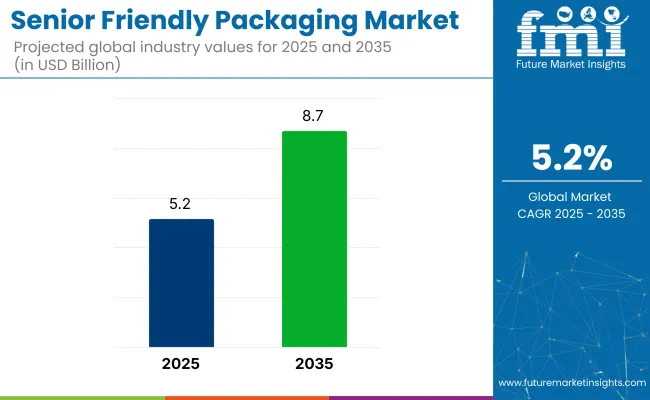

Senior friendly packaging market was valued at approximately USD 5.2 billion in 2025 and is anticipated to reach USD 8.7 billion by 2035, registering a CAGR of 5.2% over the forecast period. Sales in 2024 were estimated to reach nearly USD 5,013.6 billion, reflecting a steady rise in demand driven by an aging global population and the increasing need for packaging solutions that offer safety, ease of use, and accessibility.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 5.2 billion |

| Projected Market Size in 2035 | USD 8.7 billion |

| CAGR (2025 to 2035) | 5.2% |

Growth has been further supported by heightened consumer awareness regarding medication adherence and the growing pressure on healthcare systems to reduce administration errors and improve treatment outcomes. Senior friendly packaging has become an integral component in patient-centric design strategies, especially across pharmaceutical and consumer health product categories.

In 2024, Berry Global was recognized with Silver Awards at the FlexPack Voice Sustainability Awards for its 50% recycled-content multi-use e-commerce mailer. “Sustainability is not just something we talk about at Berry, but a principle ingrained in our culture and strategy. We believe that we are leading the industry in terms of the energy and resources we are pointing toward sustainability,” said Jerry Lamarre, Executive Vice President/GM, Engineered Materials Division, Berry Global.

Technological integration has enabled significant progress in delivering smart and adaptive packaging solutions tailored to older consumers. Features such as time-activated reminders, digital dosage trackers, and color-coded compartments have entered the market to support better compliance and caregiver communication.

Advances in material engineering have also facilitated the creation of lighter yet durable structures that simplify handling without compromising protection. Alongside this, emphasis has been placed on minimizing environmental impact by employing recyclable materials, water-based inks, and reduced secondary packaging, all while maintaining senior-friendly functionality.

Technology integration has played a growing role in advancing senior friendly packaging. Smart packaging formats have introduced features such as audible alarms, light indicators, and mobile-linked adherence monitoring systems. These innovations are being explored not only to enhance compliance but also to support caregivers in tracking medication usage.

Simultaneously, rising interest in environmental responsibility has led to efforts toward recyclable, compostable, and bio-based materials within senior-friendly formats. Looking forward, the market is expected to maintain momentum as packaging design continues to evolve in response to demographic shifts and healthcare delivery models prioritizing patient empowerment.

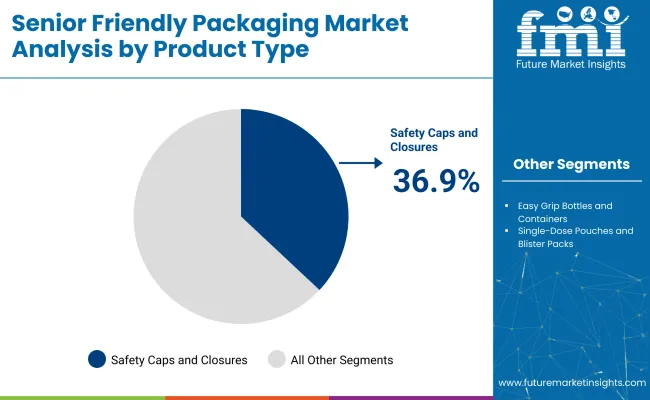

The market is segmented based on product type, application, end use, and region. By product type, the market includes easy grip bottles and containers, safety caps and closures, single-dose pouches and blister packs, and graphic labels and tags. In terms of application, the market is categorized into consumer products, medicinal tablets, pills and syrups, and body and hair care products.

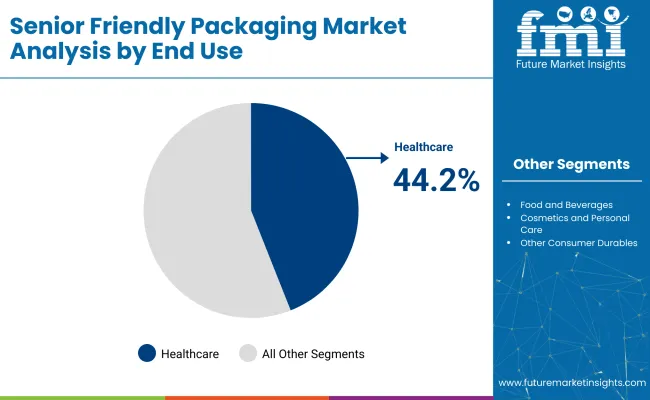

By end use, the market comprises food and beverages, healthcare, cosmetics and personal care, and other consumer durables. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

Safety caps and closures are expected to hold the largest share of 36.9% in the senior friendly packaging market in 2025, as their adoption has been driven by ergonomic grip, opening simplicity, and tamper-resistance. These components have been widely used in pharmaceutical bottles, OTC medications, and nutraceutical containers.

Grip-enhancing ridges, push-turn mechanisms, and enlarged diameters have been engineered for seniors with reduced dexterity or joint strength. Consistency in sealing and resealing performance has supported use across regulated healthcare packaging lines.

Closures designed for audible clicks and visual alignment indicators have aided users with cognitive and visual impairments. Manufacturing lines have integrated these caps with automated torque testing to ensure compliance. Adjustable torque levels and wide-thread designs have enabled both safety and accessibility in one unit. Market dominance has been retained through standardized closure formats across aging-focused product portfolios.

The healthcare end-use segment is projected to account for 44.2% of the senior friendly packaging market in 2025, as growth has been supported by aging population trends, chronic condition management, and regulatory pressure for accessible dosing.

Blister packs, pill bottles, and dispensing systems have been customized to reduce effort, confusion, and handling errors. Medication adherence tools, including labeled compartments and simplified opening systems, have been widely incorporated. Packaging design has been aligned with guidelines set by health authorities and senior advocacy groups.

Patient-centric packaging with clear fonts, color coding, and audible feedback features has been adopted to improve safety and compliance. Refill packaging and multi-dose containers have been tailored to support daily regimens and pharmacy distribution systems. Use cases in clinics, long-term care, and home-based treatments have driven scale. Continued demand has been forecasted due to the global rise in senior patient populations and elder care services.

High Production Costs and Regulatory Compliance

Senior-friendly packages require quality materials and design changes, which increases production costs. More onerous regulatory requirements for materials can also raise costs and complications for the manufacturers.

Limited Availability of Eco-Friendly Materials

Although there is a rising request for sustainable packaging solutions, numerous senior-friendly packaging strategies rely on conventional plastics. However, there are not many biodegradable or recyclable materials that can be used in approachable designs for elderly, which makes it difficult for manufacturers to strike a balance between usability and eco-design.

Aging Global Population Driving Demand

One of the major drivers for recycling in the packaging production business is the rising aging population worldwide creating this growing demand for seniors packaging i.e. easy to open and usability, and recycling. The increasing geriatric population provides a significant growth opportunity for the senior-friendly packaging industry.

Technological Integration Enhancing Usability

New technologies provide the opportunity to develop smart packaging, such as blister packs with electronic reminders or QR codes that connect to video instruction. These innovations improve the usability and safety of packaging for aging population, promoting market growth.

The demand for senior-friendly packaging in the USA is largely being driven by the increasing aging population and subsequent demand for packaging that ensures safety and ease of use for older adults. To address the physical challenges faced by seniors, packaging manufacturers are focusing on creating easy-to-open, tamper-evident, and ergonomically designed packaging.

Such packaging solutions are in great demand in the healthcare and food industry where the elders prefer packaging that require less physical effort. Furthermore, regulatory guidelines promoting the use of user-friendly packaging for healthcare products also propel the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

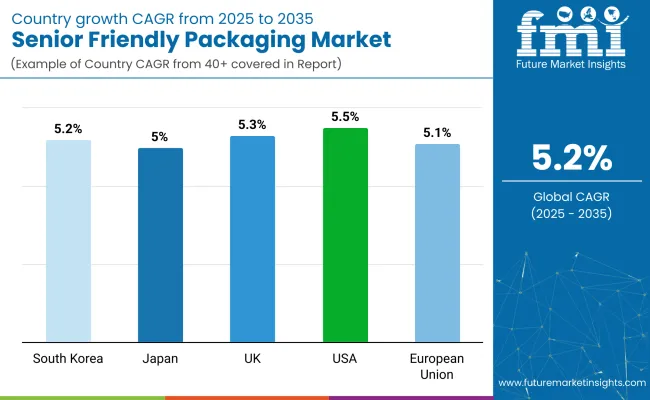

| USA | 5.5% |

The senior-friendly packaging market in the UK is making inroads with a better focus on enabling elderly people with packaging approaches that offer convenience and safety enhancements. Several industries heavily depend on easy-to-handle packaging, including pharmaceuticals, food, and personal care products, as the aging demographic increasingly drives demand for such packages.

The UK government’s strong focus on caring for its aging population has spurred businesses to create packaging that offers tactile characteristics, simpler labeling and easy-opening mechanisms. Additionally, eco-friendly sustainable packaging solutions looms Rescue products for elderly needs and also sustainable development for environment.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

The senior-friendly packaging industry in the European Union is growing steadily, propelled by the rising share of elderly citizens across member states. The ageing population in nations such as Germany, France and Italy has led to a growing demand for packaging that aids usage by older people.

Packaging that is lightweight and easy to open or helps seniors with limited dexterity navigate food products is an area of innovation. The regulatory authorities are advocating for a packaging solution that is safer for seniors in the EU, while the new trend for sustainability is driving the development of environmentally sustainable senior-friendly packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.1% |

Japan has seen incredible growth in the senior-friendly packaging market, as its population continues to age and the demand for products designed for the needs of seniors increases. Japanese packaging manufacturers are increasingly focused on creating accessible and ergonomic solutions, with a strong emphasis on easy-to-open packaging.

User-friendly packaging is not limited to cosmetics; it also applies to food, personal care and pharmaceuticals. As Japan is devoted to improving elderly citizens’ quality of life, innovations such as larger print sizes, tactile surfaces and lower physical effort needed to open packages are becoming standard.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The market for products with senior-friendly packaging in South Korea is on the rise, with a dramatic increase in its elderly population and government efforts to enhance elderly care. Packaging that offers easy access and safe handling is becoming a trend among South Korean consumers.

There is huge demand for innovations like resealable packs, single-serve packaging, and easy-to-navigate labeling. As the government concentrates on elderly care programs and the fast-growing food delivery services in the country, manufacturers are being urged to develop packaging offerings that would cater to the specific needs of senior citizens.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The global senior friendly packaging market is witnessing massive growth on account of increasing population aging in developed and emerging regions. More and more elderly consumers are needed specialized packaging solutions, and thus companies are innovating solutions that best fit the customer demand for ease-of-use, accessibility as well as safety.

However, it has led towards user-centric packaging designs which include senior-friendly components like easy-open lids, resealable packs, larger text, and high-contrast labels. Moreover, improved materials and technology made it possible to design more lightweight and ergonomic packaging solutions, a must have feature for those elderly people suffering from arthritis or reduced strength.

The overall market size for senior friendly packaging market was USD 5.2 billion in 2025.

The senior friendly packaging market expected to reach USD 8.7 billion in 2035.

The demand for senior-friendly packaging will be driven by the growing aging population and the increasing need for convenient, accessible packaging solutions. Regulatory guidelines and consumer preferences for health and safety will further fuel market growth.

The top 5 countries which drives the development of senior friendly packaging market are USA, UK, Europe Union, Japan and South Korea.

Medicinal tablets, pills, and syrups driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Senior In-Home Care Services Market Size and Share Forecast Outlook 2025 to 2035

Senior Tech Services Market Size and Share Forecast Outlook 2025 to 2035

Senior Care Product Market Analysis – Size, Share & Forecast 2025 to 2035

Senior Cat Food Market

In-Home Senior Care Franchises Market Analysis by Type, Age Group and by Region - Growth, trends and forecast from 2025 to 2035

Eco Friendly Laundry Product Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Beneficiation Reagents Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Eco-friendly Bottle Market Forecast and Outlook 2025 to 2035

Eco-Friendly Inks Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Toys Market Size and Share Forecast Outlook 2025 to 2035

Eco-Friendly Straws Market Growth - Demand & Forecast 2025 to 2035

Eco-friendly Paper Plates Market Insights - Trends & Future Outlook 2025 to 2035

Market Share Distribution Among Eco-Friendly Candle Manufacturers

Understanding Eco-Friendly Inks Market Share Trends

Eco-friendly Candle Market Report – Demand & Trends 2024-2034

Eco-Friendly Plasticizers Market

Eco-friendly Tea Packaging Market Size and Share Forecast Outlook 2025 to 2035

Keto Friendly Flavors Market

Non-eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA