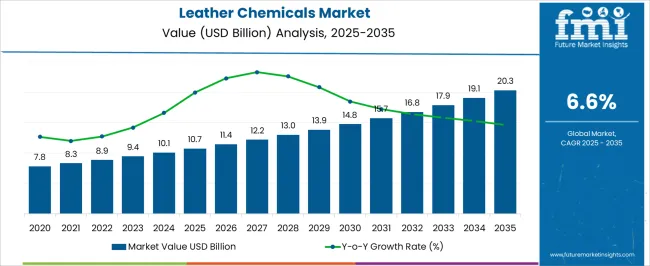

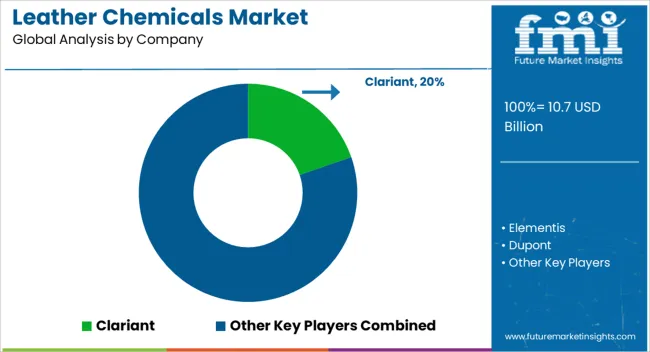

The leather chemicals market is estimated to be valued at USD 10.7 billion in 2025 and is projected to reach USD 20.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

Market estimates indicate a steady upward trajectory from USD 7.8 billion in 2025, gradually increasing to USD 8.3 billion, USD 8.9 billion, and USD 9.4 billion in the early years, reflecting rising demand from global leather manufacturing hubs. By 2030, the market is expected to surpass USD 13 billion, driven by innovations in eco-friendly tanning agents, chrome-free solutions, and high-performance finishing chemicals that cater to automotive, footwear, and fashion leather segments. The period from 2031 to 2035 is projected to witness accelerated growth, with the market anticipated to climb from USD 15.7 billion in 2031 to USD 20.3 billion in 2035, fueled by sustainability trends, increasing urbanization, and growing consumption of premium leather products across Asia-Pacific, Europe, and North America.

Rising adoption of specialty chemicals for leather preservation, water reduction technologies in tanning, and enhanced dyeing and finishing techniques are expected to further propel market expansion. Leather chemical manufacturers are anticipated to benefit from regulatory incentives promoting environmentally compliant processes and innovations targeting improved leather quality, durability, and aesthetic appeal. Overall, the market’s forecasted growth underscores a combination of rising industrial demand, sustainable product development, and strategic regional expansion by leading players.

The tanning and finishing chemicals segment holds the largest share at 35%, as leather manufacturers across the globe deploy these chemicals for primary tanning, improving leather durability, texture, and resistance to environmental factors. These chemicals are critical for processing raw hides into finished leather suitable for footwear, automotive interiors, furniture, and fashion applications.

The specialty leather chemicals market contributes 25%, driven by high-performance additives such as waterproofing agents, softeners, and performance enhancers that improve the quality, longevity, and appearance of leather, especially in premium products. The leather dyeing and coloring chemicals segment accounts for 20%, where pigments, dyes, and color-fixing agents are increasingly adopted to meet fashion trends, consumer preferences, and brand-specific color standards.

The finishing and coating chemicals market holds a 12% share, with solutions like surface coatings, protective sprays, and eco-friendly sealants enhancing aesthetic appeal, scratch resistance, and market value of leather products. Finally, the biocides and preservatives segment represents 8%, as manufacturers utilize antimicrobial and antifungal chemicals to prevent microbial degradation, mold, and odor in processed leather.

Collectively, tanning, specialty, and dyeing chemicals account for 80% of total leather chemical demand, emphasizing that processing efficiency, product quality, and end-use performance remain primary growth drivers, while finishing and preservation chemicals offer opportunities for innovation and sustainability in leather production worldwide.

| Metric | Value |

|---|---|

| Leather Chemicals Market Estimated Value in (2025 E) | USD 10.7 billion |

| Leather Chemicals Market Forecast Value in (2035 F) | USD 20.3 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The leather chemicals market is being propelled by steady demand from the global leather processing industry, with growth supported by technological advancements in chemical formulations and the rising emphasis on high-performance, sustainable solutions. Current market conditions reflect a balanced interplay between traditional processing chemicals and eco-friendly alternatives, as regulatory frameworks tighten and environmental considerations gain prominence.

Raw material availability, cost dynamics, and regional manufacturing capacities are shaping competitive positioning, while strategic partnerships between chemical producers and tanneries are enhancing supply security and product customization. In developing economies, expanding manufacturing capacity and export-oriented leather production are contributing to volume growth, whereas in mature markets, innovation in specialty chemicals is driving value expansion.

The long-term outlook is anchored in ongoing R&D to optimize efficiency, reduce environmental footprint, and comply with evolving safety norms, enabling producers to secure a competitive edge Demand stability from core leather-consuming industries such as footwear, automotive, and upholstery is expected to ensure a consistent growth trajectory for the sector over the forecast period.

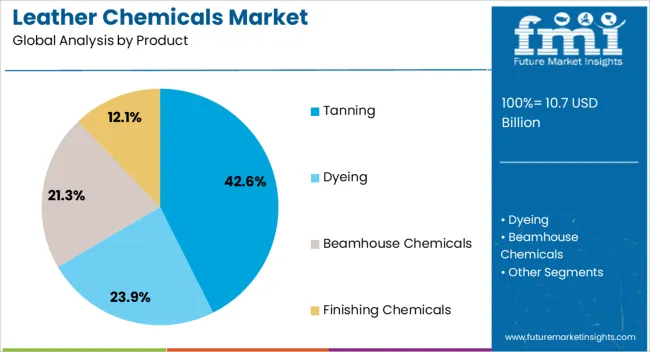

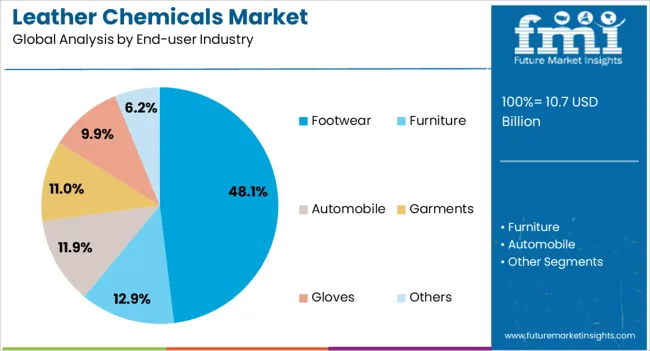

The leather chemicals market is segmented by product, end-user industry, and geographic regions. By product, leather chemicals market is divided into tanning, dyeing, beamhouse chemicals, and finishing chemicals. In terms of end-user industry, leather chemicals market is classified into footwear, furniture, automobile, garments, gloves, and others. Regionally, the leather chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tanning segment, holding 42.60% of the product category, continues to dominate due to its critical role in transforming raw hides into durable, usable leather. This segment’s leadership is underpinned by consistent demand from both mass-market and premium leather goods producers, supported by well-established processing infrastructure across key manufacturing regions.

Advances in tanning chemicals, including the development of low-chrome and chrome-free alternatives, are improving environmental compliance while maintaining performance standards. Supply chain integration between chemical manufacturers and tanneries has enhanced cost efficiency and ensured stable product availability, even amid raw material price volatility.

The segment benefits from widespread application in multiple leather product categories, sustaining its relevance despite competition from alternative processing methods Over the forecast horizon, continued investment in sustainable tanning technologies and the expansion of capacity in emerging economies are expected to reinforce this segment’s leading market position.

The footwear segment, accounting for 48.10% of the end-user industry category, retains its dominance owing to the enduring global demand for leather shoes and related products. Its market share is reinforced by strong consumption in both casual and formal footwear segments, driven by style versatility, durability, and comfort attributes unique to leather. The segment benefits from stable supply relationships between leather processors and footwear manufacturers, enabling consistent quality and timely delivery.

Consumer preferences for premium and customized products are prompting greater use of specialty chemicals that enhance leather softness, finish, and longevity. Rising disposable incomes in emerging markets are fueling volume growth, while mature markets are sustaining value growth through higher-priced, fashion-oriented offerings.

Environmental regulations are prompting footwear manufacturers to source leathers treated with eco-friendly chemicals, which in turn is stimulating innovation and adoption in the segment This alignment between performance needs and sustainability trends positions the footwear industry to remain the largest consumer of leather chemicals in the years ahead.

The leather chemicals market growth is driven by strong demand from automotive, footwear, and fashion sectors, alongside expanding manufacturing hubs in developing economies. Quality enhancement and product differentiation remain key factors shaping market dynamics globally

The leather chemicals market is witnessing robust growth due to the increasing demand for leather in automotive and footwear sectors. Vehicle interiors, including seats, steering, and dashboards, require high-quality leather that is durable, comfortable, and visually appealing. Similarly, the footwear industry is expanding globally, driven by both casual and premium segments. Manufacturers are focusing on high-performance chemicals that enhance leather strength, flexibility, and finish, ensuring longevity and resistance to wear and tear. This trend is further supported by growing disposable incomes and consumer preference for leather-based premium products. As a result, chemicals used in tanning, finishing, and dyeing processes are experiencing increased adoption, fueling revenue growth and competitive expansion in global leather manufacturing hubs.

Fashion and lifestyle products contribute significantly to leather chemicals consumption, as premium handbags, jackets, belts, and accessories increasingly dominate consumer preferences. Companies are emphasizing chemicals that deliver superior texture, color retention, and smooth finishes while catering to intricate design and aesthetic requirements. Seasonal trends, brand loyalty, and demand for luxury leather items are encouraging manufacturers to adopt specialized dyes, finishing agents, and softeners. The growing e-commerce ecosystem also accelerates product diversification, requiring chemicals that maintain quality during mass production and shipping. Emerging fashion markets in Asia-Pacific, Latin America, and the Middle East are boosting the demand for high-quality leather treated with specialty chemicals, making the fashion and lifestyle segment a critical revenue driver in the overall leather chemicals market.

Developing economies in Asia, Africa, and Latin America are emerging as significant leather production hubs, driving the need for leather chemicals. Regions like India, Bangladesh, and Vietnam are expanding footwear and garment manufacturing capacities, resulting in increased procurement of tanning agents, dyes, and finishing chemicals. Lower labor costs and supportive industrial policies in these regions make them attractive for large-scale leather production. Consequently, chemical suppliers are focusing on local partnerships, distribution networks, and customized solutions to meet specific regional requirements. The expansion of leather processing clusters in developing markets supports consistent product quality while optimizing production efficiency, making these regions a key growth engine for global leather chemicals sales and market share over the coming years.

End-users are prioritizing leather quality, durability, and unique finishes to differentiate products in competitive markets. This trend is pushing manufacturers to adopt chemicals that improve leather softness, tensile strength, and resistance to scratches and environmental stress. Specialty tanning agents, performance-enhancing finishes, and advanced dye formulations are increasingly used to achieve consistent color, texture, and visual appeal. Brands targeting premium and niche markets are particularly driving demand for customized chemical solutions. Enhanced product performance enables manufacturers to command higher pricing and establish brand credibility, while chemical suppliers benefit from recurring orders. Overall, the focus on high-quality leather and differentiated end products remains a major factor shaping demand patterns across the leather chemicals market.

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

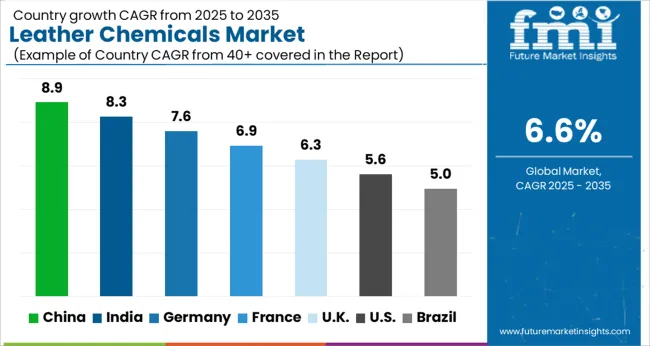

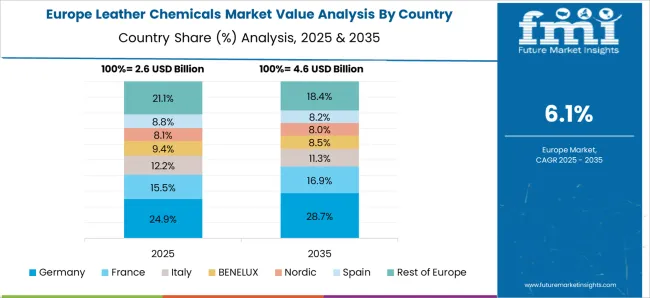

The global leather chemicals market is projected to grow at a CAGR of 6.6% from 2025 to 2035. China leads growth at 8.9%, followed by India at 8.3%, Germany at 7.6%, the UK at 6.3%, and the USA at 5.6%. Market expansion is driven by rising demand from automotive, footwear, and fashion leather segments, along with increasing production capacities in Asia-Pacific and Europe.

Developing economies, particularly China and India, are fueling industrial leather processing and specialty chemical adoption, while mature markets like Germany, the UK, and the USA emphasize high-quality production, premium leather processing, and innovative chemical applications. The analysis covers over 30 countries, with the leading markets highlighted below.

The leather chemicals market in China is forecasted to expand at a CAGR of 8.9% from 2025 to 2035, driven by rapid growth in automotive, footwear, and fashion leather production. Increasing industrial leather processing and high adoption of specialty tanning, finishing, and dyeing chemicals are propelling market demand.

Domestic manufacturers are investing in advanced chemical formulations that enhance durability, color retention, and texture. Export-oriented leather manufacturing hubs and rising consumption of premium leather products further support growth. Collaborations with global chemical suppliers aid technology transfer and product innovation.

The leather chemicals market in India is expected to grow at a CAGR of 8.3% between 2025 and 2035, fueled by expanding leather manufacturing clusters in Tamil Nadu, West Bengal, and Uttar Pradesh. Demand from footwear, garments, and accessory segments is rising steadily. Adoption of specialty dyes, tanning agents, and finishing chemicals ensures consistent quality and export competitiveness. Government support under Make in India and infrastructure upgrades in processing zones further facilitate market expansion. Strategic partnerships with international chemical firms strengthen technology integration and supply chain efficiency.

The leather chemicals market in Germany is projected to grow at a CAGR of 7.6% from 2025 to 2035, supported by high-quality leather production for automotive interiors, luxury fashion, and industrial applications. Emphasis on performance-enhancing chemicals, precise dyeing, and finishing solutions ensures durability, aesthetics, and compliance with stringent European standards. German manufacturers focus on eco-friendly chemical adoption, premium leather exports, and customized solutions for niche markets. Collaboration with research institutions accelerates development of advanced formulations.

The leather chemicals market in the UK is anticipated to grow at a CAGR of 6.3% from 2025 to 2035, driven by fashion, footwear, and luxury leather manufacturing. Specialty finishing chemicals, softeners, and dyes are increasingly adopted to meet premium product standards. Rising export demand and focus on quality leather processing facilities support market expansion. Domestic suppliers collaborate with global chemical manufacturers to enhance product offerings and maintain competitive positioning in both European and international markets.

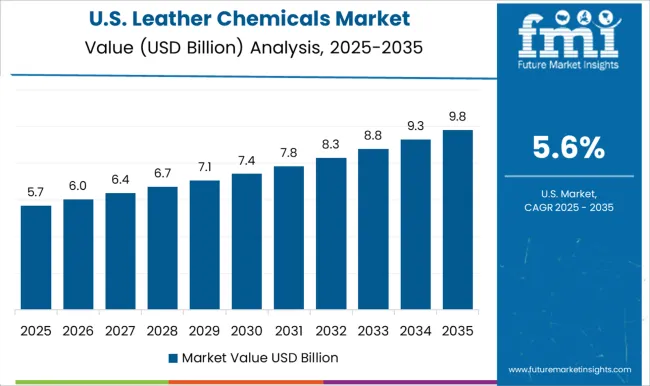

The USA leather chemicals market is expected to grow at a CAGR of 5.6% from 2025 to 2035, supported by automotive, furniture, and footwear industries. Demand for high-performance tanning, finishing, and coloring chemicals is increasing to ensure product durability and aesthetic appeal. Manufacturers focus on meeting regulatory standards and producing specialty chemicals for premium leather segments. Collaborations with international suppliers provide access to innovative formulations and technology integration. Rising domestic leather production and fashion industry demand further strengthen market growth.

Competition in the leather chemicals market is primarily shaped by product performance, chemical specialization, and the adaptability of solutions for different end-use applications. Leading players such as Clariant and Elementis dominate through a diverse portfolio of advanced tanning agents, finishing solutions, and specialty chemicals designed for automotive interiors, fashion leather, and footwear. Their products focus on enhancing leather durability, flexibility, and surface quality while maintaining consistent performance across large-scale production. Dupont and Eastman Chemical Company compete aggressively by providing high-performance dyes, softeners, protective agents, and finishing compounds that emphasize color retention, texture improvement, and long-term resistance to wear and environmental factors.

Solvay and Evonik Industries have positioned themselves around eco-friendly formulations, including chrome-free tanning solutions and additives that improve tensile strength, water resistance, and process efficiency. Arkema and SABIC contribute with specialty polymers, resins, and finishing agents for premium leather products, targeting high-end fashion and industrial leather segments that require uniformity, aesthetic appeal, and performance reliability. Mid-tier competitors such as BASF, Lanxess, Stahl Holdings, and Huntsman International focus on niche applications within the leather chemicals market. These include waterproofing solutions, antimicrobial treatments, decorative finishes, and performance-enhancing additives tailored for specialty leather products. Across the industry, strategies emphasize product differentiation, compliance with global quality and environmental standards, and customization for various leather types.

Increasingly, lifecycle support, technical advisory services, and process optimization assistance are being highlighted as value-added offerings. Product brochures and marketing materials provide detailed chemical specifications, recommended application methods, leather compatibility, environmental compliance certifications, and performance metrics. Collectively, these dynamics reflect a market focused on enhancing product quality, operational efficiency, and end-user satisfaction, while supporting manufacturers in meeting diverse industrial and commercial leather requirements globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.7 billion |

| Product | Tanning, Dyeing, Beamhouse Chemicals, and Finishing Chemicals |

| End-user Industry | Footwear, Furniture, Automobile, Garments, Gloves, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Clariant, Elementis, Dupont, Eastman Chemical Company, Solvay, Evonik Industries, Arkema, and SABIC |

| Additional Attributes | Dollar sales, market share, CAGR trends, top-growing regions, end-use industry demand (automotive, footwear, fashion), competitive landscape, key players’ offerings, regulatory compliance, specialty chemical adoption, and export-import dynamics. |

The global leather chemicals market is estimated to be valued at USD 10.7 billion in 2025.

The market size for the leather chemicals market is projected to reach USD 20.3 billion by 2035.

The leather chemicals market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in leather chemicals market are tanning, chrome, non-chrome, dyeing, water soluble, non-water soluble, beamhouse chemicals, soaking, liming, deliming & bating, finishing chemicals, polyurethane, acrylic, silicone and others.

In terms of end-user industry, footwear segment to command 48.1% share in the leather chemicals market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leather Tanning Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Leather Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Leather Jewellery Box Market Size and Share Forecast Outlook 2025 to 2035

Leather Goods Market Outlook - Size, Share, and Growth 2025 to 2035

Leather Sneakers Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Leather Dyes Manufacturers

Leather Embossing Machine Market

Industry Share Analysis for Bonded Leather Companies

Mycelium Leather Market Trends & Industry Growth Forecast 2024-2034

Bio Based Leather Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Leather Market Forecast & Growth 2025 to 2035

PU Artificial Leather Release Paper Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Leather Market Analysis Size Share and Forecast Outlook 2025 to 2035

The Microfiber Synthetic Leather Market is segmented by material, application, and end-use from 2025 to 2035

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Korea Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Demand for Automotive Interior Leather in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA