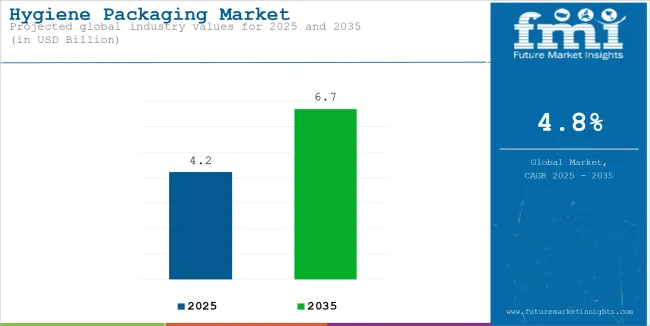

The hygiene packaging market is projected to grow from USD 4.2 billion in 2025 to USD 6.7 billion by 2035, registering a CAGR of 4.8% during the forecast period. Sales in 2024 reached USD 4.0 billion, indicating a steady demand trajectory. This growth has been attributed to the increasing consumer awareness of sanitation, infection control, and personal hygiene, particularly in healthcare, personal care, and household applications.

The rise in hospital-acquired infections (HAIs) and post-pandemic hygiene consciousness have driven the need for safe, tamper-proof, and contamination-resistant packaging solutions. Innovations in antimicrobial coatings, smart packaging, and self-sanitizing materials are transforming the industry by enhancing product safety and extending shelf life.

| Attributes | Description |

|---|---|

| Estimated Global Hygiene Packaging Market Size (2025E) | USD 4.2 billion |

| Projected Global Hygiene Packaging Market Value (2035F) | USD 6.7 billion |

| Value-based CAGR (2025 to 2035) | 4.8% |

In November 2024, Berry Global Group, Inc. is pleased to announce the successful completion of the merger between Berry’s Health, Hygiene and Specialties Global Nonwovens and Films business and Glatfelter Corporation, resulting in the creation of Magnera Corporation.

“We are excited about the completion of this transaction. With this move to optimize our portfolio, we solidify our position as a global leader of consumer-focused packaging solutions while enhancing the stability of our earnings, free cash flow and growth. We are confident that employees transferring to Magnera will benefit from the new company’s strong leadership and focused capabilities, and we are grateful for their contributions.”

The development of eco-friendly packaging solutions has been prioritized to meet environmental regulations and consumer preferences. Advancements in packaging design have led to improved durability and reduced material waste, enhancing overall sustainability. Integration of smart features, such as antimicrobial coatings and tamper-evident seals, has been implemented to ensure product safety and quality. These innovations have not only reduced the environmental footprint of packaging processes but have also opened new avenues for application in various industries.

The hygiene packaging market is expected to witness steady growth, driven by increasing demand in the healthcare and personal care sectors. Manufacturers focusing on sustainable and innovative solutions are anticipated to gain a competitive edge.

Emerging markets in Asia-Pacific and Latin America are projected to offer significant growth opportunities due to rising consumer awareness and industrialization. Strategic collaborations and investments in research and development are likely to foster product innovation and market expansion. As environmental concerns continue to influence consumer behavior, the adoption of eco-friendly hygiene packaging is expected to become a key differentiator in the industry.

The market is segmented based on product type, material type, end-use application, and region. By product type, the market includes sanitary napkin packaging, diaper packaging, wet wipes packaging, tissue packaging, cotton pad packaging, and incontinence product packaging. In terms of material type, the market is categorized into plastic films (PE, PET, BOPP), paper & paperboard, aluminum foil, biodegradable & compostable materials, and laminated multilayer materials.

By end-use application, the market comprises baby care products, feminine hygiene products, adult incontinence products, personal wipes, and medical & institutional hygiene. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Plastic films have been projected to capture 49.6% of the hygiene packaging market in 2025, attributed to their lightweight nature, high flexibility, and strong moisture barrier properties. Materials such as polyethylene (PE), polyethylene terephthalate (PET), and biaxially oriented polypropylene (BOPP) have been used extensively across baby diapers, adult care pads, and feminine hygiene products.

These films have been laminated with functional coatings or multilayer structures to deliver breathability, durability, and shelf appeal. Printable surfaces have been engineered to support branding, regulatory compliance, and product differentiation in a competitive hygiene product landscape.

The use of high-speed converting and sealing machinery has been facilitated by plastic films due to their mechanical consistency and thermal responsiveness. Automated packaging lines have increasingly adopted these substrates for their efficiency and minimal material wastage. Sustainability challenges have been addressed through the introduction of recyclable mono-material films and bio-based alternatives within the plastic film category. Research has been directed at light weighting and enhancing recyclability while maintaining product safety and hygiene compliance.

Baby care products have been estimated to account for 35.2% of total hygiene packaging demand in 2025, driven by rising birth rates in emerging economies and consistent demand in developed regions. Packaging formats such as flow wraps, pouches, and resalable bags have been adopted for diapers, wipes, and changing pads. High-absorption and breathable barrier technologies have been integrated into packaging to ensure comfort, product integrity, and leak prevention. Convenience features such as one-hand opening, soft-touch materials, and hygienic reseals have been emphasized to support caregiver ease of use.

Consumer sensitivity around baby products has led to an emphasis on packaging hygiene, non-toxic materials, and tamper-evident closures. Certification standards for baby-safe materials have guided the selection of laminates and films used in production. As urbanization and dual-income households continue to grow globally, baby hygiene products are expected to drive consistent innovation in material usage and packaging design. Manufacturers have been scaling up regional production capacities and adopting advanced converting technologies to meet rising demand in this segment.

Increasing Consumer Awareness of Health and Hygiene

The rising concern about health and hygiene among consumers is one of the important drivers for the hygiene packaging market. As awareness of contamination, food safety, and infectious diseases surges and concentrates more post-COVID-19, consumers are looking for increased cleanliness and safety in product offerings.

Packaging solutions that exclude external contamination, preserve the integrity of the product, and provide tamper-evident features are in great demand. This shift in consumer behavior has been driving the uptake of hygiene packaging across the food, personal care, and healthcare sectors.

Advancements in Packaging Technology

Innovation in packaging technology is further fueling the hygiene packaging market. Advancements in materials include antimicrobial packaging, biodegradable packaging, and intelligent packaging. Features that provide additional safety benefits for hygiene products, including tamper-evident seals, child-resistant designs, and temperature indicators, help instill greater trust in consumers as well.

It is the dual demand for effective hygiene protection and environmentally friendly solutions that have made it highly attractive to both manufacturers and consumers.

Rising Demand for Personal Care and Healthcare Products

The growing demand for personal care products, disinfectants, and healthcare items also drives the hygiene packaging market. As consumers continue to place increased importance on personal cleanliness and health maintenance, there is a greater need for effective packaging solutions that help preserve product quality.

Additionally, the aging population in North America and Europe has created a demand for easy-to-use, safe packaging specifically designed for older consumers. This demographic change has opened gates to specialized packaging in hygiene directed toward specific uses.

High Costs of Raw Materials and Production

Another very important restraining factor for the hygiene packaging market is the growing prices of raw material inputs and manufacturing operations. Plastics and special package components are very expensive in addition to a string of other basic input materials due to supply chain shocks and higher demand.

These rising costs may limit the capacity of manufacturers to invest in innovative packaging solutions or maintain competitive pricing, specifically for smaller companies that lack the financial muscles to absorb such costs. Additionally, the complexity associated with the production of high-quality hygiene costs.

Therefore, such financial pressures can limit market growth as companies become more emphasize cost-cutting measures rather than innovation, thereby stagnating the development of products and an inability to cater to the needs of changing consumers for more efficient and sustainable hygiene packaging solutions.

Shift Towards Sustainable Packaging Solutions

Sustainable packaging solutions are an emerging trend in the hygiene packaging market. Increasing consumer environmental awareness is making consumers demand minimal environmental impact from packaging. As a result, companies are embracing eco-friendly materials such as biodegradable plastics, recycled content, and renewable resources in packaging designs.

For example, most manufacturers are considering the uptake of post-consumer recycled materials. These not only reduce waste but also help create a circular economy. Such a trend can be seen in sectors such as personal care and healthcare, where sustainability is the priority for many brands as part of their corporate responsibility initiatives.

Ruse of Reusable and Refillable Packaging

The second important trend is the emergence of reusable and refillable packaging options. As people focus more on the reduction of single-use plastics and waste, many companies are now developing solutions that can be reused multiple times or refilled rather than discarded.

This helps reduce waste but also encourages consumer loyalty because consumers appreciate the convenience and sustainability of refillable products. Branded personal care and home cleaning products tend to lead in this category, where they provide reusable containers that can be easily refilled with non-toxic refill products.

Increased Focus on Hygiene and Safety

A major mega-consumer trend of hygiene packaging film involves increased attention to hygiene and safety, following global health emergencies such as the COVID-19 pandemic. There is a great need for hygienic, clean, and safe products that help prevent contamination from happening. Therefore, the demand for protection-enhanced packaging solutions with tamper-evident seals and antimicrobial material is high.

The consumer is today more likely to pick a product with hygienically sealed packaging. This stems from the requirement of safety and guarantee of integrity for the products. This change in consumer requirements does not end with healthcare. Personal care products, food packs, and any other product segment face this phenomenon.

Brands adapt to this evolution in consumer perception by innovating packaging designs. For example, it is investing in advanced materials for better barriers that are easier to handle without compromising hygiene. This focus on hygiene packaging is changing product development methodologies because manufacturers are looking to align their offerings with the growing demand by consumers that such products must be safe and clean.

India's hygiene packaging market is poised to experience a CAGR of 6.3% till 2035. The hygiene packaging market in India has been witnessing massive growth due to a range of interdependent factors. In the past decade, increased awareness among consumers in terms of health has led them to be increasingly conscious of hygiene and sanitation as a result of government campaigns and educational efforts. This change was more prominent following the COVID-19 pandemic which highlighted the relevance of hygiene and hygiene-related products.

The USA is expected to achieve a CAGR of 28.7% in the forecast period. Due to several prominent reasons, this market of hygiene packaging is accelerating highly in the USA Today’s rising health consciousness in the heads of the public at large coupled with the global crisis of COVID-19 increased a great desire to consume and carry safe hygiene goods, increasing consumer preference to make safe packaging available without any microbial contaminants.

China is expanding to grow at a CAGR of 6.0% from 2025 to 2035. The rise of the middle class in China and urbanization have brought about lifestyle changes that are convenient and accessible. With more consumers moving to cities, there is a greater reliance on packaged goods, including personal care and health products, which require effective hygiene packaging. The demand is further driven by the growth of e-commerce and food delivery services, as these sectors emphasize single-use packaging for its convenience and hygiene benefits.

UK is poised to attain a CAGR of 2.3% from 2025 to 2035. The UK hygiene packaging market is growing rapidly because of several important factors. Increasing health consciousness among consumers, specifically after the COVID-19 pandemic, has further multiplied the demand for safe and clean packaging. This trend is supported by increased awareness about food safety and sustainability, consumers are becoming increasingly mindful of product cleanliness and the environmental factors associated with it.

Japan is poised to witness a CAGR of 3.7% in the forecast period. This development of urbanization and changes in the lifestyles of people leads to higher consumption of personal care and health products, where proper hygiene packaging is in high demand. Innovative packaging technologies, including antimicrobial and biodegradable materials, are gaining popularity as environmentally responsible in Japan increase demand.

The hygiene packaging market size in Germany will grow at around 4.7% CAGR by 2035. Strong healthcare infrastructure and a proper regulatory environment promote high hygiene standards, making the manufacturer innovate and develop better packaging solutions. Online shopping also added a vital impetus, as this medium of buying products needs safe hygiene packaging so that the products can reach their destinations safely.

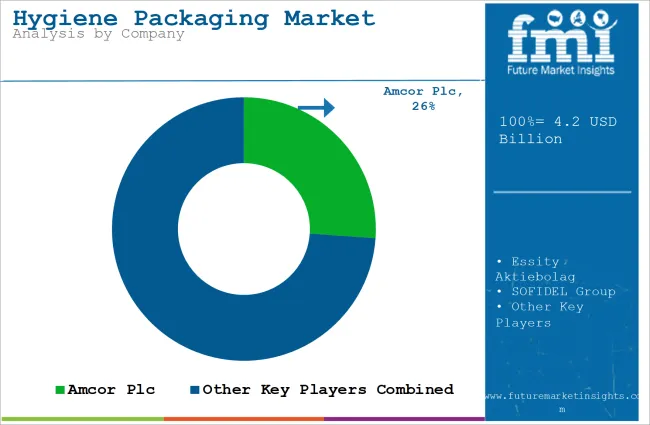

Major companies present in the hygiene packaging market are Berry Global, Amcor Plc, Mondi Group, WestRock, and Kimberly-Clark. The companies involved are using multiple growth strategies to enhance their position in the market. For example, Berry Global has been enhancing its manufacturing capacity through expansion.

Berry Global recently established a new plant in India focused on producing specific healthcare packaging solutions. With the shift, they extend their product spectrum but also give a stronger grounding in the increasing Asian market. On a similar note, Amcor has engaged actively in a quest for sustainable campaigns along with innovative designs that reduce harmful environmental impacts alongside consumers' high demand for safety and hygiene while being packaged.

Additionally, besides expansion and sustainability, mergers, and acquisitions are an important part of the strategies of these companies. For example, WestRock has been looking for strategic partnerships to enhance its product offerings and improve operational efficiencies. Similarly, Kimberly-Clark has been focusing on technological advancements in packaging materials to cater to the evolving needs of consumers, particularly in the personal care and health sectors.

So, through investment in the research and development of new and sustainable products, the companies work to introduce hygiene-friendly smart packaging solutions that contribute to increased user experience. Bringing all these strategies together has cemented their position within the hygiene packaging market's competitive landscape, providing these companies with the right tools to address changing consumer needs and regulations.

Hygiene packaging startups take innovative strategies, including sustainability and consumer safety through regulatory compliance, to succeed in their business. An example is the emergence of Notpla, a seaweed-based, biodegradable packaging solution intended to replace plastics while targeting eco-friendly solutions that are also compostable.

Lactips, another player, produces casein-based thermoplastics dissolved in water and biodegradable safe packaging alternatives aimed at healthcare. Kelpie, another advanced player, is utilizing seaweed-derived materials in bioplastic packaging, in cooperation with brand names like L'Oréal to improve personal care products' sustainability.

Startups such as FabPad and Heyday are emphasizing organic and biodegradable materials for hygiene products such as sanitary pads and diapers. Their growth strategies include direct-to-consumer models and partnerships that aim at affordability while pushing the message of waste reduction. Additionally, growPack is developing sustainable lignin- and cellulose-based packaging and has partnered with companies like Ambev to validate its compostable technologies.

The innovations of materials, strategic collaborations, and consumer-centric approaches that characterize these startups respond to the ever-rising demand for sustainable hygiene packaging solutions. With their efforts to minimize the impact on the environment and product safety, these players will shape this new industry.

The market is predicted to reach USD 4.2 billion by 2025.

The market is predicted to reach USD 6.7 billion by 2035.

The prominent companies in the hygiene packaging market include Amcor Plc, SOFIDEL Group, Kimberly-Clark Corporation, and others.

The USA is likely to create lucrative opportunities for the hygiene packaging market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hygiene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Tissue and Hygiene Paper Packaging Market

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA