The EU automotive turbocharger industry is projected to grow from USD 5.5 billion in 2025 to USD 13.4 billion by 2035, advancing at a CAGR of 9.3%. The variable geometry turbocharger (VGT) segment is expected to lead sales with a 63.0% share in 2025, while the OEM sales channel is anticipated to account for 70.0% of the distribution segment.

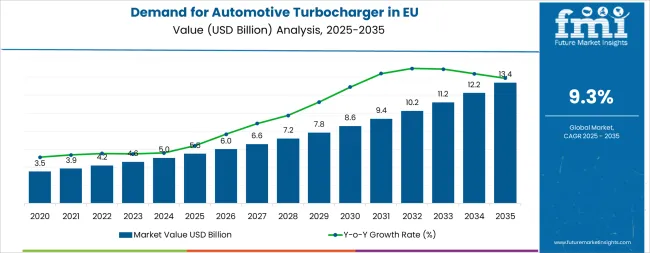

European Union automotive turbocharger sales are projected to grow from USD 5.5 billion in 2025 to approximately USD 13.4 billion by 2035, recording an absolute increase of USD 7.9 billion over the forecast period. This translates into total growth of 143.6%, with demand forecast to expand at a compound annual growth rate (CAGR) of 9.3% between 2025 and 2035. The industry size is expected to grow by nearly 2.4X during the same period, supported by the accelerating implementation of Euro 7 emission standards, increasing adoption of engine downsizing strategies, and developing applications across passenger cars, light commercial vehicles, and heavy commercial vehicles throughout European markets.

Between 2025 and 2030, EU automotive turbocharger demand is projected to expand from USD 5.5 billion to USD 9.0 billion, resulting in a value increase of USD 3.5 billion, which represents 44.3% of the total forecast growth for the decade. This phase of development will be shaped by rising implementation of Euro 7 emission standards across European automotive manufacturing, increasing adoption of turbocharged engines in mainstream passenger vehicles, and growing acceptance of downsized engine architectures across retail and commercial fleet channels. Manufacturers are expanding their product portfolios to address the evolving preferences for improved fuel efficiency, enhanced power output characteristics, and technologically advanced turbocharger systems comparable to larger displacement engine performance standards.

From 2030 to 2035, sales are forecast to grow from USD 9.0 billion to USD 13.4 billion, adding another USD 4.4 billion, which constitutes 55.7% of the ten-year expansion. This period is expected to be characterized by further expansion of electric turbocharger integration, advancement of variable geometry technologies incorporating real-time boost optimization capabilities, and development of premium hybrid turbocharging systems targeting next-generation powertrain applications. The growing emphasis on carbon neutrality commitments and increasing willingness from automotive manufacturers to invest in advanced forced induction technologies will drive demand for innovative turbocharger products that deliver authentic emission reduction benefits and fuel economy advantages.

Between 2020 and 2025, EU automotive turbocharger sales experienced robust expansion at a CAGR of 8.9%, growing from USD 3.6 billion to USD 5.5 billion. This period was driven by increasing stringency of emission regulations across European countries, rising awareness of fuel efficiency benefits among consumers, and growing recognition of engine downsizing advantages. The industry developed as major automotive OEMs and turbocharger manufacturers recognized the commercial potential of forced induction alternatives to naturally aspirated engines. Product innovations, improved durability characteristics, and advanced control system integration began establishing OEM confidence and mainstream acceptance of turbocharger products.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.5 billion |

| Industry Value (2035F) | USD 13.4 billion |

| CAGR (2025 to 2035) | 9.3% |

Industry expansion is being supported by the rapid increase in emission regulation stringency across European countries and the corresponding demand for efficient, powerful, and environmentally compliant engine solutions with proven performance in diverse automotive applications. Modern European automotive manufacturers rely on turbochargers as essential technologies for passenger vehicles, commercial fleets, and hybrid powertrain applications, driving demand for products that deliver superior fuel economy, enhanced power output, and emission compliance characteristics. Even moderate efficiency requirements, such as CO2 reduction targets, fuel consumption optimization, or performance enhancement needs, can drive comprehensive adoption of turbocharging systems to maintain optimal engine efficiency and support regulatory compliance patterns.

The growing awareness of climate change issues and increasing recognition of transportation's environmental impact are driving demand for turbocharger alternatives from certified manufacturers with appropriate quality credentials and advanced engineering practices. Regulatory authorities across EU member states are increasingly establishing clear guidelines for emission standards, CO2 reduction requirements, and fuel efficiency targets to maintain environmental sustainability and ensure automotive industry accountability. Scientific research studies and performance analyses are providing evidence supporting turbochargers' efficiency advantages and emission improvements, requiring specialized manufacturing methods and standardized design protocols for authentic fuel economy development, optimal boost pressure management, and appropriate durability profiles, including thermal resistance and bearing system optimization.

Sales are segmented by vehicle type, product type, fuel type, sales channel, actuator type, and country. By vehicle type, demand is divided into passenger cars, light commercial vehicles (LCV), heavy commercial vehicles (HCV), agricultural machinery, and construction machinery. Based on product type, sales are categorized into wastegate, variable geometry turbocharger (VGT), and twin turbo. In terms of fuel type, demand is segmented into gasoline and diesel. By sales channel, sales are classified into OEM and aftermarket. By actuator type, demand is divided into hydraulic, electric, and pneumatic. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, the United Kingdom, and the Rest of Europe.

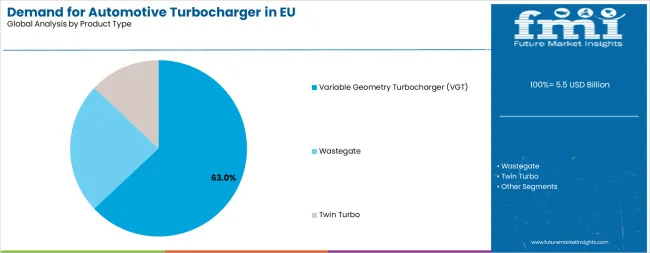

The variable geometry turbocharger (VGT) segment is projected to account for 63.0% of EU automotive turbocharger sales in 2025, establishing itself as the dominant technology category across European automotive applications. This commanding position is fundamentally supported by VGT's superior efficiency characteristics across varying engine loads, comprehensive boost control capabilities enabling optimal performance, and regulatory advantages meeting stringent Euro 7 emission requirements across passenger car and commercial vehicle segments. The VGT format delivers exceptional versatility, providing automotive manufacturers with a proven technology that facilitates emission compliance, fuel economy optimization, and power delivery enhancement essential for mainstream adoption.

This segment benefits from mature engineering expertise across European turbocharger manufacturers, well-established integration protocols with engine management systems, and extensive validation through multiple automotive OEM partnerships that maintain rigorous quality standards and performance certifications. The VGT applications offer adaptability across various engine configurations, including diesel, gasoline, and hybrid applications, supported by proven control technologies that address traditional challenges in turbo lag elimination and transient response improvement.

The VGT segment is expected to maintain its 63.0% share through 2035, demonstrating stable positioning as electric turbocharger technologies complement rather than displace variable geometry's established presence throughout the forecast period.

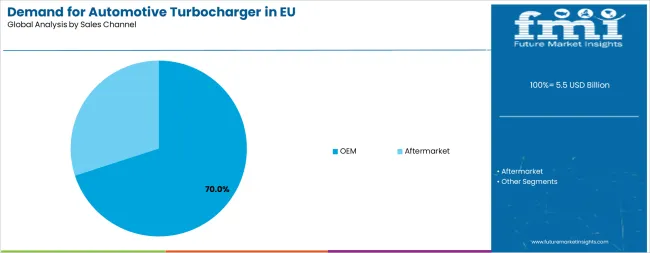

OEM channel is positioned to represent 70.0% of total EU automotive turbocharger demand across European automotive manufacturing in 2025, maintaining this substantial share through 2035, reflecting the segment's dominance as the primary integration pathway within the industry ecosystem. This considerable share directly demonstrates that OEM integration represents the largest single distribution channel, with automotive manufacturers installing turbochargers during vehicle production for emission compliance, fuel efficiency optimization, warranty coverage, and seamless engine management system integration mirroring standard automotive manufacturing practices.

Modern European automotive manufacturers increasingly view turbocharger integration as essential technology for regulatory compliance, driving demand for products optimized for specific engine platforms with appropriate performance characteristics, durability profiles that meet warranty requirements, and quality standards that maintain brand reputation and customer satisfaction. The segment benefits from continuous product innovation focused on improved efficiency performance, enhanced durability characteristics preventing premature failure, and advanced integration capabilities eliminating calibration complexity associated with aftermarket turbocharger installations.

The segment's stable share reflects proportional growth across all distribution channels, with OEM maintaining its leading position as the primary automotive manufacturer integration pathway throughout the forecast period.

Passenger cars represent the dominant portion of EU automotive turbocharger applications, accounting for the majority of sales throughout the forecast period. This vehicle category proves essential for mainstream turbocharger adoption, including compact cars, sedans, SUVs, and premium vehicle segments requiring enhanced fuel efficiency and performance characteristics under diverse European driving conditions.

The segment benefits from high production volumes across European automotive manufacturing hubs, established consumer acceptance of turbocharged engines, and regulatory pressures driving downsizing strategies throughout the forecast period. Passenger car applications enable automotive manufacturers to optimize fuel efficiency across urban and highway driving patterns while maintaining necessary power output and driving dynamics required for European consumer preferences.

Manufacturers are developing specialized passenger car turbocharger designs featuring enhanced responsiveness characteristics, improved noise-vibration-harshness (NVH) profiles, and advanced materials technologies supporting gasoline and diesel applications where consumer satisfaction and long-term durability prove critical for brand reputation and repeat purchases.

Diesel fuel type represents a substantial portion of EU automotive turbocharger applications, particularly within commercial vehicle segments where diesel engines provide superior torque characteristics and fuel efficiency advantages. This fuel category proves essential for heavy-duty applications, including long-haul trucking, commercial logistics, and industrial machinery requiring maximum power output and operational efficiency under demanding duty cycles.

The segment benefits from established diesel engine infrastructure across European commercial transportation, proven turbocharger compatibility with compression ignition combustion, and superior fuel economy characteristics supporting commercial fleet operations throughout the forecast period. Diesel applications enable fleet operators to optimize operational costs across high-mileage applications while maintaining necessary load capacity and reliability margins required for commercial transportation economics.

The segment faces headwinds from increasing environmental scrutiny, growing adoption of alternative powertrains, and regulatory pressures favoring electrification throughout passenger car applications. Despite these challenges, diesel turbocharger demand remains strong in commercial vehicle segments where alternative powertrains face technical and economic limitations.

EU automotive turbocharger sales are advancing rapidly due to accelerating Euro 7 implementation timelines, comprehensive CO2 reduction commitments, and increasing fuel cost sensitivity driving automotive manufacturer preference for efficient engine solutions. The industry faces challenges, including electrification pressures reducing internal combustion engine adoption, manufacturing cost complexities affecting vehicle pricing, and supply chain constraints limiting production scalability. Continued innovation in electric turbocharger technologies and hybrid integration remains central to industry development.

The rapidly accelerating implementation of Euro 7 emission regulations is fundamentally transforming European automotive engine design from naturally aspirated configurations to forced induction architectures, enabling substantial emission reduction capabilities previously unattainable through conventional engine technologies. Advanced turbocharger systems featuring variable geometry control and integrated waste heat recovery allow automotive manufacturers to position turbocharged engines as essential compliance solutions delivering authentic environmental benefits through proven fuel consumption reduction and CO2 emission optimization. These regulatory developments prove particularly transformative for passenger car applications, including compact vehicles, family sedans, and crossover segments, where emission compliance improvements prove essential for regulatory approval and sales eligibility across European jurisdictions.

Major European automotive manufacturers invest heavily in turbocharger integration expertise, advanced calibration capabilities, and validation processes for turbocharged powertrains, recognizing that emission standards represent critical drivers for forced induction adoption. Manufacturers collaborate with turbocharger suppliers, engine calibration specialists, and regulatory authorities to develop standardized integration protocols that validate emission performance while maintaining drivability standards supporting consumer acceptance and brand reputation.

Modern EU turbocharger producers systematically incorporate electric assistance technologies, including electrically driven compressor stages, motor-generator integration, and energy recovery systems that deliver enhanced transient response, optimal boost pressure management, and waste heat recovery capabilities, supporting hybrid powertrains, performance applications, and efficiency optimization requirements. Strategic integration of electric technologies optimized for 48-volt electrical architectures enables manufacturers to position advanced turbochargers as comprehensive powertrain efficiency solutions where transient performance directly determines driving satisfaction and fuel economy achievement.

Companies implement extensive technology development programs, automotive OEM partnerships, and electrification platforms targeting specific applications, including mild-hybrid systems requiring rapid boost response, performance vehicles benefiting from anti-lag capabilities, and efficiency-focused powertrains demanding maximum energy recovery. Manufacturers leverage electric turbocharger capabilities in marketing campaigns, OEM collaborations, and product differentiation strategies, positioning electrically assisted turbocharging as advanced powertrain solutions delivering measurable performance benefits.

European turbocharger manufacturers increasingly prioritize lightweight material implementation featuring titanium alloys, ceramic components, and advanced bearing technologies that align with vehicle weight reduction initiatives and thermal efficiency optimization philosophies. This lightweighting trend enables manufacturers to differentiate premium offerings through mass reduction strategies, improved thermal response characteristics, and enhanced durability profiles that resonate with performance-conscious automotive manufacturers seeking turbocharger alternatives without compromising reliability principles. Lightweight positioning proves particularly important for premium automotive applications where component quality requires engineering excellence supporting brand differentiation and technology leadership.

The development of ceramic turbine wheels, titanium compressor housings, and advanced bearing technologies expands manufacturers' abilities to create lightweight products delivering authentic performance characteristics without extensive durability compromise. Brands collaborate with material suppliers, aerospace technology providers, and thermal management experts to develop products balancing weight reduction requirements with durability needs, supporting marketing claims and premium positioning while maintaining operational reliability and safety acceptability across mainstream automotive applications.

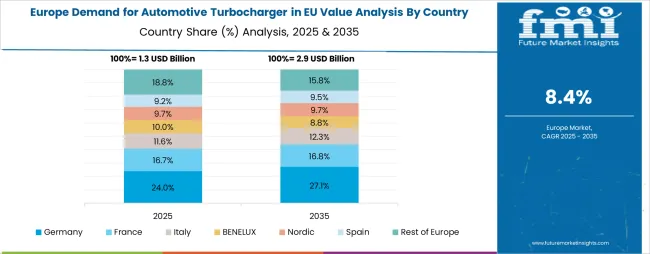

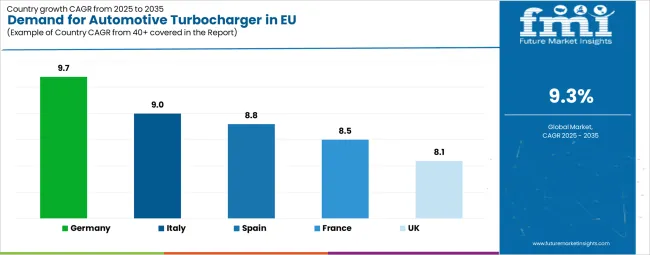

EU automotive turbocharger sales are projected to grow from USD 5.5 billion in 2025 to USD 13.4 billion by 2035, registering a CAGR of 9.3% over the forecast period. The rest of Europe region is expected to demonstrate strong growth trajectory with a 12.8% CAGR, supported by emerging automotive development, increasing turbocharged engine penetration, and growing emission regulation implementation. Germany maintains the largest share at 31.0% in 2025, expected to reach 31.3% by 2035, attributed to premium automotive manufacturing strength and established turbocharger technology leadership.

France follows with 16.5% share in 2025, though projected to decline to 14.4% by 2035 due to below-average growth despite continued diesel and commercial vehicle demand. The United Kingdom holds 14.7% in 2025, declining to 12.1% by 2035, while Italy maintains steady positioning with 12.3% in 2025 and 12.0% by 2035. Spain accounts for 11.0% in 2025, declining to 9.9% by 2035.

| Country | CAGR % |

|---|---|

| Germany | 9.7% |

| France | 8.5% |

| Italy | 9.0% |

| UK | 8.1% |

| Spain | 8.8% |

EU automotive turbocharger sales are projected to grow at a regional CAGR of 9.5% (2025–2035), reflecting the weighted average of leading European economies. Germany leads with a 9.7% CAGR, supported by its dominance in premium vehicle manufacturing and engineering excellence. Italy (9.0%) and Spain (8.8%) follow closely, leveraging strong production bases and export orientation. France grows at 8.5%, driven by diesel and commercial vehicle demand but moderated by electrification pressures, while the UK posts steady 8.1% growth linked to ULEZ policies and efficiency mandates. The rest of Europe outpaces the core markets with a remarkable 12.8% CAGR, highlighting accelerated turbocharger adoption in emerging automotive clusters. Collectively, these trends underscore a resilient EU turbocharger market propelled by emission regulations, fuel efficiency optimization, and continued demand for performance-enhancing technologies.

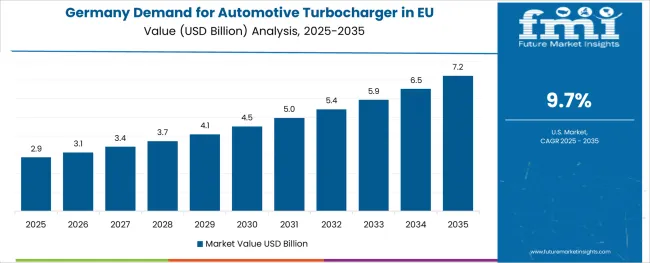

The automotive turbocharger industry in Germany is projected to exhibit robust growth with a CAGR of 9.7% through 2035, driven by world-leading automotive manufacturing expertise, comprehensive premium vehicle production leadership, and strong commitment to emission compliance throughout the country. Germany's sophisticated automotive industry and internationally recognized engineering innovation leadership are creating substantial demand for advanced turbocharger solutions across passenger car, commercial vehicle, and performance automotive applications.

Major automotive manufacturers, including Mercedes-Benz, BMW, Volkswagen Group, and Audi, collaborate extensively with turbocharger suppliers including Continental AG, BorgWarner, and Garrett Motion to develop co-engineered solutions optimized for specific engine platforms. German demand benefits from high engineering standards supporting advanced technology adoption, substantial premium vehicle production enabling sophisticated turbocharger integration, and comprehensive automotive supply chain infrastructure requiring operational excellence across component manufacturing operations.

The demand for automotive turbocharger in France is expanding at a CAGR of 8.5%, substantially supported by commercial vehicle manufacturing strength, diesel engine application heritage, and automotive production capabilities throughout major French industrial regions. France's established commercial vehicle expertise and diesel powertrain proficiency are systematically driving demand for turbocharger solutions across light commercial vehicle and heavy-duty truck segments.

Major automotive manufacturers, including Renault Group and Stellantis operations, along with commercial vehicle specialists throughout Île-de-France, Auvergne-Rhône-Alpes, and Grand Est regions, strategically invest in turbocharger integration programs to serve commercial transportation requirements. French sales particularly benefit from established diesel engine expertise supporting turbocharger optimization, substantial commercial vehicle production volumes creating replacement demand, and logistics sector requirements driving fuel efficiency focus. The electrification pressures and declining diesel passenger car adoption constrain broader growth potential compared to European averages.

The automotive turbocharger industry in the United Kingdom is expected to grow at a CAGR of 8.1% from 2025 to 2035, reflecting steady progress under ULEZ implementation requirements and comprehensive fuel economy consciousness. UK adoption concentrates throughout metropolitan centers including London, Manchester, Birmingham, and Edinburgh where emission zone requirements, fuel efficiency awareness, and regulatory compliance pressures prove most advanced throughout automotive fleet and passenger vehicle operations.

Major automotive manufacturers and turbocharger suppliers, including UK-based production facilities and distribution networks, strategically invest in turbocharged engine offerings and aftermarket support programs addressing growing demand for fuel-efficient alternatives. UK sales particularly benefit from ULEZ driving emission-compliant vehicle preference, consumer fuel cost sensitivity creating efficiency demand, and hybrid vehicle adoption creating turbocharger integration opportunities supporting regulatory requirements and performance expectations.

The demand for automotive turbocharger in Italy is growing at a steady CAGR of 9.0%, fundamentally driven by automotive manufacturing heritage, premium vehicle production capabilities, and progressive adoption of turbocharged powertrains throughout Italian automotive operations. Italy's traditionally strong automotive culture is maintaining turbocharger demand as manufacturers recognize efficiency benefits and emission compliance advantages while preserving performance characteristics.

Major automotive manufacturers and component suppliers, including operations throughout Milan, Turin, and other Italian industrial centers, strategically invest in turbocharger technology development and manufacturing capabilities addressing domestic and export requirements. Italian sales particularly benefit from premium vehicle applications requiring high-performance turbocharger solutions, commercial vehicle production supporting diesel turbocharger demand, and automotive component manufacturing expertise enabling domestic supply chain development contributing to European turbocharger production capacity.

Demand for automotive turbocharger in Spain is projected to grow at a CAGR of 8.8%, substantially supported by automotive production capabilities, component manufacturing infrastructure, and increasing turbocharged engine adoption throughout Spanish automotive operations. Spanish automotive sector's established production volumes position turbocharger suppliers as important participants supporting domestic manufacturing and export production requirements.

Major automotive manufacturing operations, including facilities throughout Madrid, Barcelona, Valencia, and other Spanish industrial regions, systematically integrate turbocharged engines meeting emission requirements and fuel efficiency targets. Spain sales particularly benefit from substantial automotive production volumes creating OEM demand, established component supply networks supporting turbocharger availability, and export-oriented production strategies requiring competitive fuel economy performance meeting diverse global regulatory standards.

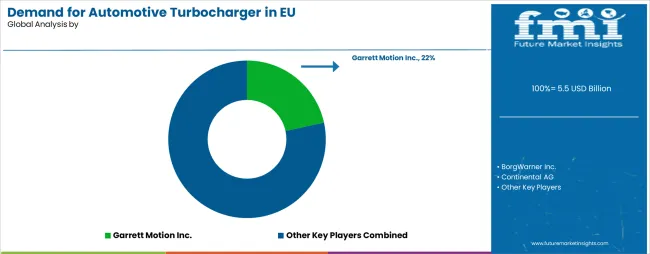

EU automotive turbocharger sales are defined by competition among multinational component manufacturers, European automotive suppliers, and specialized turbocharger producers. Companies are investing in variable geometry technologies, electric turbocharger development capabilities, lightweight material implementation, and thermal management innovation to deliver high-quality, functionally superior, and emission-compliant turbocharger solutions. Strategic partnerships with European automotive OEMs, aftermarket service expansion initiatives, and engineering programs emphasizing efficiency improvements and emission benefits are central to strengthening competitive positioning.

Major participants include Garrett Motion Inc. with an estimated 22.0% share, leveraging its comprehensive variable geometry expertise, extensive European manufacturing presence, and established automotive OEM relationships supporting consistent leadership. Garrett benefits from extensive product portfolio, technical support capabilities, and ability to provide application-specific solutions, including passenger car turbochargers, commercial vehicle systems, and performance-oriented formulations supporting diverse European automotive applications.

BorgWarner Inc. holds approximately 20.0% share, emphasizing cutting-edge electric turbocharger technologies, hybrid system integration capabilities, and premium automotive segment focus driving brand recognition and OEM preference throughout European operations. BorgWarner's success in developing products with superior transient response characteristics, advanced durability profiles, and innovative electrification features creates strong competitive positioning and mainstream acceptance, supported by comprehensive engineering resources and collaborative OEM development programs.

Continental AG accounts for roughly 12.0% share through its position as integrated automotive supplier, providing advanced turbocharger systems, comprehensive engine management integration, and technical support helping European automotive manufacturers optimize powertrain performance for specific vehicle platforms and emission requirements.

Mitsubishi Heavy Industries Ltd. and IHI Corporation represent approximately 15.0% combined share, supporting growth through industrial expertise, commercial vehicle focus, and heavy-duty turbocharger capabilities. These companies leverage engineering heritage, manufacturing scale, and technical specialization, attracting commercial vehicle manufacturers seeking reliable turbocharger alternatives with proven durability characteristics.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.4 billion |

| Vehicle Type | Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Agricultural Machinery, Construction Machinery |

| Product Type | Wastegate, Variable Geometry Turbocharger (VGT), Twin Turbo |

| Fuel Type | Gasoline, Diesel |

| Sales Channel | OEM, Aftermarket |

| Actuator Type | Hydraulic, Electric, Pneumatic |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, United Kingdom, and the Rest of Europe |

| Key Companies Profiled | Garrett Motion Inc., BorgWarner Inc., Continental AG, Mitsubishi Heavy Industries Ltd., IHI Corporation, Cummins Inc., Toyota Industries Corporation, Eaton Corporation Plc, Vitesco Technologies GmbH, BMTS Technology GmbH & Co. KG, Regional European specialists |

| Additional Attributes | Dollar sales by vehicle type, product type, fuel type, sales channel, and actuator type; regional demand trends across major European countries; competitive landscape analysis with established turbocharger manufacturers and emerging technology providers; automotive manufacturer preferences for variable geometry and electric turbocharger technologies; integration with hybrid powertrains and downsized engines; innovations in electric assistance and thermal management; adoption across passenger car, commercial vehicle, and performance automotive applications; EU regulatory framework analysis for emission standards and CO2 reduction targets; supply chain strategies; and penetration analysis for mainstream European automotive manufacturers and premium vehicle segments. |

The global demand for automotive turbocharger in EU is estimated to be valued at USD 5.5 billion in 2025.

The market size for the demand for automotive turbocharger in EU is projected to reach USD 13.4 billion by 2035.

The demand for automotive turbocharger in EU is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in demand for automotive turbocharger in EU are oem and aftermarket.

In terms of product type, variable geometry turbocharger (vgt) segment to command 63.0% share in the demand for automotive turbocharger in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Material, Thickness, Capacity, and Type of Europe Automotive Tire Market Forecast Economic Projections to 2035

Automotive Turbocharger Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

GCC Automotive Turbocharger Market Trends – Growth, Demand & Forecast 2025–2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Korea Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Western Europe Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Germany Automotive Turbocharger Market Growth – Trends, Demand & Innovations 2025–2035

United States Automotive Turbocharger Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

Demand for Automotive Lighting in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Interior Leather in EU Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA