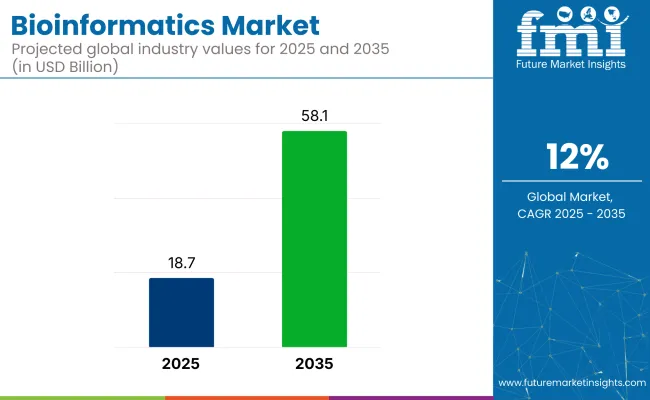

The global bioinformatics market is expected to rise from USD 18.7 billion in 2025 to around USD 58.1 billion by 2035, reflecting a CAGR of 12% during the forecast period. The market is undergoing substantial transformation driven by advancements in next-generation sequencing, AI-powered analytics, and rapid data generation from genomics and proteomics.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 18.7 billion |

| Market Size in 2035 | USD 58.1 billion |

| CAGR (2025 to 2035) | 12% |

This robust expansion is being fueled by the escalating demand for precision medicine, drug discovery innovations, and integrated healthcare data solutions. Governments and private investors are pouring capital into omics infrastructure, fostering collaborative ecosystems between research institutions, pharma companies, and computational labs.

For instance, public-private initiatives in India and China are streamlining access to genomic databases, creating a fertile ground for applications.Strategic acquisitions and cloud integration efforts by players like PerkinElmer and Eurofins Scientific are being prioritized to strengthen scalability. With the rise of big data and multi-omics, platform interoperability and AI capabilities are becoming critical for companies to stay competitive.

In January 2024, QIAGEN reaffirmed its strategic focus on expanding its footprint in the market through substantial investments in its QIAGEN Digital Insights (QDI) platform. As the demand for data-driven solutions in genomics, precision medicine, and molecular diagnostics continues to grow, QIAGEN is leveraging its expertise in artificial intelligence and natural language processing to deliver scalable, high-performance tools.

The company aims to meet the rising need for advanced data analysis in life sciences and healthcare. As Thierry Bernard, Chief Executive Officer of QIAGEN, stated, “Our significant investments into QDI demonstrate our commitment to accelerating growth and promoting innovation in the market. Based on the track record of doubledigit sales growth combined with a high level of profitability in our bioinformatics business, we believe now is the optimal time to invest.”

Demand in the bioinformatics market is primarily concentrated in three strategic segments: platforms, genomics, and medical biotechnology. These segments are drawing the majority of investment and innovation, led by global leaders in research tools, sequencing, and molecular diagnostics.

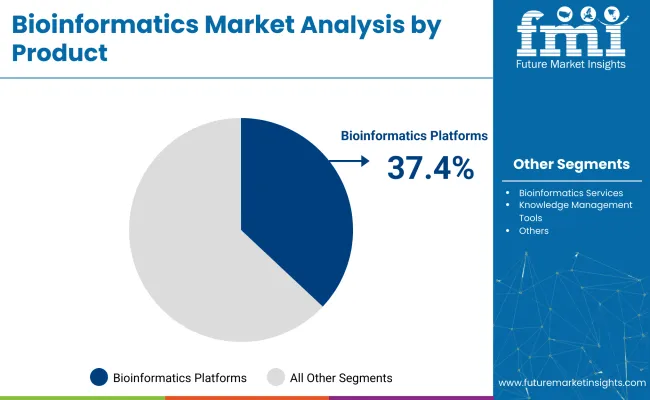

Bioinformatics platforms are projected to command 37.4% of the product category in 2025. These platforms are critical to supporting sequence alignment, data interpretation, and visualization.

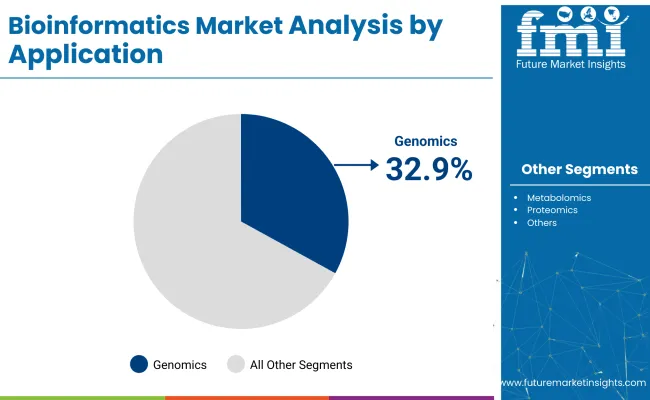

Genomics leads all application segments with a 32.9% market share in 2025. Genomic data is fundamental to identifying hereditary risks, designing personalized drugs, and optimizing trial outcomes.

Medical biotechnology accounts for 42.8% of the bioinformatics market in 2025, making it the largest sectoral contributor. It is extensively used in drug discovery, clinical trial management, and vaccine development.

The bioinformatics market is being fueled by rising demand for precision medicine, omics-based research, and AI-powered data interpretation. However, concerns related to data interoperability and stringent data privacy regulations are being observed as barriers to seamless global adoption.

Advances in omics and AI analytics are accelerating bioinformatics adoption

Significant momentum is being gained through the integration of genomics, proteomics, and metabolomics data. AI-powered platforms such as Illumina’s Emedgene (updated in 2024) are being used to interpret genetic variants with high accuracy, especially in rare disease diagnostics.

National genomics efforts in India, China, and the UK are also being prioritized to expand data repositories and collaborative infrastructure. As a result, the product is being embedded into personalized medicine and pharmaceutical development processes at an unprecedented pace.

Data interoperability and compliance challenges are restraining global deployment

Bioinformatics platforms are being limited by the absence of standardized data models, incompatible APIs, and fragmented systems. Compliance with strict frameworks such as GDPR in Europe and HIPAA in the United States is also being required, complicating cloud-based data access.

A 2023 GA4GH report revealed that more than 60% of professionals experienced regulatory delays in project delivery. Due to these issues, higher infrastructure costs and entry-level barriers are being encountered, particularly among SMEs and startups in emerging markets.

Global leadership in bioinformatics is being shaped by countries investing in omics infrastructure, AI-based platforms, and cross-disciplinary collaborations. The United States, China, India, the United Kingdom, and South Korea are emerging as influential players with strong CAGR outlooks.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 9.6% |

| United Kingdom | 9.1% |

| China | 11.2% |

| India | 11.8% |

| South Korea | 10.4% |

The market in the USA is expected to maintain dominance with a 9.6% CAGR from 2025 to 2035.

China is being viewed as a pivotal hub for bioinformatics expansion in Asia with a CAGR of 11.2% through 2035.

India is expected to grow at a CAGR of 11.8% between 2025 and 2035, positioning itself as a strong emerging market player

The UK remains a vital player in the European bioinformatics space with a CAGR of 9.1% through 2035.

South Korea is being positioned as a technology-forward leader in the East Asian bioinformatics market with a CAGR of 10.4% forecasted through 2035.

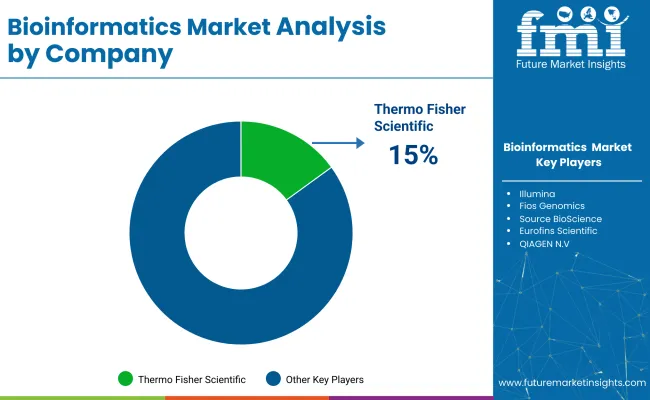

The bioinformatics market is being led by leading companies such as Thermo Fisher Scientific, Illumina, Agilent Technologies, and QIAGEN, which maintain dominance through proprietary platforms, sequencing systems, and global distribution networks. Emerging players like Fios Genomics, NeoGenomics Laboratories, and Source BioScience are being focused on niche informatics services, including contract analysis and diagnostics.

Strategic partnerships, product enhancements, and cloud integration are being prioritized to strengthen scalability. In 2024, PerkinElmer expanded its genomics software offerings to support rare disease diagnostics. Market entry is being challenged by high R&D costs, regulatory complexities, and platform standardization issues. While the market remains moderately consolidated, competitive intensity is being raised by emerging AI-driven platform developers and region-specific data analytics startups.

Recent Bioinformatics Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 18.7 billion |

| Projected Market Size (2035) | USD 58.1 billion |

| CAGR (2025 to 2035) | 12% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed | Bioinformatics Platforms (Sequence Analysis Platform, Sequence Alignment Platform, Sequence Manipulation Platform, Structural and Functional Analysis Platform, Other) |

| Application Segmentation | Genomics, Molecular Phylogenetics, Metabolomics, Proteomics, Transcriptions, Chemoinformatics and Drug Designing, Others |

| Sector Segmentation | Medical Biotechnology, Animal Biotechnology, Plant Biotechnology, Environmental Biotechnology, Forensic Biotechnology, Other Sectors |

| Regions Covered | North America, Latin America, Europe, Asia-Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Market | Thermo Fisher Scientific Inc., Eurofins Scientific, QIAGEN N.V., Agilent Technologies Inc., Illumina Inc., Waters Corporation, NeoGenomics Laboratories, Perkin Elmer Inc., Fios Genomics, Source BioScience |

| Additional Attributes | Dollar sales by product type, application, and sector, growth in personalized medicine and diagnostics, increasing demand for genomics and molecular biology applications, rise in automation and AI adoption in bioinformatics, regional trends in biotech and pharmaceutical R&D. |

The market is segmented into Bioinformatics Platforms, Bioinformatics Services, Knowledge Management Tools, and Biocontent.

The market is segmented into Genomics, Molecular Phylogenetics, Metabolomics, Proteomics, Transcriptions, Chemoinformatics and Drug Designing, and Others.

The market is segmented into Medical Biotechnology, Animal Biotechnology, Plant Biotechnology, Environmental Biotechnology, Forensic Biotechnology, and Other Sectors.

The market is segmented into North America, Latin America, Europe, Asia-Pacific, and Middle East & Africa.

The market is projected to reach approximately USD 58.1 billion by 2035.

In 2025, the market is expected to be valued at around USD 18.7 billion.

Bioinformatics platforms are expected to lead with a 37.4% share in 2025.

Medical biotechnology is projected to dominate with a 42.8% market share in 2025.

India is expected to grow at a CAGR of 11.8%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA