The biliary tract cancers treatment market for China is expected to be approximately USD 5.7 million in the year 2025 and estimated to grow steadily at a CAGR of 7.0%, and will reach about USD 11.3 million by 2035.

| Attributes | Values |

|---|---|

| Industry Size (2025E) | USD 5.7 million |

| Industry Value (2035F) | USD 11.3 million |

| CAGR (2025 to 2035) | 7.0% |

China's market alone shall contribute handsomely towards reaching the expected USD 5.7 million worth of global BTC treatment by the year 2025. The market will continue to grow at a steady pace with a CAGR of 7.0% during 2035.

Factors driving the growth in the market for BTC treatment in China are the rise of incidence rates due to rising lifestyles and diets coupled with increased older population. A significant growth is driven by increased adoption of precision medicine, targeted therapies such as FGFR inhibitors, and emerging immunotherapies.

One of the main concerns has been accessible and efficient treatments, particularly in underserved regions, for survival and improvement of patient outcomes.

The strategic collaborations among the pharmaceutical companies are acting as a driver in the market, basically. They focus on developing innovative therapies, expanding the clinical trials, and making the products affordable, losing not even a degree of innovation.

With precision medicine and targeted treatment finding more acceptance in China, BTC treatment market in the country is increasingly becoming effective in providing impactful health care to the entire nation.

The table below gives more concrete comparative analysis on the difference of CAGR six-monthly basis between the base year, 2023, and now that is, 2024, in the context of treatment for the market of China biliary tract cancers (BTCs).

Such a half-yearly analysis spotlights a large degree of changeability in the markets and the pattern of revenue realization, and thus, the stakeholders can pinpoint closer to the lastest extent of growth inside the duration of the year. The first half of the year, H1, is from January to June. The second half, H2, is from July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The biliary tract cancers (BTCs) treatment sector for the China market will be growing at 8.3% CAGR for the first half of 2023 but then increase to 7.6% for H2 of 2023. For 2024, it is expected to decline to 7.0% for H1 but is believed to rise up to 7.6% in H2. The pattern reveals a drop of 26 basis points from the first half of 2023 to the first half of 2024, but in the second half of 2024, it registers higher by 08 basis points against the second half of 2023.

This is a dynamic and fast-changing China biliary tract cancers (BTCs) treatment market, largely influenced by regulations, consumer trends, and improvements in biliary tract cancers (BTCs) treatment. Breaking up semestrially also proves crucial for businesses that chart their strategies in alignment with the trends of growth and broach through waters of complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Collaboration: Jazz Pharmaceuticals and BeiGene announced that the USA Food and Drug Administration granted accelerated approval to zanidatamab-hrii (Ziihera) to treat HER2-positive metastatic BTC in adults previously treated with disease, in November 2024. It came on the back of data from a mid-stage study which showed an objective response rate of 52%. This may have an impact on the options available for treating BTC in China, where BeiGene has a significant presence. |

| 2024 | Regulatory Approval: In January 2024, Taiho Pharmaceutical announced that Lonsurf, trifluridine/tipiracil, had received approval to use in China for the advanced BTC indications. Such approval from the appropriate authorities further underscores the commitment of Taiho towards bringing innovative oral therapies to the BTC patients in China. |

Increased investment in oncology research and development

China has massively invested in oncology R&D by the government and funding from the private sector. In return, this development has led to the evolution of innovative BTC treatments through targeted therapies and immunotherapies.

Such activities within state-of-the-art research facilities as well as collaboration with international pharmaceutical companies facilitate improvements and accelerate drug development, thus expediting faster access to advanced therapies for patients and a growing market.

Increasing adoption of precision medicine in cancer care

China is rapidly integrating precision medicine into its healthcare framework by using the progress made in genetics and biomarker-driven therapies. This now allows for more targeted therapies, such as FGFR and IDH1 inhibitors, with better patient outcomes and fewer adverse effects.

Innovation in personalized medicine fostered by the government's push and increasing clinician uptake is further enhancing the standard of care for BTC patients and driving the market.

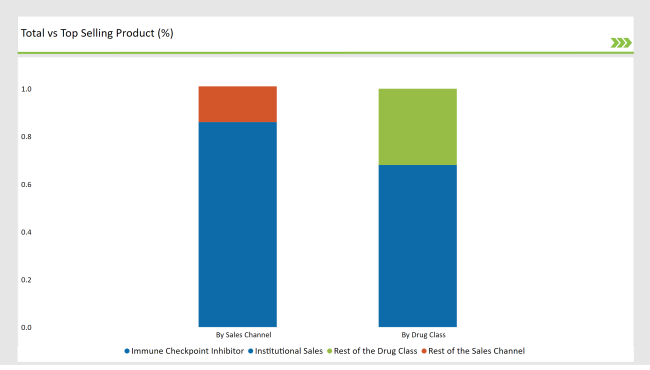

% share of Individual categories by Drug Class and Sales Channel in 2025

Targeted Therapy records significant surge in China Biliary Tract Cancers (BTCs) Treatment Drug Class

Targeted therapies, like FGFR and IDH1 inhibitors, are one of the biggest factors to contribute to improvements in survival rates and quality of life as they give a precise drug targeted at the mutation. China has taken a stride toward its adoption by improvement in the biomarker identification process and genetic profiling, given that the country places high value on innovation through technology.

The integration of these targeted therapies in combination treatments has further emphasized their value, especially on the management front of advanced cases of BTC while propelling progress made in clinical trails within the region.

The BTC treatment market in China is largely dominated by institutional sales, holding the largest market share due to the high volume of treatments provided by hospitals and cancer centers.

These institutions serve as the primary hubs for advanced BTC care, investing heavily in state-of-the-art therapies and diagnostic tools to meet patient needs. The rising incidence of BTCs in China, coupled with the demand for innovative treatment options, bolsters the reliance on institutional sales channels.

Additionally, the presence of highly skilled oncologists and the government's investments in healthcare infrastructure ensure the sustained adoption of advanced therapies, cementing the dominance of institutional sales in the BTC treatment market.

Note: above chart is indicative in nature

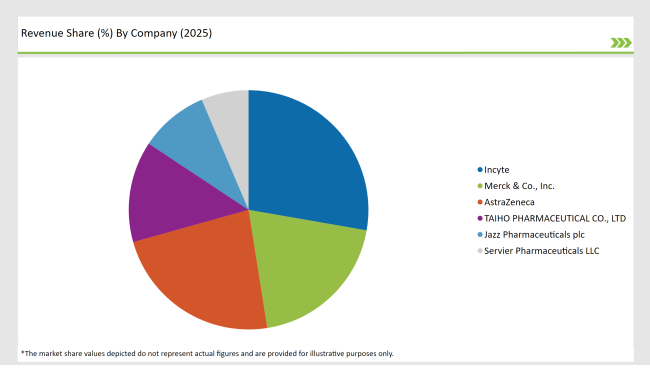

China biliary tract cancers (BTCs) treatment market is moderately fragmented; the overall market is dominated by multinational firms in partnership with regional players. DAIICHI SANKYO COMPANY, LIMITED., Incyte, Merck & Co., Inc., and AstraZeneca are some of the strongest players who have always been regarded as one of the leading technology providers, owning vast service networks and strong customer relations.

Meanwhile, regional players are steadily gaining market share through niche solutions for specific needs, such as low-cost solutions for rural healthcare and emergency response scenarios that respond well to localized needs.

Innovation and personalization are highly driving the competitive landscape in China. The major players are very keen on investing in research and development to advance the efficacy, safety, and accessibility of treatments involving BTC, driven by the country's healthcare reform and regulatory standards.

Advanced targeted therapies and personalized medicine are at the forefront in this regard. Strategic collaborations, partnerships, and acquisitions will also be key for companies to increase their product portfolio and expand geographical presence across vast and diverse healthcare in China.

Poised for Innovation and Growth This vibrant, competitive environment comprises established multinational corporations and agile regional players, placing the China BTC treatment market in a strategically advantageous position for innovation and growth.

The industry includes various type such as targeted therapy (FGFR2 inhibitors, IDH1 inhibitor, HER2-targeted agents) and immune checkpoint inhibitor (pembrolizumab, durvalumab).

In terms of route of administration, the industry is segregated into- oral and intravenous.

In terms of line of therapy, the industry is segregated into- first-line treatment and second-line treatment.

In terms of sales channel, the industry is segregated into- institutional sales and retail sales.

The China biliary tract cancers (BTCs) treatment market will grow at 7.0% CAGR by 2035.

By 2035, the sales value of the China biliary tract cancers (BTCs) treatment industry is expected to be USD 11.3 million.

Key growth factors for China biliary tract cancers (BTCs) treatment markets include increased interest in early diseases detection and prevention, improved surgical and medical procedures.

Prominent players in the China biliary tract cancers (BTCs) treatment manufacturing include Incyte, Merck & Co., Inc., AstraZeneca, TAIHO PHARMACEUTICAL CO., LTD, Servier Pharmaceuticals LLC, Jazz Pharmaceuticals plc, Relay Therapeutics, DAIICHI SANKYO COMPANY, LIMITED., BeiGene, Ltd., HUTCHMED and Exelixis, Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

China Elevator Ropes Market Size and Share Forecast Outlook 2025 to 2035

China Packaging Primers Market Size and Share Forecast Outlook 2025 to 2035

China Spinal Fusion Market Analysis - Trends, Demand & Forecast 2025 to 2035

China Outbound Meetings, Incentives, Conferences, Exhibitions (MICE) Tourism to Europe Market Size and Share Forecast Outlook 2025 to 2035

China Casino Tourism Market Analysis – Size, Growth, & Forecast Outlook 2025 to 2035

China Clay Market Size, Growth, and Forecast for 2025-2035

China Industrial Hoses Market - Size, Share, and Forecast 2025 to 2035

China Outbound MICE Tourism to US Market 2025 to 2035

China Destination Wedding Market Insights – Growth & Forecast 2025-2035

China Centrifugal Pumps Market Trends – Size, Demand & Forecast 2025-2035

China Power Tool Market Analysis – Size, Share & Forecast 2025-2035

China Educational Tourism Market Insights – Trends, Growth & Forecast 2025-2035

China Outbound Travel Market Report – Trends, Size & Forecast 2025-2035

China Sports Tourism Market Analysis – Growth, Demand & Forecast 2025-2035

China Extended Stay Hotel Market Trends – Growth, Demand & Forecast 2025-2035

China Hostel Market Analysis – Size, Share & Industry Forecast 2025-2035

China Medical Tourism Industry Analysis from 2025 to 2035

China Culinary Tourism Market Insights - Growth & Forecast 2025 to 2035

China Autonomous Crane Market: Driving Growth Through Smart Infrastructure and Industrial Automation

China Protein A Resins Market Report – Growth, Trends & Industry Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA