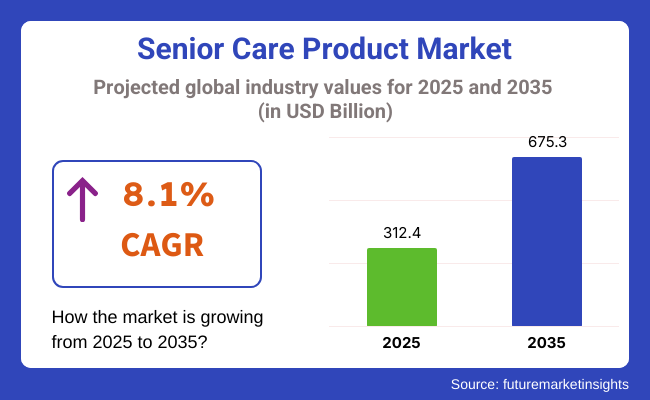

The senior care product market is envisaged to witness substantial demand as well as a booming market, worth an estimated USD 312.4 billion in 2025, and compound annual growth at the rate of 8.1% throughout the revenue forecast period of 2025 to 2035, with the global industry value reaching USD 675.3 billion by 2035. Market growth is being primarily accelerated as a response to the various dynamic demographic transitions regarding an aging population, increased health consciousness, and technological advancements in geriatric healthcare.

Supportive care products such as mobility aids, monitoring devices, and specialty nutrition are increasingly in demand due to the rising burden of chronic illness and rule over the elderly. Besides, escalating health care costs in emerging economies and supportive government policies regarding elder care infrastructural growth are strong additional factors in favor of this industry.

Technological advances take center stage, with interconnected healthcare systems and telemedicine-assisted patient care becoming the new norm in solutions for eldercare. Smart wearable integration, telemedicine platforms, and AI-enabled diagnostic equipment are driving more patient-specific and leaner care delivery, enhancing prevention and therapy results.

The nuclear family household and city dwelling are driving greater dependency on professional care services and supported living. This adjustment is causing the demand for intelligent home solutions and flexible devices that are based on older citizens who need independence and security.

The competitive dynamics are changing as businesses significantly invest in product development, regional expansion, and collaboration with healthcare professionals. Focus on total well-being, lifestyle management, and home care technologies is likely to continue driving the industry dynamics until 2035.

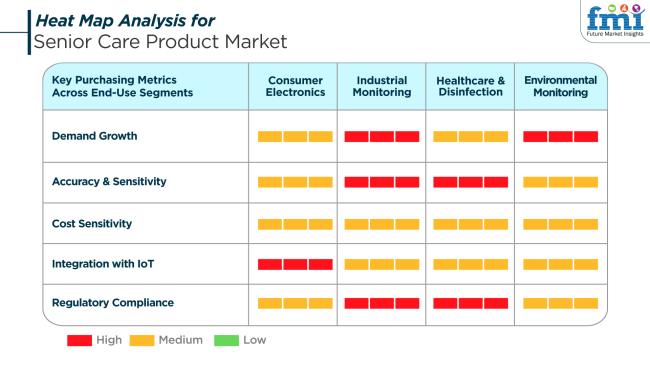

The integration of digital technologies in senior care products, in turn, shapes consumer electronics and industrial monitoring segments. In consumer electronics, the demand is mainly on the rise because of the increased preference for wearable health monitors and living aids that are voice-assisted for seniors' comfort and safety within home settings.

Developments in IoT and AI in hospitals and institutional settings are speeding up the acceptance of monitoring systems for patient movement, anomaly detection, and emergency response automation. This segment has received much scrutiny by regulators, which affects the design and procurement processes.

Healthcare and disinfection technologies are equally at the forefront, especially in post-pandemic senior care establishments, where sterilization protocols and patient safety are given prime importance. Environmental monitoring applications are heavily adopting sensors and air-quality monitoring systems to achieve healthier living conditions for the elderly population, especially in long-term care settings.

One of the most significant risks to the industry is the increasing pressure of regulatory compliance across international borders. Diverse legal frameworks and changing healthcare policies can create uncertainties in product development and deployment timelines, impacting both startups and established providers.

Economic disparities and unequal access to healthcare technologies in developing regions pose another substantial challenge. Although the demand is growing, affordability issues and inadequate healthcare infrastructure may hinder widespread adoption of senior care solutions in emerging industries.

The data privacy and cybersecurity remain persistent concerns, especially with the integration of IoT-enabled monitoring devices and health management platforms. Breaches in patient data protection could lead to regulatory actions, financial losses, and erosion of consumer trust, posing a significant risk to industry participants.

During the period between 2020 and 2024, the industry for senior care products underwent dynamic change on the back of aging populations and greater awareness of well-being in old age. There was greater emphasis on enabling independent living by way of mobility devices, home healthcare equipment, and simple-to-use health monitoring equipment.

The pandemic also hastened the use of telemedicine equipment and highlighted personal protection and hygiene equipment for the elderly. Companies began to alter products by dignity, comfort, and simplicity, and family caregivers emerged as the most powerful decision-makers in buying habits.

The industry for senior care products is expected to become more personalized, technology-driven, and wellness-oriented for 2025 to 2035. These will create a demand for AI-powered medical equipment, smart home deployments, and wearable technology that supports independent and safe aging at home.

Emotional health and cognitive health care will also take center stage, driving such products as interactive companions and therapy tools. Design and sustainability will gain prominence, with products designed to be unobtrusive, comfortable, and ecologically sustainable that appeal to older people as well as their caregivers.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Independence, safety, and basic wellness | Personalized aging solutions and whole wellness |

| Health monitors, wearables, and telemedicine | Monitoring based on AI, smart home integration, and voice-based devices |

| Simple functional products | Glamorous, unobtrusive, ergonomic, and simple products |

| Products targeting physical well-being | More emphasis on mental well-being, companionship, and mental support |

| Low cost, seniors' adoption of technology, caregiver accessibility | Infrastructure scalability, digital literacy, and balancing customization and cost |

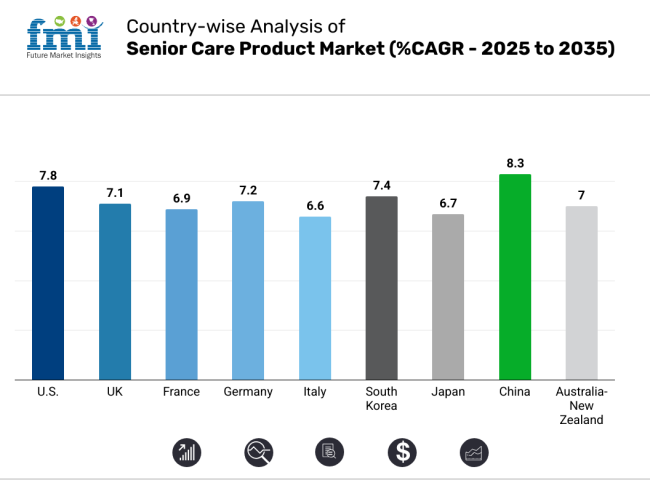

The USA industry will register growth at a 7.8% CAGR during the forecast period. An aggressively expanding geriatric population is driving this growth trajectory, as is the development of healthcare infrastructure and an increased focus among consumers toward age-related healthcare and wellness solutions. The USA has a strong foothold in established senior care technologies and product development, which keeps sustaining its industry dominance.

Increased use of smart monitoring devices, mobility aids, and home care solutions among elderly individuals, especially baby boomers, is fueling demand for the product across the region. Government-sponsored advocacy for elder care services and private investments in assisted living and home-based remote health monitoring solutions support long-term industry potential. Furthermore, rising disposable incomes and shifting preferences toward home care among older people have come a long way in fueling the consumption of premium care products.

In urban areas, the elderly living independent lifestyles are also increasingly leading to demand for products such as intelligent fall sensors, wearable warning systems, and ergonomic home installations. The emphasis on preventive care within the health industry also spurred the consumption of senior care products involving mobility aids and nutritional supplements. Study participants are also actively launching tailored products to address a wide range of functional impairments that occur with advancing age, further expanding the size of the USA industry during the forecast period.

The UK industry will grow at 7.1% CAGR during the study period. An increasing population of older adults, along with a heightened focus on aging at home, is fueling consistent demand for senior care products across the UK With most of the population being over 65 years old, healthcare infrastructure is being redesigned to embrace age-friendly choices. The National Health Service (NHS) continues to develop elder care initiatives with a center of focus on home care, which is routinely boosting the demand for mobility aids, home safety equipment, and assistance devices.

In addition, advocacy campaigns for dignified aging and government support of long-term home care services have accelerated the demand for remote care technologies and wearable monitoring devices. Urban consumers are most disposed towards senior care products of personalized intent, thus resulting in industry diversification.

The private sector's involvement in retirement community development and smart care technology is also driving industry innovation. Healthy products and comfort-providing senior care furniture are gaining consistent momentum across retail and e-commerce platforms. Also, the UK's sustainability culture is stimulating elder care solutions derived from nature, resulting in new product development initiatives in the domestic industry.

The French industry is expected to achieve 6.9% CAGR growth during the analysis period. An aging population, combined with growing healthcare expenditure on elderly care, is affecting demand for elder care products. Growing numbers of people aged over 75 are placing heavy burdens on healthcare systems and causing consumers to turn to preventative and supportive solutions.

Consumers' demand for home care equipment, such as adjustable beds, mobility scooters, and aids for daily living, is on the rise among caregivers and older individuals. France's structured public health strategies toward elderly well-being and independence are driving the consumption of straightforward and technologically advanced senior care items.

The industry is also supported by the increase in chronic diseases such as arthritis, vision and hearing loss, and mobility concerns that require assistive support products. Moreover, partnerships among public institutions and private manufacturers are expanding channels in cities and semi-cities.

Consumer preferences are shifting towards high-comfort, dignified living for older people, and hence premium products with aesthetic and ergonomic value are gaining demand. The growing trend of French digital health is also propelling the use of smart assistive devices that enable constant monitoring of health and emergency response capabilities.

The German industry will develop at 7.2% CAGR during the study period. As one of the fastest aging countries in Europe, Germany is experiencing a constant increase in demand for elder care products. A developed healthcare infrastructure, along with an encouraging reimbursement scenario, supports the accessibility and affordability of the products.

German customers show a penchant for high-standard, technology-intensive products that facilitate independent living. Assistive living devices, powered wheelchairs, and fall-detection systems are the most sought-after solutions in both urban and rural settings. The country's industrial potential in medical device production is also fueling innovation for senior care solutions.

Some companies are diversifying portfolios to encompass smart home integration and AI-based elder care monitoring systems. Apart from that, the rising demand for dementia care products and memory aid devices is opening new avenues in the industry.

Germany is also blessed with a wide network of caregivers who actively promote the use of safety and comfort-improving equipment. Government programs encouraging in-home care and professional care are also driving the industry further. The growing participation of social care providers and health insurers in subsidizing assistive products is expected to raise the user base across the forecast period.

The Italian industry will grow at a 6.6% CAGR during the study. Italy boasts one of Europe's most rapidly aging populations, with a high proportion of individuals aged above 65. Such a demographic shift is increasing demand for a variety of elderly care products centered on delivering mobility, personal care, and home safety.

With family-based care emphasized culturally, the industry is experiencing increased use of products well-suited to home caregiving settings, such as mobility devices, fall prevention equipment, and bathing safety aids. Government subsidies and local area eldercare support are making it more accessible to mainstream senior care alternatives.

However, industry awareness in a few regions is limited, and this is being compensated through healthcare marketing efforts and point-of-purchase initiatives. New technology, such as consumer-centered medical alarm devices and wristwear monitors, is proving popular among the elderly population.

Additionally, interactions between Italian caregivers and medical device makers are also enhancing product stocks in domestic markets. Growth in the e-market is also presenting an alternative window for the distribution of aged care product types, including deeper penetration and access.

The South Korean industry is expected to grow at 7.4% CAGR during the period of study. Driven by one of the fastest aging populations globally, South Korea is undergoing a paradigm shift regarding aging and eldercare. Government-initiated policies and growing health spending on old-age wellness are key drivers of the growth of the industry. Urbanization and changes in the family structure are making it easier to use independent living arrangements such as automated home safety systems, electronic location systems, and mobility aids.

Technology integration is one of the defining characteristics of the South Korean elderly care product industry. Leading electronics and health technology companies are busy constructing AI-powered caregiving equipment, smart assistive equipment, and voice-activated medical alert systems. Sales of robotic companions and teleconsultation equipment for older consumers are also on the rise.

Furthermore, a very technologically literate older consumer is more likely to use digital solutions for well-being and protection, which continues to drive product innovation. Institutional support for aging-in-place programs, as well as the growing prevalence of chronic illness, is also making durable medical equipment and ergonomic lifestyle assistance increasingly relevant.

Japan is expected to post a 6.7% CAGR during the study. As the country with the highest percentage of elderly citizens, Japan's elder care product industry is perfectly positioned. The culture is evolving to accommodate aging-in-place lifestyles and to create demand for highly effective, space-efficient, and supportive technologies.

The application of devices like wearable panic buttons, stair lifts, and independent mobility products is gaining higher adoption, especially in high-density urban areas. Government expenditure on aging infrastructure, such as eldercare housing and smart nursing facilities, is driving the demand for products.

Robotics and automation have a commanding role in Japan's senior care sector, with advancements like care robots and AI-driven monitoring solutions being implemented on a mass scale. Moreover, there is also a high incidence of health awareness and preventive care among aged individuals, thus driving the uptake of wellness and nutritional supplements at a higher rate.

Rural and semi-urban areas are being supplied with specialty care products through targeted logistics and retail penetration. Japan's well-developed industrial base offers the potential for domestic high-quality production, allowing affordability and tailor-made solutions to age-related challenges.

The China industry is expected to grow at 8.3% CAGR during the research period. A rapidly expanding aging population, together with rising disposable income and enhanced access to healthcare, is driving robust growth in the older adult care products industry.

Government initiatives to establish eldercare buildings and provide incentives for private sector investment have driven infrastructure development. Urban migration and smaller family sizes have driven the trend towards institutional and independent care solutions, increasing demand for home safety equipment, mobility aids and intelligent health monitoring systems.

China's technological prowess is being leveraged for the development of AI-based assistive solutions and Internet of Things -based eldercare solutions. There is also increased consumption of high-end, comfort-focused senior products such as therapeutic mattresses and high-tech ergonomic furniture. In addition, e-commerce penetration is enabling broader penetration of care products, particularly in second and third-tier cities.

The increasing prevalence of chronic diseases such as diabetes and cardiovascular disease among the geriatric population is also driving the demand for premium home-use monitoring devices. Healthcare digitization policies also promote innovation and industry entrance for domestic and overseas players.

The Australia-New Zealand industry will expand at 7% CAGR during the study period. Both countries have aging populations that are impacting consumer behavior and healthcare planning significantly. Public-private sector collaboration is increasingly developing to enhance elder well-being, particularly in preventing falls, home mobility, and remote health monitoring. Consumer preferences are moving towards supportive devices for active aging, including ergonomic aids, nutritionals, and telehealth-enabled monitoring devices.

Australia's National Disability Insurance Scheme (NDIS) and New Zealand's eldercare fund policies are increasing access to fundamental senior care products. There is also increasing demand for culturally sensitive care solutions and home adaptation to accommodate the diverse senior industry. Distribution is made easy by strong distribution networks and internet channels that enable easy purchase of products in both urban and rural settings.

Local manufacturers are investing in user-friendly designs and environmentally friendly materials to resonate with values across the environment. The local emphasis on well-being and balance in life further promotes adoption of whole-person care solutions such as massage chairs, hearing aids, and customized mobility devices specifically tailored for geriatric users.

Home care and chronic illness care are expected to lead in terms of industry driving force in 2025, with respective shares at 43.2% and 30.4%.

Home care seems to take the leading position as more people prefer aging in place. Even amongst seniors who have the option to stay in institutional care services such as nursing homes, there is a growing trend toward staying at home for as long as possible. This rise in demand for home care products, something that other than chronic illness care has also captured, has been influenced by several factors: increased awareness of the benefits of maintaining independence, comfort of familiar surroundings, and reducing healthcare costs related to institutional settings.

There has been a growing adoption of home safety devices, fall prevention systems, personal emergency response systems (PERS), and telehealth/telemedicine services as part of this growing trend. Companies such as Philips, Care.com, and others are becoming increasingly focused on furnishing solutions to home care needs.

Due to the rising burden of chronic conditions like diabetes, arthritis, heart disease, and dementia on the aging population, chronic illness care occupies a substantive portion of this industry. Seniors who live with these conditions need products specifically designed to care for their well-being through health management. Some of these products include medication management products, blood glucose monitoring products, physical rehabilitation products, and other products for daily living activities.

Growing awareness about the significance of chronic disease management and advances in healthcare technology have tremendously fueled the growth of this segment. Companies like Omron, Abbott Laboratories, and Medtronic have been major players in providing devices and tools for managing chronic health conditions in the senior population.

The industry in 2025 is expected to be developed by home health care along with nursing care facilities, with shares of 42.1% and 32.4%, respectively.

Home health care will likely remain the most significant end-user segment, as the preference of older people is increasingly for aging in place. Many seniors would prefer to stay in their own homes while receiving medical care, and thus, the demand for products related to home health care will continue to grow. This encompasses a wide variety of items, such as personal hygiene products, mobility devices, remote monitoring appliances, and home safety equipment.

Independence, familiarity, and comfort are strong motivators for using home care in this age group. Technological advancements like telemedicine, wearable health monitors, and remote monitoring devices also provide ways for caregivers and health professionals to improve the quality and efficiency of care, even at a distance. Some leading companies include Amedisys, LHC Group, and Brookdale Senior Living, which dominate the industry through specialized in-home care services.

Although nursing care facilities have a lower share of the industry compared to home health care, they comprise the largest segment of this industry. This sector includes long-term care homes, skilled nursing facilities, and assisted living communities that provide full-time care for elderly individuals with physical or cognitive impairments. Mobility aids, incontinence products, medication management tools, and rehabilitation are examples of the most demanded products in this sector.

Nursing care facilities are the most important when navigating the aging population, especially those that may have many complex medical needs or have more severe chronic conditions. The industry is driven by the advanced care solutions that bring quality into the lives of residents in these facilities. It works towards satisfying the needs of companies providing specialized solutions for nursing homes, such as Invacare and Medtronic, using durable medical equipment as well as tailored care solutions.

The industry is currently going through remarkable changes in tandem with the increase of older people in both developed countries and emerging economies. This industry typically features increased medical device requirements, home-care solutions, and other products that meet the specific needs of older people.

Invacare Corporation is a leading vendor with comprehensive mobility, respiratory, and home care product ranges for older adults. Similarly, Thermo Fisher Scientific Inc. is increasingly involved in this industry, with a growing focus on diagnostic and healthcare solutions that address elderly care and improve their quality of life.

Cardinal Health and AbbVie have extended their reach in the senior care segment by offering specialized products targeting elder care, such as wound care and incontinence management products. These companies primarily focus on improving the efficacy and convenience of respective products as related to the commonly experienced health issues in aging people. 3M Company and B Braun Melsungen AG have made huge investments in the senior care industry in developing advanced wound care products and medical devices that meet the needs of their aging populations.

Procter & Gamble and Kimberly-Clark Corporation, with their extensive range of hygiene and incontinence products, have a strong foothold in the senior care product segment. Stryker Corp, along with Koninklijke Philips N.V., is driving efforts to develop high-tech medical devices such as patient monitoring equipment and assistive devices to improve the healthcare and daily living of seniors. There are also some major strategic moves by GE Healthcare and Mölnlycke Health Care AB to tap into the future of elder care through advanced medical technologies and solutions for chronic conditions and prevention.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Invacare Corporation | 12-16% |

| Thermo Fisher Scientific Inc. | 10-14% |

| Cardinal Health | 9-13% |

| Abbott Laboratories | 8-12% |

| 3M Company | 7-10% |

| Other Key Players (Combined) | 38-48% |

| Company Name | Offerings & Activities |

|---|---|

| Invacare Corporation | Wide range of mobility, respiratory, and home care products for seniors. |

| Thermo Fisher Scientific Inc. | Diagnostic tools, healthcare solutions, and elderly care-focused technologies. |

| Cardinal Health | Incontinence products, wound care solutions, and elder-focused medical devices. |

| Abbott Laboratories | Specialized healthcare products for chronic conditions, including diabetes management. |

| 3M Company | Wound care products and innovative solutions for elderly medical care. |

Key Company Insights

Invacare Corporation (12-16%) still leads the industry in mobility aids, respiratory products, and home healthcare solutions for the elderly. It has expanded its operations through strategic alliances with partners and continuous innovation in assistive devices, which give elderly patients more independence in the quality of their lives.

Thermo Fisher Scientific Inc. occupies 10-14% of the industry, focusing on expansion in the senior care market through diagnostic tools and healthcare technologies. In view of advanced medical solutions that are going to be needed as people age, Thermo Fisher products will play a crucial role in newly acquired innovations addressing elderly care.

Cardinal Health (9-13%) is a further significant player whose offering includes a broad spectrum of medical products such as incontinence management and wound care solutions, thereby enhancing the comfort and health of elderly patients.

Abbott Laboratories (8-12%) bolster their position through providing specialized health solutions to elderly patients, especially for managing chronic diseases such as diabetes and those related to cardiovascular malfunctions. Moreover, the company invests highly in senior care technologies such as portable monitoring devices.

3M Company (7-10%) thus increases its footprint in the senior care industry with innovations in wound care and medical devices. Its products will be beneficial to the elderly patient cohort with chronic conditions that require consistent medical attention.

Other Key Players

Segmentation of the industry by product: incontinence products, consumables, assistive devices, and nutritional supplements. It includes adult diapers, disposable pads and liners-such as bladder control pads, male guards, and incontinence liners-belted and beltless undergarments, and maceratable wipes. Consumables include masks and gloves, gowns, dressing kits, urinary catheters, and urine bags.

Assistive devices are further divided as canes, crutches, wheelchairs, commode chairs, and accessories, in addition to assistive furniture, ostomy products, and pressure relief mattresses. Nutritional supplements multiple vitamin-and-mineral combinations, dietary fibers, food thickener and mix, and milk powder.

By type of care, the industry is classified into home care and chronic illness care.

By end user, the end users of the industry are hospitals, nursing care facilities, and home health care.

By region, the industry is divided by region, including North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa.

The industry is expected to reach USD 312.4 billion in 2025.

The industry is projected to grow to USD 675.3 billion by 2035.

The industry is expected to grow at a CAGR of 8.1% during the forecast period.

Home care and chronic illness care are key segments in the industry.

Key players include Invacare Corporation, Thermo Fisher Scientific Inc., Cardinal Health, Abbott Laboratories, 3M Company, B Braun Melsungen AG, Procter & Gamble, Stryker Corp, Koninklijke Philips N.V., GE Healthcare, Mölnlycke Health Care AB, The Golden Concepts, Smiths Group PLC, Honeywell International Inc., McKesson Corporation, Kimberly-Clark Corporation, Unicharm, Sunrise Medical, Hollister Incorporated, BW Generation Pte Ltd, Flexicare Medical Ltd., and Marlen Manufacturing & Development.

Table 01: Global Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 02: Global Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 03: Global Market Volume (Units) Analysis 2018 to 2034, By Product

Table 04: Global Market Volume (Units) Opportunity Assessment 2018 to 2034, By Product

Table 05: Global Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 06: Global Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 07: Global Market Value (US$ Million) Analysis 2018 to 2034, By Region

Table 08: North America Market Value (US$ Million) Analysis 2018 to 2023, By Country

Table 09: North America Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 10: North America Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 11: North America Market Volume (Units) Analysis 2018 to 2034, By Product

Table 12: North America Market Volume (Units) Opportunity Assessment 2018 to 2034, By Product

Table 13: North America Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 14: North America Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 15: USA Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 16: USA Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 17: USA Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 18: USA Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 19: Canada Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 20: Canada Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 21: Canada Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 22: Canada Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 23: Latin America Market Value (US$ Million) Analysis 2018 to 2023, By Country

Table 24: Latin America Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 25: Latin America Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 26: Latin America Market Volume (Units) Analysis 2018 to 2034, By Product

Table 27: Latin America Market Volume (Units) Opportunity Assessment 2018 to 2034, By Product

Table 28: Latin America Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 29: Latin America Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 30: Brazil Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 31: Brazil Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 32: Brazil Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 33: Brazil Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 34: Mexico Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 35: Mexico Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 36: Mexico Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 37: Mexico Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 38: Chile Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 39: Chile Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 40: Chile Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 41: Chile Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 42: Rest of Latin America Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 43: Rest of Latin America Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 44: Rest of Latin America Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 45: Rest of Latin America Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 46: Europe Market Value (US$ Million) Analysis 2018 to 2023, By Country

Table 47: Europe Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 48: Europe Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 49: Europe Market Volume (Units) Analysis 2018 to 2034, By Product

Table 50: Europe Market Volume (Units) Opportunity Assessment 2018 to 2034, By Product

Table 51: Europe Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 52: Europe Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 53: UK Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 54: UK Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 55: UK Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 56: UK Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 57: Germany Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 58: Germany Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 59: Germany Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 60: Germany Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 61: Italy Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 62: Italy Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 63: Italy Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 64: Italy Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 65: France Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 66: France Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 67: France Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 68: France Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 69: Spain Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 70: Spain Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 71: Spain Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 72: Spain Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 73: Russia Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 74: Russia Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 75: Russia Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 76: Russia Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 77: Nordic Countries Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 78: Nordic Countries Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 79: Nordic Countries Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 80: Nordic Countries Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 81: BENELUX Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 82: BENELUX Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 83: BENELUX Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 84: BENELUX Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 85: Rest of Europe Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 86: Rest of Europe Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 87: Rest of Europe Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 88: Rest of Europe Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 89: South Asia Market Value (US$ Million) Analysis 2018 to 2023, By Country

Table 90: South Asia Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 91: South Asia Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 92: South Asia Market Volume (Units) Analysis 2018 to 2034, By Product

Table 93: South Asia Market Volume (Units) Opportunity Assessment 2018 to 2034, By Product

Table 94: South Asia Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 95: South Asia Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 96: India Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 97: India Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 98: India Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 99: India Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 100: Malaysia Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 101: Malaysia Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 102: Malaysia Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 103: Malaysia Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 104: Thailand Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 105: Thailand Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 106: Thailand Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 107: Thailand Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 108: Indonesia Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 109: Indonesia Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 110: Indonesia Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 111: Indonesia Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 112: Rest of South Asia Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 113: Rest of South Asia Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 114: Rest of South Asia Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 115: Rest of South Asia Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 116: East Asia Market Value (US$ Million) Analysis 2018 to 2023, By Country

Table 117: East Asia Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 118: East Asia Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 119: East Asia Market Volume (Units) Analysis 2018 to 2034, By Product

Table 120: East Asia Market Volume (Units) Opportunity Assessment 2018 to 2034, By Product

Table 121: East Asia Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 122: East Asia Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 123: China Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 124: China Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 125: China Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 126: China Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 127: Japan Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 128: Japan Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 129: Japan Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 130: Japan Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 131: South Korea Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 132: South Korea Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 133: South Korea Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 134: South Korea Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 135: Oceania Market Value (US$ Million) Analysis 2018 to 2023, By Country

Table 136: Oceania Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 137: Oceania Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 138: Oceania Market Volume (Units) Analysis 2018 to 2034, By Product

Table 139: Oceania Market Volume (Units) Opportunity Assessment 2018 to 2034, By Product

Table 140: Oceania Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 141: Oceania Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 142: Australia Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 143: Australia Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 144: Australia Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 145: Australia Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 146: New Zealand Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 147: New Zealand Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 148: New Zealand Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 149: New Zealand Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 150: Middle East & Africa Market Value (US$ Million) Analysis 2018 to 2023, By Country

Table 151: Middle East & Africa Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 152: Middle East & Africa Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 153: Middle East & Africa Market Volume (Units) Analysis 2018 to 2034, By Product

Table 154: Middle East & Africa Market Volume (Units) Opportunity Assessment 2018 to 2034, By Product

Table 155: Middle East & Africa Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 156: Middle East & Africa Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 157: Türkiye Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 158: Türkiye Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 159: Türkiye Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 160: Türkiye Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 161: GCC Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 162: GCC Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 163: GCC Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 164: GCC Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 165: Israel Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 166: Israel Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 167: Israel Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 168: Israel Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 169: South Africa Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 170: South Africa Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 171: South Africa Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 172: South Africa Market Value (US$ Million) Analysis 2018 to 2023, By End User

Table 173: Rest of MEA Market Value (US$ Million) Analysis 2018 to 2034, By Product

Table 174: Rest of MEA Market Value (US$ Million) Opportunity Assessment 2018 to 2034, By Product

Table 175: Rest of MEA Market Value (US$ Million) Analysis 2018 to 2023, By Type of Care

Table 176: Rest of MEA Market Value (US$ Million) Analysis 2018 to 2023, By End User

Figure 01: Global Market Value Share, by Product (2023)

Figure 02: Global Market Value Share, by type of care (2023)

Figure 03: Global Market Value Share, by End User (2023)

Figure 04: Global Market Value Share, by Region (2023)

Figure 05: Global Market Historical Market Volume ('000 Units) Analysis, 2018 to 2023

Figure 06: Global Market Volume ('000 Units), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 07: Adult Diapers, Average Selling Price by Country (US$), 2023 to 2033

Figure 08: Bladder Control Pads, Average Selling Price by Country (US$), 2023 to 2033

Figure 09: Male Guards, Average Selling Price by Country (US$), 2023 to 2033

Figure 10: Incontinence Liners, Average Selling Price by Country (US$), 2023 to 2033

Figure 11: Belted and Beltless Under Garments Average Selling Price by Country (US$), 2023 to 2033

Figure 12: Maceratable Wipes, Average Selling Price by Country (US$), 2023 to 2033

Figure 13: Masks, Average Selling Price by Country (US$), 2023 to 2033

Figure 14: Gowns, Average Selling Price by Country (US$), 2023 to 2033

Figure 15: Gloves, Average Selling Price by Country (US$), 2023 to 2033

Figure 16: Dressing Kits, Average Selling Price by Country (US$), 2023 to 2033

Figure 17: Urinary Catheters, Average Selling Price by Country (US$), 2023 to 2033

Figure 18: Urine Bags, Average Selling Price by Country (US$), 2023 to 2033

Figure 19: Canes & Crutches, Average Selling Price by Country (US$), 2023 to 2033

Figure 20: Wheelchair, Average Selling Price by Country (US$), 2023 to 2033

Figure 21: Commode chair, Average Selling Price by Country (US$), 2023 to 2033

Figure 22: Assistive furniture and Accessories, Average Selling Price by Country (US$), 2023 to 2033

Figure 23: Ostomy Products, Average Selling Price by Country (US$), 2023 to 2033

Figure 24: Pressure Relief Mattresses, Average Selling Price by Country (US$), 2023 to 2033

Figure 25: Global Market Historical Market Value (US$ Million) Analysis, 2018 to 2023

Figure 26: Global Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 27: Global Market Absolute $ Opportunity, 2024 to 2034

Figure 28: Global Market Share Analysis (%), By Product,

Figure 29: Global Market Y-o-Y Analysis (%), By Product, 2024 to 2034

Figure 30: Global Market Attractiveness Analysis by Product, 2024 to 2034

Figure 31: Global Market Share Analysis (%), By Type of Care, 2023 to 2033

Figure 32: Global Market Y-o-Y Analysis (%), By Type of Care, 2024 to 2034

Figure 33: Global Market Attractiveness Analysis by Type of Care, 2024 to 2034

Figure 34: Global Market Share Analysis (%), By End User, 2023 to 2033

Figure 35: Global Market Y-o-Y Analysis (%), By End User, 2024 to 2034

Figure 36: Global Market Attractiveness Analysis by End User, 2024 to 2034

Figure 37: Global Market Share Analysis (%), By Region, 2023 to 2033

Figure 38: Global Market Y-o-Y Analysis (%), By Region, 2024 to 2034

Figure 39: Global Market Attractiveness Analysis by Region, 2024 to 2034

Figure 40: North America Market Share Analysis (%), By Products (2023)

Figure 41: North America Market Share Analysis (%), By Type of Care (2023)

Figure 42: North America Market Share Analysis (%), By End User (2023)

Figure 43: North America Market Share Analysis (%), By Country (2023)

Figure 44: North America Market Historical Market Value (US$ Million) Analysis, 2018 to 2023

Figure 45: North America Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 46: North America Market Attractiveness Analysis, By Products

Figure 47: North America Elder Care Products Market Attractiveness Analysis, By Type of Care

Figure 48: North America Market Attractiveness Analysis, By End User

Figure 49: North America Market Attractiveness Analysis, By Country

Figure 50: Latin America Market Share Analysis (%), By Products (2023)

Figure 51: Latin America Market Share Analysis (%), By Type of Care (2023)

Figure 52: Latin America Market Share Analysis (%), By End User (2023)

Figure 53: Latin America Market Share Analysis (%), By Country (2023)

Figure 54: Latin America Market Historical Market Value (US$ Million) Analysis, 2018 to 2023

Figure 55: Latin America Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 56: Latin America Market Attractiveness Analysis, By Products

Figure 57: Latin America Elder Care Products Market Attractiveness Analysis, By Type of Care

Figure 58: Latin America Market Attractiveness Analysis, By End User

Figure 59: Latin America Market Attractiveness Analysis, By Country

Figure 60: Europe Market Share Analysis (%), By Products (2023)

Figure 61: Europe Market Share Analysis (%), By Type of Care (2023)

Figure 62: Europe Market Share Analysis (%), By End User (2023)

Figure 63: Europe Market Share Analysis (%), By Country (2023)

Figure 64: Europe Market Historical Market Value (US$ Million) Analysis, 2018 to 2023

Figure 65: Europe Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 66: Europe Market Attractiveness Analysis, By Products

Figure 67: Europe Elder Care Products Market Attractiveness Analysis, By Type of Care

Figure 68: Europe Market Attractiveness Analysis, By End User

Figure 69: Europe Market Attractiveness Analysis, By Country

Figure 70: South Asia Market Share Analysis (%), By Products (2023)

Figure 71: South Asia Market Share Analysis (%), By Type of Care (2023)

Figure 72: South Asia Market Share Analysis (%), By End User (2023)

Figure 73: South Asia Market Share Analysis (%), By Country (2023)

Figure 74: South Asia Market Historical Market Value (US$ Million) Analysis, 2018 to 2023

Figure 75: South Asia Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 76: South Asia Market Attractiveness Analysis, By Products

Figure 77: South Asia Elder Care Products Market Attractiveness Analysis, By Type of Care

Figure 78: South Asia Market Attractiveness Analysis, By End User

Figure 79: South Asia Market Attractiveness Analysis, By Country

Figure 80: East Asia Market Share Analysis (%), By Products (2023)

Figure 81: East Asia Market Share Analysis (%), By Type of Care (2023)

Figure 82: East Asia Market Share Analysis (%), By End User (2023)

Figure 83: East Asia Market Share Analysis (%), By Country (2023)

Figure 84: East Asia Market Historical Market Value (US$ Million) Analysis, 2018 to 2023

Figure 85: East Asia Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 86: East Asia Market Attractiveness Analysis, By Products

Figure 87: East Asia Elder Care Products Market Attractiveness Analysis, By Type of Care

Figure 88: East Asia Market Attractiveness Analysis, By End User

Figure 89: East Asia Market Attractiveness Analysis, By Country

Figure 90: Oceania Market Share Analysis (%), By Products (2023)

Figure 91: Oceania Market Share Analysis (%), By Type of Care (2023)

Figure 92: Oceania Market Share Analysis (%), By End User (2023)

Figure 93: Oceania Market Share Analysis (%), By Country (2023)

Figure 94: Oceania Market Historical Market Value (US$ Million) Analysis, 2018 to 2023

Figure 95: Oceania Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 96: Oceania Market Attractiveness Analysis, By Products

Figure 97: Oceania Elder Care Products Market Attractiveness Analysis, By Type of Care

Figure 98: Oceania Market Attractiveness Analysis, By End User

Figure 99: Oceania Market Attractiveness Analysis, By Country

Figure 100: Middle East & Africa Market Share Analysis (%), By Products (2023)

Figure 101: Middle East & Africa Market Share Analysis (%), By Type of Care (2023)

Figure 102: Middle East & Africa Market Share Analysis (%), By End User (2023)

Figure 103: Middle East & Africa Market Share Analysis (%), By Country (2023)

Figure 104: Middle East & Africa Market Historical Market Value (US$ Million) Analysis, 2018 to 2023

Figure 105: Middle East & Africa Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 106: Middle East & Africa Market Attractiveness Analysis, By Products

Figure 107: Middle East & Africa Elder Care Products Market Attractiveness Analysis, By Type of Care

Figure 108: Middle East & Africa Market Attractiveness Analysis, By End User

Figure 109: Middle East & Africa Market Attractiveness Analysis, By Country

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Senior Tech Services Market Size and Share Forecast Outlook 2025 to 2035

Senior Friendly Packaging Market Size, Share & Forecast 2025 to 2035

Senior Cat Food Market

Senior In-Home Care Services Market Size and Share Forecast Outlook 2025 to 2035

In-Home Senior Care Franchises Market Analysis by Type, Age Group and by Region - Growth, trends and forecast from 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Pet Care Market Analysis – Demand, Trends & Forecast 2025–2035

Pet Care Packaging Market Insights - Growth & Forecast 2025 to 2035

Eye Care Supplement Analysis by Ingredients, Dosage Form, Route of Administration, Indication, Distribution channel and Region 2025 to 2035

Homecare Medical Devices Market Outlook – Industry Growth & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA