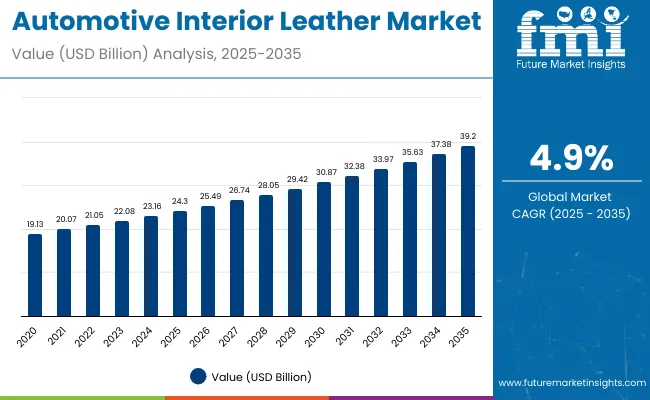

The automotive interior leather market is projected to expand steadily from USD 24.3 billion in 2025 to USD 39.2 billion by 2035, advancing at a CAGR of 4.9%. This growth reflects rising consumer preference for premium and sustainable vehicle interiors, increasing production of luxury and electric vehicles, and broader adoption of synthetic and eco-friendly leather alternatives. The market shows a consistent upward trajectory, with demand sustained by luxury car sales, increasing aftermarket customization, and innovations focused on durability, comfort, and environmental compliance appealing to modern consumers.

By 2030, the market is forecast to reach approximately USD 31.8 billion, reflecting steady growth in the first half of the period. The absolute dollar growth between 2025 and 2035 is expected to be about USD 14.9 billion, indicating measured but reliable expansion. Growth is expected to accelerate in the latter half of the period, driven by increased adoption of premium and synthetic leather options in luxury and electric vehicles.

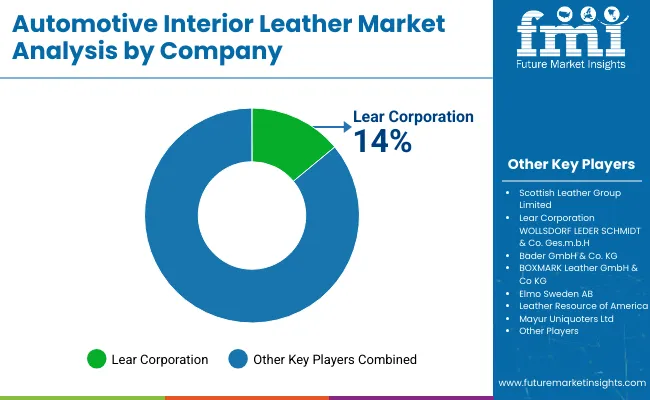

Key companies such as Lear Corporation, Seiren Co., Ltd., GST AutoLeather Inc. (Pangea), BOXMARK Leather GmbH & Co KG, and Bader GmbH & Co. KG are consolidating their positions by scaling production capacities and investing in advanced, eco-friendly leather technologies. Their innovation pipelines focus on sustainable materials, antimicrobial and thermo-cool leather solutions, enabling stronger entry into health-conscious and premium vehicle segments. Market performance will remain tied to quality control, supply chain sustainability, and regulatory compliance, which will shape competitive outcomes across key regions including China, India, and the USA

The market holds significant shares across key segments, reflecting its vital role in vehicle interiors globally. As of 2025, the seats and center stack segment is estimated to hold about 34.3% share, being the most interacted area within the vehicle cabin, greatly influencing perceived quality and luxury. North America dominates with a 40.0% share, driven by high production of premium and luxury vehicles demanding quality leather upholstery.

Growth is driven by rising disposable incomes, technological advancements, and increasing preference for sustainable, synthetic leather alternatives in economy cars. The growth of electric and shared mobility vehicles is driving demand for innovative, eco-friendly leather solutions that combine comfort and sustainability. Leading companies include Lear Corporation, Seiren Co., Ltd., GST AutoLeather Inc., BOXMARK Leather GmbH & Co KG, and Bader GmbH & Co. KG, focusing on innovation, sustainability, and expanding production capacities to capture emerging market opportunities globally.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (E) | USD 24.3 billion |

| Forecast Value in 2035 (F) | USD 39.2 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The market is expanding due to increasing consumer preference for premium and culturally significant vehicle interiors, combined with rising demand for sustainable, eco-friendly, and fortified leather alternatives. Advances in leather processing technologies, such as improved tanning and finishing methods, have enhanced product quality, durability, and aesthetic appeal, making automotive leather more attractive across diverse vehicle segments.

Growing awareness of comfort, hygiene, and clean-label materials is driving adoption, particularly in luxury, electric, and hybrid vehicle categories. The expanding use of synthetic and antimicrobial leather in vehicle interiors is broadening market reach. Product innovation and diversification, including organic and recyclable leather alternatives, are further contributing to market growth by meeting evolving consumer preferences.

As global automotive production and premium vehicle sales continue to rise, the outlook for the automotive interior leather market remains positive. With manufacturers focusing on product quality, sustainability, and enhanced functionalities, automotive interior leather is poised to gain even greater acceptance and market penetration worldwide.

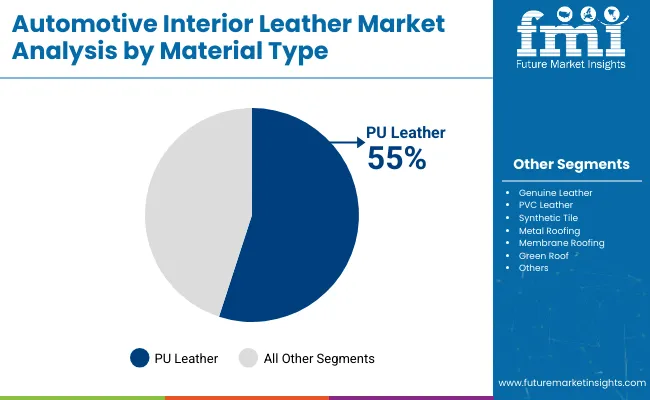

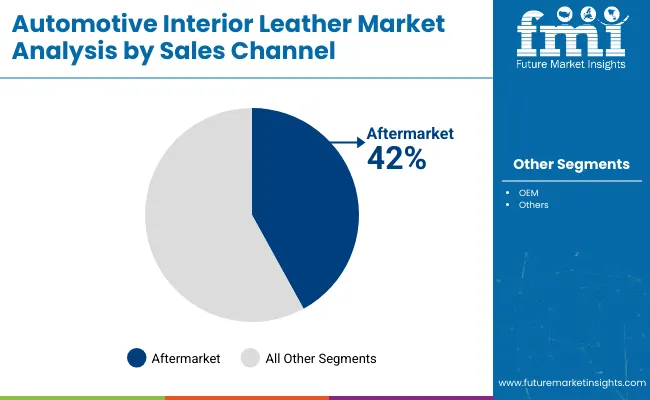

The market is segmented by material type, sales channel, and region. By material type, the market is divided into genuine leather (heavy commercial vehicles, light commercial vehicles, and passenger cars), PU leather (heavy commercial vehicles, light commercial vehicles, and passenger cars), PVC leather (heavy commercial vehicles, light commercial vehicles, and passenger cars), synthetic tile, metal roofing, membrane roofing, green roof, and others (airbags, dashboards, floor and trunk carpets, headliners, seat belts, and upholstery). Based on sales channel, the market is bifurcated into aftermarket and OEM. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

The most lucrative segment in the automotive interior leather market by material type is PU Leather, commanding a dominant market share of 55% in 2025. PU leather's rise as the lucrative choice stems from its significant cost-effectiveness, versatility, and sustainability compared to genuine and PVC leather. It provides the aesthetic and tactile appeal akin to genuine leather while offering easier production and eco-friendlier characteristics, such as being free from harmful chemicals like dioxins that are present in PVC alternatives. The growing demand for premium yet affordable vehicle interiors propels PU leather's adoption, especially in passenger cars, where comfort and luxury blend with sustainability trends.

Moreover, PU leather is favored across heavy commercial vehicles (HCV) and light commercial vehicles (LCV) segments due to its durability, low maintenance, and resistance to wear and tear, driving broader acceptance beyond luxury cars. While genuine leather remains valued for premium and luxury vehicles, PU leather's expanding use in mid-range to high-end vehicles, coupled with advancements like antimicrobial coatings and thermo-cool properties, positions it for sustained lucrative growth.

The aftermarket segment is a key growth driver, expected to capture 42% of the market in 2025. The aftermarket segment offers vehicle owners the opportunity to upgrade or customize their interiors post-purchase, often at a lower cost compared to factory-installed options. This segment benefits from increasing consumer demand for personalization and refurbishment, especially among owners of older vehicles seeking to refresh or enhance interior aesthetics and comfort.

Growing trends in vehicle customization, along with a wider variety of colors, materials, and finishes available in the aftermarket, are fueling market expansion. Additionally, the increasing availability of high-quality synthetic leathers and eco-friendly materials makes aftermarket upgrades more accessible and appealing. The aftermarket’s flexibility and innovation in catering to niche consumer preferences are expected to sustain its robust growth in the coming years, complementing the OEM segment’s stable dominance.

From 2025 to 2035, the automotive interior leather market is driven by increasing consumer preference for premium, durable, and sustainable vehicle interiors. Automakers are adopting advanced leather processing technologies to enhance comfort, durability, and aesthetics, while also improving environmental footprints by using eco-friendly synthetic and PU leathers. This shift positions leather suppliers offering high-quality, sustainable, and innovative materials as key partners supporting next-generation vehicle interiors, especially in luxury, electric, and hybrid vehicles.

Growing Consumer Preference for Premium and Sustainable Interiors Drives Market Growth

The steady rise in consumer demand for premium, comfortable, and eco-friendly vehicle interiors acts as a primary catalyst for growth in the automotive interior leather market. Increasing awareness about sustainability and health-conscious choices boosts the adoption of synthetic and PU leather alternatives, alongside traditional genuine leather. By 2025, manufacturers are expected to enhance product quality through advanced tanning, antimicrobial treatments, and eco-friendly finishing processes to meet consumer expectations for durability, comfort, and environmental responsibility.

Innovation in Material Development Expands Market Opportunities

Innovations such as antibacterial coatings, thermo-cool materials, and recyclable synthetic leathers have expanded the market’s appeal from luxury vehicles to mid-range and electric segments. These advancements improve the texture, longevity, and functionality of automotive leather interiors, creating new opportunities in both OEM and aftermarket sectors. Producers embracing sustainable sourcing, compliance with environmental standards, and quality certifications gain competitive advantages, catering to environmentally conscious and quality-driven consumers, thus reinforcing sustained market growth.

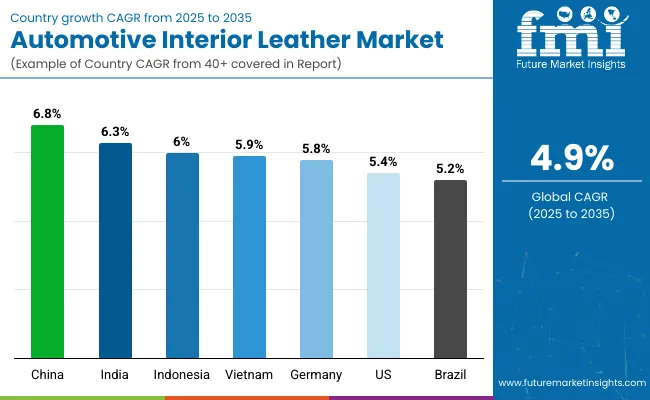

| Countries | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Indonesia | 6.0% |

| Vietnam | 5.9% |

| Germany | 5.8% |

| USA | 5.4% |

| Brazil | 5.2% |

China leads the automotive interior leather market with a CAGR of 6.8%, driven by large vehicle production, rapid EV growth, domestic OEM strength, and government incentives promoting eco-friendly materials. India follows closely with a 6.3% CAGR, supported by increasing passenger vehicle sales, rising incomes, and investments in sustainable leather technologies. Indonesia grows at 6.0% CAGR, aided by government incentives and synthetic leather adoption for cost efficiency. Vietnam’s market expands at 5.9% CAGR, driven by rising vehicle ownership and eco-conscious consumers. Germany, focused on luxury vehicles and sustainable innovation, grows at 5.8% CAGR. The USA market grows at 5.4%, propelled by luxury and EV segments. Brazil shows a 5.2% CAGR with automotive production growth and government support boosting demand.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Demand for automotive interior leather in China is growing at a CAGR of 6.8%, driven by its dominant role as the world’s largest vehicle producer and rapidly expanding electric vehicle (EV) segment. The strong presence of domestic OEMs and increasing consumer demand for premium interiors accelerate capacity expansions of leather upholstery manufacturing. Government initiatives promoting green and sustainable automotive solutions further support adoption of eco-friendly synthetic leathers and local leather sourcing. Increasing joint ventures with global leather suppliers enhance production technology and product innovation. The expanding middle-class population fuels demand for customized interiors with advanced comfort and aesthetics, positioning China as a key growth market.

Sales of automotive interior leather in India are expanding at a CAGR of 6.3%, fueled by growing passenger vehicle sales and rising urban incomes. The rise of electric and hybrid vehicles is encouraging manufacturers to integrate premium and synthetic leather options focused on sustainability. Domestic manufacturers invest in upgrading tanning and finishing processes to meet global standards. Aftermarket customization gains momentum as consumers seek aesthetic upgrades. Government encouragement of automotive manufacturing hubs and export-oriented growth contribute to market expansion. The growing middle class drives demand for cars with enhanced interiors.

Revenue from automotive interior leather in Indonesia grows at a 6.0% CAGR, supported by government incentives and a growing middle-income population. Local vehicle production expansion includes both passenger cars and commercial vehicles, boosting leather upholstery demand. Rising focus on cost-effective and sustainable synthetic leather alternatives addresses affordability concerns. Improvements in supply chain infrastructure enable better leather sourcing and processing. Aftermarket refurbishment and customization also add revenue streams. The nation's increasing participation in global automotive supply chains further drives growth.

Demand for automotive interior leather in Vietnam grows at a 5.9% CAGR, driven by rising personal vehicle ownership and industrial growth. The country’s automotive assembly plants cement demand for quality interior materials, including genuine and synthetic leather. Consumer preference shifts towards comfort, aesthetics, and sustainable materials in new vehicle purchases. Aftermarket options flourish as vehicle age and customization increase. The government’s strategy to attract more automotive investment facilitates industrial scaling and technology import.

Demand for automotive interior leather moves at a CAGR of 5.8%, led by luxury and premium vehicle production. German automakers integrate advanced leather treatments focusing on sustainability, durability, and aesthetics. Strong R&D emphasizes biodegradable tanning methods and novel synthetic leather substitutes. High consumer expectations for quality and environmental consciousness drive innovation. Germany also pioneers smart interior systems paired with leather, enhancing the premium interior experience. Stringent environmental standards accelerate eco-certified leather adoption.

Demand for automotive interior leather in the USA exhibits a CAGR of 5.4%, supported by steady luxury vehicle sales and increasing EV adoption. American consumers prioritize interior comfort, style, and eco-friendliness, spurring demand for synthetic and bio-based leathers. Aftermarket upgrades gain importance as vehicle lifecycles extend. Domestic manufacturers innovate in lightweight and antimicrobial leather products. Regulatory emphasis on sustainability fosters use of recycled and low-impact materials.

Demand for automotive interior leather in Brazil experiences a CAGR of 5.2%, driven by expanding automotive manufacturing hubs and growing middle-class vehicle ownership. Domestic automakers increasingly adopt synthetic leather options for economic and environmental reasons. Aftermarket demand thrives on vehicle refurbishment and personalization. Government incentives support automotive sector modernization. Brazil’s growing export market further stimulates leather interior production investments.

The automotive leather market is defined by the presence of several global and regional leaders that leverage advanced materials technology, sustainable production methods, and close partnerships with automotive OEMs to maintain strong market positions. Leading companies such as Lear Corporation, Seiren Co., Ltd., GST AutoLeather Inc. (Pangea), BOXMARK Leather GmbH & Co KG, and Bader GmbH & Co. KG dominate the sector through comprehensive product portfolios spanning genuine leather, PU leather, and next-generation synthetic alternatives designed for premium and mid-range vehicle interiors.

These players emphasize R&D-driven innovation, focusing on improving durability, comfort, antimicrobial performance, and eco-efficiency of leather materials. Sustainability has emerged as a major differentiator, with firms investing in bio-based materials, recyclable polymers, and closed-loop tanning processes to comply with tightening environmental regulations and growing consumer preference for green materials.

Other notable participants, including Eagle Ottawa, DK Leather Corporation, Scottish Leather Group Limited, Katzkin Leather Inc., and Mayur Uniquoters Ltd., strengthen regional competitiveness through customization capabilities, cost-efficient manufacturing, and niche specialization. Collaborations with leading automotive manufacturers enable these suppliers to align product development with the evolving needs of electrified and autonomous vehicle interiors, supporting both aesthetic and functional advancements in the mobility ecosystem.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 24.3 billion |

| Material Type | Genuine Leather (HCV, LCV, Passenger Car), PU Leather (HCV, LCV, Passenger Car), PVC Leather (HCV, LCV, Passenger Car), Synthetic Tile, Metal Roofing, Membrane Roofing, Green Roof, and Others (include alternative automotive interior materials such as microfiber leather, vinyl, suede, and novel bio-based leathers) |

| Sales Channel | Aftermarket, OEM |

| Regions Covered | North America, Latin America, Europe, Asia-Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, Japan, South Korea, Brazil, Canada, France, Mexico, Australia, and 40+ countries |

| Key Companies Profiled | Lear Corporation, Seiren Co., Ltd., GST AutoLeather Inc. (Pangea), BOXMARK Leather GmbH & Co KG, Bader GmbH & Co. KG, Eagle Ottawa, DK Leather Corporation, Scottish Leather Group Limited, Katzkin Leather Inc., Mayur Uniquoters Ltd. |

| Additional Attributes | Dollar sales by material type, share by sales channel , adoption of synthetic alternatives, expansion in automotive production, aftermarket customization trends, and rising usage of premium interior leather in luxury and mid-range vehicles |

The global automotive interior leather market is estimated to be valued at USD 24.3 billion in 2025.

The market size for automotive interior leather is projected to reach USD 39.2 billion by 2035.

The automotive interior leather market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The PU leather segment is projected to lead in the automotive interior leather market with 55% market share in 2025.

In terms of sales channel, the aftermarket segment is expected to command 42% share in the automotive interior leather market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Korea Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Demand for Automotive Interior Leather in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA