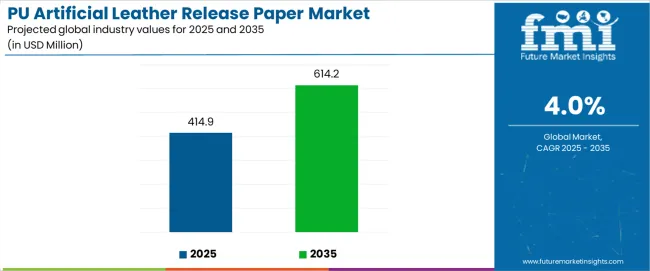

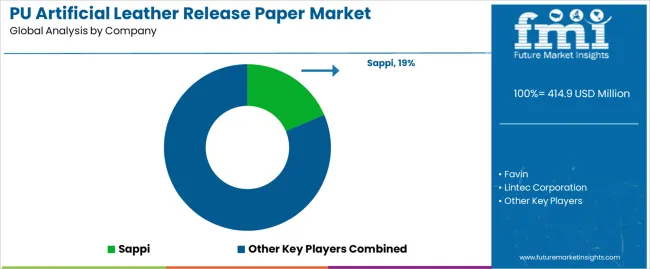

The global PU artificial leather release paper market is projected to expand from USD 414.95 million in 2025 to USD 614.23 million by 2035, reflecting a CAGR of 4.0% and absolute growth of USD 199.28 million. Regional dynamics reveal that Asia-Pacific will continue to dominate expansion, underpinned by its large synthetic leather manufacturing base in China, India, South Korea, and Vietnam. Local producers in the region are scaling capacity for footwear, automotive interiors, and furniture upholstery, all of which rely on release paper for consistent surface finishes. With rising domestic consumption and export demand, Asia-Pacific is expected to contribute the highest absolute dollar growth.

Europe is forecast to maintain steady expansion, supported by high-value artificial leather applications in luxury automotive, premium furniture, and fashion industries. Stringent EU regulations promoting eco-friendly alternatives to natural leather will further encourage manufacturers to adopt advanced release paper systems that improve process efficiency while meeting sustainability benchmarks. Growth here is moderate in percentage terms but significant in driving innovation toward recyclable and environmentally safer release paper solutions.

North America is expected to post consistent growth, driven by automotive OEMs and the rising demand for synthetic leather in sportswear and accessories. Investment in modernized production facilities, coupled with innovation in high-durability release paper for heavy-duty applications, ensures the region sustains its demand trajectory. Latin America shows gradual development, with Brazil and Mexico as primary hubs for footwear and automotive upholstery production. The Middle East and Africa are smaller contributors but are anticipated to register incremental growth, fueled by infrastructure modernization and the rising demand for cost-efficient materials in the construction and transport sectors. The regional growth outlook reflects a dual pattern where Asia-Pacific dominates in production volume and cost-competitive supply, while Europe and North America lead in technological innovation and premium-grade adoption. Latin America and MEA add incremental but strategically important contributions, ensuring balanced global growth across manufacturing and end-use demand.

| Item | Value / Description |

|---|---|

| Market Value (2025) | USD 414.9 million |

| Forecast Value (2035) | USD 614.2 million |

| Forecast CAGR (2025-2035) | 4.0% |

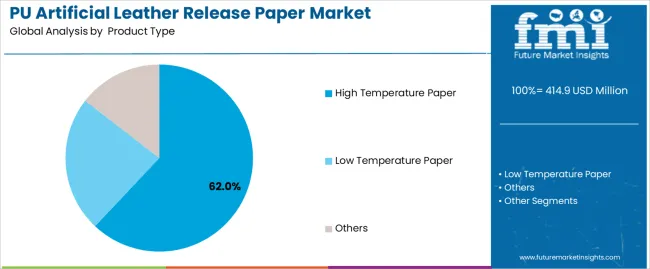

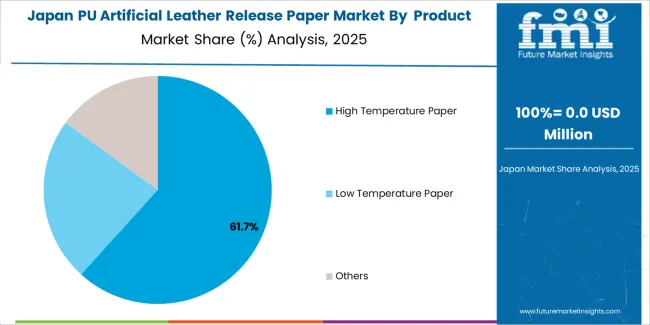

| Leading Product Type (2025) | High Temperature Paper - 62.0% share |

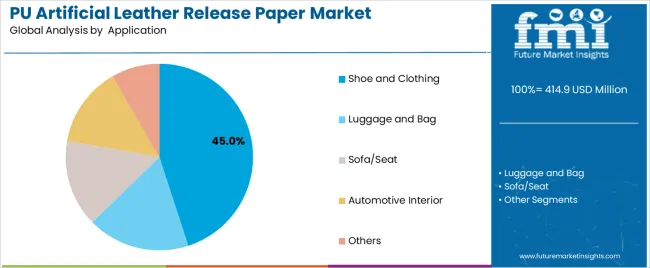

| Leading Application (2025) | Shoe and Clothing - 45.0% share |

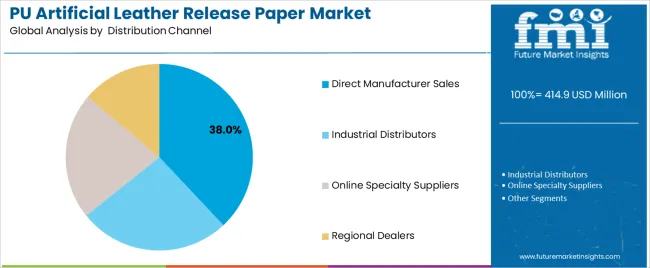

| Leading Distribution Channel (2025) | Offline - 68% share |

| Key Growth Regions | Asia Pacific; Europe; North America |

| Top Companies by Market Share | Sappi; Favin; Lintec Corporation |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 414.95 million |

| Market Forecast Value (2035) | USD 614.23 million |

| Forecast CAGR (2025–2035) | 4.0% |

| Manufacturing Trends | Technology Advancement | Quality & Performance |

|---|---|---|

| Synthetic Leather Expansion - Continuous growth in artificial leather production across automotive, footwear, and furniture industries driving demand for specialized release paper solutions. | Manufacturing Process Optimization - Advanced release paper technologies enabling improved surface quality and manufacturing efficiency in PU leather production. | Surface Quality Standards - Industry requirements establishing performance benchmarks favoring high-precision release paper components. |

| Footwear Industry Growth - Growing emphasis on synthetic leather footwear manufacturing and quality standards creating demand for premium release papers. | Temperature Resistance Enhancement - Professional manufacturing demands requiring heat-resistant papers offering superior performance while maintaining production reliability. | Release Efficiency Optimization - Quality standards requiring optimal release force distribution and minimal surface defects in manufacturing applications. |

| Automotive Interior Manufacturing - Superior performance characteristics and manufacturing capabilities making release papers essential for automotive synthetic leather applications. | Coating Technology Requirements - Certified papers with proven specifications required for professional synthetic leather production applications. | Production Technology Requirements - Advanced coating formulations and surface specifications driving need for precision manufacturing capabilities. |

| Category | Segments / Values |

|---|---|

| By Product Type | Low Temperature Paper; High Temperature Paper; Others |

| By Application | Shoe and Clothing; Luggage and Bag; Sofa/Seat; Automotive Interior; Others |

| By Coating Type | silicone Coating; Non-silicone Coating; Hybrid Coating |

| By Paper Base | Kraft Paper; Glassine Paper; Clay Coated Paper; Others |

| By Distribution Channel | Direct Manufacturer Sales; Industrial Distributors; Online Specialty Suppliers; Regional Dealers |

| By Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Segment | 2025–2035 Outlook |

|---|---|

| High Temperature Paper | Leader in 2025 with 62.0% market share; likely to maintain strong position through 2035. Superior performance in high-temperature PU processing, excellent release properties, and reliable manufacturing compatibility. Momentum: steady growth driven by automotive and furniture applications. Watchouts: cost pressures and competition from advanced coating technologies. |

| Low Temperature Paper | significant segment with 35.5% share, benefiting from footwear and clothing applications requiring moderate processing temperatures and cost-effective solutions. Momentum: rising in volume-oriented manufacturing. Watchouts: performance limitations in high-end applications. |

| Others | Specialized papers including anti-static and surface-textured varieties for specific manufacturing requirements. Momentum: moderate growth in specialized applications requiring unique surface properties and performance characteristics. |

| Segment | 2025–2035 Outlook |

|---|---|

| Shoe and Clothing | Largest application segment in 2025 at 45.0% share, supported by global footwear manufacturing growth and synthetic leather adoption in apparel industry. Driven by fashion industry trends and athletic footwear demand. Momentum: strong growth from emerging market manufacturing and premium synthetic leather applications. Watchouts: competition from natural leather alternatives and sustainability concerns. |

| Luggage and Bag | Key segment for travel goods and fashion accessories manufacturing. Requires durable release papers for high-quality surface finish and manufacturing efficiency. Momentum: steady growth through luxury goods expansion and travel industry recovery. Watchouts: economic sensitivity and changing consumer preferences. |

| Sofa/Seat | Professional furniture manufacturing segment relying on consistent release papers for upholstery and seating applications requiring surface quality and durability. Momentum: moderate growth in residential and commercial furniture markets. Watchouts: raw material cost pressures and design trend shifts. |

| Automotive Interior | Specialized segment for vehicle interior components requiring high-performance release papers for dashboard, seat, and trim applications with stringent quality standards. Momentum: strong growth from electric vehicle expansion and interior technology integration. Watchouts: automotive industry volatility and regulatory changes. |

| Distribution Channel | Status & Outlook (2025–2035) |

|---|---|

| Direct Manufacturer Sales | Dominant channel in 2025 with 38% share for industrial customers. Offers technical support, customization capabilities, and long-term supply agreements. Momentum: steady growth driven by manufacturing industry consolidation and quality requirements. Watchouts: customer concentration risks and pricing pressures. |

| Industrial Distributors | Important channel serving mid-sized manufacturers with inventory management and technical consultation services. Provides value through local presence and application expertise. Momentum: moderate growth as manufacturers seek supply chain efficiency and regional support capabilities. |

| Online Specialty Suppliers | Emerging channel for smaller manufacturers and specialty applications seeking competitive pricing and product information. Limited technical support but convenient ordering. Momentum: rising growth as digital transformation accelerates B2B purchasing and smaller manufacturers seek cost-effective sourcing. |

| Regional Dealers | Traditional channel for local manufacturers requiring immediate availability and relationship-based service. Regional expertise and customized solutions. Momentum: stable growth in established markets, declining in areas with distributor consolidation and direct sales expansion. |

| Drivers | Restraints | Key Trends |

|---|---|---|

| Expanding synthetic leather production across footwear, automotive, and furniture industries is driving demand for specialized release papers. | Raw material cost volatility and supply chain disruptions continue to impact manufacturing margins and availability. | Development of advanced coating technologies, improved release properties, and surface quality optimization are enabling superior performance. |

| Automotive Interior Innovation - Increasing use of synthetic leather in vehicle interiors and premium applications is creating demand for high-performance release papers. | Environmental Regulations - Stricter environmental standards and sustainability requirements limit certain coating formulations and processing methods. | Temperature Resistance Enhancement - Enhanced heat-resistant formulations, improved dimensional stability, and optimized release characteristics are advancing performance capabilities. |

| Manufacturing Process Excellence - Rising demand for consistent quality and manufacturing efficiency in PU leather production fuels steady release paper adoption. | Competition from Alternatives - Development of alternative release technologies and direct coating methods affect traditional paper demand. | Specialized Application Development - Emerging demand for papers tailored to automotive interior, luxury goods, and technical textile applications. |

| Quality Standards Evolution — Advanced performance requirements and surface quality specifications impact manufacturing processes and material selection. | Processing Technology Changes — Evolution in PU manufacturing methods and equipment specifications require continuous product adaptation. | Ongoing R&D Focus — Continuous improvement in coating formulations, base paper properties, and release characteristics to meet evolving manufacturing standards. |

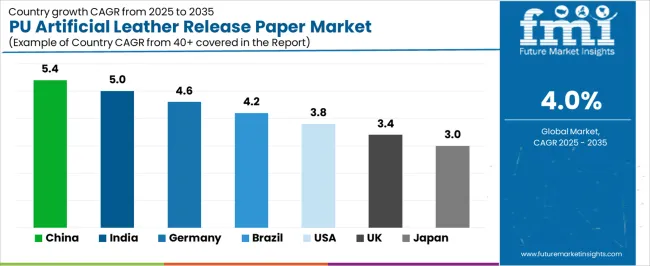

| Country | CAGR (2025–2035) |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| Brazil | 4.2% |

| United States | 3.8% |

| United Kingdom | 3.4% |

| Japan | 3.0% |

Revenue from PU artificial leather release paper in China is projected to exhibit strong growth with a market value of USD 186.4 million by 2035, driven by expanding synthetic leather manufacturing infrastructure and comprehensive production capabilities creating substantial opportunities for paper suppliers across footwear manufacturing operations, automotive interior production, and specialty furniture sectors. The country's established manufacturing tradition and expanding synthetic leather capabilities are creating significant demand for both high-temperature and low-temperature release paper systems. Major manufacturing companies and synthetic leather producers including leading footwear manufacturers are establishing comprehensive local paper supply facilities to support large-scale production operations and meet growing demand for efficient release solutions.

Revenue from PU artificial leather release paper in India is expanding to reach USD 78.2 million by 2035, supported by extensive footwear manufacturing growth and comprehensive synthetic leather industry development creating demand for reliable release paper solutions across diverse manufacturing categories and export-oriented production segments. The country's growing manufacturing sector and expanding export capabilities are driving demand for paper solutions that provide consistent manufacturing performance while supporting cost-effective production requirements. Component suppliers and manufacturing service providers are investing in local market development to support growing industrial operations and professional manufacturing demand.

Demand for PU artificial leather release paper in Germany is projected to reach USD 52.8 million by 2035, supported by the country's leadership in precision manufacturing and advanced paper technologies requiring sophisticated coating systems for automotive and premium applications. German manufacturing companies are implementing high-precision production systems that support advanced release capabilities, operational reliability, and comprehensive quality protocols. The PU artificial leather release paper market is characterized by focus on engineering excellence, component precision, and compliance with stringent environmental and performance standards.

Revenue from PU artificial leather release paper in Brazil is growing to reach USD 47.6 million by 2035, driven by manufacturing industry expansion programs and increasing synthetic leather production creating opportunities for paper suppliers serving both domestic manufacturing operations and export-oriented production contractors. The country's expanding industrial base and growing manufacturing capabilities are creating demand for release paper components that support diverse production requirements while maintaining performance standards. Manufacturing service providers and industrial supply companies are developing distribution strategies to support operational efficiency and customer satisfaction.

Demand for PU artificial leather release paper in United States is projected to reach USD 41.3 million by 2035, expanding at a CAGR of 3.8%, driven by advanced manufacturing excellence and specialized automotive capabilities supporting premium synthetic leather development and comprehensive high-performance applications. The country's established manufacturing tradition and mature automotive market segments are creating demand for high-quality release paper components that support operational performance and manufacturing standards. Component manufacturers and industrial suppliers are maintaining comprehensive development capabilities to support diverse manufacturing requirements.

Revenue from PU artificial leather release paper in United Kingdom is growing to reach USD 36.7 million by 2035, supported by manufacturing innovation and established industrial capabilities driving demand for premium release paper solutions across traditional manufacturing systems and specialty production applications. The country's manufacturing heritage and established industrial capabilities create demand for paper components that support both traditional production methods and modern high-efficiency applications.

Demand for PU artificial leather release paper in Japan is projected to reach USD 32.1 million by 2035, driven by precision manufacturing tradition and established paper technology leadership supporting both domestic manufacturing markets and export-oriented component production. Japanese companies maintain sophisticated paper development capabilities, with established manufacturers continuing to lead in coating technology and precision manufacturing standards.

European PU artificial leather release paper operations are increasingly concentrated between German precision engineering and Italian specialty manufacturing. German facilities dominate high-temperature release paper production for automotive and premium applications, leveraging advanced coating technologies and strict quality protocols that command price premiums in global markets. Italian manufacturers maintain leadership in fashion and luxury goods applications, with companies specializing in surface-textured and specialty papers driving technical specifications that smaller suppliers must meet to access premium manufacturing contracts.

Eastern European operations in Poland and Czech Republic are capturing volume-oriented production contracts through skilled labor advantages and EU regulatory compliance, particularly in standard release papers for footwear and furniture applications. These facilities increasingly serve as manufacturing capacity for Western European brands while developing their own coating expertise.

The regulatory environment presents both opportunities and constraints. REACH compliance requirements create quality standards that favor established European manufacturers over imports while ensuring consistent performance specifications. Brexit has created complexity for UK paper sourcing from EU suppliers, driving opportunities for direct relationships between manufacturers and international distributors.

Supply chain consolidation accelerates as manufacturers seek economies of scale to absorb rising raw material costs and environmental compliance expenses. Vertical integration increases, with major synthetic leather manufacturers acquiring paper production facilities to secure component supplies and quality control. Smaller manufacturers face pressure to specialize in niche applications or risk displacement by larger, more efficient operations serving mainstream manufacturing requirements.

South Korean PU Artificial Leather Release Paper operations reflect the country's advanced manufacturing sector and technology-oriented business model. Major electronics and automotive companies drive component procurement strategies for their synthetic leather operations, establishing direct relationships with specialized paper suppliers to secure consistent quality and pricing for their manufacturing processes targeting both domestic and international markets.

The Korean market demonstrates particular strength in integrating release paper technologies into automotive interior manufacturing, with companies developing products that meet stringent quality standards for premium vehicle applications. This integration approach creates demand for specific performance specifications that differ from traditional applications, requiring suppliers to adapt coating formulations and release characteristics.

Regulatory frameworks emphasize manufacturing safety and environmental protection, with Korean standards often exceeding international requirements. This creates barriers for smaller component suppliers but benefits established manufacturers who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with KC certification and comprehensive quality documentation systems.

Supply chain efficiency remains critical given Korea's technological advancement focus and competitive manufacturing dynamics. Companies increasingly pursue development contracts with suppliers in Japan, Germany, and specialized manufacturers to ensure access to advanced paper technologies while managing cost pressures. Investment in research and development supports quality advancement during extended product development cycles.

Profit pools are consolidating upstream in precision coating technology manufacturing and downstream in application-specific paper designs for automotive, footwear, and premium synthetic leather markets where certification, release performance, and consistent quality command premiums. Value is migrating from basic paper production to specification-driven, application-ready components where coating expertise, surface technology, and reliable manufacturing performance create competitive advantages. Several archetypes define market leadership: established paper manufacturers defending share through coating excellence and production scale; specialty coating companies leveraging advanced formulation expertise and customer relationships; integrated synthetic leather producers with internal paper capabilities and market access; and emerging manufacturers pursuing cost-competitive production while developing technical capabilities.

Switching costs - manufacturing compatibility, quality certification, production integration - provide stability for established suppliers, while technological advancement and performance requirements create opportunities for innovative manufacturers. Consolidation continues as companies seek production scale; direct sales channels grow for premium products while traditional distribution remains relationship-driven. Focus areas: secure automotive and premium synthetic leather market positions with application-specific performance specifications and technical support; develop coating technology and precision manufacturing capabilities; explore specialized applications including luxury goods and technical textiles.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Established Paper Manufacturers | Production scale; coating expertise; established customer base | Quality consistency; technical service; cost optimization |

| Specialty Coating Companies | Advanced formulations; technical innovation; application expertise | R&D leadership; customized solutions; premium positioning |

| Integrated Synthetic Leather Producers | Vertical integration; market access; cost control | Internal supply; quality control; market responsiveness |

| Emerging Cost-Competitive Producers | Manufacturing efficiency; competitive pricing; market entry capabilities | Production scaling; technology adoption; regional market focus |

| Technical Distributors | Market knowledge; customer relationships; technical support services | Application expertise; inventory management; customer education |

| Item | Value |

|---|---|

| Quantitative Units | USD 414.95 million |

| Product Types | Low Temperature Paper; High Temperature Paper; Others |

| Applications | Shoe and Clothing; Luggage and Bag; Sofa/Seat; Automotive Interior; Others |

| Distribution Channels | Offline; Online Channel |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | Sappi; Favin; Lintec Corporation; Dai Nippon Printing; Xinfeng Group; Matsumoto Coating Technologies; Zhejiang Chihe Technology; Fedrigoni; Superl Group; Kunshan HMC Release Materials; Shenzhen Vakye Technology; Mondi Group; Munksjö; Ahlstrom-Munksjö; Verso Corporation; Twin Rivers Paper Company; Glatfelter |

| Additional Attributes | Dollar sales by product and distribution channel; Regional demand trends (NA, EU, APAC); Competitive landscape; Offline vs. online adoption patterns; Manufacturing and coating integration; Precision coating innovations driving manufacturing enhancement, performance reliability, and technical excellence |

The global PU artificial leather release paper market is estimated to be valued at USD 414.9 million in 2025.

The market size for the PU artificial leather release paper market is projected to reach USD 614.2 million by 2035.

The PU artificial leather release paper market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in PU artificial leather release paper market are high temperature paper, low temperature paper and others.

In terms of application, shoe and clothing segment to command 45.0% share in the PU artificial leather release paper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Purified Terephthalic Acid (PTA) Market Forecast and Outlook 2025 to 2035

PUR Shippers Market Size and Share Forecast Outlook 2025 to 2035

Push Notification Service Market Size and Share Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

PU-PIR-PUR Sandwich Panel for Cold Storage Market Size and Share Forecast Outlook 2025 to 2035

Pulp Molding Tooling Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pulse Safety Resistor Market Size and Share Forecast Outlook 2025 to 2035

Pure Suspension Cell Culture Medium Market Size and Share Forecast Outlook 2025 to 2035

Public Announcement System Market Size and Share Forecast Outlook 2025 to 2035

Pure Visual Perception Solution Market Size and Share Forecast Outlook 2025 to 2035

Purified Phosphoric Acid Market Size and Share Forecast Outlook 2025 to 2035

Public Cloud Application Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pulp Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA