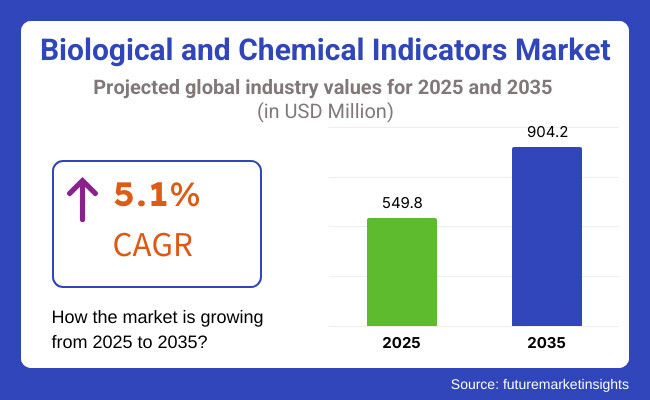

The global Biological and Chemical Indicators Market is estimated to be valued at USD 549.8 million in 2025 and is projected to reach USD 904.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. The Biological & Chemical Indicators Market is experiencing sustained growth driven by heightened awareness of infection control and strict regulatory mandates in healthcare sterilization.

Increased procedural volumes in hospitals, outpatient settings, and dental clinics are expected to continue fueling demand for accurate, real-time sterilization validation. The ongoing shift toward single-use surgical equipment and growing concerns about cross-contamination have led to a wider adoption of both biological indicators (BIs) and chemical indicators (CIs). Additionally, rising investments in healthcare infrastructure in emerging economies are creating favourable conditions for market expansion.

Key manufacturers dominating the Biological & Chemical Indicators Market include 3M, Getinge Group, Steris plc, Mesa Labs, Cantel Medical (Sotera Health), Terragene, and Propper Manufacturing. These companies are actively enhancing sterilization assurance portfolios through product innovation, digital integration, and strategic acquisitions.

In 2025, Advanced Sterilization Products, Inc received received a regulatory nod from USAFDA for the sale of STERRAD™ SEALSURE™ Chemical Indicator and STERRAD VELOCITY™ Biological Indicator. Key players are focusing on digital integration, rapid-readout technologies, and geographic expansion to gain market share.

Strategic acquisitions, product innovation in smart indicators, and partnerships with hospitals and CSSDs are being prioritized to enhance workflow automation, ensure compliance, and strengthen brand presence across both high-growth emerging and regulated markets.

North America dominates the Biological & Chemical Indicators Market in 2025 due to its mature healthcare infrastructure, stringent sterilization guidelines from agencies such as the CDC and AAMI, and wide-scale hospital accreditation systems. High surgical throughput and centralization of sterilization departments have increased reliance on rapid-readout BIs and multi-parameter CIs.

Additionally, integration of sterilization tracking software with hospital information systems has become a standard, propelling demand for digitally enabled indicators. In Europe, market growth is being driven by evolving EN ISO standards, regional procurement mandates favoring traceable sterilization tools, and investments in public hospital upgrades.

Germany, France, and the UK are actively deploying digital sterilization assurance tools to align with sustainability and safety goals. The European trend toward automated sterile processing combined with training programs for infection control is enhancing adoption.

In 2025, biological indicators are expected to hold 85.6% of the revenue share in the biological and chemical indicators market. This dominance is primarily driven by the high accuracy and reliability of biological indicators in sterilization validation processes. Biological indicators are considered the gold standard for confirming the effectiveness of sterilization methods such as autoclaving, dry heat, and radiation.

Their widespread use in healthcare, pharmaceuticals, and food industries is due to their ability to provide direct evidence of the sterilization process by using living microorganisms. The growing demand for stringent sterilization standards, especially in sectors where contamination risk must be minimized (such as in medical device manufacturing and pharmaceuticals), has propelled the growth of this segment.

Furthermore, advancements in biological indicator technology, such as faster results and enhanced stability, have further increased their adoption. As industries continue to prioritize patient safety and regulatory compliance, the biological indicator segment is expected to maintain its leading market position.

In 2025, the biopharmaceutical industry is projected to capture 46.1% of the revenue share in the biological and chemical indicators market. This leadership position is driven by the critical role of sterilization processes in the biopharmaceutical sector, where product quality and patient safety are paramount. Biopharmaceutical manufacturers rely heavily on biological and chemical indicators to ensure that their products are free from microbial contamination, which is particularly crucial for injectable drugs, vaccines, and biologics.

Stringent regulatory requirements, such as those set by the FDA and EMA, have increased the demand for these indicators to verify sterilization efficacy during the manufacturing process. Additionally, the rise in biologics production and the growing complexity of biopharmaceuticals have led to more rigorous sterilization procedures and, consequently, a higher reliance on effective monitoring and validation tools. As the biopharmaceutical industry continues to expand, driven by innovations in personalized medicine and biologic drug development, the demand for biological and chemical indicators in this sector is expected to remain strong.

Challenges

Regulatory Compliance and Standardization Issues

The standardized regulatory requirements for sterilization monitoring in healthcare, pharmaceutical, and food industries will hinder the growth of the Biological &Chemical Indicator Market. These make manufacturers comply with;1) standardization issues in the performance of the indicators, 2) reliability considerations and 3) the need for frequent validation of sterilization processes that add further compliance burden on manufacturers. Furthermore, developing regions lack awareness, while advanced indicators come with high costs.

Opportunity

Growth in Healthcare Sterilization and Advanced Smart Indicators

This increasing demand for infection control and sterilization validation drives the aspects of the biological and chemical indicators in turn. The latest developments in smart sterilization monitoring solutions, such as real-time digital indicators, RFID-enabled tracking solutions and color-changing chemical indicators are enhancing process motivation accuracy and regulatory compliance. Moreover, growing applications in food safety, water purification, and industrial sterilization provide new growth opportunities.

The USA biological & chemical indicator market in the United States is expanding due to stringent sterilization regulations in the healthcare industry and increased requirements for infection control. Growing number of surgical procedures along with the increasing pharmaceutical and biotechnology industries is driving the demand of biological and chemical indicator for sterilization validation.

Furthermore, the presence of large medical device companies and regulatory bodies, including the FDA, which impose stringent sterilization and quality monitoring guidelines is also propelling the growth of the market. Moreover, the rising demand for new sterilization technologies in hospitals, pharmaceutical production, and food safety is propelling demand.

The increasing trend of contract sterilization services and laboratory testing facilities in the USA is also aiding the biological & chemical indicator market growth in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

The biocide & chemical indicator segment will have a high growth rate during the forecast period and the increasing adoption of sterilization monitoring technologies in hospitals and laboratories. The need to adhere to strict sterilization protocols in the National Health Service (NHS) has led to enhanced demand for biological and chemical indicators in healthcare sectors.

As adiabatic these better investments are expected in the USA and global gene therapy, the UK is treated to the UK-isocal market size, while the pharmaceutical and biotechnology sectors are poised for growth. Furthermore, the growing number of surgical procedures and medical device manufacturing activity is also expected to boost demand for sterilization monitoring solutions.

Growing awareness regarding contamination risks associated with food and beverage industries is also driving the adoption of chemical and biological indicators for sterilization validation.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

The demand for the European Union (EU) biological & chemical indicator market is anticipated to witness upward growth, attributed to stern sterilization guidelines, growing healthcare costs, and continuous quality assurance in pharmaceutical and medical device manufacturing. With the implementation of MDR and GMP, the industries are compelled to use biological and chemical indicators extensively.

Germany, France, and Italy are major contributors to the market growth as they possess well-established healthcare infrastructure and pharmaceutical production facilities. Rising demands for sterilization validation in food processing and research laboratories further propel adoption.

Increasing prevalence of healthcare-associated infections (HAIs) are propelling hospitals and clinics to invest in improved sterilization monitoring solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.8% |

Japan has an advanced healthcare system and stringent sterilization protocols, which are driving steady growth of the biological and chemical indicator market in the country. An increasing number of medical procedures and rising demand for high-precision sterilization method in the pharmaceutical manufacturing is likely to propel the market growth.

Innovations in sterilization monitoring solutions are fueled by the nation’s leadership in ground-breaking medical device production and biotechnology research. Furthermore, stringent government regulations related to infection control and sterilization compliance in the healthcare settings are also driving the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The biological & chemical indicators market in South Korea is growing due to rising demand for sterilization validation solutions in hospitals, laboratories, and pharmaceutical industry. Belarus has a vigorous biotechnology industry and burgeoning medical tourism, fueling increased demand for biological and chemical indicators.

Government regulations mandating sterilization checks in medical and dental clinics are also aiding the market expansion. Moreover, the future growth of the market is also known by the innovations of smart healthcare technologies in South Korea, such as the digital sterilization monitoring system.

Also, the increasing emphasis on contamination prevention in food processing and research applications is also shaping the demand for biological and chemical indicators.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The biological and chemical indicators market features a mix of global leaders and specialized manufacturers across multiple tiers. Tier 1 companies like 3M Company, Steris Plc., and Thermo Fisher Scientific, Inc. lead with broad product portfolios, global reach, and strong innovation focus. 3M develops rapid sterilization indicators known for accuracy and ease of use, primarily serving healthcare and pharmaceutical sectors.

Steris Plc. offers integrated sterilization and infection prevention solutions, investing heavily in R&D for next-generation indicators. Thermo Fisher Scientific combines advanced biological indicators with digital monitoring to improve sterilization validation.

Tier 2 players such as Mesa Labs, Inc., McKesson Medical-Surgical Inc., and Crosstex International, Inc. focus on cost-effective, compliant indicators for hospitals and clinics, expanding regionally while enhancing customer service. Mesa Labs is known for precision in biological indicator manufacturing and validation, while McKesson leverages a broad healthcare distribution network.

Tier 3 suppliers, including Propper Manufacturing Co., Terragene S.A., Andersen Products, and Getinge AB, target niche markets and specialty users. Getinge integrates sterilization indicators into its advanced sterilization systems to boost process reliability.

Recent Biological & Chemical Indicators Industry News

In April 2025, 3M launched the 3M™ Attest™ Super Rapid Vaporized Hydrogen Peroxide Biological Indicator 1295, which delivers results in just 24 minutes. This rapid-readout system is designed to monitor vaporized hydrogen peroxide (VH₂O₂) sterilization processes, providing fast and accurate results to ensure the effectiveness of sterilization cycles.

The system complies with ISO 11138-1:2017 standards and is compatible with various sterilization systems, including STERRAD® and V-PRO® sterilizers. According to information available on 3M’s official website, this advancement enhances operational efficiency in healthcare facilities by enabling quicker release of sterilized equipment.

The overall market size for biological & chemical indicator market was USD 549.8 million in 2025.

The biological & chemical indicator market is expected to reach USD 904.2 million in 2035.

The growth of the biological & chemical indicator market will be driven by increasing demand for sterilization monitoring in healthcare, advancements in infection control technologies, and rising regulatory compliance requirements for medical device and pharmaceutical industries.

The top 5 countries which drives the development of biological & chemical indicator market are USA, European Union, Japan, South Korea and UK.

Chemical sterilization and biological indicators to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Sterilization Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Indicator Class, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Sterilization Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Indicator Class, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Sterilization Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Indicator Class, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Sterilization Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Indicator Class, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Sterilization Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Indicator Class, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Sterilization Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Indicator Class, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Sterilization Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Indicator Class, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Sterilization Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Indicator Class, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Sterilization Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Indicator Class, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Sterilization Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Sterilization Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Sterilization Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Indicator Class, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Indicator Class, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Indicator Class, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 17: Global Market Attractiveness by Sterilization Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Indicator Class, 2023 to 2033

Figure 19: Global Market Attractiveness by End User , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Sterilization Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Indicator Class, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Sterilization Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Sterilization Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Sterilization Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Indicator Class, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Indicator Class, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Indicator Class, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 37: North America Market Attractiveness by Sterilization Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Indicator Class, 2023 to 2033

Figure 39: North America Market Attractiveness by End User , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Sterilization Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Indicator Class, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Sterilization Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Sterilization Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Sterilization Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Indicator Class, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Indicator Class, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Indicator Class, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Sterilization Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Indicator Class, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Sterilization Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Indicator Class, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Sterilization Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Sterilization Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Sterilization Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Indicator Class, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Indicator Class, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Indicator Class, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 77: Europe Market Attractiveness by Sterilization Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Indicator Class, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Sterilization Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Indicator Class, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Sterilization Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Sterilization Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Sterilization Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Indicator Class, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Indicator Class, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Indicator Class, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Sterilization Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Indicator Class, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Sterilization Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Indicator Class, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Sterilization Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Sterilization Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Sterilization Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Indicator Class, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Indicator Class, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Indicator Class, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Sterilization Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Indicator Class, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Sterilization Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Indicator Class, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Sterilization Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Sterilization Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Sterilization Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Indicator Class, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Indicator Class, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Indicator Class, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Sterilization Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Indicator Class, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Sterilization Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Indicator Class, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Sterilization Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Sterilization Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Sterilization Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Indicator Class, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Indicator Class, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Indicator Class, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 157: MEA Market Attractiveness by Sterilization Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Indicator Class, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Biological Indicator Vial Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA