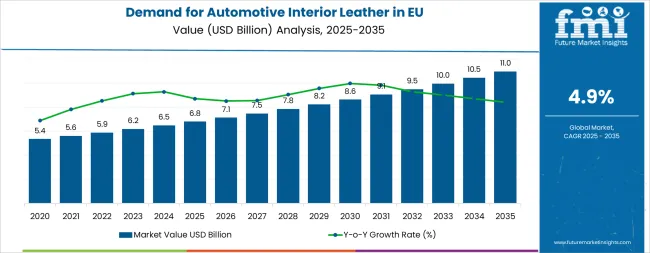

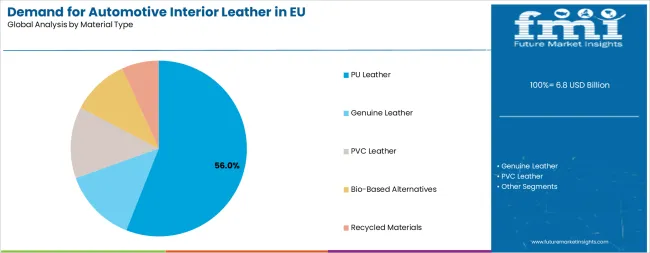

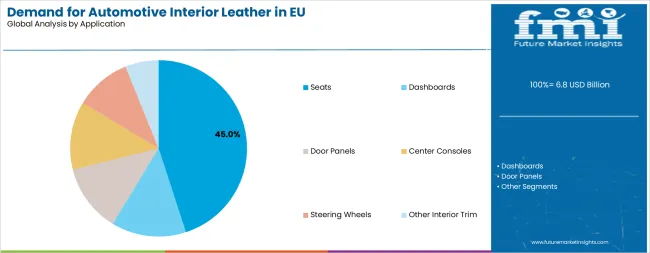

The EU automotive interior leather industry is anticipated to reach from USD 6.8 billion in 2025 to USD 11.0 billion by 2035, advancing at a CAGR of 4.9%. The PU leather segment is expected to lead sales with a 56.0% share in 2025, while the seats application is anticipated to account for 45.0% of the application segment.

European Union automotive interior leather sales are projected to grow from USD 6.8 billion in 2025 to approximately USD 11.0 billion by 2035, recording an absolute increase of USD 4.2 billion over the forecast period. This translates into total growth of 61.8%, with demand forecast to expand at a compound annual growth rate (CAGR) of 4.9% between 2025 and 2035. The overall industry size is expected to grow by nearly 1.6X during the same period, supported by the accelerating shift toward sustainable synthetic leather alternatives, increasing premium vehicle production throughout European manufacturing centers, and developing applications across seats, dashboards, door panels, and center console trim throughout European automotive markets.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6.8 billion |

| Industry Value (2035F) | USD 11.0 billion |

| CAGR (2025 to 2035) | 4.9% |

Between 2025 and 2030, EU automotive interior leather demand is projected to expand from USD 6.8 billion to USD 8.6 billion, resulting in a value increase of USD 1.8 billion, which represents 42.9% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer adoption of sustainable synthetic leather alternatives responding to environmental consciousness, increasing availability of diverse product varieties across PU leather, genuine leather, and eco-friendly vegan leather formulations, and growing mainstream acceptance of premium interior materials across mid-range vehicle segments produced throughout European manufacturing facilities. Manufacturers are expanding their product portfolios to address the evolving preferences for improved durability characteristics, authentic leather aesthetics, soft-touch surface finishes, and environmentally responsible formulations aligned with EU regulations and circular economy principles.

From 2030 to 2035, sales are forecast to grow from USD 8.6 billion to USD 11.0 billion, adding another USD 2.4 billion, which constitutes 57.1% of the overall ten-year expansion. This period is expected to be characterized by further expansion of bio-based synthetic leather technologies derived from renewable feedstocks, integration of advanced antimicrobial surface treatments addressing hygiene concerns elevated by pandemic awareness, and development of premium artisanal leather varieties targeting luxury vehicle applications produced by German premium manufacturers. The growing emphasis on environmental mandated by EU regulations including End-of-Life Vehicles Directive and increasing consumer willingness to pay premium prices for sustainable, ethically sourced interior materials will drive demand for innovative automotive interior leather products that deliver authentic premium experiences while meeting stringent environmental standards.

Between 2020 and 2025, EU automotive interior leather sales experienced robust expansion at a CAGR of 4.9%, growing from USD 5.1 billion to USD 6.8 billion. This period was driven by increasing environmental consciousness among European consumers preferring alternatives to traditional animal leather, rising awareness of animal welfare concerns and ethical sourcing requirements, and growing recognition of synthetic leather's performance advantages including consistent quality, stain resistance, and cost-effectiveness. The industry developed as major European automotive manufacturers including BMW, Mercedes-Benz, Volkswagen Group, and Stellantis recognized the commercial potential of green interior materials supporting premium positioning while addressing environmental concerns. Product innovations, improved PU leather surface finishes mimicking genuine leather characteristics, and enhanced durability performance began establishing consumer confidence and mainstream acceptance of synthetic automotive interior leather products as viable alternatives to traditional leather.

Industry expansion is being supported by the rapid increase in premium vehicle production across European manufacturing centers and the corresponding demand for high-quality, and aesthetically sophisticated interior materials with proven durability in diverse climate conditions characteristic of European regions. Modern European consumers rely on automotive interior leather as essential premium material defining vehicle quality perception, supporting comfortable seating experiences during extended European road trips, and communicating brand identity through distinctive interior design, driving demand for products that match or exceed traditional leather's tactile properties, aesthetic appeal, and durability characteristics while delivering superior sustainability credentials aligned with environmental values.

The growing awareness of animal welfare issues and increasing recognition of traditional leather production's environmental impact are driving demand for sustainable automotive interior leather alternatives from certified producers with appropriate environmental credentials and ethical manufacturing practices. Regulatory authorities including the European Commission are increasingly establishing clear guidelines for automotive interior material sustainability, chemical safety requirements under REACH regulations, and end-of-life recyclability mandates to maintain occupant safety and support circular economy objectives. Scientific research studies conducted by European automotive research institutes and environmental analyses from organizations including European Environment Agency are providing evidence supporting synthetic leather's environmental advantages and performance characteristics, requiring specialized manufacturing processes and standardized formulation protocols for authentic leather aesthetics, optimal durability properties, and appropriate chemical composition including restrictions on harmful substances, VOC emissions, and heavy metals.

The accelerating transition to electric vehicles throughout European markets fundamentally transforms automotive interior material requirements, as EVs produced by Tesla, Volkswagen ID series, BMW i-series, and emerging European EV brands increasingly feature sustainable interior materials aligning with zero-emission powertrain positioning and environmentally conscious brand messaging. Synthetic leather technologies including PU leather, bio-based alternatives derived from plant materials, and recycled content formulations prove essential for EV interior applications, delivering environmental credentials supporting sustainable mobility narratives while providing design flexibility for distinctive interior aesthetics and cost advantages supporting competitive pricing strategies. Additionally, premium European consumers increasingly view interior material sustainability as essential purchasing criteria, creating demand drivers for innovative leather alternatives demonstrating superior environmental performance through life cycle assessment, certified sustainable sourcing, and recyclability supporting circular economy principles.

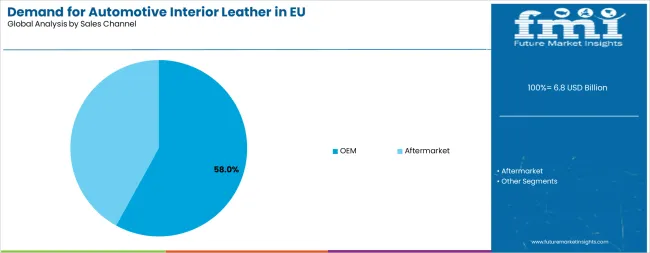

Sales are segmented by material type, application, vehicle type, sales channel, and country. By material type, demand is divided into PU leather, genuine leather, PVC leather, and other alternatives including bio-based and recycled materials. Based on application, sales are categorized into seats, dashboards, door panels, center consoles, steering wheels, and other interior trim. In terms of vehicle type, demand is segmented into passenger cars, commercial vehicles, and electric vehicles. By sales channel, sales are classified into OEM and aftermarket. Regionally, demand is focused on Germany, France, Italy, Spain, Netherlands, and Rest of Europe.

The PU leather segment is projected to account for 56.0% of EU automotive interior leather sales in 2025, establishing itself as the dominant material type across European automotive sectors. This commanding position is fundamentally supported by PU leather's excellent balance of cost-effectiveness enabling competitive vehicle pricing while maintaining premium aesthetics, superior sustainability credentials compared to traditional animal leather including lower water consumption and reduced chemical processing requirements, and comprehensive performance characteristics featuring durability, stain resistance, consistent quality, and design flexibility enabling diverse color palettes and surface textures. The PU leather format delivers exceptional versatility, providing European automotive manufacturers with a reliable material solution that facilitates premium interior positioning, environmental messaging supporting brand sustainability commitments, and manufacturing efficiency through consistent supply quality and processing characteristics.

This segment benefits from mature European supply chains, well-established manufacturing infrastructure throughout Germany, Italy, and Eastern European production centers, and extensive availability from multiple certified suppliers including BOXMARK Leather GmbH, Bader GmbH, and specialized synthetic leather producers who maintain rigorous automotive-grade quality standards and environmental certifications including Oeko-Tex and REACH compliance. Additionally, PU leather offers versatility across various applications, including seats, door panels, dashboards, and center console trim, supported by proven manufacturing technologies that address traditional challenges in surface durability, UV resistance, and cold crack performance essential for European climate conditions.

The PU leather segment is expected to maintain approximately 54-55% share through 2035, demonstrating stable positioning as newer alternative materials including bio-based leather derived from plant sources and recycled content formulations complement rather than displace PU leather's established presence throughout the forecast period. European consumer acceptance of PU leather continues strengthening, particularly among environmentally conscious demographics valuing sustainable alternatives and younger vehicle buyers prioritizing ethical sourcing over traditional animal leather heritage.

Seats are positioned to represent 45.0% of total EU automotive interior leather demand in 2025, maintaining substantial share through 2035, reflecting the segment's fundamental importance as the primary leather application area within vehicle interiors based on surface area coverage, occupant contact duration, and perceived quality significance. This considerable share directly demonstrates that seat upholstery represents the largest single leather investment per vehicle, with European automotive manufacturers including BMW, Mercedes-Benz, Audi, and Volkswagen Group prioritizing premium seat materials to deliver superior comfort, communicate luxury positioning, and establish distinctive interior character differentiating brand identity in competitive premium vehicle segments.

Modern European consumers increasingly view seat material quality as essential indicator of overall vehicle quality and luxury positioning, driving demand for leather upholstery featuring soft-touch surface finishes, authentic grain patterns mimicking premium leather characteristics, enhanced breathability supporting comfort during extended driving, and comprehensive durability withstanding intensive use over vehicle lifetime. The segment benefits from continuous product innovation focused on perforated leather surfaces supporting ventilated seat functionality, contrast stitching patterns creating distinctive design statements, multi-tone color combinations enabling interior personalization, and antimicrobial surface treatments addressing hygiene concerns particularly relevant in premium vehicle segments and post-pandemic consumer awareness.

The segment's stable share reflects proportional growth across all application categories, with seats maintaining their leading position as the primary interior leather investment priority throughout the forecast period. Premium seat leather applications increasingly feature in mid-range vehicle segments produced by Volkswagen, Peugeot, and Renault, transitioning from luxury vehicle exclusivity to mainstream availability as synthetic leather costs decline and European consumer expectations for quality interiors increase across all vehicle price segments.

OEM channels are strategically estimated to control 58.0% of total EU automotive interior leather sales in 2025, maintaining this dominant position through 2035, reflecting the critical importance of original equipment manufacturer integration for ensuring proper material specification, quality consistency, and seamless integration with vehicle interior design and assembly processes. European automotive OEMs consistently demonstrate rigorous quality requirements for interior leather materials, demanding validated performance across durability testing, colorfastness requirements, chemical safety compliance under REACH regulations, and reliable supply throughout vehicle production lifecycles without material shortage disruptions.

The OEM segment provides essential validation through extensive testing protocols including abrasion resistance, UV aging, cold crack temperature performance, and VOC emissions compliance, engineering integration ensuring optimal material selection matching specific vehicle positioning and target consumer demographics, and quality assurance processes maintaining consistent production standards across European manufacturing facilities and global production networks. Major European automotive manufacturers including Volkswagen Group, Stellantis, BMW Group, Mercedes-Benz, and Renault Group systematically specify interior leather materials for new vehicle platforms, often featuring premium leather packages in higher trim levels, synthetic leather in environmentally focused model variants, and comprehensive material specifications supporting brand identity and quality positioning in competitive segments.

The segment's stable 58% share reflects balanced growth across both OEM and aftermarket channels, with original equipment maintaining its dominant position as primary interior material source while aftermarket channels serve seat cover replacement, interior refurbishment, and customization applications popular in classic car restoration and enthusiast modification communities throughout the forecast period. OEM specifications increasingly emphasize sustainability credentials, with European manufacturers requiring environmental certifications, recycled content verification, and life cycle assessment documentation supporting corporate sustainability reporting and environmental claims.

Passenger cars are strategically positioned to contribute 65.0% of total EU automotive interior leather sales in 2025, maintaining this substantial share through 2035, representing the largest vehicle segment by production volume throughout European manufacturing centers and the primary driver of interior material innovation and premium feature adoption. European passenger car manufacturers consistently prioritize interior material quality to support brand differentiation in highly competitive markets, enhance perceived value proposition particularly important for premium positioning, and deliver comfortable cabin environments essential for consumer satisfaction during typical European driving patterns including long-distance highway travel and daily urban commuting.

The passenger car segment serves as the primary innovation testing ground for advanced interior leather technologies, with German premium sedans, luxury SUVs, and cutting-edge electric vehicles featuring pioneering material solutions including bio-based leather alternatives, recycled content formulations derived from post-consumer plastics, and sophisticated surface treatments providing antimicrobial properties, enhanced stain resistance, and improved aging characteristics. Segment dominance derives from high per-vehicle interior material content value, with premium and luxury passenger cars manufactured by German brands featuring comprehensive leather packages exceeding USD 1,500 per vehicle including seats, door panels, dashboards, center consoles, and optional extended leather trim covering instrument panels and pillar trim.

The segment's stable share through 2035 reflects the European passenger car market's continued strength in premium and mid-range segments, with interior leather adoption rates in European passenger cars consistently leading global markets due to strong consumer preference for premium materials, established leather heritage in European automotive culture, and willingness to pay for quality interior environments. Passenger car interior material specifications developed by European manufacturers increasingly influence worldwide automotive standards, with materials and design approaches proven in BMW, Mercedes-Benz, and Audi eventually adopted by volume manufacturers seeking European success.

EU automotive interior leather sales are advancing rapidly due to accelerating adoption of sustainable synthetic alternatives responding to environmental consciousness, growing premium vehicle production throughout German manufacturing centers, and increasing consumer emphasis on interior quality and craftsmanship particularly important in European automotive culture. However, the industry faces challenges, including persistent cost pressures limiting mass-market adoption of premium leather packages, regulatory compliance complexity under REACH chemical safety requirements and End-of-Life Vehicles Directive recyclability mandates, and performance requirements in diverse climate conditions across European markets from Mediterranean heat to Scandinavian cold. Continued innovation in bio-based materials, antimicrobial treatments, and recycled content technologies remains central to European automotive interior leather industry development.

The rapidly accelerating development of bio-based leather alternatives derived from renewable plant sources is fundamentally transforming European automotive interior material selection from traditional petroleum-based synthetics and animal leather to innovative sustainable materials including mushroom leather (mycelium-based), pineapple leather (Piñatex), apple leather, cactus leather, and grape leather derived from wine production waste. Advanced bio-based platforms developed by European material innovation companies and sustainable technology startups enable automotive-grade performance characteristics previously unattainable through conventional bio-material formulations, delivering authentic leather aesthetics, appropriate durability properties, and genuine sustainability credentials verified through life cycle assessment and environmental product declarations. These material innovations prove particularly transformative for premium electric vehicle applications including Tesla Model series, Volkswagen ID family, BMW i-series, and Mercedes-Benz EQ models, where sustainable interior materials prove essential for coherent environmental messaging aligning powertrain electrification with comprehensive vehicle sustainability.

Major European automotive manufacturers invest heavily in bio-based leather partnerships, material development collaborations with sustainable technology companies, and supplier qualification processes validating automotive-grade performance requirements including durability, colorfastness, and chemical safety compliance. Manufacturers collaborate with material science institutes, environmental certification organizations, and supply chain partners to develop scalable production systems that reduce bio-based material costs while maintaining quality standards supporting premium positioning and mainstream market penetration. European consumer receptivity to bio-based materials proves particularly strong among environmentally conscious demographics, younger vehicle buyers prioritizing sustainability over traditional material heritage, and premium segment customers seeking distinctive, innovative interior materials communicating environmental leadership.

Modern European automotive interior leather producers systematically incorporate advanced antimicrobial surface treatments addressing hygiene concerns elevated by pandemic awareness, providing continuous bacterial and viral reduction on high-touch interior surfaces including steering wheels, door handles, seat bolsters, and center console trim. Strategic integration of antimicrobial technologies utilizing silver ions, copper-infused coatings, and photocatalytic materials enables manufacturers to position interior leather as hygienic material solution supporting occupant health and wellness, particularly relevant for shared mobility vehicles, rental fleets, and premium vehicles emphasizing comprehensive safety and comfort features. These hygiene improvements prove essential for premium positioning, as consumers increasingly consider interior material cleanliness and antimicrobial properties as quality indicators and health protection features.

European automotive suppliers implement extensive validation testing programs demonstrating sustained antimicrobial efficacy over vehicle lifetime, safety certification ensuring biocompatibility with human skin contact, and durability verification confirming performance retention through repeated cleaning cycles and normal wear conditions. Manufacturers leverage antimicrobial performance in marketing campaigns targeting health-conscious consumers, premium vehicle differentiation emphasizing advanced material technologies, and fleet applications including ride-sharing services, taxi operations, and rental vehicles where interior hygiene proves critical for customer acceptance and operational efficiency.

European automotive manufacturers increasingly prioritize recycled content integration in interior leather formulations as essential strategy supporting circular economy principles mandated by EU regulatory frameworks including End-of-Life Vehicles Directive and emerging corporate sustainability commitments targeting carbon neutrality and waste reduction. This recycled content trend enables manufacturers to differentiate sustainable interior offerings through quantified environmental benefits including plastic waste diversion from landfills and oceans, reduced virgin material consumption, and lower carbon footprint verified through life cycle assessment, positioning vehicles as environmentally responsible choices resonating with conscious consumer segments. Recycled content positioning proves particularly important for electric vehicle applications where comprehensive sustainability narratives support zero-emission powertrain messaging and justify premium pricing through environmental value proposition.

The development of advanced recycling technologies enabling post-consumer plastic bottle conversion to automotive-grade synthetic leather, textile waste reclamation supporting material circularity, and manufacturing scrap recycling eliminating production waste expands manufacturers' abilities to create certified recycled content products delivering authentic premium characteristics without performance compromises. European brands including BMW with i-series recycled interior materials, Mercedes-Benz with sustainable interior concepts, and Volkswagen Group with environmental commitments collaborate with material suppliers, recycling technology providers, and certification organizations to develop interior leather formulations balancing recycled content maximization with durability requirements, aesthetic quality standards, and cost targets supporting mainstream adoption across vehicle segments.

European premium automotive manufacturers systematically expand interior personalization options, transforming leather specification from standard color choices to sophisticated customization programs featuring extensive color palettes, contrasting stitch patterns, perforated surface designs, embossed patterns, and multi-material combinations creating distinctive cabin environments reflecting individual customer preferences. Advanced interior personalization programs developed by German luxury manufacturers including BMW Individual, Mercedes-Benz Designo, Audi Exclusive, and Porsche Leather Package enable customers to specify bespoke interior materials, creating unique vehicles commanding premium pricing and strengthening emotional brand connections supporting customer loyalty and repeat purchase behavior. These personalization capabilities increasingly feature in mid-premium vehicles produced by Volvo, Jaguar Land Rover, and upper-trim Volkswagen Group products, transitioning from ultra-luxury exclusivity to broader premium segment availability.

European automotive interior suppliers develop comprehensive customization capabilities including rapid color matching technologies, digital design visualization tools enabling customer preview of specified combinations, and flexible manufacturing systems supporting small-batch production of custom color and texture variants without significant cost penalties. Interior personalization programs increasingly incorporate sustainability options including organic-certified leather alternatives, bio-based material selections, and recycled content formulations, addressing environmentally conscious premium consumers seeking personalized aesthetics aligned with sustainability values. The customization trend proves particularly strong in European markets where automotive purchase decisions emphasize individual expression, distinctive specification, and differentiation from standard production vehicles.

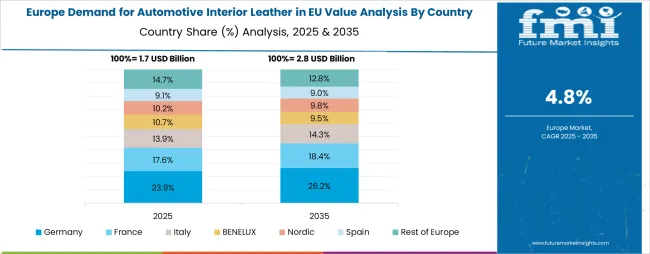

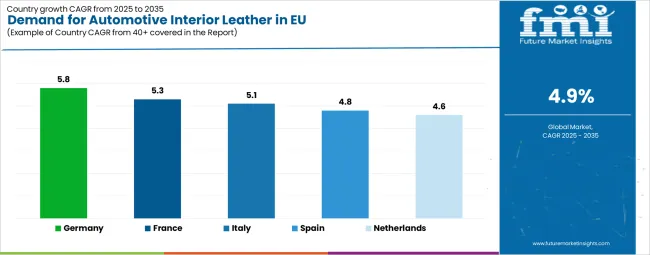

EU automotive interior leather sales are projected to grow from USD 6.8 billion in 2025 to USD 11.0 billion by 2035, registering a CAGR of 4.9% over the forecast period. Germany is expected to demonstrate the strongest growth trajectory with a 5.8% CAGR, supported by premium vehicle manufacturing leadership, extensive material innovation, and established automotive interior supplier infrastructure. France follows with a 5.3% CAGR, driven by domestic automotive production, growing premium segment focus, and sustainable material adoption.

Italy demonstrates 5.1% CAGR, supported by luxury vehicle manufacturing, leather craftsmanship heritage, and interior design excellence. Spain maintains 4.8% CAGR, attributed to volume vehicle production and expanding aftermarket applications. Netherlands shows 4.6% CAGR, supported by sustainable material emphasis and automotive industry presence.

| Country | CAGR % |

|---|---|

| Germany | 5.8% |

| France | 5.3% |

| Italy | 5.1% |

| Spain | 4.8% |

| Netherlands | 4.6% |

EU automotive interior leather sales are forecast to expand steadily, with Germany leading growth at a CAGR of 5.8%, supported by its premium vehicle production base and innovation leadership in interior materials. France follows with a CAGR of 5.3%, reflecting strong adoption of sustainable alternatives and continued development of premium automotive segments. Italy records a CAGR of 5.1%, leveraging its luxury manufacturing base and traditional craftsmanship in leather interiors. Spain grows at 4.8%, driven by volume production and aftermarket demand, while the Netherlands posts a CAGR of 4.6%, underpinned by its sustainability leadership and integration into Europe’s automotive value chain. Collectively, these figures highlight the EU’s balanced yet premium-oriented growth trajectory, shaped by regulatory pressures, sustainability priorities, and consumer demand for high-quality interior materials.

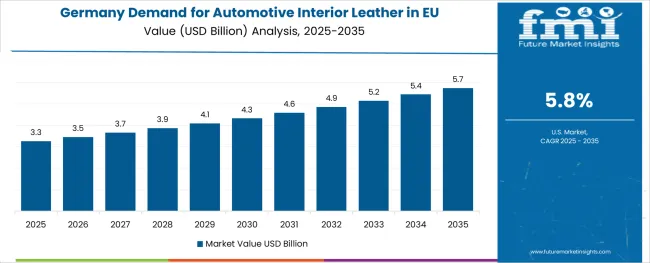

The automotive interior leather sector in Germany is projected to exhibit the strongest growth with a CAGR of 5.8% through 2035, driven by the country's position as global premium automotive manufacturing leader, home to BMW, Mercedes-Benz, Audi, Porsche, and Volkswagen Group, which collectively establish worldwide interior quality benchmarks and pioneer advanced material technologies including sustainable leather alternatives, bio-based formulations, and recycled content integration. Germany's sophisticated automotive engineering culture, comprehensive interior supplier ecosystem including BOXMARK Leather, Bader GmbH, and specialized material producers, and substantial research and development investment systematically drive demand for innovative interior leather solutions delivering superior quality, distinctive aesthetics, and environmental credentials supporting premium brand positioning.

Major German automotive interior leather suppliers maintain extensive research and development operations focused on next-generation sustainable materials, antimicrobial surface treatments supporting hygiene positioning, and advanced manufacturing processes enabling customization capabilities supporting premium personalization programs. German demand benefits from exceptionally strong domestic premium vehicle production exceeding 1.5 million units annually, robust export-oriented manufacturing with premium vehicles featuring world-leading interior quality as standard equipment for global markets, and sophisticated domestic consumer demand for quality materials, environmental sustainability, and comprehensive vehicle refinement.

The German automotive interior leather industry benefits from close collaboration between automotive OEMs, tier-one suppliers, material science institutes, and technical universities conducting fundamental research in sustainable materials, surface chemistry, and leather processing technologies. Government support through research funding programs supporting sustainable material development and regulatory frameworks encouraging circular economy approaches further strengthen Germany's competitive leadership position.

Revenue from automotive interior leather in France is expanding at a CAGR of 5.3%, substantially supported by domestic automotive manufacturing including Stellantis brands (Peugeot, Citroën, DS Automobiles) and Renault Group producing extensive vehicle ranges across premium, mid-range, and compact segments throughout French manufacturing facilities. France's automotive industry emphasizes design sophistication, material quality supporting premium positioning particularly in DS Automobiles and Renault Alpine brands, and increasing sustainable material adoption aligning with French environmental consciousness and regulatory requirements supporting circular economy principles.

Major French automotive manufacturers systematically upgrade interior material specifications across vehicle portfolios, incorporating premium leather packages in upper trim levels, synthetic leather alternatives in environmentally focused variants, and distinctive interior design approaches supporting brand differentiation in competitive European markets. French demand particularly benefits from strong domestic automotive supplier presence including Faurecia (now FORVIA) providing comprehensive interior systems, growing premium segment focus by DS Automobiles and Alpine brands requiring quality interior materials, and substantial aftermarket sector serving classic car restoration, seat cover replacement, and interior refurbishment applications popular among French automotive enthusiasts.

Paris and Lyon regions maintain automotive interior design studios influencing global styling trends, while northern and eastern French manufacturing clusters host vehicle production facilities and interior component manufacturing operations.

Revenue from automotive interior leather in Italy is growing at a CAGR of 5.1%, driven by luxury vehicle manufacturing including Ferrari producing ultra-premium sports cars, Lamborghini crafting exotic supercars, Maserati delivering luxury GT vehicles, and growing premium production by Stellantis brands throughout Italian manufacturing facilities. Italy's automotive culture emphasizes craftsmanship excellence, traditional leather heritage supporting authentic material expertise, and passionate brand identity, systematically driving demand for premium interior leather solutions supporting emotional vehicle character and luxury positioning.

Major Italian automotive manufacturers prioritize exceptional interior leather quality across vehicle portfolios, often featuring hand-selected leather hides, artisanal craftsmanship techniques, distinctive perforation patterns creating iconic interior designs, and comprehensive personalization options enabling bespoke interior specifications. Italian demand benefits from strong leather processing industry heritage centered in Tuscany and northern regions, established craftsmanship traditions applicable to automotive interior applications, and substantial luxury vehicle production requiring highest-quality leather materials commanding premium pricing.

The Italian automotive interior leather industry increasingly benefits from growing supplier presence serving both domestic luxury manufacturers and export customers seeking Italian leather expertise and design excellence. Turin region maintains automotive engineering expertise and design studios influencing global interior styling trends, while northern Italian leather processing clusters provide specialized automotive-grade materials. Italian craftsmanship excellence in leather working creates global influence despite relatively modest vehicle production volumes compared to Germany or France, with Italian leather heritage representing quality benchmark and aspiration standard.

Demand for automotive interior leather in Spain is projected to grow at a CAGR of 4.8%, substantially supported by significant volume vehicle production including Volkswagen Group facilities manufacturing SEAT and Cupra brands, Ford España producing passenger cars and commercial vehicles, Stellantis plants manufacturing Peugeot and Citroën models, Renault facilities producing various models, and growing electric vehicle manufacturing. Spanish automotive industry emphasizes efficient volume production, increasing quality standards, and growing premium trim level adoption supporting demand for interior leather materials across mid-range and volume vehicle segments.

Major automotive manufacturers operating Spanish facilities systematically upgrade interior specifications across vehicle ranges, incorporating synthetic leather trim in mid-level variants, genuine leather packages in premium trim levels, and distinctive interior designs supporting brand positioning in competitive European markets. Spanish demand benefits from substantial automotive production volumes exceeding 2 million vehicles annually, growing domestic vehicle sales supporting new vehicle interior specifications, and substantial aftermarket sector serving seat cover replacement, interior customization, and commercial vehicle refurbishment applications.

The Spanish automotive interior leather industry benefits from established supplier presence including international companies operating Spanish facilities serving local production and European exports, skilled workforce supporting quality manufacturing, and continued investment in production capacity and technology capabilities. Barcelona and Madrid regions maintain automotive engineering presence, while northern manufacturing clusters around Zaragoza, Valladolid, and Valencia host major vehicle production facilities driving interior material demand.

Demand for automotive interior leather in Netherlands is expanding at a CAGR of 4.6%, driven by exceptionally strong environmental consciousness, leadership in sustainable material innovation, and comprehensive automotive industry presence including assembly operations, automotive technology development, and interior component suppliers. Dutch automotive culture emphasizes sustainability performance, circular economy principles, and environmental responsibility, systematically driving demand for sustainable interior leather alternatives including bio-based materials, recycled content formulations, and ethically sourced genuine leather options.

Netherlands sales particularly benefit from strong consumer receptivity to sustainable materials messaging, willingness to prioritize environmental credentials over traditional material heritage, and comprehensive retail presence of electric vehicles requiring sustainable interior materials supporting coherent environmental positioning. Dutch automotive market serves as innovation testing ground for sustainable interior materials, with successful product introductions often expanding to broader European markets following Dutch market validation.

The Netherlands automotive interior leather sector benefits from sustainable material innovation ecosystem including startups developing bio-based alternatives, research institutes advancing circular economy technologies, and comprehensive environmental certification infrastructure supporting sustainability claims verification. Amsterdam and Eindhoven regions maintain automotive technology development activities, while Dutch automotive industry integration supports European supply chain networks.

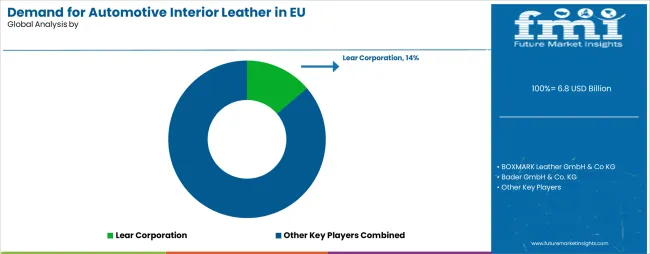

The EU automotive interior leather industry is characterized by intense competition among global tier-one suppliers, specialized European leather processors, synthetic leather producers, and sustainable material innovators. Lear Corporation leads with around 14% share, leveraging its global seating expertise, integrated systems capabilities, and sustainability-focused R&D, supplying major OEMs such as BMW, Mercedes-Benz, and Volkswagen. BOXMARK Leather follows with 12%, emphasizing premium leather and synthetic alternatives, strong customization, and certified sustainable practices. Bader GmbH holds 10% share, benefiting from German engineering excellence, long-standing OEM relationships, and advanced surface treatments. Scottish Leather Group commands 8%, serving ultra-premium segments with artisanal craftsmanship and strong sustainability credentials. Japanese firm Seiren captures 7% through synthetic leather innovations, advanced durability treatments, and partnerships with Stellantis and Volkswagen Group.

The remaining 49% is shared among diverse competitors including GST AutoLeather, Wollsdorf Leder Schmidt, Elmo Sweden, Mayur Uniquoters, and Katzkin, reflecting market fragmentation. Competitive strategies focus on bio-based alternatives, antimicrobial coatings, recycled content integration, and premium customization. Regional production expansion, sustainability certifications, and collaborations with OEMs remain critical differentiators.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.0 billion |

| Material Type | PU Leather, Genuine Leather, PVC Leather, Bio-Based Alternatives, Recycled Materials |

| Application | Seats, Dashboards, Door Panels, Center Consoles, Steering Wheels, Other Interior Trim |

| Vehicle Type | Passenger Cars, Commercial Vehicles, Electric Vehicles |

| Sales Channel | OEM, Aftermarket |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, Rest of Europe |

| Key Companies Profiled | Lear Corporation, BOXMARK Leather, Bader GmbH, Scottish Leather Group, Seiren Co., GST AutoLeather, Wollsdorf Leder Schmidt, Elmo Sweden |

| Additional Attributes | Dollar sales by material type, application, vehicle type, and sales channel; regional demand trends across major European markets; competitive landscape analysis with established European interior suppliers and global manufacturers; consumer preferences for sustainable materials and premium interior quality; integration with circular economy principles and recycled content technologies; innovations in bio-based alternatives, antimicrobial treatments, and customization capabilities; adoption across OEM and aftermarket channels; EU regulatory framework analysis for chemical safety, end-of-life recyclability, and sustainability requirements; supply chain strategies; and penetration analysis for premium, mid-range, and volume vehicle segments throughout European automotive markets. |

The global demand for automotive interior leather in EU is estimated to be valued at USD 6.8 billion in 2025.

The market size for the demand for automotive interior leather in EU is projected to reach USD 11.0 billion by 2035.

The demand for automotive interior leather in EU is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in demand for automotive interior leather in EU are pu leather, genuine leather, PVC leather, bio-based alternatives and recycled materials.

In terms of application, seats segment to command 45.0% share in the demand for automotive interior leather in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Interior Leather Market Analysis Size Share and Forecast Outlook 2025 to 2035

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Korea Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Material, Thickness, Capacity, and Type of Europe Automotive Tire Market Forecast Economic Projections to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Interior Plastic Components Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Trim Parts Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Ambient Lighting Market Growth - Trends & Forecast 2025 to 2035

Automotive Plastic Interior Trims Market Growth - Trends & Forecast 2025 to 2035

Automotive Soft Trim Interior Materials Market Growth - Trends & Forecast 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Western Europe Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Demand for Automotive Lighting in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Turbocharger in EU Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA