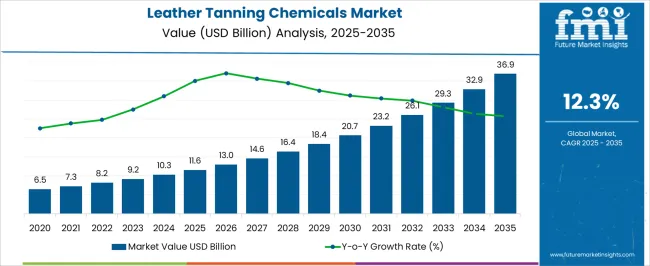

The Leather Tanning Chemicals Market is estimated to be valued at USD 11.6 billion in 2025 and is projected to reach USD 36.9 billion by 2035, registering a compound annual growth rate (CAGR) of 12.3% over the forecast period.

| Metric | Value |

|---|---|

| Leather Tanning Chemicals Market Estimated Value in (2025 E) | USD 11.6 billion |

| Leather Tanning Chemicals Market Forecast Value in (2035 F) | USD 36.9 billion |

| Forecast CAGR (2025 to 2035) | 12.3% |

The Leather Tanning Chemicals market is witnessing sustained growth, driven by rising global demand for leather in footwear, apparel, automotive interiors, and furniture applications. The market is being influenced by a combination of factors including advancements in chemical formulations, improvements in tanning efficiency, and the need for durable, high-quality leather. Increasing investment in sustainable tanning processes is further shaping the industry as manufacturers move toward reducing water consumption and minimizing environmental impact.

While chromium-based tanning methods remain dominant due to cost-effectiveness and superior leather finish, innovation in alternative eco-friendly tanning solutions is expected to expand future opportunities. Growing consumer preference for premium and luxury leather goods in both developed and emerging economies is fueling demand across multiple end-use industries.

With ongoing expansion in the textile and apparel sector, and the continuous adoption of tanning chemicals that improve leather flexibility and strength, the market outlook remains positive The ability of chemical producers to balance performance with sustainability will play a critical role in determining long-term competitiveness.

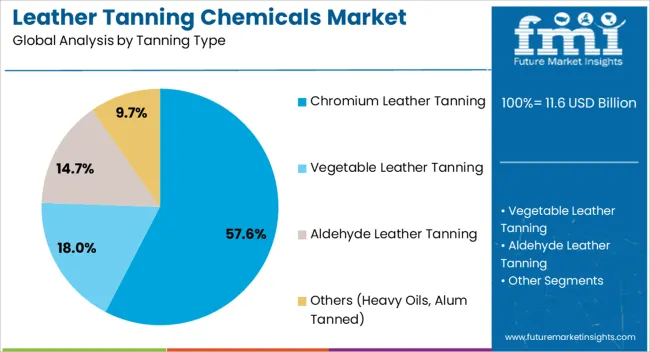

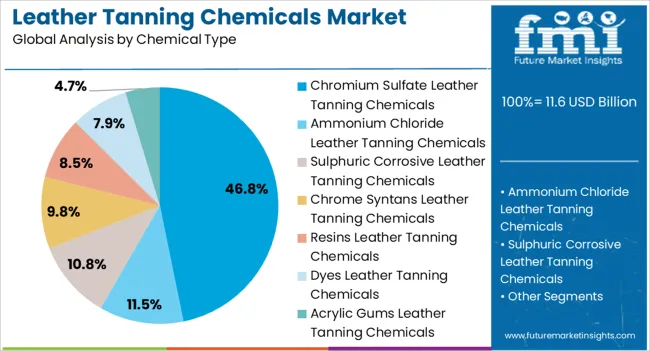

The leather tanning chemicals market is segmented by tanning type, chemical type, application type, and geographic regions. By tanning type, leather tanning chemicals market is divided into Chromium Leather Tanning, Vegetable Leather Tanning, Aldehyde Leather Tanning, and Others (Heavy Oils, Alum Tanned). In terms of chemical type, leather tanning chemicals market is classified into Chromium Sulfate Leather Tanning Chemicals, Ammonium Chloride Leather Tanning Chemicals, Sulphuric Corrosive Leather Tanning Chemicals, Chrome Syntans Leather Tanning Chemicals, Resins Leather Tanning Chemicals, Dyes Leather Tanning Chemicals, and Acrylic Gums Leather Tanning Chemicals. Based on application type, leather tanning chemicals market is segmented into Textile and Apparel Industry, Automotive Accessories, and Furniture. Regionally, the leather tanning chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Chromium Leather Tanning segment is projected to hold 57.60% of the overall market revenue in 2025, making it the largest tanning type in the industry. This dominance is being attributed to the ability of chromium tanning to deliver consistent quality, higher tensile strength, and superior resistance to heat and wear compared to alternative methods.

The process has been widely adopted due to shorter tanning cycles, lower costs, and the capacity to produce soft yet durable leather suitable for multiple applications. Industries such as footwear, automotive upholstery, and apparel have shown strong reliance on chromium-tanned leather due to its long-lasting finish and ability to retain dyes effectively.

The segment’s growth has also been reinforced by its scalability in large-scale production environments, where time efficiency and output consistency are essential Although concerns regarding environmental safety are driving research into eco-friendly alternatives, chromium tanning continues to maintain its leadership position due to its proven performance and entrenched adoption across global supply chains.

The Chromium Sulfate Leather Tanning Chemicals segment is anticipated to account for 46.80% of the market revenue in 2025, establishing itself as the leading chemical type. This segment has achieved dominance due to the widespread use of chromium sulfate as a fundamental tanning agent, which ensures deeper penetration into hides and results in enhanced softness and elasticity of leather.

The cost-effectiveness and reliability of chromium sulfate in producing high-quality leather have further solidified its role as a preferred chemical among manufacturers. Its compatibility with mass-production requirements and the ability to provide uniform tanning outcomes are critical factors contributing to its market share.

In addition, chromium sulfate’s established global supply and availability have supported its broad adoption across diverse regions While environmental regulations are prompting manufacturers to explore more sustainable options, the practical benefits of chromium sulfate in terms of production efficiency and quality consistency continue to secure its leading position within the tanning chemicals segment.

Leather is considered as a traditional material used for the manufacturing of many goods, including footwear, clothing, furniture, and automobile seats. Leather chemical tanning is a process used to stabilize its structure, so that the skin can retain its natural properties. Moreover, during the tanning process, skin structure is maintained in its open form by changing some of the collagen with complex ions of chromium. After tanning, the leather is able to withstand hundred degree Celsius hot boiling water, and become more flexible than the untreated dead skin. The most common leather tanning chemicals include vegetable tannins (extracted from tree bark), syntans, alum, glutaraldehyde, formaldehyde, and heavy oils. Chrome tanning by leather tanning chemicals is the most adopted tanning process by manufacturers; this process is most efficient and less toxic than hexavalent chromium. Though the vegetable tanning process is a traditional process, it is a process without using harmful chemicals. Vegetable tannic acids are naturally found in some plants, by using the branches, leaves, barks, or even some fruits in some specific techniques.

In order to make leather soft and pliable for use, the leather tanning chemical process is necessary during the preparing of leather. With the growing demand for technologically advanced and efficient processes for leather tanning, the demand for the leather tanning chemicals has escalated

The method of leather tanning has revolutionized the modern leather industry since the past few years. The growing consumption of leather in the end-use sector includes furniture, footwear, garments, and automotive interiors, which is estimated to create high demand for leather tanning chemicals over the forecast period. The increasing demand for luxurious leather products and the production of various colored leathers have substantially changed the scenario of the leather tanning chemicals market. There is high demand for leather tanning chemicals in developing economies, as manufacturers have invested immensely in these countries, owing to low labor costs.

Some of the top growing countries of leather such as the Republic of Korea, Taiwan, China, Indonesia, and Vietnam have been hindered by the deficiency of raw material supply, and involved in the considerable import of skin and hides. This is further expected to hamper the growth of the leather tanning chemicals market over the forecast period.

Asia Pacific is expected to remain a frontrunner in the leather tanning chemicals market over the forecast period. High demand from the region for more advanced leather chemical technologies, and the growth of the automotive, apparel, and footwear industries are expected to deliver a positive growth outlook for the leather tanning chemicals market over the forecast period. Europe's leather tanning chemicals market is estimated to gain high traction, as the apparel industry in European countries raises new standards for the quality of the clothes, and thicker leather for shoe soles, bags, cases, and straps. Factors such as increasing purchasing power of people, developing infrastructure, and improved consumer sentiments are together driving the quality of living of people, which, in turn, increases the demand for leather tanning chemicals.

The importance of leather merchandises in all aspects of everyday life has made it a highly anticipated trade item. With the growing consumption of leather items in developed countries such as the USA and Canada in the North America region, there is high market growth expected over the coming years. Latin America and the Middle East are also expected to deliver positive growth in the leather tanning chemicals market over the forecast period.

The market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, and inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators, and governing factors, along with market attractiveness as per segment. The leather report also maps the qualitative impact of various market factors on market segments and geographies.

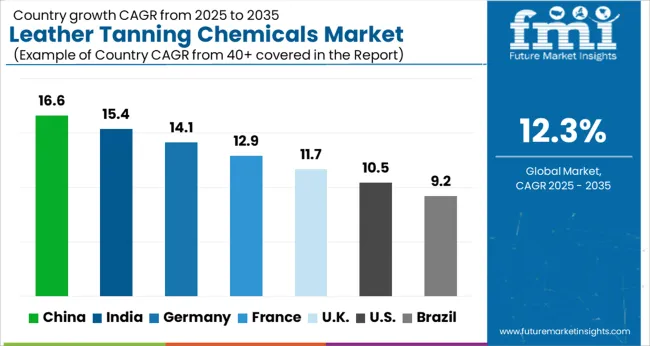

| Country | CAGR |

|---|---|

| China | 16.6% |

| India | 15.4% |

| Germany | 14.1% |

| France | 12.9% |

| UK | 11.7% |

| USA | 10.5% |

| Brazil | 9.2% |

The Leather Tanning Chemicals Market is expected to register a CAGR of 12.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 16.6%, followed by India at 15.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 9.2%, yet still underscores a broadly positive trajectory for the global Leather Tanning Chemicals Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 14.1%. The USA Leather Tanning Chemicals Market is estimated to be valued at USD 4.3 billion in 2025 and is anticipated to reach a valuation of USD 11.7 billion by 2035. Sales are projected to rise at a CAGR of 10.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 555.0 million and USD 371.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.6 Billion |

| Tanning Type | Chromium Leather Tanning, Vegetable Leather Tanning, Aldehyde Leather Tanning, and Others (Heavy Oils, Alum Tanned) |

| Chemical Type | Chromium Sulfate Leather Tanning Chemicals, Ammonium Chloride Leather Tanning Chemicals, Sulphuric Corrosive Leather Tanning Chemicals, Chrome Syntans Leather Tanning Chemicals, Resins Leather Tanning Chemicals, Dyes Leather Tanning Chemicals, and Acrylic Gums Leather Tanning Chemicals |

| Application Type | Textile and Apparel Industry, Automotive Accessories, and Furniture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

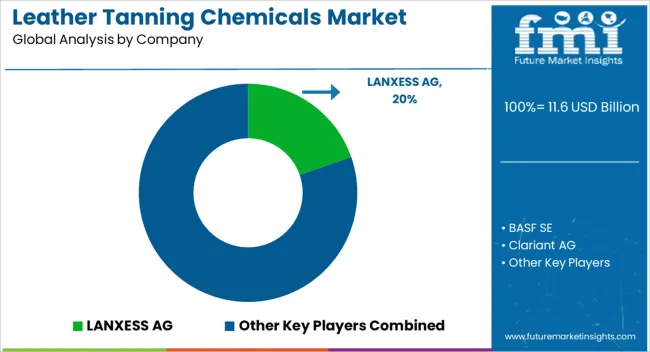

| Key Companies Profiled | LANXESS AG, BASF SE, Clariant AG, Stahl Holdings BV, TFL Ledertechnik GmbH, Buckman Laboratories International, Inc., Solvay S.A., Chromchem Ltd., Tanning Technology Corporation, and Kemin Industries, Inc. |

The global leather tanning chemicals market is estimated to be valued at USD 11.6 billion in 2025.

The market size for the leather tanning chemicals market is projected to reach USD 36.9 billion by 2035.

The leather tanning chemicals market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in leather tanning chemicals market are chromium leather tanning, vegetable leather tanning, aldehyde leather tanning and others (heavy oils, alum tanned).

In terms of chemical type, chromium sulfate leather tanning chemicals segment to command 46.8% share in the leather tanning chemicals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leather Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Leather Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Tanning Waters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Leather Jewellery Box Market Size and Share Forecast Outlook 2025 to 2035

Leather Goods Market Outlook - Size, Share, and Growth 2025 to 2035

Leather Sneakers Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Leather Dyes Manufacturers

Leather Embossing Machine Market

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

Oxo Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Self-tanning Products Market Report - Growth, Demand & Forecast 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fluorochemicals Market Size and Share Forecast Outlook 2025 to 2035

Paper Chemicals Market Growth – Trends & Forecast 2023-2033

Industry Share Analysis for Bonded Leather Companies

Roofing Chemicals Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA