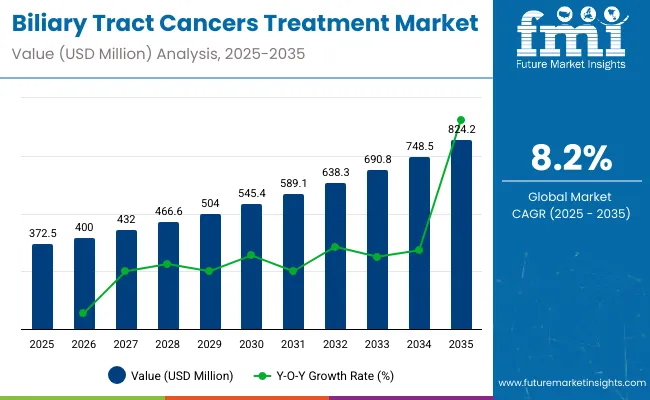

The global biliary tract cancers treatment market is projected to grow from USD 372.5 million in 2025 to USD 824.2 million by 2035, reflecting a robust compound annual growth rate (CAGR) of 8.2%. Market expansion is driven by the rising incidence of cholangiocarcinoma and gallbladder cancer, increasing awareness and early diagnosis, and breakthroughs in targeted therapies and immuno-oncology drugs.

Biliary tract cancers, though rare, are aggressive malignancies typically detected at late stages due to subtle or asymptomatic onset. Historically managed with surgery, systemic chemotherapy, and palliative care, the treatment landscape is undergoing a shift toward precision medicine, with growing reliance on biomarker-guided regimens and checkpoint inhibitors that offer improved progression-free survival.

Emerging therapies such as FGFR2 inhibitors and IDH1 inhibitors are showing efficacy in genetically defined patient subgroups, particularly those with intrahepatic cholangiocarcinoma. The pipeline is further supported by clinical trials exploring PD-1/PD-L1 inhibitors, combination immunotherapies, and tumor microenvironment modulators, which are expanding treatment options and improving response rates in previously refractory cases.

Strong regulatory momentum-including orphan drug designations, breakthrough therapy status, and fast-track approvals-is encouraging pharmaceutical investment in this space. Leading oncology firms are prioritizing biliary tract cancers in their clinical pipelines, recognizing unmet needs and opportunities in rare oncology markets.

During a 2023 panel hosted by Targeted Oncology, Dr. Lipika Goyal, Assistant Professor at Harvard Medical School, stated: “We’re seeing real momentum in the field of biliary tract cancers. With biomarker-driven therapy and new immunotherapy combinations, we’re changing the trajectory for patients with historically limited options.”

With continued advances in molecular diagnostics, expanding clinical trial enrollment, and increasing global access to next-generation oncology therapies, the biliary tract cancers treatment market is poised for accelerated and transformational growth through 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 372.5 million |

| Industry Value (2035F) | USD 824.2 million |

| CAGR (2025 to 2035) | 8.2% |

Biliary tract cancer, including cholangiocarcinoma and gallbladder cancer, is relatively rare but has been showing a rising trend in certain regions. The prevalence varies geographically, with higher rates observed in Southeast Asia, particularly in Thailand, due to risk factors like liver fluke infections. In Western countries, the incidence remains low but has increased slightly due to improved diagnostic methods and aging populations. Biliary tract cancer is more common in older adults, typically affecting individuals over 50.

Biliary tract cancer (BTC), though relatively rare, presents significant challenges due to its late diagnosis and limited treatment options. As awareness grows and research advances, various governments have begun implementing supportive measures to improve access to diagnosis, treatment, and palliative care. From national insurance coverage to fast-tracking of innovative therapies, countries are adopting diverse strategies based on their healthcare infrastructure and resources. The following overview highlights how major nations like the United States, United Kingdom, China, and India are addressing the growing need for effective biliary tract cancer care through policy support, public funding, and institutional initiatives.

The table below provides the projected CAGR of the global Biliary Tract Cancers Treatment market over different semi-annual periods between 2025 and 2035. During the first half (H1) of the decade from 2024 to 2034, the business is expected to grow at a CAGR of 9.0%, while during the second half (H2) of the same decade, the growth is expected to be a tad slower at 8.7%.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 9.0% |

| H2 (2024 to 2034) | 8.7% |

| H1 (2025 to 2035) | 8.3% |

| H2 (2025 to 2035) | 7.8% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is expected to decline slightly at 8.3% in the first half and decline moderately at 7.8% in the second half. The market lost 70.00 BPS in the first half. However, in the second half, the market gained 90.00 BPS.

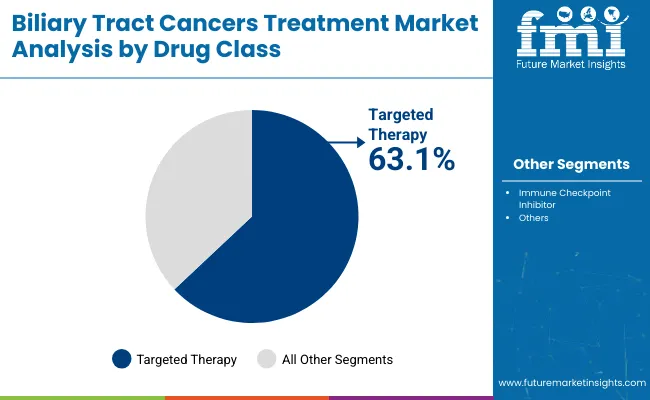

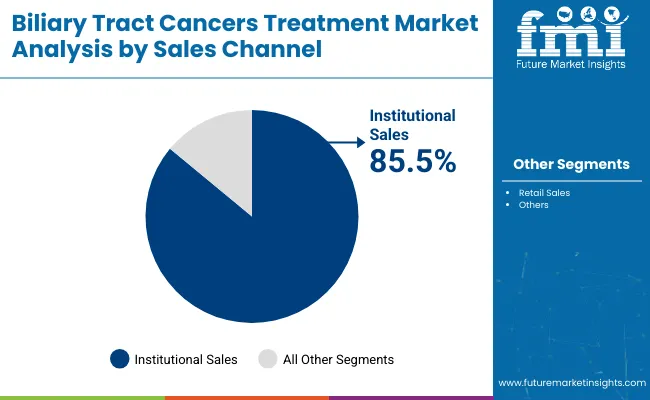

Targeted therapies dominate the market with a 63.1% share, while institutional sales channels account for 85.5% in 2025. Precision oncology, genetic profiling, and centralized hospital infrastructure are driving adoption of novel BTC treatments, particularly for FGFR2 and IDH1 mutation-positive patients.

Targeted therapy is expected to dominate the biliary tract cancer (BTC) treatment market, capturing a 63.1% share in 2025. This segment is growing rapidly due to its ability to directly inhibit cancer-specific genetic mutations or molecular pathways-offering higher efficacy and fewer side effects compared to conventional chemotherapy. Agents such as pemigatinib (FGFR2 inhibitor) and ivosidenib (IDH1 inhibitor) are proving highly effective in cholangiocarcinoma patients with FGFR2 fusions or IDH1 mutations, shifting the treatment paradigm toward personalized care.

The rise of biomarker-driven treatment is reshaping oncology, especially in rare and aggressive cancers like BTC. Clinical trials for new targeted agents continue to expand globally, supported by advancements in genomic testing and drug design. These therapies not only improve progression-free survival but also significantly reduce toxicity burdens for eligible patients.

Pharmaceutical innovators and biotech firms are actively investing in BTC-specific drug discovery pipelines, making targeted therapy the foundation of next-gen BTC care. As genetic testing becomes standard practice in oncology settings, the demand for precise, mutation-specific therapeutics is set to drive market expansion.

Institutional sales are projected to account for 85.5% of the biliary tract cancer treatment market in 2025, underscoring the central role of hospitals and specialized oncology centers in treatment delivery. BTC care is typically administered in well-equipped institutional settings due to the complex nature of therapies-particularly targeted and immunotherapies-which require continuous monitoring, infusion infrastructure, and specialist intervention.

Hospitals and cancer clinics are also the primary venues for advanced diagnostic workups, such as imaging and molecular testing, which are essential for determining eligibility for targeted therapies. The high cost of these novel treatments further contributes to bulk purchasing by healthcare institutions under payer reimbursement models. Additionally, physician-driven treatment protocols and institutional drug formularies reinforce hospital-based drug administration as the dominant sales channel.

Major biopharmaceutical companies distribute BTC drugs through institutional frameworks to ensure controlled storage, administration, and patient support services. As the number of clinical trials and high-cost personalized therapies increases, institutional settings will remain the core of BTC treatment. This trend is expected to persist, reinforced by ongoing healthcare investments, oncology care network expansion, and centralized treatment planning.

Immunotherapy is emerging as one of the most promising and revolutionary treatments for cancers of the biliary tract (BTCs). BTCs are aggressive, so immunotherapy may address one of the most important unmet medical needs in the effort to combat these challenging cancers.

Research acceleration in the area is supported by collaborations of academic institutions and pharmaceutical companies to speed up work. Immunotherapy provides durable responses and survival for patients with advanced or refractory BTCs and drives its uptake. As such, the expected increase in BTC treatment with immunotherapy will dramatically grow as further research identifies novel immune targets and combination strategies.

Very recent breakthroughs occurred in the utility of checkpoint inhibitors, especially towards PD-1/PD-L1 and CTLA-4. Studies using pembrolizumab and nivolumab have resulted in promising reports from clinical studies. Recent improvements in CAR-T cell therapy have revealed an emerging field that involves engineered T-cells in a patient for targeting selected antigens associated with cancer that can open BTC towards novel therapeutic intervention.

This significantly changes the biliary tract cancer treatment scenario in terms of its emergence due to targeted therapies, which not only focus on general killing but now specifically look for genetic mutations or molecular pathways to kill and overcome such tumors in human beings. Precision-based methods like this one are increasingly dominating the BTC market and have created greater scope in improvement with decreased side effects.

Key targeted therapies include FGFR inhibitors and IDH1 inhibitors, which have shown efficacy in subsets of BTC patients with specific genetic alterations. FGFR inhibitors target FGFR2 fusions, common in intrahepatic cholangiocarcinoma, while IDH1 inhibitors are designed for patients with IDH1 mutations, providing personalized treatment options that significantly enhance survival and quality of life.

Clinical advances and approvals on the regulatory fronts have pushed for further accelerated adaptation of targeted therapy area. For instance, pemigatinib gained regulatory approval towards the treatment of FGFR2 fusion-positive and ivosidenib for mutation-positive IDH1 BTC cases, marking this trend to depend increasingly on therapy through biomarker-based drug designs.

Increased investment in R&D is also a factor of rising targeted therapies since the pharma companies started finding new targets like HER2 amplifications and BRAF mutations. Moving forward, increasing availability of genetic profiling and companion diagnostics will make further space in targeted therapies.

Governments and agencies such as the USA There exist incentive programs launched both by Food and Drug Administration and the European Medicines Agency on orphan drugs in order to further encourage a tremendous amount of study and discovery research in such this area of healthcare.

The designations of orphan drugs are very helpful as they provide lower costs for clinical trials, tax credits, and longer exclusivity post-approval. For instance, orphan drug status provides seven years of market exclusivity in the USA and ten years in Europe, thus allowing pharmaceutical companies to reap their innovations without competition. In addition, fast-track and priority review pathways shrink the regulatory timeline; hence the market entry rate for new therapies is expedited.

These incentives have spurred innovation by reducing financial risks and encouraging smaller biotech firms and larger pharmaceutical companies to invest in novel BTC treatments, including targeted therapies, immunotherapies, and advanced drug delivery systems. With continued regulatory support, the opportunity for developing life-saving BTC therapies is vast, creating a fertile ground for market growth and innovation.

These cancers of the biliary tract are highly heterogeneous in their genetic and molecular features. This significantly makes them one of the most challenging forms to study and clinically treat. Such heterogeneity has a significant impact on the development of appropriate treatment, designing clinical studies, and proper stratification of patients involved in research.

Some BTCs have their different subtypes of intrahepatic cholangiocarcinoma with fusions FGFR2, extrahepatic cholangiocarcinoma, and gallbladder carcinoma, having respective molecular features. Variations even include some kind of biomarker such as the IDH1 mutation, amplification of HER2, and also KRAS mutation.

This variability makes it very difficult to develop any therapy universally applicable, so pharmaceutical companies have to narrow it down to pretty specific subgroups. Although this is helpful for certain populations, it greatly minimizes the appropriate markets for drugs and complicates clinical trials.

Further, heterogeneity within BTCs often leads to varied responses in treatment: some may eventually become resistant to targeted therapies. Thus, the duration for which these remain effective could be limited; again, it leads to higher costs for continued innovation. These challenges are driven by the complex nature of the genetic and molecular landscape of BTCs and significantly constrain the growth of market pace and comprehensive solutions for treatment.

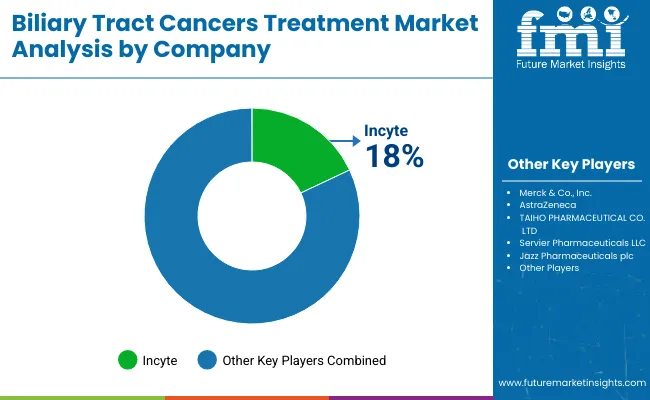

Tier 1 companies are market leaders with a global market share of 69.3%. Such firms have dedicated maximum investments toward Research & Development focusing on innovation regarding treatments. At the forefront among Tier 1 are companies AstraZeneca, Incyte and Merck & Co., Inc. Another reason, through which it is leading this space includes its strategic alliance for acquisitions so to in-license innovative new chemical entity, coupled with newer & high technology through them. It has stressed the conducting of extensive clinical trails to verify both its efficacy and safety profile.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market and holds around 30.7% market share. The top companies in tier 2 are Daiichi Sankyo Company, Limited, Jazz Pharmaceuticals plc, Relay Therapeutics, Servier Pharmaceuticals LLC, and Taiho Pharmaceutical Co., Ltd. These companies usually contract partnerships with research organizations and institutions for emerging technologies and speed up product development.

These companies often emphasize agility and adaptability, allowing them to quickly bring new treatments to market, sometimes targeting specific types of cancer or rare conditions. Additionally, the organizations pay attention to low-cost production methods to provide competitive pricing.

Tier 3 companies such as BeiGene, Ltd., Exelixis, Inc., and HUTCHMED specialize in specific products and cater to niche markets, thus providing even more diversity in the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the Biliary Tract Cancers Treatment sales remains dynamic and competitive.

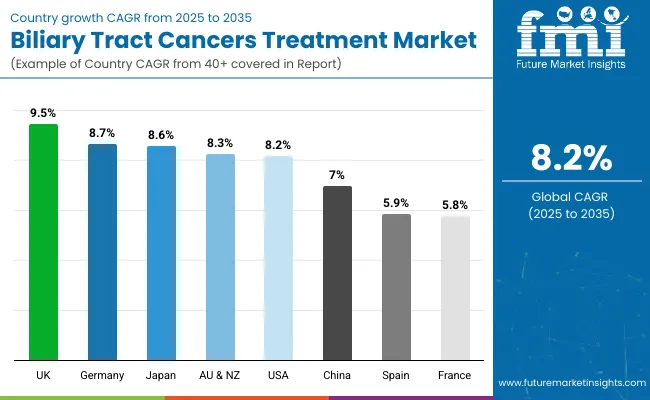

The section below covers the industry analysis for the Biliary Tract Cancers Treatment market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and MEA, is provided. The United States is anticipated to remain at the forefront in North America, with higher market share through 2035. In Asia Pacific, Japan market is projected to witness a CAGR of 8.6% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 8.2% |

| Germany | 8.7% |

| France | 5.8% |

| Spain | 5.9% |

| China | 7.0% |

| UK | 9.5% |

| Japan | 8.6% |

| Australia & New Zealand | 8.3% |

United States Biliary Tract Cancers Treatment market exhibits a CAGR of 8.2% between 2025 and 2035. In 2024 the United States holds the heist share of the North America Market and will continue to be through 2035.

In the United States, advancing genetic profiling has been the most important driver. Pemigatinib and ivosidenib target BTC patients with specific mutations. Specific genetic mutations were found, and targeted drugs such as pemigatinib and ivosidenib were developed. This is now a completely different approach for the management of BTC, which is more accurate and personalized, with better efficacy and reduced side effects compared to the traditional approach to treatment.

In the United States, where there are strong infrastructures for health care and for conducting research, these genetic profiling technologies are readily introduced into practice. Early tests that diagnose these mutations provide better patient stratification so the right therapy for the right patient is being assured.

In that sense, personalization leads to adoption, pushes the faster development of drugs approved for certain conditions, which continues to support the growth in the United States This innovative treatment paradigm also falls in line with the country's focus on precision medicine, thereby fueling both investment and demand for new BTC therapies.

United Kingdom’s Biliary Tract Cancers Treatment market is poised to exhibit a CAGR of 9.5% between 2025 and 2035. UK holds the highest share in the Western Europe regions through the forecast period following the historic trend in the region.

Leadership in precision medicine by the UK is one of the significant growth drivers for the BTC treatment market. Genetic profiling and targeted therapies are being integrated into routine clinical practice in the UK, making it a hub for personalized cancer care. Advances in genomic profiling in BTC patients also allow for key genetic mutations.

These include fusion of FGFR2 and mutation of IDH1, leading to crucial management decisions. Through this targeted treatment, patients who receive therapies best suited to their genetic makeup find better treatment outcome and fewer adverse effects than their counterparts on the conventional therapies.

Strong research programs and collaboration across academia, hospital care, and the pharmaceutical companies ensure the pursuit of precision medicine in the UK. Widespread adoption of genetic testing among BTCs together with targeted innovative therapies will foster new avenues in the treatment aspect. Thus, innovation in customized care leads not only to superior patient outcomes but also speeds the market in terms of BTCs' treatment domain.

China’s Biliary Tract Cancers Treatment market is poised to exhibit a CAGR of 7.0% between 2025 and 2035. Currently, China holds the highest share in the East Asia market, and the trend is expected to continue through the forecast period.

Liver conditions put individuals at a highly increased risk for developing BTCs, which contributes to this disease's rising incidence rates. Millions of people are afflicted with chronic liver conditions, offering a growing population in search of effective BTC treatments. The highest prevalence of the causes of biliary tract cancer treatment in China is liver diseases, such as hepatitis B and C, and liver cirrhosis.

With the increasing incidence of BTCs, there is an increasing need for advanced diagnostic tools and innovative treatment options that cater to the needs of these patients. Improving diagnosis and treatment of BTCs has become the focus of the healthcare system, thus boosting the growth of the treatment market. As the connection of liver diseases and BTCs has become better recognized, an increased number of patients are being presented early in clinics and then in hospitals to undergo proper care and treatment.

The players in the market use strategies, such as differentiated products through new formulations, strategic partnerships with healthcare providers for distribution, but perhaps the most important strategic focus of these companies is to be actively searching for strategic partners for bolstering their product portfolios and worldwide market presence.

| Report Attributes | Details |

|---|---|

| Market Size (2024) | USD 343.4 million |

| Current Total Market Size (2025) | USD 372.5 million |

| Projected Market Size (2035) | USD 824.2 million |

| CAGR (2025 to 2035) | 8.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Drug Classes Analyzed (Segment 1) | Targeted Therapy (FGFR2 inhibitors, IDH1 inhibitor, HER2-targeted agents), Immune Checkpoint Inhibitor (pembrolizumab, durvalumab) |

| Route of Administration (Segment 2) | Oral, Intravenous |

| Line of Therapy Analyzed (Segment 3) | First-line Treatment, Second-line Treatment |

| Sales Channels Covered | Institutional Sales, Retail Sales |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, China, Japan, India, South Korea, Brazil, United Kingdom |

| Key Players Influencing the Market | Incyte, Merck & Co., Inc., AstraZeneca, TAIHO PHARMACEUTICAL CO., LTD, Servier Pharmaceuticals LLC, Jazz Pharmaceuticals plc, Relay Therapeutics, DAIICHI SANKYO COMPANY, LIMITED, BeiGene, Ltd., HUTCHMED, Exelixis, Inc |

| Additional Attributes | A manufacturer of biliary tract cancers treatment would want to know dollar sales, share by drug class, preferred administration route, first- vs second-line uptake trends, and institutional vs retail demand differentiation. |

In terms of drug class, the industry is divided into- targeted therapy (FGFR2 inhibitors, IDH1 inhibitor, HER2-targeted agents) and immune checkpoint inhibitor (pembrolizumab, durvalumab).

In terms of distribution channel, the industry is segregated into- oral and intravenous.

In terms of line of therapy, the industry is segregated into- first-line treatment and second-line treatment.

In terms of sales channel, the industry is segregated into- institutional sales and retail sales.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global Biliary Tract Cancers Treatment market is projected to witness CAGR of 8.2% between 2025 and 2035.

The global Biliary Tract Cancers Treatment industry stood at USD 343.4 million in 2024.

The global Biliary Tract Cancers Treatment market is anticipated to reach USD 824.2 million by 2035 end.

United Kingdom is set to record the highest CAGR of 9.5% in the assessment period.

The key players operating in the global Biliary Tract Cancers Treatment market include Incyte, Merck & Co., Inc., AstraZeneca, TAIHO PHARMACEUTICAL CO., LTD, Servier Pharmaceuticals LLC, Jazz Pharmaceuticals plc, Relay Therapeutics, DAIICHI SANKYO COMPANY, LIMITED., BeiGene, Ltd., HUTCHMED and Exelixis, Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Molecule Type , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Molecule Type , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Molecule Type , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Molecule Type , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Molecule Type , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Molecule Type , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Molecule Type , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Molecule Type , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Molecule Type , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Molecule Type , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Molecule Type , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Molecule Type , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 22: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 23: Global Market Attractiveness by Molecule Type , 2023 to 2033

Figure 24: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Molecule Type , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Molecule Type , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Molecule Type , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Molecule Type , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 47: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 48: North America Market Attractiveness by Molecule Type , 2023 to 2033

Figure 49: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Molecule Type , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Molecule Type , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Molecule Type , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Molecule Type , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Molecule Type , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Molecule Type , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Molecule Type , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Molecule Type , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Molecule Type , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 96: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 97: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 98: Europe Market Attractiveness by Molecule Type , 2023 to 2033

Figure 99: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Molecule Type , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Molecule Type , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Molecule Type , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Molecule Type , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Molecule Type , 2023 to 2033

Figure 124: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Molecule Type , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Molecule Type , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Molecule Type , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Molecule Type , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Molecule Type , 2023 to 2033

Figure 149: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Molecule Type , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Molecule Type , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Molecule Type , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Molecule Type , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Molecule Type , 2023 to 2033

Figure 174: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Molecule Type , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Molecule Type , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Molecule Type , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Molecule Type , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 196: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 197: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 198: MEA Market Attractiveness by Molecule Type , 2023 to 2033

Figure 199: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in the Biliary Tract Cancers (BTCs) Treatment Industry

Japan Biliary Tract Cancers (BTCs) Treatment Market Growth – Demand, Trends & Forecast 2025-2035

China Biliary Tract Cancers (BTCs) Treatment Market Analysis – Size, Share & Forecast 2025-2035

Germany Biliary Tract Cancers (BTCs) Treatment Market Trends – Demand, Innovations & Forecast 2025-2035

Australia Biliary Tract Cancers (BTCs) Treatment Market Insights – Size, Share & Industry Growth 2025-2035

United States Biliary Tract Cancers (BTCs) Treatment Market Analysis – Size, Share & Trends 2025-2035

Primary Biliary Cholangitis (PBC) Treatment Market

Traction Motors Market Growth - Trends & Forecast 2025 to 2035

Traction Battery Market Growth - Trends & Forecast 2025 to 2035

Traction Inverter Market

Traction Transformer Market

Retractable Needle Safety Syringes Market Size and Share Forecast Outlook 2025 to 2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Retractable Lift Market

Retractable Needles Market

Extracts and Distillates Market

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

Contract Logistics Market Size and Share Forecast Outlook 2025 to 2035

Contract Furniture Market Analysis by Product Type, End-users, Distribution Channel, and Region from 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA