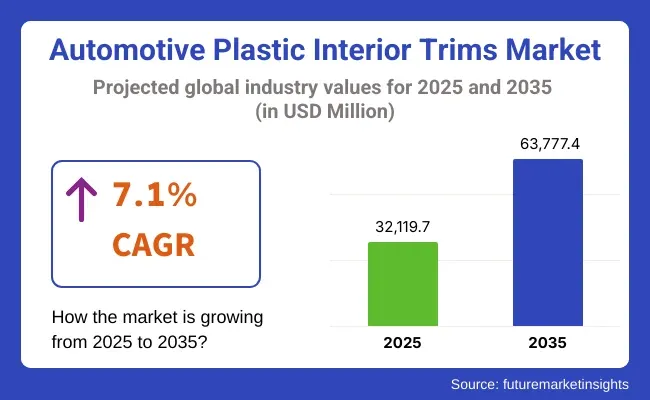

The automotive plastic interior trims market is projected to grow steadily between 2025 and 2035, driven by the automotive industry's shift toward lightweight design, cost-effective production, and enhanced in-cabin aesthetics. The market is expected to be valued at USD 32,119.7 million in 2025 and is anticipated to reach USD 63,777.4 million by 2035, reflecting a CAGR of 7.1% over the forecast period.

A crucial part in the development of a vehicle's cockpit ergonomics, safety features, and interior personalization, plastic interior trims include the components like dashboards, door panels, center consoles, pillars, and seat back panels. increasing demand for battery electric vehicles (BEVs), premium vehicle interiors, and sustainable and recyclable polymers are expected to support market expansion. Yet doubtless, VOC emissions, complex plastics recycling processes, and in-cabin temperature durability continue to be major considerations for OEMs.

This has led to some major trends in the industry, including soft-touch plastic surfaces, low-gloss and matte finishes, laser engraved surfaces, natural fiber reinforced plastics and sustainability based bio based polymers.

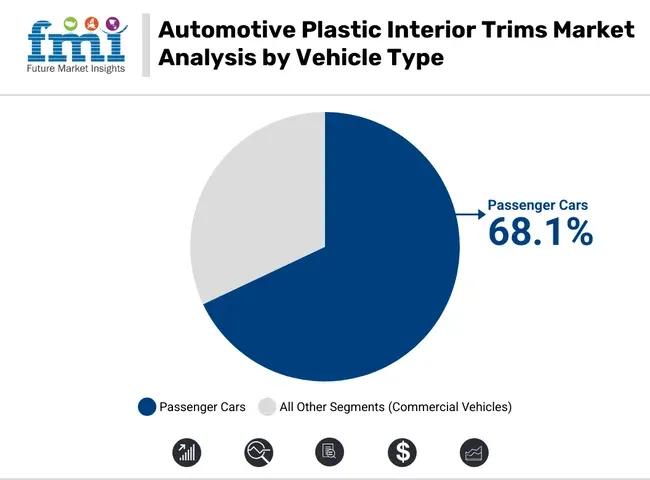

Vehicle Type Market Share (2025)

Passenger cars are expected to hold the highest share of the global automotive plastic interior trims market by 2025 with an estimated 68.1% of the total market share. The growing application of engineered plastics in different trim applications in this segment can be attributed to the rising demand for lightweight, aesthetic, and durable interior components in modern vehicles.

With a focus on premium design elements, occupant comfort, and integrated technology interfaces, automotive producers continue to accelerate the integration of plastic-based interior trims in passenger cars. As consumers increasingly expect more tailored interiors and vehicle ergonomics, more now rely on advanced interior components made from high-performance polymers that provide increased durability, thermal resistance, and design flexibility.

Electric vehicle adoption is on the rise, and automakers are spending more on smart, connected interiors, but plastic interior trims will remain integral to the evolution of passenger vehicle cabin architecture.

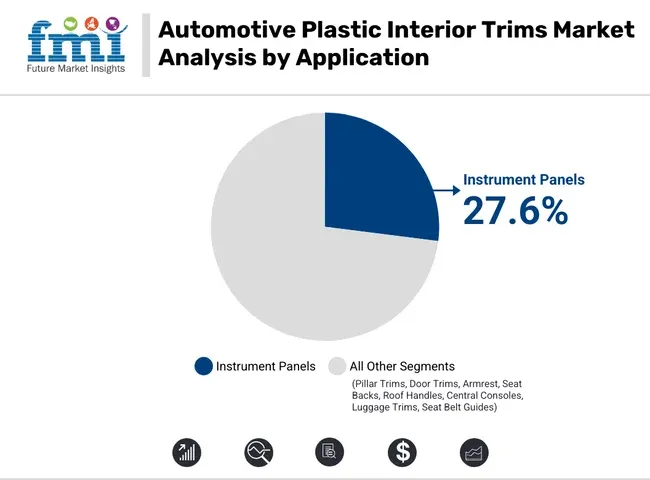

Application Market Share (2025)

By 2025, instrument panels are expected to dominate the automotive plastic interior trims market and reach an estimated 27.6% of the global market value. All-digital clusters have become the centerpiece of a vehicle's dash and are increasingly being developed using high-quality plastic materials that enable complex geometries, surface textures, and the integration of digital displays and infotainment systems.

The evolution of digital cockpits and modular designs inside the cabin have increased demand for plastics that are lightweight but durable, impact resistant and friendly to electronic components. Instrument panels are typically made from ABS, PC/ABS blends and polypropylene due to their compatibility with performance and design goals and the ability to keep production costs commandable.

Consumer demand is driving innovation in high-tech, visually sophisticated, and ergonomically sound cabin environments, and instrument panels continue to lead the way in the plastic interior trim segment, reinforcing their position as the leading application area in the automotive plastics market.

Challenges

VOC Compliance, Thermal Degradation, and Circularity

Regulatory and consumer concerns with VOC emissions from some plasticizers and finishes, and therefore interior air quality (IAQ) compliance, is as pervasive today as ever. In warmer regions, heat resistance and UV durability are other significant challenges. Furthermore, the recycling of automotive plastics is very challenging accounting for multi-material bonding, laminated surfaces, and complicated shapes of parts is impairing major OEMs responsible for the target of a circular economy.

Opportunities

EV Interior Redesign, Bio-Composites, and In-Cabin Personalization

With electric vehicles come redesigned interior architectures that feature modular trim assemblies, sound-insulating panels and sustainable surface materials. European And Japanese markets are gaining similar initiative around SOC Bio-composites using hemp, flax and kenaffibers that consist of upcycled plastics. The sustainable nature of 3D printing could also be seen as a benefit, along with opportunities in 3D-printed trim prototypes, interior color customization, and aftermarket upgrade kits for both OEMs and accessory brands.

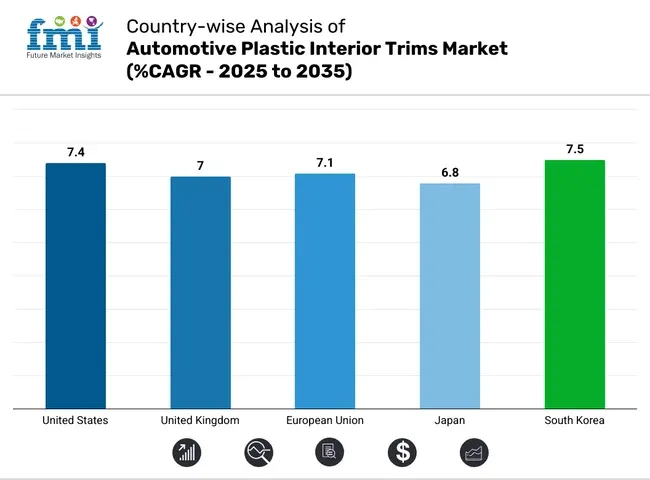

Demand for lightweight material with aesthetics and improved cabin ergonomics in passenger cars and commercial vehicles is expected to drive the market for Plastic interior trims in automotive applications in United States. ABS, polypropylene, and thermoplastic elastomers are some of the high-performance plastics that automakers are using in dashboards, door panels, and center consoles.

Other trends such as vehicle electrification and fuel efficiency are shifting OEMs toward replacing metal parts with rugged plastics trims. Customization trends and growth in premium vehicle production are also driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.4% |

The automotive plastic interior trims market in the UK is increasing exponentially, aided by the growing demand for sustainability and luxury finishes amongst both homegrown brands and high-end exports.

Plastic trims for electric vehicles (EVs) and hybrids are lightweight and recyclable, contributing to both environmental and efficiency targets. Automotive OEMs and Tier 1 suppliers are putting money into soft-touch plastics, bio-based polymers and vegan leather alternatives. New models are shaping to suit demands for more upscale interiors and modular trim designs.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.0% |

Other high-growing regions in the automotive plastic interior trims market in Europe include Germany, France, and Italy, where major automotive manufacturers are pushing for the carbon neutrality of common vehicle materials through innovation in materials science.

The European carmakers are using advanced molding technologies and surface treatments to provide premium textures, acoustic insulation, and design versatility. Move toward shared mobility and electrified vehicle platforms spurs lightweight, cost-effective trim modules EU rules on recyclability and reduced VOC emissions are shaping materials selection and design strategies.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.1% |

Japan automotive plastic interior trims market is gaining steady momentum across the globe as minimalistic design, space optimization and comfort in compact vehicles continue to thrive. Injection-molded plastic trims give Japanese automakers the ability to make their vehicles lighter, while retaining a sense of durability and tactility.

For consumers looking for low-maintenance interiors, innovations in scratch-resistant and anti-fingerprint finishes are answering the call. Japan’s predominance in hybrid and mini-vehicle manufacturing remains a nice driver for appealing and integrative plastic trims for function.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

Driven by upticks in global exports, growing EV production, and premiumization across domestic models, the automotive plastic interior trims market in South Korea is booming. In automotive the use of smart plastics, with embedded lighting, ambient controls and sensor housings, are being integrated to create a unique experience.

Laser-cut leather-like surface textures, high-precision moldings (for lightweighting), and recycled polymers are in strong demand. South Korean suppliers are collaborating with global OEMs too, to supply lightweight, customizable trims that lend themselves to quick design changes and technology-heavy cabin layouts.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

The market for automotive plastic interior trims is witnessing consistent growth due to the increasing demand for lightweight vehicles, improved aesthetics within the cabin, and cost-effective manufacturing processes.

Certainly, also I share Plastic interior trims like dashboard panels, door trims, center console, pillar garnish, and seat back covers for design flexibility, improved safety, and for integration with electronic features. Some of the driving factors of the market are vehicle electrification, modular interior architecture, increased adoption of recycled and bio-based polymers, and the OEM focus on tactile and visual refinement in the passenger compartments.

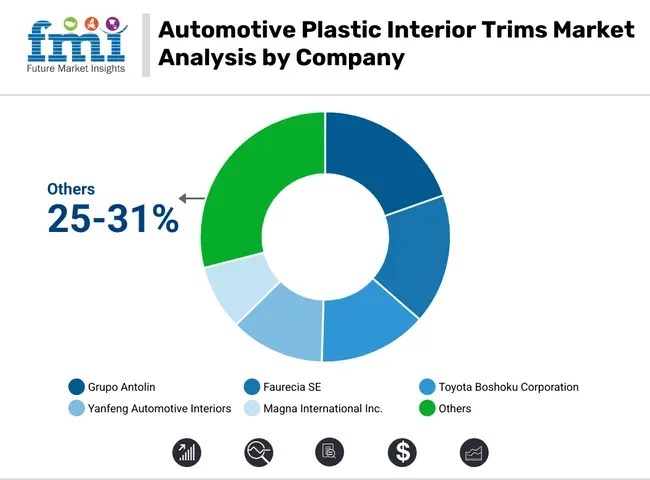

GrupoAntolin (17-21%)

Market leader in cockpit and headliner systems, Antolin is known for integrating smart surfaces and sustainable materials, with strong OEM partnerships in Europe and the Americas.

Faurecia SE (14-18%)

A pioneer in lightweight and sustainable plastic trims, Faurecia focuses on interior modularity, eco-composites, and functional aesthetics for both ICE and EV platforms.

Toyota Boshoku (11-15%)

Emphasizes ergonomic design and advanced material integration, Toyota Boshoku is expanding smart trim offerings aligned with the global shift toward connected mobility.

Yanfeng Automotive Interiors (9-13%)

Specializes in high-volume plastic trim solutions with smart integration for lighting, display surfaces, and personalization across global OEM platforms.

Magna International Inc. (6-9%)

Offers a diverse range of injection-molded and thermoformed interior trims, with a growing focus on circular materials and low-emission production processes.

Other Key Players (Combined Share: 25-31%)

Several regional Tier 1 suppliers and niche interior specialists are contributing to innovation in surface finishing, lightweighting, and acoustic enhancement, including:

The overall market size for the automotive plastic interior trims market was USD 32,119.7 million in 2025.

The automotive plastic interior trims market is expected to reach USD 63,777.4 million in 2035.

The demand for automotive plastic interior trims will be driven by increasing vehicle production, growing consumer preference for lightweight and aesthetically appealing interiors, rising adoption of electric vehicles, and advancements in durable, sustainable, and recyclable plastic materials.

The top 5 countries driving the development of the automotive plastic interior trims market are China, the USA, Germany, Japan, and South Korea.

The dashboard and door trims segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Vehicle Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 8: Global Market Volume (Units) Forecast by Application, 2017 to 2032

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2032

Table 14: North America Market Volume (Units) Forecast by Vehicle Type, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 16: North America Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 17: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 18: North America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 22: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2032

Table 24: Latin America Market Volume (Units) Forecast by Vehicle Type, 2017 to 2032

Table 25: Latin America Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 26: Latin America Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 28: Latin America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 32: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 33: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2032

Table 34: Europe Market Volume (Units) Forecast by Vehicle Type, 2017 to 2032

Table 35: Europe Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 36: Europe Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 37: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 38: Europe Market Volume (Units) Forecast by Application, 2017 to 2032

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2017 to 2032

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: East Asia Market Volume (Units) Forecast by Country, 2017 to 2032

Table 43: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2032

Table 44: East Asia Market Volume (Units) Forecast by Vehicle Type, 2017 to 2032

Table 45: East Asia Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 46: East Asia Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 47: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 48: East Asia Market Volume (Units) Forecast by Application, 2017 to 2032

Table 49: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 50: East Asia Market Volume (Units) Forecast by Sales Channel, 2017 to 2032

Table 51: South Asia & Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 52: South Asia & Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 53: South Asia & Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2032

Table 54: South Asia & Pacific Market Volume (Units) Forecast by Vehicle Type, 2017 to 2032

Table 55: South Asia & Pacific Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 56: South Asia & Pacific Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 57: South Asia & Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 58: South Asia & Pacific Market Volume (Units) Forecast by Application, 2017 to 2032

Table 59: South Asia & Pacific Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 60: South Asia & Pacific Market Volume (Units) Forecast by Sales Channel, 2017 to 2032

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 62: MEA Market Volume (Units) Forecast by Country, 2017 to 2032

Table 63: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2032

Table 64: MEA Market Volume (Units) Forecast by Vehicle Type, 2017 to 2032

Table 65: MEA Market Value (US$ Million) Forecast by Material Type, 2017 to 2032

Table 66: MEA Market Volume (Units) Forecast by Material Type, 2017 to 2032

Table 67: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 68: MEA Market Volume (Units) Forecast by Application, 2017 to 2032

Table 69: MEA Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 70: MEA Market Volume (Units) Forecast by Sales Channel, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Vehicle Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 5: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 7: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 10: Global Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2032

Figure 11: Global Market Volume (Units) Analysis by Vehicle Type, 2017 to 2032

Figure 12: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 to 2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 14: Global Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 15: Global Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 16: Global Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 17: Global Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 19: Global Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 26: Global Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 27: Global Market Attractiveness by Material Type, 2022 to 2032

Figure 28: Global Market Attractiveness by Application, 2022 to 2032

Figure 29: Global Market Attractiveness by Sales Channel, 2022 to 2032

Figure 30: Global Market Attractiveness by Region, 2022 to 2032

Figure 31: North America Market Value (US$ Million) by Vehicle Type, 2022 to 2032

Figure 32: North America Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 33: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 35: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 37: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 40: North America Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2032

Figure 41: North America Market Volume (Units) Analysis by Vehicle Type, 2017 to 2032

Figure 42: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 to 2032

Figure 43: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 44: North America Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 45: North America Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 46: North America Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 47: North America Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 49: North America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 56: North America Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 57: North America Market Attractiveness by Material Type, 2022 to 2032

Figure 58: North America Market Attractiveness by Application, 2022 to 2032

Figure 59: North America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 60: North America Market Attractiveness by Country, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) by Vehicle Type, 2022 to 2032

Figure 62: Latin America Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 63: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 70: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2032

Figure 71: Latin America Market Volume (Units) Analysis by Vehicle Type, 2017 to 2032

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 to 2032

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 74: Latin America Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 75: Latin America Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 79: Latin America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 86: Latin America Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 87: Latin America Market Attractiveness by Material Type, 2022 to 2032

Figure 88: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 89: Latin America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 90: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 91: Europe Market Value (US$ Million) by Vehicle Type, 2022 to 2032

Figure 92: Europe Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 93: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 95: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 97: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 100: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2032

Figure 101: Europe Market Volume (Units) Analysis by Vehicle Type, 2017 to 2032

Figure 102: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 to 2032

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 104: Europe Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 105: Europe Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 106: Europe Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 108: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 109: Europe Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 110: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 116: Europe Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 117: Europe Market Attractiveness by Material Type, 2022 to 2032

Figure 118: Europe Market Attractiveness by Application, 2022 to 2032

Figure 119: Europe Market Attractiveness by Sales Channel, 2022 to 2032

Figure 120: Europe Market Attractiveness by Country, 2022 to 2032

Figure 121: East Asia Market Value (US$ Million) by Vehicle Type, 2022 to 2032

Figure 122: East Asia Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 123: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 124: East Asia Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 125: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 127: East Asia Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 130: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2032

Figure 131: East Asia Market Volume (Units) Analysis by Vehicle Type, 2017 to 2032

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 to 2032

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 134: East Asia Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 135: East Asia Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 138: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 139: East Asia Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 142: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 143: East Asia Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 146: East Asia Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 147: East Asia Market Attractiveness by Material Type, 2022 to 2032

Figure 148: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 149: East Asia Market Attractiveness by Sales Channel, 2022 to 2032

Figure 150: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 151: South Asia & Pacific Market Value (US$ Million) by Vehicle Type, 2022 to 2032

Figure 152: South Asia & Pacific Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 153: South Asia & Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 154: South Asia & Pacific Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 155: South Asia & Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 156: South Asia & Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 157: South Asia & Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 158: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 159: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 160: South Asia & Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2032

Figure 161: South Asia & Pacific Market Volume (Units) Analysis by Vehicle Type, 2017 to 2032

Figure 162: South Asia & Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 to 2032

Figure 163: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 164: South Asia & Pacific Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 165: South Asia & Pacific Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 166: South Asia & Pacific Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 167: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 168: South Asia & Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 169: South Asia & Pacific Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 170: South Asia & Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 171: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 172: South Asia & Pacific Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 173: South Asia & Pacific Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 174: South Asia & Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 175: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 176: South Asia & Pacific Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 177: South Asia & Pacific Market Attractiveness by Material Type, 2022 to 2032

Figure 178: South Asia & Pacific Market Attractiveness by Application, 2022 to 2032

Figure 179: South Asia & Pacific Market Attractiveness by Sales Channel, 2022 to 2032

Figure 180: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 181: MEA Market Value (US$ Million) by Vehicle Type, 2022 to 2032

Figure 182: MEA Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 183: MEA Market Value (US$ Million) by Application, 2022 to 2032

Figure 184: MEA Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 185: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 186: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 187: MEA Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 188: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 190: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2032

Figure 191: MEA Market Volume (Units) Analysis by Vehicle Type, 2017 to 2032

Figure 192: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 to 2032

Figure 193: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 194: MEA Market Value (US$ Million) Analysis by Material Type, 2017 to 2032

Figure 195: MEA Market Volume (Units) Analysis by Material Type, 2017 to 2032

Figure 196: MEA Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 197: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 198: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 199: MEA Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 200: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 201: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 202: MEA Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 203: MEA Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 204: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 205: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 206: MEA Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 207: MEA Market Attractiveness by Material Type, 2022 to 2032

Figure 208: MEA Market Attractiveness by Application, 2022 to 2032

Figure 209: MEA Market Attractiveness by Sales Channel, 2022 to 2032

Figure 210: MEA Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Interior Plastic Components Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Interior Leather Market Analysis Size Share and Forecast Outlook 2025 to 2035

Automotive Interior Trim Parts Market Size and Share Forecast Outlook 2025 to 2035

Automotive Plastic Market in BRIC Countries - Size, Share, and Forecast 2025 to 2035

Automotive Interior Ambient Lighting Market Growth - Trends & Forecast 2025 to 2035

Automotive Plastic Market Growth – Trends & Forecast 2024-2034

Automotive Bioplastic Market Growth - Trends & Forecast 2025 to 2035

Bioplastic For Interior Market Size and Share Forecast Outlook 2025 to 2035

Automotive Soft Trim Interior Materials Market Growth - Trends & Forecast 2025 to 2035

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Korea Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

Demand for Automotive Interior Leather in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Interior Swinging Door Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA