The demand for chelating agents in the USA is expected to grow from USD 3.0 billion in 2025 to USD 5.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.5%. Chelating agents are widely used across industries, including agriculture, water treatment, pharmaceuticals, and food processing. These agents play a critical role in binding metal ions, enhancing product efficacy, and improving formulation stability. As industries continue to evolve, the demand for chelating agents is expected to rise due to their growing applications in environmental management, manufacturing processes, and health products.

The market for chelating agents shows steady growth, starting at USD 3.0 billion in 2025, with a gradual increase each year. By 2026, the market is expected to reach USD 3.1 billion, and this growth will continue, reaching USD 3.3 billion in 2027, USD 3.5 billion in 2028, and USD 3.7 billion in 2029. By 2035, the market will grow to USD 5.1 billion, reflecting strong, consistent demand across a wide range of applications in both established and emerging industries.

The chelating agent industry in the USA is expected to see steady year-over-year growth through 2035. From USD 3.0 billion in 2025, the market will rise to USD 3.1 billion in 2026 and USD 3.3 billion in 2027, reflecting a consistent increase in demand. The market will continue to grow at a similar pace over the next few years, reaching USD 3.5 billion in 2028, USD 3.7 billion in 2029, and USD 3.9 billion in 2030. By 2035, the industry is forecasted to reach USD 5.1 billion, with steady, ongoing growth driven by increased applications in agriculture, water treatment, and industrial processes.

The 10-year growth comparison shows a steady upward trajectory for the chelating agent market, with consistent annual growth. This reflects the increasing use of chelating agents in various sectors, such as agriculture, pharmaceuticals, and environmental management, ensuring long-term demand. The market is projected to expand by over USD 2 billion from 2025 to 2035, demonstrating the continued importance of chelating agents in a wide range of industries.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 3 billion |

| Industry Forecast Value (2035) | USD 5.1 billion |

| Industry Forecast CAGR (2025-2035) | 5.5% |

The demand for chelating agents in the USA is rising across multiple sectors as industries and consumers increasingly rely on these compounds for water treatment, cleaning products, agriculture, personal care and industrial processes. Chelating agents help bind metal ions, preventing unwanted reactions and improving stability in cleaning, water purification and manufacturing. Growing concern about water quality and stricter regulation on water discharge have boosted demand for chelants used in municipal and industrial water treatment. At the same time, household cleaning and personal care industries are shifting toward eco friendly, biodegradable chelating agents because of environmental and health awareness. This trend supports adoption of biodegradable alternatives over conventional non degradable chelates. As a result, manufacturers are integrating chelating agents into detergents, surface cleaners, soaps and shampoos to improve performance in hard water, extend shelf life, and reduce metal ion interference in product formulations.

Beyond cleaning and water treatment, agriculture and industrial sectors contribute significantly to demand growth. In agriculture, chelating agents improve micronutrient bioavailability in soils, enhancing crop yields and nutrient uptake, especially where soil micronutrient deficiency exists. The food processing, pulp & paper, textile and metal treatment industries also use chelants to control metal ion activity, prevent corrosion or discoloration, and maintain product quality during processing. Rising industrial output, stricter environmental compliance, and expansion in water treatment and agricultural production all push demand upward. The trend toward green chemistry and sustainable formulations further supports adoption of biodegradable chelating agents. Industry data points to consistent growth in the U.S. chelating agent market value over recent years. The increasing variety of end use applications, regulatory pressure, and rising environmental awareness are the main drivers behind expanding demand for chelating agents in the USA.

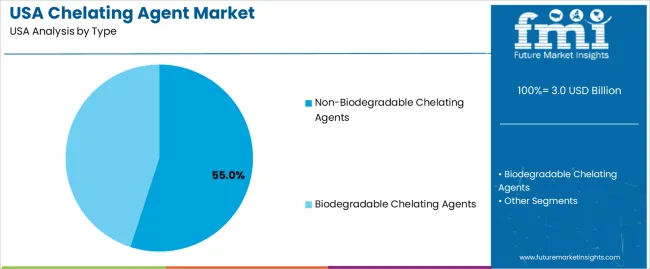

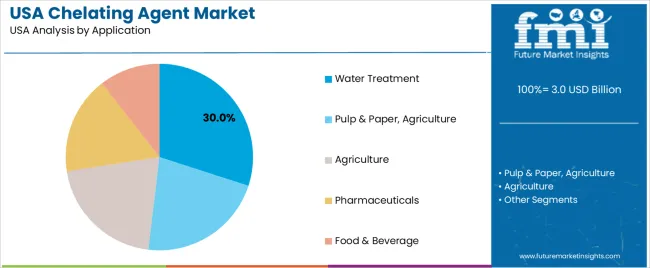

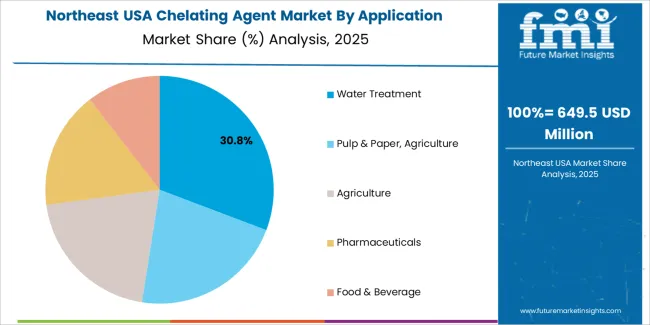

The demand for chelating agents in the USA is driven by type and application. The leading type is non-biodegradable chelating agents, accounting for 55% of the market share, while water treatment is the dominant application, capturing 30% of the demand. Chelating agents are crucial in various industries for binding and removing metal ions, preventing scale formation, and enhancing the efficiency of chemical processes. As the need for efficient water treatment and industrial processes increases, chelating agents remain essential for maintaining product quality and system efficiency across multiple sectors.

Non-biodegradable chelating agents lead the demand for chelating agents in the USA, holding 55% of the market share. Non-biodegradable chelating agents are primarily used in industrial applications where stability, efficiency, and long-term effectiveness are critical. These agents are highly effective at binding with metal ions and are often preferred in industries that require strong, long-lasting performance, such as in water treatment, cleaning, and pulp processing.

The demand for non-biodegradable chelating agents is driven by their proven effectiveness in maintaining chemical stability, reducing metal ion interference, and enhancing process efficiency. They are commonly used in applications such as cleaning systems, textile processing, and water treatment, where the removal of metal contaminants is essential. While there is increasing interest in biodegradable alternatives, non-biodegradable chelating agents continue to dominate due to their superior performance in harsh environments and long-lasting effects, ensuring their continued demand in the USA.

Water treatment is the leading application for chelating agents in the USA, capturing 30% of the demand. Chelating agents play a crucial role in water treatment processes by binding to metal ions and preventing scale formation, corrosion, and the buildup of undesirable substances. They are widely used in municipal water treatment plants, industrial water systems, and for the purification of drinking water.

The demand for chelating agents in water treatment is driven by their ability to improve the quality of water, ensure safe consumption, and enhance the efficiency of water treatment systems. As water scarcity and contamination concerns increase, the need for effective water treatment solutions continues to grow. Chelating agents are essential for removing metals such as calcium, magnesium, and iron, which can cause scaling and damage to equipment. The continued focus on water quality and environmental sustainability ensures that the demand for chelating agents in water treatment will remain strong in the USA.

The demand for chelating agents in the USA is growing, driven by sectors such as cleaning products, water treatment, pulp and paper, agriculture, and personal care. The market continues to expand, with strong USAge in detergents, industrial cleaning, and water treatment. Demand is influenced by the need for effective metal-ion control in industrial and municipal processes. This growth reflects the wide range of applications of chelating agents in improving product performance, enhancing shelf life, and maintaining system efficiency, contributing to a steady rise in market demand.

Several factors are driving the demand for chelating agents in the USA. The increasing use of chelating agents in household and industrial cleaning products is a major contributor. These agents help to soften water, improve detergent effectiveness, and prevent metal-ion interference. The growing need for water treatment at both the industrial and municipal levels is another key driver, as chelating agents play a critical role in wastewater treatment and purification. Additionally, the demand from sectors such as pulp and paper, agriculture, and personal care further supports the overall market. Regulatory requirements, especially for controlling metal contaminants in water and industrial processes, also stimulate the market for chelating agents.

Despite the growing demand, there are restraints on the use of chelating agents. Environmental concerns are one of the primary factors limiting their use. Some chelating agents are non-biodegradable and can pose a threat to aquatic ecosystems, leading to stricter regulations. Cost volatility is another restraint, as the prices of raw materials for chelating agents fluctuate, making them less affordable for some applications. Additionally, consumer preferences are shifting toward greener alternatives, with some industries moving away from conventional chelating agents in favor of more environmentally friendly solutions. These factors could potentially limit the growth of the chelating agent market in the USA.

One of the key trends in the USA is the shift toward biodegradable and eco-friendly chelating agents due to growing environmental concerns. This trend is driven by stricter regulations and the increasing demand for sustainable solutions across industries. Another trend is the expanding use of chelating agents in personal care, cosmetics, and agriculture, where they are used to improve product stability and nutrient availability in fertilizers. The need for advanced water treatment solutions, especially in response to stricter wastewater discharge regulations, is also driving the demand for chelating agents. As industries such as pulp and paper, detergents, and food and beverage continue to grow, the applications of chelating agents are broadening, further influencing demand.

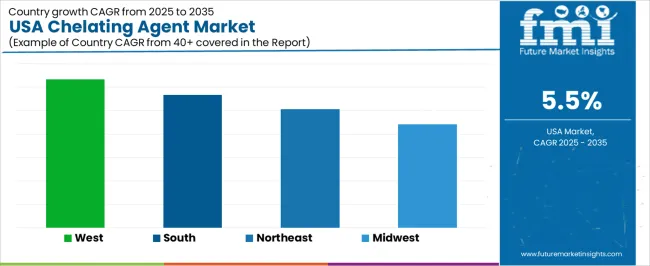

The demand for chelating agents in the USA shows steady growth across regions, with the West leading at a CAGR of 6.3%. The South follows with a CAGR of 5.7%, driven by industries such as agriculture, water treatment, and pharmaceuticals. The Northeast shows moderate growth at 5.1%, supported by its strong chemical and industrial sectors. The Midwest has the lowest growth rate at 4.4%, reflecting a more traditional industrial landscape. These regional differences are influenced by factors such as industrial concentration, technological adoption, and sector-specific demand for chelating agents in applications like metal ion removal, agriculture, and industrial processes.

| Region | CAGR (%) |

|---|---|

| West | 6.3 |

| South | 5.7 |

| Northeast | 5.1 |

| Midwest | 4.4 |

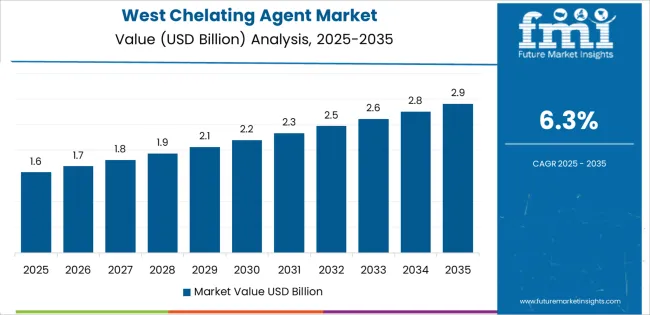

The demand for chelating agents in the West is projected to grow at a CAGR of 6.3%, driven by the region’s strong presence in agriculture, water treatment, and pharmaceuticals. The West, particularly in states like California, has a large agricultural sector, where chelating agents are used to improve the availability of micronutrients in fertilizers and soil treatments. Additionally, the region's growing focus on water quality and environmental sustainability is driving demand for chelating agents in water treatment processes, where they are used to bind heavy metals and improve the effectiveness of filtration systems. The pharmaceutical and biotechnology industries in the West also rely on chelating agents in drug formulation and metal ion sequestration. These factors, combined with the region's innovative approach to environmental and industrial challenges, ensure that the demand for chelating agents remains strong.

In the South, the demand for chelating agents is expected to grow at a CAGR of 5.7%, supported by the region's agricultural and industrial sectors. The South has a significant agricultural industry, where chelating agents are used to enhance nutrient uptake in crops, improve irrigation systems, and support soil health. The increasing focus on sustainable farming practices and precision agriculture is driving the adoption of chelating agents as part of efforts to optimize crop yields and reduce environmental impacts. Additionally, industries such as water treatment and oil and gas in the South are increasingly using chelating agents for metal ion removal and process optimization. As both industrial and agricultural applications for chelating agents expand, the demand for these chemicals is expected to continue growing in the South.

In the Northeast, the demand for chelating agents is projected to grow at a CAGR of 5.1%, driven by the region's well-established chemical and industrial sectors. The Northeast, with its concentration of manufacturing and processing plants, uses chelating agents in a variety of applications, including metal ion removal, water treatment, and industrial cleaning. The demand for chelating agents is also supported by the region's strong pharmaceutical and biotechnology industries, where they are used in drug formulation, diagnostics, and metal ion sequestration. Additionally, the growing need for environmental remediation and waste management solutions is driving the use of chelating agents in cleaning up industrial waste and managing water quality. While growth is steady, the Northeast’s mature industrial landscape ensures a consistent, reliable demand for chelating agents.

The demand for chelating agents in the Midwest is expected to grow at a CAGR of 4.4%, reflecting slower growth compared to other regions. The Midwest, which is a key center for manufacturing, agriculture, and energy, uses chelating agents in various industrial applications, including metal extraction, water treatment, and agriculture. However, the adoption of chelating agents is somewhat slower in this region, possibly due to the more traditional nature of some industries and less focus on advanced agricultural or environmental solutions. Despite this, the demand for chelating agents is steady as industries modernize and adopt newer technologies. The Midwest's significant agricultural activity, particularly in crop production, continues to drive demand for chelating agents to enhance soil fertility and improve crop yields. As industrial processes evolve and environmental concerns grow, the demand for chelating agents in the Midwest is expected to increase gradually.

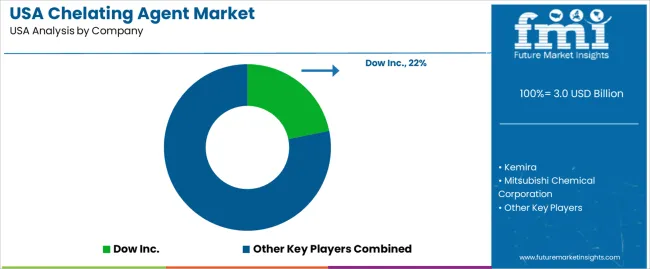

Demand for chelating agents in the United States is rising as industries such as water treatment, cleaning products, agriculture, and industrial processing increasingly require chemicals that bind metal ions and improve stability or performance. Key suppliers in this market include Dow Inc. (with about 21.8% share), Kemira, Mitsubishi Chemical Corporation, and Nippon Shokubai. These firms supply chelating agents used in detergents, metal processing, pulp and paper treatment, and wastewater management.

Competition in the chelating agent industry centers on product performance, regulatory compliance, and versatility. Suppliers focus on offering chelators with strong binding capacity, stability across a range of pH levels, and suitability for diverse applications from household cleaners to industrial effluent treatment. Another competitive aspect is regulatory compliance: formulations must meet U.S. environmental and safety standards, especially for water treatment and consumer products. Suppliers who offer a broad portfolio—ranging from biodegradable chelators to high performance industrial-grade chemicals—gain an edge. Marketing materials typically highlight chelation strength, thermal and chemical stability, solubility, and compatibility with other treatment chemistries. By aligning with demand for reliable, environmentally acceptable chelating solutions, these companies aim to secure and expand their position in the U.S. chelating agent market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Type | Non-Biodegradable Chelating Agents, Biodegradable Chelating Agents |

| Application | Water Treatment, Pulp & Paper, Agriculture, Pharmaceuticals, Food & Beverage |

| Key Companies Profiled | Dow Inc., Kemira, Mitsubishi Chemical Corporation, Nippon Shokubai |

| Additional Attributes | The market analysis includes dollar sales by type, application, and company categories. It also covers regional demand trends in the USA, driven by the increasing use of chelating agents in various industries such as water treatment, agriculture, pharmaceuticals, and food & beverage. The competitive landscape highlights key manufacturers focusing on innovations in both biodegradable and non-biodegradable chelating agents. Trends in the growing demand for sustainable and eco-friendly chelating agents, particularly in water treatment and agriculture, are explored, along with advancements in formulation and regulatory requirements. |

The demand for chelating agent in USA is estimated to be valued at USD 3.0 billion in 2025.

The market size for the chelating agent in USA is projected to reach USD 5.1 billion by 2035.

The demand for chelating agent in USA is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in chelating agent in USA are non-biodegradable chelating agents and biodegradable chelating agents.

In terms of application, water treatment segment is expected to command 30.0% share in the chelating agent in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chelating Agent Market Growth & Forecast 2025 to 2035

Chelating / Sequestering Agents Market Size and Share Forecast Outlook 2025 to 2035

Industrial Plant Derived Chelating Agent Market Size and Share Forecast Outlook 2025 to 2035

Demand for Mask Reticle Cleaning Agent in USA Size and Share Forecast Outlook 2025 to 2035

Chelating Facial Masks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA