to deliver effective alternatives that meet performance standards while reducing environmental footprint. This transition not only addresses compliance requirements but also enhances brand positioning, making eco-friendly chelators a major growth driver in both developed and emerging personal care markets.

Regulatory scrutiny on conventional chelators

A key restraint for the market is the tightening of regulatory norms concerning non-biodegradable chelating agents, particularly EDTA and its derivatives. These agents, while effective and cost-efficient, are under increasing scrutiny for their persistence in wastewater and potential environmental accumulation. In regions such as the EU, clean-label and eco-compliance requirements are intensifying pressure on formulators to limit or reformulate with alternatives. This creates added costs for manufacturers, particularly those dependent on legacy formulations, and could slow adoption where cost-sensitive consumer bases dominate, thereby restraining overall growth momentum.

Integration into multifunctional clean-label formulationsAn emerging trend is the integration of chelating agents into multifunctional cosmetic and personal care products that emphasize clean-label, vegan, and natural claims. Brands are using chelators not only to stabilize formulations but also to enhance consumer-perceived product safety and compatibility with sensitive skin. In premium skin care, chelators are being positioned alongside antioxidants, hyaluronic acid, and microbiome-balancing actives as part of holistic formulations. This aligns with consumer demand for fewer but higher-quality products. As multifunctionality becomes central to new launches, chelators are gaining visibility as indispensable supporting ingredients.

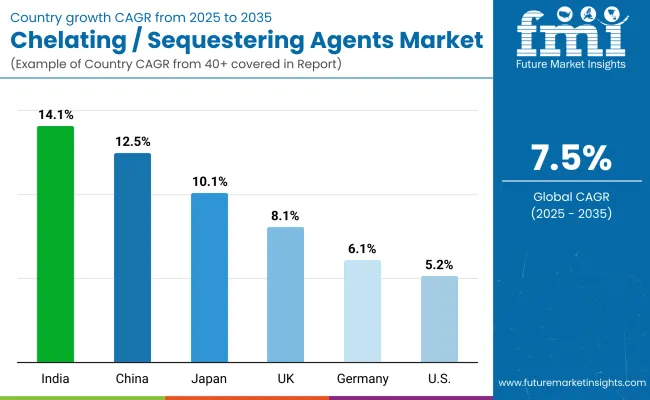

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.5% |

| USA | 5.2% |

| India | 14.1% |

| UK | 8.1% |

| Germany | 6.1% |

| Japan | 10.1% |

The global Chelating / Sequestering Agents Market shows strong regional variation, shaped by regulatory frameworks, consumer demand patterns, and industrial formulation practices. Asia-Pacific leads the growth trajectory, anchored by India (14.1% CAGR) and China (12.5% CAGR), driven by rapid expansion in personal care manufacturing, rising demand for premium cosmetics, and a shift toward eco-friendly ingredients. India benefits from strong domestic consumption and export-oriented cosmetic production, while China’s market growth is propelled by regulatory encouragement of sustainable and biodegradable raw materials.

Europe maintains a solid growth profile, with the UK (8.1% CAGR) and Germany (6.1% CAGR) supported by stricter compliance with sustainability standards and clean-label mandates. Regulatory frameworks under the EU drive adoption of bio-based alternatives and innovation in gluconates and citric acid chelators. Japan (10.1% CAGR) demonstrates robust demand for dermocosmetic and sensitive-skin formulations, reflecting consumer preference for biotech-driven ingredients. In contrast, the USA (5.2% CAGR) shows steadier growth due to market maturity, with gradual shifts toward biotechnology-derived chelators driven by clean-label positioning and premium product launches.

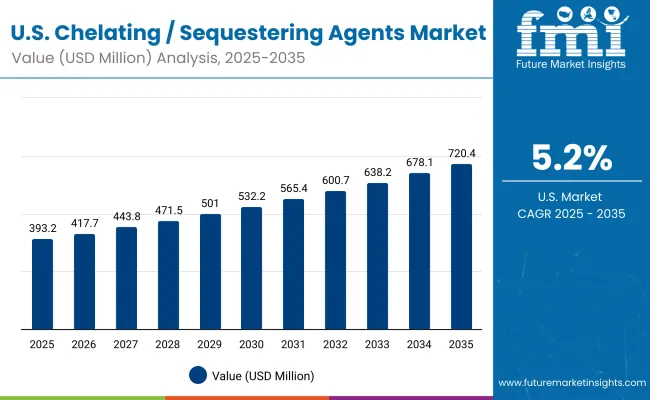

| Year | USA Chelating / Sequestering Agents Market (USD Million) |

|---|---|

| 2025 | 393.25 |

| 2026 | 417.79 |

| 2027 | 443.87 |

| 2028 | 471.57 |

| 2029 | 501.00 |

| 2030 | 532.26 |

| 2031 | 565.48 |

| 2032 | 600.77 |

| 2033 | 638.26 |

| 2034 | 678.09 |

| 2035 | 720.41 |

The Chelating / Sequestering Agents Market in the United States is projected to grow at a CAGR of 5.2% (2025 -2035), driven by rising demand for safe, stable, and multifunctional cosmetic formulations. Regulatory compliance with FDA standards and heightened consumer focus on clean-label claims are prompting manufacturers to adopt chelators to ensure product stability and safety. The use of metal ion chelators is especially strong in hair care and skin care categories, where preventing oxidative damage is critical. Premium brands are reformulating with biodegradable and eco-friendly alternatives, further expanding market opportunities.

The Chelating / Sequestering Agents Market in the United Kingdom is expected to grow at a CAGR of 8.1% (2025 -2035), supported by rising adoption in premium cosmetics, dermocosmetic formulations, and clean-label personal care products. Consumer demand for transparency and eco-certified products is fueling the replacement of traditional EDTA with citric acid, gluconates, and biotechnology-derived chelators. Multinational and regional brands are leveraging these agents to enhance formulation stability, prevent oxidative degradation, and meet EU/UK regulatory standards on sustainability. Academic collaboration and innovation funding for green chemistry are further encouraging new product development, strengthening the UK’s role as a hub for clean-label beauty innovations.

India is witnessing rapid growth in the Chelating / Sequestering Agents Market, which is forecast to expand at a CAGR of 14.1% through 2035, the highest among key countries. Strong demand is being driven by the booming personal care and cosmetics sector, where both multinational and domestic brands are expanding production facilities to meet rising consumer spending. MSMEs and tier-2 city manufacturers are increasingly adopting chelating agents to improve formulation stability and product quality in affordable skincare and hair care lines. The regulatory environment is also evolving, with greater emphasis on eco-friendly and biodegradable chelators, pushing companies to transition away from legacy EDTA-based solutions.

The Chelating / Sequestering Agents Market in China is expected to grow at a CAGR of 12.5% (2025 -2035), one of the fastest among major economies. Growth is driven by strong expansion in the cosmetics and personal care industry, where chelators are vital for stabilizing advanced skin care and color cosmetic formulations. Domestic manufacturers are rapidly scaling production, while international brands are localizing clean-label product lines to align with consumer preference for safe, eco-friendly ingredients. Government initiatives promoting sustainable chemistry and stricter cosmetic safety standards are accelerating the shift toward biodegradable and biotechnology-derived chelators, creating opportunities for both local and global suppliers.

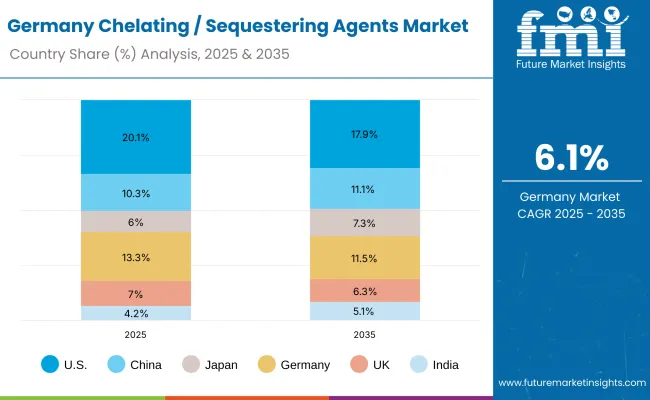

| Country | 2025 Share (%) |

|---|---|

| USA | 20.1% |

| China | 10.3% |

| Japan | 6.0% |

| Germany | 13.3% |

| UK | 7.0% |

| India | 4.2% |

| Country | 2035 Share (%) |

|---|---|

| USA | 17.9% |

| China | 11.1% |

| Japan | 7.3% |

| Germany | 11.5% |

| UK | 6.3% |

| India | 5.1% |

The Chelating / Sequestering Agents Market in Germany is projected to grow at a CAGR of 6.1% (2025 -2035), supported by its role as a hub for high-quality personal care and cosmetics manufacturing. German formulators are increasingly integrating chelating agents into dermocosmetic products and premium skin care lines, ensuring stability, safety, and compliance with strict EU regulatory standards. A strong push toward biodegradable and eco-certified chelators is accelerating, with citric acid, gluconates, and biotechnology-based solutions gaining traction as replacements for EDTA. Germany’s leadership in green chemistry innovation and its emphasis on clean-label positioning are further strengthening adoption.

| USA By Functional Role | Value Share % 2025 |

|---|---|

| Metal ion chelators | 42.8% |

| Others | 57.2% |

The Chelating / Sequestering Agents Market in the United States is projected to grow steadily, reaching USD 720.41 million by 2035, up from USD 393.25 million in 2025, reflecting a CAGR of 5.2%. Growth is driven by personal care and dermocosmetic product launches, where chelators are used to stabilize formulations and prevent oxidative degradation. While traditional EDTA continues to dominate, the market is gradually transitioning toward citric acid, gluconates, and biotechnology-derived alternatives as sustainability regulations tighten. USA consumers’ strong demand for fragrance-free, dermatologist-tested, and clean-label products further strengthens the outlook for eco-friendly chelating solutions.

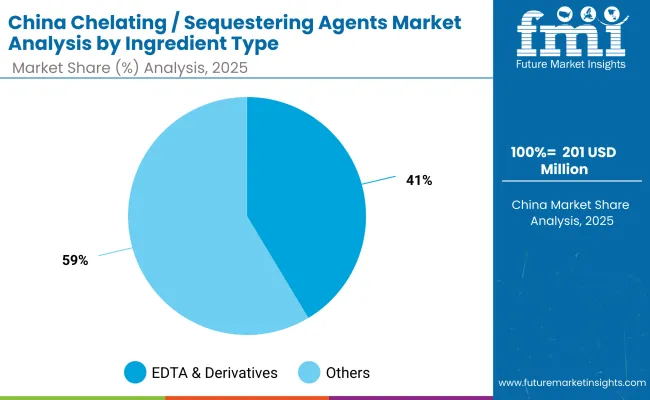

| China By Ingredient Type | Value Share % 2025 |

|---|---|

| EDTA & derivatives | 41.4% |

| Others | 58.6% |

The Chelating / Sequestering Agents Market in China is forecast to expand rapidly, growing at a CAGR of 12.5% (2025 -2035), supported by the country’s role as one of the world’s largest producers and consumers of cosmetics. A major opportunity lies in the shift from EDTA toward biodegradable and biotechnology-derived chelators, aligning with tightening regulatory standards and consumer demand for eco-friendly formulations. Domestic brands are actively reformulating with citric acid and gluconates, while international companies are localizing clean-label products to meet rising demand from urban middle-class consumers. The integration of chelating agents in skin brightening, anti-aging, and microbiome-friendly formulations positions China as a growth hotspot for both global suppliers and domestic innovators.

| Company | Global Value Share 2025 |

|---|---|

| BASF | 8.0% |

| Others | 92.0% |

The Chelating / Sequestering Agents Market is moderately fragmented, with a mix of global chemical giants, regional suppliers, and specialized innovators competing across diverse applications in personal care, cosmetics, and industrial formulations. BASF leads with an 8% global share, leveraging its broad chelator portfolio, extensive distribution, and focus on sustainable chemistry. Other multinational players such as Nouryon, Dow, Evonik, Clariant, and Solvay are expanding their presence through eco-friendly chelating solutions and biotechnology-driven alternatives that align with rising regulatory and consumer sustainability demands.

Mid-sized companies like Innospec, Seppic, and Jungbunzlauer are strengthening their positions by offering application-specific solutions, particularly in premium cosmetics, dermocosmetics, and natural product formulations. These players focus on clean-label and eco-certified chelators such as gluconates and citric acid derivatives to capture niche segments. Competitive differentiation is increasingly shifting from commodity EDTA-based products toward biodegradable, bio-based, and multifunctional chelators that deliver added value in stability, safety, and sustainability.

Innovation pipelines are focused on biotechnology-derived chelators, circular chemistry approaches, and compliance with COSMOS/ECOCERT standards, signaling a clear transition toward next-generation solutions. The ability to balance cost efficiency with environmental compliance will define long-term leadership, as consumer-facing brands demand greener ingredient portfolios from their suppliers.

Key Developments in Chelating / Sequestering Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,952.1 Million |

| Functional Role | Metal ion chelators , Stabilizing agents, Hard-water neutralizers |

| I ngredient Type | EDTA & derivatives, Gluconates, Citric acid & salts, Biotechnology-derived chelators |

| Delivery System | Free form, Pre-dispersed solution, Powder concentrate |

| Physical Form | Solution/concentrate, Powder, Granules |

| Application | Skin care products, Hair care products, Bath & shower formulations, Color cosmetics |

| End Use | Personal care manufacturing, Premium cosmetics, Dermocosmetic products |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FARO Technologies, Inc., 3D Digital Corporation, 3D Systems, Inc., Autodesk, Inc., Artec 3D, Automated Precision, Inc. (API), Carl Zeiss Optotechnik GmbH, Creaform Inc., Direct Dimensions Inc., GOM GmbH, Hexagon AB, Konica Minolta, Inc., NextEngine Inc., Nikon Corporation, OGI Systems Ltd, and ShapeGrabber |

| Additional Attributes | BASF, Nouryon , Clariant , Dow, Evonik , Ashland, Innospec , Seppic , Solvay, Jungbunzlauer |

The global Chelating / Sequestering Agents Market is estimated to be valued at USD 1,952.1 million in 2025.

The market size for the Chelating / Sequestering Agents Market is projected to reach USD 4,023.1 million by 2035.

The Chelating / Sequestering Agents Market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key ingredient types in the Chelating / Sequestering Agents Market are EDTA & derivatives, Gluconates, Citric acid & salts, and Biotechnology-derived chelators.

In terms of functional role, the metal ion chelators segment is projected to command the largest share at 48.1% of the Chelating / Sequestering Agents Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chelating Facial Masks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chelating Agent Market Growth & Forecast 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Demand for Chelating Agent in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA