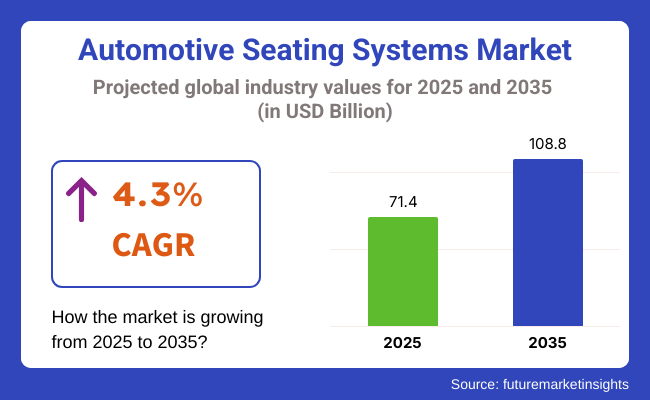

The global automotive seating systems market is poised for robust expansion over the next ten years, with demand projected to reach USD 71.4 billion in 2025 and be worth USD 108.8 billion by 2035. This translates into a steady CAGR of roughly 4.3% during the 2025 to 2035 forecast period.

As automakers continue to refine vehicle interiors to meet ever-evolving consumer expectations, seating systems have become far more than simple fixtures, they are now critical touchpoints that blend safety, comfort, aesthetics, and functionality. From the foundational cushioning materials and frame structures to advanced comfort and safety subsystems, seating systems contribute significantly to overall vehicle value and play a central role in brand differentiation.

Over the past few years, one of the most influential factors driving market growth has been the surging consumer demand for enhanced ergonomics and personalized comfort. Longer average commute times, especially in urban and suburban areas, have made seat fatigue a genuine pain point, prompting manufacturers to integrate adjustable lumbar support, multi-density foam layers, and memory functions even in mainstream vehicle models.

At the same time, rising interest in health-monitoring features has spurred the development of seats equipped with pressure-mapping sensors and posture-correction algorithms. Beyond comfort, seats are now integral components of modern safety systems: side-impact airbags, active head restraints, and integrated belt-pre-tensioners have all migrated into the seat architecture, reducing injury risk and lowering overall vehicle liability. As safety regulations tighten worldwide, this combination of comfort and protection will remain a cornerstone of seating innovation.

Looking ahead, lightweighting and technological integration are set to further propel market expansion through 2035. Automakers are increasingly turning to advanced composites, such as carbon fiber and high-strength aluminum alloys, for seat frames and structural elements, balancing strength with weight savings that support fuel efficiency and, in electric vehicles, extended driving range.

Meanwhile, a new wave of “smart seats” is on the horizon: climate-controlled surfaces with active heating and ventilation, embedded massage modules, and even real-time biometric monitoring tied into the vehicle’s infotainment and driver-assistance systems.

The table below presents the annual growth rates of the global automotive seating systems market from 2025 to 2035. With a base year of 2024 extending to 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance, highlighting emerging trends and developments.

These figures show the growth of the sector in each half-year between 2024 and 2025. The automotive seating market is expected to grow at a CAGR of 4.3% from 2025 to 2035, with growth accelerating in H2.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 4.1% (2024 to 2034) |

| H2 2024 | 4.2% (2024 to 2034) |

| H1 2025 | 4.3% (2025 to 2035) |

| H2 2025 | 4.5% (2025 to 2035) |

In the period from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 4.3% in the first half but increase to 4.5% in the second half. In H1, the sector experienced an increase of 20 BPS, while in H2, there was a larger rise of 30 BPS. This trend reflects the growing demand for advanced seating technologies, including smart features, lightweight materials, and enhanced comfort, all of which drive the market in vehicle segments.

The global automotive seating market is segmented by vehicle type into passenger cars, light commercial vehicle, heavy commercial vehicle, and others (agricultural, construction, military, recreational, off-road, and industrial vehicles). By seat type, the market is divided into split seat, bench seat, bucket, and others (jump seats, fold-flat seats, and configurable modular).

Distribution channels include OEM and aftermarket. Technology segmentation covers heated, powered, powered & heated seats, and standard seat. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

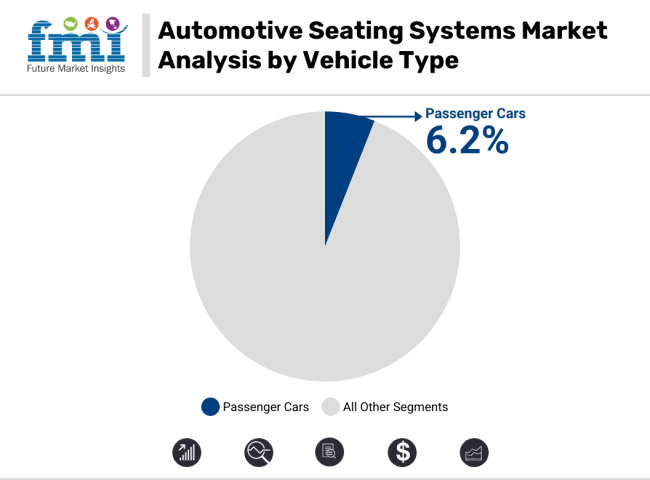

The passenger cars segment is the fastest growing in the market. The segment is poised to achieve a CAGR of approximately 6.2% between 2025 and 2035. This growth is largely driven by increasing demand for advanced comfort features, such as heated and powered seats, in luxury and mid-range passenger cars. The rising adoption of electric vehicles and autonomous driving technology is also pushing manufacturers to innovate seating designs focused on ergonomics and passenger experience.

The light commercial vehicle (LCV) segment is witnessing steady growth fueled by expanding e-commerce and logistics industries globally. LCVs are increasingly used for last-mile deliveries and urban transportation, which is boosting demand for durable, ergonomic seating solutions that improve driver comfort during long hours on the road.

The heavy commercial vehicle (HCV) segment is growing moderately, supported by the global increase in freight transportation, infrastructure projects, and construction activities. Demand for robust and safety-compliant seats that can withstand harsh operating conditions is driving innovation in this segment, including the integration of suspension seats and enhanced safety belts.

The other segment includes specialty vehicles such as agricultural machinery, construction equipment, and recreational vehicles. This segment is growing at a slower rate due to the niche nature of the applications, but it remains important because these vehicles require highly customized seating solutions that focus on durability and operator comfort in challenging environments.

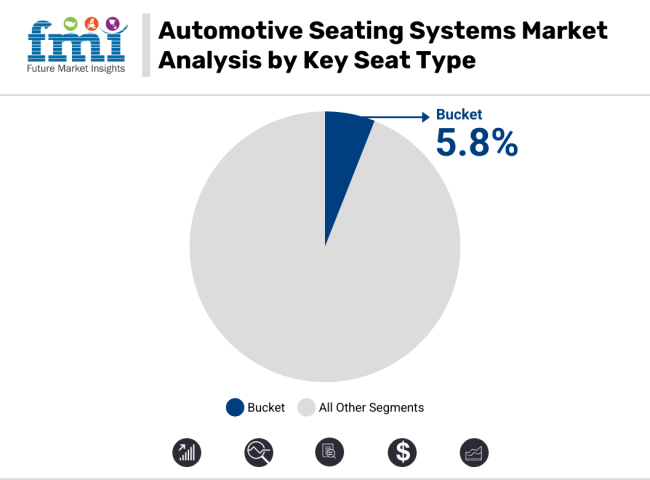

The bucket seat segment is the fastest growing, projected to grow at a CAGR of approximately 5.8% between 2025 and 2035, driven by increasing consumer preference for comfort, enhanced ergonomics, and sporty aesthetics, especially in luxury cars, SUVs, and performance vehicles. Bucket seats provide individualized seating with better lateral support, making them popular in passenger cars focusing on driver and passenger comfort.

Moreover, advances in automotive technology have integrated features like adjustable lumbar support, heating, cooling, and memory settings into bucket seats, further boosting their attractiveness. The growing trend toward sportier vehicle designs and the increasing focus on safety, bucket seats help keep occupants better secured during sudden maneuvers, also contributing to the segment’s rapid adoption.

The split seat segment remains widely used due to its versatility and ability to fold down partially or fully, offering flexible cargo and passenger configurations. This type is commonly seen in SUVs, crossovers, and hatchbacks, appealing to families and outdoor enthusiasts who value adaptability.

The bench seat segment, while more traditional, is still prominent in light and heavy commercial vehicles, pickup trucks, and budget cars. Its simplicity and capacity to accommodate three passengers make it cost-effective and practical for utilitarian use.

The other segment includes specialized seating such as jump seats, modular seats, and fold-flat seats used in buses, vans, and specialty vehicles, catering to niche applications requiring space optimization or additional passenger capacity.

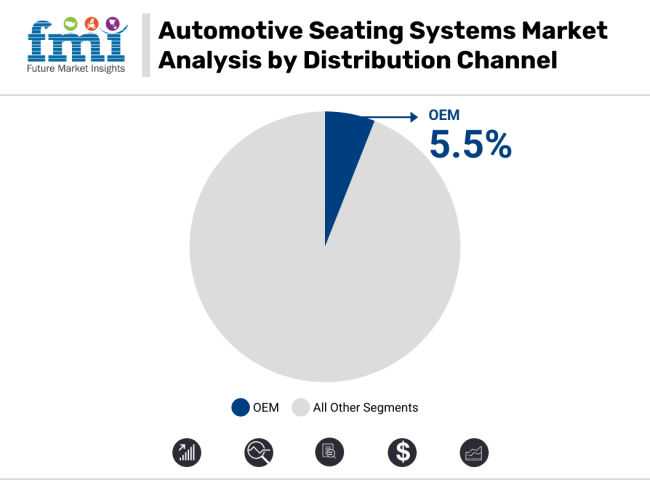

The OEM (original equipment manufacturer) segment is the fastest growing in the market, projected to expand at a CAGR of approximately 5.5% from 2025 to 2035. This growth is fueled by the increasing global production of new vehicles, especially in emerging economies where demand for modern, comfortable, and technologically advanced seating solutions is rising. OEMs focus on integrating advanced features such as heated seats, powered adjustments, memory functions, and ergonomic designs directly into vehicles at the manufacturing stage.

These innovations not only enhance passenger comfort but also improve safety and comply with stricter regulatory standards. Additionally, OEMs benefit from strong partnerships with automakers, allowing them to capitalize on trends like electric vehicles and autonomous driving, which require specialized seating configurations.

On the other hand, the aftermarket segment caters primarily to vehicle owners who seek to replace, upgrade, or customize their existing seats. Growth in the aftermarket is driven by increasing vehicle age and ownership worldwide, prompting consumers to invest in comfortable, durable, and affordable seating options without purchasing new vehicles.

Aftermarket players offer a wide range of products, including seat covers, cushions, repair kits, and performance seats that appeal to cost-conscious buyers and automotive enthusiasts. However, the aftermarket faces challenges such as varying quality standards and regulatory hurdles, which can limit growth compared to the OEM segment.

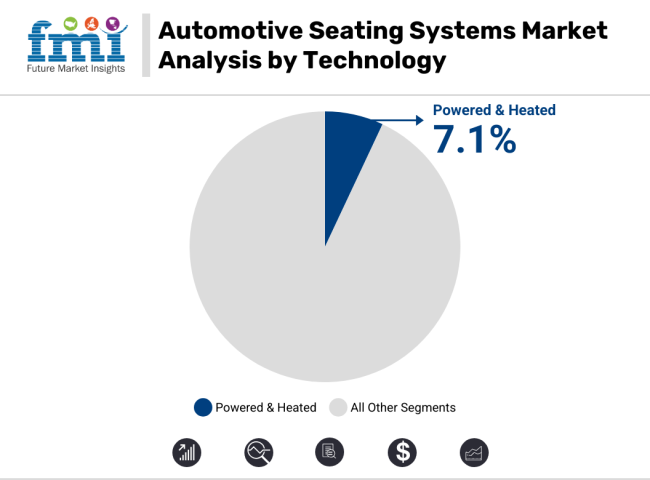

The powered & heated seat segment is the fastest growing. This segment is expected to register a CAGR of approximately 7.1% during the forecast period, fueled by rising consumer demand for enhanced comfort and convenience, particularly in premium and mid-tier vehicle categories.

These seats combine electronic adjustability, allowing drivers and passengers to fine-tune seat position, lumbar support, and tilt, with heating functionality, providing thermal comfort in colder regions. Advances in seat technology also incorporate memory settings and integration with vehicle safety systems.

The powered seat segment is also expanding steadily due to its focus on providing superior ergonomics and ease of use. Powered seats enable precise electronic adjustments that help reduce driver fatigue on long journeys and accommodate a wider range of body types and preferences. This technology is becoming standard in many mid to high-end vehicles as buyers increasingly seek customizable comfort features. Growth in electric vehicle adoption further supports this segment, as powered seats align well with the tech-forward image of EVs.

The heated seat segment is growing consistently, particularly in regions with colder climates such as North America, Europe, and parts of Asia-Pacific. Heated seats improve occupant comfort during winter months, reducing the need for extensive cabin heating and improving energy efficiency. Increasing consumer awareness of thermal comfort benefits and the rising number of vehicle models offering optional heated seats contribute to steady demand growth.

The standard seat segment remains significant due to its cost-effectiveness and simplicity, predominantly in entry-level and budget vehicles. While demand for standard seats is stable, it is gradually declining in markets where consumers are shifting towards more advanced seating technologies. Standard seats often serve as a baseline, with many vehicles offering upgrades to powered or heated variants as optional features.

Rising Demand for Ergonomic, Adjustable Seats Boosting Sales of Automotive Seating System

The rising demand for ergonomic and adjustable seats is transforming the automotive seating systems market. Consumers increasingly prioritize comfort and health, leading manufacturers to design seats with enhanced lumbar support, customizable contours, and pressure-relieving materials. According to industry reports, ergonomic seating reduces driver fatigue by up to 30%, improving safety during long drives.

Adjustable seating, including power-adjustable and memory seats, has gained traction due to its ability to cater to individual preferences. Features like height, tilt, and recline adjustments ensure optimal posture, attracting both premium and economy vehicle buyers. In 2023, vehicles with advanced seating technologies accounted for over 40% of global car sales, highlighting growing consumer demand.

Moreover, integrating sensors for posture correction and real-time monitoring of vital health parameters is revolutionizing the sector. These innovations, coupled with an increased focus on personalization, drive robust growth in the automotive seating market.

Integrating Advanced Safety Features into Seats Revolutionizes Automotive Seating System

Integrating advanced safety features into automotive seating systems reshapes vehicle safety standards and enhances passenger protection. Modern seats are now equipped with innovations like built-in airbags, which deploy from the seat to reduce impact during collisions, and active head restraints that minimize whiplash injuries. Additionally, seatbelt pre-tensioners are being embedded into seats to tighten belts instantly in the event of a crash, ensuring passengers are securely held in place.

Some manufacturers are incorporating side-impact sensors that adjust seat positioning milliseconds before a collision to mitigate injuries. Child safety seats with integrated harness systems and adjustable configurations are also gaining traction, improving safety for young passengers.

These advancements enhance rider safety and reduce liability risks for automakers. Reports indicate vehicles with advanced seating safety features have seen a 15% reduction in crash-related injuries, boosting consumer trust and demand, particularly in premium markets.

Rising Demand for Reconfigurable, Intelligent, and Lightweight Automotive Seating Systems Globally

The automotive seating systems market is evolving rapidly, driven by the demand for intelligent, flexible, and feature-rich solutions. Manufacturers focus on enhancing user experience by designing reconfigurable seats that maximize space efficiency. These seats can swivel to facilitate conversations, fold for additional cargo room, or adjust to create a flat surface for easier product transportation.

Incorporating advanced features like massage functions, drowsiness alerts, and climate control, modern seating systems prioritize comfort and convenience. Premium vehicles now include sophisticated features such as automatic heating and integrated smart technologies, improving safety and reducing accident vulnerabilities.

Additionally, lightweight designs improve fuel efficiency, aligning with sustainability goals. Growing demand for premium vehicles and economy cars, particularly in developing markets like India and Brazil, further boosts opportunities for the automotive seating systems market, which is expected to grow steadily in the coming years.

Increasing Interest in Temperature and Humidity Controlled Seating Technology

Increasing global warming at high temperatures makes it even more difficult for people to travel in vehicles. This affects both the people driving and those riding in vehicles. It is anticipated that automotive seating systems market players will likely incorporate new technology in response to the growing number of climate and environmental concerns. For instance, if a passenger automobile is kept in the sun all day, the heat trapped inside the vehicle will make it unpleasant for both the passenger and the driver to sit inside the vehicle.

However, technological developments have led to the creation of climate-controlled seating technology in car seats, which enables customers to rapidly cool their seats whenever they want to. To accomplish this goal, these seats were designed with perforated inserts and built-in chillers and fans. Similarly, the chairs include built-in heaters based on cloth, which are helpful when the weather is chilly. As a result, an increasing emphasis is placed on providing automotive seating system seats with climate control.

Massage seats are often only available in higher-end vehicles sold by original equipment manufacturers (OEMs). However, powered, heated, and ventilated applications are now commercialized and utilized in various cars that fall into more reasonable price ranges. For example, car original equipment manufacturers (OEMs), including Mercedes-Benz, BMW, Jaguar, and Cadillac, offer massage seats for the front passengers of their vehicles.

For example, in February 2022, Kia introduced the new cheap MPV Carens in the Indian automotive seating systems market. It featured front seats with ventilation.

From 2020 to 2024, the global automotive seating system market witnessed steady growth, fueled by rising demand for comfort, customization, and intelligent seating solutions. The increasing focus on enhancing passenger experience has driven the adoption of advanced technologies such as heated and ventilated seats, memory functions, and smart sensors for posture correction.

Innovations in materials, such as lightweight composites and eco-friendly fabrics, contributed to improved durability, comfort, and vehicle fuel efficiency. Additionally, the growing popularity of electric and autonomous vehicles has accelerated the demand for reconfigurable and multifunctional seating systems tailored to modern mobility needs.

Looking ahead to 2025 to 2035, the automotive seating system market is expected to expand rapidly, driven by advancements in modular seating designs, integrated safety features, and user-centric innovations. Emerging markets with rising vehicle production and consumer preferences for premium and ergonomic seats will further propel the adoption of intelligent seating solutions that prioritize comfort, flexibility, and cutting-edge functionality.

Tier-1 companies account for around 50-55% of the overall market, with a product revenue from the automotive seating systems market of more than USD 50 million. Magna International, Lear Corporation, Adient, and other players.

Tier-2 and other companies such as Tachi-S Engineering USA., Inc., RCO Engineering, and other players are projected to account for 45-50% of the overall market, with the estimated revenue under the USD 50 million through the sales of automotive seating systems.

The section below covers the industry analysis for automotive seating systems in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa, is provided. This data helps investors keenly observe and go through recent trends and examine them in an ordered manner.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| India | 4.5% |

| China | 4.0% |

| The USA | 3.8% |

| Japan | 3.5% |

| Germany | 3.2% |

Localized manufacturing and increased investments by global automotive giants are key factors driving the growth of the automotive seating systems market in India. Localized production reduces costs by minimizing import dependency and enabling manufacturers to offer competitively priced vehicles with advanced seating systems. This affordability attracts middle-class consumers, a significant segment of India’s growing automotive market.

Global companies like Lear Corporation and Adient have expanded their presence in India, setting up manufacturing plants to cater to domestic and export demand. For instance, Adient's Pune facility specializes in producing modular seating solutions tailored to the needs of Indian consumers. Additionally, localized production ensures faster adaptation to market preferences, such as ergonomic designs for compact cars widely popular in India.

Partnerships between automakers and technology companies are significantly boosting R&D for automotive seating systems in the USA, driving innovation and enhancing consumer experience. As automakers focus on advanced features like adjustable seating, climate control, and integrated safety technologies, collaborating with tech firms accelerates the development of smart, multifunctional seating systems. Companies like Ford have partnered with tech giants like Google to integrate AI and IoT into vehicle interiors, optimizing seating comfort and personalization.

These collaborations help integrate cutting-edge technologies such as smart sensors, posture correction systems, and interactive seat controls, improving comfort and safety. For instance, Ford’s partnership with Lear Corporation has created adjustable and heated seats with integrated sensors to monitor the driver’s posture.

This convergence of automotive and tech expertise not only enhances vehicle value but also drives demand in the USA market, as consumers seek vehicles with superior comfort, safety, and advanced features.

Investments in lightweight engineering and smart materials are playing a crucial role in boosting Germany's automotive seating systems market. By using advanced materials like carbon fiber composites and high-strength aluminum, manufacturers can create lighter yet durable seating systems without compromising on comfort or safety.

Companies such as Volkswagen and Mercedes-Benz are incorporating lightweight seating designs into their premium models. These innovations not only enhance the driving experience but also align with the growing consumer demand for more fuel-efficient vehicles.

Smart materials like memory foam and thermo-regulating fabrics also provide added comfort while improving the overall vehicle interior. This focus on lightweight, high-performance materials drives growth in Germany's automotive seating systems market, meeting consumer needs and sustainability goals.

Technological advancements are transforming the automotive seating system market, focusing on enhanced comfort, functionality, and durability. Smart seating solutions with features like memory settings, pressure sensors, and posture correction are elevating passenger comfort and personalization. Automakers are increasingly using lightweight composites and durable, breathable fabrics to improve both seating longevity and overall vehicle efficiency.

Premium features such as multi-zone climate control, massaging functions, and reconfigurable designs are becoming standard, especially in SUVs and electric vehicles, optimizing space and utility. Modular and foldable seating configurations further cater to diverse consumer needs, from maximizing cargo space to improving passenger convenience. As the demand for ergonomic and feature-rich seating grows, these innovations are driving the widespread adoption of advanced seating systems, making them a cornerstone of modern automotive interiors.

Recent Industry Developments

The vehicle type is further categorized into passenger cars, light commercial vehicle, heavy commercial vehicle and others.

The seat type is further classified into split seat, bench seat, bucket and others.

The distribution channel is further classified into OEM and aftermarket.

The technology is further classified into heated, powered, powered & heated and standard seat.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The automotive seating systems was valued at USD 68.5 billion in 2024.

The demand for automotive seating systems is set to reach USD 71.4 billion in 2025

The global automotive seating systems is driven by comfort, longer commutes and customization to enhance passenger riding experience.

The seating systems demand is projected to reach USD 108.8 billion in 2035.

The passenger cars are expected to lead during the forecasted period due to demand for comfort long distance commute.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive seating accessories Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Systems Market Trends - Growth & Forecast 2025 to 2035

Automotive Ignition Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Actuation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Energy Recovery Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Turbo Compounding Systems Market Growth – Trends & Forecast 2025 to 2035

Automotive Personal Navigation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Gesture Recognition Systems Market

Automotive Touch Screen Control Systems Market Growth - Trends & Forecast 2025 to 2035

ADAS Market Growth - Trends & Forecast 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA