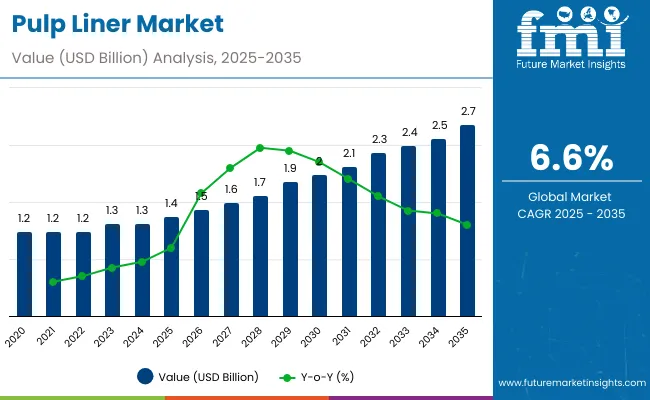

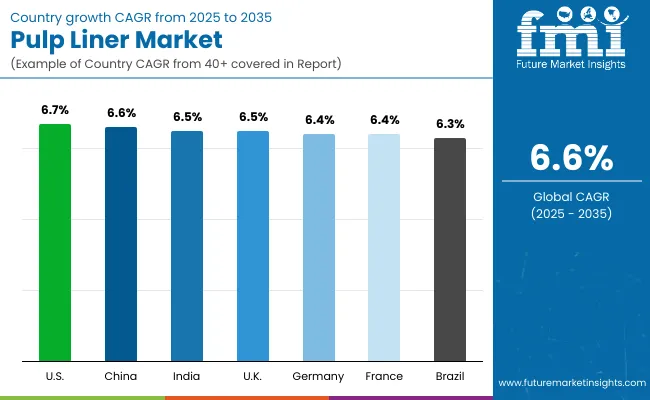

The pulp liner market is set to increase from USD 1.4 billion in 2025 to USD 2.7 billion by 2035, advancing at a CAGR of 6.6%. This expansion reflects regulatory bans on single-use plastics, corporate sustainability mandates, and growing e-commerce packaging demand. The market is on course to nearly double, cementing pulp liners as a vital segment of the sustainable packaging industry.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.4 billion |

| Industry Value (2035F) | USD 2.7 billion |

| CAGR (2025 to 2035) | 6.6% |

From 2025 to 2030, the market will add nearly USD 0.5 billion, led by strong growth in food and beverages, grocery retail, and quick-service restaurants. From 2030 to 2035, expansion of USD 0.8 billion will be supported by healthcare, agriculture, and industrial packaging. Innovations in PFAS-free coatings, lightweighting, and automation will ensure pulp liners scale efficiently while meeting strict sustainability and regulatory requirements across global markets.

From 2020 to 2024, the pulp liner market expanded steadily as moldedfiber and recycled paper pulp became sustainable alternatives to plastics. Foodservice, beverages, and consumer goods dominated demand, supported by growing e-commerce shipments and national bans on plastic packaging. Retailers and brands increasingly sought recyclable, cost-efficient options, with moldedfiber and corrugated pulp becoming preferred solutions for multipacks and trays.

By 2035, the pulp liner market will reach USD 2.7 billion at 6.6% CAGR. Moldedfiber will remain dominant, supported by automation, smooth finishes, and branding capabilities. Innovations in moisture-resistant coatings and circularity integration will extend applications in chilled foods, pharmaceuticals, and industrial goods. Asia-Pacific will lead demand due to manufacturing scale and modernization, while Europe and North America emphasize stricter compliance with plastic bans and recycled content regulations.

The pulp liner market is expanding rapidly as governments enforce stricter sustainability regulations and companies commit to reducing plastic dependency. Foodservice, retail, and e-commerce operators increasingly use pulp liners to protect and brand packaged goods while ensuring recyclability. Consumer awareness of eco-friendly packaging also drives market growth, strengthening demand across value chains.

Healthcare, agriculture, and premium packaging provide additional opportunities. Coating advancements extend pulp liner usability to chilled and moisture-sensitive applications, while automation boosts productivity and lowers costs. With regulatory support, brand adoption, and scalable innovations converging, pulp liners are becoming a mainstream choice in global packaging strategies.

The pulp liner market is segmented by material, product type, end-use industry, and region. Materials include moldedfiber, recycled paper pulp, virgin paper pulp, corrugated fiber, and composite fiber. Product types consist of cup and bottle liners, protective packaging liners, carton liners, tray liners, and industrial liners. End-use industries include food and beverages, pharmaceuticals and healthcare, retail and consumer goods, agriculture, and industrial goods. Regions covered are North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

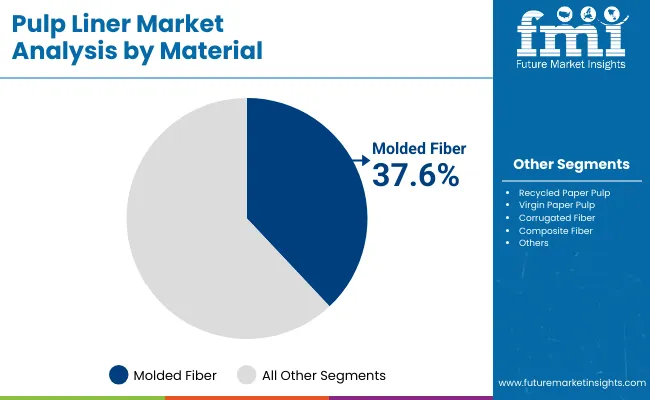

Moldedfiber will hold 37.6% share in 2025, making it the leading material choice for pulp liners. Its recyclability, cost efficiency, and versatility ensure widespread adoption in beverages, trays, and logistics packaging. Foodservice and retail brands are drawn to moldedfiber’s alignment with sustainability targets, reinforcing its dominance in global markets.

Future adoption will be fueled by PFAS-free coatings, improved surface finishes, and automation-ready processes. Moisture resistance and durability improvements enable use in chilled foods and healthcare applications. Manufacturers integrating recycled furnish support circularity, ensuring moldedfiber remains central to pulp liner innovation through 2035.

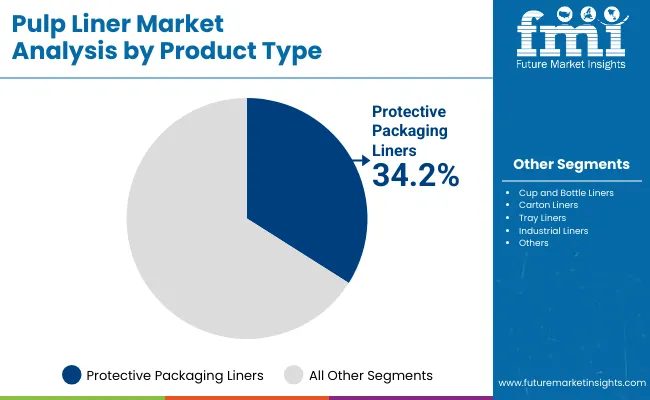

Protective packaging liners are expected to capture 34.2% market share in 2025, favored for e-commerce, logistics, and fragile goods protection. Their ability to replace foams and plastics with recyclable, cost-effective solutions ensures strong demand across global supply chains. Consumers and retailers prioritize protective pulp liners for safety and sustainability benefits.

Expansion into agriculture and industrial packaging further strengthens the segment’s role. Lightweight and customizable designs reduce material use while offering branding opportunities. With compatibility for automated systems and retail-ready finishes, protective packaging liners will remain a backbone of modern logistics and packaging strategies.

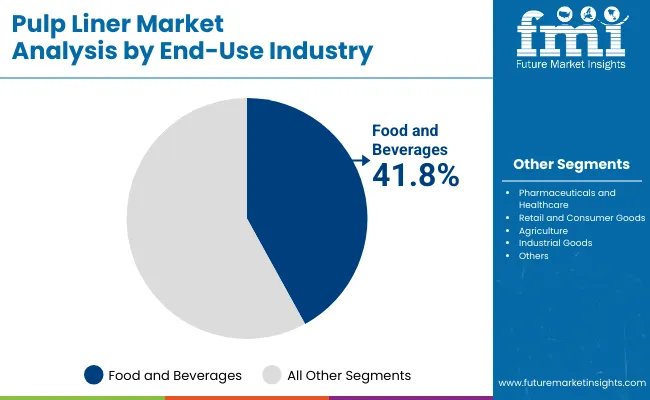

Food and beverages will command 41.8% share in 2025, making it the largest end-use sector. Pulp liners protect packaged meals, beverages, and fresh produce while complying with strict regulations banning single-use plastics. Brands and retailers rely on recyclable pulp liners for sustainability and consumer appeal.

Trends in convenience foods, delivery services, and packaged beverages strengthen demand. Beverage multipacks and chilled food packaging increasingly adopt coated pulp liners for durability. As global packaged food consumption rises, food and beverages will remain the cornerstone of pulp liner adoption through 2035.

Growth is driven by plastic bans, sustainability regulations, and rising demand for recyclable packaging. Food, retail, and e-commerce operators lead adoption, while coatings and automation improve performance. Pulp liners align with corporate commitments to reduce carbon footprints, ensuring consistent growth across industries.

Barriers include higher costs than plastics, performance issues in humid environments, and uneven recycling infrastructure. Variability in recovered pulp quality adds challenges, affecting consistency and adoption in price-sensitive markets.

Significant opportunities exist in healthcare, agriculture, and premium packaged foods. PFAS-free coatings, printability, and automation readiness enable entry into high-value applications. Export packaging compliant with global sustainability standards strengthens adoption in trade-oriented economies. Key trends include development of moisture-resistant coatings, lightweighting, and digital print integration. Brands emphasize recyclability and traceability, while automation in moldedfiber production enhances efficiency. Circular economy policies further reinforce adoption of pulp liners.

The pulp liner market is expanding worldwide, led by Asia-Pacific where Japan and South Korea drive premium adoption. North America and Europe emphasize regulatory compliance and recycled content integration, while Latin America and the Middle East & Africa strengthen demand through agriculture and retail packaging.

The USA pulp liner market is projected to expand at 6.7% CAGR, supported by robust demand from foodservice chains, grocery retailers, and e-commerce packaging. Corporate sustainability mandates and consumer awareness accelerate transitions to recyclable moldedfiber solutions. PFAS-free coatings, FDA-approved materials, and automation-enabled production lines are enhancing product suitability for chilled foods, pharmaceuticals, and personal care packaging, further strengthening long-term adoption across industries.

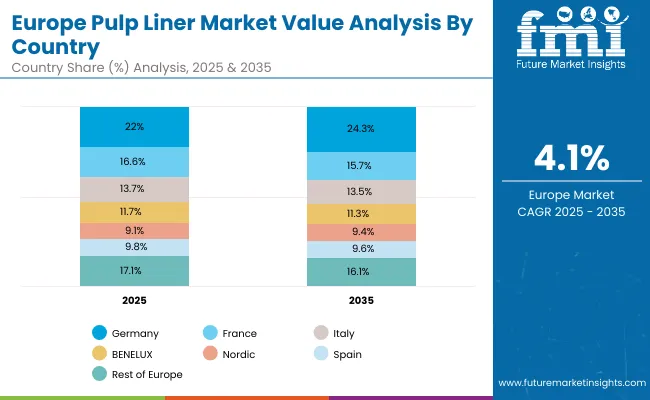

Germany is expected to register 6.4% CAGR, underpinned by stringent packaging regulations such as the VerpackG law and high consumer preference for eco-friendly packaging. The food and beverage sector leads adoption, particularly in ready-to-eat meals and beverages. Healthcare companies also integrate coated pulp liners into pharmaceutical packaging. High recycling rates, combined with EU-wide sustainability mandates, ensure Germany remains a pioneer in fiber-based packaging solutions.

The UK pulp liner market will grow at 6.5% CAGR, driven by Extended Producer Responsibility (EPR) schemes and the Plastic Packaging Tax. Grocery retailers and e-commerce companies lead the transition to moldedfiber liners for multipacks, trays, and protective logistics packaging. Pharmaceutical and healthcare sectors are also testing pulp alternatives for regulated goods, while consumer demand for recyclable solutions accelerates industry-wide adoption.

China is forecast to grow at 6.6% CAGR, with demand fueled by packaged food expansion, consumer electronics, and cross-border e-commerce. Large-scale domestic manufacturing ensures competitive pricing, enabling widespread adoption across retail and industrial goods. Export packaging is increasingly adopting pulp liners to comply with sustainability requirements in North America and Europe, strengthening China’s position as both a consumer and supplier of pulp-based packaging.

India’s pulp liner market will expand at 6.5% CAGR, driven by rapid growth in organized retail, agriculture exports, and online food delivery. Nationwide bans on single-use plastics provide a favorable regulatory environment, pushing retailers and consumer brands toward fiber-based packaging. Pulp liners are increasingly adopted for agricultural produce, beverages, and consumer goods packaging, enabling India to align with sustainability mandates and strengthen its global trade competitiveness.

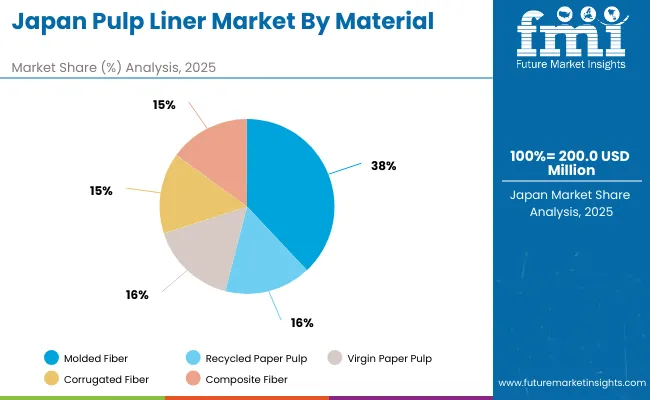

Japan is expected to lead growth with a CAGR of 7.3%, benefiting from advanced recycling infrastructure and demand for premium sustainable packaging. High-performance pulp liners are adopted in premium food, pharmaceuticals, and personal care packaging, with emphasis on moisture resistance and branding capabilities. Automation-ready production systems guarantee precision and quality, enabling Japanese companies to pioneer high-value pulp packaging solutions in Asia-Pacific.

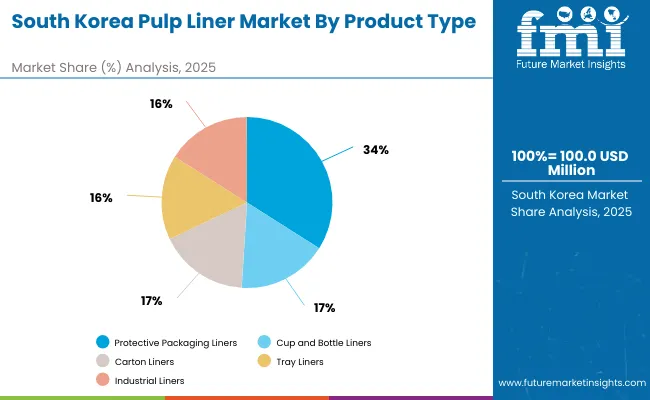

South Korea is forecast to grow at 7.2% CAGR, fueled by strong adoption in e-commerce, food delivery, and consumer electronics packaging. Beauty and personal care brands favor pulp liners for sustainable product presentations, while electronics exporters shift to recyclable fiber packaging for international compliance. Advanced retail infrastructure and strong consumer preference for eco-friendly packaging reinforce demand across multiple sectors.

Japan’s pulp liner market, valued at USD 200 million in 2025, is led by moldedfiber with 35.9% share, driven by sustainability and protective performance. Recycled paper pulp holds 19.4%, widely used in food packaging and shipping. Virgin paper pulp accounts for 18.6%, chosen for premium and hygiene-sensitive applications. Corrugated fiber represents 16.1%, valued for durability in industrial packaging. Composite fiber secures 10.0%, reflecting niche usage in advanced liners. This distribution demonstrates Japan’s strong transition toward eco-friendly moldedfiber and recycled pulp, while maintaining traditional substrates for diverse consumer and industrial end-use applications in packaging and logistics.

South Korea’s pulp liner market, worth USD 100 million in 2025, is dominated by protective packaging liners with 33.6% share, reflecting demand from e-commerce and electronics. Cup and bottle liners account for 21.0%, supported by food and beverage growth. Carton liners hold 18.4%, ensuring product stability in transit. Tray liners represent 16.2%, primarily serving food retail and ready-to-eat meals. Industrial liners secure 10.8%, used in heavy-duty applications. This segmentation highlights South Korea’s balance between consumer-oriented applications and industrial demand, with protective packaging emerging as the key growth driver, supported by sustainability initiatives and increasing packaging innovations.

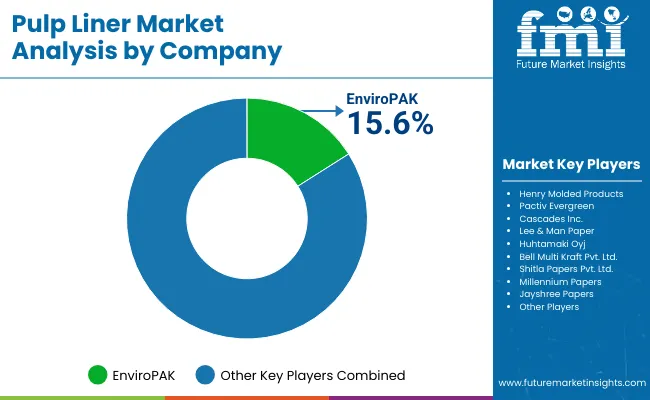

The pulp liner market is moderately fragmented with global leaders such as Huhtamaki Oyj, Cascades Inc., Pactiv Evergreen, and Lee & Man Paper dominating through automation, coating innovation, and expanded capacity. Their multinational presence ensures partnerships with leading consumer brands and retailers.

Niche players like EnviroPAK and Henry Molded Products specialize in protective molded solutions. Regional firms such as Bell Multi Kraft, Shitla Papers, Millennium Papers, and Jayshree Papers compete on cost and localized supply. Competitive strategies emphasize lightweighting, PFAS-free coatings, printability, and traceability, reinforcing pulp liners as central to sustainable packaging evolution.

Key Developments of Pulp Liner Market (Verified)

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| By Material | Molded Fiber, Recycled Paper Pulp, Virgin Paper Pulp, Corrugated Fiber, Composite Fiber |

| By Product Type | Cup and Bottle Liners, Protective Packaging Liners, Carton Liners, Tray Liners, Industrial Liners |

| By End-Use Industry | Food and Beverages, Pharmaceuticals and Healthcare, Retail and Consumer Goods, Agriculture, Industrial Goods |

| Key Companies Profiled | EnviroPAK, Henry Molded Products, Pactiv Evergreen, Cascades Inc., Huhtamaki Oyj, Lee & Man Paper, Bell Multi Kraft, Shitla Papers, Millennium Papers, Jayshree Papers |

| Additional Attributes | Growth driven by sustainability mandates, e-commerce logistics, and coating innovations. |

The Pulp Liner Market will be valued at USD 1.4 billion in 2025.

The Pulp Liner Market will reach USD 2.7 billion by 2035.

The Pulp Liner Market will expand at a CAGR of 6.6% during 2025–2035.

The molded fiber segment will lead the Pulp Liner Market in 2025 with a 37.6% share.

The Asia-Pacific region will be the fastest-growing market, led by Japan at 7.3% CAGR.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pulp Roll Cradle Market Forecast and Outlook 2025 to 2035

Pulp Molding Tooling Market Size and Share Forecast Outlook 2025 to 2035

Pulpwood Market Size and Share Forecast Outlook 2025 to 2035

Pulp Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Pulp Drying Equipment Market Trend Analysis Based on Type, End-Use, Region 2025 to 2035

Pulp Moulding Tooling Market

Pulp Washing Equipment Market

Pulp Cells Market

Repulpable Tape Market Size and Share Forecast Outlook 2025 to 2035

Beet Pulp Market Size and Share Forecast Outlook 2025 to 2035

Hydrapulper Market Size and Share Forecast Outlook 2025 to 2035

Wood Pulp Market Analysis – Demand & Growth Forecast 2024-2034

Drum Pulper Market

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Basket Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Citrus Pulp Market Analysis - Trends & Growth Forecast 2025 to 2035

Market Share Breakdown of the Molded Pulp Basket Industry

Hardwood Pulp Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA