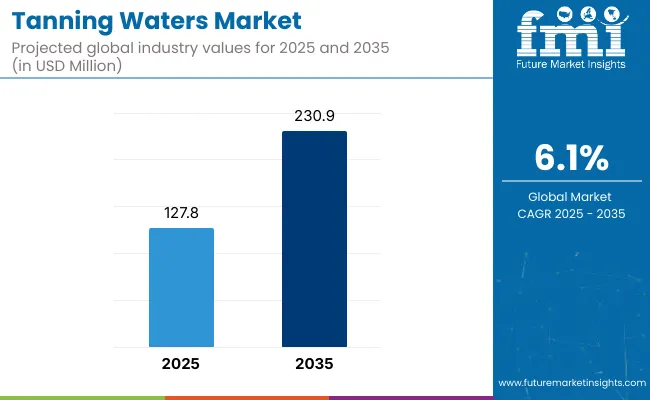

The Tanning Waters Market is expected to record a valuation of USD 127.8 million in 2025 and USD 230.9 million in 2035, which equals a growth of 80.5% over the decade. The overall expansion represents a CAGR of 6.1% and a 1.8X increase in market size.

| Metric | Value |

| Tanning Waters Market Estimated Value in (2025E) | USD 127.8 million |

| Tanning Waters Market Forecast Value in (2035F) | USD 230.9 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

During the first five-year period from 2025 to 2030, the market increases from USD 127.8 million to USD 171.85million, which accounts for 42.7% of the total decade growth. This phase records steady adoption in skincare routines, facial tanning products, and hydrating formulations, driven by the need for non-invasive, streak-free self-tanning solutions. Gradual tanning waters dominate this period as they cater to over 30% of facial and body applications requiring daily use flexibility.

The second half from 2030 to 2035 contributes USD 59 million, equal to 57.3% of total growth, as the market jumps from USD 171.85million to USD 230.9 million. This acceleration is powered by widespread deployment of natural ingredient formulations, clean beauty innovations, and premium DTC brands offering targeted skincare-plus-tanning hybrids. Natural/organic-based formats capture a larger share above 55% by the end of the decade. Packaging and formulation upgrades add recurring revenue, increasing the spray bottle format share beyond 38% in total value.

From 2020 to 2024, the Tanning Waters Market transitioned from a niche beauty trend into an emerging product category, supported by growing consumer demand for lightweight, hydrating, and streak-free tanning solutions. During this early phase, market momentum was largely driven by clean beauty positioning, skincare-tanning hybridization, and the rise of direct-to-consumer (DTC) brands. Leading players such as Isle of Paradise, St. Tropez, and Tan-Luxe captured strong visibility, contributing to over 65% of category revenues through strategic online-first launches and high-performance gradual tanning products. Competitive differentiation centered around natural ingredient formulations, no-transfer claims, and inclusivity across skin tones. Larger cosmetic houses were present but often underweighted in this format, treating tanning waters as part of seasonal or limited-edition ranges.

Demand for tanning waters is projected to expand to USD 127.8 million in 2025, with a compound annual growth rate (CAGR) of 6.1% through 2035. The revenue mix is expected to evolve, with premium skincare-integrated tanning waters gaining preference across markets like the USA, UK, China, and Japan. Product innovations increasingly emphasize hydration, anti-aging benefits, and natural actives like coconut water and botanical extracts.

Traditional leaders are experiencing growing competition from emerging clean beauty brands and regional players in Asia-Pacific who are offering water-based formats tailored to localized skincare routines. Established brands are expanding into face-specific tanning waters, refillable formats, and dermatologist-tested claims to retain consumer trust.

The competitive advantage is shifting from standalone product performance to ecosystem depth spanning sustainable packaging, loyalty-driven DTC strategies, and AI-powered shade matching tools. Recurring revenue models are being tested through subscription boxes, mini packs, and bundling with skincare regimens. As clean-label and functional benefits converge, the market is likely to favor brands that deliver inclusive, ingredient-transparent, and digitally personalized tanning water solutions across a global consumer base.

The tanning waters market is expanding due to its alignment with skincare-centric beauty routines. Unlike traditional self-tanners, tanning waters offer hydration, anti-aging actives, and vitamin-enriched formulations. Products combining coconut water, aloe vera, and botanical antioxidants now serve dual purposesproviding a natural tan while improving skin health. This hybrid positioning appeals to consumers seeking lightweight, non-comedogenic, and multifunctional solutions, especially in facial care.

Rapid growth of direct-to-consumer (DTC) channels and influencer-backed launches has accelerated tanning water adoption. Startups like Isle of Paradise and Bali Body have leveraged TikTok and Instagram to normalize clear, no-transfer tanning waters, reaching younger consumers who prioritize clean aesthetics, transparency, and convenience.

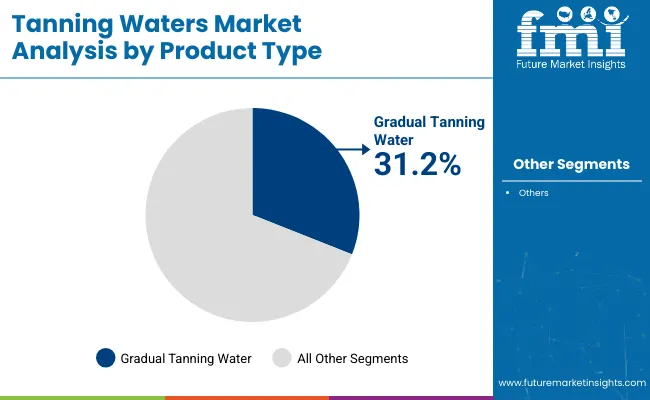

The tanning waters market is segmented by product type, ingredient base, functionality, packaging format, distribution channel, and region, reflecting the category’s innovation depth and diverse consumer use cases. Product type includes gradual tanning water, instant tanning water, face and body tanning waters, tanning mists, self-tan sprays, tanning water serums, and lotionseach addressing varying levels of tan intensity, skin zones, and reapplication preferences.

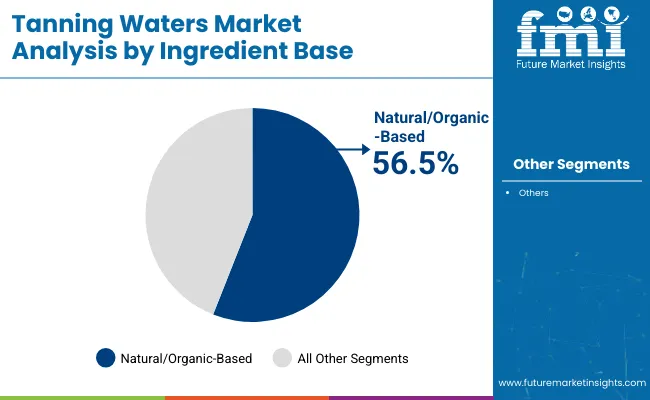

Ingredient base covers natural/organic-based formulations such as coconut water, aloe vera, and botanical extracts like green tea and chamomile, alongside synthetic/chemical-based ingredients like dihydroxyacetone (DHA), erythrulose, glycerin, and alcohol-based formats, which ensure tanning efficacy and formulation stability.

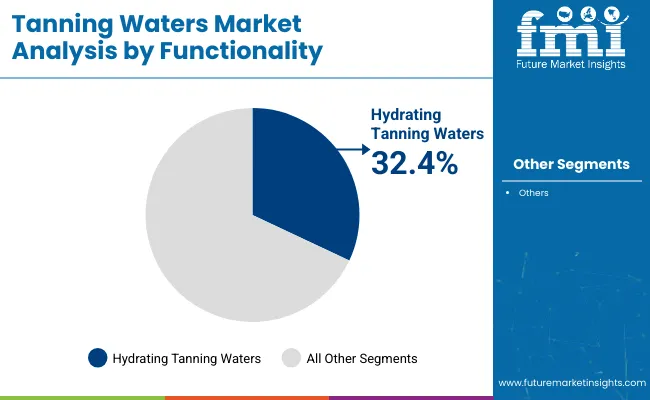

Functional segmentation spans hydrating tanning waters, fragrance-infused variants, SPF-enriched options, anti-aging benefits, and streak-free or transfer-resistant formats designed to enhance user experience and product performance. Packaging formats include spray bottles, pump bottles, mist cans, dropper bottles, and travel-size packs, each supporting different use occasions and shelf appeal.

Distribution channels encompass beauty retail chains, e-commerce platforms, specialty cosmetic stores, pharmacies and drugstores, supermarkets and hypermarkets, salon and spa retail, and direct-to-consumer (DTC) brands, indicating an omni-channel expansion across premium and mass-market access points. Regionally, the market is active in North America, Europe, Asia-Pacific, and emerging areas across Latin America and the Middle East & Africa, driven by varying climate influences, digital retail maturity, and evolving beauty routines.

| Product Type | Value Share% 2025 |

|---|---|

| Gradual Tanning Water | 31.2% |

| Others | 68.8% |

Gradual tanning water is expected to dominate the product type segment in 2025 with a 31.2% market share, reflecting its strong consumer appeal as a buildable, low-risk self-tanning solution. Its ease of use, minimal transfer, and compatibility with daily skincare routines have positioned it as the preferred format for new users and skincare-conscious consumers alike.

Compared to instant or spray-based variants, gradual tanning water allows controlled application with natural-looking results, contributing to higher repeat usage. The remaining 68.8% is shared across instant formats, face/body-specific waters, and mists, which cater to more specialized or occasional-use segments.

| Ingredient Base | Value Share% 2025 |

|---|---|

| Natural/Organic-Based | 56.50% |

| Others | 43.5% |

Natural/organic-based formulations are projected to lead the ingredient base segment with a 56.5% value share in 2025, driven by consumer preference for clean-label, skin-friendly ingredients. Tanning waters infused with coconut water, aloe vera, and botanical extracts like chamomile and green tea are increasingly favored for their dual benefits of hydration and skin nourishment.

This segment resonates strongly with health-conscious and sensitive-skin users who seek transparency in beauty formulations. In contrast, the remaining 43.5%comprising synthetic bases like DHA, erythrulose, and glycerincontinues to support efficacy-driven products but faces growing pressure from the clean beauty movement.

| Functionality | Value Share% 2025 |

|---|---|

| Hydrating Tanning Waters | 32.4% |

| Others | 67.6% |

Hydrating tanning waters are set to account for 32.4% of the functionality segment’s value share in 2025, highlighting their strong alignment with modern skincare-first beauty preferences. These formulations appeal to users seeking a natural tan without compromising skin moisture, often featuring ingredients like hyaluronic acid, coconut water, or aloe vera. Their rise reflects growing demand for multipurpose products that offer both aesthetic and dermatological benefits.

While other functionalitiessuch as SPF, anti-aging, or fragrance-infused variantscollectively make up 67.6%, hydration remains the cornerstone of differentiation, particularly in facial tanning waters and daily-use routines.

Rise of Skincare-Tanning Hybrids

The integration of skincare functionality into tanning products has become a key growth lever for the tanning waters market. Unlike traditional self-tanners, which often dry out the skin or leave streaks, modern tanning waters are formulated with hydrating and skin-beneficial ingredients such as hyaluronic acid, aloe vera, vitamin C, niacinamide, and botanical extracts. These hybrid products not only offer a sun-kissed glow but also enhance skin texture, lock in moisture, and address sensitivity and redness.

This dual-functionality appeals to consumers who are increasingly seeking minimal-step beauty routines that are gentle on the skin. The skincare-first approach of tanning waters is particularly attractive to facial product users, as it eliminates the need for heavy creams or transfer-prone lotions. With consumers becoming more aware of what they apply to their skin, the ability of tanning waters to deliver cosmetic results alongside dermatological benefits is becoming a strong purchase driver.

The market is also benefiting from a shift in beauty marketing that emphasizes skin health and radiance over artificial or deep bronzing, especially in urban and wellness-focused consumer segments. As brands continue to highlight their formulas’ hydration and skin-conditioning properties, skincare-tanning hybrids are expected to dominate product development pipelines.

Surge in DTC and Social-First Brand Strategies

The growth of direct-to-consumer (DTC) and social-first strategies has transformed the go-to-market model for tanning waters, allowing newer brands to bypass traditional retail gatekeepers and engage directly with niche consumer communities. Brands such as Isle of Paradise, Tan-Luxe, and Bali Body have successfully leveraged Instagram, TikTok, and YouTube to build cult followings through influencer campaigns, real-time product tutorials, and unfiltered reviews.

These platforms allow for viral education on proper application, before-and-after visuals, and benefit demonstrations, which have been critical in introducing consumers to the unique clear format of tanning waters. Moreover, the social-first branding appeals to younger audiences who value authenticity, user-generated content, and immediate product gratification. DTC models also enable brands to launch limited-edition drops, subscription-based refills, and bundle strategies that encourage repeat purchasing and personalization.

Without relying on legacy retailers, DTC players can experiment with branding, packaging, and formulations tailored to specific micro-segments such as vegan skincare, fragrance-free formats, or shade-specific solutions. As a result, the tanning waters category is seeing faster product innovation cycles and more agile marketing strategies compared to traditional self-tanning formats. This ecosystem, enabled by digital-native brand building and e-commerce scalability, is significantly driving category penetration and revenue growth.

Limited Consumer Awareness in Emerging Markets

One of the major restraints for the tanning waters market is the limited consumer awareness and low market penetration across emerging economies in regions such as Latin America, Southeast Asia, Africa, and parts of Eastern Europe. In these markets, cultural norms often do not prioritize sunless tanning, and there is a stronger inclination toward either natural sun exposure or traditional cosmetic routines. Furthermore, consumers may not be familiar with the concept of a clear, water-based tanning product, leading to confusion about its benefits or efficacy compared to more well-known self-tanning creams and sprays.

Another challenge is the relatively low offline visibility of tanning waters in these regions, where modern trade channels and DTC brands may not yet be as developed. As a result, product discovery remains limited to digitally savvy consumers, often concentrated in urban centers. In addition, higher price points for premium, ingredient-rich tanning waters can be a deterrent in price-sensitive markets. While awareness is slowly building through influencer spillover and global brand expansions, the lack of culturally contextual marketing, limited shelf presence, and minimal education on usage continue to restrict broader consumer adoption in these regions, ultimately constraining global market growth potential.

Shift Toward Clean, Transparent Formulations

The tanning waters market is undergoing a significant shift toward clean beauty, with consumers increasingly demanding transparency in ingredients, ethical sourcing, and minimalist, skin-safe formulations. As part of this trend, tanning water brands are moving away from synthetic fragrances, harsh alcohols, and parabens, replacing them with naturally derived actives, plant-based humectants, and skin-calming botanicals.

Formulations that feature coconut water, chamomile, aloe vera, and green tea are gaining traction due to their perceived gentleness and added skincare benefits. Brands are also actively communicating their cruelty-free, vegan, and dermatologically tested certifications on packaging and digital platforms to reinforce consumer trust. Regulatory pressures and consumer pushback against greenwashing have made clean formulation claims a differentiator, especially in the DTC space. This transparency extends to product labeling, where simplified ingredient lists, sustainability indicators, and pH-balanced formulas are now emphasized as core value propositions.

As tanning waters are often used on sensitive facial skin, safety and purity are becoming primary purchase criteria. With beauty consumers increasingly aligning their purchases with personal values and wellness priorities, the clean beauty trend is not only elevating product formulation standards in the tanning waters segment but also redefining what constitutes premium value and long-term brand loyalty.

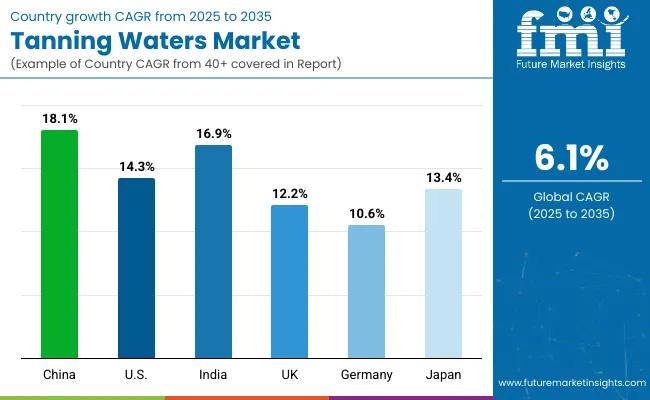

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 18.1% |

| USA | 14.3% |

| India | 16.9% |

| UK | 12.2% |

| Germany | 10.6% |

| Japan | 13.4% |

The tanning waters market is experiencing robust global growth, with China leading at a CAGR of 18.1% between 2025 and 2035, driven by rising awareness of skincare-integrated tanning solutions, the expansion of e-commerce, and shifting beauty ideals among Gen Z consumers. India follows closely with a 16.9% CAGR, supported by growing urban demand for multifunctional, natural ingredient-based beauty products like coconut and aloe vera-infused waters. The USA market, growing at 14.3%, remains a key revenue driver due to high product familiarity, dominance of DTC brands, and strong consumer preference for clean-label, hydration-focused tanning waters.

Japan’s 13.4% CAGR reflects a maturing market aligned with skincare-first routines and minimalistic aesthetics that favor lightweight, streak-free tanning formats. In the UK, a 12.2% CAGR is driven by innovation in facial tanning waters and sustained consumer engagement with influencer-led beauty trends. Germany, while posting a more modest 10.6% CAGR, continues to expand gradually through the demand for organic-certified and dermatologically tested formulations. Across these countries, the market’s growth is being shaped by digital-first marketing, demand for skincare hybrids, and the increasing alignment of tanning waters with clean beauty standards and wellness-oriented personal care.

| Year | USA Tanning Water Market (USD Million) |

|---|---|

| 2025 | 41.44 |

| 2026 | 43.29 |

| 2027 | 45.23 |

| 2028 | 47.25 |

| 2029 | 49.37 |

| 2030 | 51.58 |

| 2031 | 53.88 |

| 2032 | 56.29 |

| 2033 | 58.81 |

| 2034 | 61.44 |

| 2035 | 64.19 |

The Tanning Waters Market in the United States is projected to grow at a CAGR of 4.5%, driven by the expanding demand for skincare-integrated self-tanning solutions and a shift toward clean, hydration-focused beauty routines. Gradual tanning waters and face-specific formulations are gaining popularity due to their natural finish and ease of daily use, particularly among Gen Z and millennial consumers. The strong presence of direct-to-consumer brands has accelerated awareness and accessibility, with influencer-driven marketing playing a significant role in category expansion.

Growth is also supported by increasing shelf space in beauty retail chains and pharmacies, where clear-label, non-comedogenic tanning waters are positioned as safe alternatives to traditional bronzers and lotions. As consumers seek multifunctional products that align with their skincare goals, brands are responding with hybrid formulations that hydrate, tan, and nourish the skin simultaneously. Additionally, refillable formats and travel-size options are gaining momentum due to consumer interest in sustainable and on-the-go beauty.

The Tanning Waters Market in the United Kingdom is expected to grow at a CAGR of 12.2%, driven by increasing consumer preference for natural-looking tans, the rise of clean beauty movements, and strong market penetration of facial-specific tanning waters. British consumers, particularly millennials and Gen Z, are gravitating toward clear, non-transfer formulations that align with minimalist skincare routines and sensitive skin needs.

The UK market has seen a surge in demand for gradual tanning waters and hybrid products enriched with botanicals, hyaluronic acid, and vitamin-infused ingredients. Premium brands have capitalized on this by offering tailored face and body products that combine self-tanning with skincare benefits. Additionally, the UK’s established beauty retail ecosystemranging from Boots and Superdrug to online platforms like Cult Beautyprovides strong visibility and accessibility. The category is further expanding through influencer marketing, seasonal promotions, and high engagement on TikTokand Instagram. While self-tan mists and serums are gaining popularity, facial tanning waters remain a leading format, especially within wellness and skincare-focused consumer groups.

The Tanning Waters Market in India is forecast to expand at a strong CAGR of 16.9% through 2035, driven by rising awareness of skincare-integrated beauty routines, increasing internet penetration, and growing exposure to global clean beauty trends. While India has traditionally not been a core market for sunless tanning, urban millennials and Gen Z consumersparticularly in tier-1 and emerging tier-2 citiesare increasingly seeking lightweight, non-greasy products that enhance skin radiance without UV exposure.

Influencer marketing, Korean and Western beauty content, and dermatologist-backed recommendations are helping shift perceptions around self-tanning from artificial bronzing to skin-enhancing hydration. The market is also seeing traction through e-commerce-first product launches and DTC platforms offering plant-based tanning waters featuring ingredients like aloe vera, coconut water, and botanical extracts. With skincare literacy improving and disposable income rising, beauty consumers are experimenting with facial tanning waters, especially as part of travel kits or summer skincare bundles. Domestic startups and regional wellness brands are expected to localize tanning water positioning by integrating Ayurveda-aligned ingredients and catering to diverse Indian skin tones.

The Tanning Waters Market in China is expected to grow at a CAGR of 18.1%, the highest among leading economies, as evolving beauty standards and cross-border trends fuel demand for sunless tanning solutions. Traditionally, tanning has held limited appeal in China, where fair skin is culturally valued. However, younger consumers are now embracing a more globalized beauty perspective that prioritizes healthy glow and skincare functionality over deep pigmentation.

The rise of wellness-centered beauty, K-beauty influence, and hydration-driven skincare is reshaping demand for clear, light-textured tanning waters. Domestic DTC brands and cross-border e-commerce platforms such as Tmall Global and Xiaohongshu are rapidly expanding the market by promoting hybrid products enriched with ingredients like coconut water, niacinamide, and green tea extract.

Influencer-driven product discovery and growing acceptance of natural tan enhancers are pushing facial tanning waters into the spotlight, particularly in urban centers like Shanghai, Shenzhen, and Beijing. Additionally, competitively priced formulations by emerging Chinese beauty tech startups are democratizing access to tanning waters across mid-tier cities and college-going youth.

| Countries | 2025 Share (%) |

|---|---|

| USA | 32.4% |

| China | 11.2% |

| Japan | 8.3% |

| Germany | 9.6% |

| UK | 13.9% |

| India | 5.4% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 27.8% |

| China | 18.9% |

| Japan | 9.1% |

| Germany | 8.3% |

| UK | 11.6% |

| India | 10.3% |

The Tanning Waters Market in Germany is anticipated to expand at a CAGR of 10.6% between 2025 and 2035, reaching a more mature growth trajectory compared to emerging markets. While Germany’s share of global sales is expected to decline from 9.6% in 2025 to 8.3% by 2035, the market continues to exhibit resilience in niche and premium skincare segments. High consumer awareness about UV-related skin damage has reinforced the preference for self-tanning solutions, especially among women aged 30-55.

Dermatologically tested formulations with clean-label claims are being prioritized, aligning with Germany’s longstanding demand for skin-safe, allergy-friendly products. Hydration-rich tanning waters are gaining attention due to their streak-free, lightweight nature and integration of skincare ingredients like hyaluronic acid, glycerin, and aloe vera. Pharmacy chains and organic beauty retailers remain the dominant sales channels, although growth in online platforms is picking up due to demand for international niche brands.

Younger German consumers are exploring sunless glow routines, often pairing tanning waters with facial serums and mist applications for a subtler finish. However, regulatory scrutiny on DHA (dihydroxyacetone) and consumer concerns about artificial fragrance and preservatives continue to influence product reformulation. Domestic brands are responding with short-ingredient-list SKUs and bio-certified tanning mists. Cross-border imports from France, the UK, and South Korea are also enriching product variety.

| USA By Product Type | Value Share% 2025 |

|---|---|

| Gradual Tanning Water | 32.50% |

| Others | 67.5% |

The tanning waters market in the USA is projected to grow from USD 41.44 million in 2025 to USD 64.19 million by 2035, registering a CAGR of 4.5% during the forecast period. Gradual tanning water is estimated to account for 32.5% of the product-type value share in 2025, while the remaining 67.5% is captured by instant or hybrid formats such as fast-developing sprays and skincare-infused tanning waters. Growth is being driven by shifting consumer preference away from UV-based tanning toward clean-label, sunless alternatives that offer safer bronzing effects.

The appeal of mess-free application, quick absorption, and transparent formulation has allowed tanning waters to outperform traditional lotions and mousses in urban markets. With product positioning now focused on hydration, skincare actives, and streak-free finishes, multifunctionality is being prioritized in new launches. Online retail is accelerating category visibility through influencer-led content and DTC-exclusive releases.

Innovations such as custom tone matching, fragrance-free variants, and sensitive skin-focused formulas are further expanding appeal among Gen Z and dermatologically conscious users. As awareness of skin cancer risks from sunbeds and tanning booths increases, tanning waters are expected to become a staple in the USA beauty routines across gender and age segments.

| China By Ingredient Base | Value Share% 2025 |

|---|---|

| Natural/Organic-Based | 61.5% |

| Others | 39.0% |

million of total market value in 2025. The demand surge is being powered by the expanding middle-class consumer base prioritizing safe, skin-friendly alternatives to sun-based tanning. Natural and organic-based formulations are commanding a dominant 61.5% share in the Chinese market, as ingredient transparency and clean beauty become decisive purchase drivers. Consumers are showing greater sensitivity toward chemical-free, hydrating formulations infused with botanicals, antioxidants, and soothing agents like aloe vera or green tea.

This preference shift is being reinforced by stringent local regulations and social media amplification of wellness-centric beauty routines. Moreover, premium brands are positioning natural tanning waters as skincare hybrids, offering gradual bronzing effects alongside moisturizing and anti-aging benefits. The rising influence of Gen Z and millennials in Tier 1 and Tier 2 cities, coupled with their inclination toward vegan and cruelty-free cosmetics, is enhancing product uptake. As a result, companies focusing on eco-friendly packaging, clean ingredient labels, and skin-nourishing actives are expected to tap into significant white spaces in this fast-evolving market.

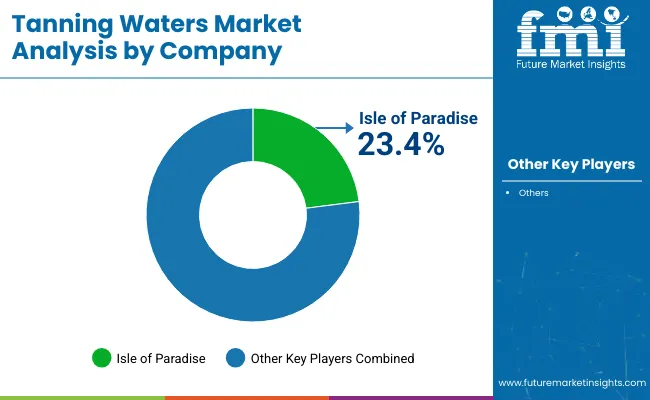

The Tanning Waters Market remains moderately fragmented, shaped by global personal care majors, mid-sized innovators, and niche disruptors competing across clean, skincare-infused, and sprayable water-based formats. Key players like L'Oréal Paris, St. Tropez, and Bondi Sands hold strong positions due to broad distribution, multifunctional claims, and dermatologist-backed actives such as hyaluronic acid and niacinamide. Mid-sized brands including Tan-Luxe, Vita Liberata, and MineTan are gaining traction with clean-label, skin-adaptive tanning waters tailored for premium consumers in North America and Europe.

Niche players like Isle of Paradise, which holds the highest global value share at 23.4% in 2025, alongside James Read, Bali Body, and Three Warriors, are building loyalty among Gen Z and millennial audiences through vegan formulations, sustainable sourcing, and influencer-led campaigns. These brands differentiate through innovations in color-correcting mists, natural DHA, and biodegradable packaging. As the market evolves, value is increasingly tied to wellness-aligned positioning, microbiome-friendly ingredients, and tech-enabled engagement, with players shifting toward hybrid tanning-skincare formats and digitally enhanced consumer journeys.

Key Developments in Tanning Waters Market

| Item | Value |

|---|---|

| Quantitative Units | USD 127.8 Million |

| Product Type | Gradual Tanning Water, Instant Tanning Water, Face Tanning Water, Body Tanning Water, Tanning Mists, Self-Tan Sprays, Tanning Water Serums, Tanning Water Lotions |

| Ingredient Base | Hydrating Tanning Waters, Fragrance-Infused Tanning Waters, Tanning Waters with SPF, Anti-Aging Tanning Waters, Transfer-Resistant/Streak-Free Tanning Waters |

| Packaging Format | Spray Bottles, Pump Bottles, Mist Cans, Dropper Bottles, Travel-size Packs |

| Distribution Channel | Beauty Retail Chains, E-commerce Platforms, Specialty Cosmetic Stores, Pharmacies & Drugstores, Supermarkets & Hypermarkets, Salon & Spa Retail, Direct-to-Consumer (DTC) Brands |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Isle of Paradise, St. Tropez, Tan-Luxe, Bondi Sands, Vita Liberata , James Read, Bali Body, MineTan , L'Oréal Paris, Three Warriors |

| Additional Attributes | Dollar sales by product format and skin type compatibility, segmentation by gender-neutral and vegan-certified formulations, adoption trends in dermatologically tested and fragrance-free variants, growth in hybrid skincare-tanning innovations, packaging preferences in recyclable and travel-friendly formats, seasonal demand spikes influenced by tourism and festival calendars, e-commerce acceleration through influencer-led product discovery, regional trends shaped by sunless tanning regulations and UV awareness campaigns, and formulation innovations using natural DHA alternatives, vitamin-enriched bases, and hydrating actives like hyaluronic acid and glycerin. |

The global Tanning Waters Market is estimated to be valued at USD 127.8 million in 2025.

The market size for the Tanning Waters Market is projected to reach USD 230.9 million by 2035.

The Tanning Waters Market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in the Tanning Waters Market include Spray Bottles, Mists, and Pump Dispensers, designed for even and mess-free application.

In terms of functionality, Hydration-Boosting Tanning Waters are projected to command a 32.4% share in the Tanning Waters Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Self-tanning Products Market Report - Growth, Demand & Forecast 2025 to 2035

Leather Tanning Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA