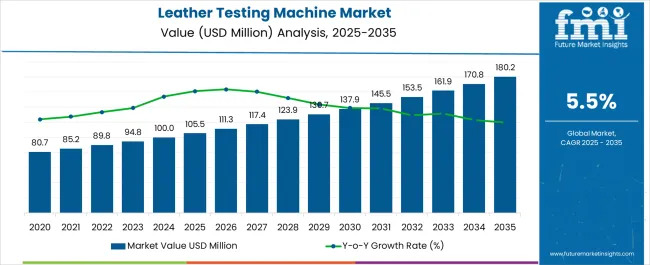

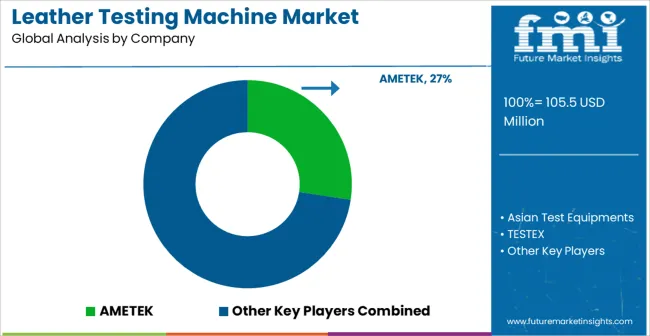

The Leather Testing Machine Market is estimated to be valued at USD 105.5 million in 2025 and is projected to reach USD 180.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Leather Testing Machine Market Estimated Value in (2025 E) | USD 105.5 million |

| Leather Testing Machine Market Forecast Value in (2035 F) | USD 180.2 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Leather Testing Machine market is experiencing steady growth driven by increasing demand for quality assurance and performance testing across the leather manufacturing industry. The future outlook for this market is shaped by rising standards in product durability, safety, and consumer expectations, which necessitate reliable testing solutions. Growing investment in leather production facilities and expansion of footwear, upholstery, and automotive leather segments are contributing to the market’s expansion.

Advancements in testing equipment technology, including enhanced automation, precision measurement, and software integration, are enabling manufacturers to ensure consistent product quality. Additionally, regulatory compliance and adherence to international quality standards are driving the adoption of advanced leather testing machines.

The market is further supported by the need for efficiency in production lines, reduction in product defects, and data-driven quality control processes As leather consumption continues to rise in both developed and emerging economies, the Leather Testing Machine market is expected to maintain consistent growth, with significant opportunities in footwear and other high-demand applications.

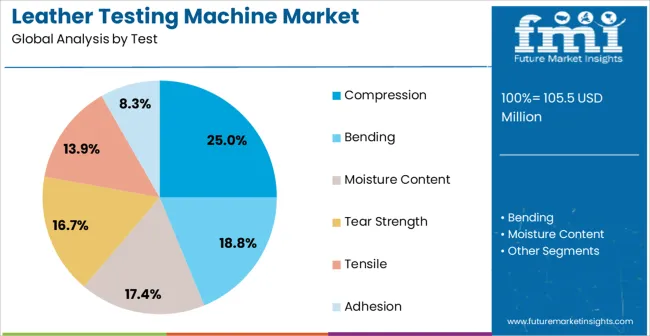

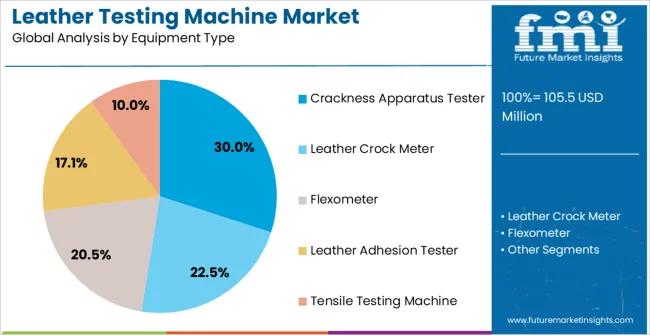

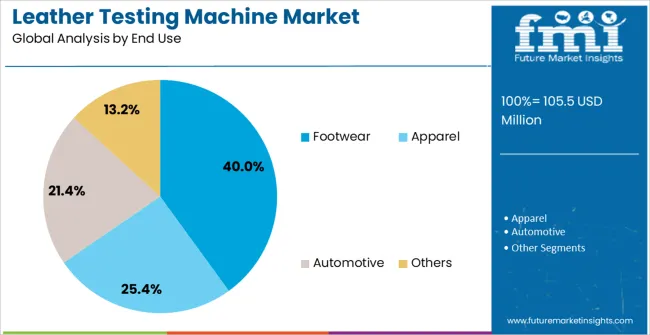

The leather testing machine market is segmented by test, equipment type, end use, and geographic regions. By test, leather testing machine market is divided into Compression, Bending, Moisture Content, Tear Strength, Tensile, and Adhesion. In terms of equipment type, leather testing machine market is classified into Crackness Apparatus Tester, Leather Crock Meter, Flexometer, Leather Adhesion Tester, and Tensile Testing Machine. Based on end use, leather testing machine market is segmented into Footwear, Apparel, Automotive, and Others. Regionally, the leather testing machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The compression test segment is projected to hold 25.00% of the Leather Testing Machine market revenue share in 2025, making it a leading test type. This dominance is attributed to the critical role of compression testing in assessing the mechanical strength and deformation characteristics of leather materials.

The segment has benefited from increasing quality control requirements in footwear, upholstery, and automotive leather applications, where material performance under stress is essential. The integration of advanced sensors and automated testing systems has enhanced the precision and repeatability of compression tests, supporting consistent product evaluation.

The growing emphasis on product reliability, durability, and adherence to international standards has further reinforced the importance of compression testing Additionally, the rising demand for premium and high-performance leather products has contributed to the expansion of this test type, making it a key driver of market growth.

The crackness apparatus tester segment is expected to capture 30.00% of the Leather Testing Machine market revenue share in 2025, positioning it as a leading equipment type. The growth of this segment has been driven by the necessity to evaluate the flexibility and resistance of leather to cracking under bending and repeated use.

Enhanced equipment design and precision measurement capabilities have improved the accuracy and reliability of crackness testing, ensuring leather products meet high-quality standards. The increasing adoption of performance-driven manufacturing and regulatory compliance in the leather industry has accelerated demand for crackness apparatus testers.

The ability to perform consistent and repeatable testing for diverse leather types, including natural and synthetic materials, has made this segment a crucial component of quality assurance processes, supporting continued market growth.

The footwear end-use industry segment is anticipated to account for 40.00% of the Leather Testing Machine market revenue in 2025, making it the leading end-use application. This growth is fueled by the high demand for durable, comfortable, and performance-oriented footwear across global markets.

Leather testing machines provide manufacturers with precise assessment tools to evaluate the mechanical properties, flexibility, and crack resistance of materials used in footwear production. The emphasis on quality, durability, and compliance with consumer safety standards has reinforced the adoption of testing machines in this segment.

Additionally, increasing consumer awareness regarding product longevity and comfort, combined with the growth of premium and athletic footwear markets, has accelerated market demand The ability to optimize material selection and production processes through reliable testing has made footwear the dominant end-use industry segment, driving consistent revenue growth.

Leather testing machine is used to determine the chemical and physical properties of leather, such as water spots, rub fastness, adhesion, tear strength and others which is carried out in the testing laboratory. Leather is a flexible and durable material used in clothing, belt, footwear, handbags, and luggage, etc.

To maintain quality standards of leather, it is essential to check the quality of raw stock such as chemicals like sodium sulfide, lime, and sulfuric acid and this is efficiently driving the leather testing machine market across the globe. Accordingly, to get standard leather of required quality for a specific end use, it is necessary to use the leather testing machine.

The leather testing machine has the ability to measure the performance of leather under different parameters such as adhesion, tear, and stretch to make sure that the leather meets appropriate performance needs for safety and quality administration. These factors are boosting the leather testing machine market.

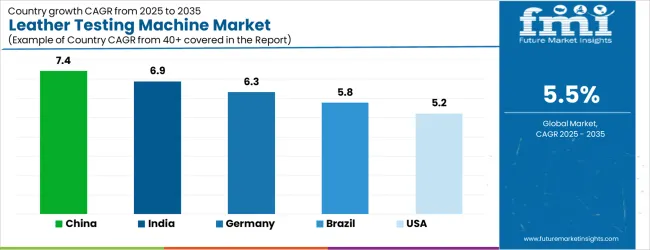

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| USA | 5.2% |

| UK | 4.7% |

| Japan | 4.1% |

The Leather Testing Machine Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Leather Testing Machine Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Leather Testing Machine Market is estimated to be valued at USD 39.9 million in 2025 and is anticipated to reach a valuation of USD 39.9 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 5.5 million and USD 3.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 105.5 Million |

| Test | Compression, Bending, Moisture Content, Tear Strength, Tensile, and Adhesion |

| Equipment Type | Crackness Apparatus Tester, Leather Crock Meter, Flexometer, Leather Adhesion Tester, and Tensile Testing Machine |

| End Use | Footwear, Apparel, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AMETEK, Asian Test Equipments, TESTEX, SatatonMall, Ektron Tek, Agilent Technologies, Heng Yu Instrument, Illinois Tool Works, Shanghai Songdun, Shenzhen Reger Instrument, Shimadzu, MTS Systems, and Applied Test Systems |

The global leather testing machine market is estimated to be valued at USD 105.5 million in 2025.

The market size for the leather testing machine market is projected to reach USD 180.2 million by 2035.

The leather testing machine market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in leather testing machine market are compression, bending, moisture content, tear strength, tensile and adhesion.

In terms of equipment type, crackness apparatus tester segment to command 30.0% share in the leather testing machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Market Share Distribution Among Leak Testing Machine Providers

Leather Embossing Machine Market

Leak testing Machine Market

Pack Testing Machines Market

Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tensile Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Hardness Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Resonant Testing Machine Market

Lubricant Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Universal Testing Machine Market Growth – Trends & Forecast 2025-2035

Compression Testing Machines Market Size and Share Forecast Outlook 2025 to 2035

Permeability Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA