The United States biliary tract cancers treatment will reach around USD 231.0 million by 2025. The market is expected to rise with 8.2% CAGR during the period 2025 to 2035, which makes the market size reach approximately about USD 507.2 million by the end of 2035.

| Attributes | Values |

|---|---|

| Industry Size (2025E) | USD 231.0 million |

| Industry Value (2035F) | USD 507.2 million |

| CAGR (2025 to 2035) | 8.2% |

The increased development in its advanced healthcare infrastructural foundation, importance, and increasing consciousness for cancer-related needs in the nation, coupled with rising demand for advanced and targeted innovation.

The USA will greatly influence the international market in terms of treatment to BTC in the year 2025 at around USD 231.0 million. Further, CAGR growth for over the next six years until 2035 is envisioned at 8.2%.

The drivers of the market include the burgeoning incidence of BTCs in changing lifestyle conditions and an aging population. Greater adoption of precision medicine and targeted therapies, including FGFR inhibitors and immunotherapies, is thus another market booster. The unmet need to ensure that such therapies reach underserved populations where survival rates are low thus drives the market.

Market growth also results from strategic collaborations between market leaders pharmaceutical firms. In essence, partnerships mainly target advanced therapy developments, enlargement of clinical trials, and cost with no innovation compromises.

In response to the demand in precision medicine and targeted therapies, the USA BTC treatment market becomes much more effective within the health care system.

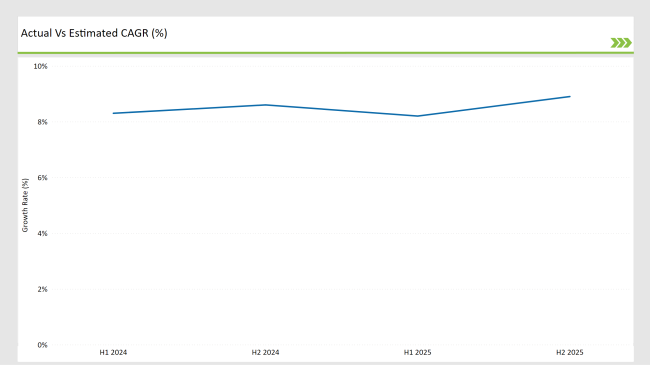

The table below shows a more comparative assessment in terms of the six-monthly variation in CAGR between the base year, 2023, and the current year, 2024, specifically for the United States biliary tract cancers (BTCs) treatment market.

Analysis over a semi-annual basis showcases huge changes in market dynamics and patterns of generating revenues, thus assisting the stakeholders have a proper picture of growth during the year ahead. H1 represents the first half of the year, which runs from January to June, and H2 is July to December.

H1 January to June Period H2 July to December Period

The biliary tract cancers (BTCs) treatment sector for the United States market will be growing at 8.3% CAGR for the first half of 2023 but then increase to 8.6% for H2 of 2023. For 2024, it is expected to decline to 8.2% for H1 but is believed to rise up to 8.9% in H2.

This indicates a decrease by 10 basis points between the first half of the year 2023 and that in the first half of 2024. Still, on registering higher against the second half of 2023, in the second half of 2024, it jumps 33 basis points.

This is an evolving and dynamically changing United States biliary tract cancers (BTCs) treatment market, significantly influenced by factors such as regulations, consumer behaviors, and developing biliary tract cancers (BTCs) treatments. Breaking up semestrially is also critically important for

| Date | Development/M&A Activity & Details |

|---|---|

| November 2024 | Regulatory Approval: USFDA granted accelerated approval of zanidatamab-hrii (Ziihera) manufactured by Jazz Pharmaceuticals for HER2-positive metastatic biliary tract cancer in adults. |

| November 2024 | Clinical Trial: Merck announced that its phase III trial for pembrolizumab (Keytruda) has reported with positive results for combination treatment with chemotherapy for advanced BTC. |

| March 2024 | Regulatory Approval: BeiGene announced the market approval for tislelizumab after positive phase II trial results |

Breakthroughs in Target and Precision Therapies

The incorporation of targeted therapies and precision medicine is highly propelling the United States BTC treatment market. New drugs like FGFR inhibitors and IDH1 inhibitors are facilitating the use of targeted treatments in the form of genetic mutations to provide better results with fewer side effects.

Innovation in biomarker-based therapies has become a backbone for the exact targeting of BTC and has provided a new ray of hope for advanced and refractory cancer patients. These developments are particularly valuable in enhancing treatment efficiency and addressing unmet clinical needs, making them indispensable in modern cancer care.

Higher investment in research and drug development

The rising investments of research and development of pharmaceutical companies and healthcare organizations are speedily propelling the development of advanced BTC treatments in the United States Increased demand in new therapies, including immunotherapies and combination treatments, brought about a rise in clinical trials and drug approvals. Moreover, the development of minimally invasive treatments and biomarker-driven therapy will better the survival rate and quality of life.

These initiatives, thereby catering to the demands of patients, will enhance the market by catering to the challenges created against treatment efficacy and accessibility. The emphasis on innovation and strategic

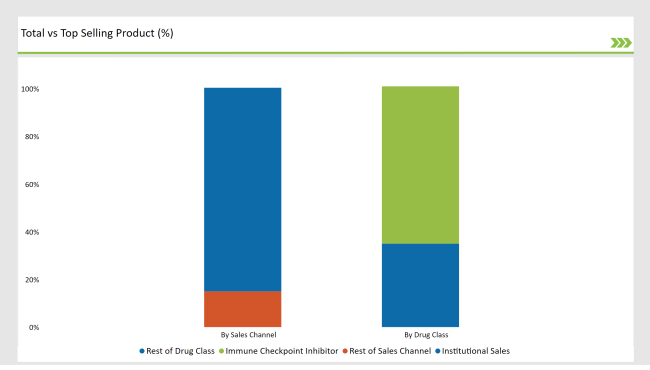

% share of Individual categories by Drug Class and Sales Channel in 2025

Targeted Therapy records significant surge in United States Biliary Tract Cancers (BTCs) Treatment By Drug Class

Targeted therapies, such as FGFR and IDH1 inhibitors, are critical in improving survival rates and quality of life through targeted treatments that can be directed to genetic mutations. Their use is largely supported by the discovery of biomarkers and genetic profiling, which can better guide treatment options.

Furthermore, their ability to be used in combination with other therapies, including immunotherapies, has further cemented their place, especially in advanced-stage BTC cases and clinical trials.

The BTC Treatment Market is dominated by institutional sales, holding the largest market share due to the significant volume of treatments administered through hospitals and cancer centers. These institutions are primary care providers for advanced BTC cases, investing in cutting-edge therapies and diagnostic technologies to enhance patient care.

The increasing prevalence of BTCs, coupled with a demand for novel treatment options, further drives the reliance on institutional channels. The availability of skilled oncologists and specialized infrastructure ensures consistent utilization of advanced treatments, solidifying their leadership in the BTC treatment market.

Note: above chart is indicative in nature

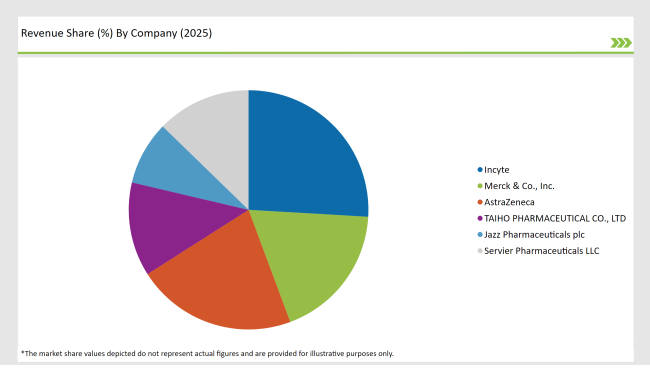

The United States biliary tract cancers (BTCs) treatment market is relatively fragmented with international players and domestic players, constantly competing in an ever-changing field.

The main leaders are Incyte, Merck & Co., Inc., and AstraZeneca who dominate the market with state-of-the-art technologies, powerful service networks, and strong client relationships. However, regional players, increasingly, start to gain share by offering special solutions to limited sectors like emergency response and rural healthcare.

The competitive landscape focuses on innovation and customization. Leaders are investing a lot in R&D to enhance the efficiency, mobility, and environmental sustainability of biliary tract cancers (BTCs) treatment to meet the strict regulatory requirements and evolving consumer demand for safer, faster, and eco-friendly sterilization solutions.

The market is divided based on drug type into targeted therapy like FGFR2 inhibitors, IDH1 inhibitor, HER2-targeted agents and immune checkpoint inhibitor like pembrolizumab, durvalumab.

The market is classified into segments on the basis of type of route of administration, oral and intravenous.

According to the basis of line of therapy, the industry is classified as- first line of treatment and the second line of treatment.

Institutional and Retail sales are the key segments based on sales channel

The market for BTC treatment is expected to grow at 8.2% from 2025 through 2035.

At the end of 2035 the market for BTC treatment in the USA is expected to hold USD 507.2 million.

The main growth drivers for United States biliary tract cancers (BTCs) treatment markets are the rising interest in early diseases detection and prevention, and advanced surgical and medical procedures.

Notable players in the United States biliary tract cancers (BTCs) treatment manufacturing companies are Incyte, Merck & Co., Inc., AstraZeneca, TAIHO PHARMACEUTICAL CO., LTD, Servier Pharmaceuticals LLC, Jazz Pharmaceuticals plc, and more.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in the Biliary Tract Cancers (BTCs) Treatment Industry

Japan Biliary Tract Cancers (BTCs) Treatment Market Growth – Demand, Trends & Forecast 2025-2035

China Biliary Tract Cancers (BTCs) Treatment Market Analysis – Size, Share & Forecast 2025-2035

Germany Biliary Tract Cancers (BTCs) Treatment Market Trends – Demand, Innovations & Forecast 2025-2035

Australia Biliary Tract Cancers (BTCs) Treatment Market Insights – Size, Share & Industry Growth 2025-2035

Biliary Tract Cancers Treatment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

United States Axillary Hyperhidrosis Treatment Market Growth – Size, Share & Industry Trends 2025-2035

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA