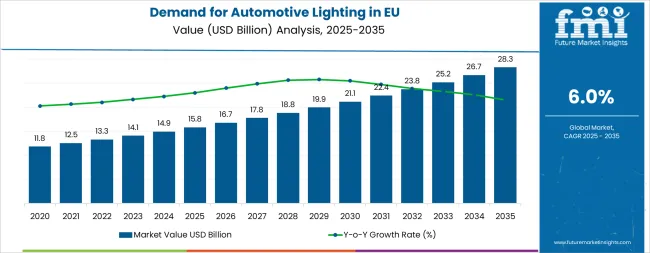

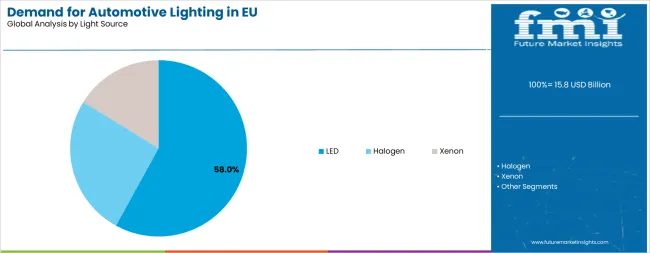

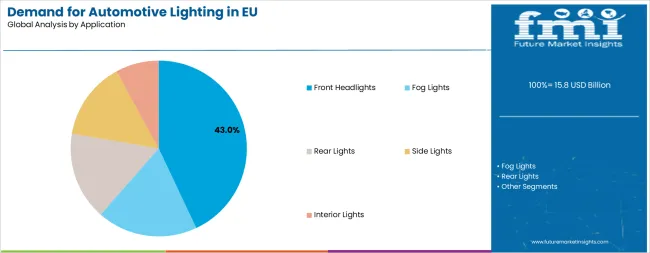

The EU automotive lighting industry is projected to grow from USD 15.8 billion in 2025 to USD 28.3 billion by 2035, advancing at a CAGR of 6.0%. The LED technology segment is expected to lead sales with a 58.0% share in 2025, while the headlights application is anticipated to account for 43.0% of the application segment.

European Union automotive lighting sales are projected to grow from USD 15.8 billion in 2025 to approximately USD 28.3 billion by 2035, recording an absolute increase of USD 12.6 billion over the forecast period. This translates into total growth of 79.7%, with demand forecast to expand at a compound annual growth rate (CAGR) of 6.0% between 2025 and 2035. The overall industry size is expected to grow by nearly 1.8X during the same period, supported by the accelerating shift toward electric vehicles, increasing adoption of advanced driver assistance systems (ADAS), and developing applications across adaptive lighting, matrix LED, laser headlamps, and intelligent lighting control systems throughout European automotive markets.

Between 2025 and 2030, EU automotive lighting demand is projected to expand from USD 15.8 billion to USD 21.3 billion, resulting in a value increase of USD 5.5 billion, which represents 43.7% of the total forecast growth for the decade. This phase of development will be shaped by rising adoption of electric vehicles requiring highly efficient lighting solutions, increasing integration of ADAS technologies demanding adaptive and intelligent lighting systems, and growing mainstream acceptance of matrix LED and laser technologies across premium and mid-range vehicle segments. Manufacturers are expanding their product portfolios to address the evolving preferences for improved energy efficiency, enhanced visibility performance, glare-free high-beam capabilities, and aesthetically distinctive designs comparable to luxury vehicle lighting standards established by German premium manufacturers.

From 2030 to 2035, sales are forecast to grow from USD 21.3 billion to USD 28.3 billion, adding another USD 7.1 billion, which constitutes 56.3% of the overall ten-year expansion. This period is expected to be characterized by further expansion of laser headlamp technology across premium segments, integration of advanced communication lighting systems supporting vehicle-to-everything (V2X) connectivity as part of EU smart mobility initiatives, and development of customizable interior ambient lighting solutions targeting premium and luxury applications. The growing emphasis on pedestrian safety regulations mandated by UNECE standards and increasing consumer willingness to pay premium prices for advanced lighting technologies will drive demand for innovative automotive lighting products that deliver superior visibility, enhanced safety features, and personalized user experiences aligned with European sustainability and safety priorities.

Between 2020 and 2025, EU automotive lighting sales experienced robust expansion at a CAGR of 6.0%, growing from USD 11.8 billion to USD 15.8 billion. This period was driven by increasing electrification of vehicle platforms throughout European markets, rising awareness of road safety standards and pedestrian protection requirements mandated by EU regulations, and growing recognition of lighting's critical role in vehicle aesthetics and premium brand identity. The industry developed as major European automotive OEMs including BMW, Mercedes-Benz, Audi, Volkswagen Group, and Stellantis recognized the commercial potential of advanced lighting technologies. Product innovations, improved LED efficiency, adaptive driving beam (ADB) capabilities, and distinctive lighting signature designs began establishing consumer confidence and mainstream acceptance of premium automotive lighting solutions as essential safety and styling feature.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 15.8 billion |

| Market Value (2035) | USD 28.3 billion |

| CAGR (2025-2035) | 6.0% |

Industry expansion is being supported by the rapid increase in premium vehicle production across European manufacturing centers and the corresponding demand for sophisticated, energy-efficient, and safety-compliant lighting solutions with proven performance in diverse driving conditions characteristic of European roadways, weather patterns, and regulatory environments. Modern European consumers rely on automotive lighting not only for basic visibility but as a critical safety feature supporting night driving on high-speed autobahns, adverse weather navigation through Alpine regions and Northern European climates, pedestrian detection in dense urban environments, and communication with other road users, driving demand for products that exceed stringent EU regulatory requirements while delivering superior illumination performance, adaptive functionality, and distinctive styling characteristics essential for premium brand differentiation.

The growing awareness of road safety issues and increasing recognition of lighting technology's role in accident prevention are driving demand for advanced automotive lighting solutions from certified European manufacturers with appropriate UNECE homologation and quality assurance practices. Regulatory authorities including the European Commission and UNECE are increasingly establishing stringent guidelines for automotive lighting performance, beam pattern requirements, glare control standards to protect oncoming drivers, and energy efficiency mandates supporting electric vehicle development. Scientific research studies conducted by European automotive research institutes and engineering analyses from organizations including TÜV and Euro NCAP are providing evidence supporting advanced lighting technologies' safety advantages and functional improvements, requiring specialized manufacturing processes and standardized validation protocols for optimal beam patterns, appropriate color temperature specifications complying with EU standards, and precise photometric performance, including adaptive beam control and intelligent lighting management systems supporting autonomous driving development.

The accelerating transition to electric vehicles throughout European markets fundamentally transforms automotive lighting requirements, as EVs manufactured by Tesla, Volkswagen ID series, BMW i-series, and emerging EV brands demand highly efficient lighting systems to minimize battery drain while supporting extended range performance critical for consumer acceptance. LED and advanced solid-state lighting technologies prove essential for European EV applications, delivering superior energy efficiency compared to traditional halogen or xenon HID systems while providing design flexibility for distinctive brand identity expression and aerodynamic integration supporting reduced drag coefficients. The autonomous and semi-autonomous vehicles being developed and tested throughout European markets require sophisticated lighting systems supporting sensor integration, communication capabilities with pedestrians and cyclists in urban environments, and enhanced visibility for computer vision systems, creating new demand drivers for intelligent lighting solutions beyond traditional illumination functions.

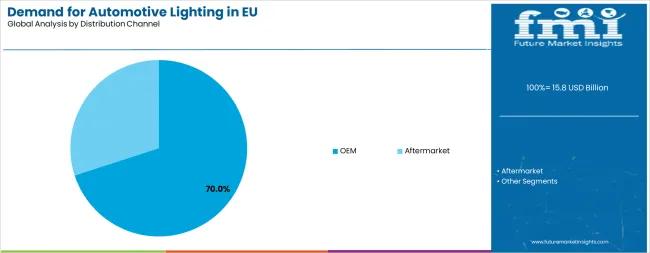

Sales are segmented by technology type, application, vehicle type, distribution channel, and country. By technology type, demand is divided into LED, halogen, xenon/HID, laser, and OLED. Based on the application, sales are categorized into headlights, tail lights, fog lights, daytime running lights (DRL), ambient interior lighting, and signal lights. In terms of vehicle type, demand is segmented into passenger cars, commercial vehicles, and electric vehicles. By distribution channel, sales are classified into OEM and aftermarket. Regionally, demand is focused on Germany, France, Italy, United Kingdom, Spain, and Rest of Europe.

The LED technology segment is projected to account for 58.0% of EU automotive lighting sales in 2025, establishing itself as the dominant technology platform across European automotive markets. This commanding position is fundamentally supported by LED's superior energy efficiency delivering up to 85% power savings compared to halogen alternatives critical for electric vehicle range optimization, extended operational lifespan exceeding 50,000 hours reducing maintenance requirements, and exceptional design flexibility enabling compact packaging, distinctive lighting signatures, and complex adaptive beam patterns essential for premium brand differentiation in competitive European markets dominated by German luxury manufacturers.

The LED format delivers exceptional versatility, providing European manufacturers with a reliable technology platform that facilitates advanced adaptive lighting capabilities mandated by evolving EU safety regulations, dynamic beam pattern adjustment responding to steering inputs and GPS navigation data, and intelligent control integration supporting comprehensive ADAS functionality including pedestrian detection, traffic sign recognition, and automated driving features. LED technology benefits from mature European supply chains, well-established manufacturing infrastructure throughout Germany, France, and Eastern European production centers, and extensive availability from multiple certified global suppliers including OSRAM Continental, Lumileds, and Nichia who maintain rigorous automotive-grade quality standards.

The LED-based lighting offers versatility across various applications, including adaptive matrix LED headlights, sequential turn signals, dynamic OLED tail lights, and sophisticated ambient interior illumination systems, supported by proven manufacturing technologies that address traditional challenges in thermal management, optical precision, and color consistency requirements. The LED segment's dominance extends across premium, mid-range, and increasingly entry-level vehicle segments produced throughout Europe.

The LED segment is expected to increase its share to approximately 65.0% by 2035, demonstrating continued growth as newer technologies including laser and OLED complement rather than displace LED's established dominance throughout the forecast period.

Headlights are positioned to represent 43.0% of total EU automotive lighting demand in 2025, maintaining substantial share through 2035, reflecting the segment's fundamental importance as the primary forward illumination system essential for safe driving on European roadways including high-speed autobahns, rural roads, and densely populated urban environments. This considerable share directly demonstrates that headlights represent the largest single application investment per vehicle, with European automotive manufacturers including BMW, Mercedes-Benz, Audi, and Volkswagen Group prioritizing advanced headlight technologies to deliver superior visibility performance, enhanced safety capabilities, and distinctive lighting signatures that establish premium brand identity and technology leadership in competitive global markets.

Modern European consumers increasingly view advanced headlight systems including matrix LED, adaptive driving beam (ADB), and laser technology as essential safety features rather than optional upgrades, driving demand for intelligent lighting capabilities that automatically adjust beam patterns, provide glare-free high-beam operation protecting oncoming drivers, dynamic cornering illumination responding to steering inputs, and extended-range visibility exceeding 600 meters for high-speed highway driving. The segment benefits from continuous innovation focused on digital micromirror device (DMD) projection systems enabling pixelated beam control, laser technology modules delivering exceptional range performance, and intelligent lighting control integrating with front-facing cameras, navigation data, and vehicle-to-infrastructure (V2I) communication.

The segment's stable share reflects proportional growth across all application categories, with headlights maintaining their leading position as the primary lighting investment priority throughout the forecast period. Advanced headlight technologies including Audi's Digital Matrix LED, BMW's Laserlight, and Mercedes-Benz's Digital Light systems increasingly transition from luxury vehicle exclusivity to mainstream adoption across mid-range segments produced by Volkswagen, Peugeot, and Renault, driven by EU safety incentives, consumer safety awareness, and manufacturing cost reductions.

OEM channels are strategically estimated to control 70.0% of total EU automotive lighting sales in 2025, maintaining this dominant position through 2035, reflecting the critical importance of original equipment manufacturer integration for ensuring proper system performance, UNECE regulatory compliance, and seamless vehicle integration meeting stringent European quality standards. European automotive OEMs consistently demonstrate exceptionally rigorous quality requirements for lighting systems, demanding validated performance across diverse operating conditions from Arctic winters to Mediterranean summers, precise photometric specifications meeting country-specific homologation requirements, and reliable operation throughout vehicle lifecycle without premature failure.

The OEM segment provides essential validation through extensive testing protocols including thermal cycling, vibration resistance, and accelerated aging procedures, engineering integration ensuring optimal electrical and thermal management within vehicle architecture, and quality assurance processes maintaining consistent production standards across European manufacturing facilities spanning Germany, France, Italy, Spain, Czech Republic, and Poland. Major European automotive manufacturers including Volkswagen Group, Stellantis, BMW Group, Mercedes-Benz, and Renault Group systematically specify advanced lighting technologies for new vehicle platforms, often featuring adaptive matrix LED headlights, dynamic sequential turn signals, and integrated ADAS lighting supporting automated driving features that establish technology leadership and differentiate premium offerings in global export markets.

The segment's stable 70% share reflects balanced growth across both OEM and aftermarket channels, with original equipment maintaining its dominant position as primary lighting system source while aftermarket channels serve replacement parts demand, LED upgrade kits particularly popular in Eastern European markets, and customization applications throughout the forecast period. OEM specifications increasingly influence aftermarket product development, with replacement parts required to match original equipment performance characteristics and maintain UNECE regulatory compliance standards.

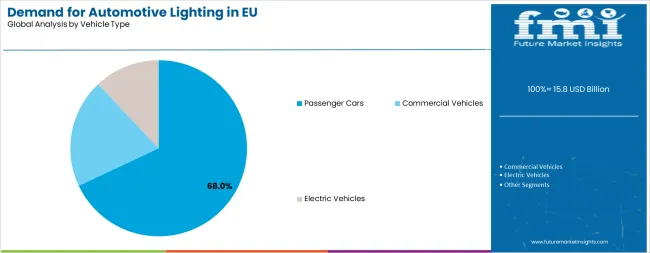

Passenger cars are strategically positioned to contribute 68.0% of total EU automotive lighting sales in 2025, maintaining this substantial share through 2035, representing the largest vehicle segment by production volume throughout European manufacturing centers and the primary driver of lighting technology innovation and premium feature adoption. European passenger car manufacturers consistently prioritize lighting system advancement to support brand differentiation in highly competitive markets, safety enhancement meeting stringent EU pedestrian protection regulations, and aesthetic appeal critical for maintaining premium positioning against global competitors.

The passenger car segment serves as the primary innovation testing ground for advanced lighting technologies, with German premium sedans, luxury SUVs, and cutting-edge electric vehicles featuring pioneering solutions including Audi's Digital Matrix LED with 1.3 million pixels, BMW's Laserlight technology, Mercedes-Benz's Digital Light projection systems, and sophisticated ambient interior lighting creating immersive cabin experiences across 64 color options. Segment dominance derives from exceptionally high per-vehicle lighting content value, with premium and luxury passenger cars manufactured by German brands featuring comprehensive lighting packages exceeding USD 2,500 per vehicle including advanced adaptive headlights, OLED tail lights, and customizable interior ambient systems.

The segment's stable share through 2035 reflects the European passenger car market's continued strength in premium and mid-range segments, with lighting technology adoption rates in European passenger cars consistently leading global markets. Passenger car lighting specifications developed by European manufacturers increasingly influence worldwide automotive standards, with technologies proven in BMW, Mercedes-Benz, and Audi eventually adopted by volume manufacturers including Volkswagen, Peugeot, Renault, and global brands seeking European market success.

EU automotive lighting sales are advancing rapidly due to accelerating electric vehicle adoption requiring highly efficient lighting solutions, stringent UNECE safety regulations mandating advanced adaptive lighting capabilities, and increasing consumer emphasis on vehicle aesthetics and distinctive brand identity particularly important in premium European markets. The industry faces challenges, including exceptionally high development costs for advanced lighting technologies limiting mainstream adoption across volume segments, complex regulatory approval processes varying between EU member states despite harmonization efforts, and substantial technology transition costs for manufacturers upgrading production capabilities to support next-generation lighting systems. Continued innovation in solid-state lighting technologies, intelligent control systems, and communication lighting capabilities remains central to European automotive lighting industry development.

The rapidly accelerating development of matrix LED and adaptive driving beam (ADB) lighting systems throughout European markets is fundamentally transforming automotive illumination from static beam patterns to intelligent, dynamic lighting responding to driving conditions, traffic situations, and environmental factors in real-time. Advanced matrix LED platforms developed by European tier-one suppliers including HELLA, Valeo, and Automotive Lighting (Marelli) feature individually controllable LED elements arranged in high-resolution arrays enabling selective beam shuttering, creating dark zones protecting oncoming drivers and preceding vehicles while maintaining maximum illumination in surrounding areas, effectively delivering continuous high-beam operation without glare risk to other road users. These intelligent lighting systems prove particularly transformative for European driving conditions including high-speed autobahn travel, winding Alpine mountain roads, and densely populated urban environments, where maximum visibility proves essential for safety while traditional high-beam usage remains severely limited by glare concerns affecting other drivers.

Major European automotive lighting suppliers invest heavily in matrix LED technology development, miniaturized LED packaging enabling higher resolution arrays exceeding 84 individually controllable segments, and intelligent control systems processing front-facing camera inputs, GPS navigation data, and multiple vehicle sensors to optimize lighting performance dynamically. Manufacturers collaborate with semiconductor companies including Infineon and STMicroelectronics, optical design specialists, and European automotive OEMs to develop scalable solutions that reduce per-vehicle costs while maintaining exceptional performance standards supporting UNECE regulatory approval and exceeding Euro NCAP safety assessment requirements. Matrix LED systems increasingly feature in mid-range vehicle segments produced by Volkswagen, Peugeot, and Renault, transitioning from luxury vehicle exclusivity established by Audi and BMW to mainstream adoption as manufacturing costs decline and EU regulatory incentives encourage advanced lighting technology deployment supporting Vision Zero road safety initiatives.

European premium automotive manufacturers systematically incorporate laser headlight technology delivering illumination ranges exceeding 600 meters, nearly doubling the effective visibility distance compared to conventional LED high-beam systems and providing critical safety advantages for high-speed autobahn driving at 200+ km/h and rural road navigation characteristic of European roadways. Laser lighting systems pioneered by BMW in collaboration with OSRAM utilize high-intensity laser diodes exciting phosphor converters to generate brilliant white light exceeding 5,500 Kelvin color temperature, achieving exceptional luminous efficiency in compact packaging enabling distinctive styling and aerodynamic optimization essential for premium vehicle design differentiation. These extended-range lighting solutions prove essential for European luxury vehicles and increasingly support autonomous vehicle development, as computer vision systems require enhanced illumination for long-distance object detection, classification, and decision-making supporting safe automated driving operation on European highways.

European lighting manufacturers including ZKW Group working with Audi and Automotive Lighting collaborating with BMW implement extensive validation testing programs, sophisticated thermal management systems ensuring reliable operation across temperature extremes from -40°C to +85°C, and comprehensive safety system integration preventing hazardous laser exposure through mechanical shutters, redundant failsafe mechanisms, and compliance with international laser safety standards. Manufacturers leverage extended-range performance in marketing campaigns targeting German premium vehicle buyers, safety positioning emphasizing accident prevention through early hazard detection at highway speeds, and ultimate technology leadership, positioning laser headlights as the pinnacle lighting solution delivering unmatched visibility performance. Laser technology increasingly features in flagship models from BMW 7 Series, Audi A8, and Mercedes-Benz S-Class, with manufacturers offering hybrid configurations combining laser high-beam modules with matrix LED low-beam and adaptive lighting functions.

European automotive manufacturers increasingly prioritize communication-capable lighting systems supporting vehicle-to-everything (V2X) connectivity as part of EU smart mobility initiatives, enabling vehicles to transmit intentions, warnings, and operational status information through lighting displays visible to pedestrians, cyclists, and other road users in complex urban environments. This communication lighting trend aligns with European Commission goals for connected and automated mobility, enabling manufacturers to differentiate advanced autonomous and semi-autonomous vehicles through intuitive light-based messaging, projected crosswalk illumination indicating pedestrian right-of-way at unmarked crossings, and dynamic lighting patterns communicating vehicle operating modes to surrounding road users unfamiliar with automated driving behaviors. Communication lighting proves particularly important for autonomous vehicle acceptance in European cities, as pedestrians and cyclists traditionally rely on eye contact and driver gestures to assess crossing safety, requiring alternative communication methods for driverless operation anticipated in urban mobility services.

The development of high-resolution projection systems utilizing digital micromirror device (DMD) technology, programmable LED matrices displaying text, symbols, and warning messages, and standardized communication protocols supporting interoperability across vehicle brands manufactured throughout Europe expands manufacturers' abilities to create effective communication lighting solutions. European brands including Mercedes-Benz with Digital Light, Audi with Digital Matrix LED, and Volkswagen Group collaborate with human factors researchers at technical universities, regulatory authorities including UNECE developing communication lighting standards, and technology providers specializing in computer vision and augmented reality to develop systems balancing communication effectiveness with regulatory compliance, aesthetic integration matching premium vehicle design language, and manufacturing cost considerations supporting mainstream deployment beyond ultra-premium vehicle segments.

European premium automotive manufacturers systematically expand interior ambient lighting offerings, transforming cabin illumination from basic visibility support to sophisticated mood lighting systems featuring millions of color options, dynamic lighting programs synchronized with selectable driving modes, and personalization capabilities supporting individual driver preferences stored in vehicle memory systems. Advanced ambient lighting systems developed by European suppliers integrate throughout premium cabin interiors, including door panels featuring fiber optic illumination, dashboard trim with edge-lit designs, footwells, center consoles, headliners creating starlight effects, and even seat piping illumination, creating immersive lighting environments that enhance perceived quality, support premium brand identity particularly important for German luxury manufacturers, and improve occupant comfort during extended European road trips.

These sophisticated interior lighting systems increasingly feature in mid-range vehicles produced by Volkswagen Group brands, transitioning from luxury segment exclusivity established by Mercedes-Benz with 64-color ambient lighting and BMW with customizable interior lighting packages to mainstream availability as LED costs decline and European consumer expectations for personalized vehicle experiences increase. European automotive lighting suppliers including HELLA, Valeo, and Grupo Antolin develop comprehensive ambient lighting packages, centralized control modules managing multiple lighting zones throughout vehicle interiors, and seamless integration with vehicle infotainment systems enabling user customization through touchscreen interfaces and smartphone applications. Interior lighting systems increasingly incorporate wellness features aligning with European consumer health consciousness, including circadian rhythm support through color temperature adjustment, welcome and farewell lighting sequences creating premium experiences, and dynamic lighting responses to entertainment content and driving events enhancing emotional connection with vehicles.

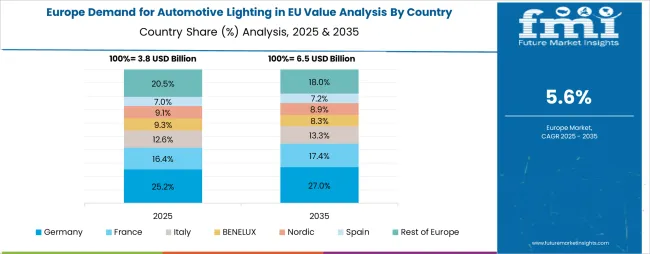

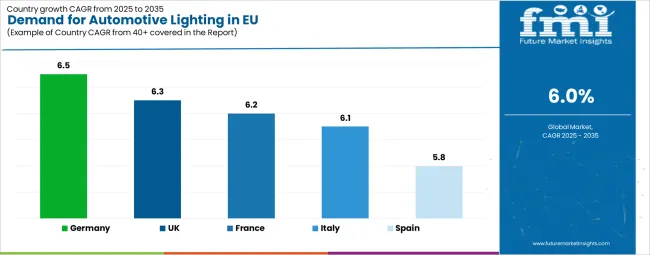

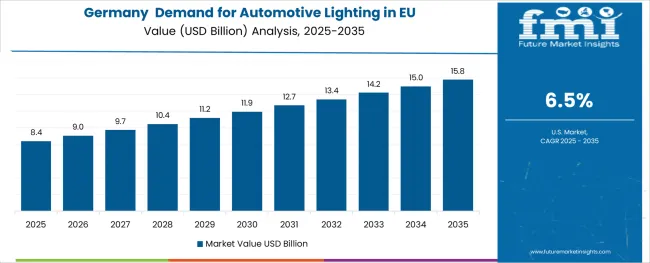

EU automotive lighting sales are projected to grow from USD 15.8 billion in 2025 to USD 28.3 billion by 2035, registering a CAGR of 6.0% over the forecast period. Germany is expected to demonstrate the strongest growth trajectory with a 6.5% CAGR, supported by premium vehicle manufacturing leadership, extensive lighting innovation, and established automotive industry infrastructure. The United Kingdom follows with a 6.3% CAGR, driven by premium vehicle production, strong aftermarket culture, and regulatory alignment with EU standards.

France and Italy demonstrate 6.2% and 6.1% CAGR respectively, supported by domestic automotive manufacturing, growing EV adoption, and increasing consumer demand for advanced safety features. Spain maintains 5.8% CAGR, attributed to volume vehicle production and expanding electric vehicle manufacturing.

EU automotive lighting sales are projected to grow at a regional CAGR of 6.2% (2025–2035), reflecting consistent expansion across major European economies. Germany leads with 6.5% growth, supported by its dominance in premium vehicle manufacturing, innovation leadership in advanced headlamp and adaptive lighting technologies, and a mature supplier ecosystem. The United Kingdom follows at 6.3%, with growth driven by premium and luxury brands such as Jaguar Land Rover, Bentley, and Aston Martin, which continue to emphasize high-performance lighting systems despite Brexit-related challenges. France posts a 6.2% CAGR, benefiting from the strong presence of Stellantis and Renault Group, both increasingly integrating LED and adaptive lighting technologies. Italy expands at 6.1%, leveraging its luxury sports car heritage and a growing supplier base in advanced lighting solutions. Spain grows at 5.8%, supported by large-scale vehicle production and increasing investments in EV manufacturing, which accelerates demand for efficient and lightweight lighting systems.

Revenue from automotive lighting in Germany is projected to exhibit the strongest growth with a CAGR of 6.5% through 2035, driven by the country's position as global premium automotive manufacturing leader, home to BMW, Mercedes-Benz, Audi, Porsche, and Volkswagen Group, which collectively pioneer advanced lighting technologies including matrix LED, laser headlights, digital light projection, and OLED applications setting global industry standards. Germany's sophisticated automotive engineering culture, comprehensive automotive ecosystem spanning OEMs to tier-one suppliers, and substantial research and development investment systematically drive demand for cutting-edge lighting solutions delivering superior performance, distinctive design differentiation, and technology leadership establishing premium brand positioning in competitive global markets.

Major German automotive lighting suppliers including HELLA (now part of Faurecia), Automotive Lighting (Marelli), and ZKW Group maintain extensive research and development operations focused on next-generation lighting technologies, adaptive systems supporting autonomous driving development, and intelligent control integration leveraging artificial intelligence and machine learning. German demand benefits from exceptionally strong export-oriented production, with premium vehicles manufactured domestically featuring world-leading lighting technology as standard equipment for global markets, combined with robust domestic consumer demand for technology-forward vehicles, comprehensive safety systems exceeding regulatory requirements, and willingness to pay premium prices for advanced features.

The German automotive lighting industry benefits from close collaboration between automotive OEMs, tier-one suppliers, and technical universities including RWTH Aachen and Technical University of Munich conducting fundamental research in solid-state lighting, photonics, and optical design. Government support through research funding programs and regulatory frameworks encouraging lighting innovation further strengthen Germany's competitive position.

Revenue from automotive lighting in the United Kingdom is expanding at a CAGR of 6.3%, substantially supported by premium and luxury vehicle manufacturing including Jaguar Land Rover producing Range Rover and Defender models, Bentley Motors crafting ultra-luxury vehicles, Aston Martin delivering high-performance sports cars, and McLaren Automotive engineering advanced supercars, all requiring sophisticated lighting solutions matching premium positioning. The UK's automotive industry, while smaller than Germany's by production volume, maintains exceptionally high per-vehicle content value driven by luxury vehicle focus and advanced technology integration.

Major UK automotive operations systematically adopt cutting-edge lighting technologies across vehicle ranges, often featuring adaptive LED systems, distinctive lighting signatures supporting brand identity, and sophisticated interior ambient lighting creating luxury cabin environments. British demand particularly benefits from strong aftermarket modification culture, with enthusiast communities actively upgrading lighting systems beyond factory specifications, combined with continued regulatory alignment with EU standards ensuring technology compatibility and supplier continuity despite Brexit.

The UK automotive lighting sector benefits from established supplier relationships with European tier-one companies, domestic engineering expertise in optical design and electronic controls, and growing investment in electric vehicle production including Nissan Sunderland manufacturing European Leaf production and emerging EV startups. London and Southeast England automotive design centers influence global lighting styling trends, while Midlands manufacturing clusters maintain production expertise.

Revenue from automotive lighting in France is growing at a CAGR of 6.2%, fundamentally driven by substantial domestic automotive manufacturing including Stellantis brands (Peugeot, Citroën, DS Automobiles) and Renault Group producing extensive vehicle ranges across premium, mid-range, and compact segments throughout French manufacturing facilities. France's automotive industry emphasizes design innovation, technology integration, and increasing electrification supporting demand for modern lighting solutions, distinctive styling supporting brand differentiation, and energy-efficient systems optimizing electric vehicle range performance.

Major French automotive manufacturers systematically introduce vehicles with advanced lighting specifications, responding to consumer demand for modern designs incorporating LED daytime running lights, sequential turn signals, and distinctive lighting signatures while meeting stringent EU safety regulations. French demand particularly benefits from strong domestic preference for French automotive brands supported by cultural affinity, growing electric vehicle adoption driven by government incentives and urban access restrictions, and substantial aftermarket sector serving replacement and upgrade applications. Automotive lighting supplier Valeo maintains headquarters in France, operating extensive research and development facilities advancing adaptive lighting technologies, LED systems, and intelligent lighting control supporting both domestic and global automotive manufacturers.

The French market benefits from government support for automotive industry competitiveness, substantial investment in electric vehicle development including Renault's comprehensive EV strategy, and continued export production serving European and global markets. Lyon and Paris regions maintain automotive engineering centers, while northern and eastern France host major vehicle production facilities.

Revenue from automotive lighting in Italy is expanding at a CAGR of 6.1%, driven by luxury sports car manufacturing including Ferrari producing ultra-premium performance vehicles, Lamborghini crafting exotic supercars, Maserati delivering luxury GT vehicles, and growing volume production by Stellantis brands including Fiat, Alfa Romeo, and Lancia throughout Italian manufacturing facilities. Italy's automotive culture emphasizes design excellence, performance engineering, and passionate brand identity, systematically driving demand for distinctive lighting solutions supporting emotional vehicle character and premium positioning.

Major Italian automotive manufacturers prioritize advanced lighting technologies across vehicle portfolios, often featuring aggressive headlight designs, distinctive LED light signatures becoming iconic brand elements, and sophisticated interior ambient lighting enhancing luxury cabin environments. Italian demand benefits from strong domestic automotive passion supporting premium vehicle sales, growing electric vehicle adoption in urban centers including Milan and Rome implementing access restrictions, and substantial aftermarket sector serving modification, customization, and performance upgrade applications popular in enthusiast communities.

The demand of automotive lighting in Italy increasingly benefits from growing supplier presence, with Automotive Lighting (Marelli, formerly Magneti Marelli) operating extensive Italian operations including engineering centers and manufacturing facilities serving European and global customers. Turin region maintains automotive engineering expertise and design studios influencing global styling trends, while northern Italian manufacturing clusters support component production and system integration. Italian automotive design leadership in lighting styling creates global influence despite relatively modest production volumes compared to Germany or France.

Demand for automotive lighting in Spain is projected to grow at a CAGR of 5.8%, substantially supported by significant volume vehicle production including Volkswagen Group facilities manufacturing Seat and Cupra brands, Ford España producing passenger cars and commercial vehicles, Stellantis plants manufacturing Peugeot and Citroën models, Renault facilities producing Captur and other models, and growing electric vehicle manufacturing including Seat Cupra Born and future VW Group EV production. Spanish automotive industry emphasizes efficient volume production, increasing technology adoption, and growing electrification supporting demand for cost-effective lighting solutions, modern LED systems, and energy-efficient technologies.

Major automotive manufacturers operating Spanish facilities systematically upgrade lighting specifications across vehicle ranges, incorporating LED daytime running lights, halogen-to-LED headlight transitions in mid-range segments, and advanced lighting packages in premium trim levels matching European market expectations. Spanish demand benefits from substantial automotive production volumes exceeding 2 million vehicles annually, growing domestic electric vehicle sales driven by government incentives and expanding charging infrastructure, and strategic location enabling efficient export to European and North African markets.

The Spanish automotive lighting industry benefits from established supplier presence including international tier-one companies operating Spanish facilities serving local production and European exports, skilled workforce supporting quality manufacturing, and continued investment in production capacity and technology capabilities. Barcelona and Madrid regions maintain automotive engineering presence, while northern manufacturing clusters around Zaragoza, Valladolid, and Valencia host major vehicle production facilities driving lighting demand.

EU automotive lighting sales are defined by intense competition among established European tier-one suppliers, global lighting manufacturers, and specialized technology companies. Companies are investing in adaptive lighting development, matrix LED technology advancement, laser system commercialization, intelligent control systems, and distinctive design capabilities to deliver high-quality, technologically superior, and aesthetically distinctive automotive lighting solutions meeting stringent European regulatory requirements. Strategic partnerships with European automotive OEMs, technology licensing agreements, regional manufacturing expansion supporting localized production, and comprehensive research and development programs are central to strengthening competitive position in technology-intensive European markets.

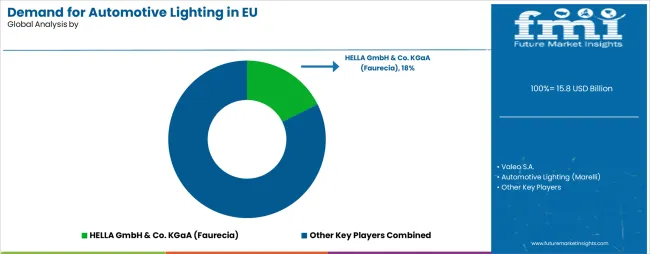

Major participants include HELLA GmbH & Co. KGaA (now part of Faurecia) with an estimated 18.0% share of EU automotive lighting sales, leveraging its position as leading European lighting supplier, comprehensive product portfolio spanning all lighting applications from headlights to ambient interior systems, and technology leadership in LED systems, matrix LED development, and advanced electronics integration supporting ADAS functionality. HELLA benefits from exceptionally strong relationships with German premium manufacturers including BMW, Mercedes-Benz, and Volkswagen Group, extensive engineering capabilities across optical design and electronic controls, and comprehensive European manufacturing footprint including facilities in Germany, Czech Republic, and Romania supporting efficient high-volume production. The company's electronics expertise enables integrated lighting solutions supporting vehicle communication systems, sensor integration, and autonomous driving development, positioning HELLA as technology partner rather than component supplier to European OEMs.

Valeo S.A. holds approximately 15.0% share of EU automotive lighting sales, emphasizing comprehensive automotive visibility systems including lighting, wipers, and camera technologies, strong technology development in adaptive lighting and ADAS integration, and strategic positioning as preferred supplier for French automotive manufacturers including Renault Group and Stellantis brands while maintaining substantial business with German premium manufacturers. Valeo's success in developing BeamAtic adaptive driving beam technology, matrix LED systems featuring up to 32 individually controlled segments, and comprehensive LED lighting portfolios creates strong competitive positioning supported by global scale, extensive research and development investment exceeding EUR 2 billion annually across all automotive systems, and comprehensive manufacturing presence throughout Europe including France, Poland, Czech Republic, and Spain. The company's systems integration approach enables seamless integration of lighting with front-facing cameras, radar systems, and vehicle control units supporting advanced driver assistance and autonomous driving applications.

Automotive Lighting (Marelli, formerly Magneti Marelli) accounts for roughly 12.0% share of EU automotive lighting sales through its position as major European lighting supplier serving premium and volume manufacturers, comprehensive technology portfolio including LED, laser, and OLED lighting solutions, and strong Italian heritage supporting design excellence and performance vehicle applications. The company benefits from established relationships with Stellantis brands including Alfa Romeo, Maserati, and Fiat, growing business with German premium manufacturers seeking design expertise and advanced technology capabilities, and comprehensive European manufacturing presence including facilities in Italy, Germany, Poland, and Czech Republic supporting efficient production and responsive customer service. Automotive Lighting's expertise in complex optical designs, advanced LED packaging technologies, and sophisticated interior ambient lighting systems positions the company as premium technology supplier supporting European manufacturers' differentiation strategies.

ZKW Group represents approximately 10.0% share of EU automotive lighting sales, supporting growth through specialized focus on premium headlamp systems, technology leadership in matrix LED and laser lighting applications, and strategic partnerships with German luxury manufacturers including Audi, BMW, and Porsche. ZKW's concentrated expertise in complex headlamp systems featuring high-resolution matrix LED arrays, laser technology modules, and advanced optical designs enables exceptional performance and distinctive styling supporting premium brand positioning. The company benefits from Austrian engineering excellence, sophisticated manufacturing capabilities including advanced automation and precision assembly processes, and collaborative development partnerships with OEM customers enabling co-creation of breakthrough lighting technologies. ZKW's laser headlight systems feature prominently in flagship models including Audi A8 and BMW 7 Series, establishing technology leadership credentials.

Koito Manufacturing Co., Ltd. holds approximately 8.0% share of EU automotive lighting sales through European operations serving Japanese and Korean automotive manufacturers operating European production facilities, growing business with European OEMs seeking proven technology and manufacturing excellence, and comprehensive product portfolio spanning all lighting applications. The company benefits from global scale as world's largest automotive lighting manufacturer, extensive technology development capabilities supporting LED, laser, and OLED applications, and manufacturing presence in European markets serving Toyota, Nissan, Hyundai, and Kia production facilities while expanding relationships with European manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.3 billion |

| Technology Type | LED, Halogen, Xenon/HID, Laser, OLED |

| Application | Headlights, Tail Lights, Fog Lights, DRL, Ambient Interior Lighting, Signal Lights |

| Vehicle Type | Passenger Cars, Commercial Vehicles, Electric Vehicles |

| Distribution Channel | OEM, Aftermarket |

| Countries Covered | Germany, France, Italy, United Kingdom, Spain, Rest of Europe |

| Key Companies Profiled | HELLA, Valeo, Automotive Lighting (Marelli), ZKW Group, Koito Manufacturing, Stanley Electric, OSRAM Continental |

| Additional Attributes | Dollar sales by technology type, application, vehicle type, and distribution channel; regional demand trends across major European markets; competitive landscape analysis with established European tier-one suppliers and global lighting manufacturers; consumer preferences for advanced lighting features and premium applications; integration with ADAS technologies and autonomous driving systems; innovations in matrix LED, laser, and OLED technologies; adoption across OEM and aftermarket channels; UNECE regulatory framework analysis for automotive lighting standards; supply chain strategies; and penetration analysis for premium, mid-range, and volume vehicle segments throughout European automotive markets. |

The global demand for automotive lighting in EU is estimated to be valued at USD 15.8 billion in 2025.

The market size for the demand for automotive lighting in EU is projected to reach USD 28.3 billion by 2035.

The demand for automotive lighting in EU is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in demand for automotive lighting in EU are front headlights, fog lights, rear lights, side lights and interior lights.

In terms of light source, LED segment to command 58.0% share in the demand for automotive lighting in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Material, Thickness, Capacity, and Type of Europe Automotive Tire Market Forecast Economic Projections to 2035

Automotive Lighting Actuators Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lighting Market Size, Growth, and Forecast for 2025 to 2035

Automotive Lighting Accessories Market Growth - Trends & Forecast 2025 to 2035

Automotive Adaptive Lighting Market

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Korea Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Automotive Interior Ambient Lighting Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Turbocharger in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Interior Leather in EU Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA